7 ESG Screening Tools to Know About

ESG screening is no longer just a box to tick.

It’s a key part of risk management, supplier due diligence, and sustainable investing.

Whether you’re in procurement, compliance, or finance, working with the right tool can make all the difference.

Below, we break down seven of the most useful ESG screening solutions, showing what they do best and how they can support your ESG goals across complex supply chains and third-party networks.

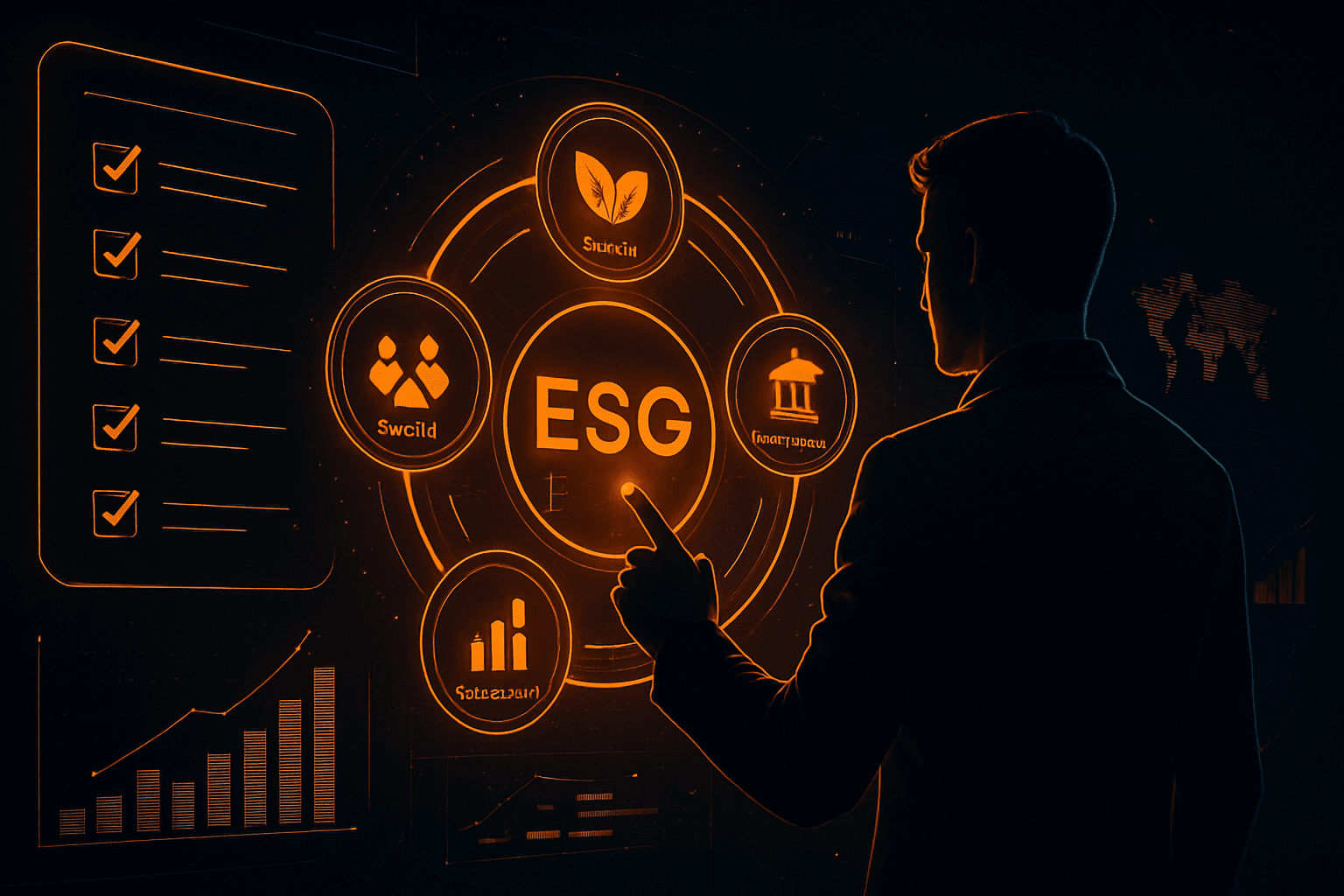

Veridion is much more than an ESG screening tool.

It’s a complete intelligence platform built to meet the needs of procurement teams, investors, banks, and compliance professionals.

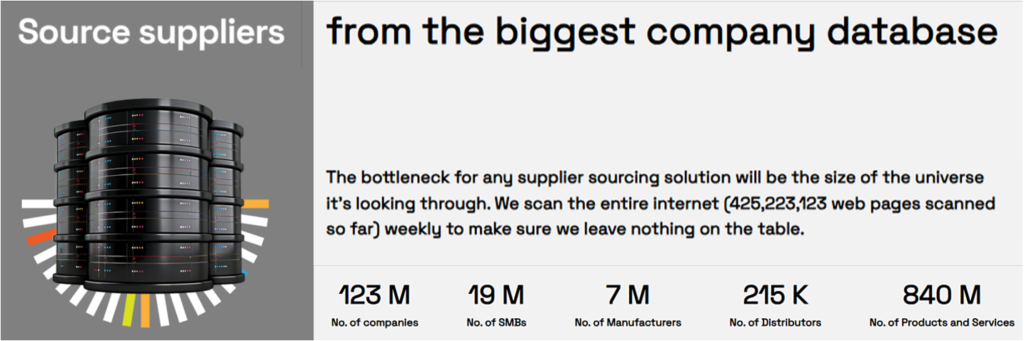

With the largest global company database, covering over 120 million operating companies across 250+ geographies, Veridion delivers unmatched visibility into your third-party ecosystem.

Source: Veridion

For each company, Veridion generates a comprehensive profile with more than 60 data points.

These span from firmographic and product information to specific ESG data, including:

Veridion even estimates emissions using recognized conversion tables like EXIOBASE3 and regional emissions factors such as those from the IEA (International Energy Agency).

It also provides granular location data, including secondary sites and the purpose of each facility.

This enables precise analysis of climate, biodiversity, GHG emissions, and human rights risks, helping companies assess location-specific ESG exposures with confidence across a rich taxonomy of ESG factors.

