How to Prevent Vendor Fraud

Key Takeaways:

Vendor fraud is one of the most dangerous types of corporate fraud.

It’s hard to detect. It often involves collusion. And it can quietly damage your financial and operational data for years.

As they say, prevention is better than cure.

That’s why, in this article, we’ll share five best practices for preventing vendor fraud from entering or impacting your organization.

Let’s start building your first line of defense!

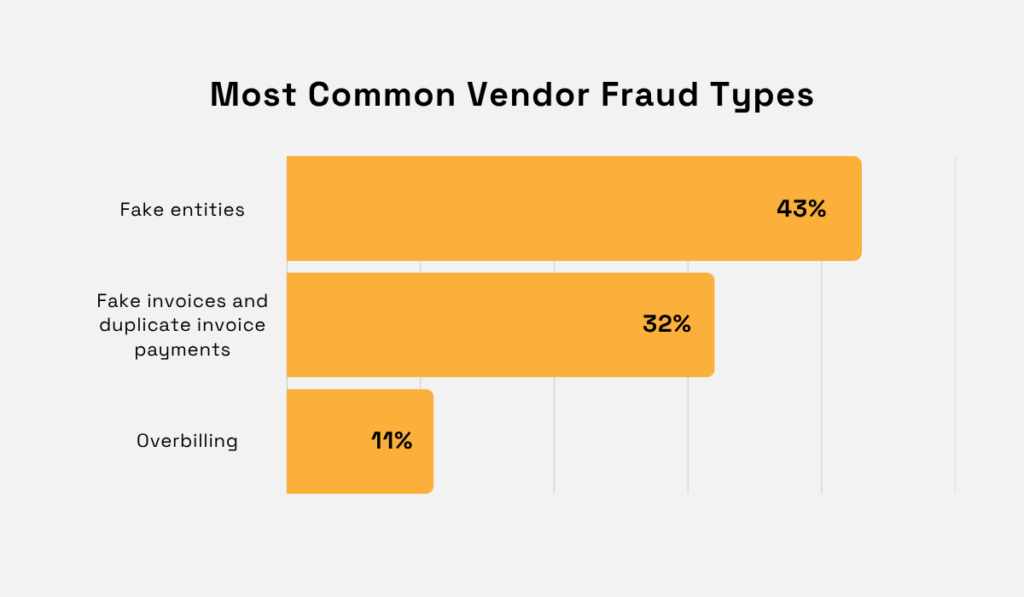

CreditSafe’s most recent report on vendor fraud showed that the three most common fraud types include fake vendors, fake invoices and duplicate invoice payments, and overbilling.

All three types rely on falsified supplier details, whether that entails inventing a fake company, claiming unperformed services, or impersonating a legitimate vendor.

Illustration: Veridion / Data: CreditSafe

The antidote in all cases is conducting robust vendor verification, both prior to contracting and on an ongoing basis.

With proper controls, companies can confirm vendors’ identity and the legitimacy of their invoices before any payments are made.

For instance, the accounting team should regularly verify vendor details before releasing payments.

Best practices include:

