How to Find Suppliers In Indonesia

Key Takeaways:

Looking to expand your supplier base in Southeast Asia beyond China?

With its growing manufacturing sector and competitive costs, Indonesia is becoming a key destination for global procurement teams.

Still, finding reliable Indonesian suppliers from across the world can be challenging.

In this article, you’ll learn where to start, what to watch out for, and how to navigate Indonesia’s unique sourcing landscape with confidence.

Indonesia’s diverse manufacturing industries, competitive labor costs, and active government support have made it a fast-rising player in global supply chains.

That’s no surprise.

With over 17,000 islands, Indonesia is the world’s largest archipelagic state and the fourth most populous country, home to over 280 million people.

Its economy is driven by a large, predominantly young workforce, and is seeing strong growth in both consumer spending and industrial output.

The government is also accelerating this momentum through initiatives like the 2018 Making Indonesia 4.0 roadmap.

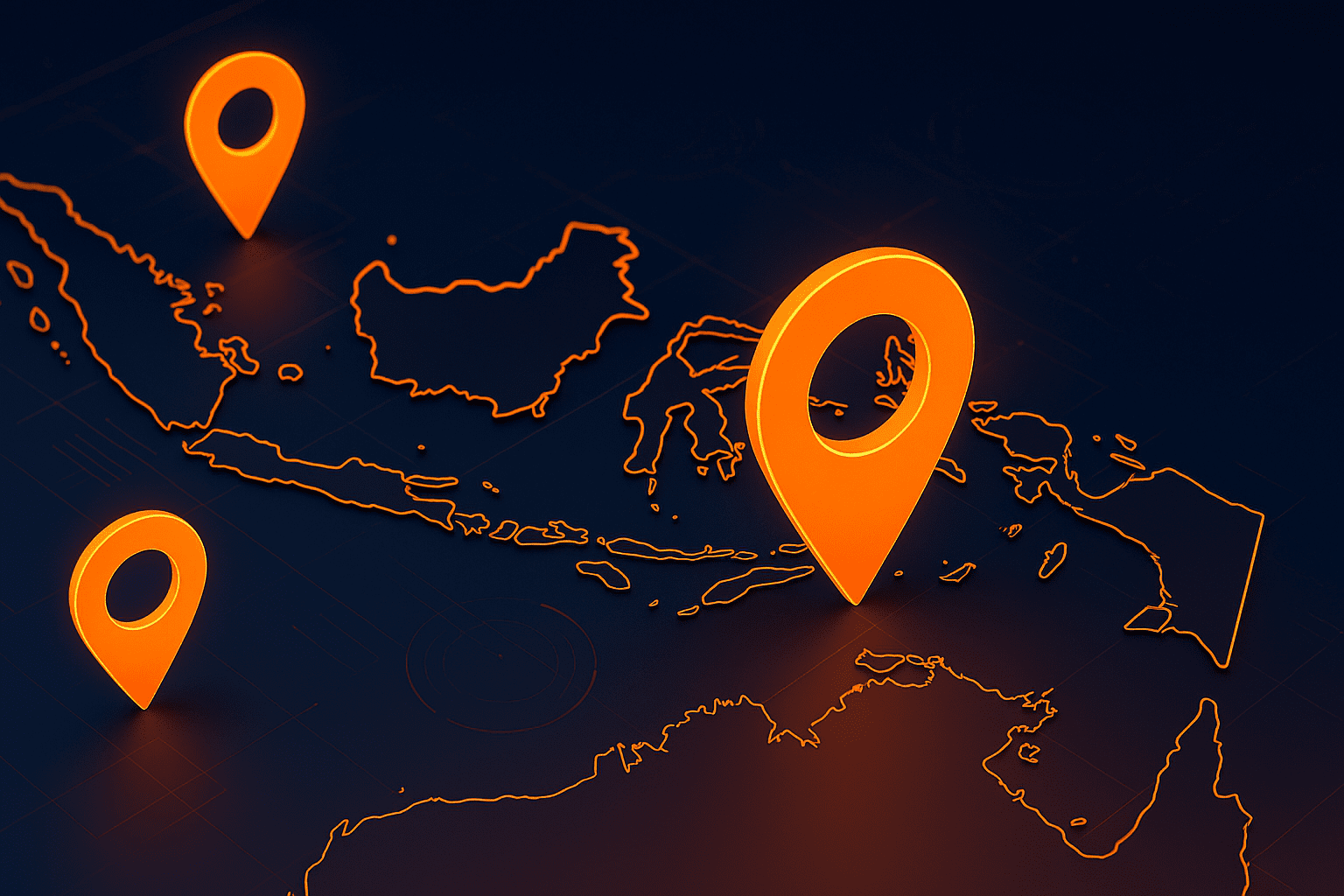

This plan not only outlines future goals but also highlights Indonesia’s economic progress so far.

In just 15 years, Indonesia has added 30 million workers, doubled average wages, and seen household spending increase eightfold.

