5 Big Challenges of ESG Data Management

Key Takeaways:

ESG and sustainability are key topics these days.

Investors, regulators, and stakeholders increasingly want to know how companies perform not just financially, but also in terms of environmental impact, social responsibility, and governance.

But as the demand for ESG reporting grows, and regulations evolve, many companies are hitting roadblocks.

Collecting, analyzing, and reporting ESG data is anything but simple.

In this article, we’ll break down five of the biggest challenges companies face when managing ESG data—and why tackling them is key to staying compliant, credible, and competitive.

Let’s get started.

While there’s a growing focus on responsible sourcing across industries, ESG regulations and reporting frameworks have yet to be consolidated and unified.

This is largely because ESG encompasses a broad range of issues, and different regions and industries prioritize different aspects.

Navigating these regulations is a significant challenge, especially given the sheer number of regulations.

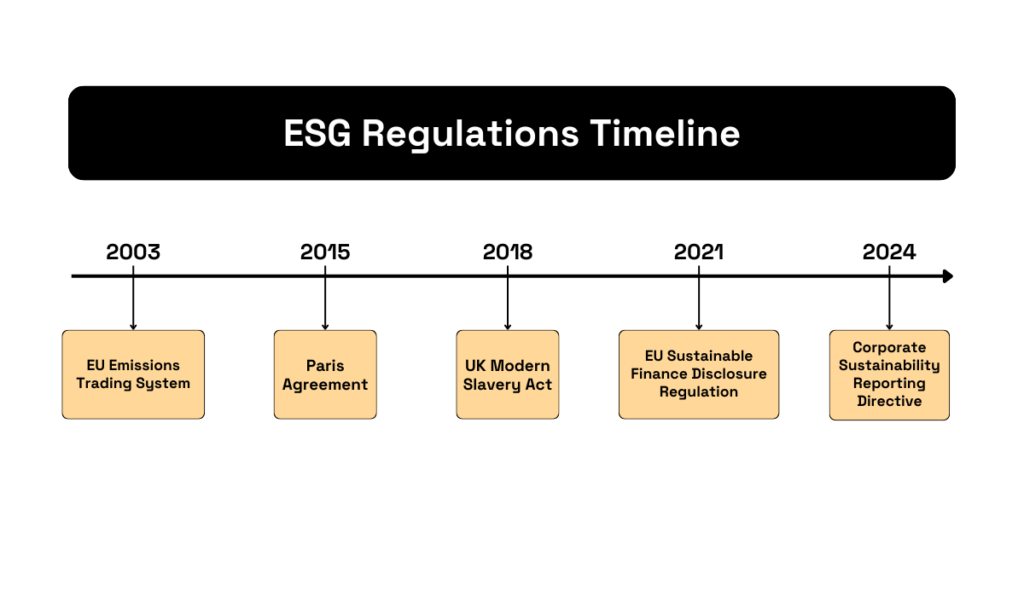

And data shows a continuous increase in regulations over the past decade.

Illustration: Veridion / Data: PR Newswire

According to ESG Book research, 1,255 new ESG regulations have been introduced worldwide since 2011, compared to only 493 between 2001 and 2010.

But, while difficult, keeping up with these regulations is necessary to protect yourself from current and future negative consequences, including legal risk, fines, and reputational damage.