Source: Veridion

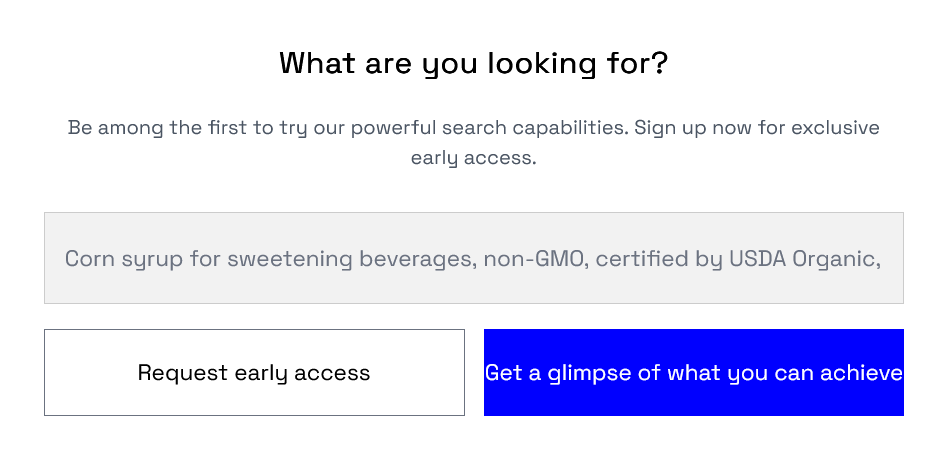

You can search Veridion’s global database based on your exact needs—by industry, product, location, or ESG characteristics—and discover new suppliers that meet your ESG and compliance standards.

Source: Veridion

And if you already have a supplier list, you can upload it to Veridion, and the platform will validate, deduplicate, and enrich your data with enhanced company attributes, including ESG data.

This is especially useful for procurement teams working to clean and standardize supplier records while preparing for regulatory reporting or ESG audits.

Beyond this, Veridion continuously monitors suppliers for changes in their activities.

Whether it’s a new deforestation controversy or a change in emissions data, Veridion’s system alerts you to potential risks, so you can take early action.

All of this is made possible by AI and machine learning.

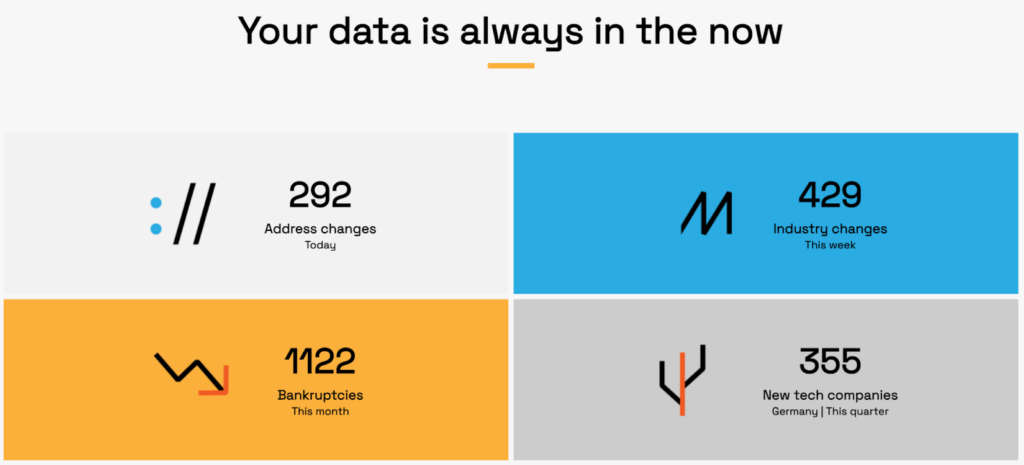

Veridion captures 100% of operating companies with an online presence—that’s over 123 million entities—and refreshes data weekly.

Source: Veridion

The engine pulls from billions of websites and petabytes of data from both global and local news outlets, official registries, and a company’s own digital footprint, then runs an extensive validation process to ensure unmatched data quality.

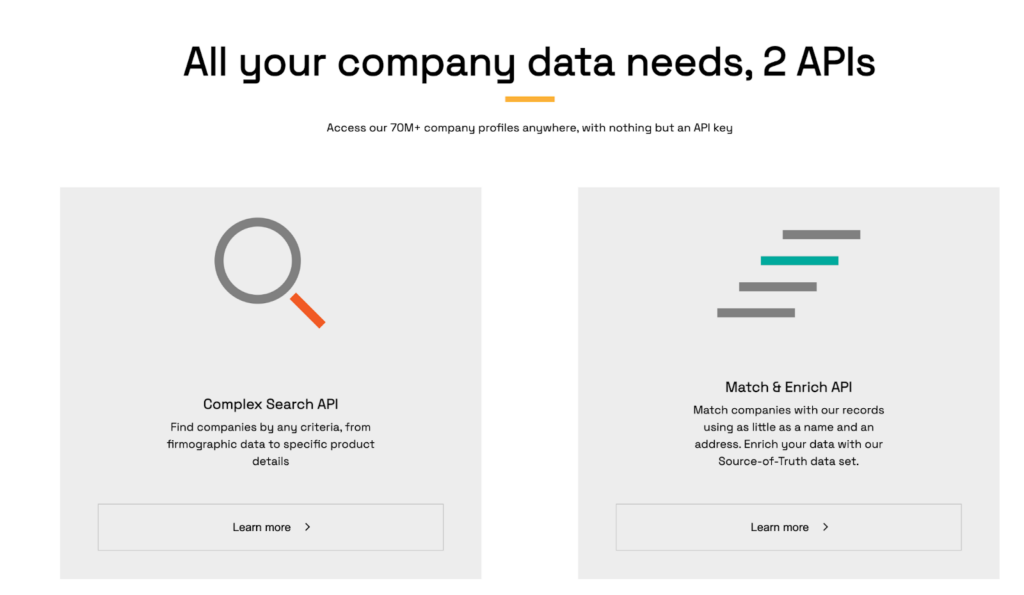

How can this data be delivered to you?

You can access Veridion’s ESG data in a format that works best for your workflow.

Either batch delivery in monthly-updated CSV files or API integration that plugs into your internal systems for seamless ESG data updates and supplier screening.

Source: Veridion

With all of its capabilities, Veridion is built to serve diverse sectors, from procurement to investments, insurance, and banking.

Investors use it to meet growing LP demands for ESG data.

Procurement leaders rely on it to source and monitor compliant suppliers.

And compliance teams use it to track and report against key regulations such as:

Ready to see what Veridion can do for you?

Download our data sample or get in touch to discuss how we can help you meet your ESG goals at scale.

