ESG Investing Due Diligence: Assessing a Company’s Operational Footprint

Key Takeaways:

ESG performance is no longer a niche topic. It has gone mainstream, shaping investment decisions every day.

And as ESG gains importance, so does ESG due diligence.

Designed to uncover a company’s sustainability practices and potential risks, this process can be complex and labor-intensive, especially when you’re working with incomplete or unreliable data.

If you’ve been struggling with ESG due diligence yourself, this article is for you.

In it, we’re breaking down six steps in ESG investing due diligence to help you make more ethical, informed, and less risky decisions.

Without a structured framework, your assessments are far more likely to be subjective, inconsistent across companies, or even completely irrelevant.

So, start by defining the key metrics most relevant to the industries and companies you invest in.

A clear set of criteria will standardize your process and help you compare apples to apples across organizations.

Be sure to incorporate the full scope of ESG, not just environmental factors.

This includes:

| Environmental | A company’s impact on the environment, including carbon emissions, energy usage, water consumption and pollution, waste management, biodiversity impact, climate risk exposure, etc. |

| Social | A company’s impact on people, including employees, customers, and communities. This includes workforce diversity and inclusion, employee well-being, labor practices, human rights policies, etc. |

| Governance | Corporate leadership, ethics, and transparency, covering areas such as board composition, business ethics and anti-corruption policies, tax transparency and compliance, etc. |

Yes, there are a lot of topics to consider, but you don’t actually need to end up with a long list of metrics.

Just a focused set of the most relevant ones will do.

In fact, Tamara Kostova, CEO at Velexa, a provider of tech solutions for financial institutions, recommends narrowing your scope and focusing on real impact:

Illustration: Veridion / Quote: FinTech Global

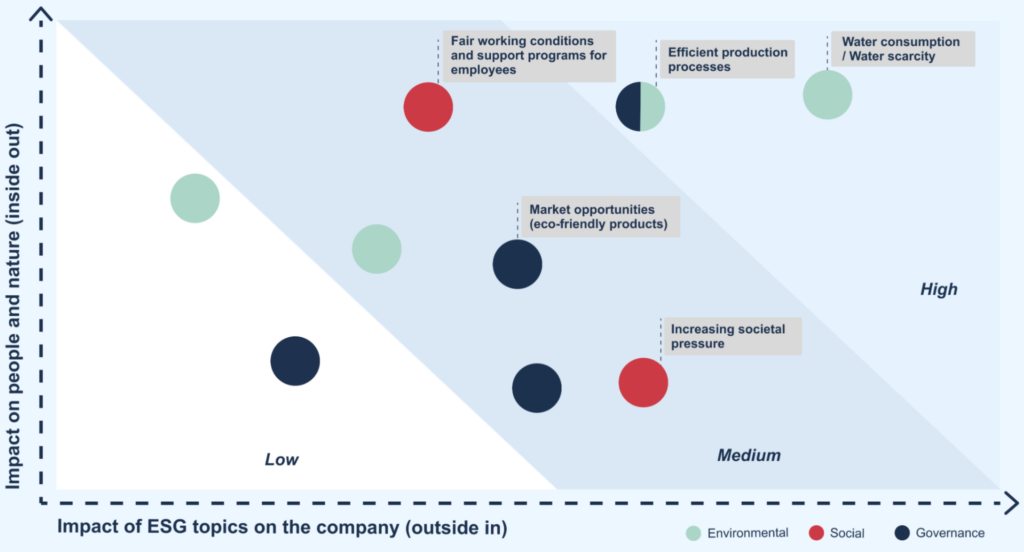

To determine which factors matter most, you can use an ESG materiality assessment, a tool designed to identify and evaluate the relative importance of specific ESG topics.

Many organizations now apply double materiality, meaning a topic is considered material if it meets either (or both) of these criteria:

| Inside-out perspective (impact on society) | How a company affects people and the environment |

| Outside-in perspective (impact on business) | How financial and non-financial factors influence the company’s operations |

These insights are typically visualized in a materiality matrix, arranged along X- and Y-axes and grouped according to impact.

