The Full Guide to ESG Data

Key Takeaways:

Investors, consumers, and regulatory bodies increasingly prioritize sustainability and social responsibility.

Naturally, access to accurate ESG data has never been more vital.

But where do you get this data?

And why exactly do you need it?

Those are the questions we’ll be answering in this article.

Read on to learn more about ESG data and how you can harness its full potential to drive both sustainability and profitability within your organization.

ESG data provides insights into a company’s environmental, social, and governance (ESG) attributes.

It can be broadly categorized into three key areas:

| Environmental data | Measures a company’s impact on the environment, including carbon emissions, energy usage, water consumption and pollution, waste management, biodiversity impact, climate risk exposure, etc. |

| Social data | Assesses a company’s impact on people, including employees, customers, and communities. It entails insights on workforce diversity and inclusion, employee well-being, labor practices, human rights policies, etc. |

| Governance data | Evaluates corporate leadership, ethics, and transparency, covering areas such as board composition, business ethics and anti-corruption policies, tax transparency and compliance, etc. |

As ESG considerations become increasingly important, so does access to this kind of data.

It’s used by investors, analysts, companies, policymakers, and consumers to make better-informed decisions about an organization’s effectiveness, risk, and sustainability.

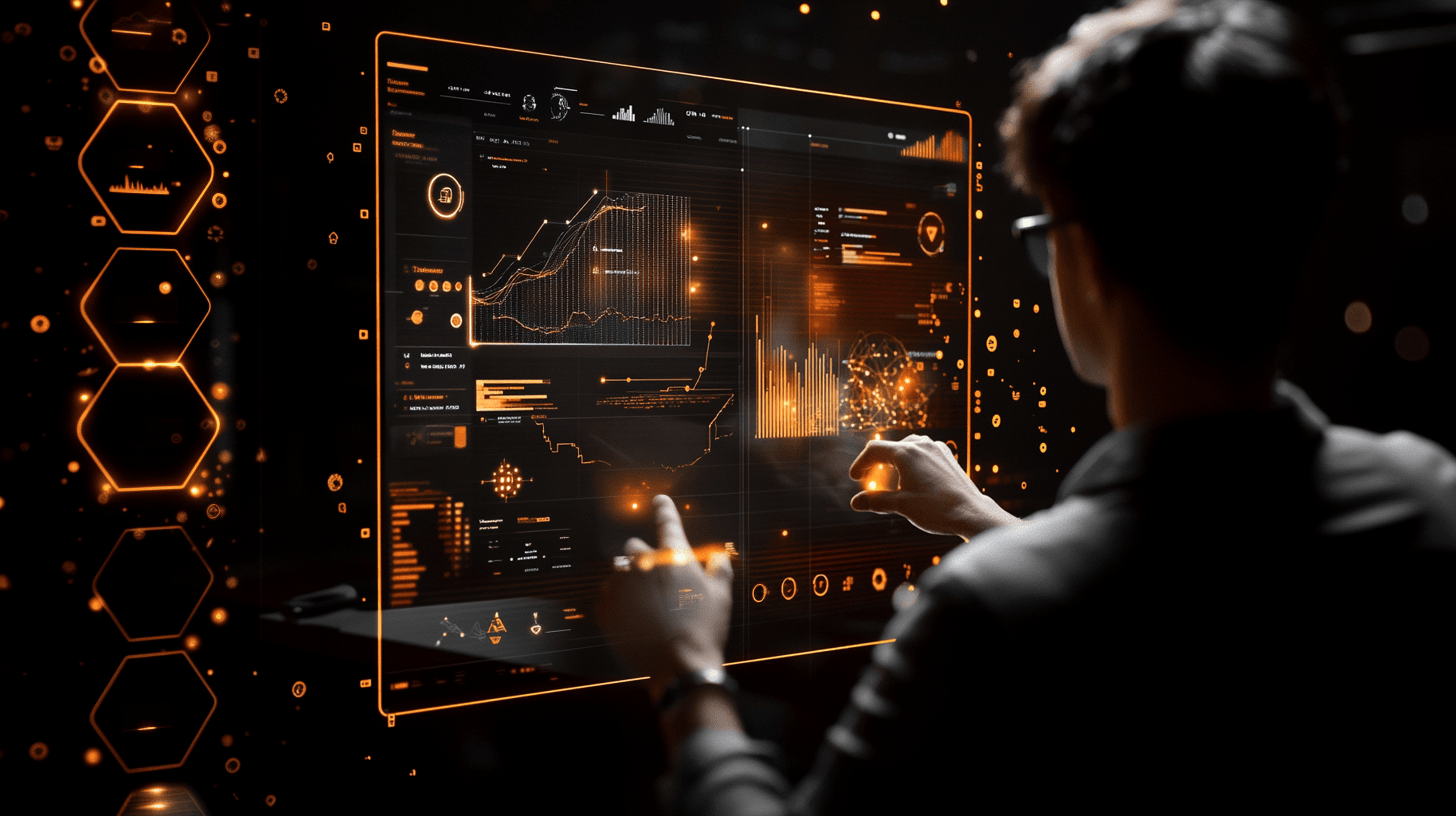

A 2024 survey by the Thomson Reuters Institute shows just how crucial ESG is nowadays.

As it turns out, 71% of C-suite and functional leaders agree or strongly agree that their company is willing to invest in ESG as a competitive advantage—up from 60% in 2023.

