Most Common ESG Compliance Mistakes and How to Avoid Them

Key Takeaways:

Are your ESG efforts setting your company up for success or failure?

With increasing regulatory scrutiny, a lack of ESG compliance results in more than just reputational damage.

It can easily lead to decreased employee loyalty, lengthy lawsuits, and hefty fines, too.

All of this puts your company at significant risk.

That’s why, in this article, we uncover the most frequent ESG compliance mistakes companies make and show how you can avoid them.

By the end, you’ll have a clear roadmap to strengthen your ESG strategy, ensuring both compliance and long-term business success.

Get ready to turn ESG from a liability into a competitive advantage.

High-quality ESG data is the foundation of ESG compliance.

Yet, many organizations fail to recognize this and don’t invest in data reliability, ultimately risking stakeholder distrust and legal consequences.

Take Dior, for instance.

In 2024, it was discovered that some of the company’s suppliers exploited their workers, forcing them to sleep in the factory and work around the clock.

What did Dior do about it?

Nothing, as they stated that they didn’t know about this. And that’s exactly what the biggest issue was.

A Milan court found that Dior failed to take “appropriate measures to check actual working conditions or technical capabilities” of suppliers, placing them under judicial administration for a year.

Source: Forbes

To boost your ESG data reliability and avoid such incidents, consider implementing standardized data collection and verification processes.

Two types of solutions can be used to support this effort.

First up is ESG management software.

This technology automates data analysis and reporting on environmental impact, social responsibility, and governance practices, eliminating mistakes and centralizing vital information.

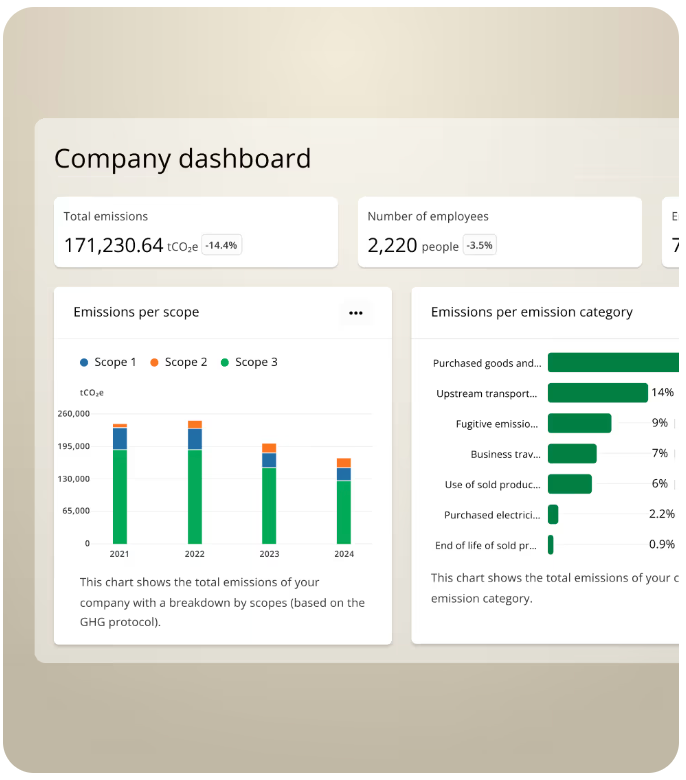

For example, it can calculate your company’s carbon footprint across Scopes 1, 2, and 3 using certified methodologies to identify emission hotspots with precision, as shown below:

Source: Plan A

Essentially, such software offers an accurate, 360-degree view of your organization’s ESG performance, simplifying compliance reporting.

But, even if your internal ESG data is flawless, what about your suppliers, vendors, and partners?

As demonstrated in the Dior example, their ESG performance affects your compliance and reputation, too.

That’s where AI-powered big data platforms like Veridion come in.

With access to a global database covering 120+ million companies across 200+ geographies, Veridion provides real-time, high-accuracy ESG insights—updated weekly.

Below, you can see all the ESG topics we cover:

Source: Veridion

Plus, our unique process extracts and analyzes data from company websites and news sources, ensuring our profiles reflect both company statements and public perceptions.

In other words, nothing slips through the cracks with Veridion.

