How to Mitigate ESG Risks In Your Supply Chain

Key Takeaways:

Do you know how much non-compliance with ESG laws could cost your company?

Under the EU’s Corporate Sustainability Reporting Directive (CSRD), fines can reach up to 5% of your net worldwide turnover.

That’s not just a slap on the wrist—it’s a business-altering penalty.

And the financial risks are just the beginning.

With global regulations tightening and consumer expectations rising, ESG failures can severely damage your reputation, drive away customers, and jeopardize partnerships.

Fortunately, ESG risks are manageable if you take the right steps early and often.

Read on to learn the most effective ways to mitigate ESG risks in your supply chain, starting with your own internal strategy.

You can’t reduce ESG risks in your supply chain if you haven’t defined what “good” looks like in the first place.

That’s why the first—and most important—step is establishing clear internal ESG standards.

These should reflect your company’s values, align with local and global regulations, and give your suppliers a consistent benchmark to follow.

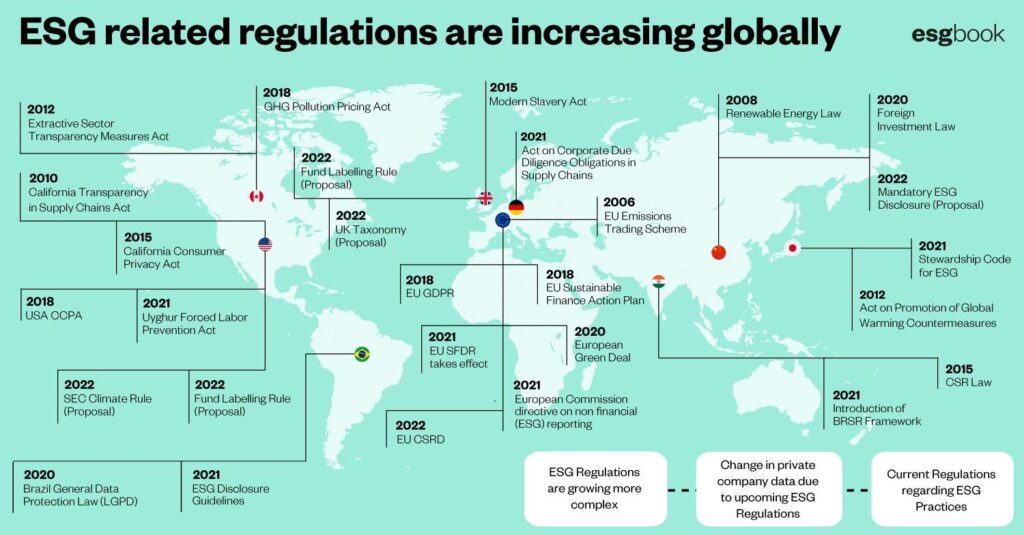

As you can see from the map below, ESG regulations have grown rapidly worldwide.

Source: ESG Book on LinkedIn

For example, if you’re operating in the EU, you’ll need to comply with the Corporate Sustainability Reporting Directive (CSRD), which demands detailed sustainability disclosures, including supply chain data.

In the U.S., for instance, California’s new SB 253 act requires companies to report full greenhouse gas emissions across their operations, including Scope 3 emissions.

And that’s where things get complex, and fast.

Scope 3 emissions are the indirect emissions that occur outside your own operations.

They include emissions from raw material production, supplier operations, product use, and even end-of-life disposal.

In many industries, Scope 3 makes up over 90% of a company’s total carbon footprint.

