How to Find Suppliers In Vietnam

Key Takeaways:

As businesses diversify their supply chains, especially in the wake of rising China+1 strategies, Vietnam has become a key sourcing destination.

Yet many struggle to identify verified, trustworthy Vietnamese suppliers.

This article explores why that’s a challenge, where to look, and how to go beyond surface-level platforms.

Let’s jump right into it.

Vietnam has firmly positioned itself as a rising manufacturing powerhouse.

From textiles and garments to electronics, furniture, and consumer goods, it’s steadily climbing the value chain.

Multinationals like Samsung, Nike, and Foxconn already have major operations here, and many others are following suit as part of the ongoing China+1 strategy.

Source: Google

Vietnam’s export footprint has grown impressively, rising from around $320 billion in 2019 to approximately $440 billion in 2023, a compound annual growth rate of 8.2%.

The appeal is clear.

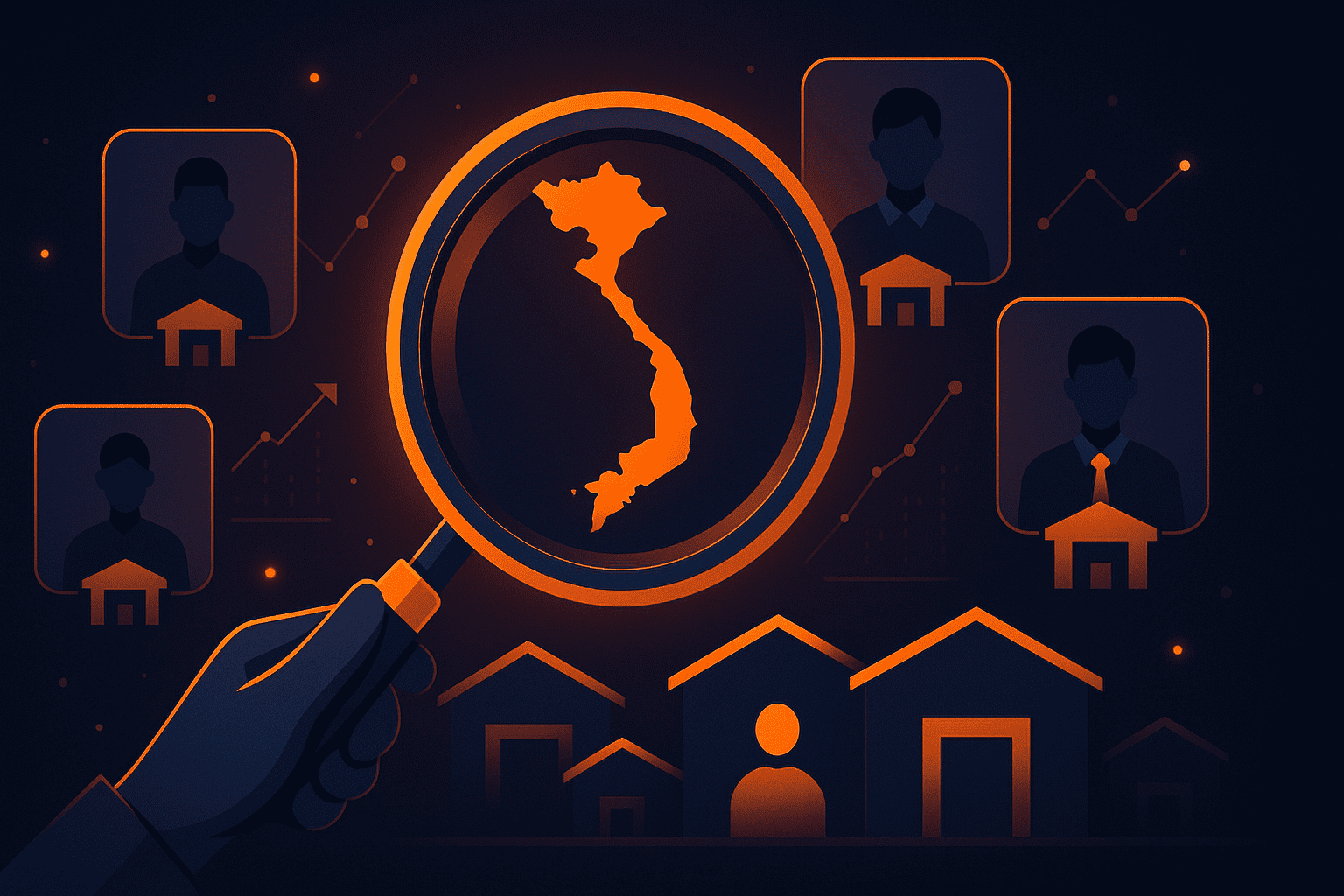

Labor costs in Vietnam are significantly lower than in China.

As of early 2025, the average factory worker’s salary in Vietnam is between $304 and $340 per month, while the minimum hourly wage starts at $1.03 in top regions.

Illustration: Veridion / Data: talentnet

Even with rising living expenses, these labor costs remain significantly lower than in China, where wages in coastal manufacturing zones can exceed $600–700/month.

For labor-intensive industries like apparel or furniture, that cost difference is hard to ignore.

