5 Reasons Why ESG Data Is Important for Procurement

Key Takeaways:

More and more companies are using ESG data to find, evaluate, and select suppliers. But many are still on the fence.

Some feel like they don’t have the skills they need to leverage it. Others just want to avoid investing in one more software or data provider.

But the pros of ESG-driven procurement far outweigh the cons, and will become only more important in upcoming years.

In this article, we’ll look at the five top reasons why ESG data is important.

Let’s dive in.

ESG data allows procurement professionals to evaluate suppliers not just by cost or quality, but also by sustainability performance.

And, according to most industry leaders, this will become only more critical in the coming years.

KPMG’s Future of Procurement report from 2024 shows that the majority of the surveyed senior procurement professionals believe that regulatory and ESG demands will heavily influence sourcing in the next 3 to 5 years.

Illustration: Veridion / Data: KPMG

Suppliers will increasingly be expected to show strong ESG performance and regulatory compliance, with sustainability playing a central role.

Procurement, on the other hand, will be in charge of choosing suppliers that best fit the sustainability bill.

This should come as no surprise.

Companies have plenty of reasons to prioritize ESG-compliant suppliers.

One is that without them, companies can’t achieve their own ESG goals.

By working with unsustainable suppliers, they’ll likely struggle to remain competitive in an increasingly environmentally conscious market.

Plus, they’ll find it difficult to meet not just regulatory requirements, but also customer and investor expectations.

It’s a losing strategy on every front.

Nawar Alsaadi, founder and CEO of Kanata Advisors, a Toronto-based ESG Fintech advisory firm, agrees:

Illustration: Veridion / Quote: LinkedIn

The bottom line is: choosing sustainable suppliers is important for more reasons than one.

But doing so is often easier said than done.

For starters, companies need reliable data that will empower them to evaluate the sustainability performance of potential suppliers.

This includes metrics such as suppliers’ atmospheric contamination, carbon footprint, illegal deforestation, and water usage.

And that’s exactly where things get tricky.

Why?

Because most companies don’t have the resources to collect and verify such data on their own.

Luckily, supplier data providers like Veridion solve this issue.

Veridion equips procurement teams with all the data they need to assess suppliers’ greenhouse gas (GHG) emissions, biodiversity, and other ESG factors, as seen below.

Source: Veridion

It offers extensive data, detailed insights, and updates in four major areas:

The data also gets updated weekly, ensuring you’re always making decisions based on the latest, most accurate information.

And the best part is, you can simply describe exactly what you need using natural language.

For example, you can search for sustainable suppliers using a prompt like this one:

Find suppliers of sustainable packaging materials (e.g., recycled, biodegradable, or reusable) with low carbon footprints and third-party ESG certifications.

Veridion will find the best matches in seconds:

Source: Veridion

This type of supplier discovery is critical for aligning procurement with company ESG goals.

But the efforts can’t stop there.

Your entire sourcing process—from supplier scoring and tendering to onboarding—should be influenced by ESG priorities.

If sourcing aligns with them, sustainable suppliers will be scored more favorably, stand out more clearly during tendering, and move through onboarding faster thanks to their alignment with ESG standards.

In short, sustainability and other ESG priorities should guide who you discover, but also how you evaluate, select, and onboard them.

Providers like Veridion give you the data foundation to make that happen.

Procurement teams are under pressure to deliver on a critical task: ensure that supply chain risks are detected on time and managed properly.

In fact, according to a 2024 report from Economist Impact, 86% of C-suite executives trust procurement to conduct supplier risk and performance management, as well as deal with contingent labor and service providers.

Illustration: Veridion / Data: Economist Impact

This shows healthy confidence in procurement.

But it also means they’ll likely take the heat if issues do come up.

There’s no denying that supply chains can expose companies to a number of risks, mainly because companies often lack visibility over their suppliers.

These risks are mainly driven by ESG factors, like corruption or labor rights abuses.

Even the biggest companies, like Volkswagen, have experienced the negative effects of these risks firsthand.

In 2024, thousands of Volkswagen vehicles ended up getting seized by US customs over a suspicion that some electronic components were produced through forced labor in China.

Source: Euronews

Two individuals with insider knowledge reportedly said that Volkswagen wasn’t aware of the origin of the components in question.

