How to Find Suppliers In South Africa

Key Takeaways:

South Africa’s position as a trade hub is gaining fresh attention, especially as global shipping routes shift and Red Sea traffic gets redirected.

However, many companies hesitate to source there because supplier networks are unfamiliar, data is incomplete, and export readiness is uneven.

By outlining South Africa’s key industries and offering practical advice for identifying reliable businesses, this guide will help you navigate the market and make the most of its opportunities.

South Africa is attracting international interest thanks to its industrial diversity, established infrastructure, and strategic trade agreements.

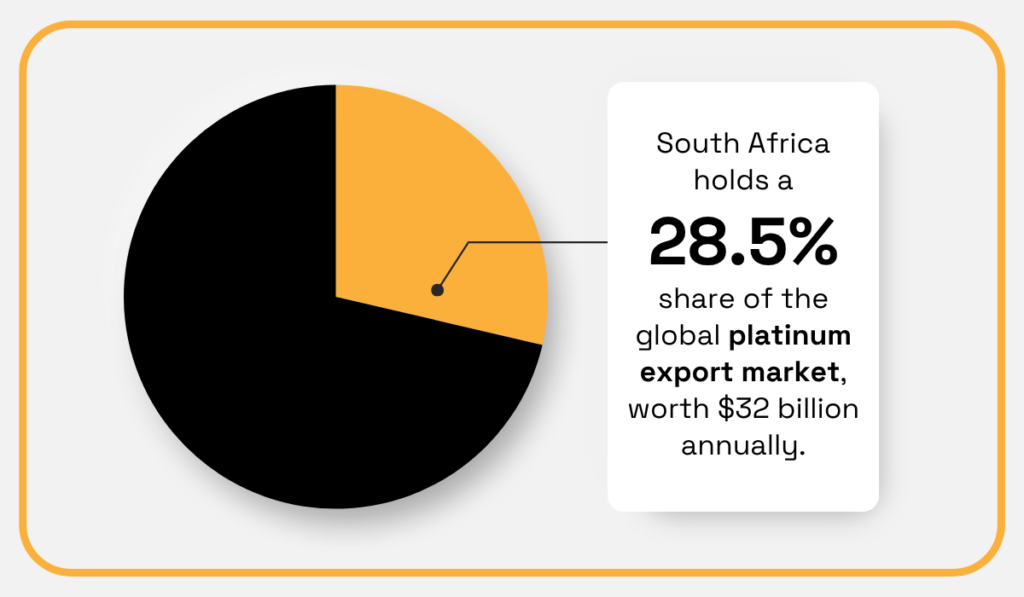

The country remains the world’s largest exporter of macadamia nuts while holding a dominant position in the global platinum trade, with a 28.5% share of a $32 billion annual export market.

Illustration: Veridion / Data: Commodity

South Africa also ranks as a top global exporter of gold, citrus, and table grapes, but its broad industrial base extends beyond mining and agriculture.

For instance, South Africa’s automotive industry witnessed a boom in 2023, with vehicle production increasing by 13.9% to reach a record 633,332 units.

Thembinkosi Pantsi, entrepreneur and National Vice Chairperson of the National Automobile Dealers’ Association (NADA), highlights the automotive sector’s growing significance:

Illustration: Veridion / Quote: Daily Maverick

It should be noted that Pantsi’s remarks underline the urgency of addressing the industry’s ongoing challenges, including U.S. tariffs, rising wage demands, and growing competition from Chinese imports.

But despite these pressures, South Africa’s labor costs remain competitive (although higher than in Southeast Asia), and its mature business environment continues to draw international buyers.

The country’s advanced infrastructure and economic stability set it apart from other sourcing markets on the continent, with key regional hubs like Johannesburg, Cape Town, and Durban anchoring commercial and industrial activity.

