Barriers to ESG Transparency and How to Overcome Them

Key Takeaways:

These days, companies face growing pressure from investors, consumers, and regulators alike to demonstrate full accountability and transparency in their ESG practices.

But actually delivering on these expectations is often easier said than done.

Even the organizations that are most committed to unlocking complete ESG transparency encounter significant challenges along the way.

Fortunately, these obstacles can be overcome.

In this article, we’ll explore the five most common barriers to ESG transparency and share practical strategies to help you navigate them.

Whether you’re just beginning your ESG journey or trying to improve your existing reporting processes, these insights will help you stay ahead of the potential roadblocks.

As of now, there’s no single, universally accepted ESG reporting framework.

Instead, companies are faced with a tangled web of more than a dozen standards, each with its own metrics, disclosure rules, and focus areas.

This kind of fragmentation makes it difficult to figure out which metrics actually matter and how to report in a way that’s clear and consistent.

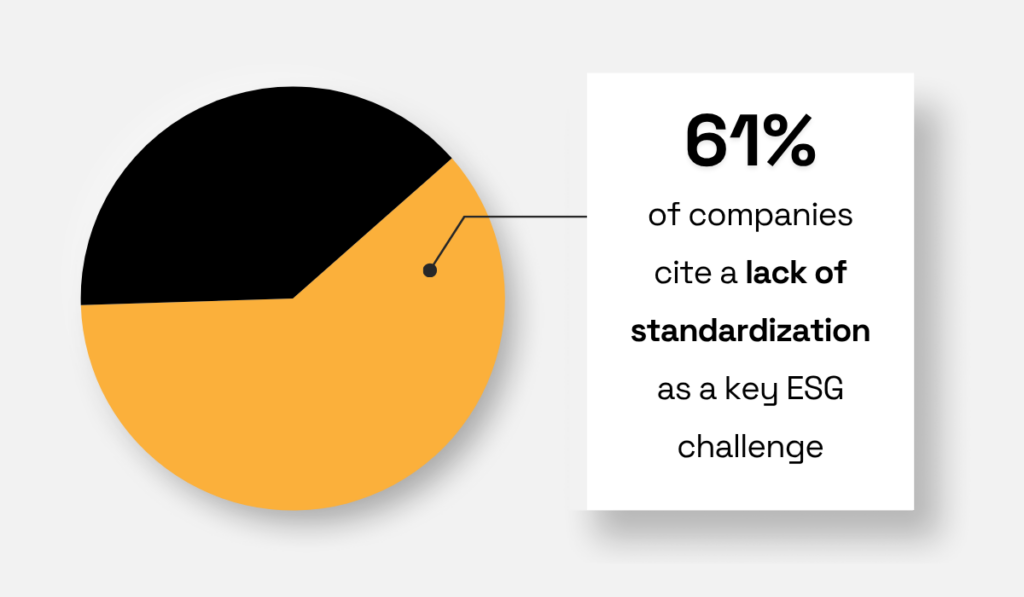

In fact, the 2023 Kroll survey revealed that 61% of companies see the lack of standardization as their biggest ESG challenge.

Illustration: Veridion / Data: Kroll

This is because inconsistent use of standards easily results in non-comparable, cherry-picked disclosures, making it harder for stakeholders to assess or benchmark performance objectively.

The result?

Confusion, inefficiencies, and even missed opportunities.

Andrew Probert, Business Unit Managing Partner at ERM, a sustainability consultancy, agrees:

Illustration: Veridion / Quote: Kroll

The smart move here is to take a more strategic approach to ESG reporting.

That starts with understanding what frameworks are out there and choosing the ones that best match your industry, goals, overall strategy, and stakeholder expectations.

Here’s what to consider:

| Regulatory Requirements | Are there mandatory ESG disclosure laws in your region or industry? |

| Industry Relevance | Some frameworks are sector-specific (e.g., SASB focuses on financial materiality by sector). |

| Stakeholder Expectations | Investors, customers, and employees may favor globally recognized standards like TCFD or ISSB. |

| Alignment with Strategic Goals | Does the framework support your ESG priorities, targets, and KPIs? |

| Global vs. Local Reach | Multinational companies may benefit from globally recognized frameworks such as GRI, TCFD, or ISSB. |

| Level of Detail and Complexity | Consider your organization’s ESG maturity, data capabilities, and available resources. |

| Interoperability | Frameworks like ISSB aim to integrate and consolidate existing standards (e.g., TCFD, SASB). |

To get started, check out free online resources like Point B’s overview of ESG frameworks and standards across the U.S., Europe, and other regions.

