5 Types of Technology Used for ESG Data Management

Key Takeaways:

Managing ESG data has come a long way thanks to technology.

While some organizations are still stuck with spreadsheets and manual processes, the right tools can significantly improve ESG data management.

Think automation of tedious tasks, deeper insights, improved accuracy, and significant time savings.

In this blog, we’ll explore five key technologies that are transforming how organizations handle ESG data.

So, if you’re involved in sustainability, data analysis, or ESG reporting, keep reading to discover how these tools can benefit you and your organization.

An essential type of technology we’ll start with is data collection tools.

After all, extensive, high-quality data forms the basis of any successful ESG data management process.

Data collection tools are essential not only for gathering data from your existing systems but also for supplementing and expanding your databases with broader, external ESG data.

A great first step, according to Sustainserv managing director Matthew Gardner, is to understand your current data landscape.

Illustration: Veridion / Quote: ESG Dive

This means examining the data within your ERP, HR, and supply chain systems, as well as your CRM and asset management platforms.

These systems often hold valuable ESG-related information, though it might not be readily apparent or easily accessible.

Collecting this data can involve integrating with these systems directly through APIs or using specialized data extraction tools.

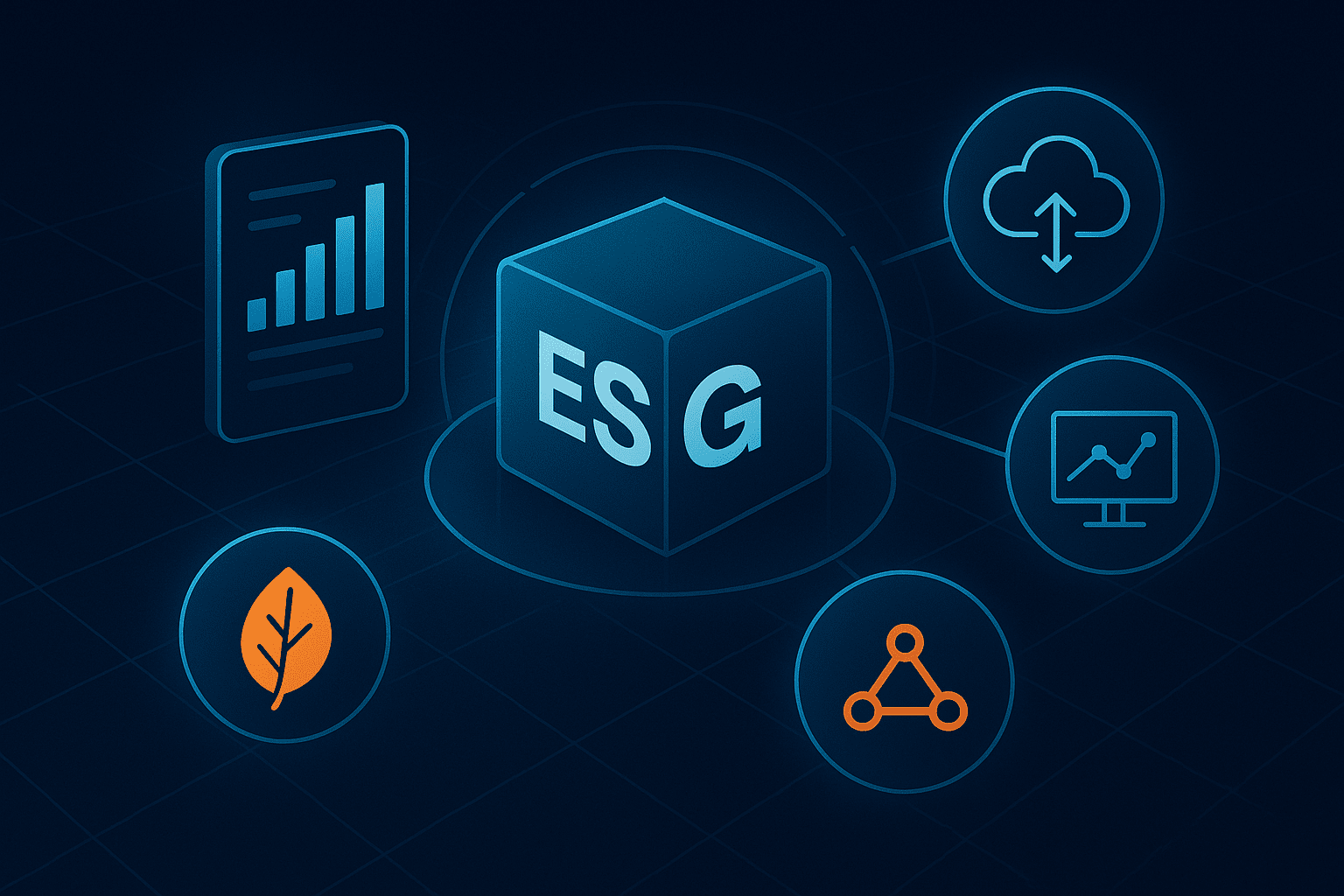

One such tool is Novisto, designed to collect and structure data from these often-siloed systems.

Source: Novisto

Novisto integrates directly with all your internal systems to automatically extract, structure, and centralize ESG data for accurate, audit-ready reporting.

While consolidating internal data is a crucial first step, you’ll likely encounter gaps in the information you need for comprehensive ESG reporting.

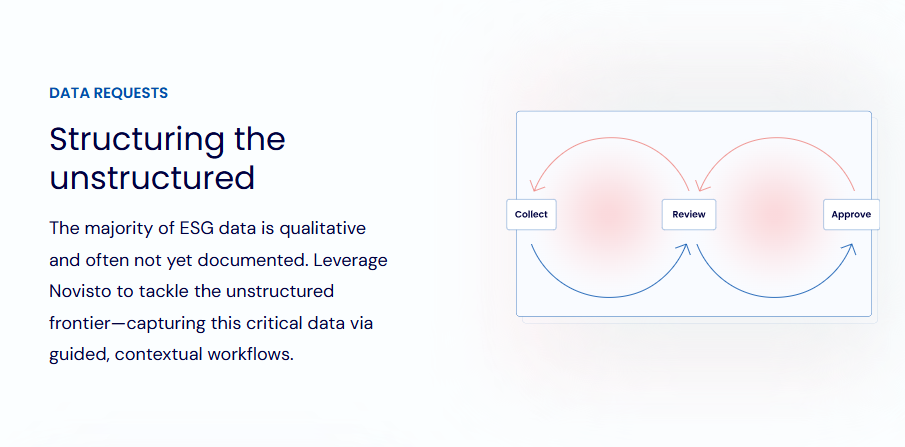

This is where external ESG data collection and enrichment services like Veridion become invaluable.

Source: Veridion

Veridion uses proprietary AI and machine learning models to scan the internet, continuously collecting ESG data on over 120 million companies worldwide.

This allows you to enrich your existing company datasets with real-time ESG data through services like Match & Enrich, uncovering more than 60 data points per company profile.

More specifically, the ESG data covered is illustrated below.

Source: Veridion

This regularly updated data provides real-time insights and enables you to monitor your suppliers for potential ESG risks.