Source: sea-vet.net

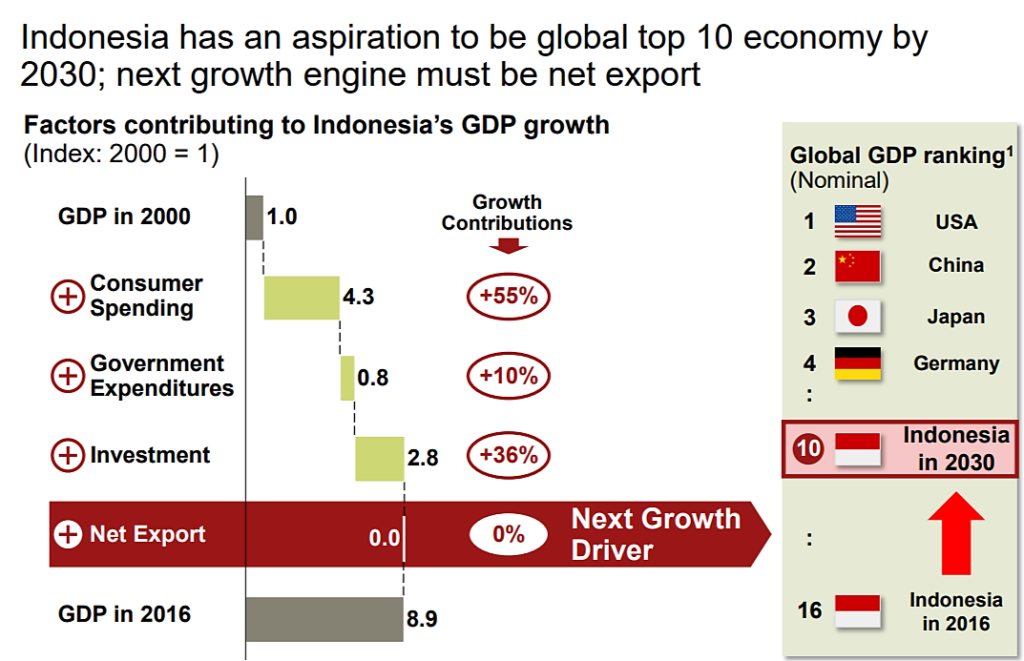

Investment and corporate activity surged as well, helping the country rise from 27th to 16th in global GDP rankings.

These gains have laid a strong foundation for Indonesia’s next phase of industrial growth.

Key industries—central to the Making Indonesia 4.0 roadmap—include food and beverages, automotive, electronics, chemicals, textiles, and basic metals.

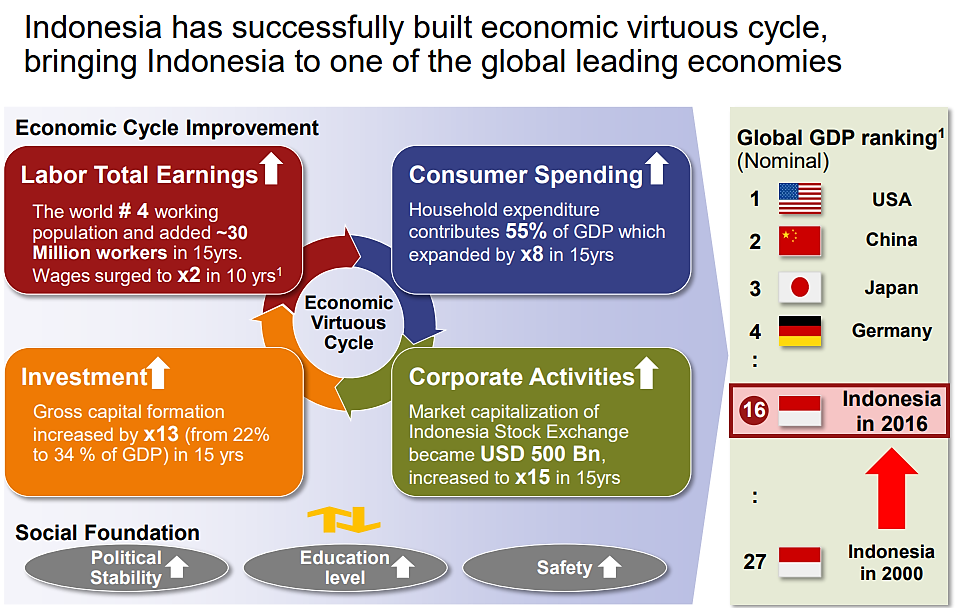

Despite the income growth, the average hourly wage of a factory worker in Indonesia ($0.70–$1.00) remains significantly lower than in China ($3–$6).

Illustration: Veridion / Data: World Salaries

Beyond favorable cost dynamics, Indonesia benefits from political stability and steady economic development.

In recent years, the country has posted GDP growth rates of around 5%, with a favorable outlook for 2025.

This growth has been driven primarily by strong domestic consumption, alongside rising public and foreign investment.

