ESG Reporting Frameworks vs Standards: Differences Explained

Key Takeaways:

Nowadays, there’s certainly no shortage of initiatives and regulations pushing companies to report on their environmental, social, and governance (ESG) performance.

Since no single ESG reporting framework or standard applies globally, navigating the options can feel overwhelming.

What’s the difference between a framework and a standard—and how do you choose the right ones?

Let’s break it down so you can build credible, impactful ESG reports that meet stakeholder and regulatory expectations.

ESG reporting frameworks provide organizations with high-level guidance on what sustainability topics to report and how to structure disclosures.

Unlike standards, frameworks generally don’t prescribe detailed metrics or specific data points.

Instead, they offer principles, categories, or themes that help shape meaningful, stakeholder-relevant ESG reporting.

These frameworks have been—and continue to be—developed by various non-governmental organizations and government institutions.

Without a single global effort uniting these initiatives, a wide variety of reporting frameworks has emerged.

Some of the most prominent are shown below.

Source: Veridion

What’s worth noting is that this variety creates significant complexity in ESG reporting.

For example, a large international company may be subject to several voluntary and regulatory frameworks, depending on where it operates.

Likewise, some frameworks cover all ESG aspects, while many focus solely on environmental factors.

That’s why most companies combine multiple frameworks to meet regulatory requirements and stakeholder expectations.

