How to Break ESG Data Silos

Key Takeaways:

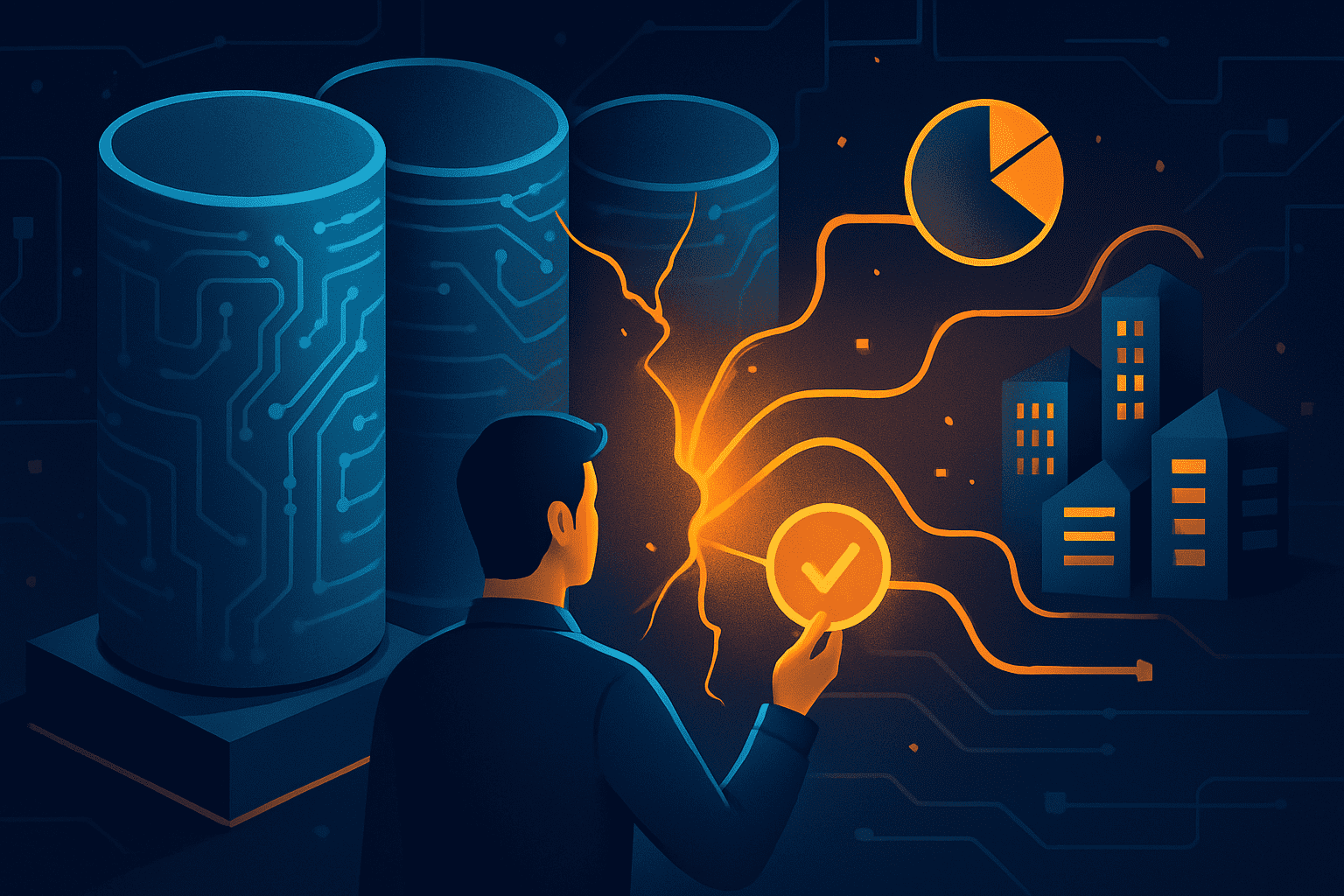

Data silos plague 90% of organizations, and the problem goes even deeper when it comes to ESG data.

Isolated, disconnected information slows reporting, increases risk, and makes it harder to meet regulatory and stakeholder expectations.

Breaking those silos today is a business necessity.