Looking ahead, Indonesia sees exports as its next major growth engine—a point illustrated in the roadmap excerpt below:

Source: sea-vet.net

To meet its industrial targets, the government is modernizing sectors like electronics, metals, and automotive while promoting sustainable practices.

It’s also taking targeted policy steps to move further up the value chain, most notably by banning raw nickel exports in 2020.

Nickel, a key input for EV batteries and stainless steel, is now being processed domestically to support Indonesia’s goal of becoming a global hub for nickel-based manufacturing.

In parallel, the country already serves as a major manufacturing base for Japanese automakers like Honda, Toyota, and Suzuki.

In 2023 alone, Indonesia exported 470,000 completely built-up (CBU) vehicles.

Together, these efforts are laying the groundwork for the country’s EV ambitions.

As Indonesia’s Minister of Trade Zulkifli Hasan put it:

Illustration: Veridion / Quote: Regfollower

Hasan made this statement during the launch of Indonesia’s free trade agreement (FTA) negotiations with the Gulf Cooperation Council (GCC), an economic alliance of six Gulf countries:

This is just one of several FTAs Indonesia is actively pursuing, in addition to its participation in a broad network of regional and bilateral trade agreements:

At the time of writing, Indonesia is very close to signing a comprehensive deal with the EU (expected by the end of 2025) and is awaiting further response from the US side.

In negotiations with the US so far, Indonesia has offered tariff cuts, deregulation measures, and investment incentives.

In return, it’s pushing for equal treatment, asking for the same tariff levels applied to other regional exporters.

As Coordinating Minister for Economic Affairs Airlangga Hartarto emphasized:

Illustration: Veridion / Quote: Setkab

So, what does this quote and everything else we covered mean for international procurement teams?

In short, Indonesia offers clear advantages for global buyers, including:

Next, let’s explore what challenges might still be holding procurement teams back from connecting with reliable Indonesian suppliers.

Indonesia is a populous country, which means much of its demand is generated internally.

On the one hand, this drives economic growth by supporting a growing base of local suppliers.

On the other hand, it keeps many Indonesian businesses—especially SMEs—focused primarily on national, regional, or even local markets.

For instance, while Indonesia’s digital economy is expanding rapidly and internet penetration is high at 74.6%, many businesses still lack a web presence, particularly one that’s bilingual.

Sure, larger and export-oriented companies often have websites in both Indonesian and English.

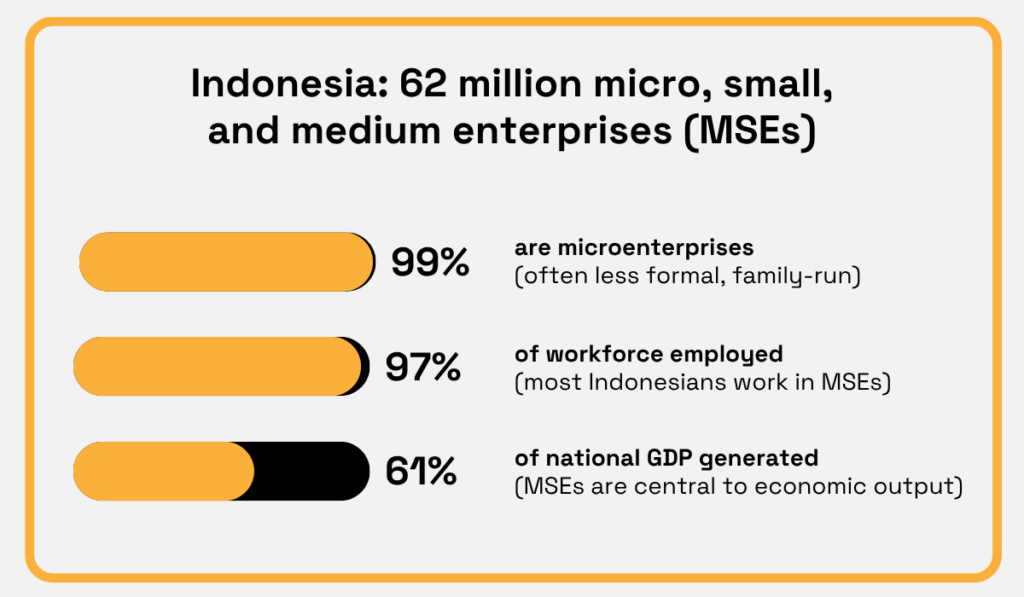

But as shown below, Indonesia is also home to over 62 million small businesses:

Illustration: Veridion / Data: 60 Decibels

Naturally, many of these businesses either have no website or one available only in Indonesian, which complicates online supplier searches.

What about e-commerce platforms?

Indonesia’s e-commerce sector is booming, with projections exceeding $130 billion in 2025.

Yet, major sites like Made in Indonesia and Tokopedia are either fully in Indonesian or provide only partial English support.

As a result, even the initial steps—finding and verifying potential suppliers online—can be challenging for international procurement teams.