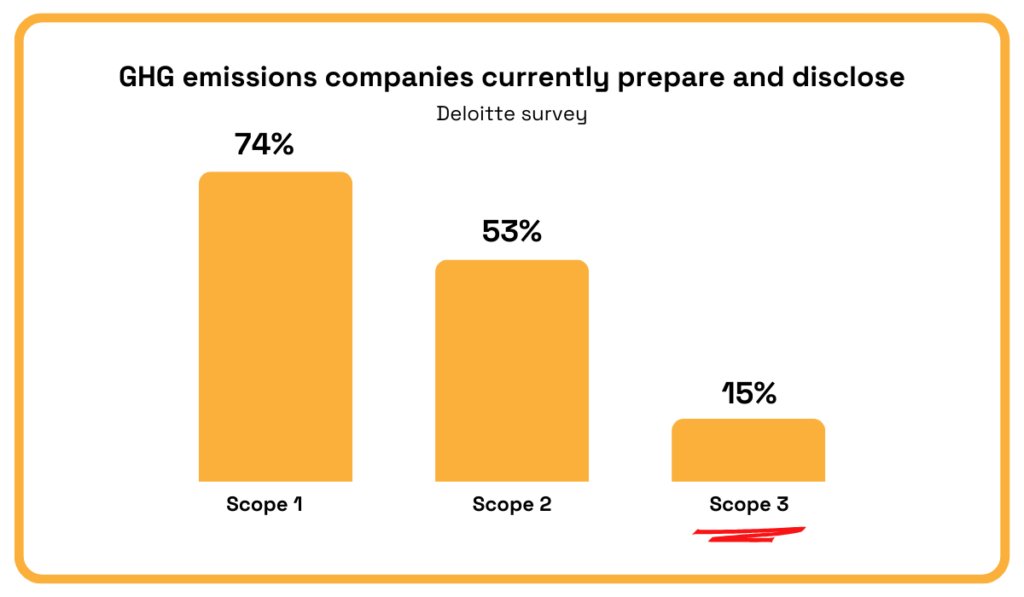

Yet only 15% of businesses report on them, according to Deloitte’s 2024 Sustainability Action Report.

Illustration: Veridion / Data: Deloitte

Without Scope 3 visibility, you’re flying blind on your biggest environmental risks.

So, how do you make that visible and actionable?

Start by translating your ESG goals into concrete, measurable supplier requirements.

Whether your priorities are carbon reduction, labor standards, or anti-corruption, your expectations must be specific and enforceable.

Use established frameworks to give your standards structure and credibility.

These might include the following:

| Enviromental | Science Based Targets initiative (SBTi), ISO 1400 |

| Social | UN Global Compact, SA8000 |

| Governance | OECD Guidelines, SASB standards |

Then embed these requirements directly into supplier codes of conduct, onboarding processes, contracts, and RFQs.

When ESG expectations are clearly stated from day one, they become part of how you do business, not just a checklist at the end.

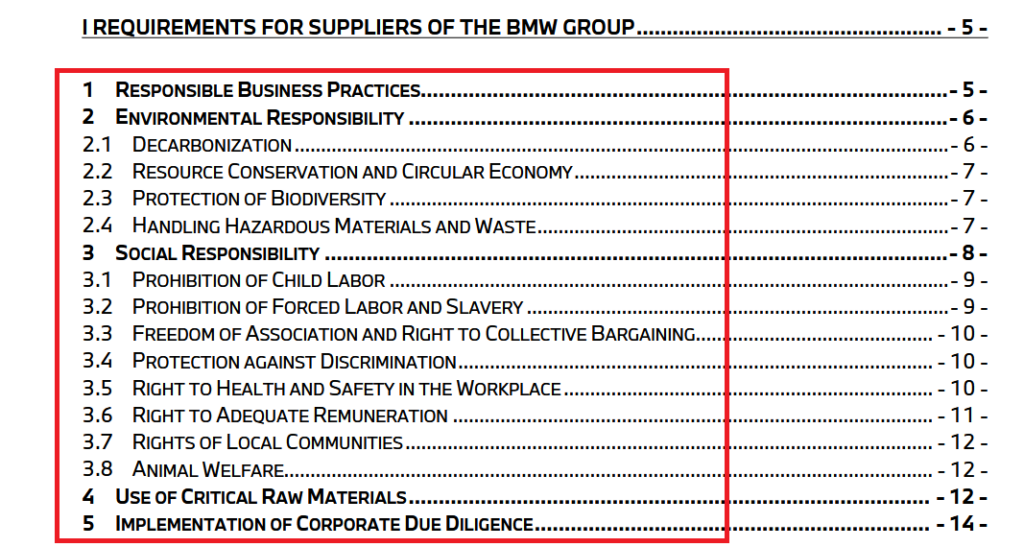

Look at BMW Group, for example.