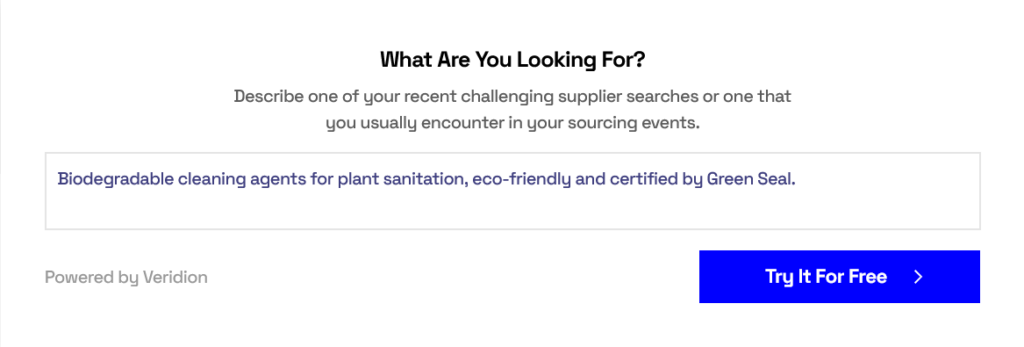

Plus, if you’re looking to source more responsible and sustainable suppliers, Veridion’s Search API & Scout service simplify the process, enabling you to find the right suppliers using natural language searches.

Source: Scout

In short, effective data collection tools are essential for building a robust ESG data foundation.

By combining the power of internal data integration with external data enrichment, you can gain a comprehensive view of your supply chain’s ESG performance.

Just as data quality and depth are important, it’s also essential to consolidate and organize all of this data.

Data integration platforms do exactly that.

And they’re certainly much-needed tools.

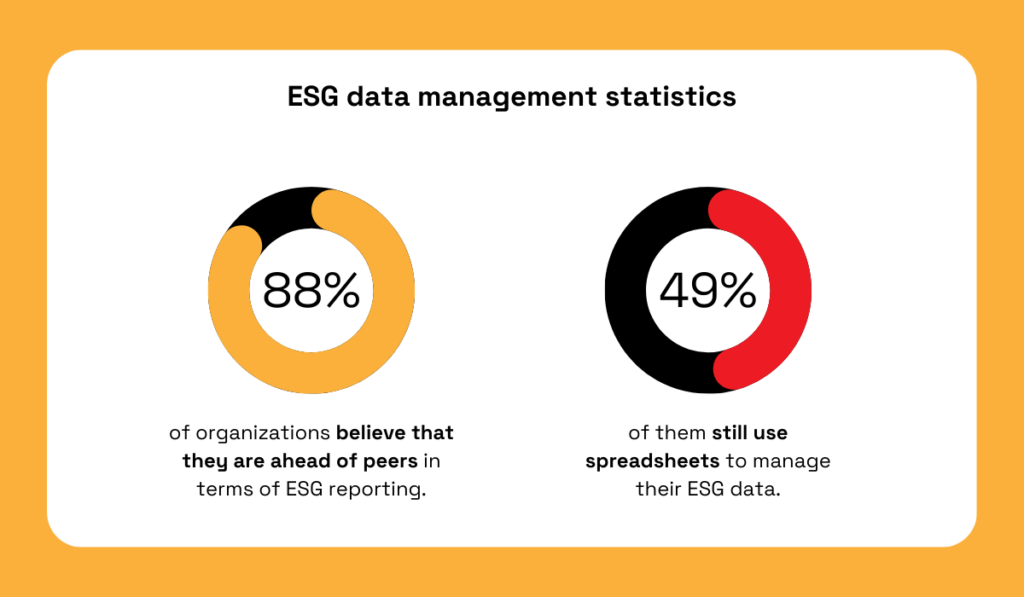

To illustrate why, take a look at this statistic from KPMG.

Illustration: Veridion / Data: KPMG

As you can see, while organizations are confident in their ESG management and reporting capabilities, the reality tells a different story.

In fact, even when organizations collect the right data, half of the surveyed companies aren’t maximizing their potential due to inadequate integration practices and reliance on outdated management methods.