Additionally, 82% believe ESG’s role in corporate performance will grow, compared to 72% in the previous year.

Illustration: Veridion / Data: Thomson Reuters

In short, the focus on ESG is quickly growing.

And at the heart of it all?

Accurate, up-to-date, and comprehensive ESG data.

Only with this type of information can companies track, measure, analyze, and ultimately improve their performance and minimize risk.

Now that you understand what ESG data is, let’s go over some specific ways organizations benefit from it.

With ESG data, you can track and manage the company’s ESG performance as well as provide accurate and verifiable ESG reports when the audit time rolls around.

That way, you ensure compliance with regulations, frameworks, and standards related to environmental and social issues, such as:

Remember, ignoring ESG regulations can be a huge risk.

Regulatory bodies are cracking down, and businesses that don’t align with these rules face serious consequences.

Take investment advisory firm WisdomTree, for example.

In 2024, the SEC charged them with failing to adhere to their own investment criteria for ESG-marketed funds.

The company promised that these funds excluded companies involved in fossil fuels and tobacco, yet the SEC found that wasn’t the case at all.

Source: ESGDive

Without admitting or denying the SEC’s findings, WisdomTree agreed to a cease-and-desist order, censure, and a $4 million civil penalty.

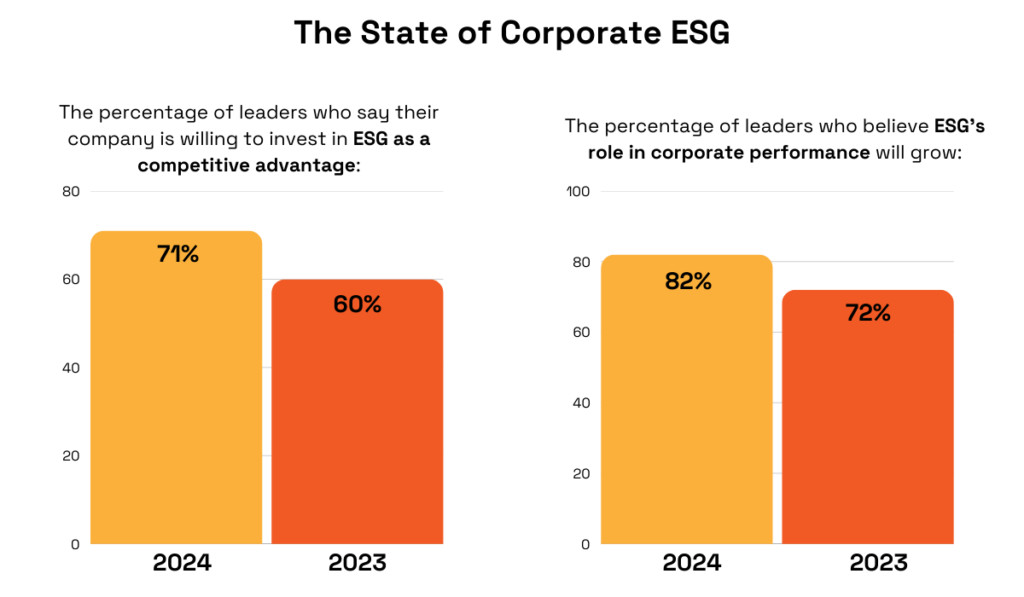

And the stakes are only getting higher, says Kurt Gottschall, a partner at law firm Haynes Boone and former SEC lawyer:

Illustration: Veridion / Quote: Responsible Investor

So, to avoid these hefty fines, you need ESG data that’s up-to-date, substantiated, and truthful.