Source: Veridion

Because of this, you finally gain full visibility into your partners’ ESG efforts, shielding your company from noncompliance risks and disruptions.

Too often, companies treat ESG as a separate, check-the-box initiative, rather than integrating it into their core operations.

This is a problem.

Why?

Because if your ESG efforts aren’t aligned with your company’s broader strategy, you may eventually deviate from them entirely, increasing the risk of noncompliance.

To avoid this, integrate ESG considerations into decision-making at all levels and embed ESG principles into your corporate strategy by directly linking them to business objectives.

Eneni Oduwole, Non-Executive Director at IT solutions provider ActivEdge Technologies, offers an example:

Illustration: Veridion / Quote: LinkedIn

Of course, business success will always be your top priority.

So, to ensure the ESG efforts aren’t at odds with your company’s goals, it’s best to conduct a materiality assessment.

This process helps organizations identify the ESG issues most relevant to their operations, success, and stakeholders.

Mark Thomas, President of Escoute Consulting, an internationally recognized leader in IT governance, risk, and compliance, is all about this method:

Illustration: Veridion / Quote: TechTarget

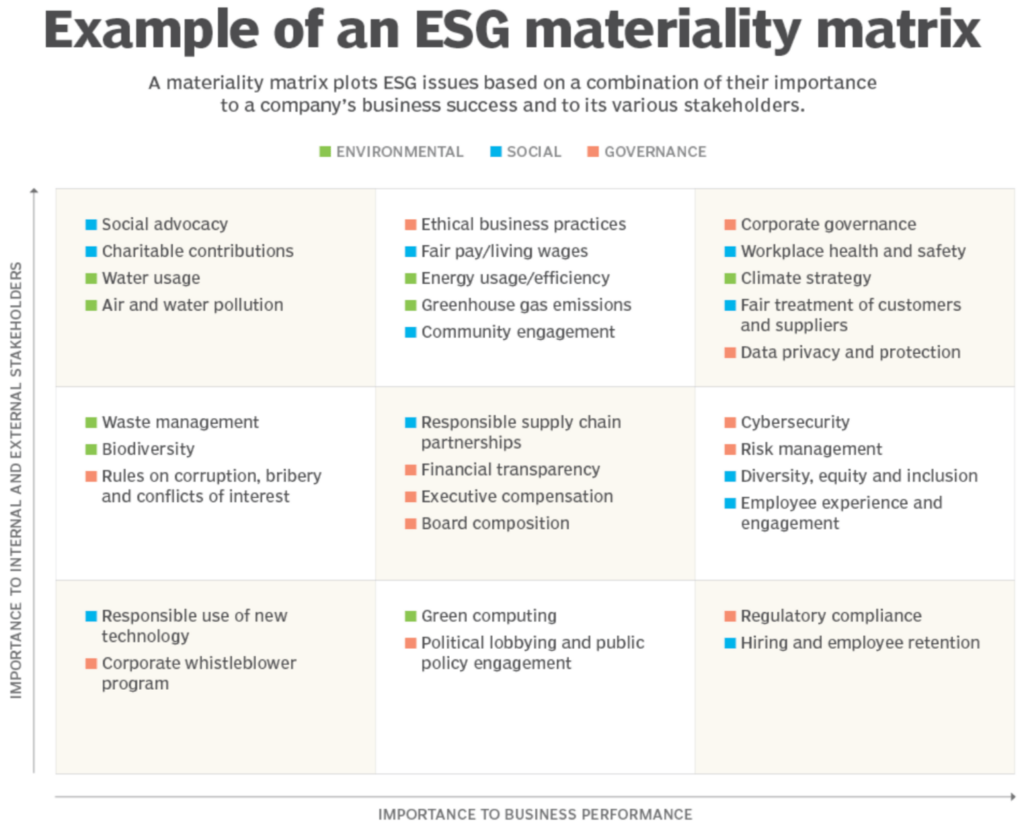

When he worked on an ESG materiality assessment for one organization, Thomas used the following approach:

Plotting relevant ESG issues in a materiality matrix, he placed issues important to business success on the x-axis, while those important to stakeholders were placed on the y-axis.

Ultimately, the quadrant of the matrix that contained issues that were most important to both the stakeholders and business success was the one that was prioritized.