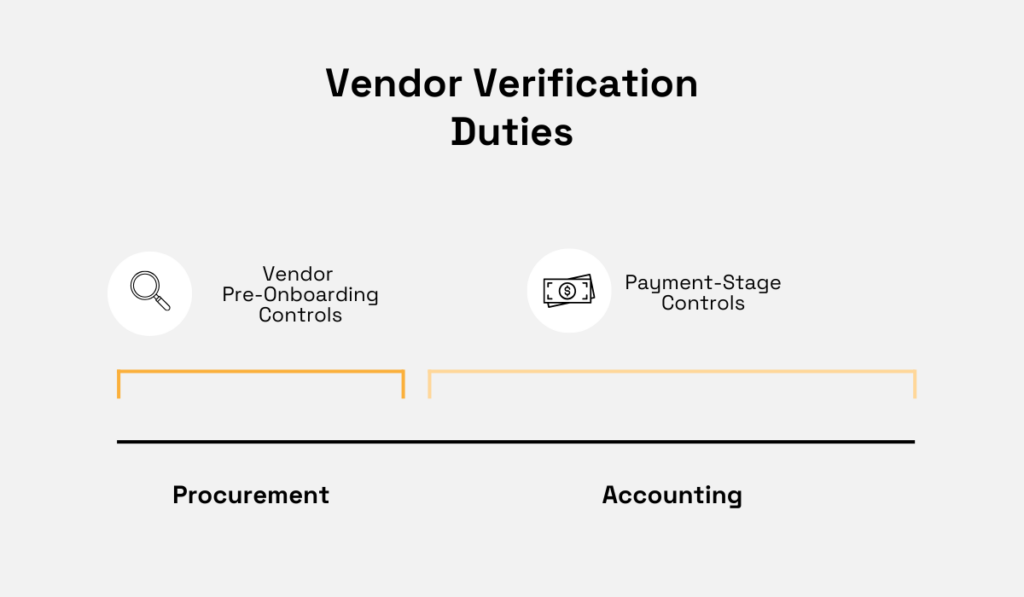

But accounting is only responsible for verifying vendor and invoice authenticity during ongoing collaborations.

The most effective fraud prevention begins with procurement.

Source: Veridion

By conducting thorough due diligence before onboarding, procurement can prevent fraudulent entities from entering the supply chain altogether.

Best practices at this stage include verifying:

But you can only do this effectively if you have access to reliable, unbiased vendor information.

The best way to collect it is to use third-party data providers like Veridion.

Such providers act as independent data sources that help confirm vendor legitimacy and both verify and predict their performance.

Veridion in particular collects as many as 320 different data attributes on over 134M companies worldwide.

This includes everything from vendor website domains and URLs to registered latitude and longitude.

To further ensure data accuracy and freshness, Veridion uses AI algorithms to update its databases every week.

Source: Veridion

Veridion and similar data providers also help streamline two additional processes: automating data collection and keeping it centralized for faster, more efficient procurement.

Both are crucial factors in preventing vendor fraud.

Let’s discuss the latter in more detail.

Many companies still maintain vendor data across multiple spreadsheets and systems.

If you’re one of them, you might be wondering what all the fuss is about.

Sure, managing multiple data sources takes extra time, but is there really any harm beyond that?

Well, in short, yes.

Fragmented vendor data can create blind spots and inconsistencies, and even conceal fraudulent transactions.

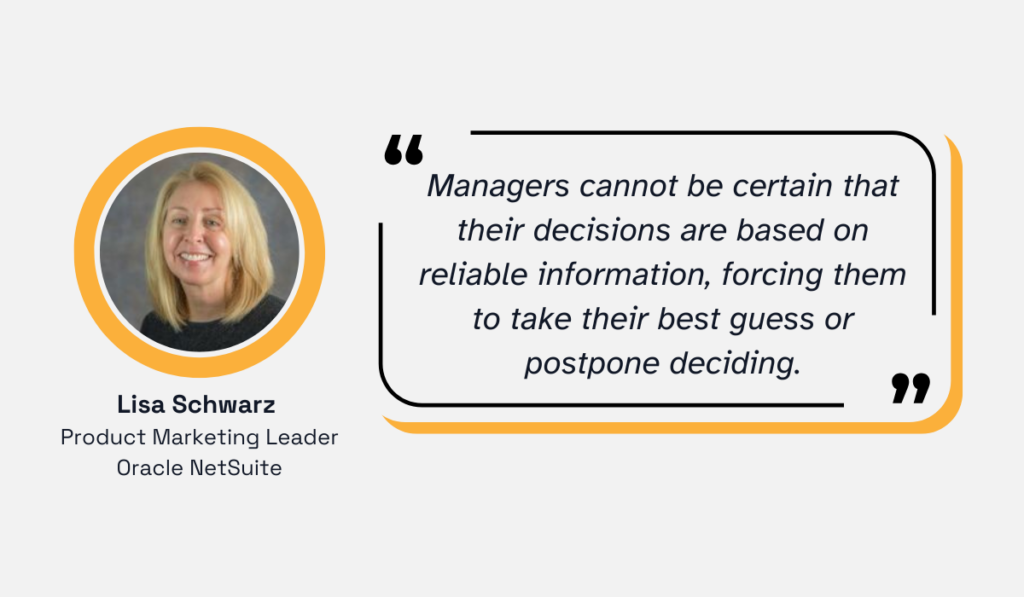

Lisa Schwarz, Product Marketing Leader for Oracle NetSuite, explains why that’s the case.