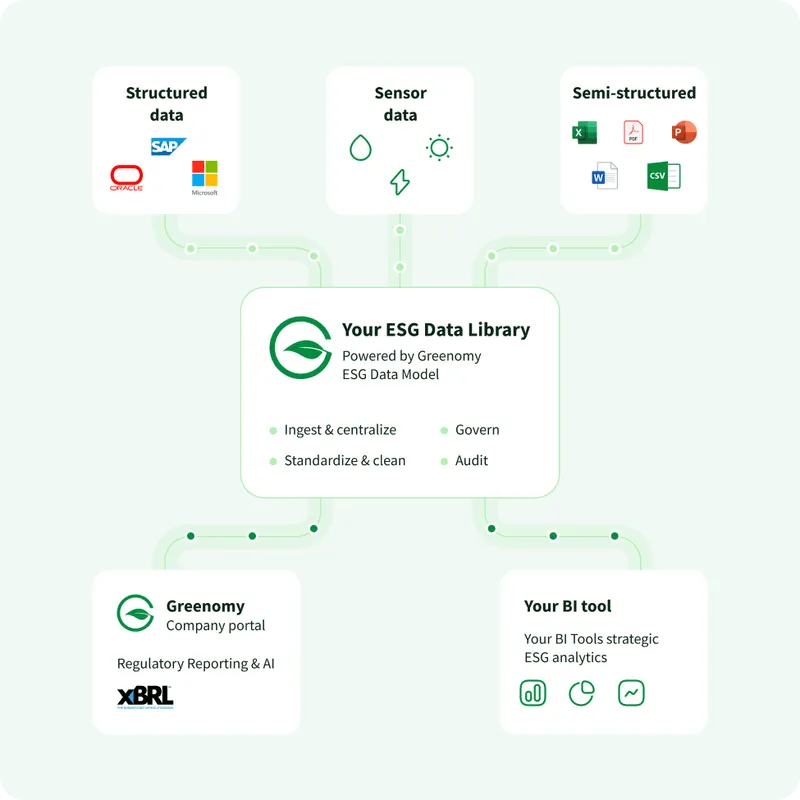

Let’s illustrate this with an example platform, Greenomy.

The image below shows how this platform functions and the types of data it can consolidate.

Source: Greenomy

As you can see, data integration platforms can handle both structured data from platforms like Veridion and semi-structured data that might be scattered across your teams in spreadsheets, documents, or databases.

This consolidation eliminates data silos and ensures everyone works with the same information.

Plus, these platforms can integrate sensor data from IoT devices.

For example, sensors in a manufacturing plant could track energy consumption in real time, providing valuable data for emissions tracking and energy efficiency initiatives.

Finally, you can even re-ingest already processed data, like analytics from BI tools, keeping everything in one central repository.

Centralizing all this information is a key benefit of integration platforms.

It creates a single source of truth, improving data consistency, reducing errors, and simplifying reporting.

These solutions also offer a significant advantage: data assessment and transformation.

For example, tools like Crux can pull in data from various sources and automate the verification process with real-time validation checks and alerts.

Source: Crux

Crux also automates data transformation and standardization, turning it into structured, usable data.

Ultimately, this prepares your ESG data for use by other technologies, such as business intelligence tools for analysis and reporting software for generating disclosures.

This seamless flow of information is crucial for efficient and effective ESG data management.

Next are business intelligence (BI) tools, which transform your ESG data into usable, decision-grade insights.

Before we go further, it’s important to state the obvious: the effectiveness of any business platform depends on the amount and quality of your data.

As IBM’s former Chief Data Officer, Inderpal Bhandari, explains, optimizing ESG management requires fact-based data and the right data architecture.

Illustration: Veridion / Quote: IBM

After collecting data from the right ESG data providers, BI solutions essentially help visualize and analyze these metrics.

A leading tool in this space is Microsoft Power BI, a powerful and versatile platform known for its interactive dashboards and extensive data connectivity options.

It’s particularly useful for ESG data analysis and visualization because it allows users to connect to various data sources, create compelling visuals, and share insights easily.

Plus, while you can build custom dashboards in BI tools, there are also numerous pre-built ESG reporting templates that simplify the process.