Not only does such data help you proactively address areas of potential noncompliance within your operations, but it also provides demonstrable proof of adherence to relevant regulations.

When you think about ESG initiatives, saving money might not be the first thing that comes to mind.

But it can be.

ESG data is crucial for efforts like energy efficiency, waste reduction, and responsible sourcing, all of which help eliminate resource inefficiencies and cut costs over time.

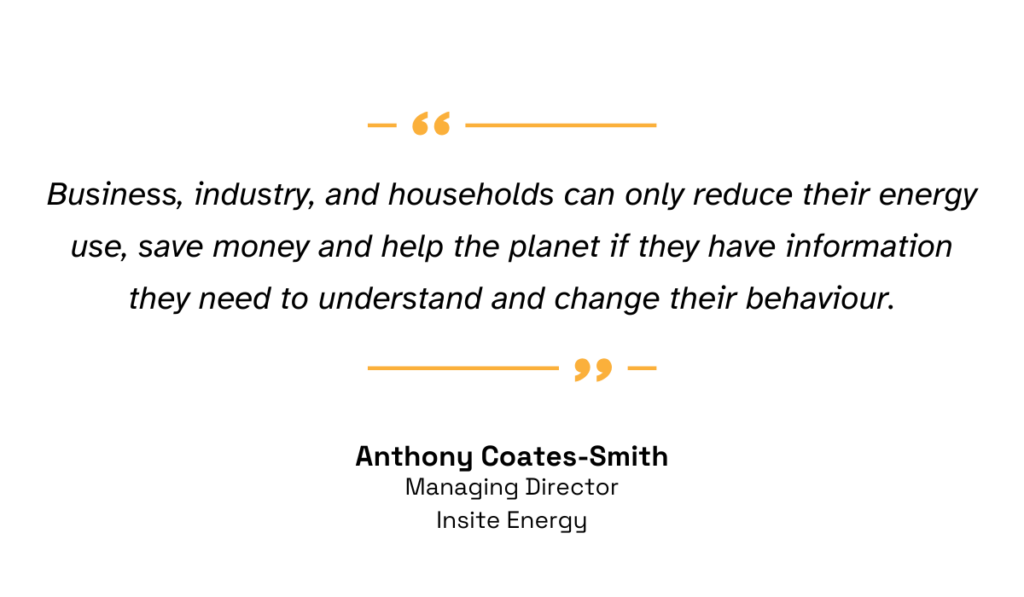

Anthony Coates-Smith, Managing Director at Insite Energy, a heat network operations services provider, puts it best:

Illustration: Veridion / Quote: Illuminaire

With reliable data, you can make decisions that make sense for both the planet and your budget.