For one, implementing comprehensive safeguards and policies is nearly impossible when you have data silos.

Secondly, fragmented data isn’t reliable, so it can postpone or hinder accurate, informed decision-making.

This includes decisions about, for instance, whether a vendor is legitimate or not.

Illustration: Veridion / Quote: Oracle NetSuite

On the other hand, centralizing vendor information provides a single source of truth and, in turn, improves transparency, simplifies audits, and reduces the risk of fake or duplicate vendor accounts.

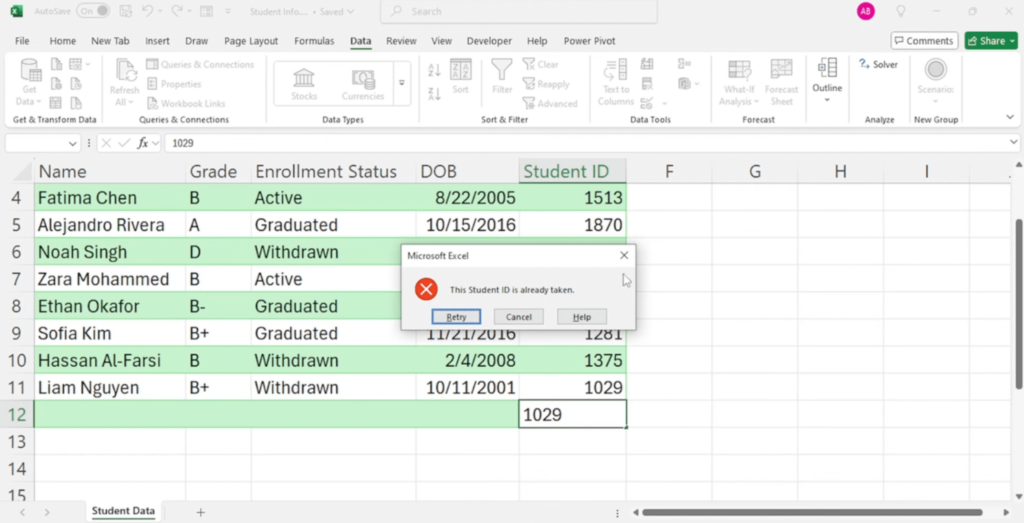

To illustrate this, let’s imagine you accidentally entered duplicate vendor data into a system.

Since all information is kept in that one system, you’ll be able to spot your duplicate entry immediately, rather than potentially months later.

Most systems will automatically notify you of duplicates thanks to built-in alerts.

Similar alerts can even be added to simple tools, such as spreadsheets.