Global Risk Profile (GRP) offers a suite of compliance and risk management tools to help organizations identify, assess, and mitigate third-party risks—ESG-related and beyond.

Among its solutions is an ESG due diligence tailored for teams that need fast, regulation-aligned screenings before onboarding suppliers or business partners.

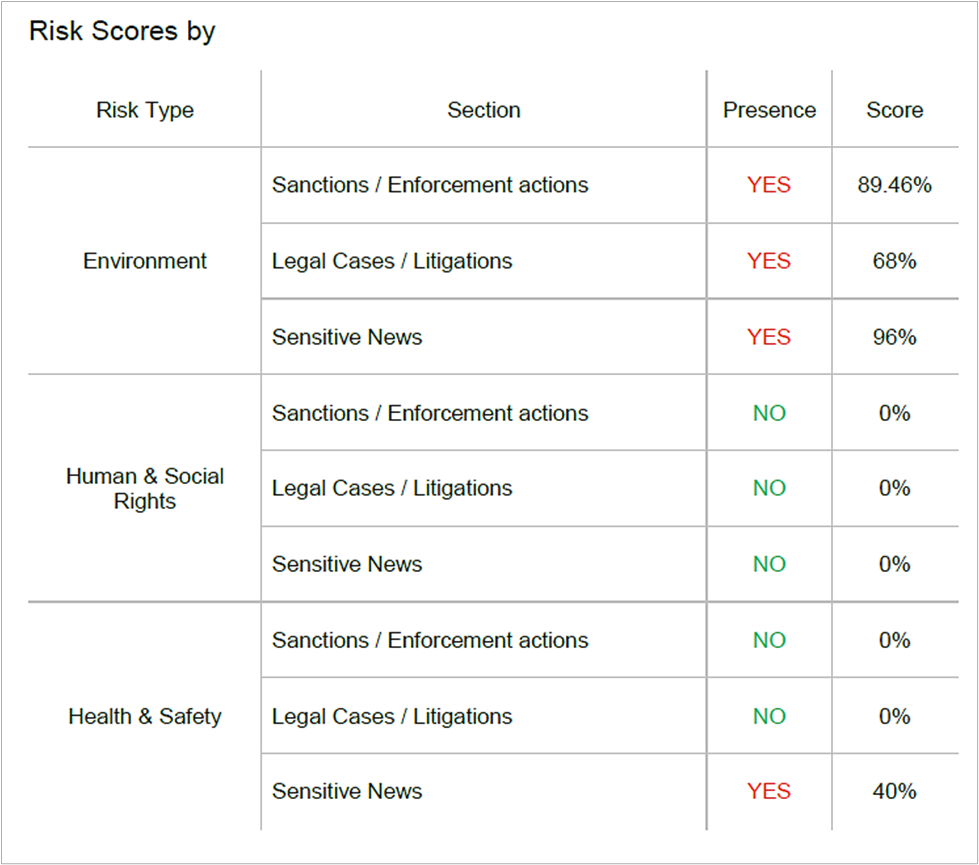

Their ESG screening reports evaluate environmental, human rights, and safety risks and can be delivered within 72 hours, starting at €290.

Here’s a sample:

Source: Global Risk Profile

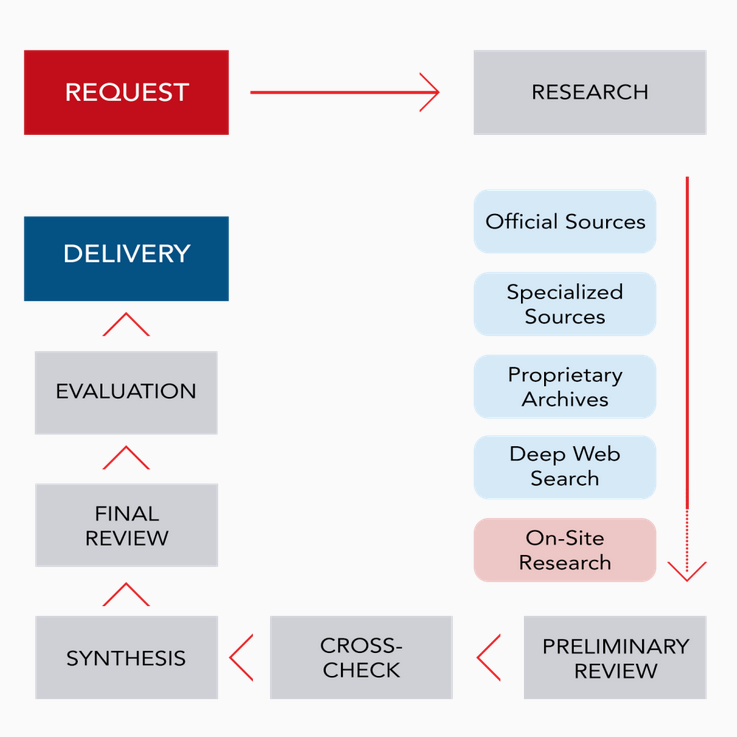

GRP sources data from over 1,500 official, specialized, and proprietary sources, including deep web content and, if needed, on-site verification.

Source: Global Risk Profile

They operate across 185 countries and also offer AML screening for corruption, fraud, and terrorism financing.

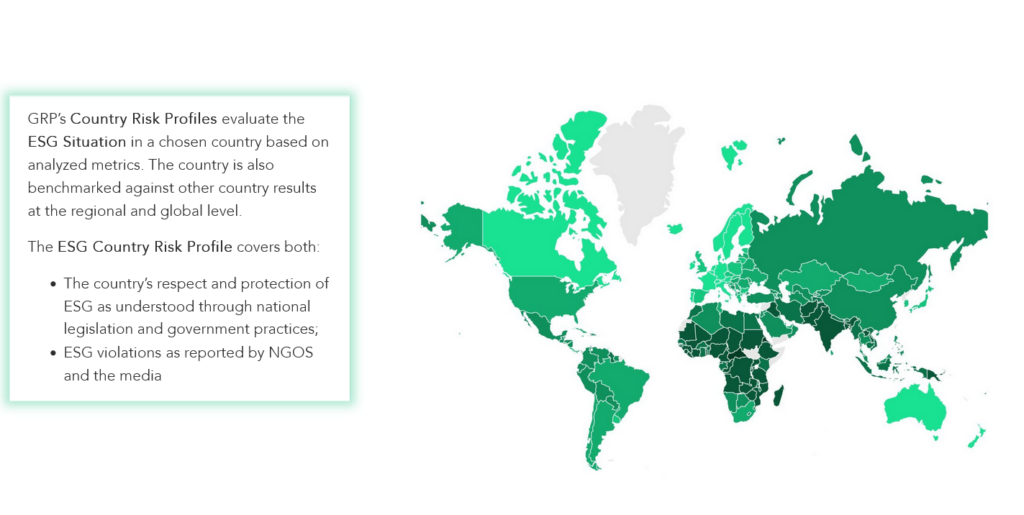

One standout feature is GRP’s ESG Country Risk Profiles.