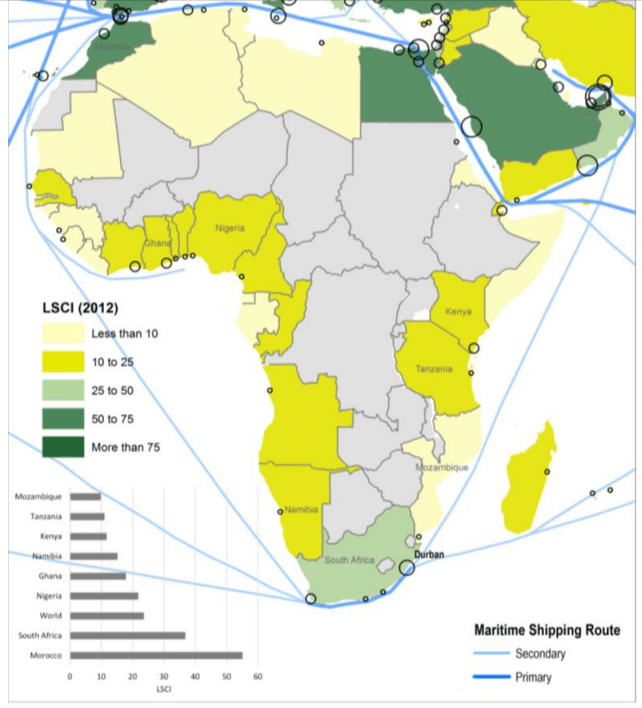

In particular, the Port of Durban stands out as one of Africa’s busiest, offering direct maritime routes to Asia and Europe, as illustrated below.

Source: International Transport Forum

The Liner Shipping Connectivity Index (LSCI), which measures how well countries are integrated into global shipping networks, shows that South Africa has long held a strong regional position.

That said, capacity constraints at key ports like Durban have limited its ability to fully capitalize on growing trade opportunities.

While targeted investments in regional hubs are still missing, on the policy front, South Africa already benefits from several important trade frameworks.

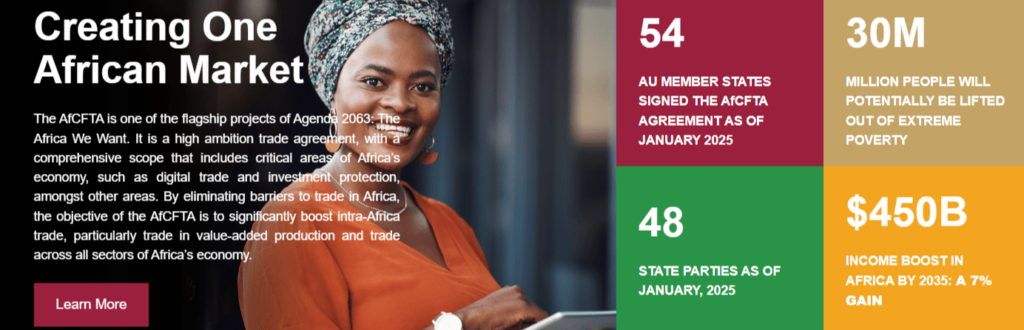

The African Continental Free Trade Area (AfCFTA) simplifies cross-border trade within Africa by reducing tariffs and harmonizing customs procedures.

With 54 member states ratifying the agreement, a unified market poses a significant advantage for enterprises looking to build regional supplier networks or serve multiple African markets.

Source: AfCFTA

Combined with the EU-SADC Economic Partnership Agreement (EPA), which grants preferential access to European markets, South Africa has a uniquely strategic sourcing gateway for companies targeting both African and international supply chains.

In short, South Africa’s economic diversity, infrastructure, and global connectivity offer sourcing advantages that few African markets can match.

For all the country’s sourcing potential, organizations need to be aware of several structural hurdles when sourcing from South Africa.

Most of these stem from poor market visibility and data reliability, as well as communication barriers.

But let’s zoom out for a moment.