This guide outlines practical, actionable ways to unify ESG data management and build the foundations for more reliable, connected, and transparent reporting.

Knowing who’s responsible for ESG data and ensuring smooth collaboration between departments is the first step to breaking down silos.

Data fragmentation often stems from unclear ownership and isolated teams, and research underlines how widespread the problem is.

According to a recent MuleSoft report, only 10% of organizations say they have no issues with fragmented and isolated data.

Illustration: Veridion / Data: MuleSoft

For ESG, where datasets span everything from emissions and supplier audits to workforce diversity, those silos are often even deeper.

Just think about procurement, compliance, and sustainability teams, where each is tracking ESG metrics independently.

The only possible outcome? Serious misalignment.

One department might prioritize supplier price points while another focuses on emissions or labor practices, leading to conflicting decisions and inefficient reporting.

ESG and Sustainability Advocate, Matthew Sekol, explains the issue in this way:

Sustainability offices have been collecting activity greenhouse gas emissions data from across the business […] and from suppliers. While this data is valuable for compliance purposes, it remains inaccessible to other departments that may need it for analysis and decision-making.

And it’s not just missed opportunities you’re dealing with. When your internal departments are isolated and out of sync, you’re looking at various inefficiencies and increased risk exposure.

Source: Veridion

So, how do you fix this?

The first step to clarifying data ownership and increasing engagement between departments lies in building a formal ESG governance structure.

These committees or advisory boards would need to involve all relevant functions like procurement, legal, HR, IT, and marketing.

Many leading companies have also introduced the ESG Controller role that serves to oversee data quality, reporting standards, and regulatory alignment across teams.

According to Ellen Weinreb, ESG and CSO recruiter and consultant, this emerging role comes down to navigating organizational dynamics, driving accountability, and getting things done.

Illustration: Veridion / Quote: Trellis

Of course, oversight alone isn’t enough.