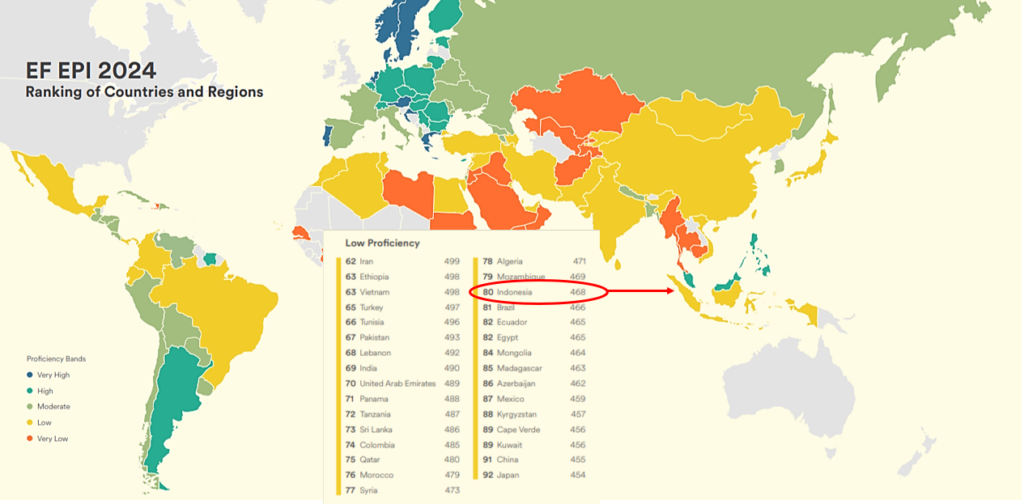

These difficulties are compounded by Indonesia’s relatively low English proficiency, especially when compared to many other supplier markets.

As the 2024 EF English Proficiency Index shows, the country ranks 80th out of 116 countries with a score of 468 out of 700.

Source: EF

While this isn’t ideal, English proficiency tends to be higher in the capital, Jakarta (523 points), and other major cities like Surabaya, Jayapura, and Palembang.

Still, for procurement teams, native-language-only websites and platforms remain a key barrier during early-stage supplier discovery.

Once potential suppliers are identified, it’s usually easier to find someone who speaks English—or to work through a local consultant.

But even then, cultural norms can introduce new challenges.

For example, Indonesian timelines are generally more flexible than in the West—a concept known locally as jam karet, or “rubber time.”

As Daris Salam, COO Indonesia at InCorp, explains:

Illustration: Veridion / Quote: Cekindo

Beyond jam karet, Indonesian business culture emphasizes personal relationships, respect for hierarchy, and flexibility in negotiations.

This means interactions may not follow strict timelines and can require patience and long-term relationship-building.

Contracts, too, are often less detailed and more open to renegotiation than in many Western contexts.

Ultimately, the issue isn’t a lack of suppliers.

The challenge lies in their makeup (mostly SMEs), limited English web presence, and the country’s distinct business customs.

That said, some platforms can help bridge these gaps.

Despite the challenges, several platforms can help international procurement teams discover and connect with Indonesian suppliers more easily.

Below are some of the most useful starting points.

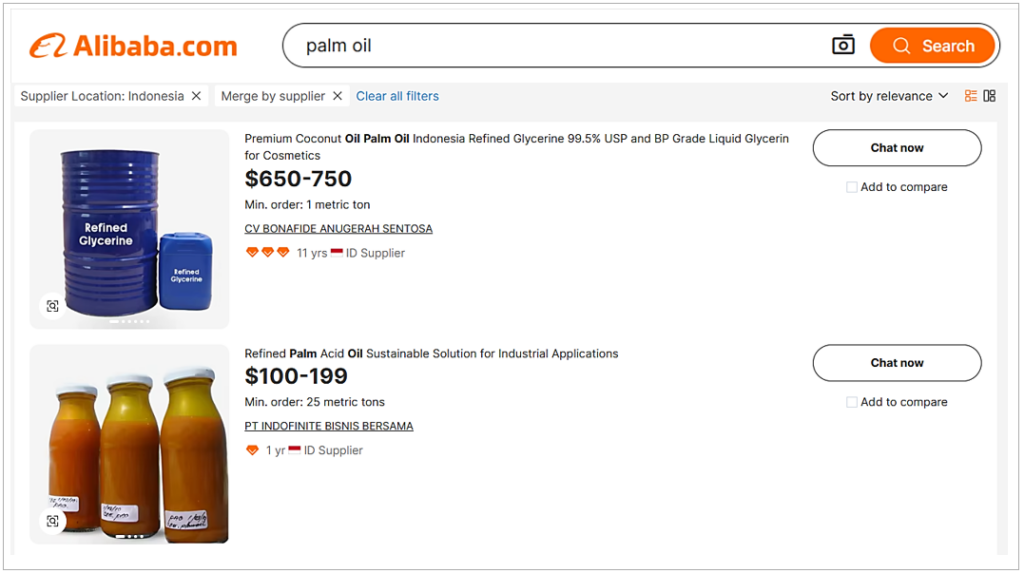

Marketed as one of the largest B2B platforms globally, Alibaba lets procurement teams browse products, contact suppliers, and negotiate pricing and delivery terms.