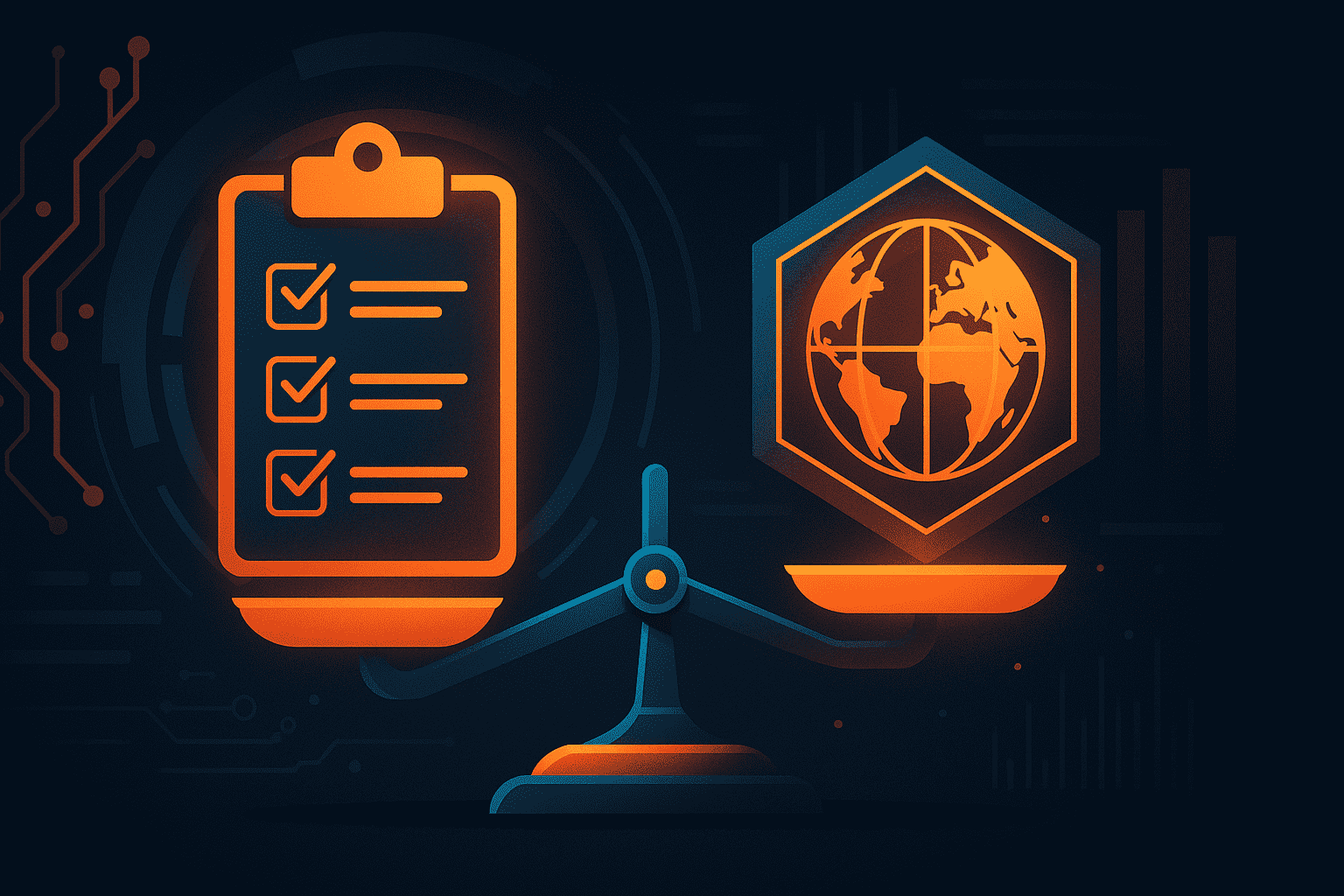

This is reflected in a 2023 study by the International Federation of Accountants (IFAC), where over 85% of organizations said they use several ESG reporting frameworks and standards:

Illustration: Veridion / Data: IFAC

As IFAC CEO Kevin Dancey highlights:

“This patchwork system does not support consistent, comparable, and reliable reporting.”

Despite this fragmentation, companies continue to rely on ESG frameworks.

Why?

Because they help align company disclosures with global sustainability goals, address stakeholder expectations, and structure reporting to showcase priorities and progress.

They also offer valuable guidance as organizations navigate evolving regulations and work toward greater transparency and accountability.

With that in mind, let’s look at the standards associated with ESG reporting frameworks.

Not all ESG frameworks come with corresponding standards, but every ESG standard builds on a framework’s foundational goals.

Standards translate high-level principles into measurable, reportable data.

They typically define what must be reported, how it should be measured, and in some cases, which thresholds must be met.

This level of detail is what enables consistency, comparability, and even auditability across organizations and sectors.

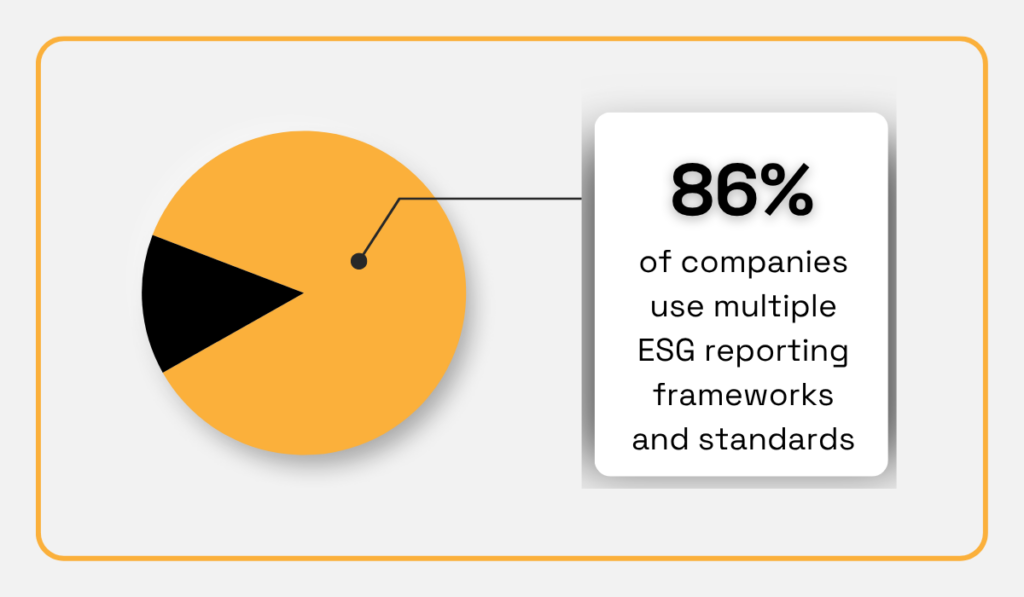

Let’s take the Global Reporting Initiative (GRI) as an example. Its standards include clearly defined disclosures, such as total greenhouse gas emissions.