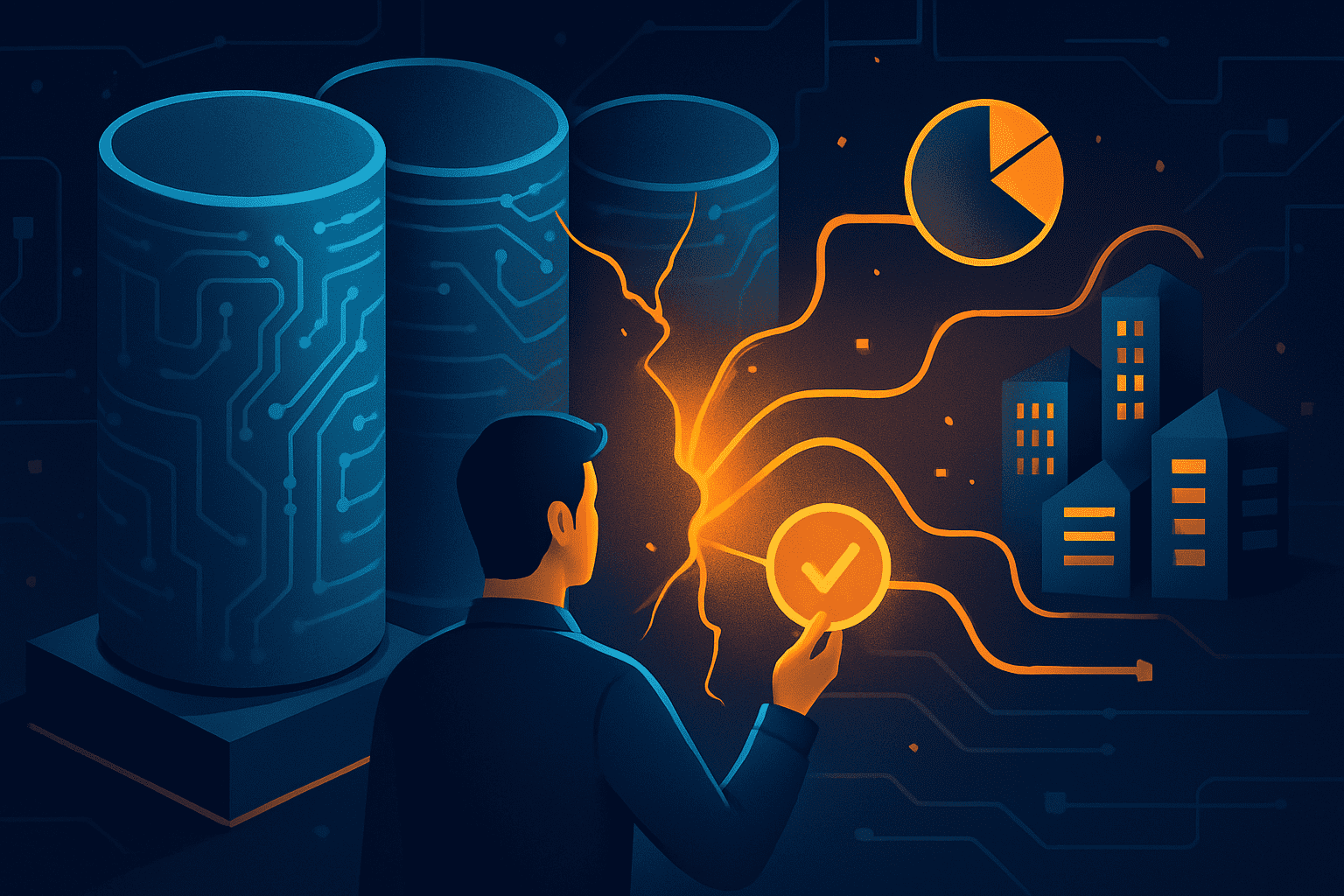

You’ll still need to assign clear ownership over each ESG dataset.

A practical way to do this is with a RACI framework or responsibility assignment matrix, clarifying how individuals and/or teams relate to each data stream.

Source: Veridion

This prevents miscommunication, outdated reporting, and fragmented decision-making.

Once ownership is defined, regular cross-departmental syncs and shared KPIs help maintain ongoing alignment while opening room for innovation.

For instance, one of CircleIT’s clients successfully tackled Scope 3 emissions through a joint initiative, resulting in a scalable, transparent program that reduced emissions and improved data accuracy.

This wouldn’t have been possible without a clear division of roles and responsibilities, and a steady data flow between:

In this case, the ITAD provider supported the client’s process, but with the right structure in place, your business can manage initiatives like this independently.

Ultimately, clear ownership combined with structured collaboration reduces reliance on intermediaries, helping your business build stronger, faster, and more reliable ESG data practices.

To make ESG data useful, your business needs to standardize how that data is structured and reported.

Without shared data formats, even the most deliberate and well-prepared ESG initiatives struggle to deliver insights you can actually use.

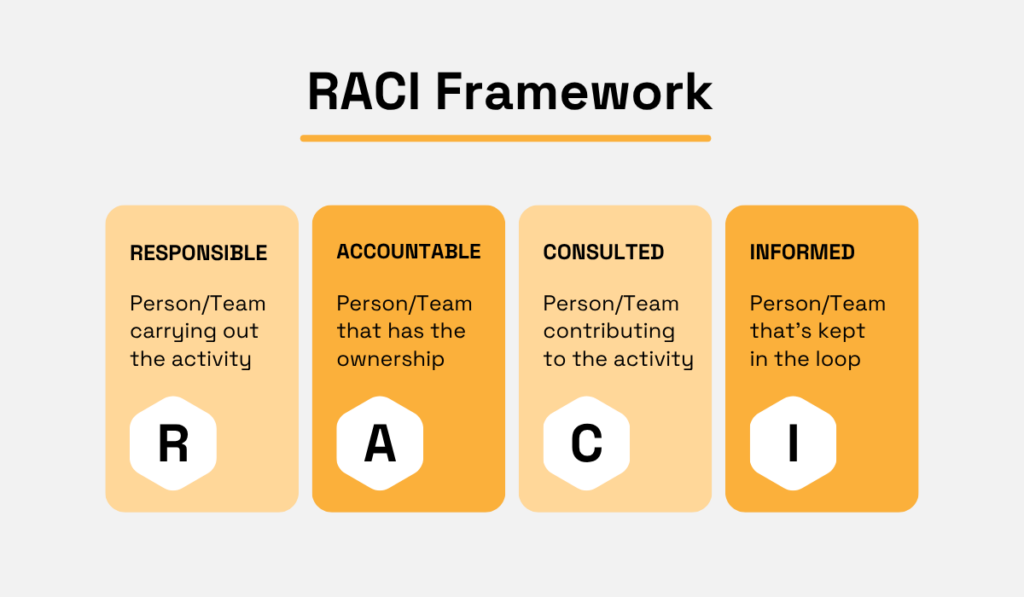

As Bloomberg’s Nadia Humphreys explains, the lack of data standardization means that companies can’t make any use of the information they already have.

