6 Common Mistakes when Gathering Competitive Intelligence

Key Takeaways:

Gathering competitive intelligence has never been easier.

But at the same time, it’s also never been harder to make sense of it all.

With mountains of data constantly coming in, advanced tools with steep learning curves, and markets that change overnight, it’s surprisingly easy to get things wrong.

That’s why, in this article, we break down the six most common mistakes in gathering competitive intelligence, explain why you should avoid them, and show you what to do instead.

It’s easy to fall into the trap of trying to collect every possible piece of information about your competitors.

After all, more data equals better decisions, right?

Well, not necessarily.

Without a clear sense of purpose, gathering large amounts of information can quickly lead to information overload, burying valuable insights under a mountain of noise.

Marius Ivanauskas, Chief Delivery and Operations Officer at Linklaters, a leading global law firm, explains:

Illustration: Veridion / Quote: Forbes

To avoid this, Ivanauskas recommends defining key metrics aligned with business goals and prioritizing actionable insights over data volume.

One effective way to achieve this is by establishing Key Intelligence Questions (KIQs).

KIQs are fundamental questions framed around your strategic objectives.

They guide research and analysis, ensuring that every piece of data collected directly contributes to informed, goal-oriented decision-making.

By setting KIQs upfront and collecting only the information needed to answer them, your analysis becomes more efficient, focused, and impactful.

Flavio Cotrim Paneque, Legal Consultant on International Matters at Paneque Consulting, agrees:

Illustration: Veridion / Quote: LinkedIn

Your specific KIQs should align with your company’s broader priorities.

For example, if sustainability is a strategic focus, you might track competitors’ performance on ESG metrics.

Here are a few sample KIQs to get you started:

For more example questions like these, visit the Octopus Intelligence website. They offer a truly extensive list of KIQs across different topics.

Just as there can be too much information, there can also be too little.

This happens when you focus solely on competitor pricing strategies as the main factor in your competitive analysis, instead of looking at the bigger picture.

Price is, after all, only one part of the value equation.

Customers often make decisions based on service, brand reputation, features, or overall experience, not just cost.

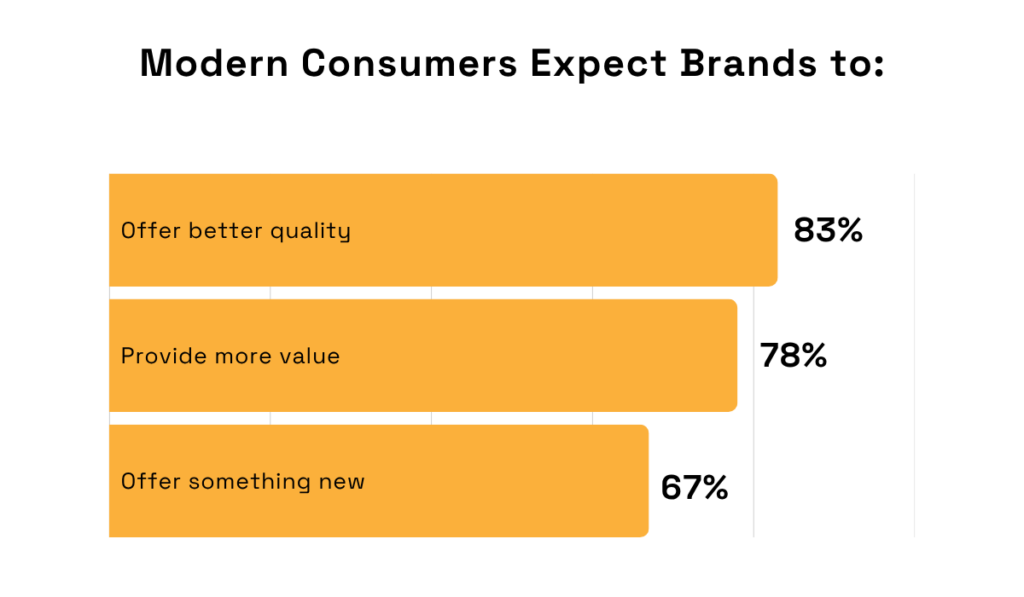

The 2025 EY survey confirms this, showing that most consumers expect both quality and value from brands and even want them to “offer something new.”