Here’s a look at how that standard is structured:

Source: GRI

As shown above, this standard breaks down one of the key ESG topics—greenhouse gas (GHG) emissions—into concrete disclosures, reporting requirements, and clearly defined terms.

Notably, GRI 305—based on the GHG Protocol—introduced the now widely accepted list of seven greenhouse gases that organizations should disclose.

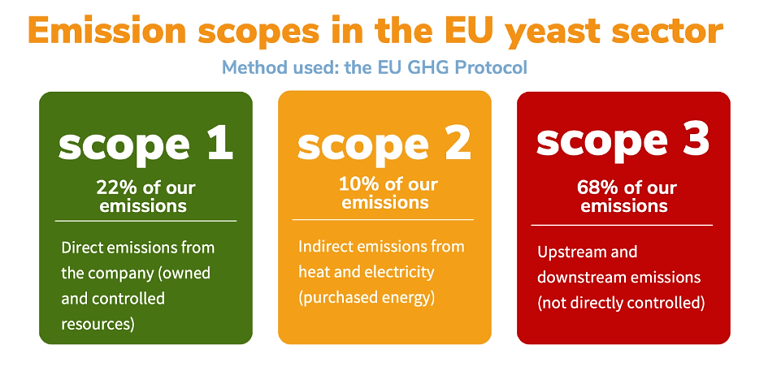

It also formalized the classification of emissions into three distinct scopes:

This breakdown helps organizations clearly identify and report where their emissions originate—whether from internal operations, energy use, or activities upstream or downstream in the supply chain.

For example, in the yeast production sector, the Confederation of European Yeast Producers (COFALEC) used this emissions framework to quantify its footprint across all three scopes:

Source: COFALEC

This structured approach enables consistent and comparable reporting across companies and industry sectors by clearly defining what to report and how.

Importantly, this emissions classification has been adopted—albeit with slight variations—by other major standards, including the EU’s ESRS (under the CSRD) and the ISSB’s IFRS S2.

This growing alignment helps streamline ESG disclosures and strengthens the reliability of reported data, particularly on climate-related topics.

In other words, while ESG standards may differ in terminology or emphasis, many are converging on shared methodologies like the GHG emissions scopes.

Ultimately, this ongoing harmonization makes it easier for companies to meet diverse reporting requirements using a unified and consistent data set.

With so many ESG initiatives out there, it helps to focus on the most widely used and influential ones.

Below is a quick overview of key frameworks and standards that shape ESG reporting today.

The United Nations Sustainable Development Goals (UN SDGs) are not technically a reporting framework or standard.

Rather, they represent a widely recognized set of global priorities that many organizations use to guide and align their ESG reporting efforts.

Launched in 2015, the SDGs outline 17 interconnected goals aimed at ending poverty, protecting the planet, and promoting peace and prosperity by 2030.

Source: UN

Thanks to their global reach and inclusive language, the SDGs are often used by companies to shape ESG strategies and communicate sustainability efforts.

While the UN provides high-level indicators for each goal, these remain general, offering guidance on what to measure (e.g., “CO₂ emissions per capita” or “proportion of women in leadership roles”) but not how to measure it.

Importantly, the SDGs are entirely voluntary.

As a result, while companies and reporting standards like GRI or SASB often map their disclosures to the SDGs, they must rely on more technical standards for detailed ESG metrics and methodologies.