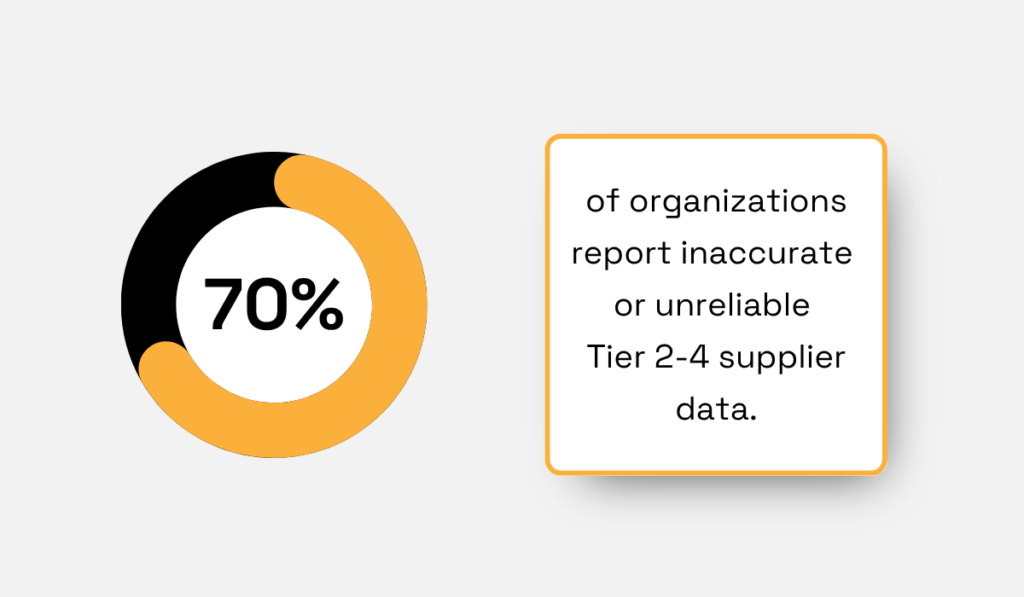

According to Sphera’s research, 70% of organizations report that their Tier 2-4 supplier data is often inaccurate or unreliable.

Illustration: Veridion / Data: Sphera

Although this is global data, such challenges are especially pronounced in markets like South Africa, where many supplier directories remain outdated, containing broken or incorrect contact information.

Imagine a common scenario where your sourcing team has trouble confirming whether a listed supplier is a legitimate manufacturer or a middleman.

This creates significant risk for would-be buyers, such as:

Moreover, critical details like minimum order quantities (MOQ), lead times, or available certifications are also frequently missing, slowing down the entire process.

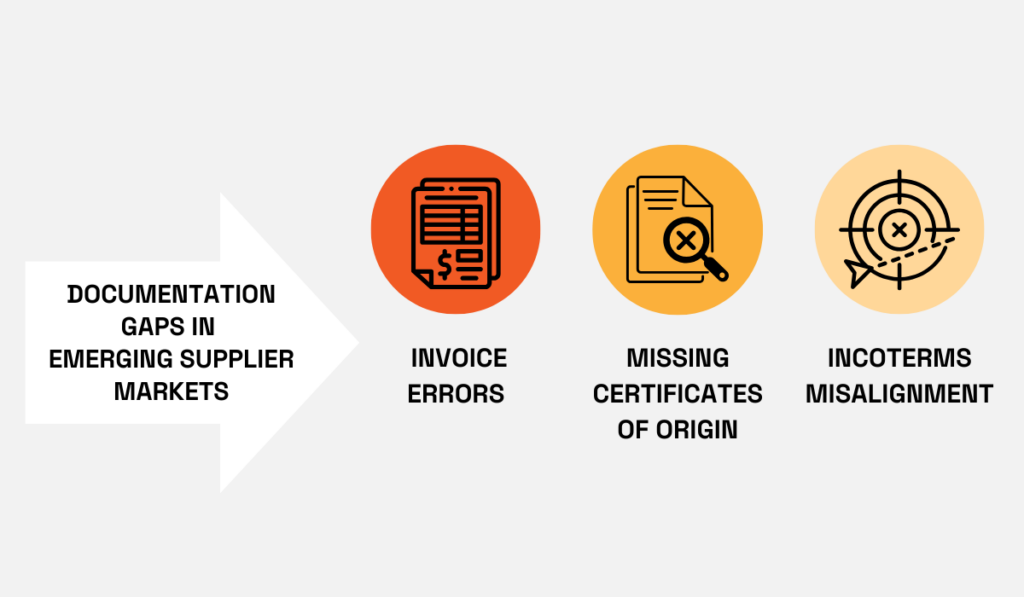

Another notable challenge is the lack of export readiness among smaller South African businesses.

While many cater successfully to domestic markets, comparatively fewer suppliers have experience navigating international buyer requirements, from packaging and Incoterms to formal compliance documentation like ISO certifications or CE marks.

Source: Veridion

Issues with invoices and general documentation are especially common, with these gaps complicating shipments and contributing to delays.