Illustration: Veridion / Quote: Bloomberg

While this issue may seem straightforward, it’s both complex and widespread.

Different teams like procurement, finance, and sustainability often track ESG metrics using different tools, naming conventions, and reporting cycles.

And without alignment, it’s nearly impossible to consolidate, compare, or audit this data reliably.

That’s why it’s essential to apply a shared ESG data standard across departments.

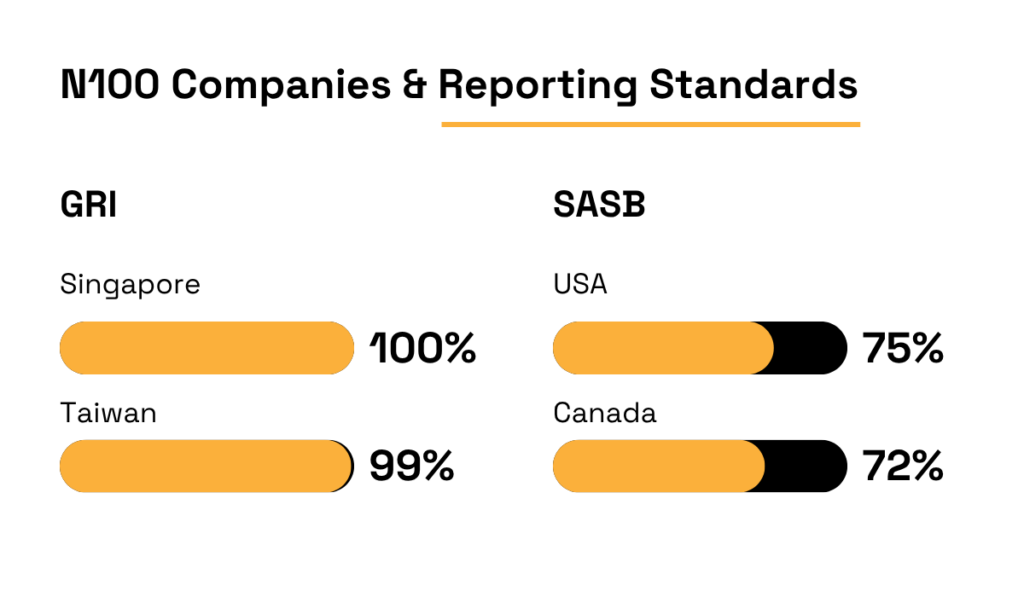

Commonly used frameworks, such as GRI (Global Reporting Initiative), CSRD (Corporate Sustainability Reporting Directive), and SASB (Sustainability Accounting Standards Board), give structure to ESG reporting and enable consistency across internal and external disclosures.

A 2022 KPMG survey revealed that almost all N100 companies report on sustainability by adopting structured standards, although the choice varies significantly by country and sector.

Illustration: Veridion / Data: KPMG

To complicate things further, most companies don’t rely on a single framework, but combine guidelines from several sources instead.

In fact, a 2021 FEI report found that 85% of companies use multiple ESG frameworks to cover different reporting obligations and stakeholder needs.

With that in mind, how are you supposed to proceed?

Start by identifying which standards your business is legally required to follow, such as CSRD in the EU or the SEC’s climate disclosures in the U.S.

Then, fill the gaps by mapping those against voluntary frameworks like GRI or SASB.

Further clarification of data categories, naming rules, and metrics that are specific to your operations creates an internal ESG taxonomy that harmonizes overlapping metrics and answers your needs.

As Dr. Choen Krainara, research analyst and ESG scholar and mentor, explains, the ultimate goal is to enable easy comparison and reliably benchmark your ESG performance against peers.