Their suppliers are bound by a detailed Supplier Code of Conduct, backed by specific contractual obligations for production materials.

Source: BMW

ESG is built into every purchasing decision they make, which makes it possible to monitor and enforce compliance across a global supply chain.

The takeaway?

If you want to mitigate ESG risks in your supply chain, you need to start with your own playbook.

Because if you don’t know what you expect—or you don’t tell your suppliers—then how can you hold anyone accountable?

This is where risk mitigation begins: not with reacting to issues, but by preventing them through clear expectations and proactive strategy.

Most ESG-related supply chain issues don’t come out of nowhere.

They show signs—if you know where to look.

And that’s exactly what initial due diligence is for.

Before you even think about signing a supplier, take the time to vet their ESG track record.

This early screening process is your first line of defense, and one of the most effective ways to avoid costly surprises later.

Here’s what to look for:

| ESG policies and public commitments | Does the supplier have any documented standards or policies around sustainability, labor rights, or anti-corruption? |

| Third-party certifications | Have they earned ISO 14001, SA8000, or aligned with frameworks like GRI or SBTi? |

| Past violations or controversies | Search public records and news sources for any history of fines, environmental damage, or labor violations. |

| Transparency in reporting | Are they disclosing Scope 1 and 2 emissions? What about Scope 3, which often makes up the largest share of supply chain impact? |

But let’s be real: performing this level of research manually is exhausting, slow, and prone to gaps.

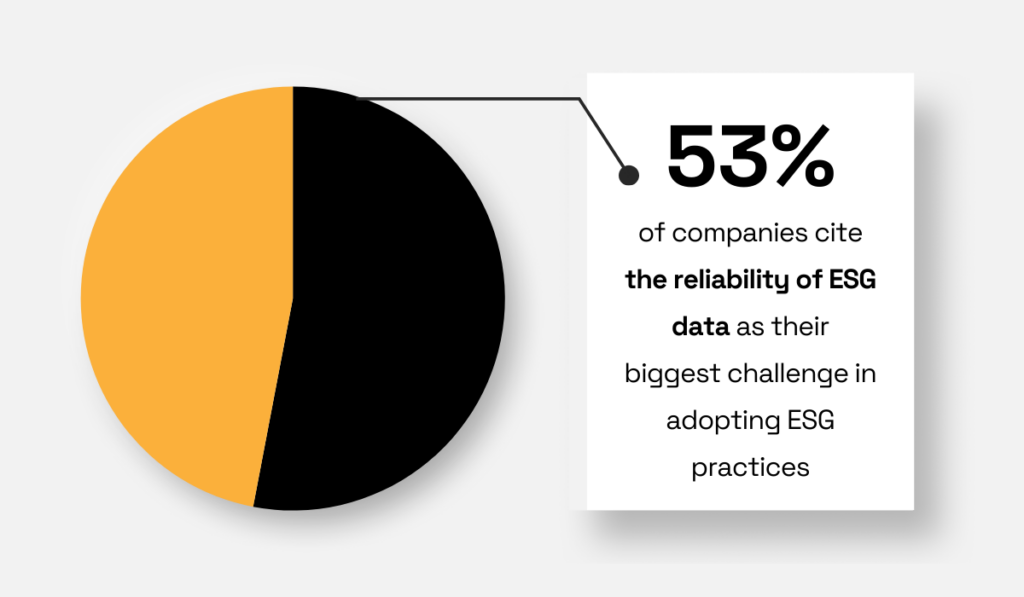

And even companies that want to do better run into the same wall: unreliable ESG data.

According to Capital Group, 53% of organizations cite the reliability of ESG data as their biggest challenge.

Illustration: Veridion / Data: Capital Group

While environmental metrics like emissions are improving, social factors, such as worker rights, safety, or community impact, are still difficult to quantify.

In fact, a majority of respondents said they don’t know how to measure social impact at all, as one portfolio manager at a state-affiliated investor in Asia points out in the report:

“With climate change and the transition, there are clear targets and clear measurability. But where are the metrics for social factors? What measures can we use to say this community or this demographic is being left behind?”