Source: Anser’s Excel Academy on YouTube

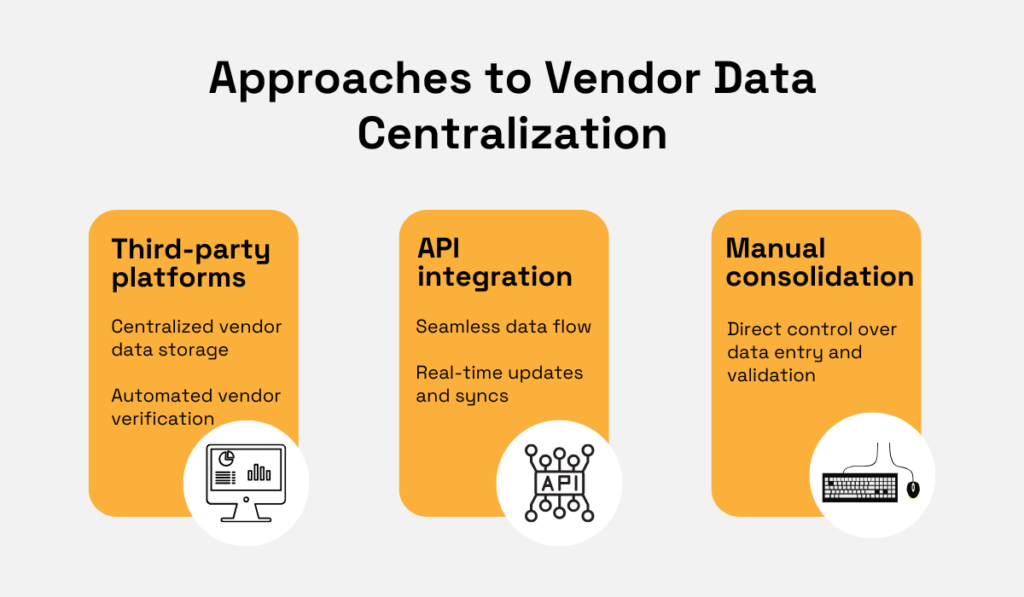

But let’s take a step back: how can you effectively centralize vendor information in the first place?

You can approach this in several ways, outlined in the visual below.

Source: Veridion

It’s up to you which approach you’ll choose.

But, generally speaking, any type of automation is preferable over manual handling, especially in terms of reducing human error.

Technology helps you do this and so much more, including detecting anomalies that might indicate fraud.

Machines are often better at detecting anomalies than humans.

There’s no two ways about it: they’re faster, more consistent, and less prone to subjective influences like intuition or mood.

And, with vendor data becoming increasingly complex and voluminous, machine-powered anomaly detection is fast turning into the only sensible approach.

Bobby Falconer, Associate Partner at Kaizen Analytix, agrees.

He says that most companies can no longer rely on manual anomaly detection to efficiently handle rising data complexity and volume.

Illustration: Veridion / Quote: SupplyChainBrain

Falconer mentions that machine-powered fraud detection, especially when driven by AI, can immediately detect a range of red flags.

He illustrates this on several real-world examples, including:

All these anomalies could indicate fraud.

While humans may overlook them, fraud detection tools detect and flag them instantly and, more importantly, without exception.

In Falconer’s view, AI is especially effective at this task.

And he’s far from being the only professional highlighting AI’s strengths in this area.

Lee-Ann Perkins, Assistant Treasurer at Ankura Consulting Group, also suggests that AI-enabled fraud detection has two important advantages over alternatives:

Real-time monitoring and growing cost-effectiveness.

Illustration: Veridion / Quote: Association for Financial Professionals

On top of that, unlike rule-based systems, AI-powered ones can also learn from data, improve over time, and adjust to evolving threats.

But regardless of the technology you choose, fraud detection tools should boost your efficiency and accuracy in identifying red flags early.