However, a major downside is its overwhelming focus on Chinese suppliers, with around 98% of registered businesses on the platform.

To find Indonesian suppliers, you need to search for a product first and then apply the “Supplier Country/Region” filter.

For example, a search for palm oil—one of Indonesia’s major exports—returns just two Indonesian suppliers after applying the filter.

Source: Alibaba

While the number of Indonesian suppliers on Alibaba may vary by product category, this example highlights the platform’s limitations beyond China.

Even with location filters, search results often include Chinese companies or Chinese-owned businesses based in Indonesia.

Supplier vetting also varies widely, so due diligence is essential.

The only available overall figure on Indonesian suppliers is Alibaba’s 2020 plan to onboard 5,000 Indonesian SMEs by 2025—a modest number given the country’s supplier base.

In summary, Alibaba can be useful for initial research, but it’s far from comprehensive when sourcing from Indonesia.

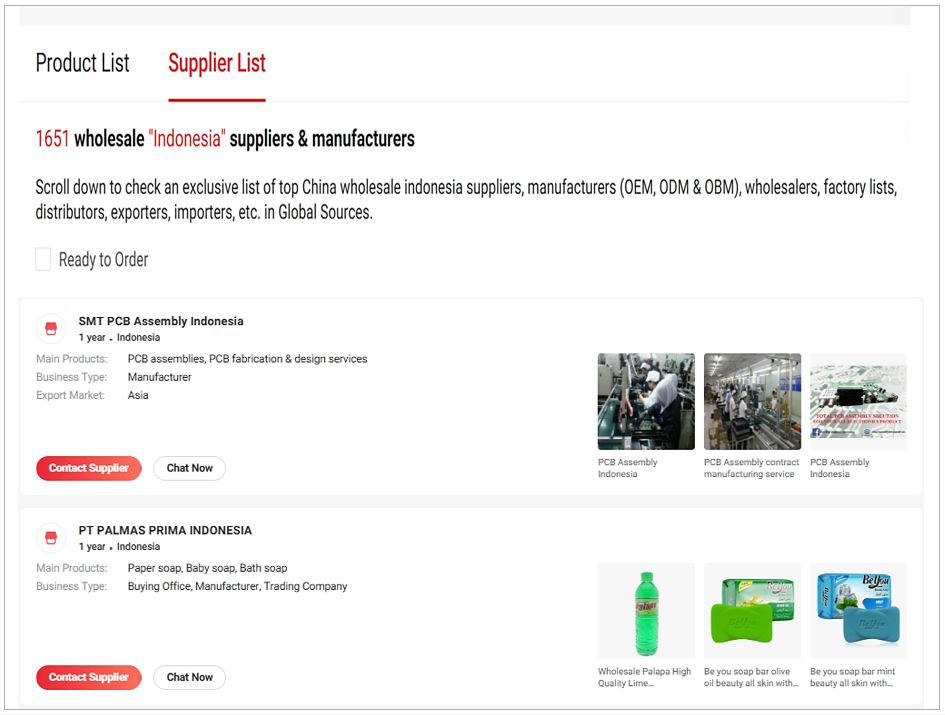

Global Sources is a multichannel B2B platform primarily focused on China, India, Vietnam, and South Korea.

That said, it does list some Indonesian suppliers.

A general search for “Indonesia” returns around 2,500 results, but many are Chinese companies referencing Indonesia.

When location filters are applied, the number narrows to about 1,600 Indonesian-based suppliers.

Source: Global Sources

While this is presumably fewer than on Alibaba, Global Sources offers a few key advantages.

First, the platform applies stricter vetting during supplier registration, helping reduce the risk of scams.

Second, supplier profiles tend to be more detailed, often including product categories, company overviews, production capacity, and quality control measures.

In addition to supplier discovery, Global Sources also offers paid services such as customized supplier searches, due diligence, factory visits, and more.

It also organizes trade shows, which we’ll explore later.

Overall, Global Sources offers fewer Indonesian suppliers but compensates with more in-depth profiles and stronger supplier vetting.