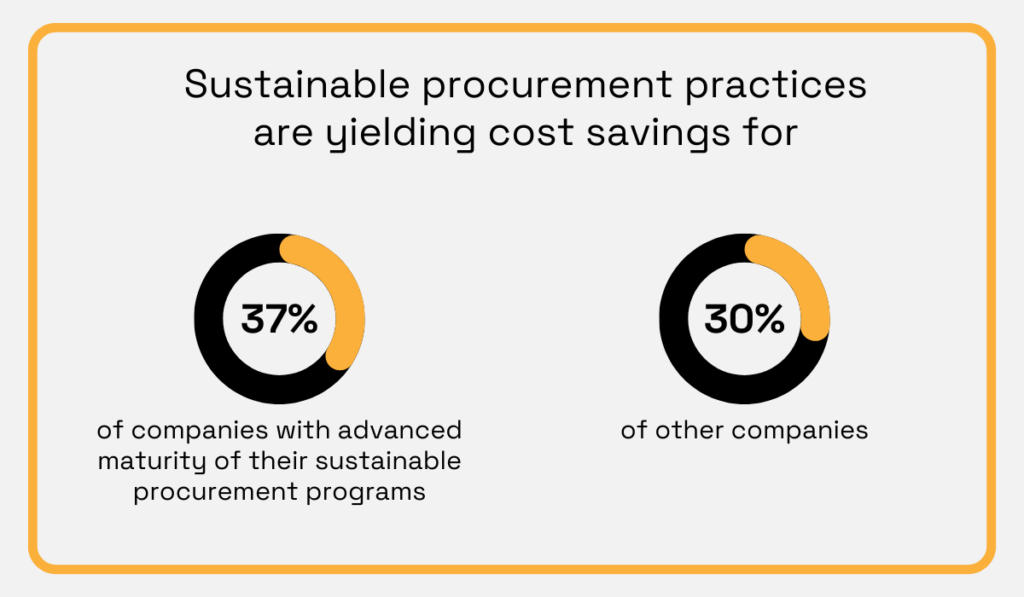

And the numbers back this up.

A 2024 EcoVadis and Accenture survey found that around 30% of companies are already saving money through sustainable procurement practices.

Illustration: Veridion / Data: EcoVadis

Take Schneider Electric, a global leader in electrification, automation, and digitization, for example.

Recognized as the world’s most sustainable company by Time Magazine and Corporate Knights, Schneider has embedded sustainability into its core business strategy—and it’s paying off.

Chris Leong, their Chief Sustainability Officer, explains:

Illustration: Veridion / Quote: CNBCTV 18

For instance, Schneider adopts a circular economy approach, designing products to last longer, function more efficiently, and be reused.

That way, they minimize raw material consumption and waste while driving cost savings.

Their strategy proves that sustainability and profitability aren’t opposing forces at all.

They’re two sides of the same coin.

ESG data helps companies communicate their commitment to sustainability and social responsibility to the public.

This transparency can, in turn, boost company reputation, build trust, and even attract new customers who value ethical business practices.

Tim Kraft, Associate Professor at NC State Poole College of Management, puts it this way:

Illustration: Veridion / Quote: Poole College of Management

Because of this, they can make more educated decisions when purchasing products and choosing which brands to support.

And the brands they want to support are those that promote sustainability and ethical business practices.

In fact, Kraft further notes that when companies properly convey their sustainability efforts, they not only build consumer trust but also increase consumers’ willingness to buy their products.

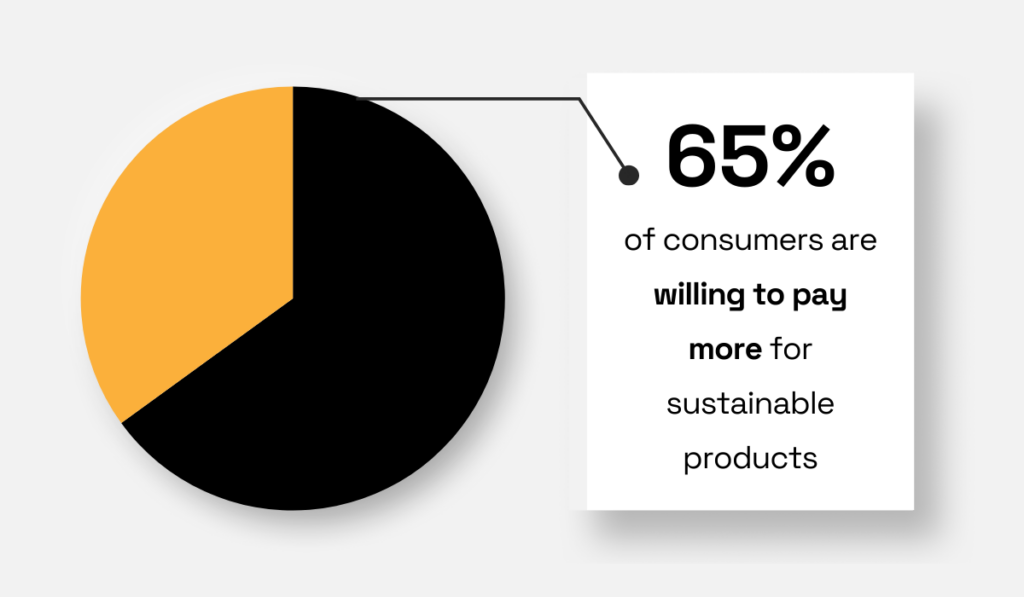

This is in line with the findings from a 2025 BlueYonder survey, which shows that 65% of consumers are willing to pay more for sustainable products.

Illustration: Veridion / Data: BlueYonder

But trust doesn’t happen overnight.

To win over conscious consumers, companies must back up their claims with real, verifiable ESG data.