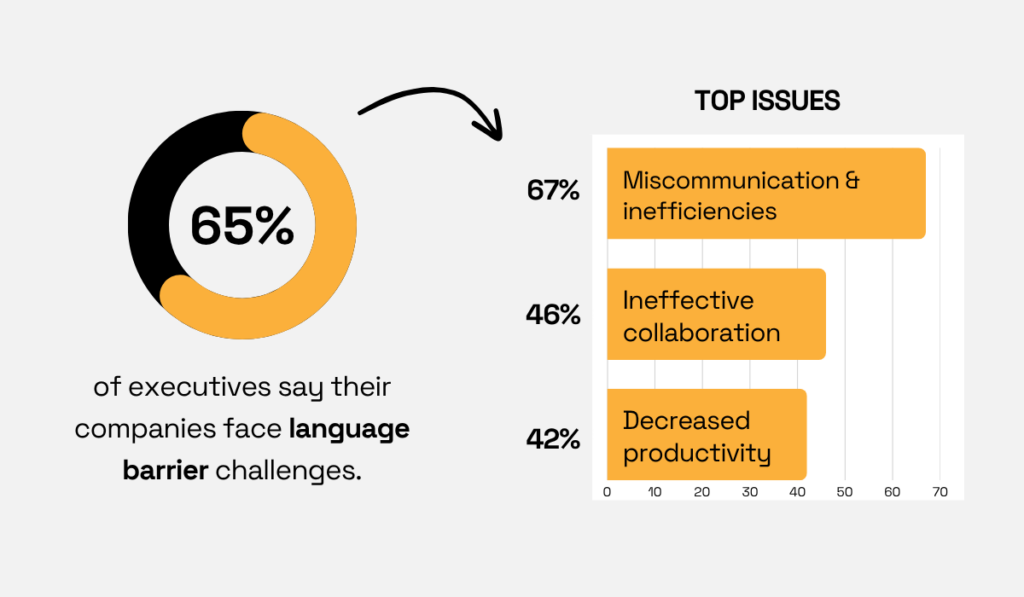

Language barriers further complicate supplier discovery and communication.

A Forbes Insights study found that two in three executives report language barriers within their own multinational workforces, creating a multitude of issues.

Illustration: Veridion / Data: Forbes Insights

With issues like miscommunication (67%) and decreased productivity (42%) affecting companies internally, these challenges multiply in a broader market like South Africa.

The country’s official (and business) language is English, but the South African population speaks several other languages, including Afrikaans, Zulu, and Xhosa.

As such, it’s not difficult to see how this plurality creates communication barriers that extend to supplier websites, product documentation, and business directories.

And since many listings lack clear, English-language information, international buyers can find it difficult to identify, contact, and properly assess potential suppliers.

Fortunately, modern supplier discovery tools and location intelligence platforms can help bridge these gaps.

But more on that in the following sections.

Online platforms for supplier discovery simplify sourcing in any region, including South Africa.

The four options we’re focusing on here each have different strengths, limitations, and ideal use cases.

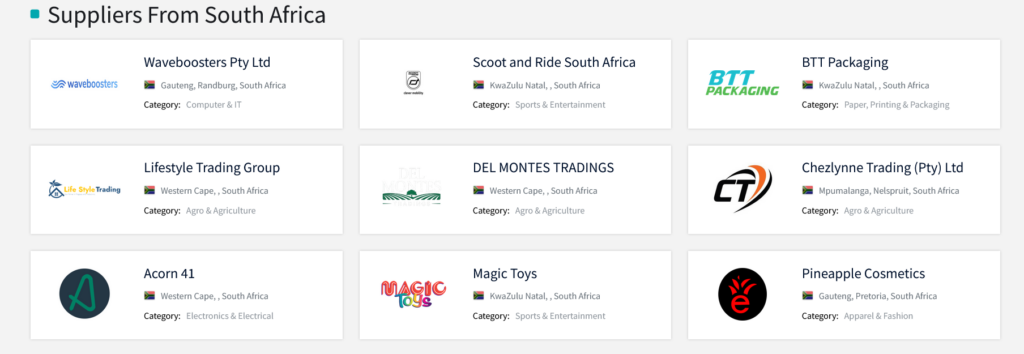

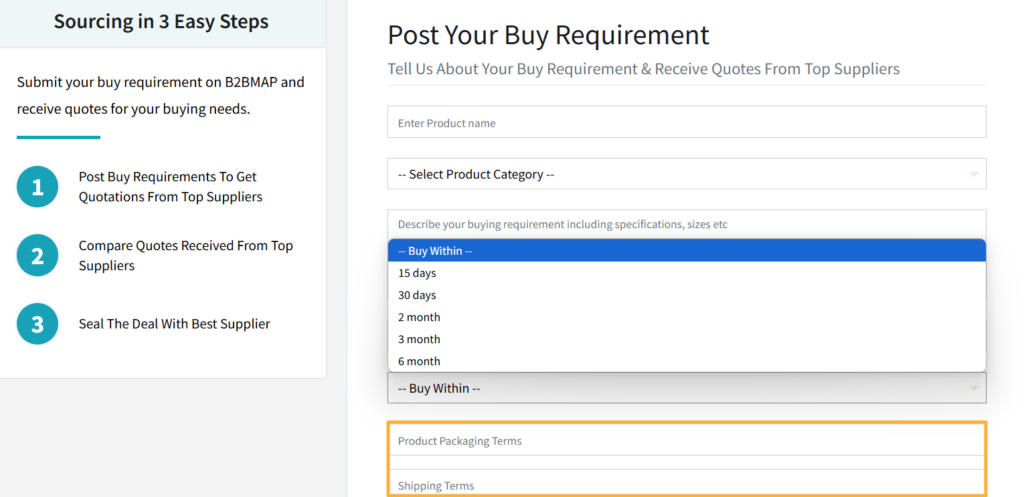

When it comes to general supplier discovery, B2BMap is a good starting point.