Illustration: Veridion / Data: EY

Tracking competitors’ pricing alone won’t help you meet those expectations.

In fact, over-focusing on price can lead to unnecessary discounting and margin erosion.

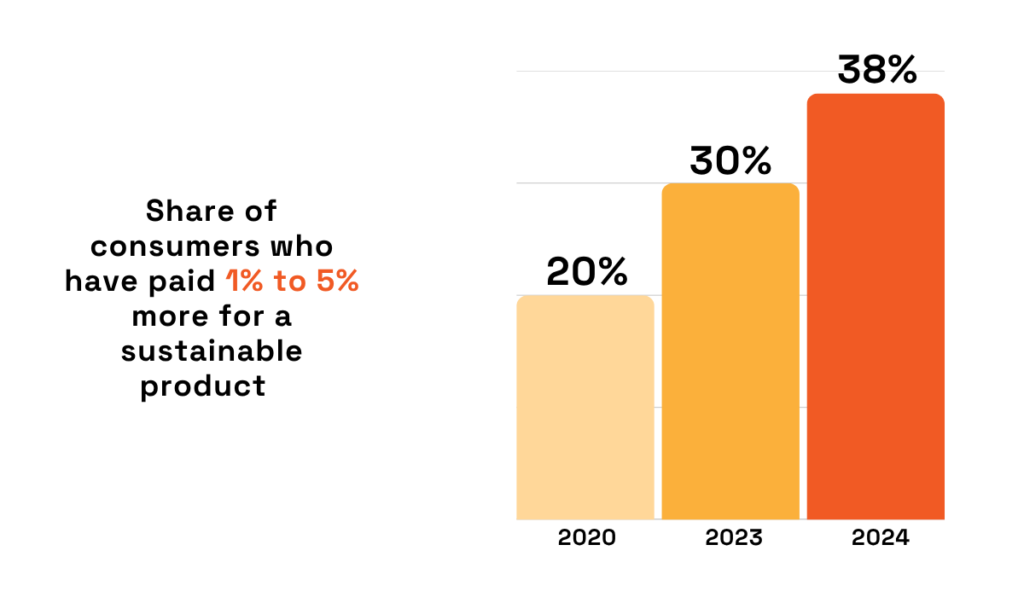

This can significantly hurt profitability, especially when you consider that many consumers are actually willing to pay more for products or services that align with their values.

For example, the 2025 Capgemini survey shows that a significant number of consumers have paid a premium for a sustainable product.

And that number seems to be rising.

Illustration: Veridion / Data: Capgemini

In short, discounting isn’t the only way to win customers.

Sometimes, it can even do more harm than good.

It’s no surprise, then, that major retailers like Target are moving away from price-matching their competitors.

Now, that’s not to say you should ignore competitor pricing altogether.

Instead, use it as one data point within a broader view that includes product differentiation, customer experience, support, and brand positioning.

Here are the competitive intelligence elements to pay attention to:

Source: Veridion

By analyzing all of these factors together, you’ll gain a deeper understanding of your competitors, and perhaps even win over some of their customers.

Speaking of customers, many companies make the mistake of focusing only on competitors’ products and strategies, while overlooking the consumers themselves.

They fail to ask who their competitors’ customers are, how they are targeted, and why they choose those brands.

This can cause you to miss valuable insights that could help expand your own customer base.

A 2024 Forbes survey proves that brand loyalty is fragile, with many customers saying they are willing to switch brands if they find one that better aligns with their values or offers better quality.

Illustration: Veridion / Data: Forbes

So, why miss the chance to become that better alternative?

By analyzing your competitors’ customers, you gain a deeper understanding of their experiences and preferences, uncovering potential market gaps that your business could fill.