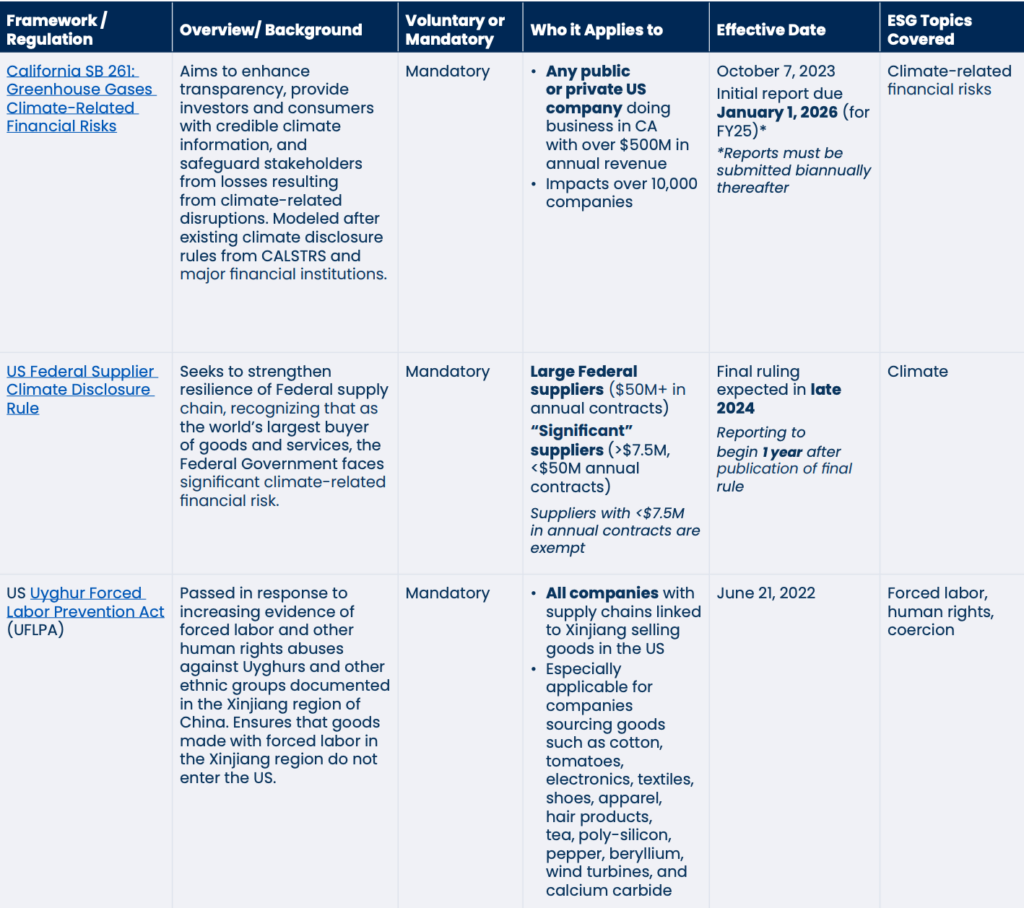

It summarizes important information such as scope, background, disclosure requirements (voluntary vs. mandatory), applicability, and more across many common frameworks:

Source: Point B

While it doesn’t list every single framework out there, it’s a solid starting point for getting your bearings and figuring out the best combination of standards for your company.

In some companies, ESG just isn’t a top priority for leadership.

It’s often seen as a “nice to have” rather than a business-critical initiative, mostly because the ROI isn’t always immediate.

But that mindset creates real problems.

When ESG doesn’t have executive backing, it gets underfunded, siloed, or deprioritized, ultimately leading to poor data availability, superficial reporting, and a lack of accountability.