Source: B2BMap

A global B2B directory with a dedicated section on South African suppliers, the platform primarily lists wholesalers, manufacturers, and service providers.

Organizations can search across multiple industries like agriculture, textiles, and machinery, helping them find the best match based on specific requirements.

Source: B2BMap

The main advantage of this platform is its simplicity.

The categories are broad, and listings include basic company info and contact details, as well as a general overview of products.

However, the flip side of having a general database like this one is that you don’t get an overview of specific certifications, MOQs, or quality control mechanisms that can prove to be a dealbreaker.

Source: B2BMap

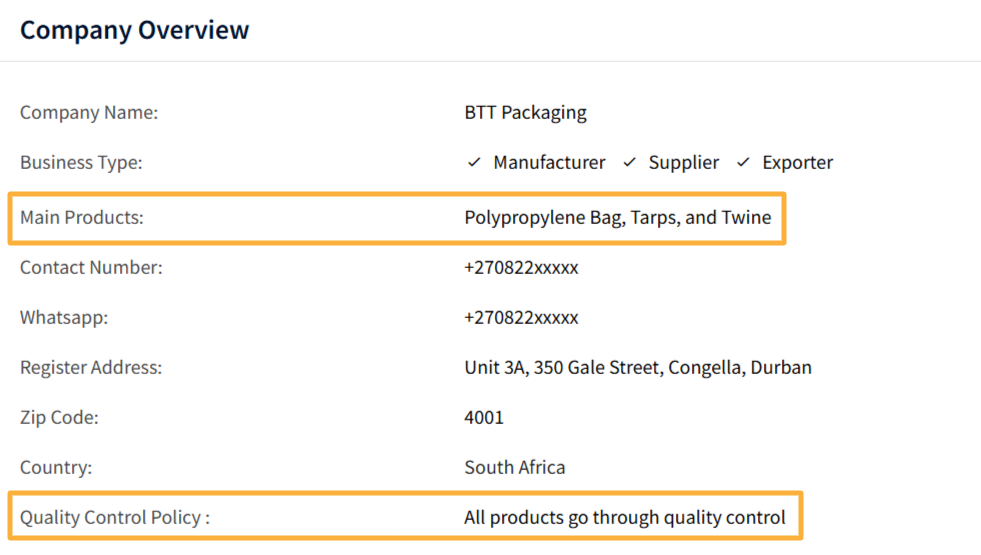

Some of these information gaps can be filled with alternatives such as TradeWheel.

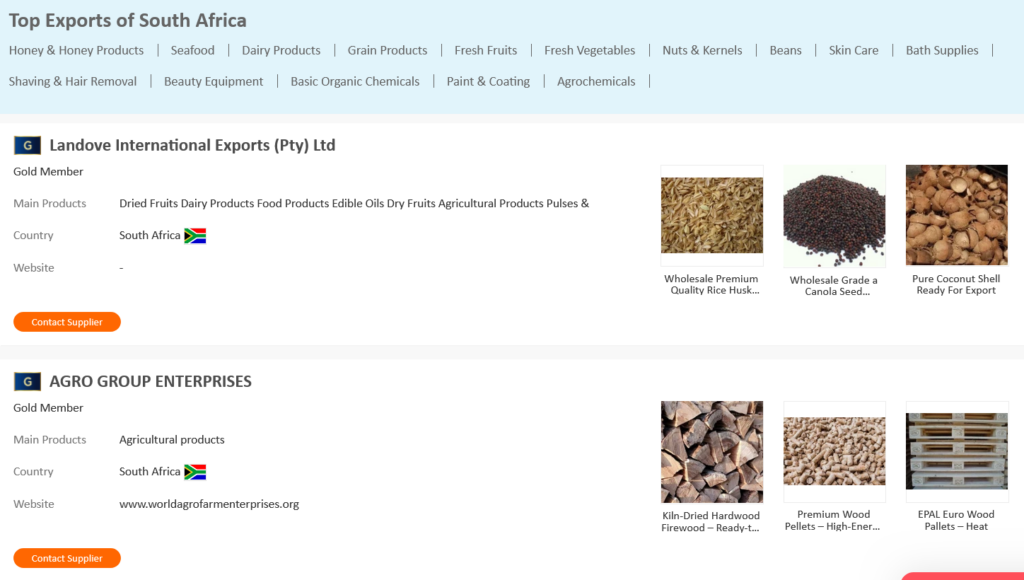

This global B2B marketplace is well-suited for buyers looking to make bulk orders of South African products in categories like agriculture, apparel, and food.