Take Lucid Motors, an American EV manufacturer and a major Tesla competitor right now, for example.

They have capitalized on Tesla’s shift away from what originally attracted many of its customers—electric vehicles—toward autonomous driving.

Lucid’s interim CEO, Marc Winterhoff, noted that they’re seeing an increasing number of Tesla owners trading in for the Lucid Air and the upcoming Gravity model:

Illustration: Veridion / Quote: Electrek

Essentially, Tesla has stopped meeting customers’ expectations, and Lucid has emerged as a strong alternative at the perfect moment.

Ultimately, consumer loyalty lies with brands that deliver what customers truly want.

By understanding those wants, you can attract them to your side.

Therefore, analyze your competitors’ audiences in terms of demographics, psychographics, buying behaviors, and brand loyalty.

According to Jeremy Bradley-Silverio Donato, COO at Zama, an open-source cryptography company, online reviews are a great place to start:

Illustration: Veridion / Quote: Forbes

That’s right.

They reveal what people appreciate about competitors, where they fall short, and where expectations go unmet, offering clear opportunities for you to step in and win them over.

Monitoring only your closest rivals in the same product category or industry leaves dangerous blind spots for indirect competitors, substitutes, and disruptors.

The harsh reality is that disruptors rarely come from within your core market.

They often emerge from adjacent industries or entirely new business models.

So, if you’re not paying attention, you might not notice them until they’ve already become a major threat.

Perhaps the most famous example of this is Blockbuster vs. Netflix.

In 2000, Blockbuster was the undisputed leader in home entertainment: a household name with thousands of stores.

Netflix, by contrast, was a small startup mailing DVDs to a niche audience.

Netflix wasn’t even on Blockbuster’s radar; their focus was on beating Hollywood Video and other brick-and-mortar rental competitors.

In fact, Blockbuster’s executives famously laughed off an opportunity to buy Netflix for $50 million that same year.

Fast-forward to today: Netflix is a $250+ billion streaming powerhouse, while Blockbuster filed for bankruptcy in 2010.

Source: Fortune

Blockbuster could have led the shift to digital entertainment, but instead, they dismissed it as a passing fad.

Had they paid closer attention to emerging trends and indirect competition, they might have made better strategic choices and stayed a household name.

Don’t make the same mistake.

Make sure you conduct annual landscape scans to explore the broader competitive environment and identify emerging threats early.

During this process, apply the ”Jobs to Be Done” thinking.

Instead of asking, “Who else sells what we sell?” ask:

“What is the customer really trying to accomplish, and what other ways could they achieve it?”

This one simple change in how you think helps reveal your real competitors, including unexpected or non-obvious alternatives that meet the same underlying customer needs.

Collecting competitive intelligence without turning it into actionable insights doesn’t drive decisions.

Decision-makers need context to act, or opportunities are lost.

In other words, when competitors make moves, the signals are there, but without proper analysis, you often react too late to make a difference.

Take what happened with Nokia as a cautionary tale.

In the late 1990s and early 2000s, they dominated the mobile world.

But all of that began to change in 2007.

This is when Apple launched the iPhone, a powerful handheld computer with a sleek touchscreen, an intuitive operating system, and access to an app ecosystem that opened endless possibilities.

Soon after, Google introduced Android, a flexible operating system that other smartphone manufacturers could adapt to their hardware.

With that, the era of feature phones was over, and the smartphone revolution had begun.

Source: Gizoom

Nokia saw this change, but didn’t understand it.

They kept focusing on hardware, trying to sell as many devices as possible, blind to the fact that the real future was software, services, and user experiences.

By the time they realized this, it was too late.

This is why competitive insights must always be paired with thorough analysis, asking questions like, “So what?” and “Now what?”

One useful tool for this is a SWOT analysis, a method for evaluating performance, competition, risk, and potential of a business.

It can be applied to an entire organization, a product line, a division, or even an industry.