They benchmark a country’s ESG landscape based on national legislation and reported violations, helping procurement teams and investors contextualize supplier risk at a geographic level.

Source: Global Risk Profile

For broader oversight, GRP users can scale into EDERIS™, the company’s full third-party risk management platform.

To see how GRP supports banks, investors, and global corporations, explore their real-world case studies.

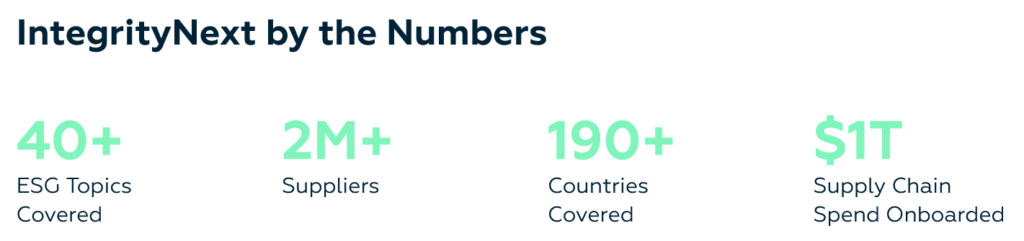

IntegrityNext is an ESG screening platform focused on procurement and supply chain sustainability.

With more than 2 million suppliers connected across 190 countries, the platform enables companies to evaluate and monitor ESG risks across global supply chains.

It covers over 40 critical ESG topics.

Source: Integrity Next

On the environmental side, IntegrityNext offers insight into suppliers’:

Social metrics include child labor, modern slavery, labor rights, diversity, and living wage standards.

On the governance front, the platform covers corruption, bribery, data protection, cybersecurity, business continuity, and code of conduct adherence.

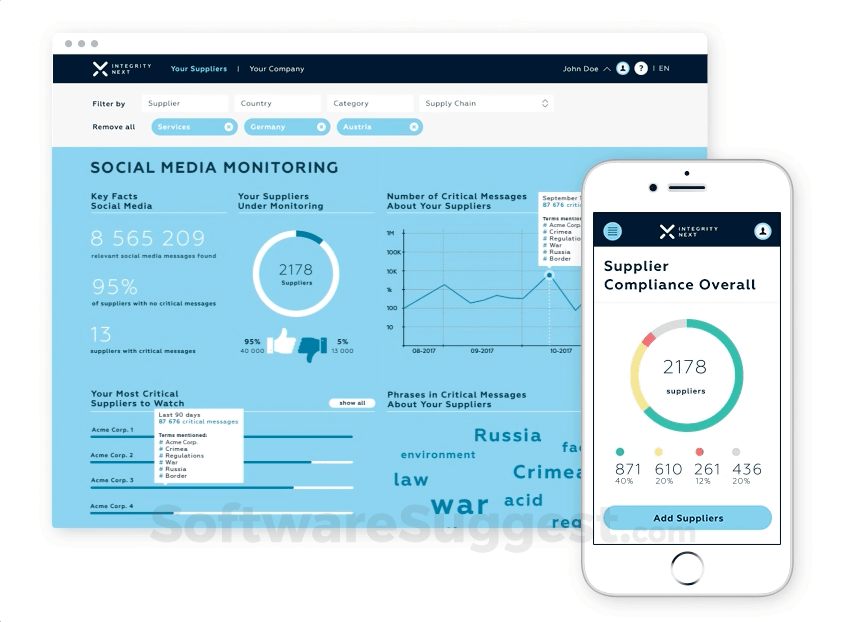

What makes IntegrityNext especially effective is its Critical News Monitoring feature.

As soon as you upload your supplier list, the platform uses AI to scan over one billion media messages daily, sourcing information from NGOs, news outlets, authorities, and even employees, to detect and alert users to any reputational or regulatory risks.

Source: Software Suggest

Unlike some traditional screeners, which focus on periodic data updates, IntegrityNext delivers continuous oversight, similar to Veridion’s risk alert system.

In late 2024, IntegrityNext launched a dedicated module for EUDR (EU Deforestation Regulation) compliance.

Source: ESG Today

It features automated supplier data collection, geolocation-based risk analysis, and trend tracking for commodities like palm oil, timber, cocoa, and soy.

The platform also integrates with ERP and supply chain systems, making it practical for large, complex operations.

Overall, IntegrityNext is a smart choice for organizations that need fast deployment, broad supplier coverage, and strong media monitoring.