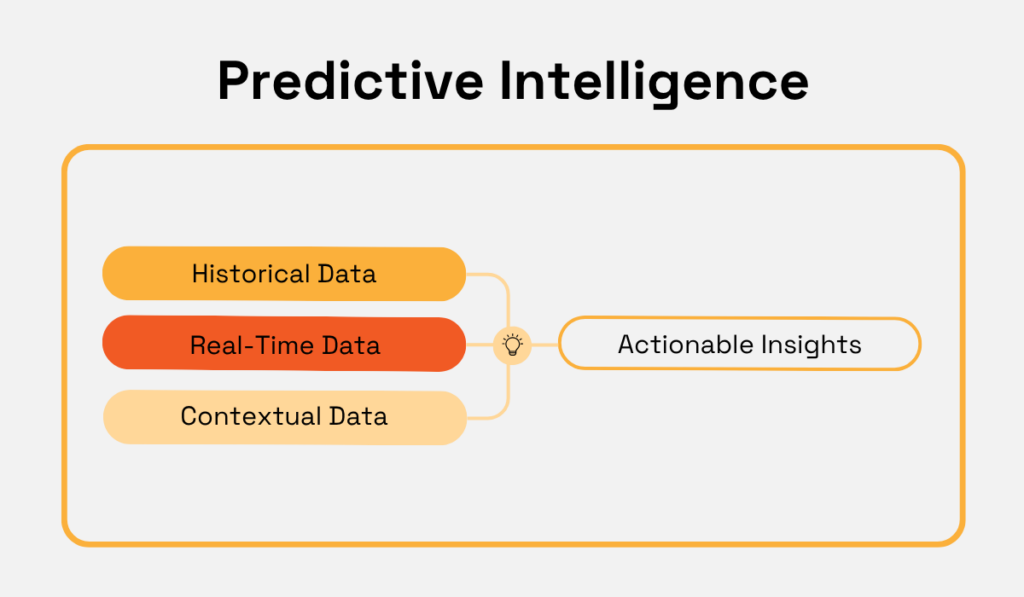

This is especially true if your tools also provide predictive intelligence.

In this case, technology is used not just to detect existing anomalies, but also to predict future ones based on existing data patterns.

Source: Veridion

Of course, you should never rely solely on technology to catch potential fraud.

Instead, you should use it as an assistive resource for your most trusted fraud detectors: your employees.

It’s still essential that humans know how to detect fraud themselves and what to do in case they spot red flags.

In other words, they should have solid fraud awareness and go-to protocols to fall back on.

No technology can replace real, human judgment.

But also, no technology can prevent fraud if humans allow it.

Both reasons make it crucial to train your employees on fraud awareness.

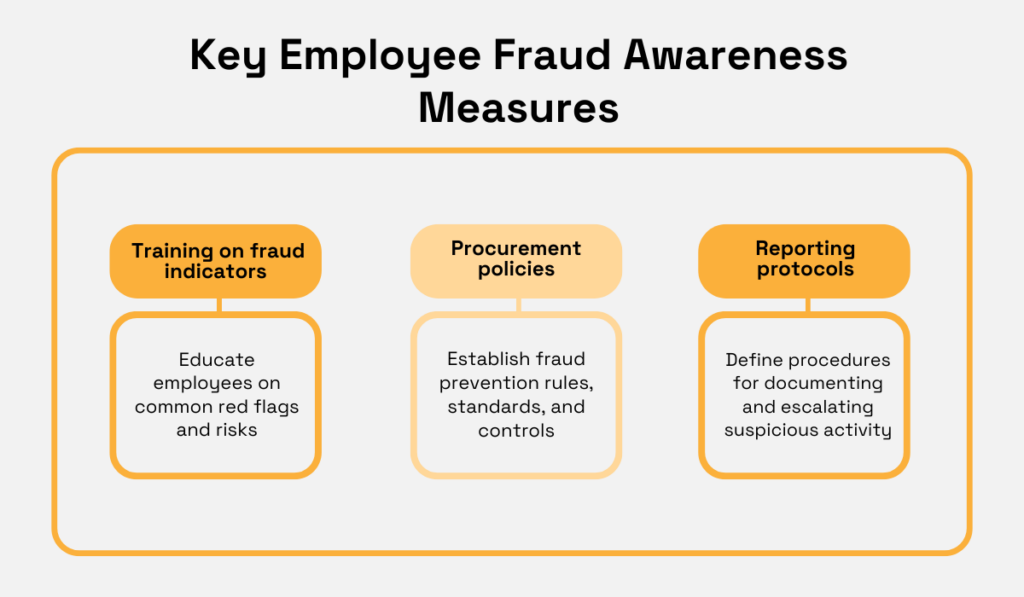

More precisely, your employees should know:

Teaching them this and establishing clear protocols transforms employees from a potential liability into your first line of defense.

So, how do you actually go about it?

Well, each of these risks can be addressed with three key measures: ongoing training on fraud indicators, clear procurement policies, and defined reporting protocols.

Source: Veridion

Protocols, policies, and training don’t have to be established or conducted in-house.