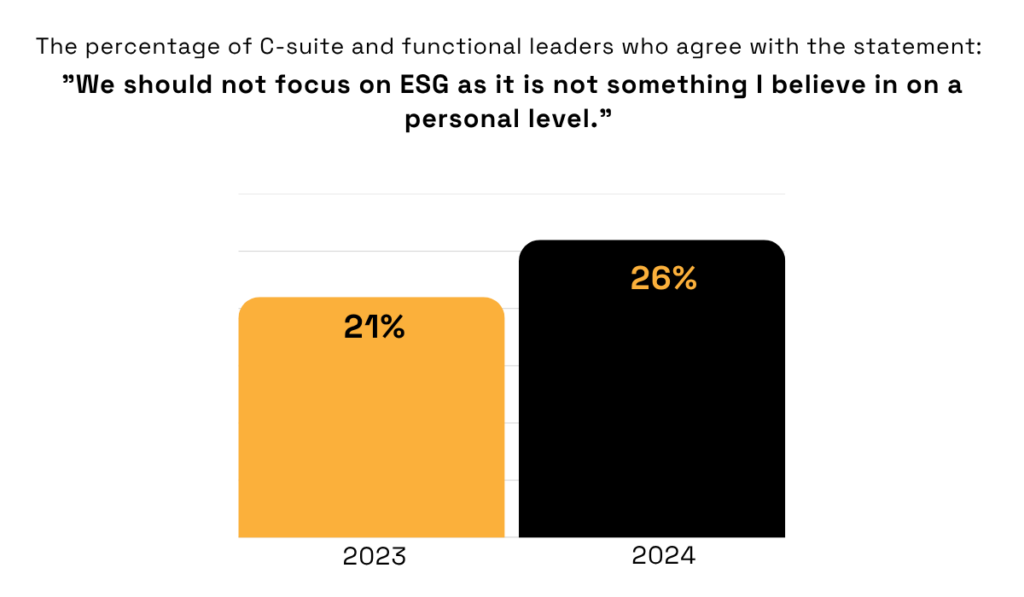

A Thomson Reuters survey offers some insight into how ESG is currently viewed by the C-suite, revealing that, while many acknowledge its importance, not all are convinced.

In 2023, 21% agreed with the statement, “We should not focus on ESG as it is not something I believe in on a personal level.”

However, that number increased to 26% in 2024, signaling a growing pocket of skepticism.

Illustration: Veridion / Data: Thomson Reuters

If this mirrors the mindset within your organization, educating leadership on ESG’s strategic value can help.

Link ESG initiatives to outcomes like cost savings or talent retention—concrete benefits that the leadership will understand and appreciate.

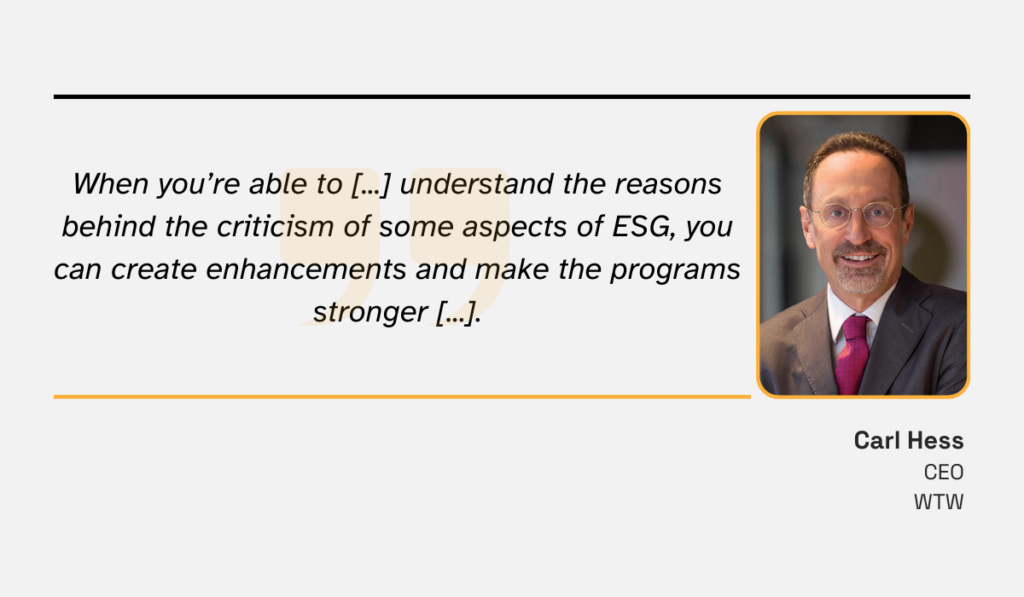

Carl Hess, CEO of WTW, offers valuable advice from a leader’s perspective:

Illustration: Veridion / Quote: WTW

What does this mean for you?