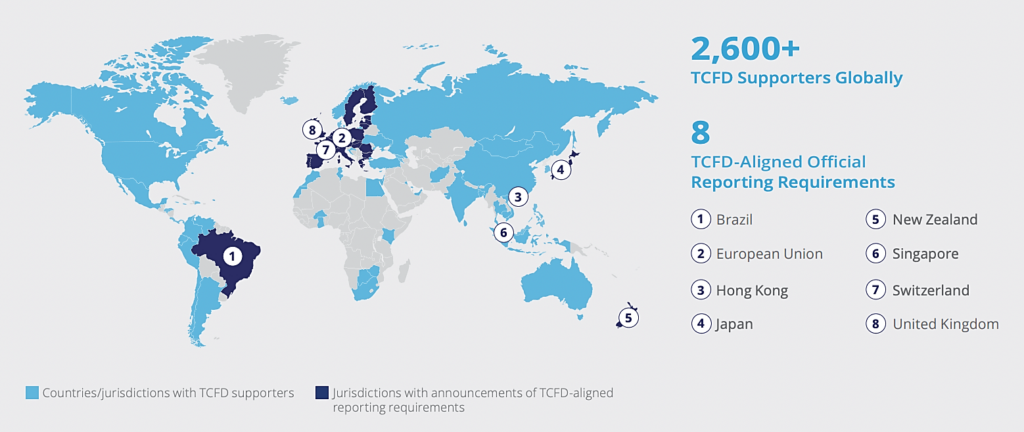

Established in 2015 by the Swiss-based Financial Stability Board, the Task Force on Climate-Related Financial Disclosures (TCFD) developed a voluntary framework for reporting climate-related financial risks and opportunities.

Unlike ESG standards, the TCFD does not prescribe specific metrics, allowing companies flexibility in how they report.

However, its global influence is undeniable: over 2,600 organizations support the TCFD, and countries within the EU, UK, and Japan have made TCFD-aligned disclosures mandatory for large firms.

Source: FSB

The TCFD framework focuses primarily on the “E” in ESG, specifically climate change, and how its physical and transitional impacts could affect a company’s financial performance.

In July 2024, the TCFD was officially disbanded, and its recommendations were integrated into the IFRS Sustainability Disclosure Standards (SDS), developed by the ISSB.

These new standards retain the TCFD’s foundational structure while adding greater detail around climate scenario analysis and emissions disclosures.

Although the TCFD as an entity has been retired, its framework continues to shape global climate reporting and now forms the backbone of emerging international sustainability standards.

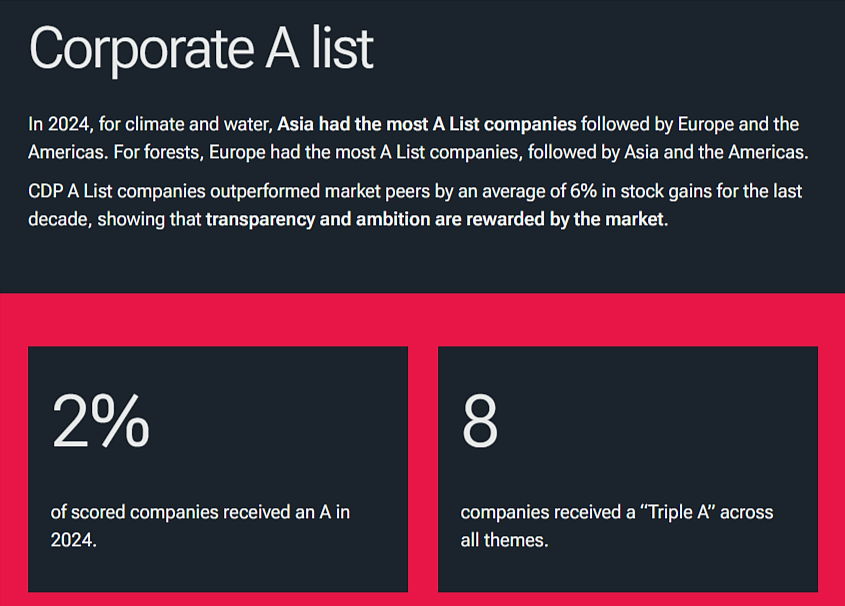

Founded in 2000, the Carbon Disclosure Project—now simply known as CDP—is a global non-profit that operates one of the most widely used environmental disclosure systems.