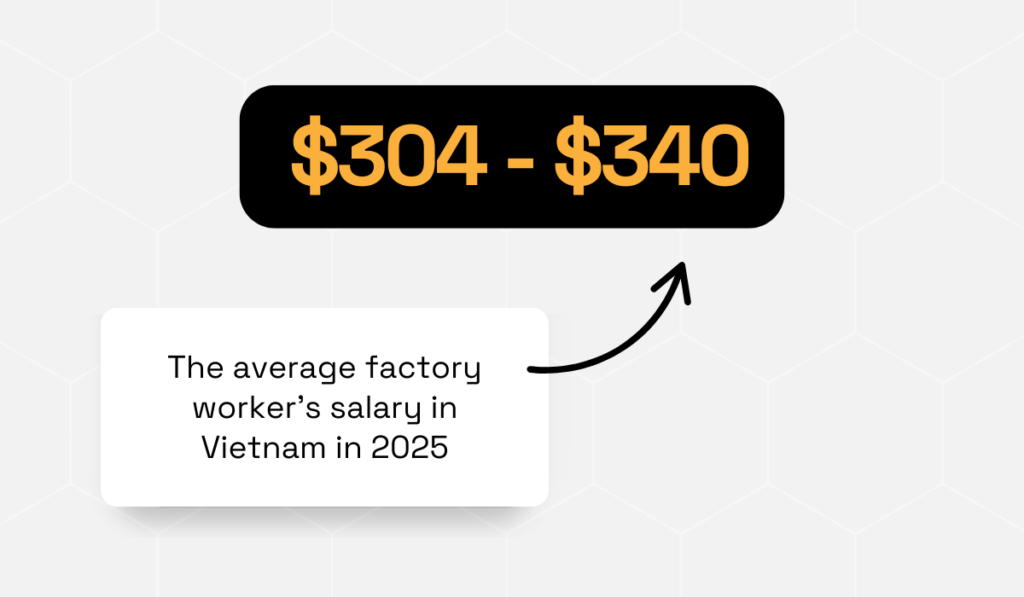

Vietnam is also politically stable, actively welcoming foreign investment, and increasingly integrated into global trade networks.

It’s part of both the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), as well as numerous other free trade agreements.

Source: Vietnam Briefing

However, recent headlines have raised some concerns, especially for U.S. businesses.

In April 2025, the U.S., Vietnam’s largest export destination, imposed a 46% tariff on certain Vietnamese goods, citing issues related to trade imbalances and transshipped Chinese components.

Source: Google

Through intense negotiations, that threat was scaled back to a temporary 10% tariff, giving both sides time to resolve the dispute.

While these developments have created some uncertainty, most experts agree that companies shouldn’t overreact.

Source: The Investor

Vietnam’s trade officials have moved quickly to address U.S. concerns, and industry groups like the American Apparel & Footwear Association remain optimistic about a resolution.

Compared to the risks and costs associated with Chinese sourcing, including ongoing tariffs, IP concerns, and geopolitical pressures, Vietnam continues to offer a more stable and cost-effective alternative.

But while Vietnam is a promising sourcing destination, finding suppliers there isn’t as straightforward as typing a few keywords into Google or Alibaba.

For one, many popular supplier discovery platforms, including the ones procurement teams rely on most, are heavily skewed toward the U.S., EU, or China.

Vietnam, and Southeast Asia in general, often feels like an afterthought.

The coverage is limited, the data is sparse, and it’s hard to tell whether a listed supplier is actually a factory or just a middleman.

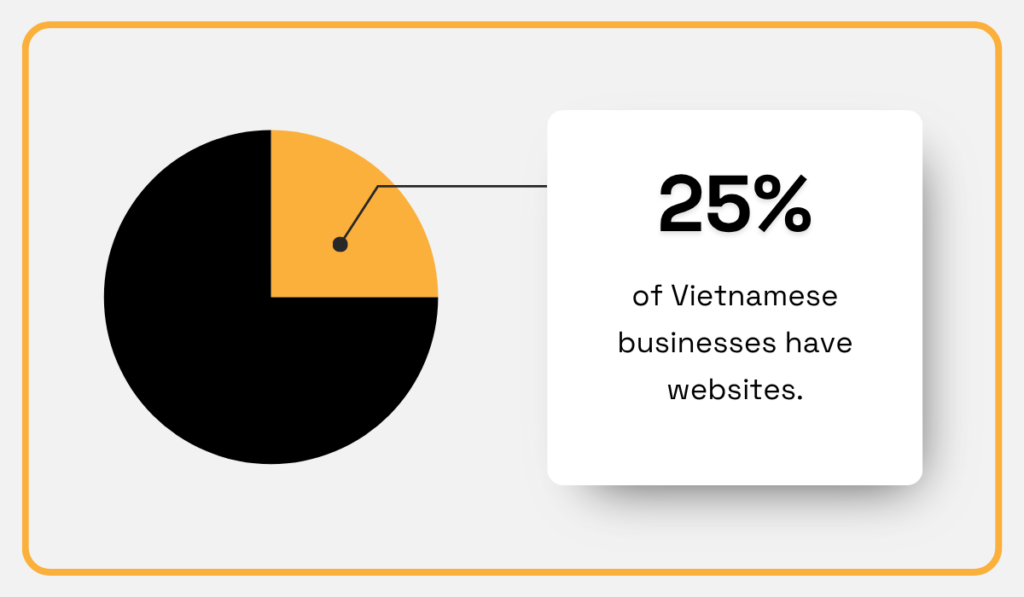

Part of the issue is digital infrastructure.

According to the Vietnam Internet Network Information Center (VNNIC), only around 25% of Vietnamese businesses have websites.

Illustration: Veridion / Data: VnExpress

Many companies invest instead in social media or e-commerce platforms, skipping formal websites altogether.

This creates two problems.

First, legitimate suppliers may be invisible to data providers who rely solely on crawling company websites.