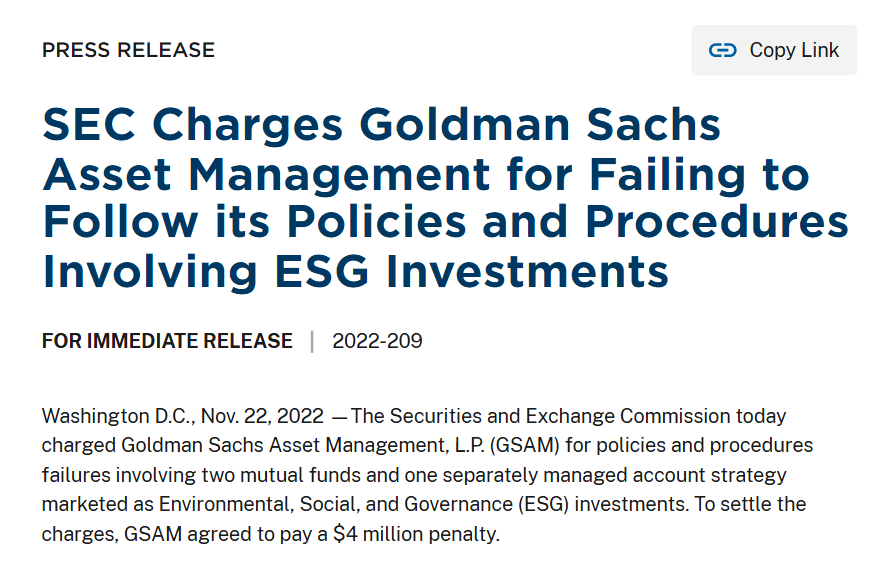

Take Goldman Sachs, for example.

In 2022, the SEC fined the firm for failing to both establish and consistently follow proper ESG policies and procedures.

Source: SEC

Despite branding its products as ESG-compliant to meet investor demand, Goldman Sachs didn’t deliver on its promises and was fined $4 million as a result.

To protect your own business from similar problems, focus on closely monitoring regulatory updates and understanding key ESG regulations in every country or region where you operate or source.

In the EU, for example, staying compliant requires navigating frameworks like:

To put this into perspective, here’s a quick timeline showing when these key regulations were introduced:

Source: Veridion

To meet these requirements, you have to evaluate your suppliers’ ESG practices and ensure they align with applicable directives.

It’s not easy—but it’s worth it.

As Eric Hensley, CTO and CSO of Aravo, puts it, adapting to these regulations ultimately benefits both organizations and the world at large.

Illustration: Veridion / Quote: Aravo

To summarize, a deep dive into your supply chain is crucial.

This involves evaluating not just your direct suppliers but also higher tiers of suppliers, subcontractors, and other partners throughout your value chain.

Doing so will minimize your own risks while contributing to a more sustainable and equitable global economy.

Even with modern technological advancements, many procurement teams still rely on manual processes, spreadsheets, and outdated systems for collecting and managing ESG data.

Naturally, this traditional approach creates management inefficiencies and prevents effective sustainability efforts.

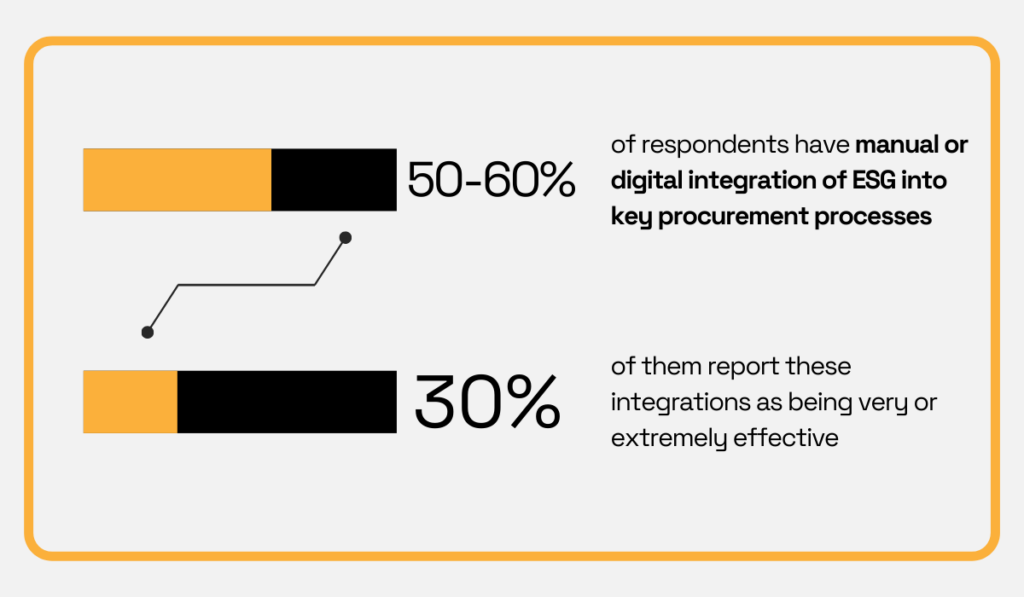

Take the CIPS 2024 Sustainable Procurement Barometer, for example.