Here’s an example of what this might look like:

Source: WifOR

This process gives you a much clearer and more precise picture of what to prioritize in your assessments.

And with a solid framework in place, you can then move on to data collection.

It’s always best to start with what’s already publicly available.

Documents such as sustainability statements, commitments, reports, and regulatory filings are typically the easiest to track down and analyze.

They also offer valuable insight.

Such documents can reveal a lot about how management views ESG issues, their level of transparency, and the maturity of internal ESG governance.

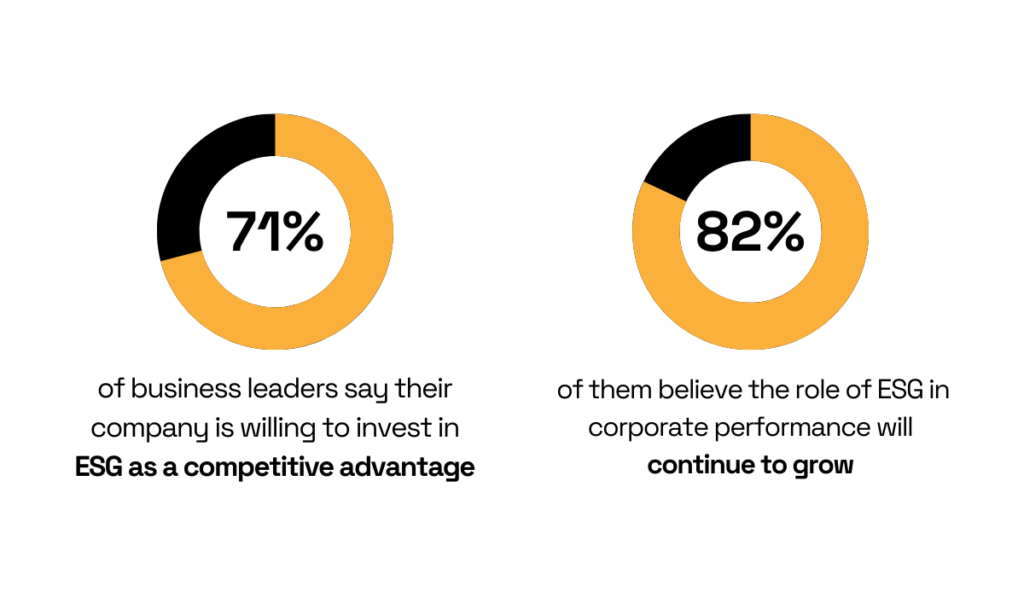

According to the Thomson Reuters Institute, most company leaders say they’re willing to invest in ESG as a competitive advantage and believe its role in corporate performance will continue to grow.

Illustration: Veridion / Data: Thomson Reuters Institute

That sounds promising, but are they actually putting money where their mouth is?

That’s what you’ll be trying to determine in this step.

Detailed, transparent reporting is usually a good sign. Weak or vague reporting, on the other hand, can indicate hidden risks or poor accountability.

Start by locating a company’s ESG statement, like the one from Coca-Cola HBC shown below.

Source: Coca-Cola HBC

In this type of document, companies outline their metrics, targets, tactics, policies, and guidelines across all ESG areas.

This shows how they approach ESG and how seriously they take it. It can also help you confirm that you selected the right metrics in the previous step.