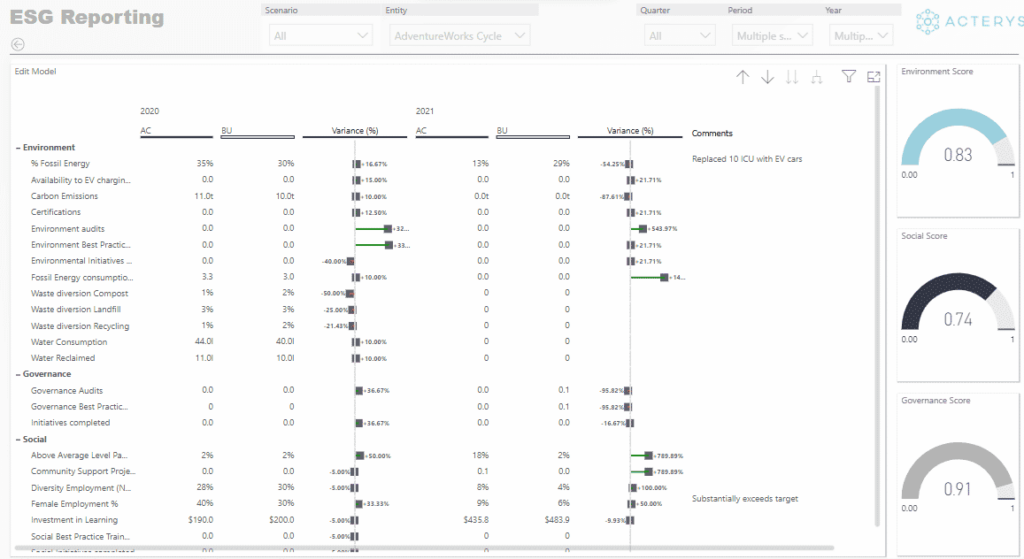

For example, the following template by Acterys displays various ESG metrics for a single company, including an ESG score.

Source: Acterys

There are also custom-built solutions in Power BI, like PwC’s ESG Intelligence tool, which offers a comprehensive suite of features.

They span from ESG performance monitoring and reporting to ratings and company pre-assessment according to various ESG frameworks and standards.

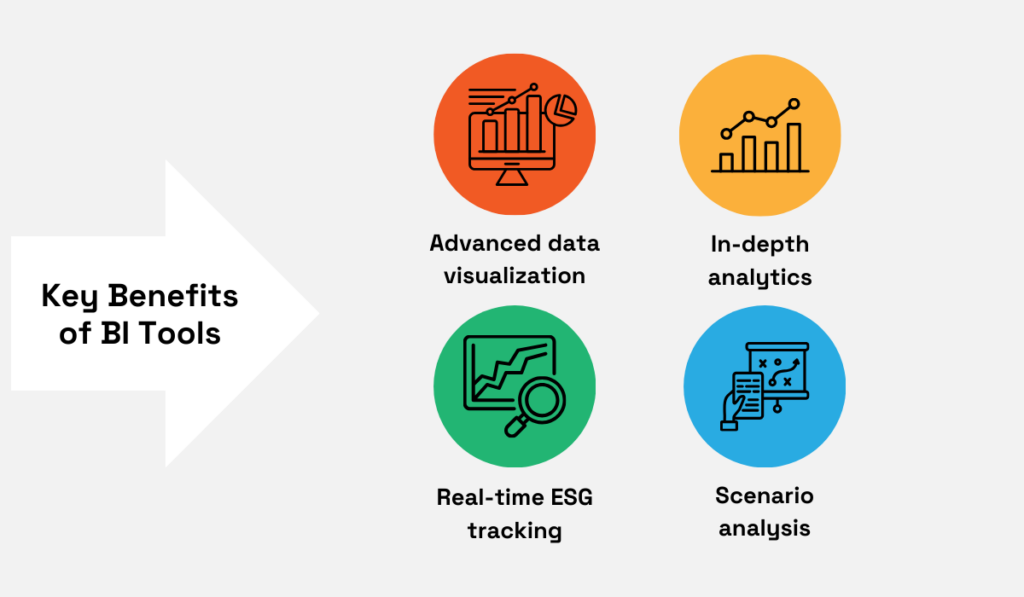

The benefits of using these systems are numerous, but four key advantages stand out, illustrated below:

Source: Veridion

While we’ve focused on Power BI to illustrate the benefits of this technology, there are many other ESG-specific data visualization and analysis tools worth exploring, including Supplier.io, SpheraCloud, FigBytes, and Greenstone Enterprise.

No matter which you choose, BI tools are essential for turning ESG data into actionable intelligence.

They empower organizations to move beyond simple data collection and reporting toward a deeper understanding of ESG performance.

They also help you identify areas for improvement and make strategic decisions that drive positive change.

A key area where technology benefits ESG data management is reporting.

As Brandon Potter, director for Microsoft Cloud for Sustainability, explains, navigating the complex landscape of ESG reporting frameworks and standards is a significant challenge.

Illustration: Veridion / Quote: Microsoft

He emphasizes the need for companies to account for specific areas like different emission types, water and waste management, and other key ESG factors.

However, the right tools can significantly streamline this process, ensuring efficiency and accuracy.

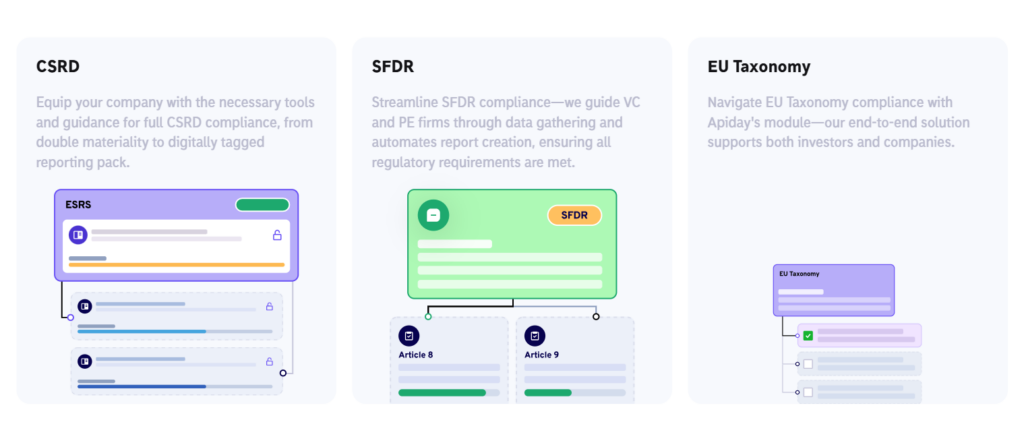

One example is Apiday, a platform offering robust ESG reporting features specifically designed to support compliance.

Apiday helps companies adhere to regulations like CSRD, SFDR, and the EU Taxonomy through an end-to-end process of data collection, automated report creation, and secure data storage.

Source: Apiday

Whether you use Apiday’s built-in data aggregation features or integrate with another tool, the system significantly reduces manual effort in data analysis and reporting.

Features like streamlined data reuse across different frameworks and automatic KPI management further enhance efficiency.

Of course, Apiday is just one of many available tools.

Other options include:

As a tip, when choosing a reporting tool, look for automation capabilities and features that simplify ESG disclosure workflows.

Also, consider AI-powered functionality to further enhance reporting.

For instance, Sunhat offers an AI feature trained specifically for ESG and sustainability.

It goes beyond basic reporting automation by providing audit-ready answers to complex ESG questions, analyzing trends, and identifying potential risks and opportunities.

Source: Sunhat

This simplifies reporting and stakeholder communication by delivering clear, concise, and data-driven insights.