Illustration: Veridion / Quote: LinkedIn

Standardizing ESG data unlocks several operational gains, from simplifying integration into central ESG platforms to improving cross-functional reporting.

Remember: If your ESG data isn’t structured the same way across your business, you’re increasing avoidable risk and adding extra admin work while missing strategic insights.

The sooner you align your formats and taxonomies, the faster you’ll be able to break down those data silos.

Without a central platform to anchor and synchronize ESG data, silos remain intact.

ESG platforms consolidate information from across your business and supplier network, enabling:

Still, adoption is uneven.

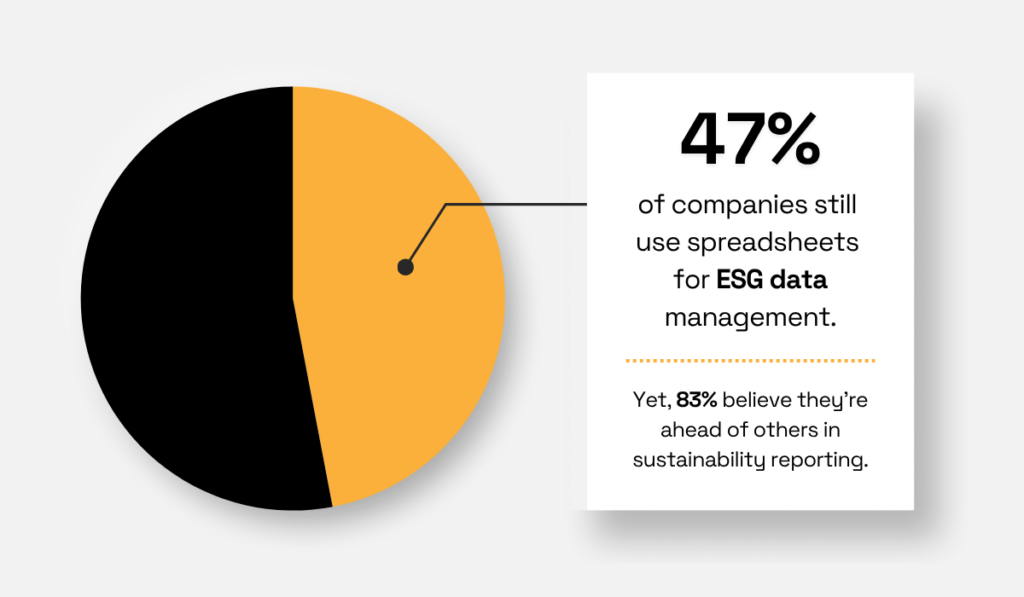

According to KPMG, while many companies feel confident in their ESG data management, nearly half still rely on spreadsheets to track it.

Illustration: Veridion / Data: KPMG

That said, there’s momentum in the right direction.

The same report shows 59% of organizations are now using advanced data systems to support more accurate, efficient, and audit-ready sustainability reporting.

In parallel, a Thomson Reuters study found that up to 74% of companies rely on third-party ESG tools daily, whether for risk monitoring, supplier assessments, or regulatory reporting.

Illustration: Veridion / Data: Thomson Reuters

So, does the growing use of multiple tools reduce the role of ESG data platforms?

Quite the opposite—it strengthens the case for a centralized ESG hub.

A central platform won’t replace every solution you use, but it plays a critical role in connecting and aligning them for maximum efficiency.

It reduces silos, improves collaborative access, and ensures reporting consistency across departments working with different systems.

In other words, with everyone working from a single, structured source of truth, you can finally move past chasing down Excel files, email attachments, or scattered dashboards.

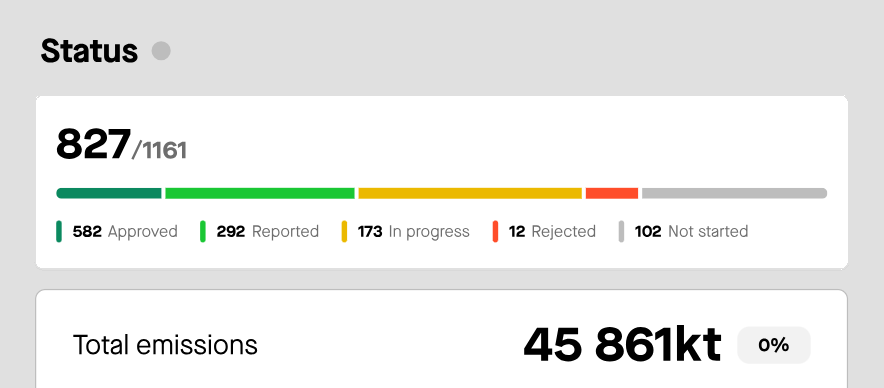

Take Sweep, for example.