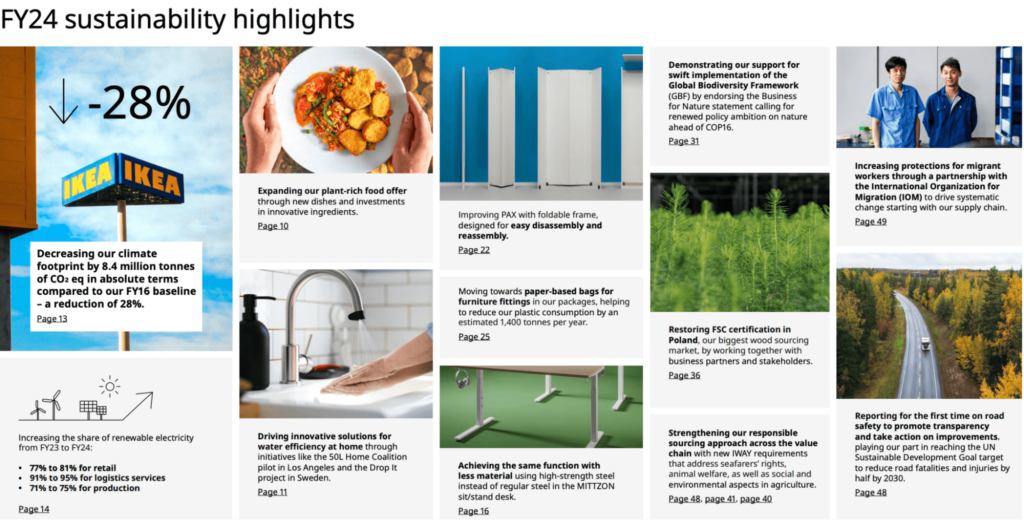

For more specific information about a company’s progress, review its ESG reports.

For instance, IKEA publishes an annual report that provides an overview of its strategy on various topics, along with specific results, often comparing performance to the previous year.

Source: IKEA

Here’s an important tip: try not to look at these numbers in isolation. They only show a snapshot in time.

Always review older reports to understand how performance has changed over several years.

A company’s latest results may look strong, but earlier reports might reveal a negative trend.

You need historical context if you want to truly understand whether a company is truly improving or simply presenting a favorable moment in time.

Still, it’s not advisable to simply take a company at its word.

A vital part of effective ESG due diligence is cross-checking company disclosures against external sources, whether independent rating agencies, media reports, or business intelligence platforms.

Because in the end, it’s not unusual for self-reported ESG claims to be exaggerated or flat-out inaccurate.

In fact, according to a 2023 PwC survey, 94% of investors believe corporate sustainability reporting contains at least some unsupported claims.

Illustration: Veridion / Data: PwC

That’s why it’s vital to detect inconsistencies and potential risks before it’s too late.

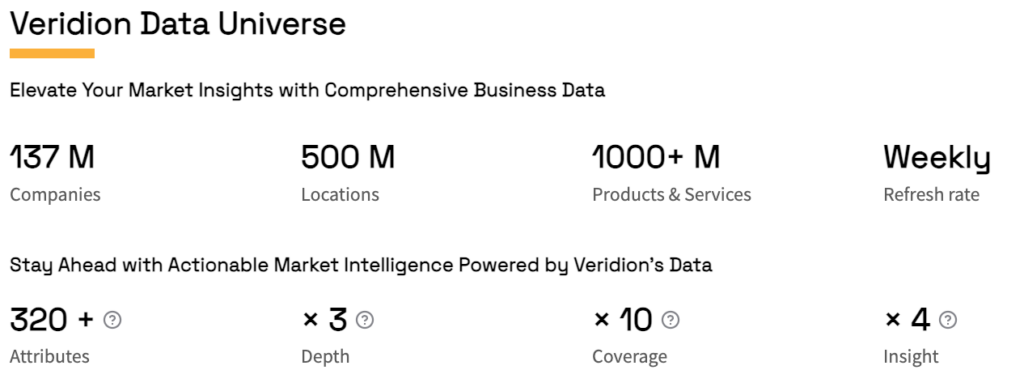

To achieve this, more investors are turning to AI-powered business intelligence platforms like Veridion.

Instead of chasing scattered data across dozens of sources, you get a centralized view of millions of companies, large and small, public and private, from around the world:

Source: Veridion

It’s a reliable, efficient way to test whether a company’s ESG promises hold up, as these platforms invest heavily in data accuracy.