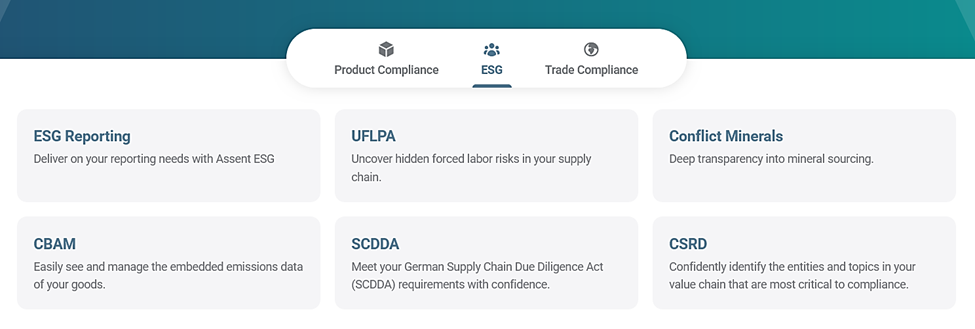

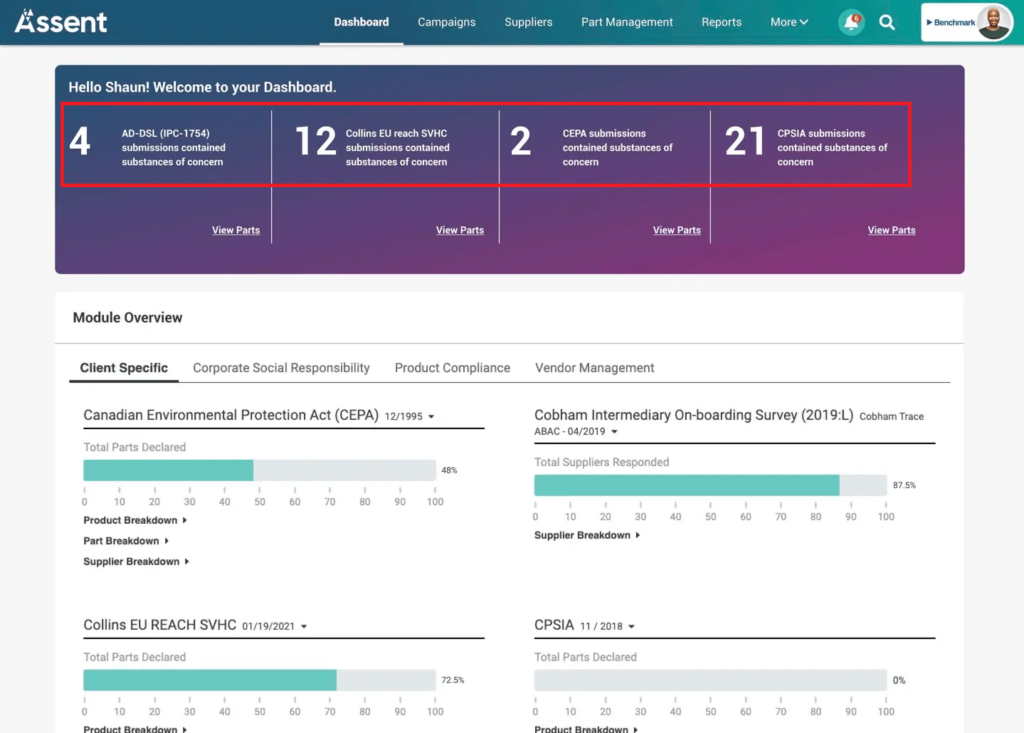

Assent is a supply chain sustainability management platform primarily for manufacturers needing to meet complex product compliance and ESG requirements.

It helps companies collect, manage, and report supply chain data in line with a wide range of international regulations, including REACH, PFAS, RoHS, TSCA, SCIP, Proposition 65, UFLPA, and responsible minerals rules.

Source: Assent

By centralizing data at the product, part, and supplier level, Assent supports auditable due diligence across the entire supply chain.

While Assent’s platform spans many compliance areas, its enhanced supplier screening service stands out for ESG-related use cases.

It screens suppliers using the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) frameworks, enabling companies to align with globally accepted ESG standards.

Source: G2

The platform pulls data from diverse sources, including traditional and paywalled media, print publications, social media, and sanctions and watchlists like OFAC and denied party lists.

It covers 182 countries and supports analysis in 18 languages.

Users receive alerts on any developments that could pose ESG or reputational risks and have the option to supplement third-party data with direct supplier surveys conducted through the same platform.

Source: Software Advice

Compared to tools like Veridion, which offers dynamic enrichment and weekly updates, Assent is more focused on compliance documentation and supplier risk profiling, particularly for manufacturers managing product-related ESG data at scale.

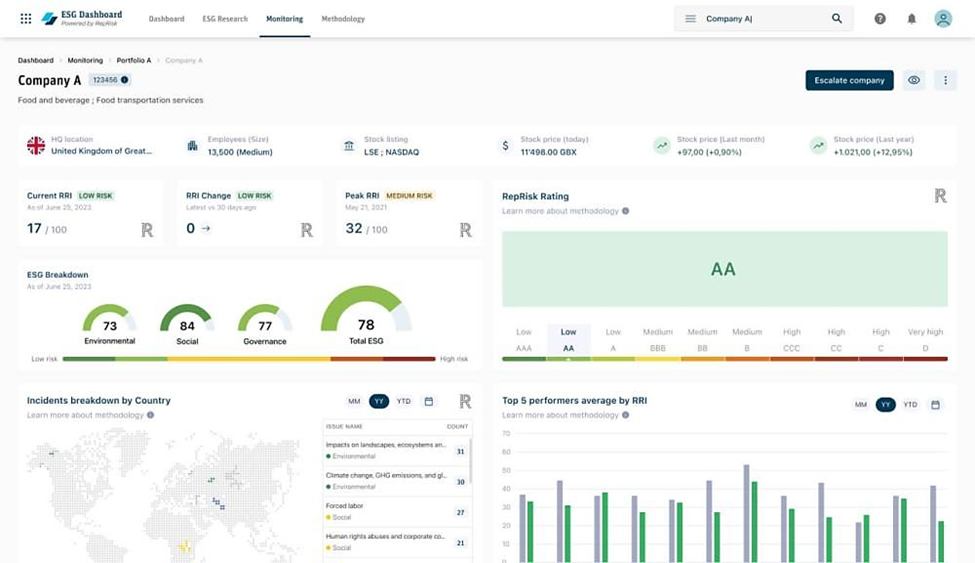

RepRisk is an ESG risk data provider tailored for banks, asset managers, insurers, and institutional investors.

Using AI combined with expert human review, it screens over 150,000 public sources and stakeholders daily in 23 languages, covering everything from local newspapers and blogs to regulatory announcements and NGO reports.