The report, based on online surveys of both buyers and suppliers, clearly highlights suboptimal ESG data integration.

It shows that 40 to 50% of respondents lack any ESG data integration in their processes, whether that’s manual or digital.

Illustration: Veridion / Data: CIPS

Even among those who do have some level of integration, only few rate their current processes as truly effective.

Clearly, there’s room for improvement.

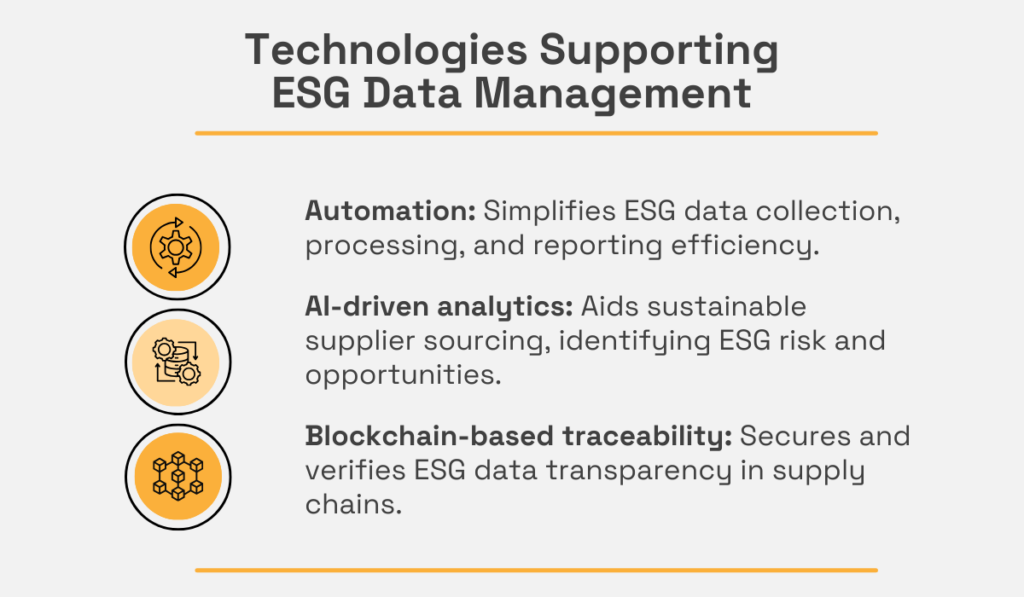

More specifically, three key technology areas offer solutions.

Source: Veridion

Many platforms out there use a combination of automation and AI-capabilities to simplify ESG data collection and management.

There are sourcing solutions like Veridion for supplier intelligence, systems like EcoVadis for sustainability ratings, SupplyShift for supply chain transparency, or even SAP Ariba for integrated procurement and ESG data management.

There’s also blockchain technology, with its decentralized and immutable ledger system, which offers transformative potential.

It enables real-time tracking of materials and products throughout the supply chain, ensuring ethical sourcing, reducing fraud, and verifying compliance with ESG standards.