Lou Blatt, Senior VP and CMO at OpenText, explains the role of information in this context:

“And the key to building an ethical supply chain is information. Organizations need to have the tools and technologies in place to access data from not only their suppliers, but also their suppliers’ suppliers, and make that information accessible to partners and customers.”

Simply put, ESG data helps businesses prove they’re walking the talk, reinforcing trustworthiness and credibility across their entire supply chain.

As a result, they become much more attractive to new customers, some of whom are willing to pay a premium for sustainable products.

It’s not just consumers who care about companies’ ESG practices—employees value these issues, too.

This means that, by demonstrating a commitment to sustainability and social responsibility, you can unlock increased employee loyalty, better recruiting outcomes, and improved retention.

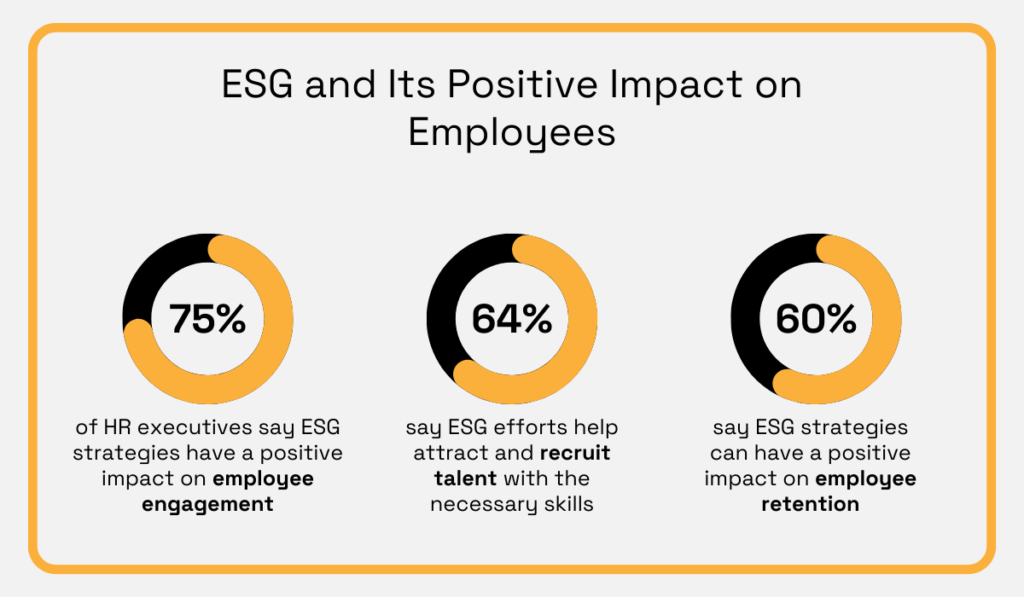

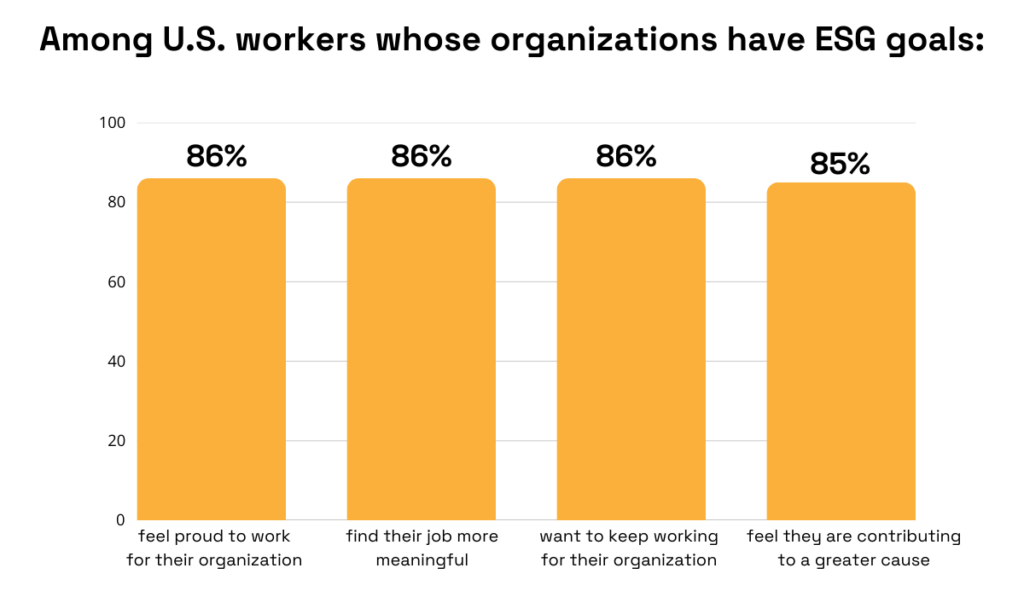

A 2023 SHRM survey backs this up.