Don’t get defensive if your ideas get rejected. Instead, try to understand the source of skepticism.

Is it cost concerns? Reputational risk? A lack of measurable impact?

Once you figure out why they’re hesitant, you can tailor the conversation to show how ESG directly supports their objectives.

Fortunately, there’s growing evidence of ESG’s positive business impact.

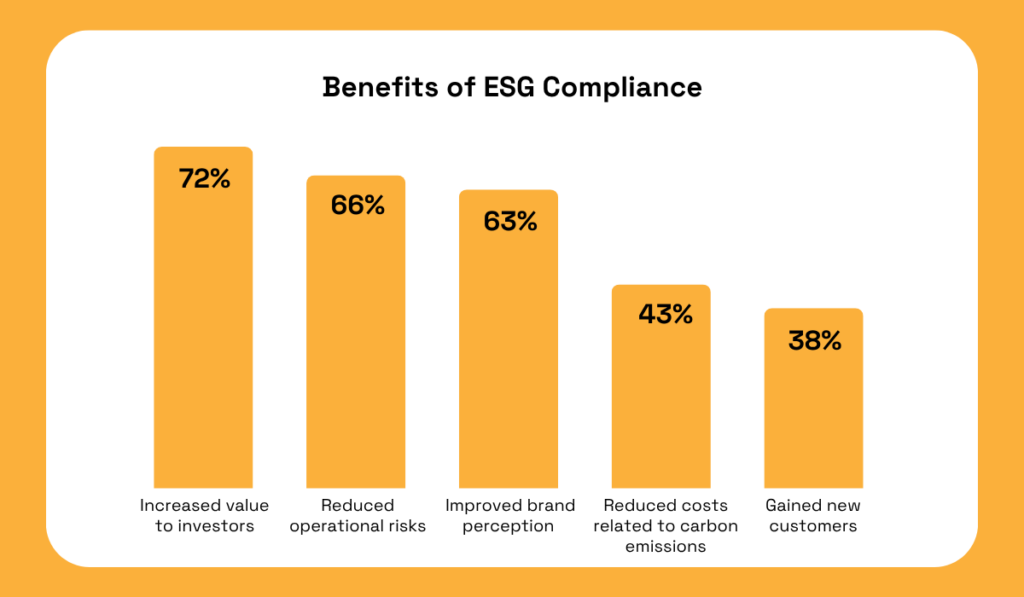

For instance, a DNV research found that ESG compliance boosts brand reputation, brings new customers, helps mitigate operational risks, and so much more.

Illustration: Veridion / Data: DNV

Use research like this, along with relevant success stories, to show what’s possible when ESG is given the attention it deserves.

The business case is there—it just needs to be made in a way that speaks the language of leadership.