Its voluntary framework invites companies, cities, and states to report on climate-related risks, water security, and deforestation.

Each year, more than 20,000 organizations respond to CDP’s standardized questionnaires, often at the request of investors or large customers.

Submissions are assessed and scored from A to F based on transparency, disclosure quality, and environmental performance.

As shown below, only 2% of the companies scored in 2024 earned a spot on CDP’s prestigious A-List, recognized for leadership on climate, water, and forest-related disclosures.

Source: CDP

Companies on CDP’s A List outperformed market peers by an average of 6%, underscoring how transparency can drive investor confidence.

CDP questionnaires are based on the GHG Protocol and closely aligned with TCFD recommendations, making them compatible with other major ESG frameworks.

Although participation is voluntary, CDP data is increasingly used by investors, regulators, and supply chain partners to evaluate climate risk and corporate readiness.

By participating in CDP, companies can disclose their environmental impact in a standardized format that enables benchmarking, scoring, and greater accountability.

Founded in 1997, the Global Reporting Initiative (GRI) offers one of the most widely adopted ESG reporting frameworks in the world.

By mid-2025, over 14,000 organizations were using GRI Standards to disclose their ESG impacts in a consistent, transparent, and comparable way.

Notably, around 65% of these disclosures focus on environmental topics, such as climate change and energy use.

While GRI remains a voluntary framework with standards, GRI-aligned reporting is often expected by investors, regulators, and other stakeholders.

All the above makes GRI the global leader in sustainability reporting.

Source: GRI

GRI’s modular system is designed for flexibility and depth, comprising:

Organizations begin with the Universal Standards, apply relevant Sector Standards to identify material topics, and then report on those using the appropriate Topic Standards.

The Sector Standards are continually expanding, with a goal of covering 40 sectors to improve relevance and comparability across industries.

This structure enables detailed, consistent reporting while remaining adaptable to different company sizes and sectors.

Recent updates have further aligned GRI with TCFD and IFRS frameworks, reinforcing its position as a foundational tool for credible, globally recognized sustainability reporting.

Founded to help companies disclose financially material ESG information, the Sustainability Accounting Standards Board (SASB) developed 77 industry-specific standards tailored to sector-specific risks and opportunities.

These voluntary standards enable organizations to report on the sustainability factors most relevant to their operations.

Ultimately, this makes ESG disclosures more comparable, decision-useful, and cost-efficient for investors.

As shown below, SASB Standards are widely adopted for industry-specific ESG reporting.

Illustration: Veridion / Data: SASB

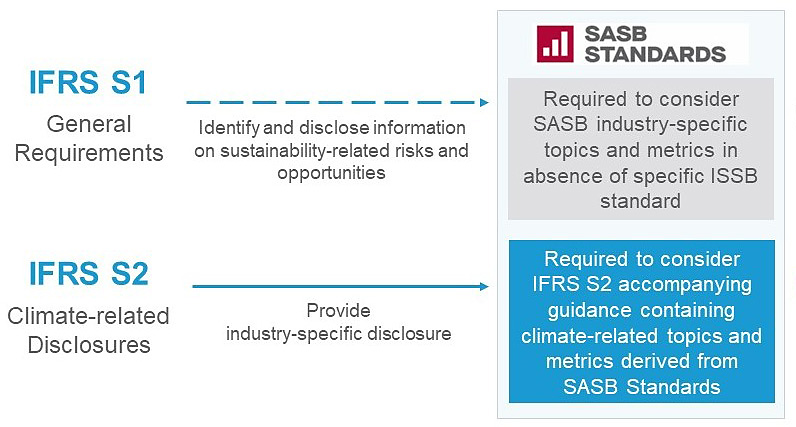

Established in 2021 by the International Financial Reporting Standards (IFRS) Foundation, the International Sustainability Standards Board (ISSB) has integrated SASB Standards into its broader sustainability reporting framework.