Source: Veridion

In a way, a competitor SWOT analysis puts you in the mindset of your competitors.

It examines their internal strengths and weaknesses, as well as the external opportunities and threats they face.

This creates a more well-rounded perspective, helping you make proactive strategic decisions rather than simply reacting to what others are doing.

Competitor landscapes change quickly.

New players enter the market, innovative products launch, pricing shifts, and partnerships form, sometimes practically overnight.

In such a fast-moving environment, relying on outdated intelligence can only lead to flawed assumptions and slow reactions.

And this can cost you greatly.

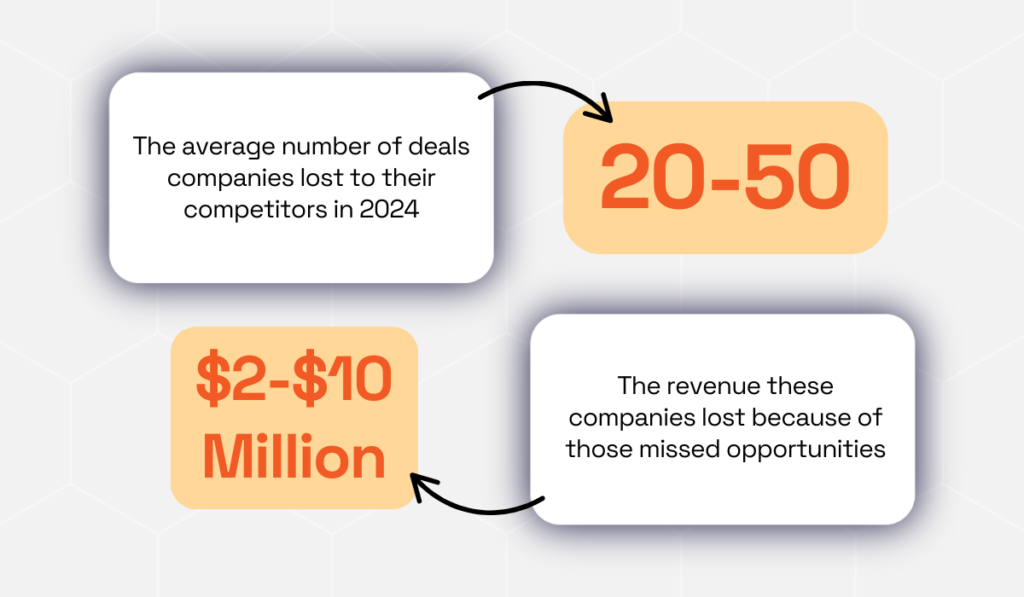

According to Crayon’s 2025 survey, enterprises lose $2–$10 million annually in competitive deals they could have won, simply because sales teams weren’t armed with the right insights.

Illustration: Veridion / Data: Crayon

The lesson?

Competitive intelligence should be treated as a continuous process, not a one-off project.

Otherwise, you’re bound to miss some vital insights.

So, collect it frequently, and ensure your sources are reliable and up-to-date.

Sounds time-consuming? Not anymore.

There are now tools that can do it for you automatically.