Below, you can see an example of such a matrix:

Illustration: Veridion / Quote: TechTarget

Once material ESG issues are identified, embedding them into corporate objectives becomes more intuitive.

They don’t feel like extra work—they make business sense.

And when ESG is fully integrated, compliance is much easier and sustainable, too.

Companies often fail to involve key stakeholders in their ESG efforts, whether internal (employees, managers, etc.) or external (suppliers, consumers, NGOs, and regulators).

However, by doing so, they risk launching initiatives that miss the mark, don’t resonate with the people they’re meant to serve, and fail to meet regulatory standards.

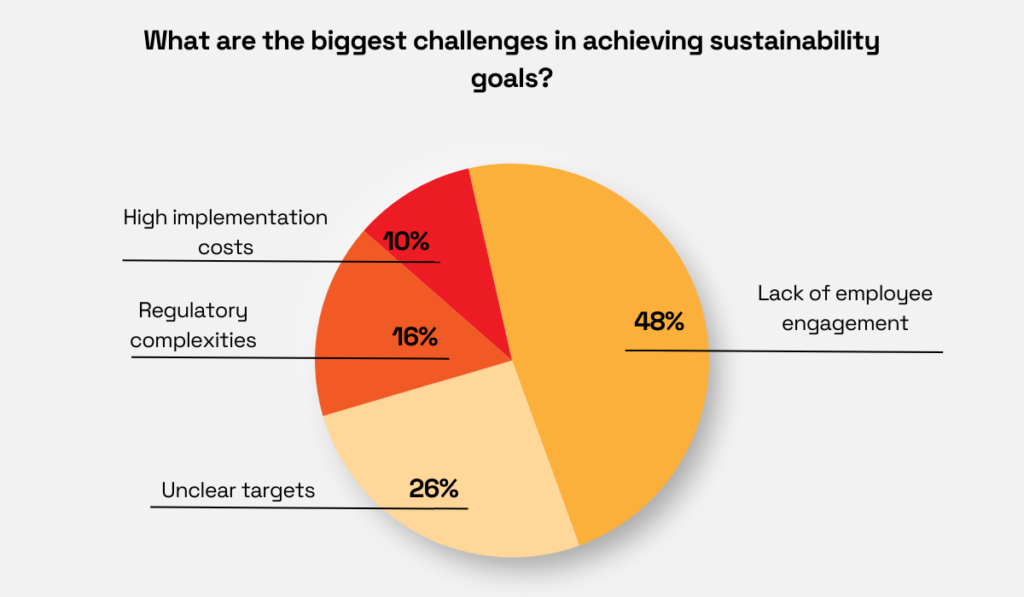

For example, a World Economic Forum survey found that 48% of companies cite a lack of employee engagement as the biggest challenge in achieving sustainability goals.

Illustration: Veridion / Data: World Economic Forum

But why does this problem occur in the first place?

Because traditional ESG strategies tend to be top-down.

Leaders set goals, push policies, and expect results.

And when employees feel ESG is just another corporate directive rather than a shared mission, engagement plummets.

Therefore, to ensure meaningful impact and compliance, companies should foster open communication and actively incorporate stakeholder feedback into ESG policies.

Walmart, for instance, does this very well.

According to their website, they always engage various stakeholders to understand what truly matters to them:

Illustration: Veridion / Quote: Walmart

And they don’t just send a blanket email.

They use tailored approaches: surveys and social media for customers, live events and direct conversations for shareholders, and so on.

Ultimately, by making ESG a two-way conversation, Walmart not only ensures compliance but also stays ahead of trends and strengthens its reputation.

It’s definitely a win-win strategy.

Focusing on ESG as a branding tool rather than a genuine effort to drive positive change is all too common.