The software allows you to track Scope 3 emissions, visualize trends, and run advanced analytics on massive datasets from a single dashboard.

Source: Sweep

But what sets platforms like this apart is their ability to integrate AI features, such as auto-classifying incoming data, spotting anomalies, and generating predictive risk insights based on historical patterns.

As one Chief Supply Chain Officer in the luxury manufacturing sector explains, integrating AI enables you to capture external data that expands and even contradicts what internal data offers.

Illustration: Veridion / Quote: Thomson Reuters

That’s where Veridion complements these platforms perfectly.

While not a standalone ESG dashboard, Veridion acts as the real-time data engine behind one, providing near-weekly updates and truly global coverage.

It delivers structured, constantly updated intelligence on over 130 million global suppliers, drawing data from multiple sources in line with our ESG data strategy.

The goal is to prioritize classification consistency and tell apart genuine, measurable actions from polished ESG commitments.

Source: Veridion

From monitoring controversy statuses, risk severities, and corporate involvement levels to validating sustainability claims, everything is structured for immediate use.

Bottom line?

A centralized ESG platform powered by accurate, integrated data is what ultimately dismantles silos, enabling your business to report more efficiently, manage risks more effectively, and make informed decisions with confidence.

Automating the flow of ESG data from multiple sources is the final step in breaking data silos for good.

This is what ultimately ensures fast and consistent reporting that’s based on the most up-to-date information across departments.

Done right, it saves time, reduces errors, and keeps decision-making aligned.

That said, integration is far from simple.

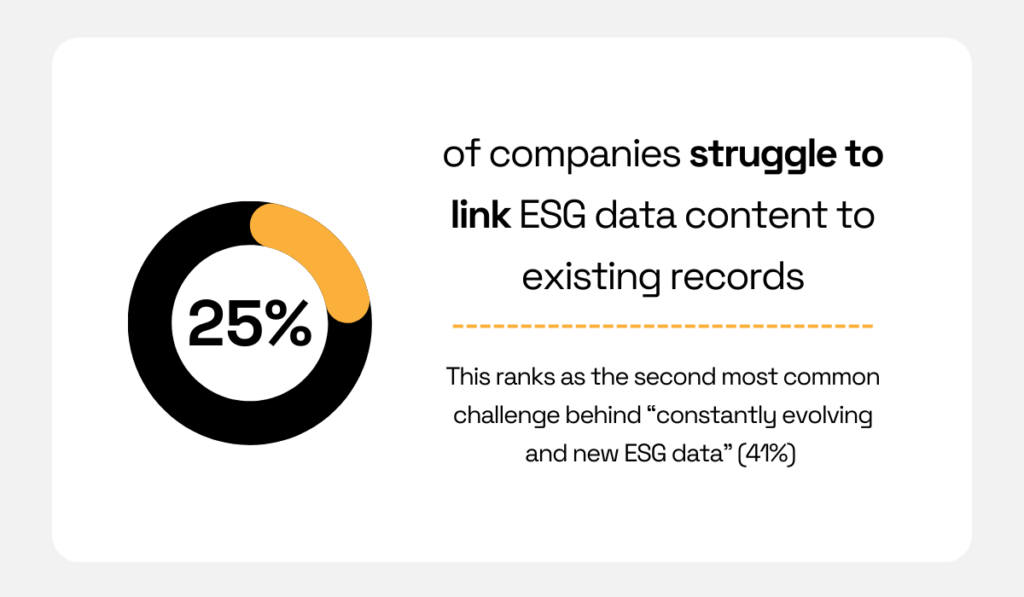

According to Bloomberg, a quarter of organizations consider linking ESG data to their existing entity and instrument data as a top ESG data management challenge.