That lack of transparency, especially on social issues in global supply chains, is one of the biggest roadblocks to effective ESG due diligence.

So, how do you close the gap?

That’s where trusted data partners come in.

Platforms like Veridion can help you access validated ESG profiles for millions of companies worldwide.

You can filter suppliers based on your criteria—whether that’s avoiding links to deforestation, identifying firms with strong labor standards, or specific certifications.

Source: Veridion

Better yet, with the help of AI and machine learning, supplier profiles update weekly, so you’re not relying on outdated PDFs or chasing disclosures manually.

Instead, you get near real-time ESG data on suppliers’ carbon footprint, water usage, social risk factors, corruption, and more—so you can make smarter decisions, faster.

Source: Veridion

This robust due diligence at the start will help you eliminate high-risk suppliers before they become a liability.

It also gives you a stronger foundation for collaboration with suppliers that are willing to grow with your ESG goals.

Initial due diligence is critical—but it’s only the beginning.

Why?

Because ESG risks don’t stay static.

Suppliers change. Regulations evolve. New issues emerge.

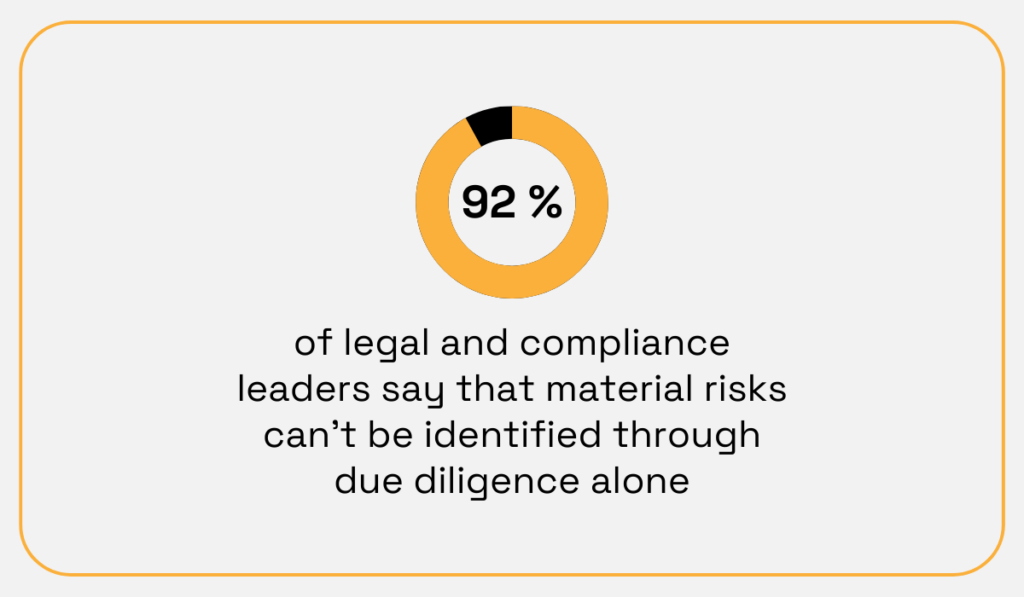

That’s why ongoing monitoring is just as important as early screening, and research backs this up.

According to Gartner, 92% of legal and compliance leaders say material risks couldn’t have been identified through due diligence alone.

Illustration: Veridion / Data: Gartner

Chris Audet, Vice President of Research for GCs and CCOs at Gartner, explains:

“The only way to surface those risks was through actual engagement with the third party and through ongoing risk identification over the course of the third-party relationship.”

So, to truly mitigate risks (ESG included), you need a strategy that goes beyond the initial due diligence.

You must regularly assess supplier ESG performance to stay ahead of evolving risks.

What kinds of risks should you monitor over time?

Left unchecked, these risks can lead to fines, reputational fallout, supply disruptions, and failed partnerships.