However, not knowing the risks you’re dealing with doesn’t mean they won’t harm you.

Quite the contrary.

Knowing the risks allows you to mitigate them in advance or choose not to work with risky suppliers in the first place.

This is possible to achieve regardless of how many suppliers you have or how complex your requirements are.

The BMW Group, for example, has an incredibly vast, global supply chain.

But this doesn’t stop them from ensuring their suppliers aren’t exposing them to ESG-related risks.

According to the company representative, suppliers are contractually obliged to meet ESG due diligence standards.

If they fail to do so, the company takes appropriate measures.

Illustration: Veridion / Quote: Supply Chain Digital

If BMW can do it, you can do it, too.

Use ESG data to assess suppliers’ risk profiles, avoid unethical practices, and ensure long-term operational stability.

And don’t forget to establish clear ESG standards that your suppliers can follow and, more importantly, hold them accountable if they violate them.

Between 2011 and 2023, ESG regulations increased by 155% compared to the previous period.

And many new regulations are already on the horizon.

For example, California climate law is set to take effect in 2026, obliging companies to disclose their Scope 1, 2, and 3 GHG emissions, both upstream and downstream.

New York state is also considering legislation that would require companies to disclose how they’re trying to eliminate human trafficking within their supply chain processes.

So, it’s expected that other states and countries are likely to follow suit.

This puts even more pressure on procurement to avoid the ever-growing number of landmines that could put their companies at risk.

What’s worse, procurement teams aren’t the only ones aware of this.

Leadership is, too.

As many as 70% of executives consider legal and regulatory non-compliance the main external risk threatening their companies, according to the aforementioned Economist Impact report.

They are also turning to procurement for solutions, ranking sustainability and ESG objectives as the second-highest priority for procurement.

Illustration: Veridion / Data: Economist Impact

But meeting complex regulatory requirements is simply not possible without access to supplier ESG data.

A case study from Chartis Research illustrates this perfectly.

After Russia invaded Ukraine, a Swedish public agency had to adhere to a sanctions program covering its entire supply chain.

To do so, the agency needed to implement a new ESG due diligence program for over 2,000 suppliers.

The problem? It lacked the necessary ESG data for 75% of its supplier base.

Source: Chartis

The agency tackled this by adopting an ESG portal, which equipped it with more comprehensive ESG supplier data, helped validate it, and gave the agency insights into suppliers’ ESG rankings.

While this certainly helped them comply with the new regulations, it also resulted in other added benefits, like improved risk awareness.

So, while your main goal at the moment may be just ticking the compliance box, try to consider how you can take things a step further, too.

As we’ll see next, going the extra mile pays off.

ESG compliance is becoming critical for building and maintaining a positive corporate reputation.

More and more customers want to know that what they’re buying comes from ethical, transparent supply chains, and ESG data plays a big role in that.

The PwC 2024 Voice of the Consumer Survey found that consumers are, on average, willing to spend 9.7% more for sustainably produced or sourced goods.

Perhaps that’s the case because 85% of them also say they experienced the disruptive effects of climate change in their daily lives.

So, it makes sense they want to support companies that are trying to make things better.

Illustration: Veridion / Data: PwC

But consumers aren’t just drawn to products labeled as sustainable. They also respond well to products with any kind of ESG-related claim.