Illustration: Veridion / Data: Bloomberg

In other words, you might have well-organized, detailed ESG entries for different suppliers and products, but without strong integration mechanisms, that data quickly becomes disconnected and unreliable.

That’s why investing in ESG data integration should be a top operational priority.

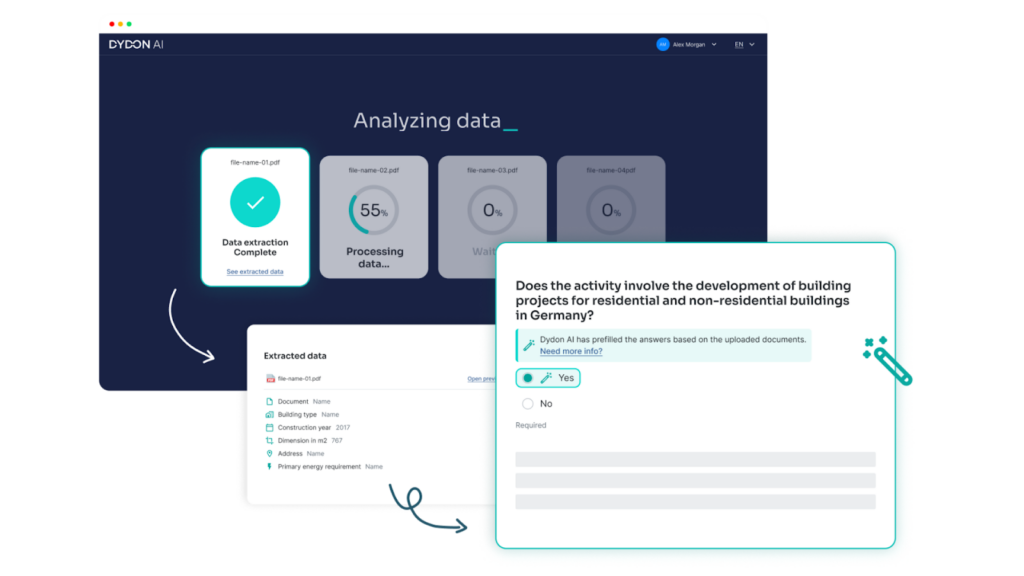

There are a few ways you can approach this, starting with deploying tools like Dydon AI.

Dydon AI specializes in extracting and classifying unstructured ESG data buried in reports, websites, or supplier documents, and organizing it into structured templates you can use immediately.

Source: Dydon AI

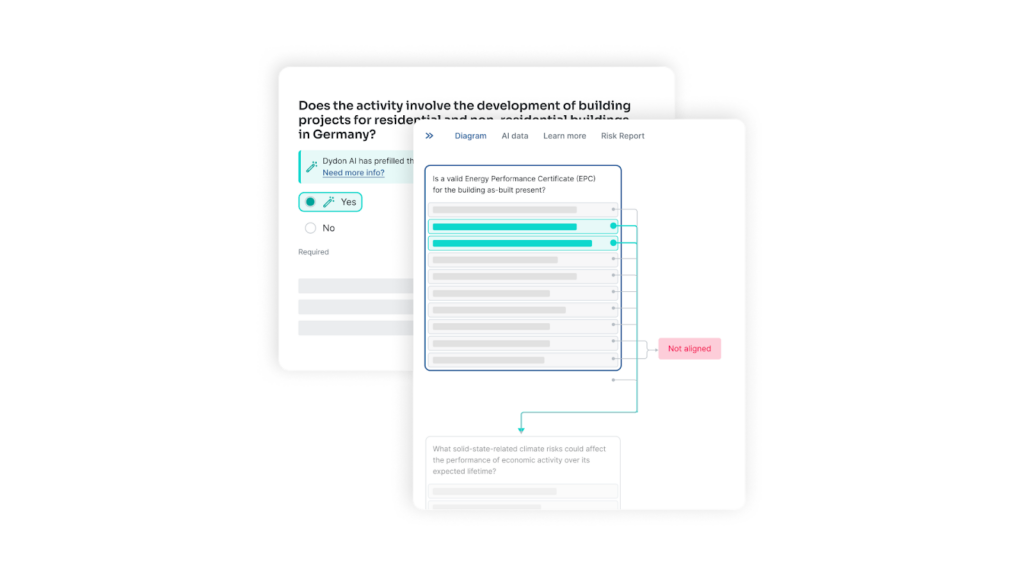

As shown below, while this tool isn’t built for ESG strategy or enterprise-wide analytics, it’s an excellent choice for prefilling information and simplifying compliance reporting.