Source: TradeWheel

The platform offers advanced filters that enable buyers to sort by supplier country, product type, and minimum order quantity.

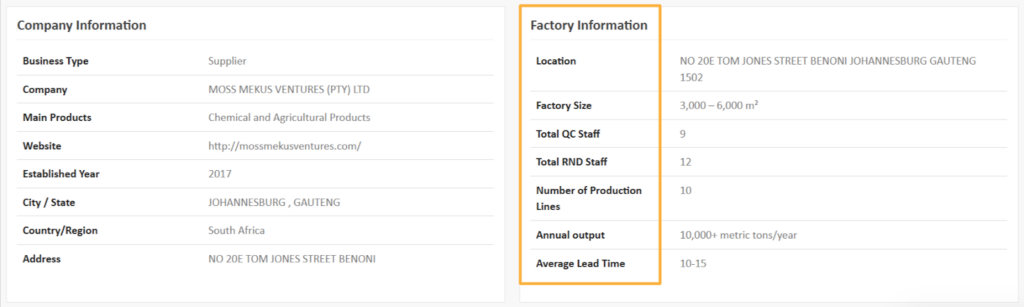

Supplier profiles are more detailed, featuring product showcase, quality control process information, FAQs, and key factory information.

Source: TradeWheel

However, the level of detail varies depending on the supplier.

Since many of the listings are from intermediaries or resellers, it’s also impossible to guarantee access to direct manufacturers.

One solution that enables direct contact and outreach is Lusha.

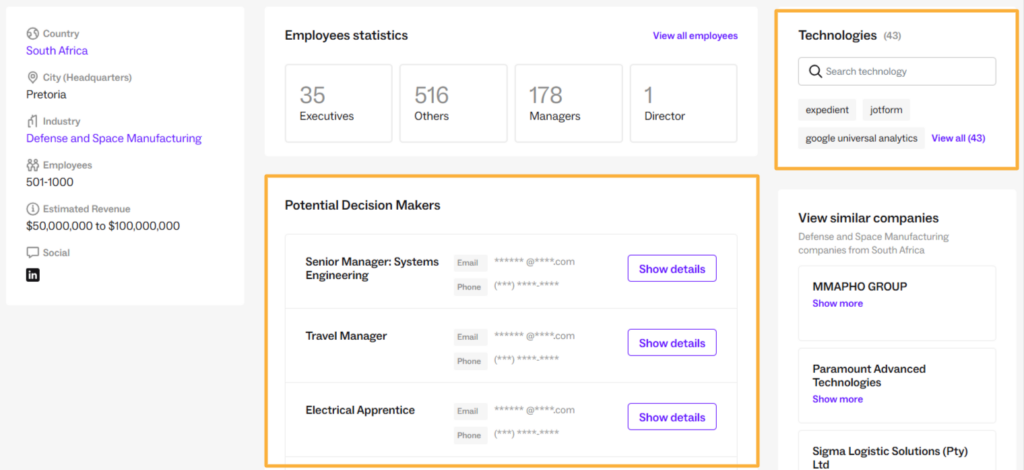

This lead generation and business contact platform offers verified company profiles with direct contact details for decision-makers.

Source: Lusha

The database has close to 300 entries for wholesale companies in South Africa, but keep in mind that this is mostly sales intelligence, rather than a dedicated sourcing solution.

In other words, if you want to build targeted lists of wholesalers and manufacturers and bypass intermediaries, this is a viable option, but don’t expect product-level information.

Of course, sourcing requires insights from as many different sources as possible.

So, if you’re willing to dig a little deeper or make direct connections, you should also consider alternative sourcing channels.

If supplier directories and sourcing platforms aren’t delivering the results you need, other effective routes can help you discover reliable suppliers in South Africa.

For instance, trade shows remain one of the most valuable sourcing channels.

Events like the Africa Food Show (formerly Food & Beverage West Africa) gather hundreds of vetted suppliers under one roof.

The show’s website offers a searchable list of over 350 exhibitors, complete with brochures, product videos, and contact information.

Source: The Africa Food Show

That way, you’re getting a sense of each supplier’s offer before reaching out.

You can also browse event platforms like 10Times, which list upcoming trade shows across industries and regions, along with exhibitor lists you can filter by category or product.

Here’s just one example, focusing on exhibitors from the fashion and apparel sector.