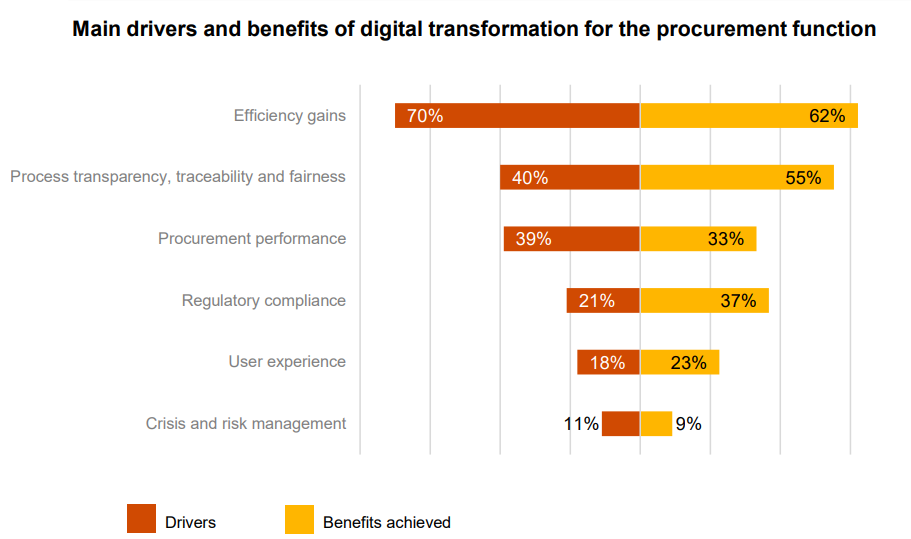

And these technologies drive results.

Consider this PwC data comparing drivers of procurement digital adoption with the actual reported benefits.

Source: PwC

The key benefits of adopting ESG technology—efficiency, transparency, and regulatory compliance—are all directly connected with ESG performance.

Simply put, using the right technologies is essential for effective ESG data management.

Platforms, blockchain, and advanced analytics offer powerful tools to overcome the limitations of manual processes, leading to higher quality data and unlocking the full potential of ESG.

ESG reporting is still in its early days.

With multiple frameworks already in place and many more emerging, companies are struggling to keep up.

Small and medium-sized enterprises (SMEs) are particularly affected.

In fact, they usually find themselves receiving many conflicting or uncoordinated requests like ESG questionnaires that ask for different information, each being structured and formatted differently.

And the result is significant ESG data gaps for procurement teams.

How can you build a comprehensive picture of your supply chain’s sustainability performance when your suppliers are reporting against different metrics, using different formats, and struggling to provide complete information?

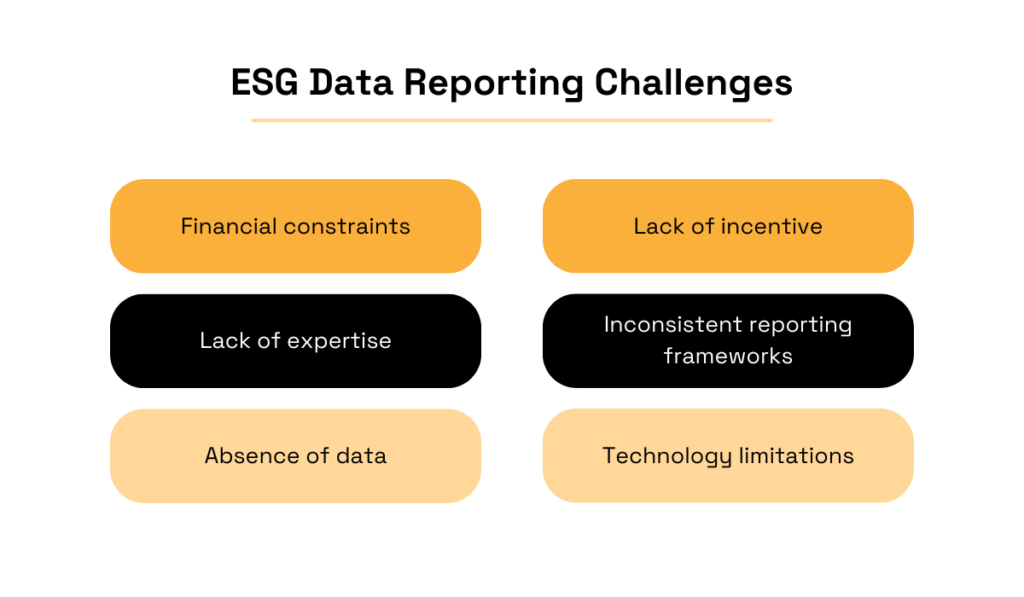

Unfortunately, the suppliers face several key challenges themselves when it comes to ESG data reporting.

Source: Veridion

These struggles ultimately create roadblocks and inconsistencies, making it harder for buyers to track and meet their ESG goals.

To address these challenges, it’s important to work closely with suppliers.