And second, buyers are left with limited ways to verify credibility or reach out directly.

But, as VNNIC director Nguyen Hong Thang says, companies don’t understand what that means for their business:

Illustration: Veridion / Data: VnExpress

Language can also be a barrier.

Some local platforms like Shopee Vietnam or Sendo are entirely in Vietnamese and weren’t built with international buyers in mind.

Source: Shopee

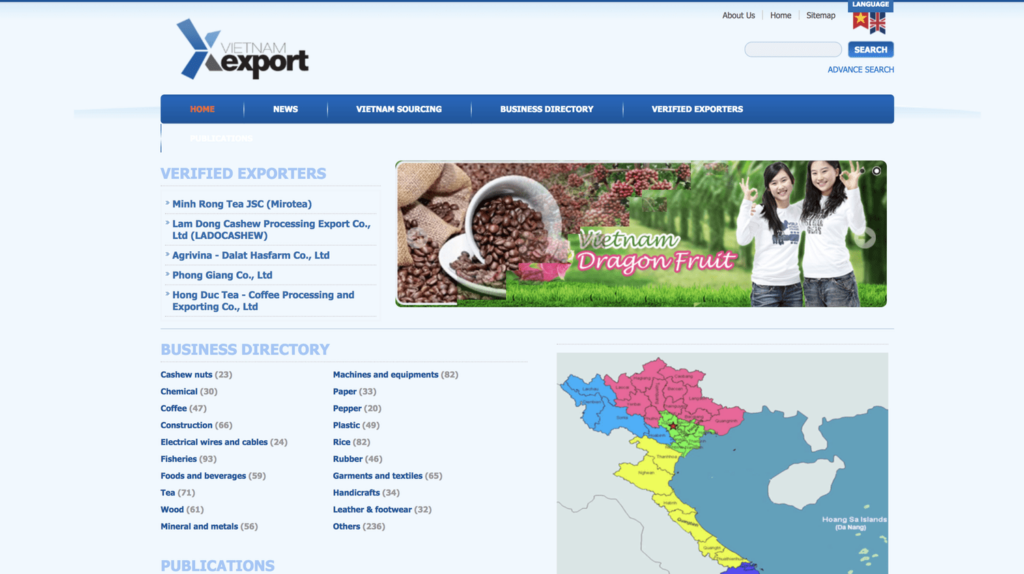

Others, like older business directories or government-run sites, are outdated or lack key details, such as factory addresses, product categories, or contact information.

One of them is VietnamExport, the official online exporter directory managed by the Ministry of Industry and Trade.

Source: Cosmo Sourcing

While the site distinguishes between verified and non-verified exporters, the actual information provided is extremely limited.

Listings often include only vague product keywords or general business descriptions, with little to no detail on minimum order quantities (MOQs), lead times, pricing tiers, or capabilities.

Worse, according to Vietnam Daily, their spot-check revealed that around 40% of the listed contact information was out of date.

So, while there’s no shortage of suppliers in Vietnam, the tools most procurement professionals use to find them aren’t built to surface them reliably.

That’s where alternative platforms and smarter data come into play.

Yes, sourcing from Vietnam can be challenging, but not impossible.

There are a handful of platforms that can at least point you in the right direction and help you begin filtering through local suppliers.

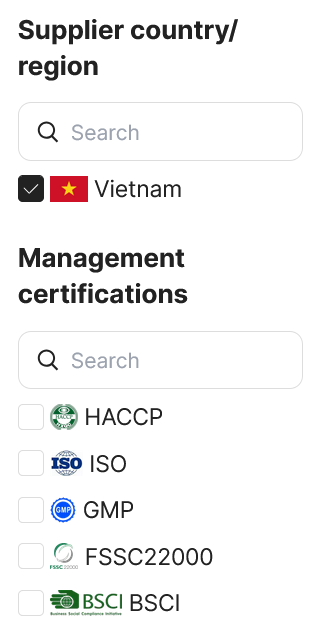

Still one of the largest B2B marketplaces in the world, Alibaba includes Vietnamese suppliers alongside its dominant base of Chinese vendors.

You can filter by supplier location and look for manufacturers holding relevant management certifications.

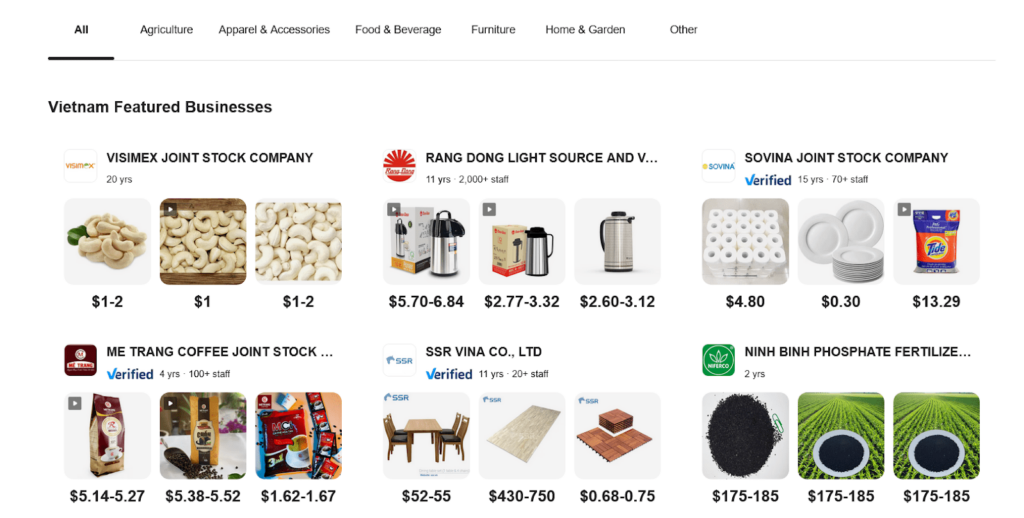

Source: Alibaba

There’s even a dedicated Vietnam Pavilion, where you can search for suppliers across various industries, from apparel and furniture to agriculture and food and beverage.