It also strengthens assurance and builds trust by ensuring data accuracy and alignment with reporting standards.

In short, ESG reporting software plays a vital role in streamlining the often-complex process of ESG disclosure.

By automating tasks, ensuring compliance, and providing deeper insights, these tools empower organizations to communicate their ESG performance effectively and build trust with stakeholders.

After collecting, structuring, and standardizing your ESG data, secure and accessible storage becomes paramount.

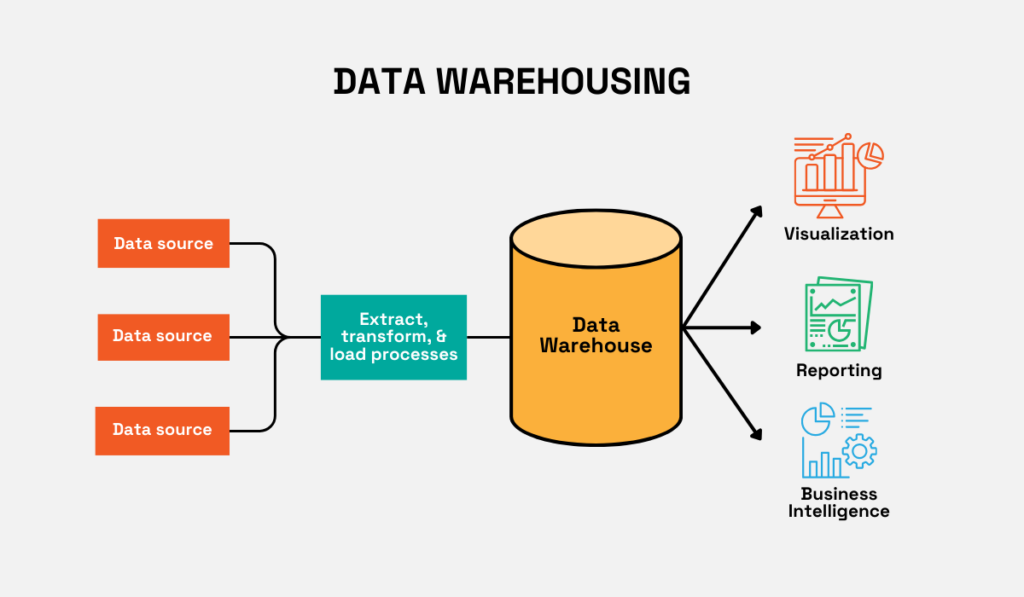

Cloud-based data warehouses offer a robust solution for storing and accessing large datasets efficiently.

Let’s start with a quick visual of how data warehousing works.

Source: Veridion

A key capability to look for is the ability to consolidate ESG data from various sources into a single repository.

Once your ESG data is integrated and standardized, cloud-based data warehouses act as the central hub, offering long-term storage, high-performance access, scalability, and strong data security.

It’s important to choose a warehouse that supports the scale and complexity of your ESG data.

For example, Google BigQuery supports exabyte-scale storage, tables with up to 10,000 columns, and features like automated data loading and transformation.