Source: 10Times

Another valuable resource is business chambers and national industry associations.

The South African Chamber of Commerce and Industry (SACCI) can provide supplier referrals, contact points, and connections to regional chambers or local trade networks.

Meanwhile, industry-specific bodies like SAFLEC (South African Footwear and Leather Export Council) and NAMC can give you a quick overview of reliable businesses.

Source: SAFLEC

Additionally, sector reports help buyers understand specific product categories and the overall state of the industry.

Finally, government supplier registries, such as the Central Supplier Database (CSD), list companies registered to supply goods and services to public institutions.

Although these registries focus on domestic procurement, the suppliers usually meet basic compliance and documentation standards.

This makes them a helpful starting point when creating a shortlist.

Using these alternative sources together with digital platforms gives you a fuller and more reliable view of South Africa’s suppliers, and helps you find partners you might otherwise miss.

Traditional platforms often offer limited supplier vetting, which exposes businesses to risks like unreliable partners, unclear pricing, and missing compliance information.

That’s where Veridion comes in.

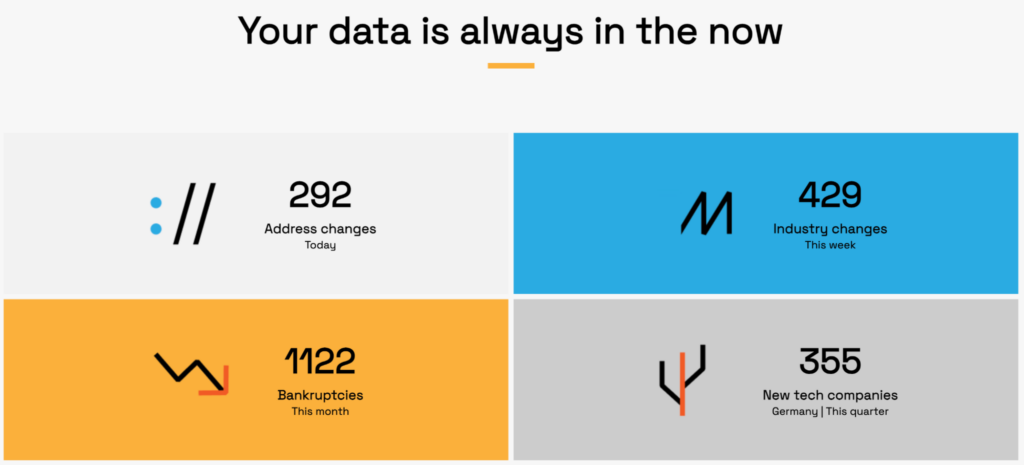

Veridion offers AI-powered supplier discovery and location intelligence with weekly-updated insights on suppliers worldwide.

Source: Veridion

It gathers a wide range of data, including company details, product info, compliance records, certifications, ESG data, and more.

Using AI and machine learning, Veridion collects and organizes this data from sources like business directories, corporate filings, ESG reports, supplier websites, news, and social media activity.

Simply put, if a supplier has any digital presence, Veridion will find it.

While many platforms focus mainly on the US, EU, or East Asian markets, Veridion offers deep coverage of South Africa and broader African sourcing markets.

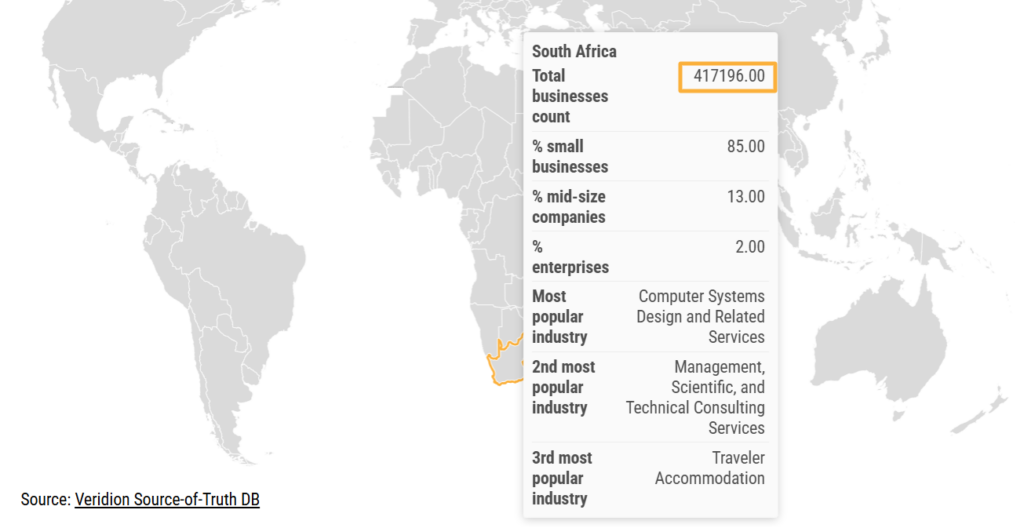

As you can see below, you get access to over 417,000 South African companies, and you can filter them by product type, factory location, business size, certifications, and more.