Source: Alibaba

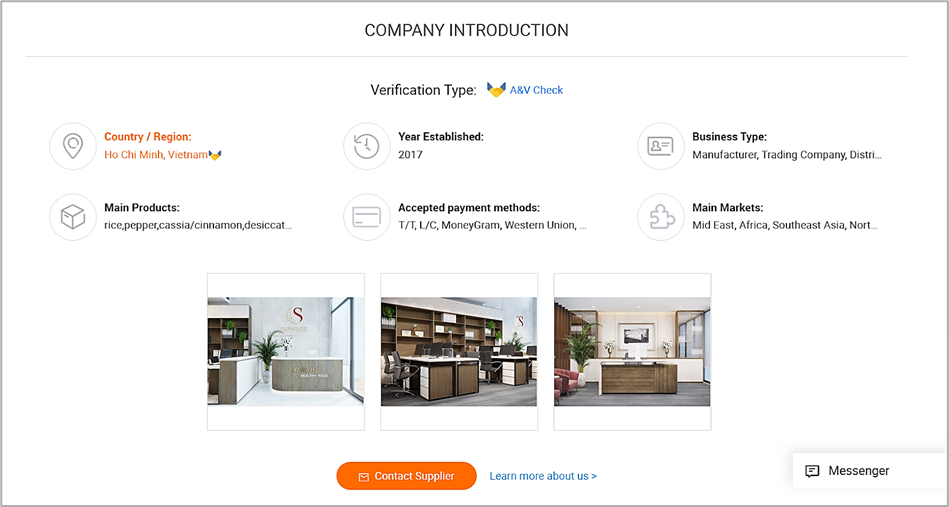

Each supplier has a landing page, which typically includes:

Below is a snapshot of one supplier profile:

Source: Alibaba

Moreover, each listing lets you contact suppliers directly.

However, be cautious.

Scams and misrepresented listings do exist, and buyers should conduct due diligence before making commitments.

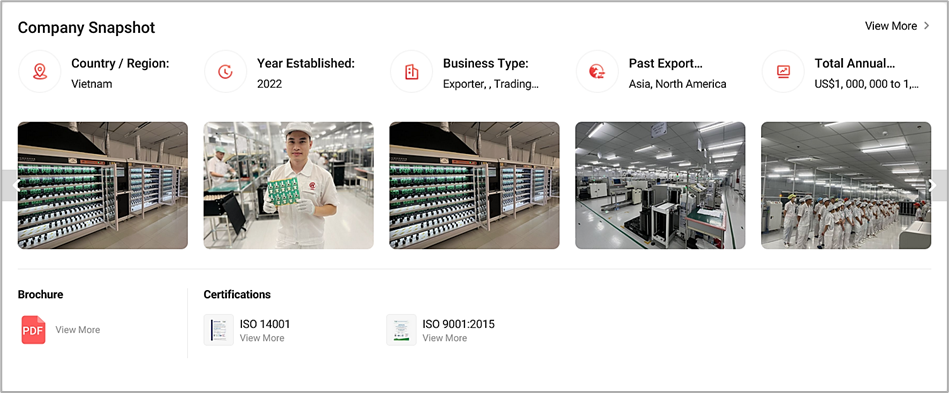

Global Sources is a multichannel B2B online marketplace and sourcing platform that lists verified suppliers from China, Vietnam, India, and South Korea.

Supplier profiles often contain rich details, including product categories and trading capabilities, company descriptions and videos, information about quality control processes, as well as firmographic data and certifications.

Source: Global Sources

There is also a direct inquiry option on each profile, as you can see below:

Source: Global Sources

You can also submit an RFQ directly on the platform and receive multiple responses from vetted suppliers.

Additionally, Global Sources organizes in-person trade shows, such as the Global Sourcing Fair Vietnam, where buyers can meet suppliers face-to-face.

Source: Global Sources

The downside is that the platform only lists pre-vetted suppliers, so the overall pool may be more limited than on open-access directories.