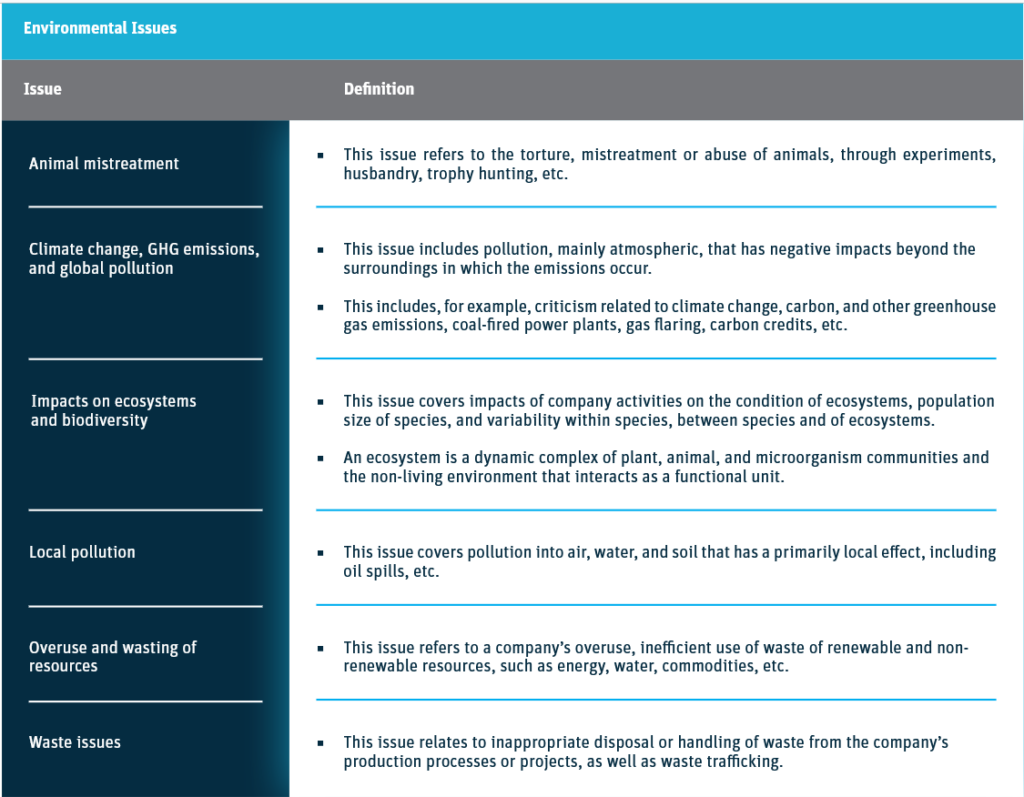

The platform tracks 28 core ESG issues, such as climate change, child labor, corruption, biodiversity impacts, and toxic product recalls.

Here are the environmental issues:

Source: RepRisk

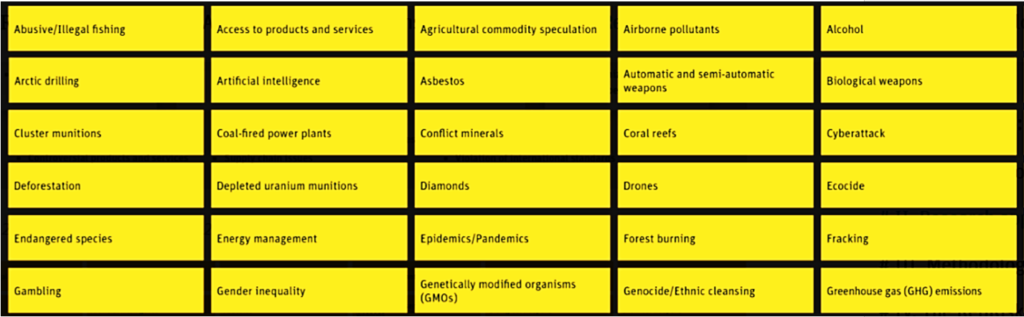

These are further expanded into 80 ESG “hot topics” (some shown below) and ultimately mapped to 108 ESG risk factors.

Source: RepRisk

RepRisk explicitly integrates its data with widely recognized frameworks, including the SDGs, SASB, SFDR, the UN Global Compact, and the German Supply Chain Act, enabling clients to assess ESG exposure through globally accepted lenses.

Compared to Veridion, which emphasizes data validation and company enrichment, RepRisk does not verify reported allegations but instead conducts quality checks and curates sources.

Its risk intelligence is made available via client platforms like the ESG Risk Platform and ESG Risk Monitor, as well as through scheduled flat-file deliveries or custom system integrations.

Source: RepRisk

RepRisk’s data is particularly useful for screening large portfolios or tracking ESG risks tied to investments and infrastructure projects.

It’s a go-to solution for financial institutions that need granular, controversy-focused ESG insights aligned with regulatory and investor expectations.