Veridion, for example, uses proprietary machine-learning models and a multi-step validation process to extract data from both global and local news sources, as well as companies’ digital footprints.

Data is updated weekly to ensure the most current and relevant insights.

Here’s how our data manufacturing process works:

| Data Extraction and Analysis | Veridion extracts and analyzes data from company websites and news sources to ensure our profiles reflect both company statements and public perception. |

| Data Classification | Data is classified using a rigorous ESG taxonomy organized into Pillars, Themes, and Risks. |

| Sentiment Analysis | We incorporate sentiment analysis to evaluate the tone and intent behind ESG actions. This allows us to compare public commitments with actual performance, offering a more comprehensive picture of ESG effectiveness. |

| Profile Enrichment | ESG profiles are enriched with additional firmographic attributes, such as company location, products, services, NAICS classification, employee count, and revenue. This provides context to ESG efforts within broader business operations. |

But our data isn’t just accurate and up-to-date. We also deliver exceptional breadth and depth of insight.

Our taxonomy covers a wide range of ESG topics:

Source: Veridion

Ultimately, platforms like Veridion give you the power to quickly validate data, spot emerging concerns, and uncover ESG blind spots companies may not even realize they have.

Because data reliability is at the core of any successful ESG assessment.

The most valuable insights often come from engaging directly with companies.

This is where you speak with employees and management and assess the premises, if not in person, then at least virtually.

Matthew Gray, Associate Director of Risk and ESG Engagement at Morningstar, an independent investment insights provider, explains why this is so valuable:

Illustration: Veridion / Quote: Sustainalytics

On his many site visits, Gray experienced this firsthand.

He would chat with employees to understand their grasp of sustainability and how integrated it was into their day-to-day.

He would examine procurement and waste management practices, and even visit nearby communities to see how the company impacted those closest to it.

Gray offers some advice for such visits:

“Not only are the site visits important, but so is visiting companies at their headquarters.”

This allows you to “read the room,” notice cultural nuances in discussions, evaluate how hosts prepare for your visit, and gain a sense of their overall culture.

It provides valuable context on how a company approaches ESG and how committed they truly are.

Just be sure to go prepared.

It’s best to draft an ESG questionnaire beforehand, especially if visiting multiple companies.

This ensures your time yields structured, actionable insights without anything slipping through the cracks.