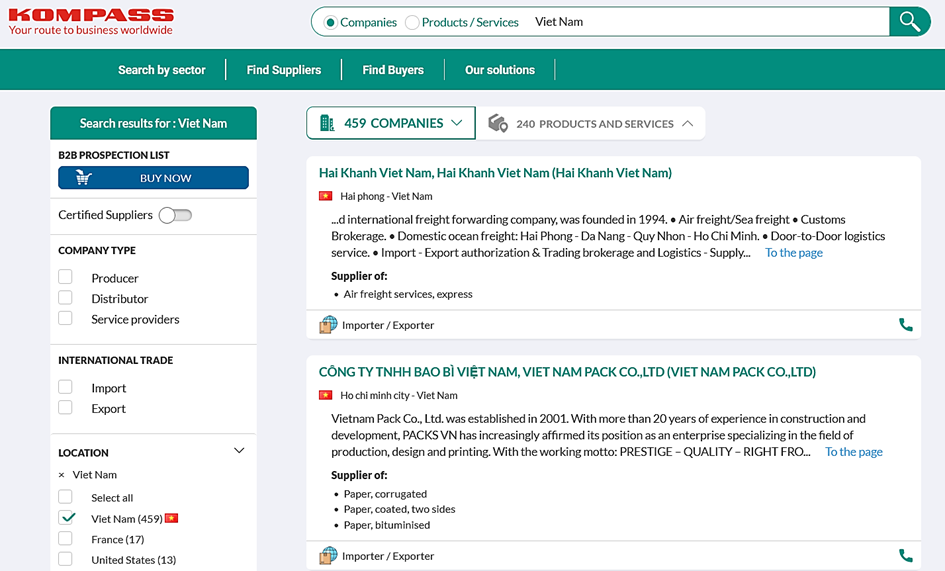

Kompass is essentially a global business directory, offering supplier contact information, product classifications, and some operational insights.

Searching “Vietnam” returns over 3,300 listings, while “Viet Nam” yields 459 companies.

Source: Kompass

Supplier profiles include:

Similar to other platforms, there is also a contact button and “Ask for a Quote” option.

Source: Kompass

But what makes Kompass different is that it includes not just manufacturers and traders but also professional service providers, such as engineering firms and business consultants.

This makes it useful for broader sourcing or partnerships.

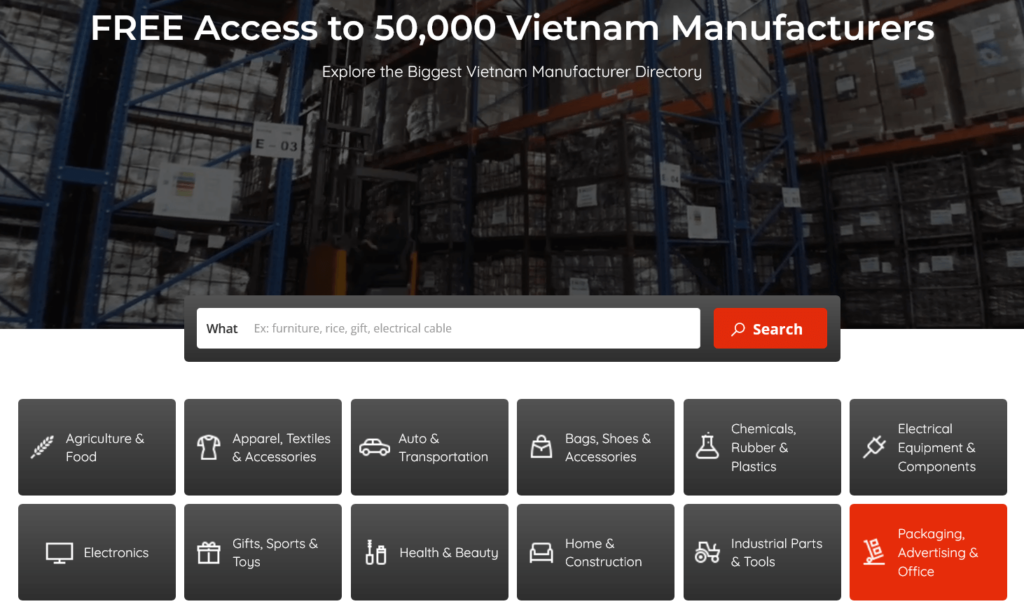

If you’re specifically looking for Vietnamese manufacturers, Viet Factory is a strong starting point.

It claims to be the country’s largest manufacturing directory, listing around 50,000 companies, and it’s free to access.

Source: Viet Factory

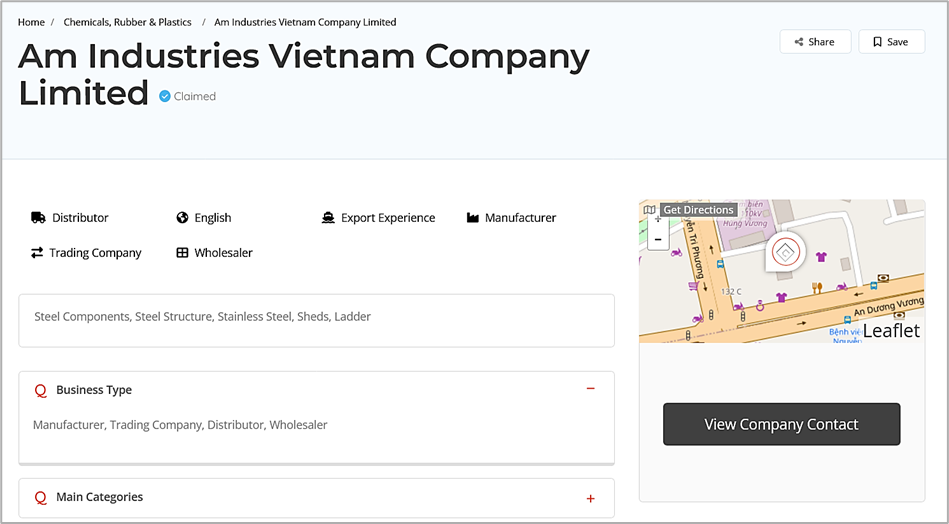

You can browse suppliers by category and then refine your search using filters like business type (e.g., manufacturer, distributor, trading company), export experience, or whether the company offers English-language support.

Many profiles are publicly visible without logging in, although full contact details require registration.