Source: Veridion

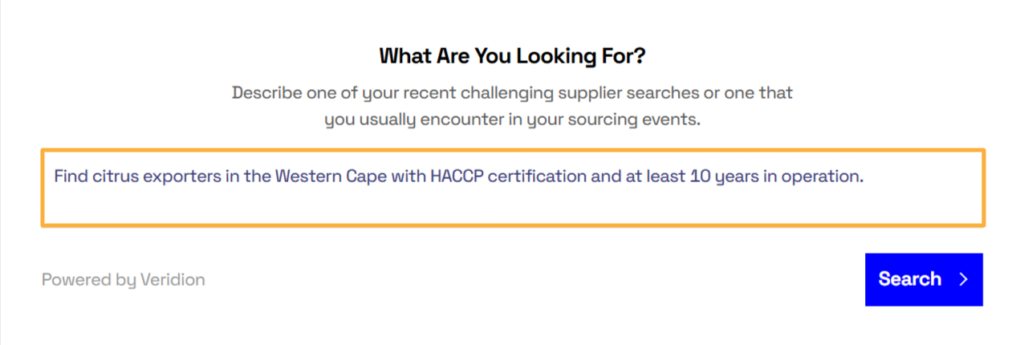

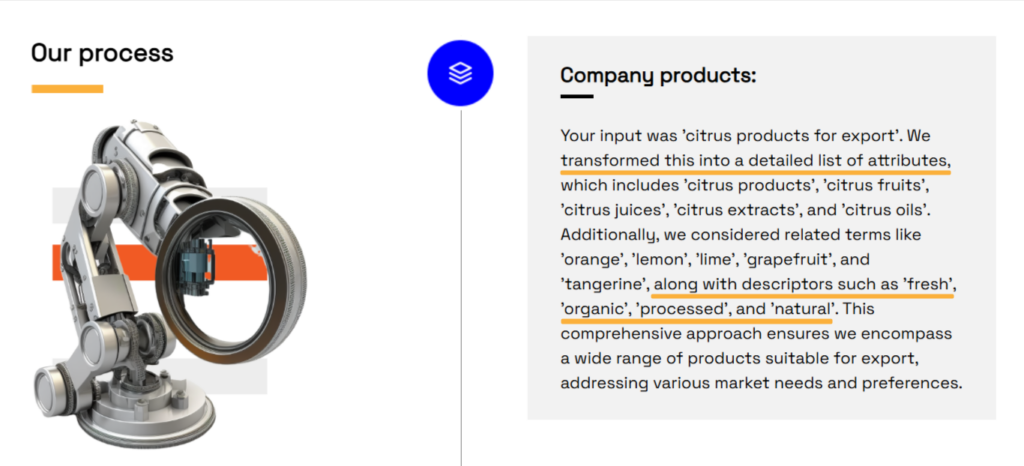

To make building extensive shortlists even easier, Veridion offers a supplier discovery tool called Scout that supports natural language search.

Instead of using strict filters, you can type complex queries just like you would in conversation, adding as much detail as needed.

Check the search for citrus exporters with HACCP certification and longevity criteria:

Source: Veridion

In mere seconds, Scout delivered a preview of 81 matching suppliers, complete with business details, confidence scores, key certifications, and more.

On top of the speed, Scout makes each search smarter by intuitively suggesting relevant categories and improvements to refine results further.

Source: Veridion

For businesses navigating a fragmented market like South Africa, where supplier data is often incomplete or unreliable, Veridion becomes an invaluable tool.

It speeds up supplier qualification and helps you avoid hidden intermediaries.

South Africa has an enormous sourcing potential, but like many emerging markets, it comes with real challenges.

Between fragmented supplier networks, outdated directories, and language barriers, finding reliable, export-ready suppliers isn’t always straightforward.

While platforms like TradeWheel and B2B Map provide a basic starting point, data-driven solutions like Veridion deliver global, verified supplier data for faster, better-informed decisions.

If you’re weighing South Africa against options like Morocco or Egypt, its diverse industries, solid infrastructure, and trade access give it a clear advantage.

The key is to source strategically—and use the right tools to do it.