It found that 75% of HR executives believe ESG strategies positively impact employee engagement, while 60% say ESG initiatives enhance retention.

Plus, 64% report that ESG efforts help attract and recruit talent with the necessary skills.

Illustration: Veridion / Data: SHRM

But why does ESG matter so much to employees?

The same survey offers insights from workers’ perspectives.

As it turns out, among U.S. workers whose organizations have ESG goals, 86% feel proud to work for their company and find their job more meaningful.

Additionally, 85% believe they are contributing to a greater cause.

Illustration: Veridion / Data: SHRM

Essentially, people want to feel that their company is making a real, positive impact on the world.

This sentiment is especially strong among younger workers.

Rachel Murray, Wellbeing and Benefits Manager at the law firm Latham & Watkins, explains:

Illustration: Veridion / Quote: The HR Director

Many Gen Z workers, in particular, feel a strong responsibility to protect the environment, says Murray.

So, when they see their employer falling short on sustainability, it can take a toll on their well-being and mental health.

But, by using ESG data to show real progress, organizations can reassure employees that they’re working toward a better future—not just for society but for their workforce as well.

We’ve discussed the many benefits of ESG data, but where can you actually find it?

And more importantly, how can you be sure that it’s truly reliable?

When it comes to ensuring information quality, the safest bet is AI-powered big data platforms.

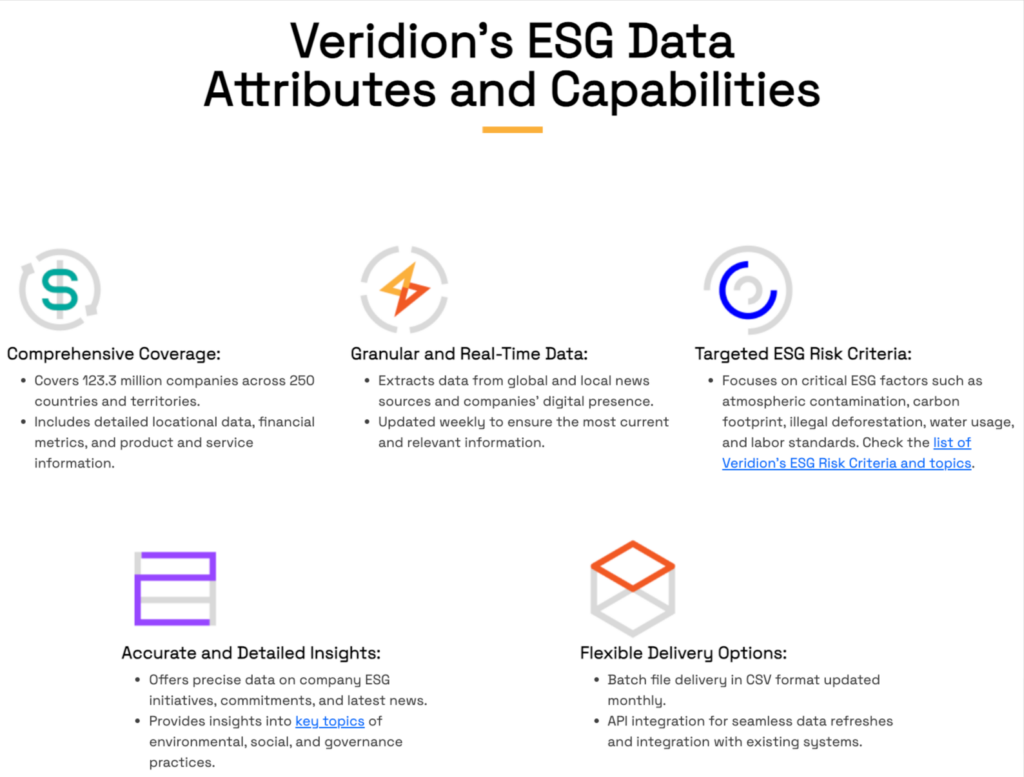

Veridion is one of them.