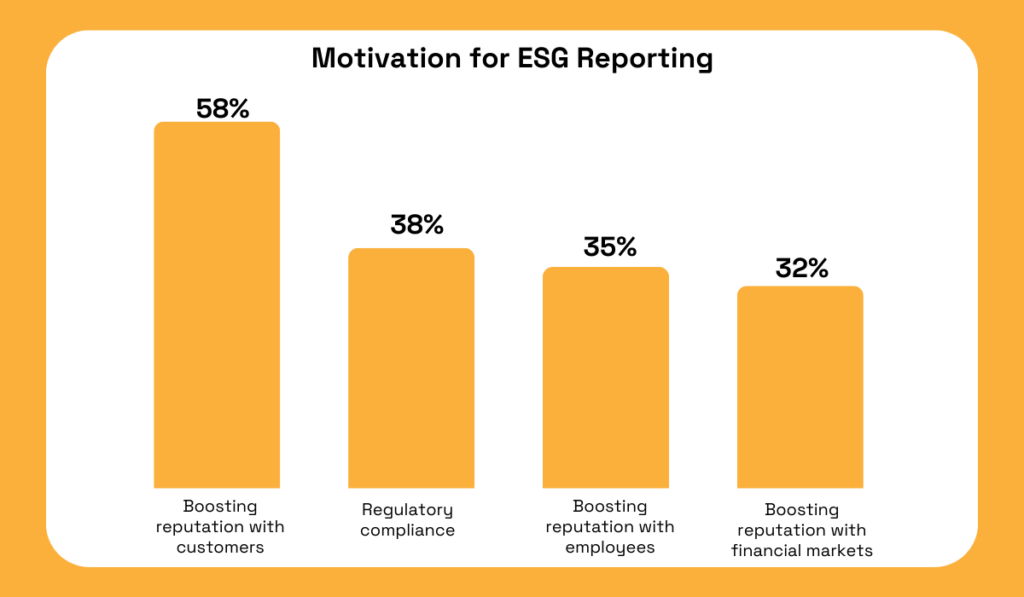

According to a study by BARC, 58% of companies cite boosting reputation with customers as the primary driver of ESG reporting.

Illustration: Veridion / Data: BARC

Is reputation important?

Yes, it certainly is.

But viewing ESG solely through this lens often leads to greenwashing—exaggerating or misrepresenting ESG achievements.

This is something regulators don’t take lightly.

For example, Deutsche Bank-owned asset manager DWS was recently fined €25 million ($27 million) for overstating its ESG credentials.

DWS had publicly claimed to be a “leader” in ESG investing and emphasized its deep commitment to sustainability.

However, an investigation by the Frankfurt state prosecutor’s office revealed that these claims “did not correspond to reality,” misleading investors from mid-2020 to early 2023.

Source: Reuters

This case highlights the risks of using ESG primarily as a PR tool.

When companies exaggerate too much, they face fines, lawsuits, and reputational damage.

That doesn’t mean you should swing in the opposite direction and “greenhush”, i.e. keep ESG efforts quiet to avoid scrutiny.

So what should you do, then?

The best approach is to focus on real, measurable, and achievable ESG improvements and communicate them transparently.

Dr. Jacob Bethem, a sustainability researcher and Associate Teaching Professor at Arizona State University, offers this advice to those who want to make a real, positive impact:

Illustration: Veridion / Quote: Business Journalism

He suggests using established frameworks like the Sustainability Accounting Standards Board (SASB) or the Global Reporting Initiative (GRI) to craft an informed ESG strategy.

When you genuinely prioritize sustainability and social responsibility, following these standards becomes second nature, reducing the temptation to fabricate data and the risk of penalties.

After all, ESG isn’t about looking good, but about doing good.

Many companies proudly champion environmental sustainability. But what about the other pillars of ESG?

Diversity, labor rights, and ethical leadership often take a back seat, despite being just as critical.