This means agreeing on a common ESG reporting framework that works for them while also meeting your company’s needs and industry standards.

Focusing on helping vendors give you the most important ESG data, shown below, is also key.

Source: Veridion

If these practices don’t work, you have a few other options.

One is trying to support and incentivize participation by providing training, resources, and even grants to help suppliers invest in ESG data collection and reporting.

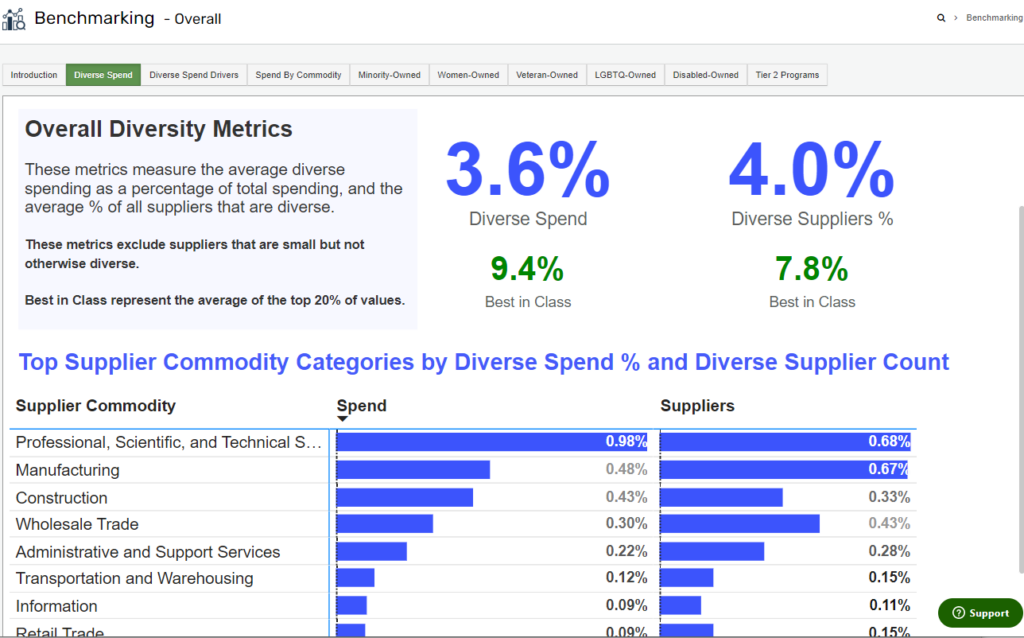

The second option is to use tools like Veridion, EcoVadis, SupplyShift, and Supplier.io, which can support your sustainability initiatives.

Supplier.io, for example, is a sustainability-focused platform that can be used to track and monitor your supplier diversity metrics as well as source new responsible suppliers.

Source: Supplier.io

This platform also provides reports on diverse spend drivers, the ownership status of your suppliers, and can even fill in data gaps by providing verified information on supplier greenhouse gas emissions.

Of course, when it comes to certain ESG data points, the responsibility still falls on suppliers.

But the increasing pressure on companies to improve transparency and reporting is a clear sign: things are starting to change.

Moving forward, collaboration, supplier support, and smarter use of technology will be essential to closing data gaps and overcoming the challenges of ESG data management.

Even when companies successfully gather ESG data from their suppliers, ensuring its quality remains a significant problem.

Consider this.

In Deloitte’s 2024 Sustainability Action Report, company executives were asked about their top three challenges regarding ESG data.

The vast majority put data quality on their list.

Illustration: Veridion / Data: Deloitte

More specifically, 57% of them cited data quality as the very top concern, highlighting the persisting difficulty in controlling incoming supplier data.