Its objective is to deliver a unified global baseline for ESG disclosures that meet the needs of capital markets.

The ISSB’s first two standards—IFRS S1 (general sustainability disclosure) and IFRS S2 (climate-related disclosure)—directly incorporate SASB’s industry-specific metrics and the TCFD recommendations.

The diagram below illustrates how SASB Standards underpin IFRS S1 and S2:

Source: SASB

As shown, SASB’s sector-specific metrics are essential to applying ISSB standards, especially when reporting on material ESG issues beyond climate.

Together, SASB provides the technical detail, ISSB delivers the global disclosure framework, and the IFRS Foundation ensures governance.

This creates a coherent, investor-focused system for globally consistent sustainability reporting.

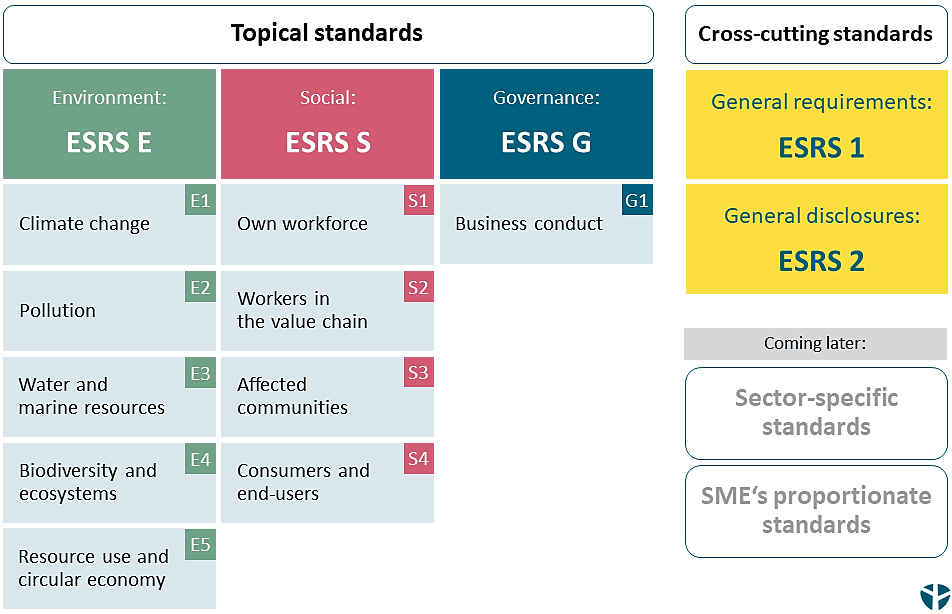

The European Union’s Corporate Sustainability Reporting Directive (CSRD) significantly expands ESG disclosure requirements.

It mandates sustainability reporting from large EU-based companies, listed SMEs, and non-EU companies with substantial operations in the EU.

Through staggered implementation that began with 2024 reporting, the CSRD is expected to apply to over 50,000 companies.

Reporting must follow the European Sustainability Reporting Standards (ESRS), which define what ESG information must be disclosed.

As shown below, the ESRS framework includes 10 topical ESG standards, two cross-cutting standards, and additional sector-specific and SME-focused standards currently in development.

Source: Denkstatt

Together, the CSRD and ESRS aim to enhance the transparency, consistency, and decision-usefulness of ESG disclosures for stakeholders and investors, both within Europe and globally.

By establishing rigorous, assured, and standardized reporting requirements, this mandatory framework is reshaping corporate sustainability practices and driving a new era of accountability in ESG reporting.

Having covered the major ESG frameworks and standards, it’s important to understand how they differ and how they work together.