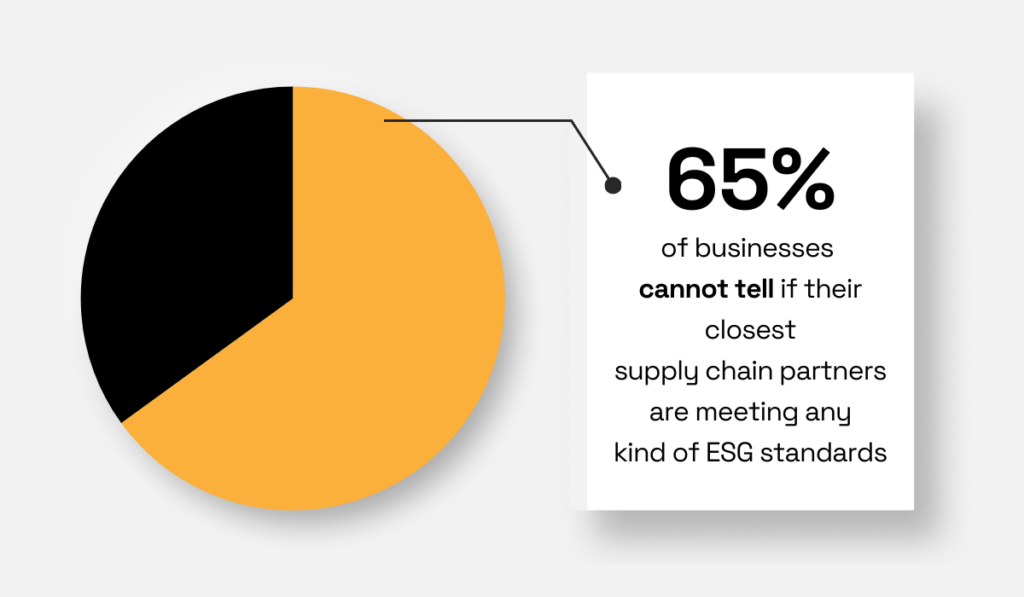

And yet, many businesses struggle to know whether their suppliers even meet ESG standards.

A Coupa study found that nearly two-thirds (65%) of businesses can’t tell if their closest supply chain partners are meeting ESG standards.

Illustration: Veridion / Data: Coupa

Even more concerning, 57% admit they don’t have an effective risk management system in place to ensure ESG integrity in their supply chains.

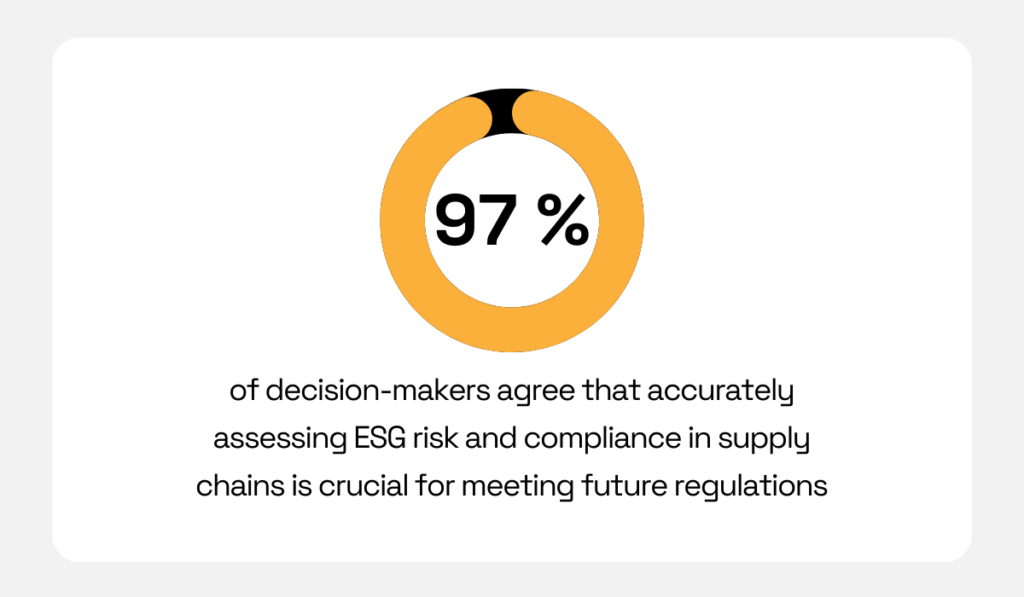

However, 97% of decision-makers agree that being able to assess ESG risk and compliance accurately is crucial for meeting future regulations.