Source: Viet Factory

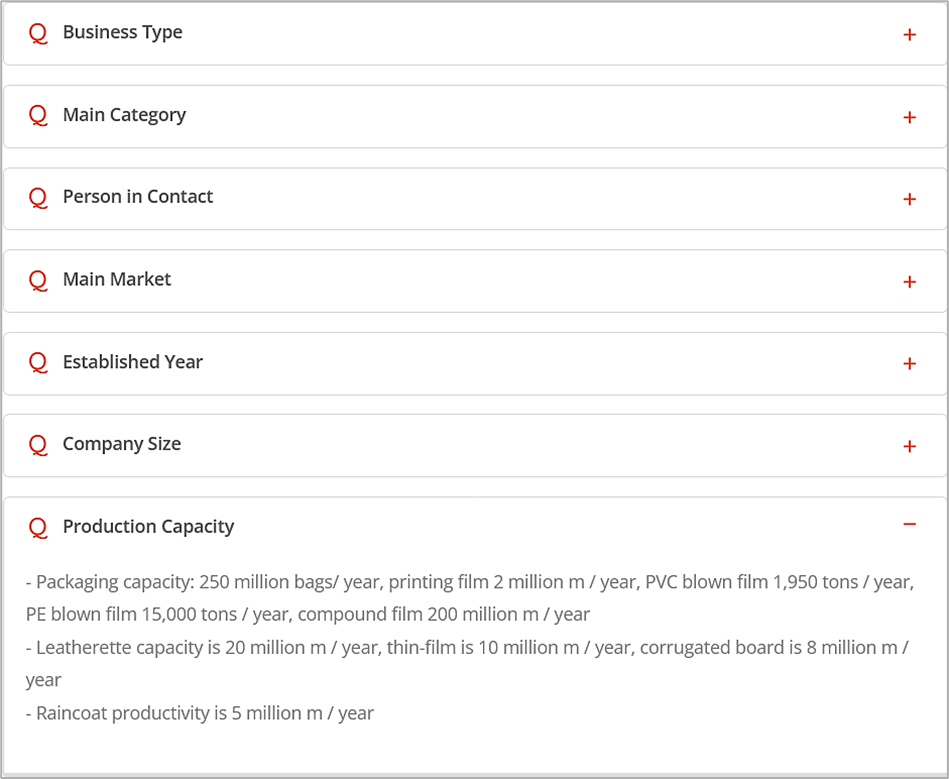

Some supplier profiles offer more depth than others.

In addition to basic company descriptions, you’ll often find details like company size, year established, main contact person, and production capacity.

Source: Viet Factory

You can message suppliers directly from the profile and even save your favorite suppliers into a personal collection for future projects.

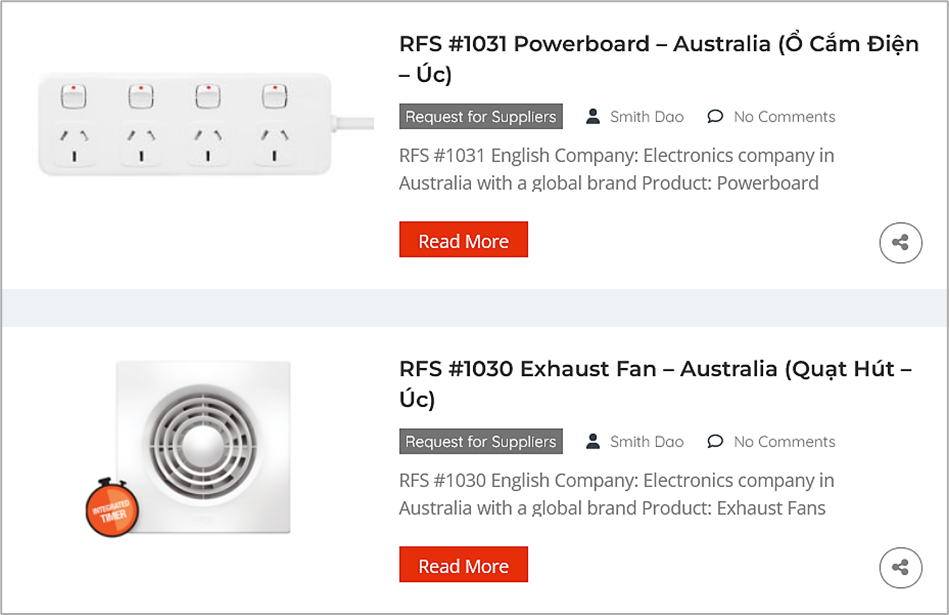

Beyond browsing, Viet Factory also lets you create Request for Supplier (RFS) posts with specific sourcing needs, allowing relevant manufacturers to reach out to you.

Source: Viet Factory

The platform also offers automated supplier matching, connecting you with the top three manufacturers that best fit your request.

If supplier directories and sourcing platforms aren’t delivering the results you need, there are still other effective routes worth exploring.

Particularly if you’re willing to dig a little deeper or make direct connections.

Chambers of commerce are one such option.

While they’re often overlooked, both local and international chambers can be surprisingly helpful in making business introductions.

As one Reddit user put it:

Source: Reddit

Organizations like AmCham Vietnam and EuroCham Vietnam maintain directories of member companies, host networking events, and sometimes facilitate B2B connections.

However, not all members are Vietnamese-owned manufacturers.

Some are multinationals or service providers, so it’s worth checking the type of companies they list.

Another avenue is Vietnam’s network of trade and industry associations.

These groups represent thousands of domestic manufacturers and often provide member lists, supplier referrals, and industry-specific support, and are active in helping connect foreign buyers with export-ready suppliers.

Some of them are:

Many of them also promote companies that meet certain standards, whether that’s sustainable production, ethical labor practices, or experience with international markets.

