How B2B Forms Stain Your Data Quality

Find suppliers across any category or industry with advanced filtering, real-time search capabilities, and weekly data updates.

We love our data, and now that you're here, you're one step closer to loving it too.

A wide sample of data, so you can explore what is possible with our data

Choose ->

built with procurement in mind. Focused on manufacturers, products and more

Choose ->

built with insurance in mind. Focused on classifications, business activity tags and more

Choose ->

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

Choose ->

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Choose ->

A wide sample of data, so you can explore what is possible with our data

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Keep up to date with our technology, what our clients are doing and get interesting monthly market insights.

In business, we ALL fill out forms. For most of us, that’s a weekly event, and for many of us, it happens multiple times per day.

The list of forms we must fill out is a long one, especially for those of us who work in sales or marketing roles.

Registration forms for webinars and virtual events. Registration forms for conferences and industry events. Registration forms for training courses. Registration forms for internal company activities and development programs.

Forms for expenses!

And more forms for business development: applying for partnership programs, industry sponsorships, and so on.

And EVEN more forms for each individual new entry (for customers, contacts, deals, and more) in our CRM systems.

All in all, I’m sure some of us fill out 100+ forms per week.

My favorite form question of all: what industry is your company in?

I have to ask you: how often do you find an appropriate industry category in each form? (I hear snickering in the background…)

And two, how much time do you take to make the right choice? After all, making the right choice matters, right? It should.

Let’s take a look at some real-life examples.

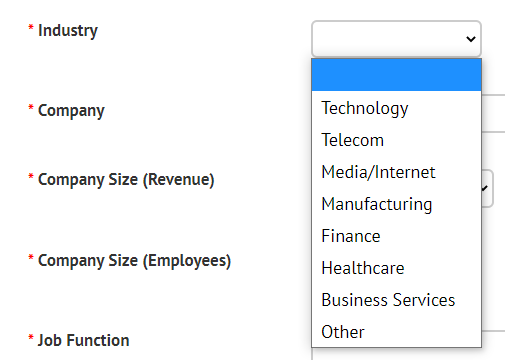

The first one is an event registration form from one of the largest b2b marketing community organizations that run a well-attended series of events and programs.

If I work for a CRM company and were registering for one of their events, I guess “Technology” is the right answer (see below). But the same choice would be true for EVERY SaaS, PaaS, DaaS, and IT company that also attends the event.

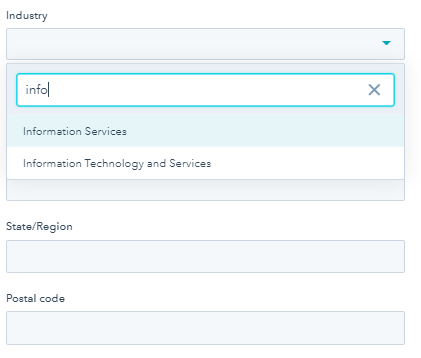

The second example comes from the new company/new account set-up form, or screen, within one of the most respected CRM systems on the market.

Their platform is adapt at auto-filling information in some instances but only provides two industry categories, so far as I can see, for ALL participants in the tech world.

See below:

There’s NO clear distinction between services, hardware, software, and data; actually, the two categories are confusing and partly redundant for no particularly good reason! (Full disclosure – we completely AVOID using their classifications in our ICP. Ask what source we use instead!!)

As a data-centric industry, why do we accept this? Why do we use (/buy) solutions that lack the most basic tools? That understand the essential qualities of data that are required for essential go-to-market insights?

We could go on, but I think the problem is obvious by now. Actually, make that problems.

Besides, is THIS data good enough to help us achieve our business goals?

We, marketers, need to be very careful what we ask of our users.