Since there is no single global ESG framework or standard, organizations are encouraged to use both in tandem.

As Dan Byrne from the Corporate Governance Institute puts it:

Illustration: Veridion / Quote: CGI

With that in mind, let’s recap the key differences:

ESG frameworks provide overarching principles and structure for sustainability reporting. They guide organizations on what to disclose and how to present the information. Frameworks tend to be broad and adaptable across sectors and regions.

ESG standards, by contrast, specify the exact disclosures and metrics required. They are more technical and prescriptive, ensuring ESG data is consistent, comparable, and auditable.

Used together, frameworks and standards create a robust ESG reporting foundation, balancing flexibility with rigor, and strategic guidance with measurable accountability.

With numerous ESG frameworks and standards available, selecting the right ones can feel overwhelming.

A good starting point is aligning with:

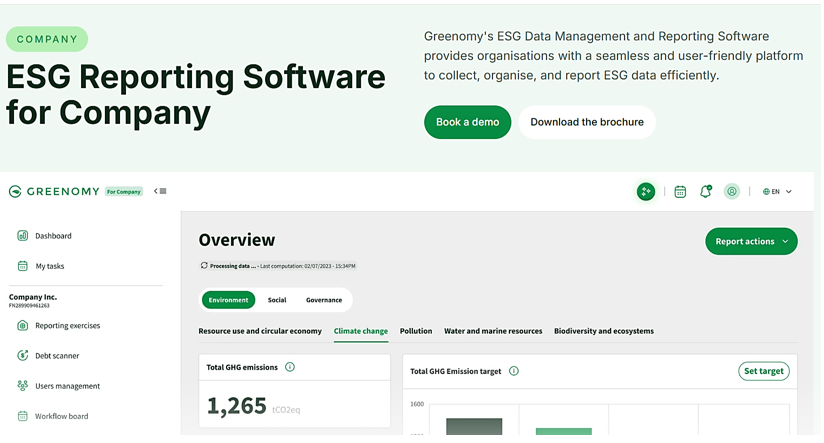

To simplify this process, many organizations turn to ESG reporting platforms that help identify relevant frameworks and map disclosures across them.

One such tool is Greenomy, which offers a user-friendly platform for ESG data collection, organization, and reporting.

Source: Greenomy

In addition to software, some providers also offer advisory services to support ESG strategy and help navigate the nuances of evolving regulations.

Yet even the best platforms rely on one critical element: high-quality ESG data.

Without trustworthy, real-time data, no tool, framework, or standard can deliver meaningful insights or credible disclosures.

As IFAC CEO Kevin Dancey underscores:

Illustration: Veridion / Quote: Green Central Banking

Remember, frameworks explain the why and what of ESG disclosure, while standards define the how.

But turning either into actionable, trusted insight hinges on data that is accurate, timely, and scalable.

This is especially true when navigating complex supply chains or cross-border operations.

And this is where platforms like Veridion make a real difference.

By delivering real-time, structured ESG intelligence on all companies with an active web presence, Veridion helps organizations bridge the gap between ambition and execution.

Below is a snapshot of the ESG-related data points Veridion captures:

Source: Veridion

With data coverage spanning over 123 million companies across 200+ geographies, Veridion enables you to:

Combined with the alignment tips and ESG reporting tools mentioned above, these capabilities help transform ESG reporting from a manual burden into a scalable, insight-driven process.

Ultimately, successful ESG reporting relies on combining high-level frameworks and detailed standards with the right tools for data collection, verification, and ongoing management.

As ESG reporting becomes increasingly mandatory and data-driven, companies must navigate evolving standards with clarity and confidence.

This begins with aligning reporting efforts to the frameworks and standards most relevant to their operations and goals.

Equally important is leveraging the right tools, ensuring data quality, and maintaining consistency across disclosures.

Together, these steps enable your organization to meet compliance requirements while generating meaningful sustainability insights that engage stakeholders and support long-term value creation.