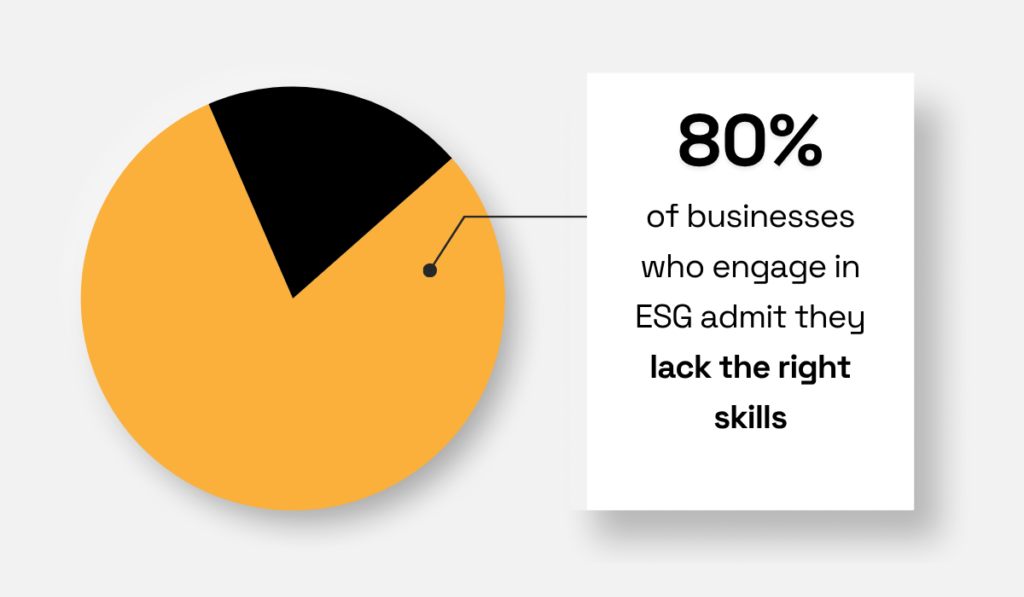

Another common challenge companies face is that employees and managers often lack the knowledge or training needed to understand, track, and report ESG metrics effectively.

This can result in inaccurate data inputs, weak cross-functional collaboration, and incomplete, vague, or inconsistent ESG reporting.

As a matter of fact, the 2023 survey by The Open University found that 80% of businesses engaged in ESG admit they lack the necessary skills across all three ESG pillars.

Illustration: Veridion / Data: The Open University

So, what’s the fix?

Simple: education and training.

Take OCS, a global facilities services company, as an example. They invest heavily in ESG training.

In 2024, they launched a targeted educational program for their Group Executive Committee, supported by external specialists in climate and ESG governance.

According to their website:

“The training encompassed regulatory trends, stakeholder needs, and the risks and opportunities associated with climate transition. It was further guided by our double materiality assessment and climate risk analysis.”

Now, OCS is expanding this training across its global workforce through a new ESG awareness course.

Moreover, OCS Indonesia has also introduced the VOCIFY Green Apprenticeship Programme for logistics workers.

The curriculum offers hands-on experience in sustainable logistics operations and is certified by respected British institutions, including ABE and the Chartered Institute of Logistics and Transport (CILT).

Yohanes Jeffry Johari, Managing Director and President Director of OCS Indonesia, commented:

Illustration: Veridion / Quote: OCS

Overall, by investing in role-specific training across the organization, OCS is improving ESG transparency and making meaningful progress toward its sustainability targets.

But not every organization has the resources to roll out large-scale training programs like these.

Fortunately, effective ESG education can still be achieved through passive integration into existing training efforts.

Maisie Ganzler, Strategic Advisor at Bon Appétit Management Company, an on-site restaurant company offering full food-service management, explains:

Illustration: Veridion / Quote: TechTarget

As a former food industry executive, Ganzler shared the example of onboarding a new chef tasked with developing menus.

During training, the chef could be taught that reducing beef and cheese consumption could significantly lower carbon emissions, for instance.

In this case, the training doesn’t just say what to do; it explains why it matters, linking everyday decisions to the bigger ESG picture.

The takeaway?

ESG learning opportunities are everywhere and more accessible than ever.

By investing time, thought, and even modest resources into ESG training, you can make a difference and equip your teams to unlock complete transparency and drive real progress.