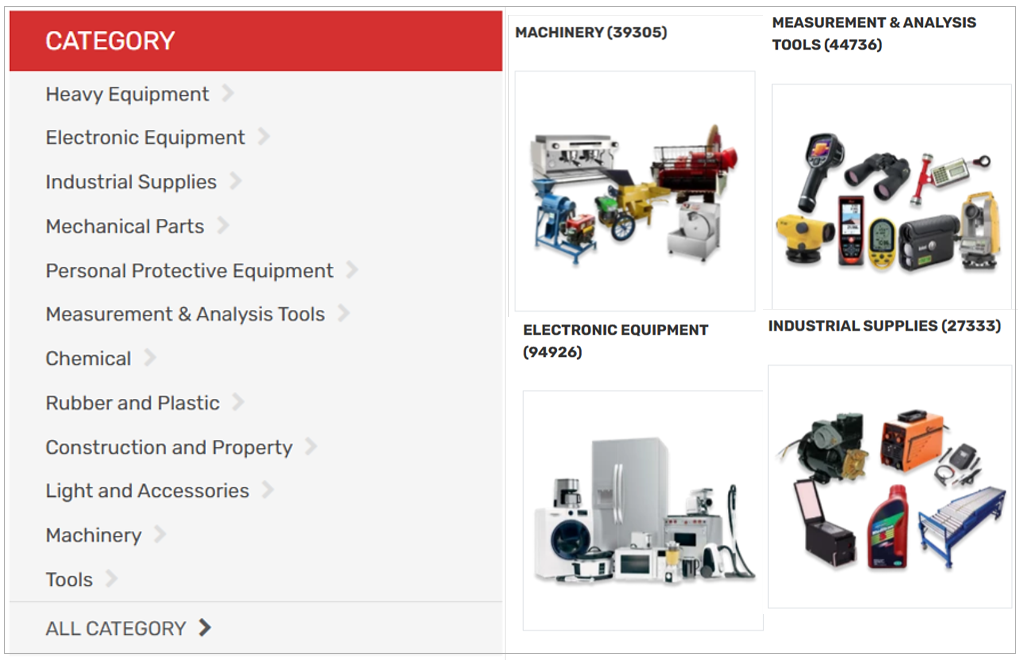

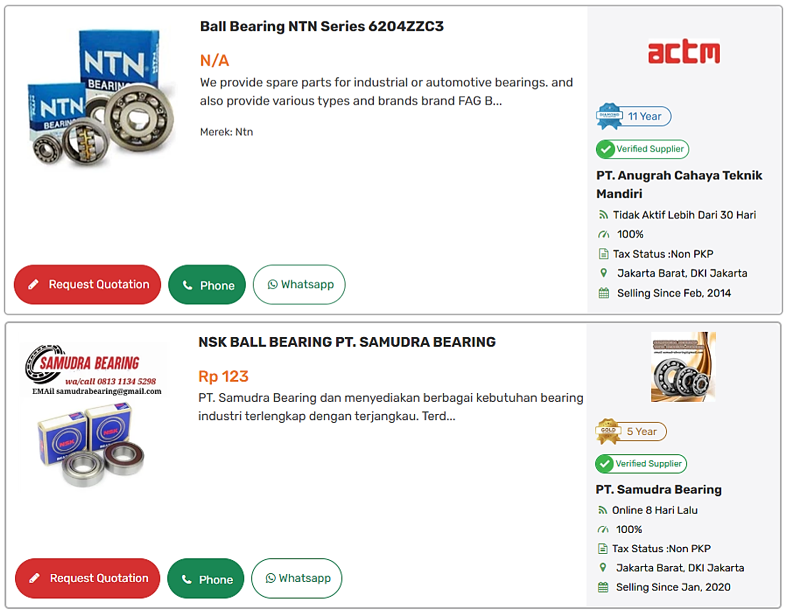

Indo Trading is one of Indonesia’s leading B2B e-commerce platforms.

It offers English-language search, category navigation, and some product and company descriptions, making it more accessible to international buyers.

Businesses can register, browse products, and submit RFQs directly to potential suppliers through the platform.

According to Tradewheel, Indo Trading hosts over 80,000 suppliers across more than 15,000 categories.

To illustrate, here are some of the key product categories:

Source: Indo Trading

While Indo Trading includes categories such as food & beverages and personal beauty products, its core focus is on industrial goods, machinery, electronics, and general wholesale products.

English-language support works reasonably well for navigation and search, but product results are often mixed—some in English, others in Indonesian.

Source: Indo Trading

Despite this, Indo Trading remains one of the most accessible Indonesia-based B2B platforms for international procurement teams.

Its local supplier base and category breadth make it a useful starting point, especially for sourcing specific product categories.