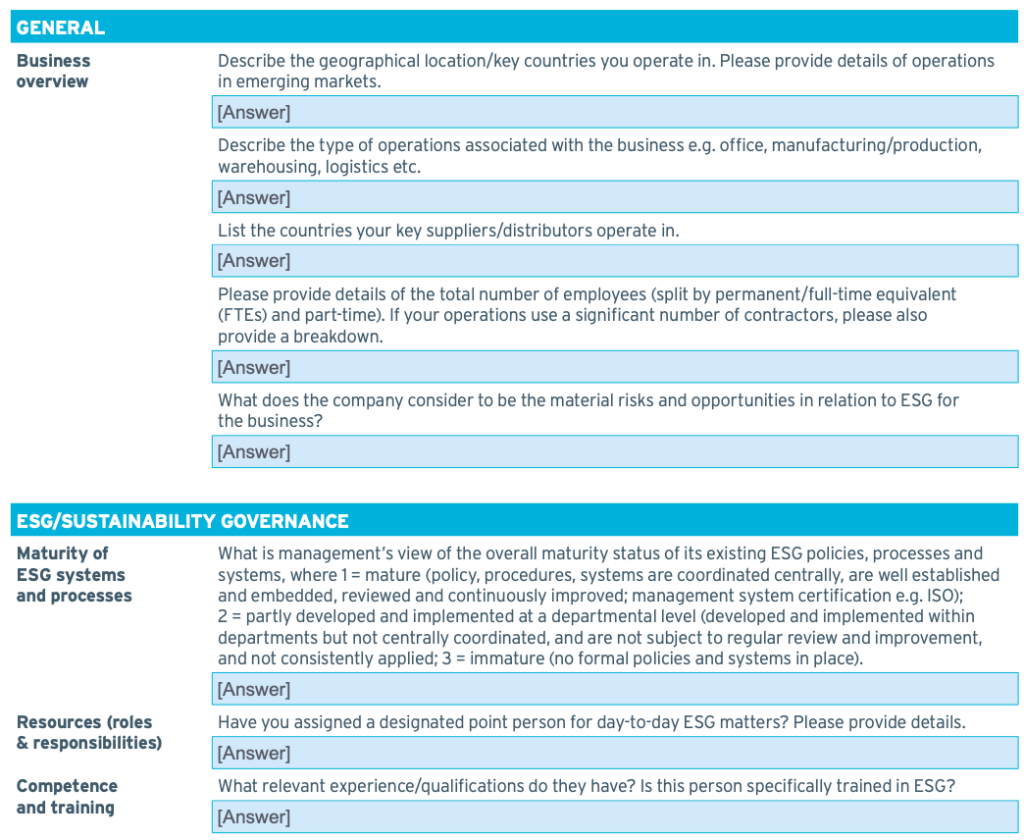

There are plenty of templates online to help you get started, like the one shown below.

Source: Invest Europe

But be sure to tailor your questions to your specific goals, keeping in mind the metrics and topics you outlined at the beginning.

Overall, seeing ESG in action, talking to people on the ground, and observing company culture firsthand is irreplaceable.

If the opportunity for you to visit arises, grab it.

Now that you have gathered all the information you could, it’s time to start putting it into action.

In this step, you’ll be evaluating company performance against recognized ESG standards and frameworks.

This will give you a better context for their overall ESG efforts and success.

After all, a company may appear “good” in isolation but fall short when compared to global regulatory expectations.