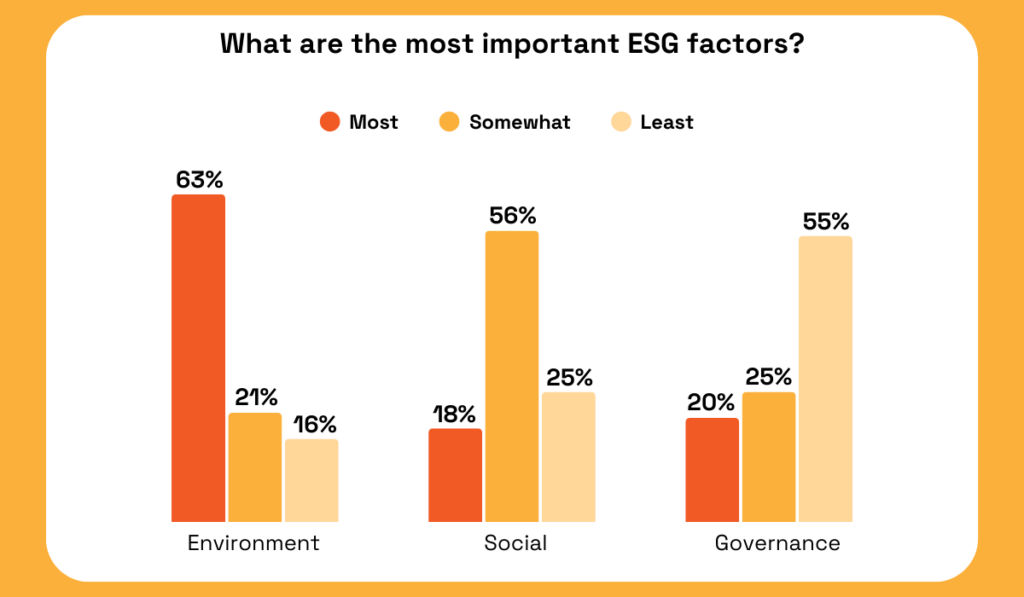

A survey by GlobalData confirms this imbalance, revealing that 63% of companies prioritize environmental factors.

Illustration: Veridion / Data: GlobalData

However, many ESG frameworks now mandate comprehensive reporting across all three pillars, and neglecting one area can lead to overall noncompliance.

For example, social issues like wage disparities or gender discrimination can result in class-action lawsuits, causing both financial and reputational harm.

Take Nike, for instance.

The company recently agreed to settle a sexual discrimination lawsuit that had been hanging over its head since 2018.

The case stemmed from an internal survey that exposed a toxic “boys’ club” culture where women were “devalued and demeaned,” and sexual harassment went unchecked.

Source: OregonLive

The fallout?

A large-scale investigation, nearly a dozen senior executives forced out, and years of legal battle.

These aren’t just ethical failures; they’re financial and legal liabilities that can cripple a company.

That’s why a holistic ESG strategy is so essential.

You need to think beyond carbon footprints and commit to fair labor practices, diversity, ethical leadership, and corporate accountability to ensure complete ESG compliance.

ESG regulations are evolving at lightning speed, making it difficult for companies to stay on top of everything.

A recent analysis by ESG Book shows just how challenging it is, revealing that global ESG regulations have increased by 155% over the past decade.

llustration: Veridion / Data: ESG Book

But here’s the catch: if you’re not keeping up, you risk noncompliance.

So, how do you make sure you’re always in the loop?

Here are some simple strategies to help you out.

The most effective approach is to maintain a dedicated compliance team or work with ESG consultants to stay informed about regulatory updates.

Alex Hardwick, Director of Sustainability Planning and Enablement at Cority, an enterprise Environmental Health, Safety and Quality software service, explains:

Illustration: Veridion / Quote: Cority

This ensures that your team is well-connected with professional and industry bodies, which can help identify changes that might otherwise slip under the radar.

On an individual level, there are a lot of helpful resources that keep track of regulatory updates you can follow.

For instance:

| ESG regulatory bodies | SEC (U.S.), EU Commission, ISSB, IFRS |

| Newsletters | From GRI, SASB, CDP, TCFD |

| Reports | From OECD, the World Economic Forum, and the UN Global Compact |

| News | From Reuters ESG, Financial Times (FT Moral Money), ESG Today, etc. |

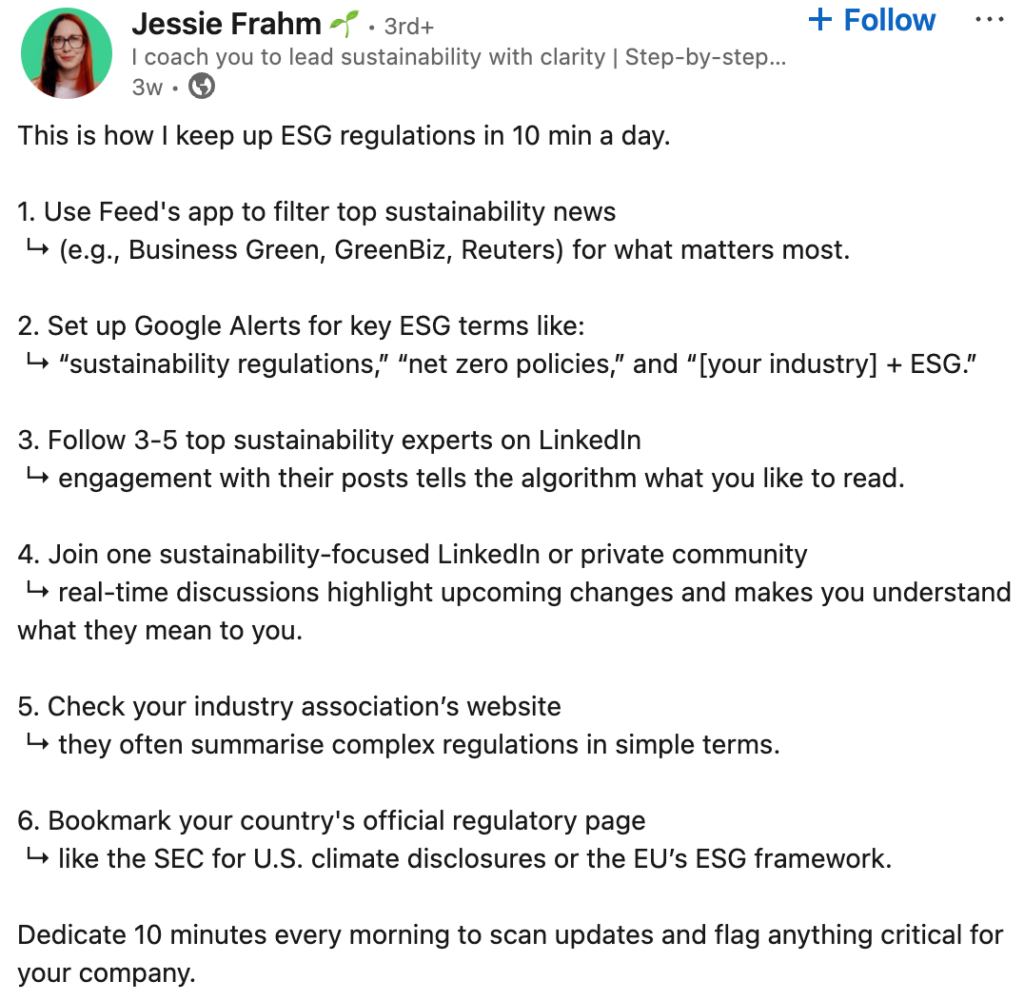

And here’s the good news: you don’t need to spend hours each day to stay informed.

Even small, consistent steps can help you stay compliant.

Take it from Jessie Frahm, Sustainability Coach and Corporate Trainer at Planet One Point Five, who stays on top of ESG regulations in just 10 minutes a day:

Source: Jessie Frahm on LinkedIn

The bottom line?

Staying compliant doesn’t have to be overwhelming.

With the right team, tools, and sources of information, staying up to date with ESG regulations becomes much more manageable.

Companies sometimes take a “set it and forget it” approach to ESG, setting ambitious goals but failing to actively work toward them.