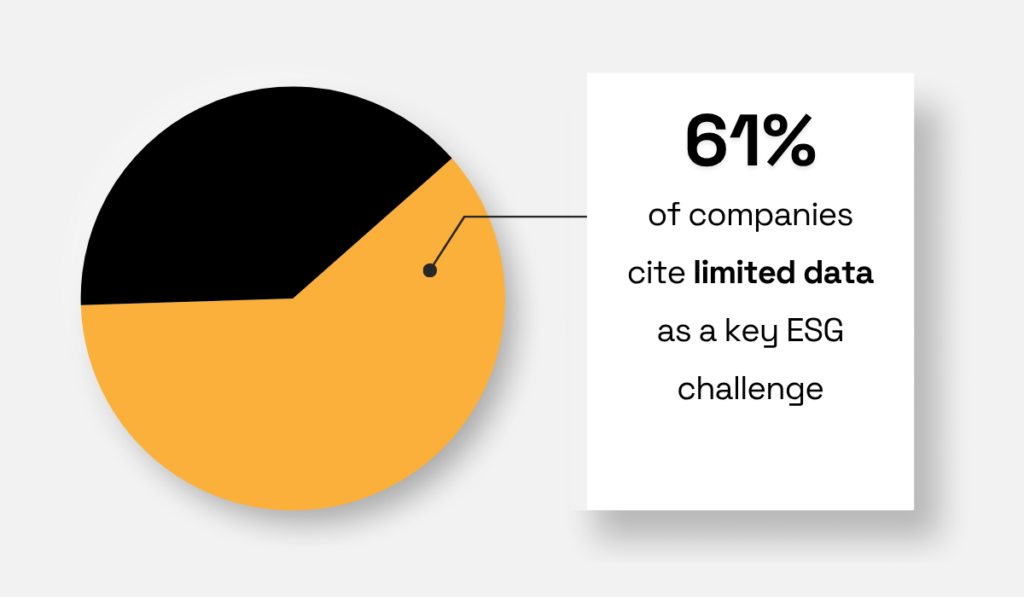

You can’t have ESG transparency without accurate, easily accessible ESG data.

Yet too often, this data is scattered across systems and formats, making it difficult to compile and analyze, especially if collected manually or through systems not built for ESG reporting.

The Kroll survey we mentioned earlier highlights just how widespread the issue is, revealing that 61% of companies cite limited data as their biggest challenge in ESG reporting.

Illustration: Veridion / Data: Kroll

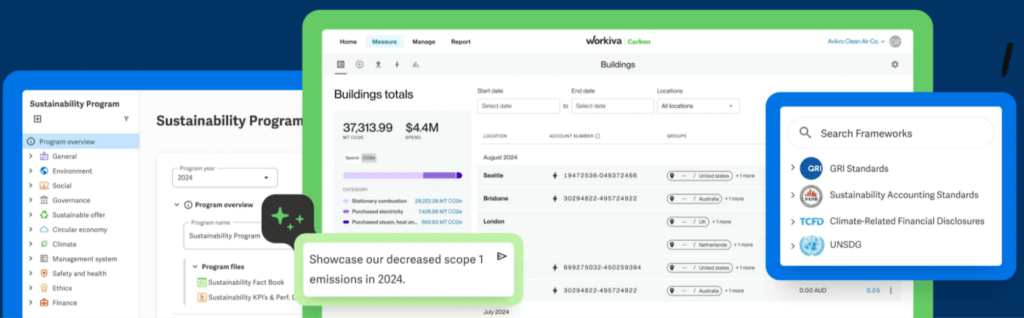

The only way to overcome this is to retire outdated systems and establish a unified, trusted data foundation.

Digital solutions like ESG compliance software (shown below) are designed for exactly this.

Source: Workiva

They centralize data from multiple departments, automate reporting, and ensure alignment with leading frameworks and standards.

At Hershey, they already know how game-changing this kind of software can be.

Their solution allows different departments to collaborate, share data, comment, and manage sign-offs all in one place, boosting overall transparency and efficiency.

Rachael Staab, former Manager of ESG and Sustainability Reporting at Hershey, noted:

Illustration: Veridion / Quote: Workiva

More than 100 subject matter experts contribute to Hershey’s approximately 130-page sustainability report and half a dozen additional disclosures covering over 800 metrics.

Before adopting the software, the team had to manually reconcile 800+ comments across 35 PDFs, a process that took two weeks before even reaching the external design agency.

After switching to ESG software, however, they were able to resolve over 600 comments in just six hours, enabling the agency to deliver a new draft within 48 hours.

That’s the power of digital ESG solutions.

They unlock more streamlined collaboration, real-time editing, and automated workflows, reducing complexity and breaking down silos.

Ultimately, this enables data to flow freely and transparently to all stakeholders.

No confusion. No bottlenecks.

Your internal ESG data is one thing—external supply chain ESG data is another.

Both are important for full ESG transparency and truly informed decision-making.

But here’s the problem: global supply chains are vast, complex, and notoriously difficult to monitor, especially beyond Tier 1.