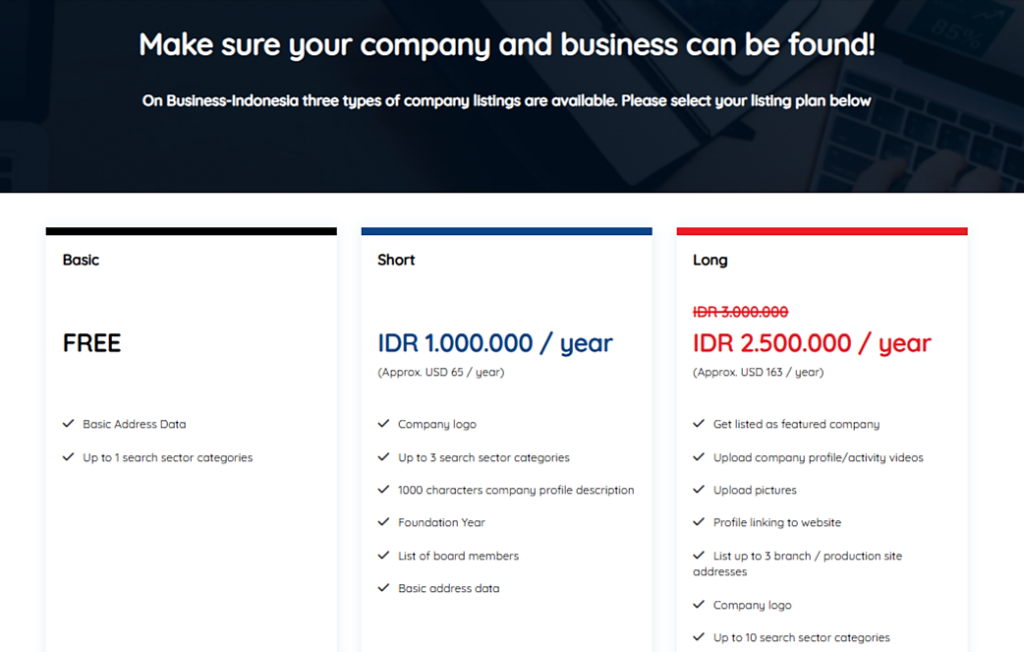

Business Indonesia isn’t an e-commerce engine, but rather an online business directory and service platform managed by the German-Indonesian Chamber of Industry and Commerce.

It serves as an investor guide and a business matchmaking tool between Indonesian companies and international buyers or investors.

Unlike typical B2B marketplaces, platforms like Business Indonesia—often run by Chambers of Commerce—offer an alternative way to discover suppliers.

The number of listings depends on how many Indonesian businesses choose to register, usually for free, though paid options offer added visibility.

Source: Business Indonesia

As an investor or buyer, you can freely browse Business Indonesia’s company listings by sector.

Basic access is free, but some features, such as direct matchmaking or access to networking events, may require registration or involve additional fees.

While Business Indonesia doesn’t publish its total number of registered companies, third-party directories like Global Database report around 40,000 listed Indonesian suppliers.

Although not a conventional sourcing site, Business Indonesia offers a structured starting point for identifying local companies, especially those open to foreign partnerships.

If B2B platforms and directories aren’t yielding the results you need, there are additional sourcing avenues you can take.

Let’s see what they are.

Like Business Indonesia, both local and international Chambers of Commerce can be valuable partners for establishing business connections.

These organizations often maintain searchable databases of registered Indonesian companies, typically accessible at no cost.

In addition, chambers and professional associations frequently provide referrals and sourcing support, either across all industries or within specific sectors.

For example, the Indonesian Chamber of Commerce and Industry (KADIN) represents the full spectrum of Indonesian business sectors.

With a network of over 75,000 businesses, KADIN’s international service arm—KADIN Business Service Desk—acts as the main point of contact for foreign buyers and investors.

Source: KADIN

As shown, KADIN offers a wide range of services, such as business matching and market research, often at no extra cost.

Other notable sectoral or country-related chambers and associations include:

Depending on their scope, member base, and responsiveness, these and similar organizations can be valuable sourcing allies.

Still, response times, language proficiency, and service quality may vary, so patience and longer procurement timelines are often necessary.

Whether organized by the Ministry of Trade, an industry association, or a sourcing platform like Global Sources, trade shows remain among the most effective ways to find reliable Indonesian suppliers.

They allow you to meet potential partners face-to-face (a preferred approach in Indonesian business culture), start building relationships, and inspect product samples firsthand.

If you’re not targeting a specific sector, one of the largest and most relevant events is Trade Expo Indonesia (TEI), which will be held in October 2025 in BSD City near Jakarta.

Source: TEI

TEI features a wide range of export-ready Indonesian products and sectors while also attracting exhibitors from over 140 countries.

While these events offer valuable opportunities, traveling to trade shows across Indonesia can be time-consuming and costly.

That’s why it’s smart to create a shortlist of potential suppliers first and focus on events where several of them are likely to exhibit, making your visit far more efficient and productive.

To recap, attending trade shows takes effort and budget, but it helps you build trust quickly and uncover sourcing opportunities you might not find online.

Platforms, directories, associations, and trade shows can all help you discover Indonesian suppliers.

However, each comes with limitations—whether in scope, supplier coverage, geographic focus, or the need for travel and paid services.

Veridion, our supplier intelligence engine, helps overcome these barriers.

Its AI-driven bots continuously scan and extract data from publicly available online sources to build a global, real-time database of suppliers with at least a minimal digital footprint.

Veridion crawls and classifies everything from company websites and e-commerce platforms to business directories and local news outlets, updating results weekly.