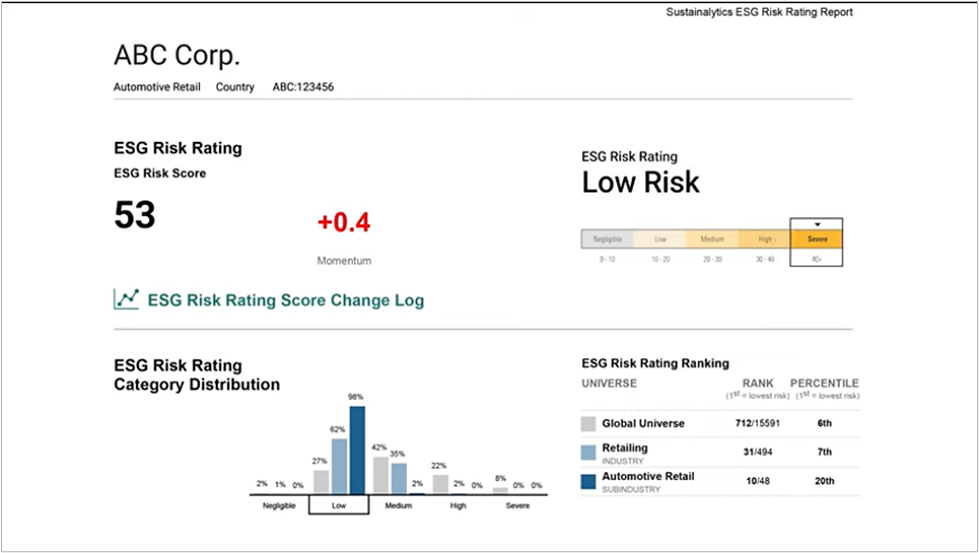

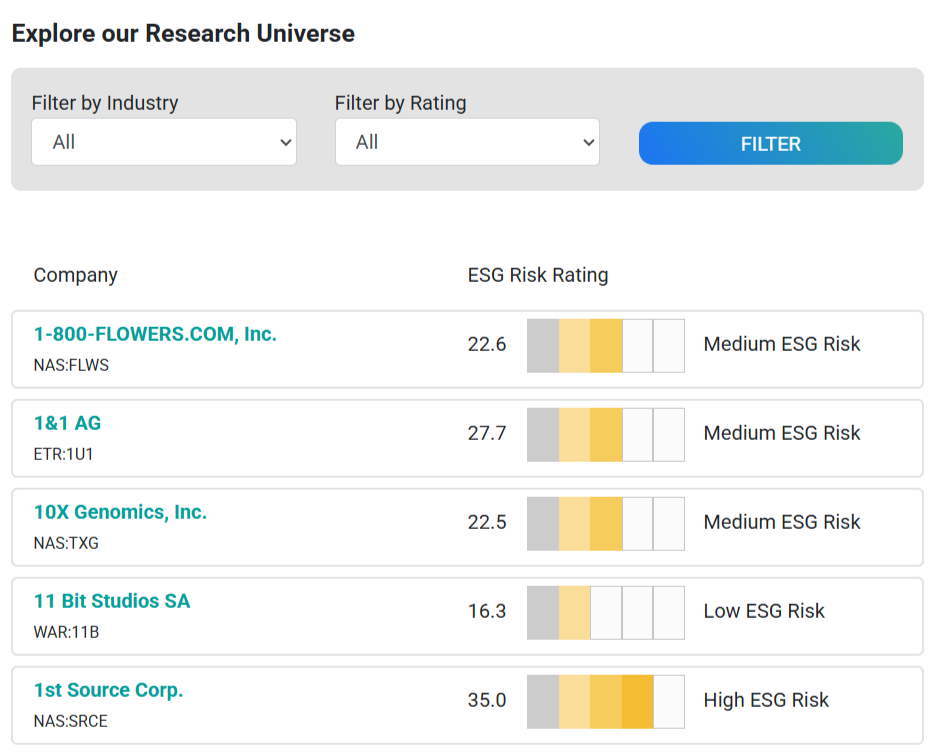

Sustainalytics, a Morningstar company, is a well-established ESG research, ratings, and data provider that supports investors and asset managers in evaluating sustainability risks.

The platform offers a variety of ESG screening tools, including:

For controversies research, Sustainalytics monitors over 700,000 news stories each day, using advanced technology to flag ESG-related incidents such as environmental accidents, labor violations, or corruption scandals.

Each controversy is evaluated through a structured framework that considers the severity of the incident, company accountability, and whether it reflects a broader pattern of misconduct.

While controversy data is updated in real time, other key ESG indicators—like management scores and corporate governance data—are updated annually.

This may limit data freshness for users needing weekly or monthly insights like those offered by Veridion.

The firm provides ESG coverage on over 20,000 issuers, including all major market indexes and large private firms.

Source: Sustainalytics

ESG research includes 150 ESG indicators, 40 event indicators, and 33 governance indicators, compiled from company filings, regulatory disclosures, industry associations, and public domain content such as news and reports.

Here is how the database looks:

Source: Sustainalytics

Sustainalytics also offers positive ESG screening through its Sustainable Products Research, which helps investors identify companies that generate revenue from sustainable goods and services.

How to access this data?

Access is provided through Sustainalytics’ Global Access client platform, where users can retrieve company profiles, filter firms using ESG criteria, and export customized reports to Excel.

Sustainalytics’ ESG data can also be integrated into internal systems via APIs or data feeds.

That said, Sustainalytics remains a go-to for investors who want comprehensive, framework-aligned ESG risk ratings and controversy data.