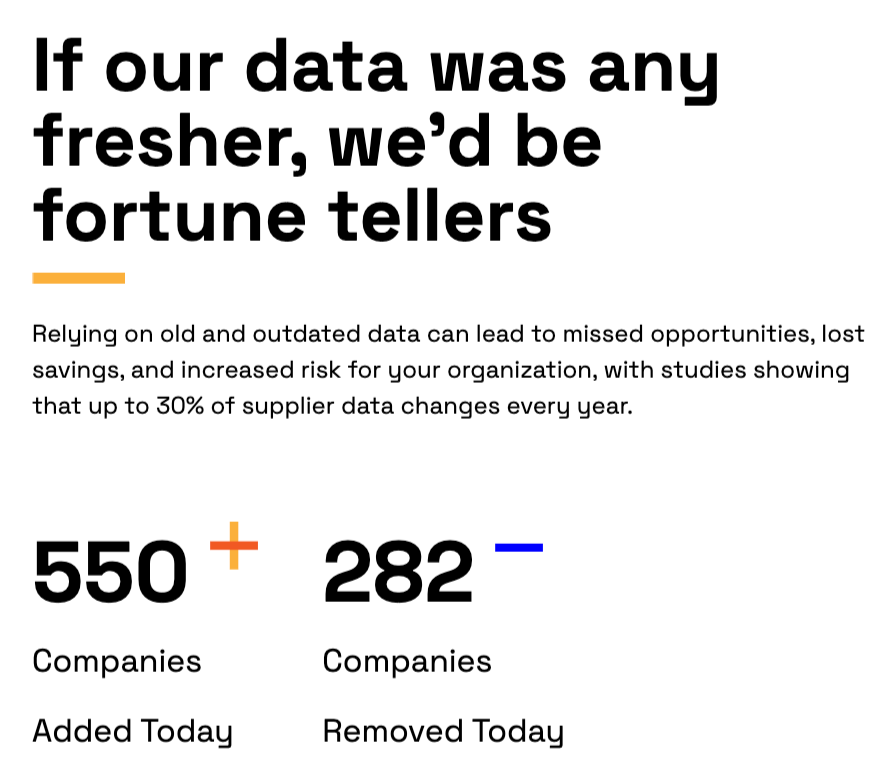

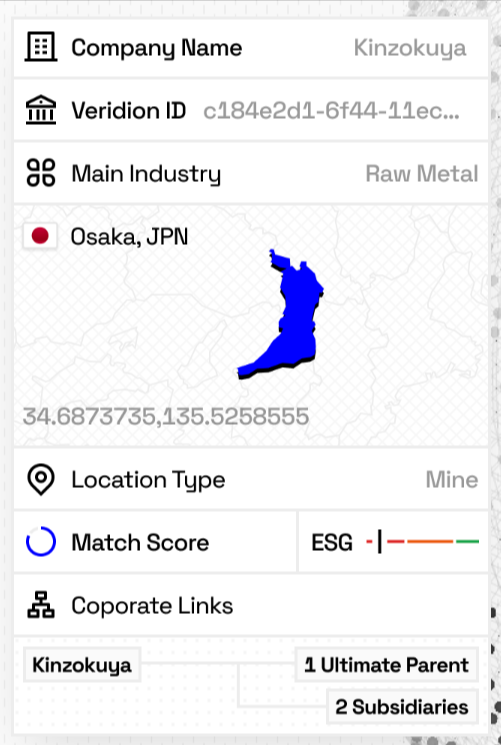

Take our competitive intelligence platform, Veridion, as an example.

Powered by AI, Veridion continuously indexes and verifies data from various sources.

This includes company websites, public registries, regulatory filings, online product catalogs, social profiles, and trusted news sources.

Source: Veridion

We make sure to only process first-party or publicly accessible information, feeding it through advanced AI models to ensure accuracy and relevance.

The best part?

Unlike traditional providers that update quarterly or annually, Veridion refreshes its data weekly.

By monitoring real-time digital signals, like company disclosures, website changes, and online activity, we deliver the freshest, most precise business intelligence available.

Source: Veridion

In fact, our rigorous validation process ensures over 95% accuracy, so you can always trust the information you receive.

No need to manually sift through endless websites anymore, or worry about data’s relevance.

If a company has an online presence, Veridion can provide everything you need to know about it in seconds, regardless of its location or size.

If you’ve caught yourself making some of these mistakes, don’t worry.

There’s still time to turn things around.

After all, competitive intelligence isn’t something you master overnight. It’s a skill built over time.

The key is approaching it with a clear purpose and consistency, rather than treating it as a one-off mission to hoard as much information as possible.

In the end, when you have the right insights and use them the right way, a whole new world opens up: one where your business decisions are agile, data-driven, and, most importantly, proactive.

And that’s exactly what your competitors fear the most.