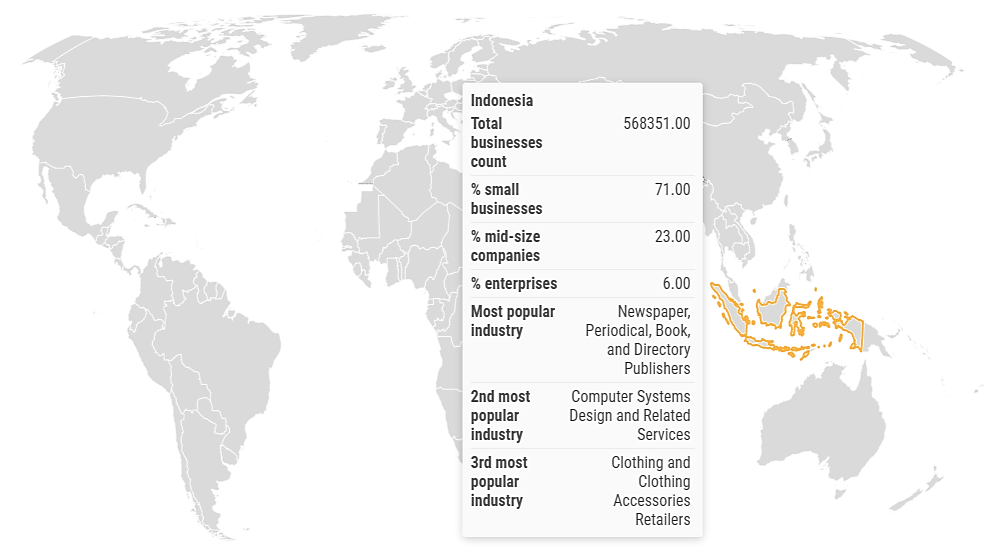

At present, Veridion’s database includes over 550,000 Indonesian suppliers.

Source: Veridion

After the raw data is collected, Veridion’s classifiers filter it to build detailed supplier profiles, each with up to 80 structured data points.

All data is verified, with confidence scores assigned.

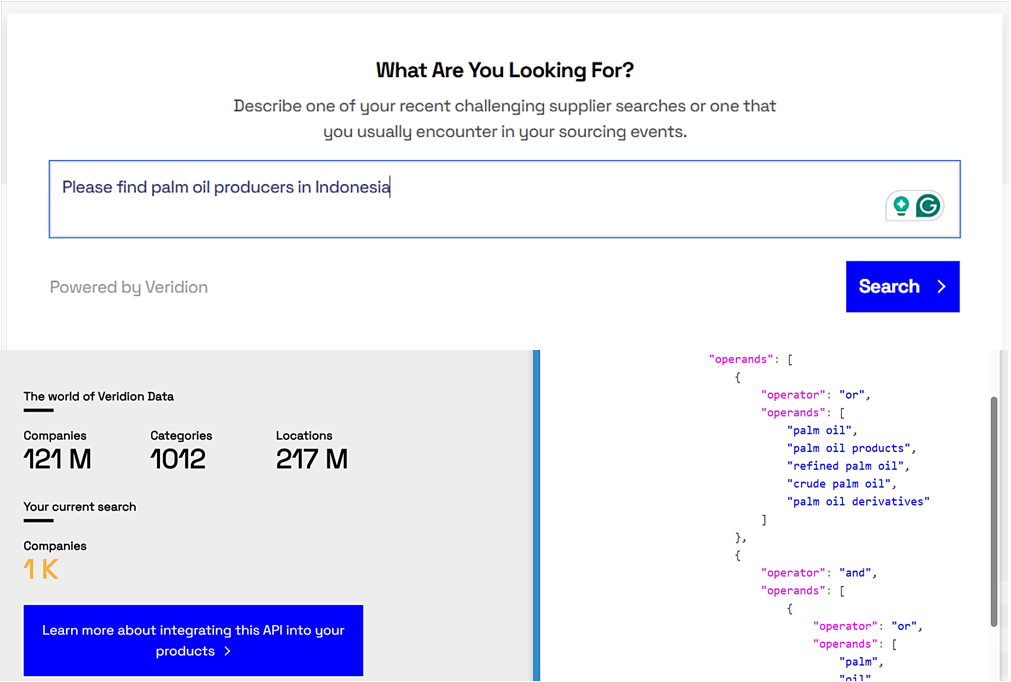

To search for Indonesian suppliers, you can use Scout, our natural language search engine.

Just describe what you’re looking for and get tailored results in seconds.

Below is an example search for palm oil producers in Indonesia.

Source: Veridion

As shown, Veridion surfaced around 1,000 Indonesian companies.

Once the database is integrated with your tools, you can filter results further by product details, production capacities, sustainability certifications, ESG compliance, and more.

This depth of data—combined with its accuracy and freshness—makes Veridion a powerful solution for discovering and evaluating suppliers globally, including Indonesia.

With up-to-date insights on Indonesian suppliers, your procurement team can make faster, more informed sourcing decisions and build supplier relationships with greater confidence.

Indonesia offers a growing base of capable, cost-effective suppliers, but finding the right partners requires the right tools.

From global and local platforms or directories to trade shows and chambers of commerce, each sourcing channel has its strengths.

Pairing them with advanced data solutions like Veridion can help your procurement team streamline sourcing in Indonesia and beyond, reducing risk, and securing competitive advantages for your business.