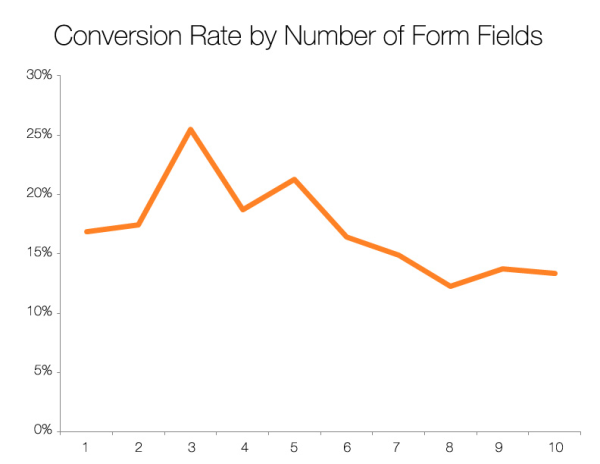

The data/conversion rate trade-off is very real:

In other words, we need to make sure we need every field in our forms, because of the high cost associated to adding a new field.

A form with 3 fields will have a completion rate of ~25%, whereas a form with 6 fields will see ~15%.

So the question becomes “do we actually need to ask so many questions?”.

Is the reward worth the price?

If we think of how we typically look at MQLs and how useful the answers are at saving qualification time, the answer tends to be a definitive “hell yes!”.

But let’s take a moment and think of our business goals.

Let’s think about a very basic and obvious challenge:

How do I segment and profile these companies in a meaningful, sufficiently granular way? What if I rely on this information to fuel my ICP? Or size key market segments? Or identify competitors? Or enrich my existing first-party data?

Will the gathered data actually help us answer these questions and achieve our business goals?

Or will it be vague enough to lead to an answer as opposed to the answer?

…Using data enrichment APIs to avoid the conversion/data tradeoff:

This approach has 3 immediate advantages:

Not all providers are equal.

This is especially true when it comes to data.

Data is significantly more difficult to evaluate than software, so I want to leave you with a methodology that is centered around your needs:

Will the vendor have the right coverage?

Data vendors have wanted and unwanted biases in their data. In other words, coverage will vary significantly by geography, company size, and industry. Make sure to ask your data vendor about their coverage before you choose them.

Will the vendor provide enough data?

When asking users questions, we need to be careful to ask the minimum number of questions that would help us. With data enrichment, the opposite applies: the more fields, the better. Why not have a granular business activity field used for briefing and a more high-level one used for MQL purposes?

Will the vendor provide fresh data?

It might not be obvious from the outside, but most vendors measure refresh cycles in months. Make sure yours measures it in days or weeks.

Will the vendor enrich the data where we need it?

If I need the data enriched in my CRM or ABM software, can the vendor connect with my first-party data at that level?

As with most data vendor evaluation processes, the quickest way to test would be to test with historical data.

We need to provide them with a dataset that is relevant and indicative of what we’ll see in the future. And make sure the volume is at least in the hundreds, so it’s statistically relevant.

Once we’ve gone through the “PoC” enrichment with a vendor, it’s important to test the results correctly. We need to look at at least 3 things:

Hopefully, this is starting to look like an approach that (a) doesn’t leave the user frustrated, (b) helps us be successful with our business goals, and (c) looks more like a XXI century approach.

We think having high-quality external data is essential to good decision-making in all b2b go-to-market decisions.

B2B marketing lacks the breadth, depth, and volume of external insights that consumer marketers have used for years: research, market studies, competitive intel, rich demographic (attribute) data, etc.

So the basics – like industry classifications – are essential to creating a solid foundation from which to drive many of your business goals.

If you sell across different verticals, industry classifications are essential.

If you compete in multiple product categories or have a very specific offering in an emerging category, you need granular industry classifications.

If you are crafting a business case for a new product in an adjacent category, you need accurate industry classification to support your market sizing needs.

If you’ve been disappointed by the lack of granular data coming from your CRM, ABM, MAP, CDP (long list!!), or other platforms, we’d love to hear from you.

Soleadify looks at b2b data differently – find out more about our story here or connect with us on LinkedIn here.

Check out how Soleadify has helped Tier 1 companies improve their business results using our high-performance, project-ready data.