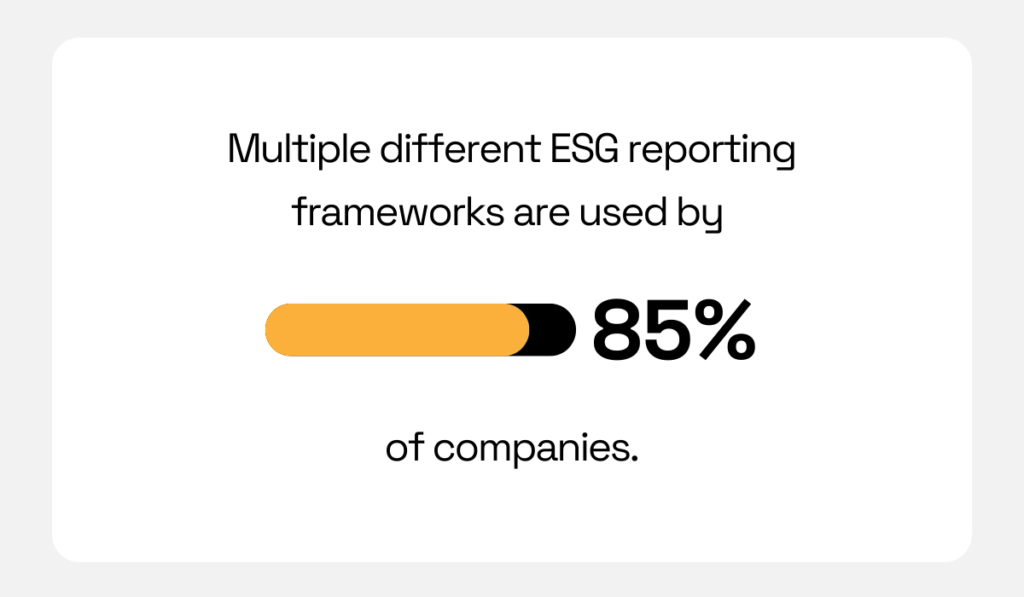

A major contributing factor is the lack of a unified, global ESG reporting framework.

This absence of standardization leaves suppliers and buyers without clear guidance on what data to collect and how to present it.

This is a reality for 85% of companies that, according to a 2021 FERF report, use multiple reporting frameworks for their ESG data.

Illustration: Veridion / Data: FEI

As mentioned earlier, the sheer number of frameworks, including GRI, SASB, TCFD, and CSRD, creates complexity.

This results in a scenario where some suppliers might report certain data points while others omit them entirely, leading to an incomplete and fragmented dataset.

Plus, if the methodologies used to collect and calculate data differ between suppliers, comparisons and data aggregations become unreliable.

Ultimately, this can make effective ESG data management and drawing data-driven conclusions incredibly difficult.