Illustration: Veridion / Data: Coupa

So, how can you stay on top of evolving ESG risks?

The answer lies in continuous ESG risk monitoring.

This can be done through a mix of technology and direct engagement.

Risk monitoring solutions, like Veridion, are a game-changer for tracking real-time supplier data and identifying risk signals.

Source: Veridion

You can set custom ESG risk factors, receive instant alerts, and even see supplier updates weekly, ensuring you’re never working with outdated data.

Beyond that, you’ll also want to conduct on-site audits to directly verify compliance and assess suppliers’ operations firsthand.

Consider IKEA’s IWAY audit system.

The IWAY audits involve comprehensive on-site evaluations where auditors engage directly with supplier management and employees.

These audits assess various aspects, including legal compliance, labor practices, and environmental impact.

For instance, auditors review age verification processes to prevent child labor, examine working hour records to ensure fair compensation, and inspect facilities for safety and environmental standards.

Stefano Bizioli Galli, Senior Sustainability Compliance Auditor at IKEA, explains:

“During the audit, we must ask for evidence related to whether the supplier has met all applicable requirements. Suppose we don’t have this kind of evidence. In that case, we can have a considerable risk of IWAY deviations because specific requirements are connected to, for example, the minimum salary or the registration of worked hours.”

Such thorough on-site assessments enable IKEA to identify gaps that might not be evident through supplier questionnaires or data analysis alone.

Importantly, IKEA doesn’t just use audits to police its suppliers.

It uses them to identify gaps, offer support, and give partners a chance to improve, proving that risk mitigation and collaboration go hand in hand.

When you spot ESG risks, your first instinct might be to cut ties with the supplier.

But before you make any hasty decisions, remember that collaboration often leads to better outcomes than punishment.

Rather than dropping non-compliant suppliers immediately, offer them support where improvement is possible.

Providing training, tools, or incentives can help suppliers align with your ESG goals, leading to stronger, long-term, and more sustainable partnerships.

This not only mitigates risks but also helps build a supply chain that evolves with your ESG vision.

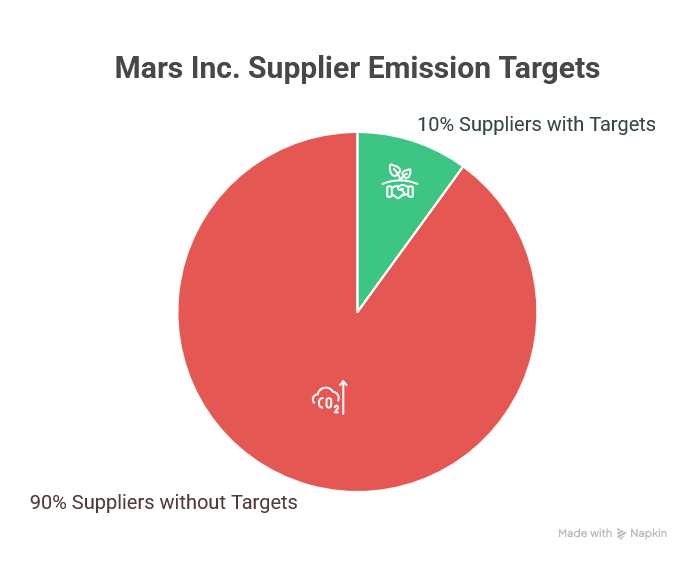

Take Mars Inc., for example.

The company has recognized that most of its environmental impact comes from its supply chain—95% of its 30 million-tonne CO2 footprint is tied to suppliers.

Yet when Mars surveyed its top 200 suppliers, only 20 had set science-based targets for greenhouse gas emissions.

Illustration: Veridion / Data: Reuters

But rather than severing ties, Mars worked closely with its suppliers, encouraging them to set their own sustainability targets and supporting their transition to more sustainable practices.

Through this ongoing collaboration, 80 of Mars’s top suppliers, representing 25% of its CO2 footprint, are now on track to meet science-based targets.

This didn’t happen overnight, but over time, trust was built.