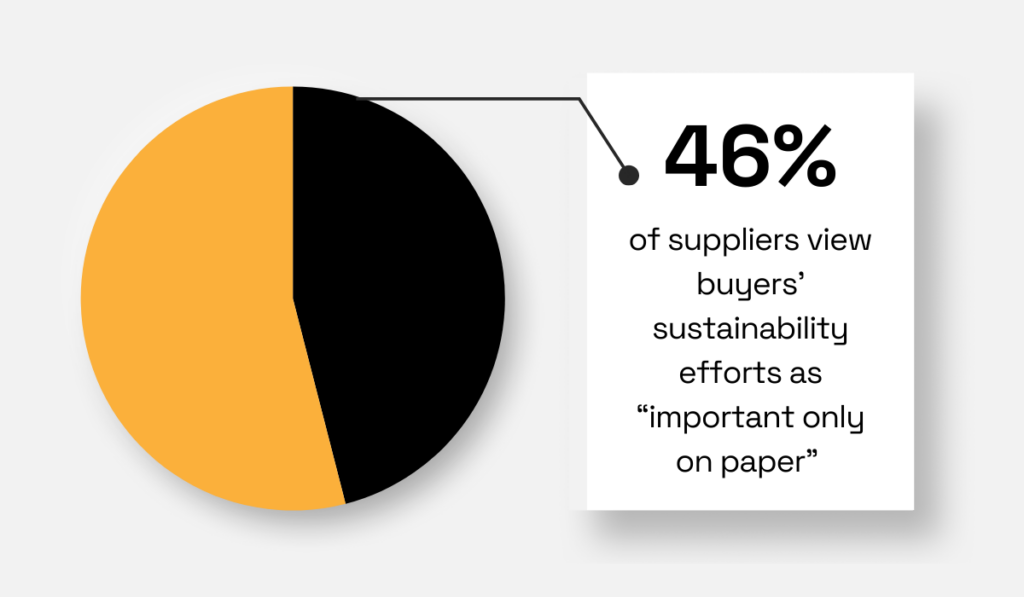

A 2024 EcoVadis survey suggests that even external stakeholders remain skeptical about companies’ true commitment to ESG.

As it turns out, 46% of suppliers believe their customers’ sustainability commitments matter “only on paper.”

llustration: Veridion / Data: EcoVadis

The problem is that if you don’t track your progress, ESG goals can become stagnant, and you may unknowingly fall short of compliance and improvement targets.

Just look at Facebook and its parent company, Meta.

Recently, Meta agreed to pay $1.4 billion to Texas for illegally collecting biometric data without proper consent.

Source: Financial Times

This perfectly illustrates how, if you fail to track your ESG performance—especially in areas like data privacy and ethical AI use—you may only realize your shortcomings when regulators force you to.

So, how do you avoid this fate?

Simple: track your ESG goals like your business depends on it—because it does.