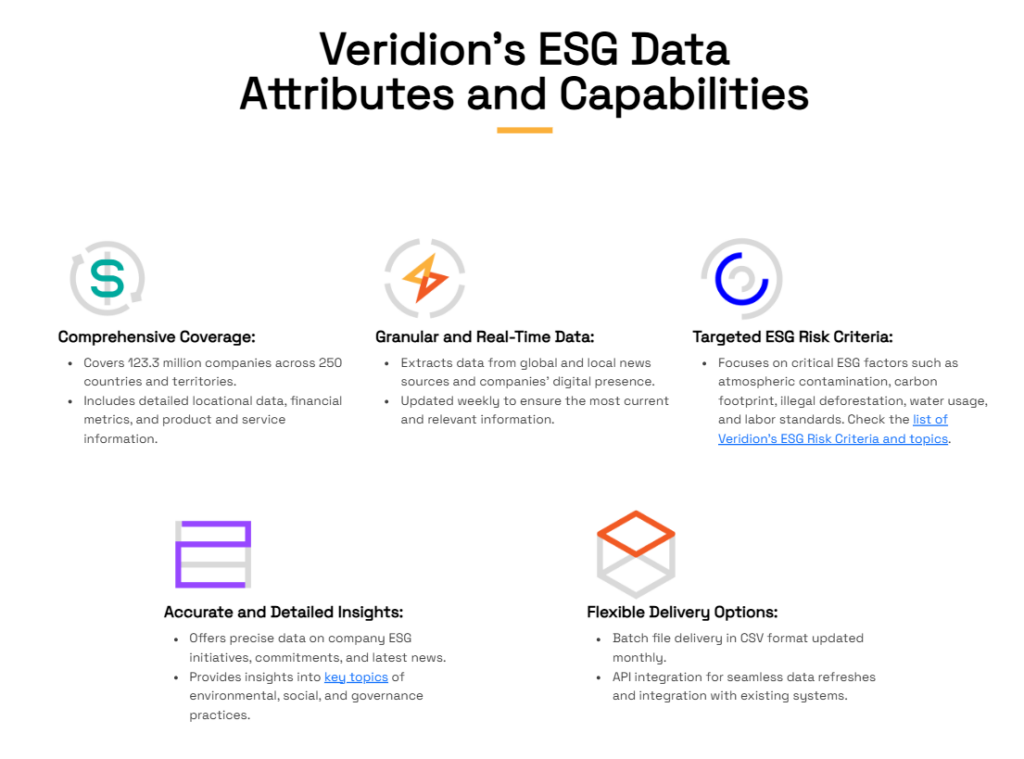

While the future may hold more unified standards, a current solution is to enhance supplier data with solutions like Veridion.

Our AI-powered data engine gathers information from various online sources, including public registries, corporate websites, social media, and news outlets.

Source: Veridion

This data is updated weekly, ensuring you’re working with the freshest insights when sourcing for suppliers or conducting their ESG assessments.

Our global database of over 120 million businesses provides more than 80 key data points for each company profile, including financial stability, ESG compliance, historical performance, and specific product offerings.

As you can see from the image below, the ESG data you get for each supplier is extensive.

Source: Veridion

Plus, Veridion’s Match & Enrich API allows you to supplement and standardize any type of supplier-provided data.

The API works by intelligently matching your existing supplier data with Veridion’s comprehensive database, enriching it with missing information, and standardizing it into a consistent format.

This ultimately increases confidence in the reliability and usability of your ESG data, enabling more informed decision-making and more effective sustainability initiatives.

Just as inconsistencies in supplier reporting frameworks create external data challenges, poor internal coordination can cause equally significant issues within an organization.

Having different departments on the same page regarding ESG data ensures consistent data collection and reporting.

It also empowers the organization to accurately assess its overall sustainability performance.

However, teams often have varying priorities and track different metrics based on their specific requirements.

For example, take a look at the next image illustrating the common ESG-related objectives of the procurement, finance, and compliance teams.

Source: Veridion

While these differing aims are understandable, problems arise when there’s a lack of coordination between teams or a unified approach to ESG objectives.

This lack of alignment can lead to duplicated efforts, conflicting data, and an incomplete understanding of the organization’s true ESG performance.

Pierre-Olivier Brial, CEO of Manutan, echoes this sentiment:

Source: Veridion / Quote: Manutan

He explains that procurement processes, in particular, are often hindered by siloed departments, which restrict access to crucial information.

For example, a procurement team might be unaware of the sustainability criteria prioritized by the product development team, leading to the selection of suppliers that don’t meet overall company ESG objectives.

To tackle this challenge, it’s essential to break down cross-team barriers.

This includes overcoming reluctance to collaborate, reconciling different data frameworks and metrics, and addressing the use of isolated software systems that prevent seamless data sharing.

Each barrier needs attention to foster a truly collaborative environment.

McKinsey suggests four measures to break down silos and unify your company initiatives:

Keeping teams informed about each other’s goals and the overall company ESG objectives is crucial, as is transparency with data, potentially achieved through consolidating data in unified systems.

An interesting approach is rotating executives between particularly siloed departments, as it can help bridge communication gaps and foster a shared understanding of different team priorities.

Overall, addressing this challenge requires company-wide support and participation.

However, with the right strategies and tools, achieving a unified and effective approach to ESG data management is possible.

With that, we’ll wrap up this article.

In these five sections, we’ve looked at the difficulties posed by evolving regulations, data gaps, and quality issues, as well as the critical role technology plays in addressing these challenges.

We’ve also touched on the importance of cross-team collaboration to ensure success in ESG data management.

By understanding these challenges, you can better prepare your organization to handle the dynamic ESG landscape.

Ultimately, your goal should be to enhance ESG reporting, meet regulatory standards, and build a more sustainable and responsible organization.