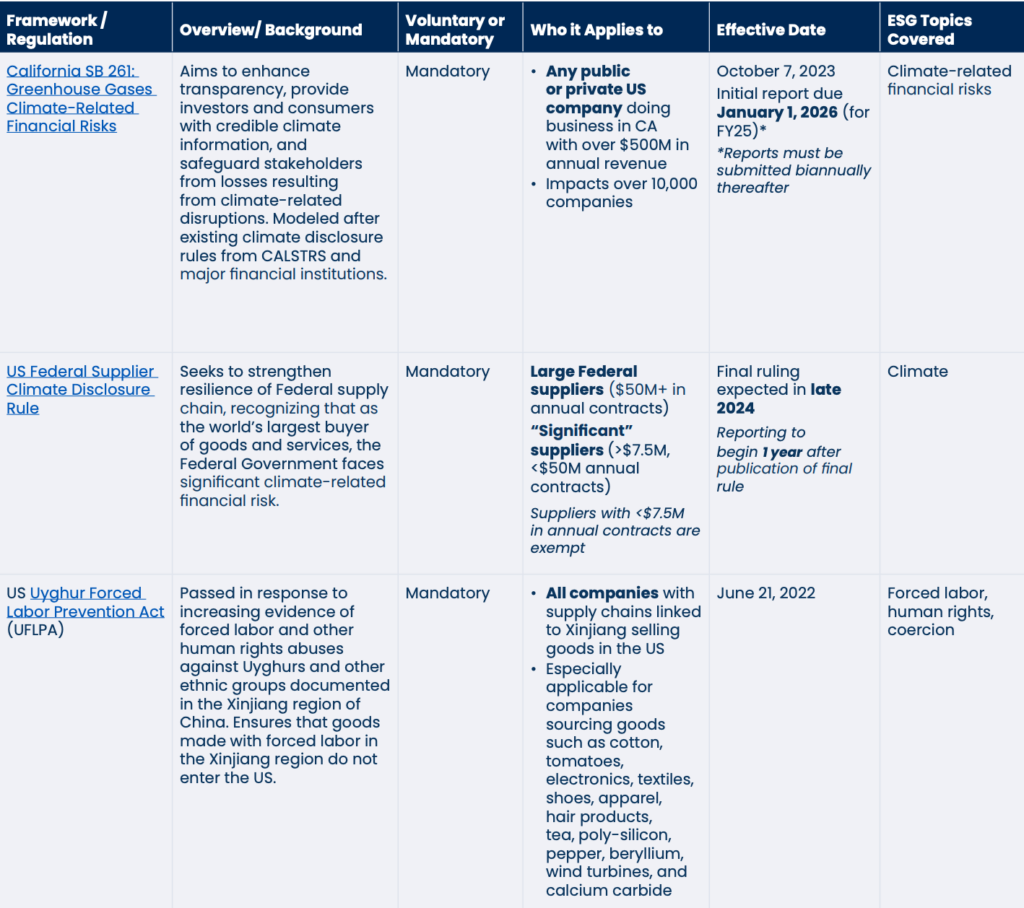

Now, there are hundreds of such frameworks, some voluntary, others government-mandated.

To start, focus more on the latter, as non-compliance with these can carry more serious consequences.

Some key frameworks include:

| Corporate Sustainability Reporting Directive (CSRD) | Prescribes rules for organizations to report sustainability disclosures across several environmental and social topics |

| National Greenhouse and Energy Reporting (NGER) | The Australian national framework for reporting and disseminating company information about GHG emissions, energy production, and energy consumption |

| Streamlined Energy and Carbon Reporting (SECR) | UK government guidance for organizations required to disclose their energy use, GHG emissions, and related information |

| Sustainable Finance Disclosure Regulation (SFDR) | Aims to standardize the reporting of ESG metrics for financial products and entities within the EU |

Still, if the sheer number of these frameworks starts to feel overwhelming, worry not.

There are plenty of online resources that outline major ones and their applicability.

One particularly useful resource is this document by Point B.

Source: Point B

It explains major frameworks in great detail (yet clearly), outlining who they apply to, what topics they cover, and their disclosure requirements.

It can point you in the right direction.

All in all, this step is all about evaluating whether the company meets, exceeds, or lags behind industry norms, global best practices, and, most importantly, regulatory requirements.

It’s key in separating the best from the rest.

This final step forms the foundation of smart investment decisions. Not just for you, but for most investors today.

According to PwC, 75% of investors consider how a company manages sustainability-related risks an important factor in their investment choices.

Illustration: Veridion / Data: PwC

By performing risk scoring, you can identify material ESG weaknesses and estimate both their likelihood and potential impact.

This, in turn, guides your investment strategy, steering you away from areas where the risk is too high.

Keep in mind that you won’t be simply listing potential risks here, but assigning a risk score to each company and topic, categorizing them as follows:

After all, not all risks are equal. Some are severe enough that the safest option is to stay away, while others are manageable with occasional monitoring.

For more accurate and efficient assessments, consider using automated sustainability technology designed for investors.

Typically powered by AI, these tools remove subjective judgment from the process, providing transparent, rules-based risk scores that reflect real materiality.

Source: Clarity AI

They align with major global standards, offer built-in metrics, and allow you to create custom profiles so you can focus on what matters most to you.

For instance, you can adjust which ESG topics to include, their relative importance, and how to handle missing data.

Whether following industry standards or applying your own materiality matrix, these tools adapt to your own investment goals, keeping you in control and delivering reliable, actionable insights.

The sheer complexity and scope of ESG due diligence can seem daunting, no doubt about it.

But the key to success lies in adopting a disciplined, data-driven process like the one outlined in this article.

With structure, high-quality data, and clearly defined metrics, you’ll be far better equipped to identify real opportunities, avoid hidden risk, and invest in companies that deliver long-term impact.

In a time where companies make too many big promises and offer too little proof, that’s the only way to make smarter, more confident investment decisions.