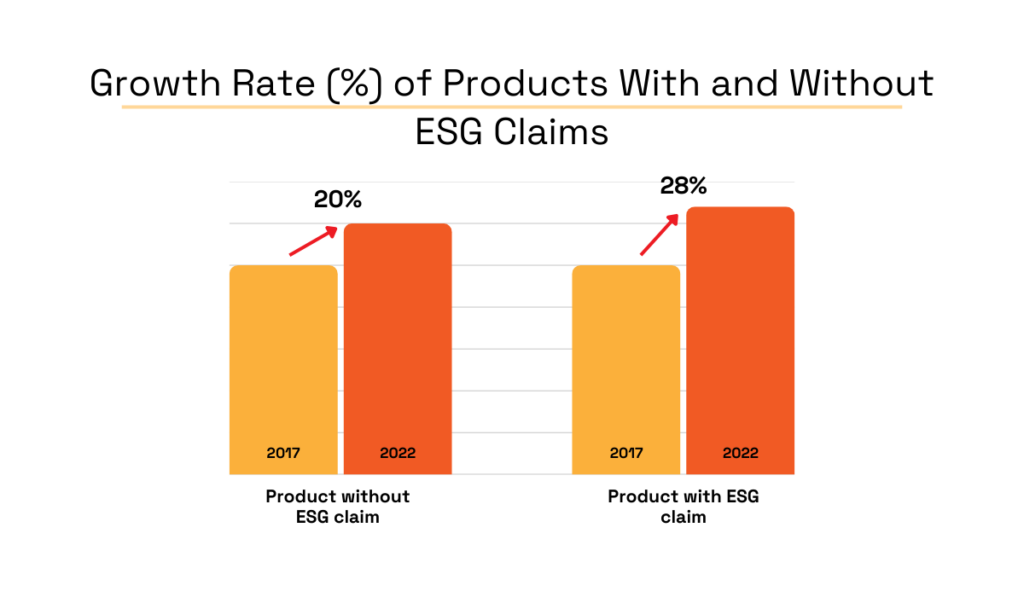

McKinsey research shows that, from 2017 to 2022, products with claims like “vegan” or “biodegradable” saw 28% cumulative growth.

Products without such claims, on the other hand, grew more slowly at a rate of 20%.

Illustration: Veridion / Data: McKinsey

But it’s not just consumers who prefer companies with sustainable and ethical practices.

Potential partners and investors do, too.

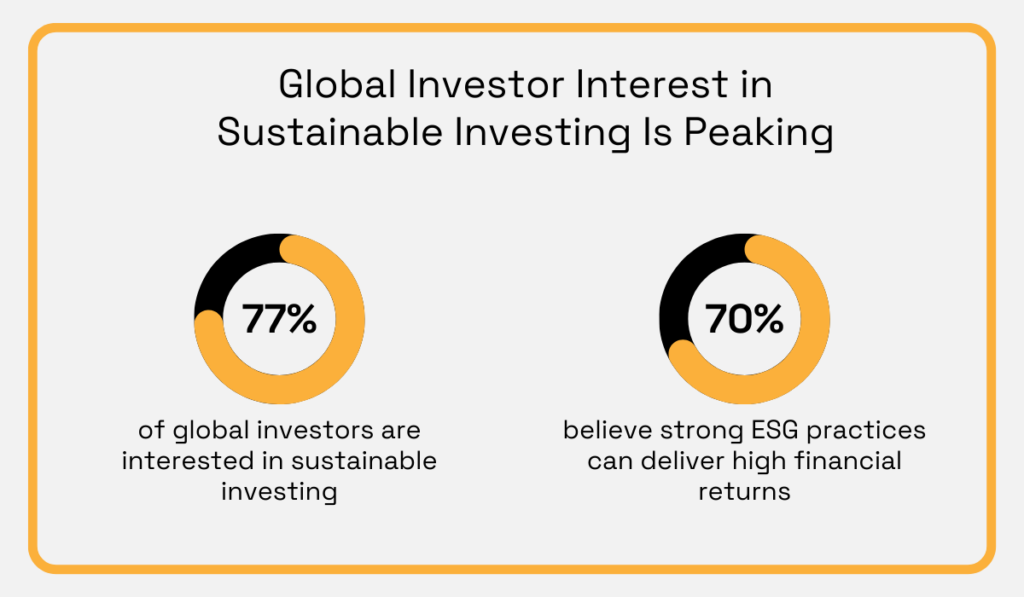

For example, Morgan Stanley’s 2024 research shows that interest in sustainable investing is both high and growing, with over three-quarters of investors now expressing interest.

While that may be so for many reasons, one that stands out is that 70% of them also believe that strong ESG practices can lead to strong financial returns.

Illustration: Veridion / Data: Morgan Stanley

So, there’s no shortage of reasons why companies should prioritize ESG compliance.

And many are indeed taking note.

Patagonia, for example, built its entire brand on environmental sustainability, while 90% of S&P 500 companies now regularly publish ESG reports.

Many of these companies have learned the main lesson: ethical and sustainable practices are a must for attracting investors and partners and driving customer loyalty.