Barry Parkin, Chief Procurement and Sustainability Officer at Mars, sums it up:

Illustration: Veridion / Quote: Reuters

The bottom line is: you can’t reduce what you don’t influence.

If your suppliers aren’t on board with your ESG goals, your impact will fall short.

But with continuous engagement, like regular meetings, joint projects, and shared resources, you can foster a relationship that benefits everyone.

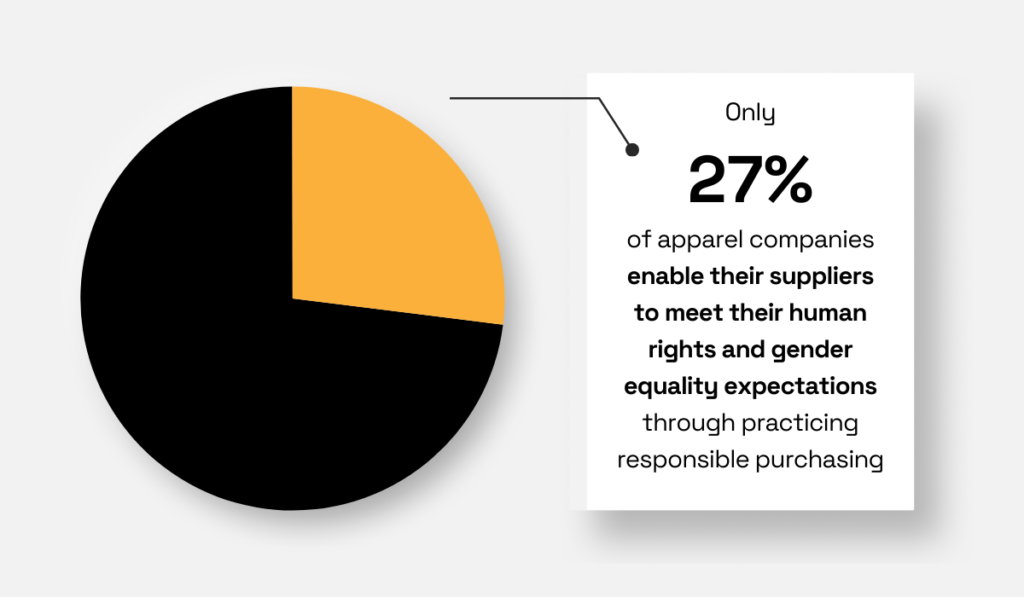

Unfortunately, not all industries embrace this approach.

In the apparel sector, for example, companies often set high ESG standards for their suppliers but don’t make it easy for them to meet those standards.

In fact, only 27% actually enable their suppliers to comply.

Illustration: Veridion / Data: WBA

Poor purchasing practices—like short lead times, last-minute order changes, and late payments—undermine suppliers’ ability to comply with ESG goals, creating a cycle of frustration and non-compliance.

From excessive overtime and unsafe working conditions to unauthorised subcontracting.

This brings us to an uncomfortable truth: buyers can be part of the problem.

ESG risk isn’t just something suppliers deal with—it’s a supply chain issue.

And building sustainable, resilient partnerships requires shared responsibility.

You need to create the space for honest conversations, offer support, and, just as importantly, ensure that your own business practices don’t sabotage the standards you’re expecting suppliers to meet.

There are plenty of ways to engage and collaborate with suppliers on ESG issues:

Collaboration, not punishment, is what turns ESG risk into ESG resilience.

The stronger the relationship with your suppliers, the better you can collectively address ESG challenges and mitigate risks.

Together, you can build a more sustainable, compliant, and ethical supply chain.

Mitigating ESG risks in your supply chain shouldn’t be about reacting to violations.

It should be about preventing them through clear expectations, active oversight, and meaningful collaboration.

That starts with defining what ESG success looks like for your business and your suppliers.

It continues with diligent screening, smart data use, and regular monitoring, including on-the-ground audits that provide insight you can’t get from dashboards alone.

And most importantly, it requires building relationships, because compliance improves when suppliers feel supported, not punished.

After all, your suppliers are extensions of your values.

When you engage them as partners, not just vendors, ESG stops being a risk and starts becoming a competitive advantage.