Gone are the days of having to manually sift through countless data sources.

Veridion automates data gathering, providing access to a global database that covers over 120 million companies across over 200 geographies.

Source: Veridion

Plus, Veridion tracks updates for every company on a weekly basis, so you never have to worry about incomplete or outdated information.

In fact, thanks to our unique data manufacturing process, we deliver greater accuracy than any other provider.

| Data Extraction and Analysis | Veridion extracts and analyzes data from company websites and news sources to ensure our profiles reflect both company statements and public perception. |

| Data Classification | Data is classified using a rigorous ESG taxonomy organized into Pillars, Themes, and Risks. |

| Sentiment Analysis | We incorporate sentiment analysis to evaluate the tone and intent behind ESG actions. This allows us to compare public commitments with actual performance, offering a more comprehensive picture of ESG effectiveness. |

| Profile Enrichment | ESG profiles are enriched with additional firmographic attributes, such as company location, products, services, NAICS classification, employee count, and revenue. This provides context to ESG efforts within broader business operations. |

The result of this meticulous process is an exceptionally rich, broad, and accurate set of business profiles that cover a wide range of ESG topics.

You can see these topics in the image below.

Source: Veridion

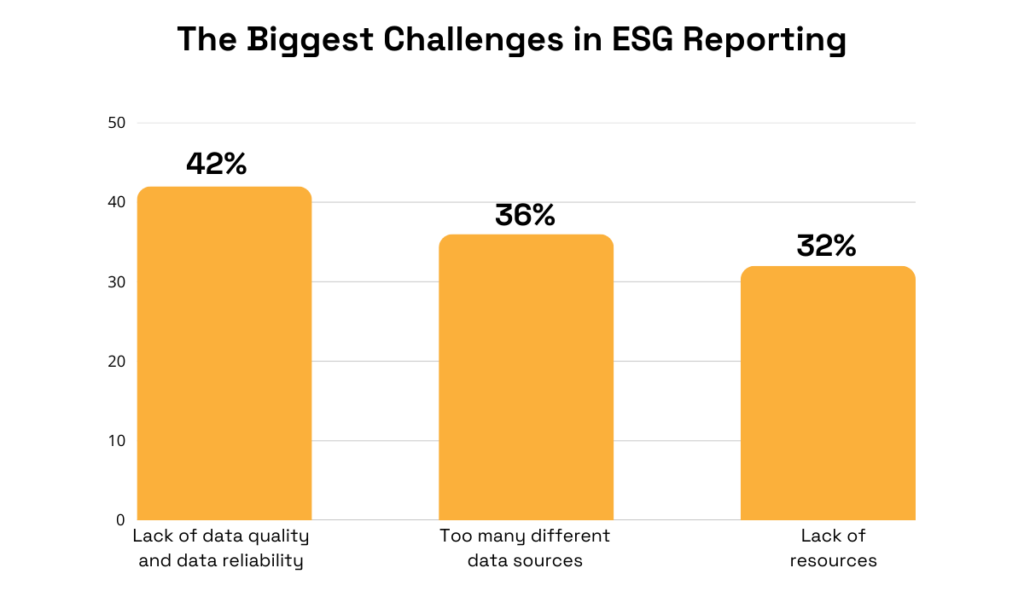

At the end of the day, ESG is a very data-intensive challenge.

But compiling data is no easy feat, especially if you don’t have any tools to help you out.

A 2023 BARC survey confirms this, revealing that the biggest hurdles in ESG are poor data quality, unreliable sources, and a lack of resources.

Illustration: Veridion / Data: BARC

Luckily, Veridion eliminates these issues by continuously scraping the internet for the latest information and using only the most reliable sources, all with little to no effort on your part.

Ultimately, this ensures that you always have a complete and up-to-date picture of the business landscape, empowering you to integrate sustainability into your core operations with confidence.

ESG pressures are here to stay.

To navigate these new challenges and meet stakeholder demands, you need reliable insights into your own and your partners’ sustainability performance.

That’s where ESG data comes in, empowering you to make informed decisions and proactively manage potential risks.

And ultimately, with such data-driven strategies, you can build a more sustainable world while strengthening your bottom line and competitive edge.

It’s a win on all fronts.