To do the same, make sure ESG data informs your supply chain decisions.

Higher upfront costs often keep companies from shifting to ESG-compliant procurement.

It often requires investing in software, databases, and other solutions that give you access to verified ESG data.

Then, you may also need to invest in employee training.

Finally, supplier evaluation may become longer and more complex, translating to higher costs.

However, despite all of this, ESG compliance does pay off.

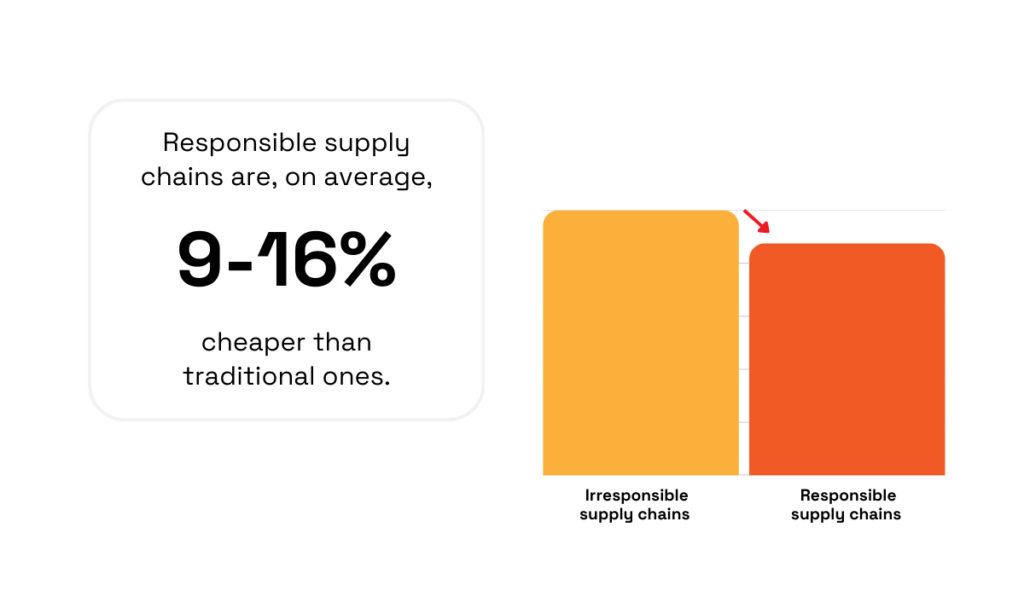

In fact, the World Economic Forum found that responsible supply chains are actually 9% to 16% cheaper.

Illustration: Veridion / Data: World Economic Forum

Several factors contribute to these cost savings.

The most obvious one is that compliant suppliers help companies avoid fines and reduce unexpected costs, like the costs of product recall or customs delays due to non-compliance.

On top of that, according to McKinsey, ESG-conscious companies focus more on finding ways to boost operational efficiency and reduce waste.

This naturally cuts costs, even if that’s not the main objective.

A third contributing factor is fewer supply chain disruptions, a benefit linked to choosing suppliers based on ESG data.

This is no small thing, considering that disruptions can eat up as much as 6% to 10% of a company’s annual revenue.

Illustration: Veridion / Data: Economist Impact

Finally, we shouldn’t overlook the fact that ESG-compliant procurement also gives companies access to more favorable contracts they wouldn’t qualify for otherwise.

For instance, a study found that companies with poor Environmental and Social (E&S) performance are 24% less likely to have their contracts renewed or renegotiated.

In case renegotiation does happen, these companies usually get worse terms.

Again, a losing strategy on all fronts.

The bottom line is that, even though incorporating ESG data into your procurement processes requires an initial investment, it can bring a substantial ROI down the line.

Besides, ESG compliance is no longer negotiable.

Cost efficiency is just an added reason to make the switch as soon as possible.

ESG data plays a big role in making smarter procurement decisions.

It helps reduce risk, cut costs, and build stronger, more sustainable supplier relationships.

As new regulations roll in and expectations from investors, partners, and consumers continue to grow, having access to this data will give you a serious advantage.

But it’s not about being perfect from day one.

Rather, it’s about making steady progress.

The sooner you begin integrating ESG into procurement, the better positioned you’ll be to navigate change and justify the trust you get from leadership.