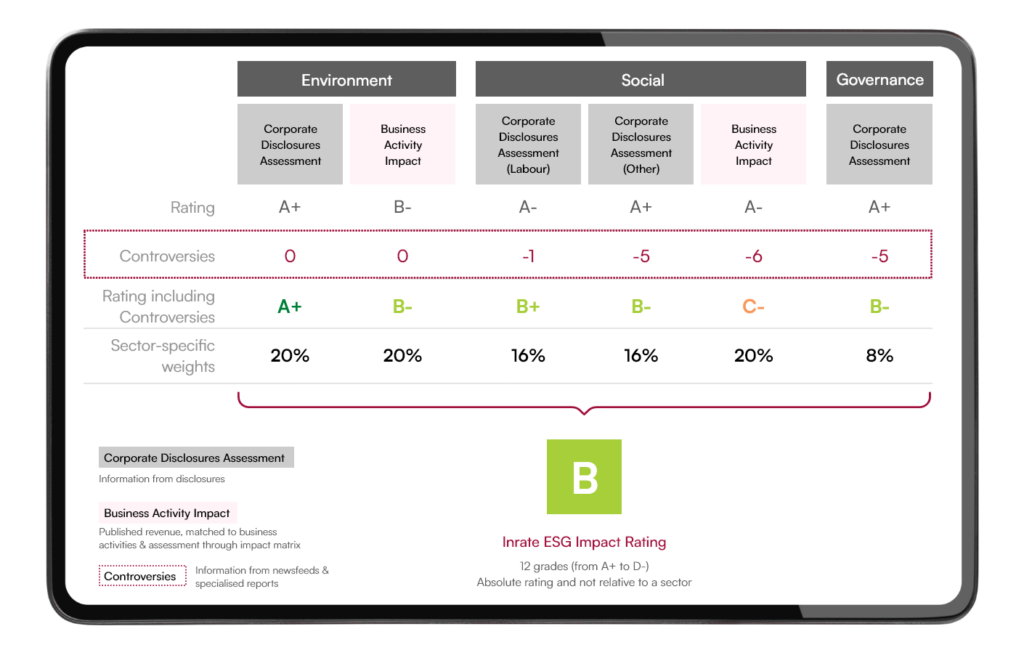

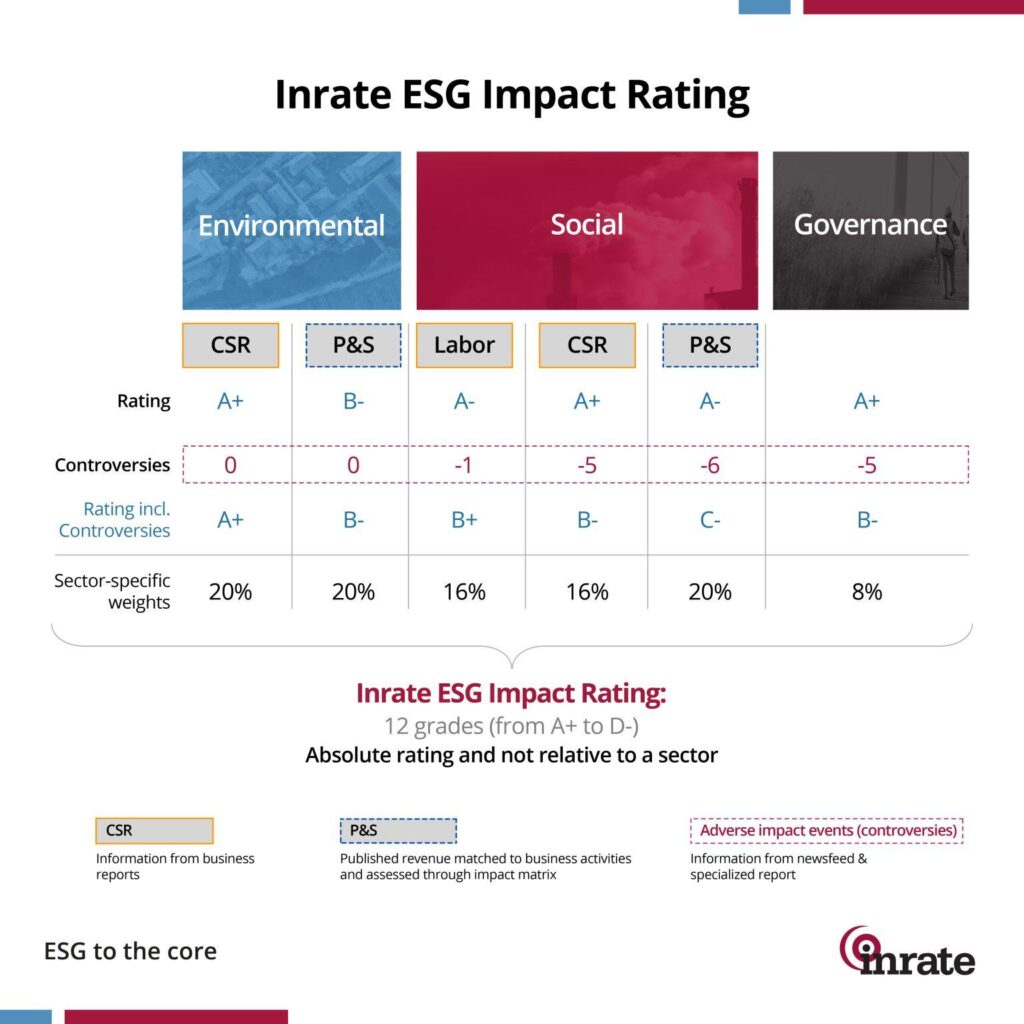

Inrate is a sustainability data and ESG ratings provider with a strong investor focus.

Its ESG screening services help investors and companies meet emerging regulations like CSRD, SFDR, and the EU Taxonomy, with a methodology built around assessing impact rather than just risk.

This makes Inrate especially relevant for those who want to understand how a company’s operations affect people and the planet, not just how the company manages ESG issues internally.

Inrate’s ESG screening includes:

It evaluates over 38 types of controversies and flags involvement with 60 categories of adverse products, such as controversial weapons or harmful substances.

These screenings are applied to over 10,000 public companies, with the same methodology adaptable to private firms.

Source: Inrate

Controversy screening is grounded in over 200,000 credible news sources, including global and regional media.

The sources are assessed bi-weekly based on the real-world impact of reported issues.

Inrate evaluates each incident using parameters such as degree of involvement, scale and depth of the impact, and the durability of consequences.

Company disclosures and credible third-party data are also used, with all data undergoing multi-level quality control to ensure accuracy.

For UNGC screening, Inrate provides customized evaluations of a company’s alignment with the UN’s principles on human rights, labor, environment, and anti-corruption.

This can include optional insights into controversial weapons, ESG violations, product risks, and environmental/labor performance, tailored to fit the client’s ESG policy thresholds.

Source: Inrate

Data is accessible via Inrate’s intuitive client interface or delivered through custom formats such as API, FTP, CSV, or XLSX, depending on the organization’s needs.

Source: Inrate on LinkedIn

Inrate updates its data on an annual basis, which is less frequent than platforms like Veridion (which updates weekly), but comparable to Sustainalytics.

While it lacks real-time monitoring or integrated media alerts, it offers a unique impact-based perspective and deep ESG insight, particularly valuable for long-term investors and impact-focused screening.

To recap, here’s an overview of the ESG screening tools we covered:

| Tool | Coverage | Data source | Key features | Best for |

|---|---|---|---|---|

| Veridion | 120M+ companies across 250+ regions | AI + ML on global web data, news, registries, and company websites | Weekly updates, ESG + emissions data, supplier search & enrichment, alerts, API & CSV delivery | Full ESG lifecycle: discovery, screening, and monitoring |

| Global Risk Profile | 185 countries, 1,500+ sources | Official + specialized sources, proprietary archives, deep web, optional on-site verification | ESG & AML screening, fast due diligence reports, country risk profiles | Quick supplier vetting and country-level ESG risk insights |

| IntegrityNext | 2M+ suppliers in 190 countries | News media, NGOs, authorities, internal monitoring algorithms | 40+ ESG topics, real-time news alerts (1B+/day), EUDR compliance, SCM/ERP integration | Ongoing supply chain monitoring with fast alerts |

| Assent | 182 countries, 18 languages | Media (incl. paywalled), sanctions lists, denied parties lists, company data, user surveys | GRI/SASB screening, product compliance (REACH, PFAS, etc.), alerts, supplier surveys | Manufacturers managing ESG compliance at product level |

| RepRisk | 150k+ sources in 23 languages | Public sources incl. media, blogs, NGOs, regulators; no validation of allegations | Daily ESG risk signals, 108 factors, controversy tracking, mapped to SDGs, SFDR, SASB | Investors screening portfolios for ESG controversies and reputational risks |

| Sustainalytics | 20k+ issuers globally | Company filings, regulatory disclosures, public/media sources, industry associations | 150 ESG indicators, real-time controversy updates, positive screens, Global Access platform | Investors needing robust ESG ratings and framework-aligned data |

| Inrate | 10k+ public firms + private | 200k+ news sources, company disclosures, verified third-party data, bi-weekly controversy checks | 700+ indicators, impact-focused, 38 controversies, 60 product exclusions, annual updates | Impact screening with strong controversy and UNGC focus |

Choosing the right ESG screening tool will help you gain visibility, manage risks, and build sustainable business relationships.

Each tool featured here brings unique strengths, whether you need real-time alerts, deep controversy analysis, or reliable data to meet evolving regulations.

The key is finding one or more solutions that fit your goals, your industry, and the level of ESG transparency you need.

The pressure to act responsibly is only growing.

So, which tool(s) will help you lead the way?

Start exploring, and take your ESG strategy from reactive to resilient.