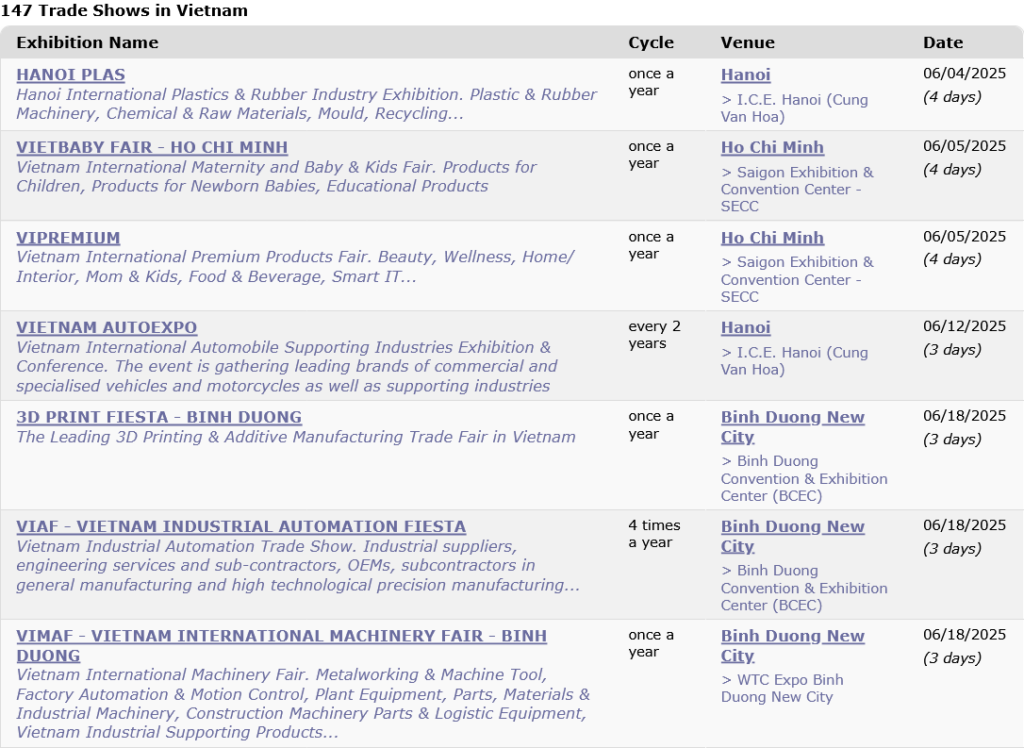

Then there are trade shows, arguably one of the most direct and effective ways to meet Vietnamese manufacturers face-to-face.

Attending a trade fair allows you to see product samples firsthand, compare offerings, and build trust through in-person conversations.

As another Redditor advised:

“Textile and apparel expos. This is where you will also make valuable trade connections and supply chain connections. You will have some significant travel expenses, but downstream, if you work hard, you will reap big rewards.”

Trade shows exist for nearly every major industry in Vietnam, from textiles and garments to furniture, machinery, and even welding and components.

The image below highlights some of the events happening this year:

Source: EventsEye

Of course, trade shows come with trade-offs.

They’re limited to specific dates and locations, can involve travel costs, and aren’t always easy to search or access online.

Still, for buyers who are serious about building long-term relationships with reliable Vietnamese suppliers, they remain a highly valuable sourcing channel.

As helpful as directories and trade shows can be, sometimes they just don’t go far enough, especially if you’re sourcing at scale or under time pressure.

That’s where a global supplier intelligence platform like Veridion becomes indispensable.

While most tools tend to focus on suppliers in the U.S. and EU, Veridion was built for a global reality, including emerging markets.

Vietnam is a prime example.

A this moment, Veridion delivers supplier profiles on nearly 700,000 Vietnam businesses, as shown in the map below:

Source: Veridion

These profiles span suppliers across all major sectors, from textiles and apparel to electronics, industrial parts, food processing, and more.

That’s the kind of coverage you simply won’t find on legacy directories.

How does it work?

Veridion uses AI and machine learning to extract data from billions of online sources, including government registries, customs filings, local business listings, supplier websites, ESG disclosures, and more.

If a company has even a minimal digital footprint—and Vietnamese suppliers often do—it’s likely Veridion will surface it.

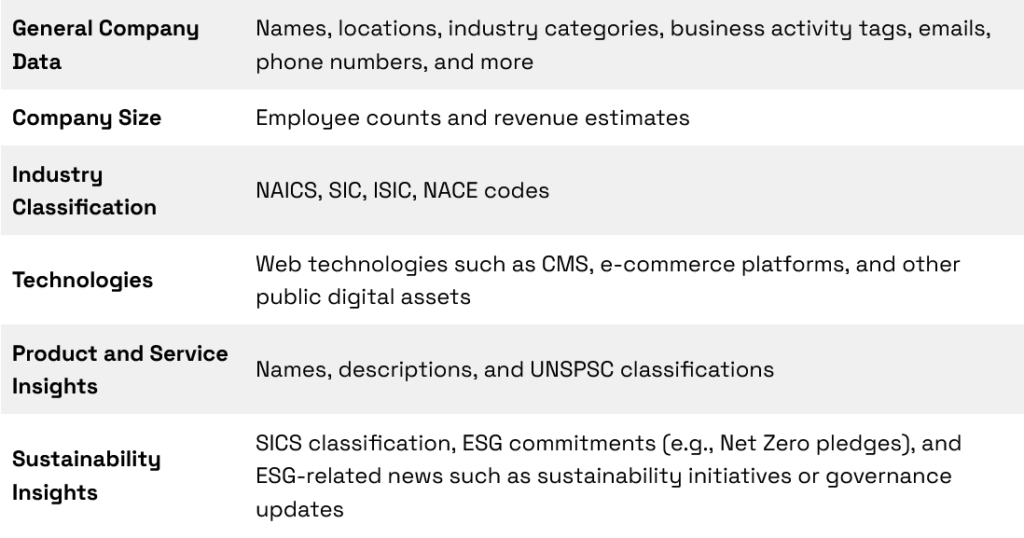

From that data, Veridion builds rich supplier profiles, with over 80 structured data points per company, including:

Here’s just a sample of the data Veridion captures:

Source: Veridion

This level of depth means you can screen potential suppliers based on real operational capabilities, not just a vague business description or outdated trade listing.

Unlike directories that are updated quarterly (or less), Veridion’s database is refreshed weekly.

And all profiles are verified, so you’re not wasting time chasing dead leads or dealing with middlemen misrepresenting themselves.

When it comes to actually searching for suppliers, you can search by location, certification type, production scale, or product category, among other criteria.

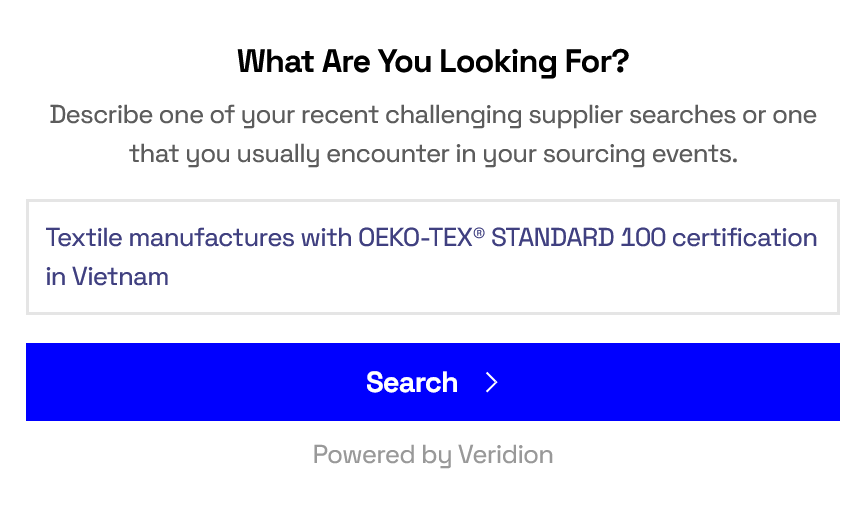

Or if you’re short on time, you can use Veridion Scout to search by using natural language.

Scout lets you type exactly what you’re looking for, down to specific product needs, capabilities, and geographic location.

For example:

Source: Scout

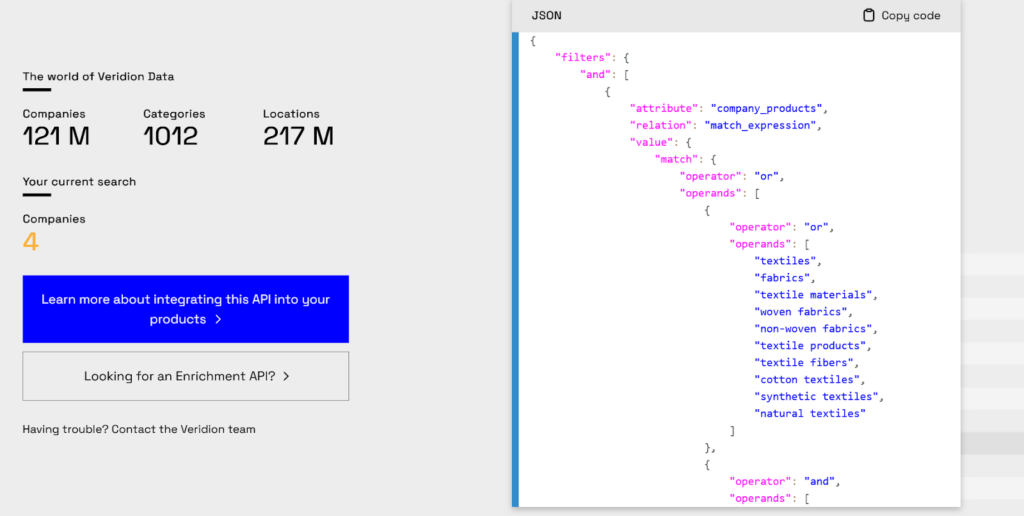

It then instantly returns a ranked list of suppliers that match your request, with no guesswork required.

For the query above, Scout found four suppliers that meet precisely this criteria.

Source: Scout

With its scale, speed, and depth of data, Veridion gives you a way to cut through the noise.

It helps you discover suppliers you wouldn’t otherwise find, validate them faster, and source with confidence, even in under-digitized markets like Vietnam.

Vietnam is a rising star in global manufacturing, but sourcing there remains a challenge.

Between outdated directories, language barriers, and the limits of traditional platforms, finding the right supplier isn’t easy.

While platforms like Alibaba and Viet Factory offer a starting point, solutions like Veridion provide the global, verified, and real-time supplier data needed to make confident decisions quickly.

Whether you’re diversifying away from China or entering Southeast Asia for the first time, better visibility leads to better partnerships.

So, make sure you’re looking for Vietnamese suppliers in the right places—using the right tools.