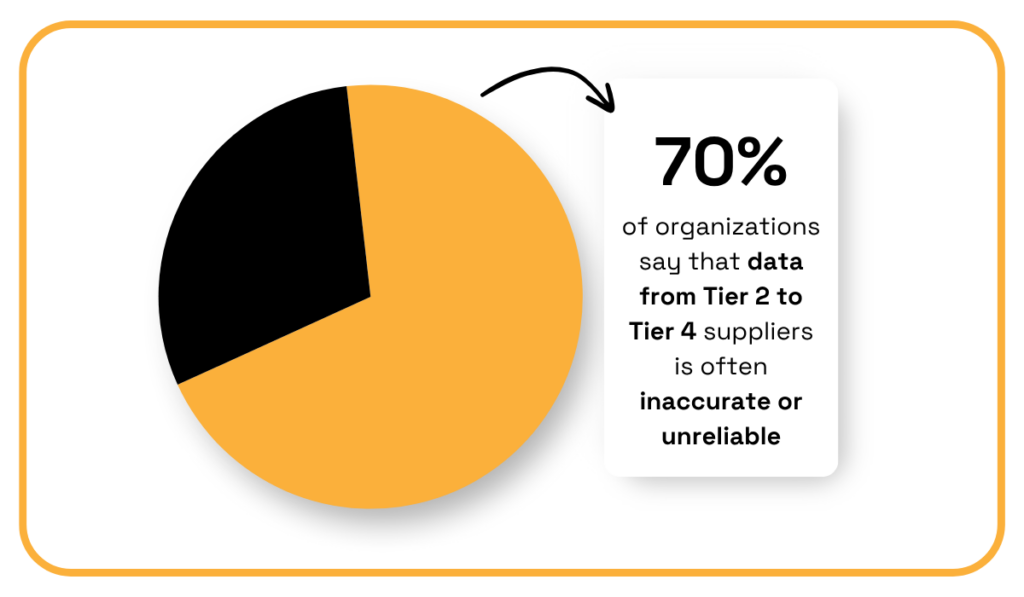

In fact, research from Sphera shows that 70% of organizations report unreliable or incomplete data for their Tier 2–4 suppliers.

Illustration: Veridion / Data: Sphera

As a result, many companies focus only on tracking Tier 1 suppliers, leaving significant gaps in ESG data from deeper levels of the supply chain.

However, without clear, verifiable data from all suppliers, your ESG disclosures fail to reflect the full scope of your company’s environmental and social impact.

That incomplete picture can expose you to serious risks.

Just look at Apple.

Despite their resources and reputation, they faced repeated scrutiny due to labor violations at a Tier 1 supplier.

Source: Business & Human Rights Resource Centre

At the end of the day, your suppliers’ ESG compliance is your compliance, too.

That’s why visibility into their practices and ESG performance is non-negotiable.

The good news?

You don’t have to solve this challenge alone.

There are now dedicated services that tackle supply chain data gathering, including Veridion, our own AI-powered market intelligence platform.

Built for procurement, risk, and ESG teams, Veridion gives you instant insight into ESG exposure across 100+ million companies and 200 million locations worldwide.

What sets us apart is the accuracy, depth, and richness of our data, driven by a proprietary four-step process:

| Data Extraction and Analysis | Veridion extracts and analyzes data from company websites and news sources to ensure our profiles reflect both company statements and public perception. |

| Data Classification | Data is classified using a rigorous ESG taxonomy organized into Pillars, Themes, and Risks. |

| Sentiment Analysis | We incorporate sentiment analysis to evaluate the tone and intent behind ESG actions. This allows us to compare public commitments with actual performance, offering a more comprehensive picture of ESG effectiveness. |

| Profile Enrichment | ESG profiles are enriched with additional firmographic attributes, such as company location, products, services, NAICS classification, employee count, and revenue. This provides context to ESG efforts within broader business operations. |

The result?

Veridion captures the full ESG footprint—commitments, actions, targets, certifications, and controversies—across every tier of the supply chain.

We classify this information across three core pillars—Environmental, Social, and Governance—broken down into granular Themes and Risks.

You can see the full list of these themes in the image below.

Source: Veridion

In short, Veridion delivers fresh, detailed, and precise ESG insights you won’t find anywhere else.

With our data, you can make smarter decisions, avoid disruptions, and stay compliant with confidence and ease.

Yes, ESG challenges are real, and they’re not going away anytime soon.

That’s why the companies that face them head-on are the ones that keep winning, ensuring compliance while strengthening resilience, trust, and long-term value.

Now is the time to invest: in the right tools, your people, and reliable data.

It’s the only path to true transparency—and with it, smarter decisions and lasting success.