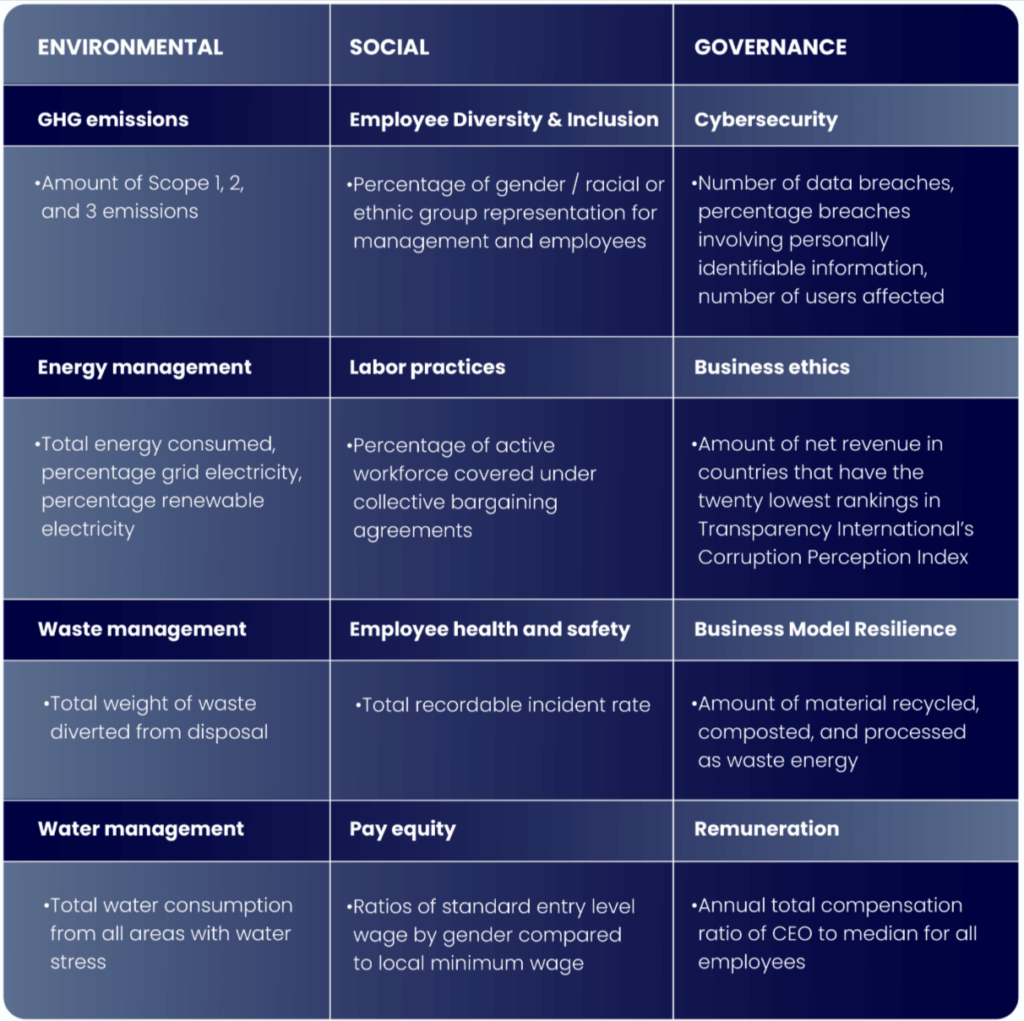

Start by setting clear KPIs, both quantitative and qualitative, to accurately measure performance.

Here are some ESG metric examples from Novisto that are worth considering:

Source: Novisto

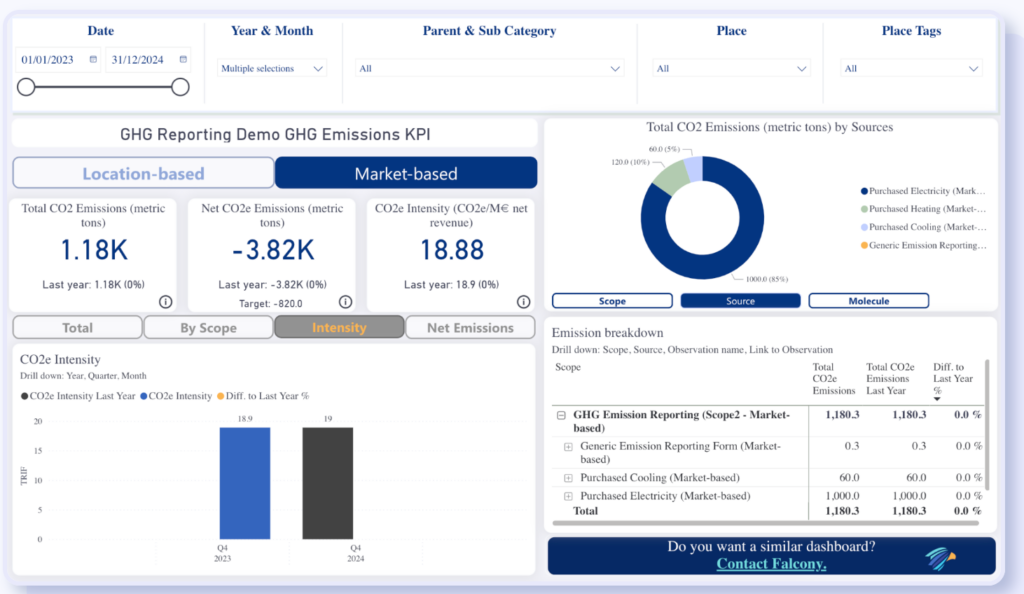

If you’re using ESG management software, tracking becomes even easier.

The system collects and analyzes data for you, turning vast amounts of data into actionable insights through dashboards and reports, as shown below.

Source: Falcony

That means fewer errors, more precision, and improved efficiency.

Remember: if you don’t track, you can’t comply.

So, stay vigilant, monitor your progress, and keep improving.

By steering clear of these common mistakes and adopting smarter ESG strategies, you’re not just ensuring compliance.

You’re building a more resilient, ethical, and profitable business.

In fact, those that prioritize ESG the right way don’t just survive regulatory changes.

They thrive, attracting top talent, investors, and loyal customers along the way.

So, when implementing tips from this article, don’t do it out of obligation.

Do it because it’s your shortcut to true, sustainable success.