Source: Dydon AI

Just think about the hours you can save by simply minimizing manual data entry on disclosure requests.

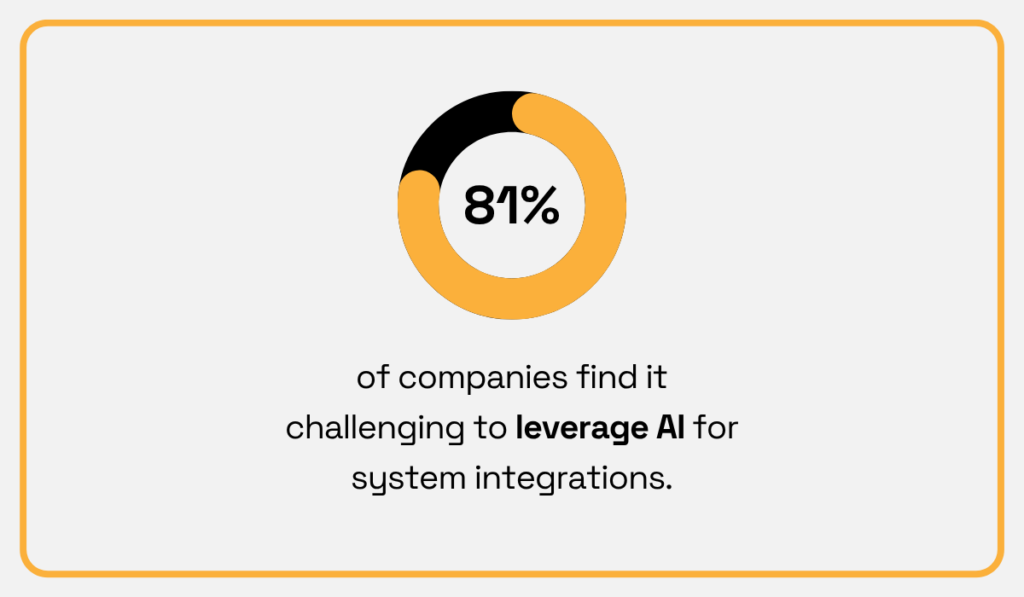

However, getting an AI-powered tool is far from an instant fix.

Reports show that integration remains a major hurdle for 95% of companies, with 81% finding it difficult to leverage AI effectively without the right infrastructure.

Illustration: Veridion / Data: MuleSoft

But what’s behind these issues?

One major factor is the lack of connected infrastructure and APIs to link systems effectively.

As Karim Trojette, Global MuleSoft Alliance Leader at Deloitte Digital, puts it:

There’s no AI without APIs. AI can only be effective when the infrastructure supports it—this means having a robust, enterprise-wide strategy that includes every app and system integrated.

That’s exactly why Veridion’s real-time Match & Enrich API is designed to streamline this process.

As shown in the video, our live, integrated API eliminates manual work, enabling you to automatically update and enrich each supplier profile with just a few basic inputs.

Source: Veridion on YouTube

In addition to core business data, you’re getting ESG-specific attributes like sustainability commitments, emissions data, certifications, and risk indicators.

In conclusion, the lack of automation and integration translates to fragmented, stale, and inaccurate ESG data.

That’s why investing in reliable tools and enterprise-wide integration is the necessary step toward making your ESG data accessible, accurate, and actionable.

Breaking ESG data silos isn’t a one-time fix, but a shift in operational mindset.

Beyond tools and frameworks, what matters is building data practices designed for integration, transparency, and agility.

When ESG data flows freely across your organization, you reduce compliance risks, improve decision-making speed, and boost credibility with stakeholders and regulators alike.

Ultimately, companies that treat ESG data as a shared, strategic asset—rather than isolated department property—position themselves to lead on both performance and sustainability.

The sooner you start, the stronger your long-term advantage.