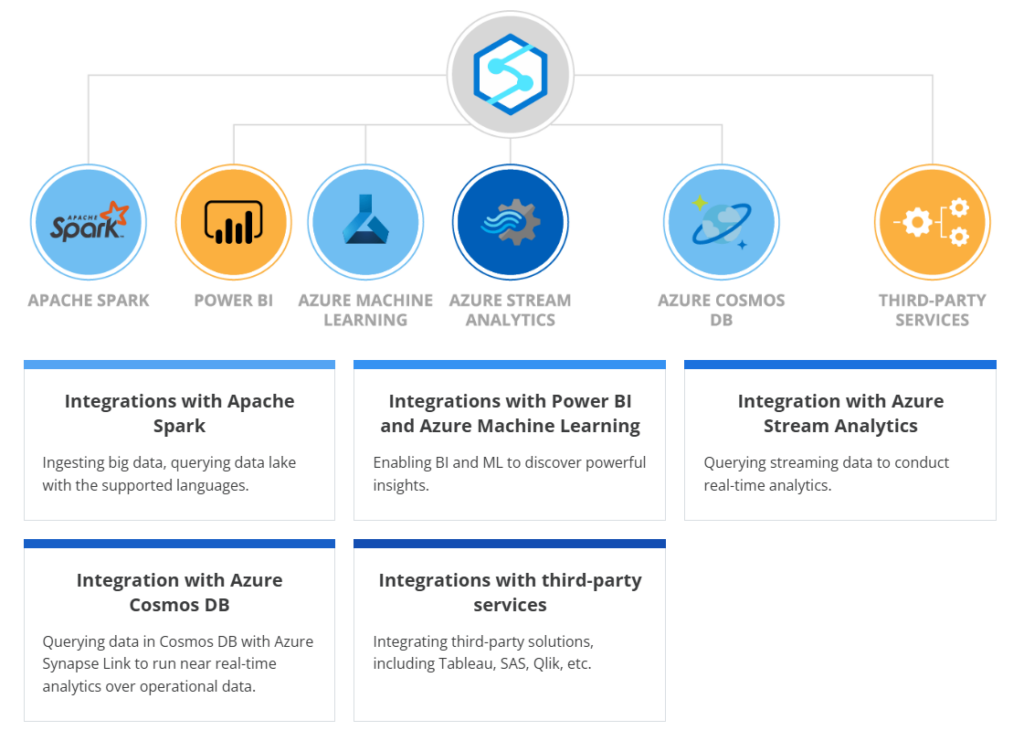

Meanwhile, Azure Synapse Analytics goes beyond just storage by integrating with tools like Power BI, Azure Machine Learning, and Cosmos DB to accelerate analytics and enable deeper insights.

Source: SCNSoft

Overall, when deciding on cloud data storage, consider the price per gigabyte and the costs associated with accessing the data, such as query fees and data transfer charges.

A thorough cost analysis is essential for optimizing your budget.

It’s also worth comparing data warehouses, data lakes, and data lakehouses, so here’s a quick breakdown:

| Data Warehouse | Data Lake | Data Lakehouse | |

|---|---|---|---|

| Overview | Optimized for structured data | Handles raw and unstructured data | Combines structured and unstructured data handling |

| Primary Purpose | Reporting and analytics | Storing diverse data sources | Unified reporting and exploration |

| ESG Data Suitability | Ideal for structured data like emissions metrics | Suitable for raw data (e.g., IoT or media inputs) | Integrates structured reports with raw data |

| Use Cases for ESG | KPI tracking, regulatory disclosures | Collecting diverse ESG data sources | Combined analytics and reporting |

| Scalability & Cost | Limited for unstructured data, higher cost for processing | Highly scalable, cost-effective for raw storage | Balanced cost and performance |

As you can see, warehouses are better for structured data, offering quick access for reporting and analytics, while data lakes are suited for unstructured data like sensor readings.

Data lakehouses combine the strengths of both, allowing storage and analysis of both structured and unstructured data within a single repository.

In any case, choosing the right storage depends on your data needs and how you plan to use it.

Consider your data volume, structure, and access requirements to select the optimal solution for your ESG data management strategy.

The right choice will ensure your data is secure, accessible, and ready to power meaningful ESG insights.

And there you have it—five key technologies shaping the landscape of ESG data management.

As we’ve explored, technology touches every stage of the process, from the initial data gathering and integration to how data is stored, analyzed, and reported.

By understanding these tools, you’re better equipped to choose solutions that align with your organization’s goals, compliance needs, and reporting frameworks.

Ultimately, the right tech stack doesn’t just streamline ESG data management.

It empowers your team to uncover deeper insights, improve decision-making, and stay ahead in a rapidly evolving sustainability landscape.