If you lack internal expertise in fraud prevention, don’t hesitate to outsource these tasks to external consultants.

Alternatively, you can turn to off-the-shelf solutions, such as on-demand fraud awareness courses, books, checklists, and similar self-service resources.

These can provide a solid solution if you want to raise awareness on a limited budget.

Source: Praxis42

With that said, it’s advisable you don’t skimp on fraud awareness training.

CreditSafe’s Country Director of North America, Steve Carpenter, agrees:

“Of course, data quality isn’t the only factor that can increase the risk of vendor fraud. As our study indicates, the quality and efficacy of training plays a major role in a company’s success rate of detecting and preventing vendor fraud.”

So, you want to invest in a high-quality program.

But even that is just one piece of the puzzle.

As Brad Deflin, CEO and Founder of Total Digital Security, suggests, training efficacy also depends on how motivated employees are to master fraud prevention.

The higher their level of motivation, the more likely they are to internalize and apply what they learn.

To increase it, Deflin suggests framing fraud prevention skills as life skills.

Illustration: Veridion / Quote: Association for Financial Professionals

He believes that employees will be more engaged if they view fraud prevention as applicable in daily life, rather than as a narrow, job-specific ability.

Applying these best practices will help you build and strengthen internal fraud awareness.

This will further empower your teams to identify suspicious activity early and strengthen overall organizational resilience.

Most companies don’t want to think about this, but it’s true: whether knowingly or not, internal employees often facilitate vendor fraud.

This can happen due to many different causes, but two of the most common ones include collusion and lax oversight.

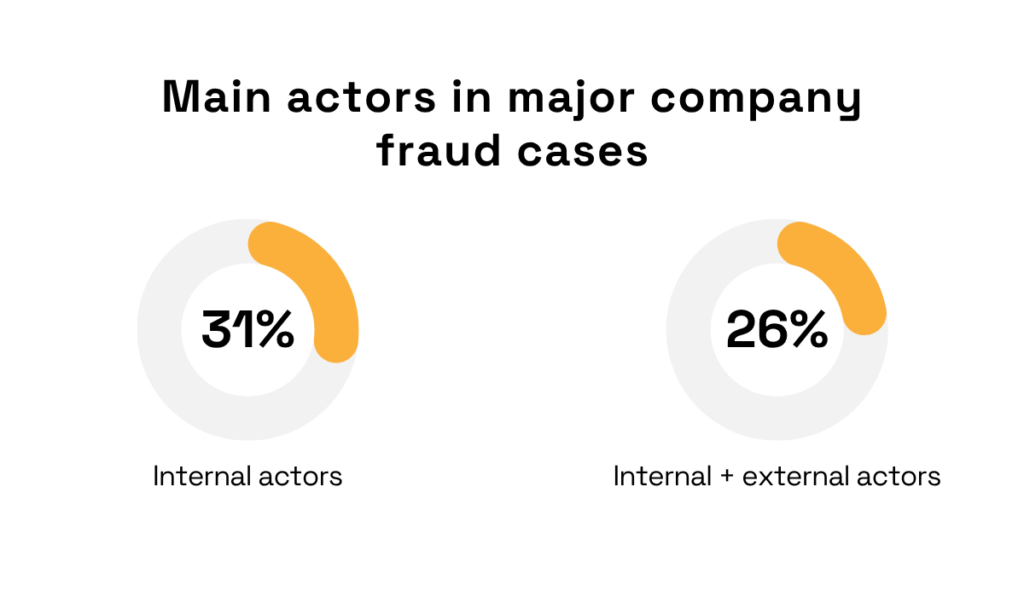

For instance, PwC’s Global Economic Crime and Fraud Survey 2022 found that 57% of the most disruptive or serious company frauds were conducted by internal perpetrators.

Some acted independently, while others colluded with external actors.

Illustration: Veridion / Data: PwC

As mentioned, employees may or may not be aware that they’re facilitating or allowing fraud to happen.

So, your training, policies, and other resources and controls should aim to help you avoid both scenarios.

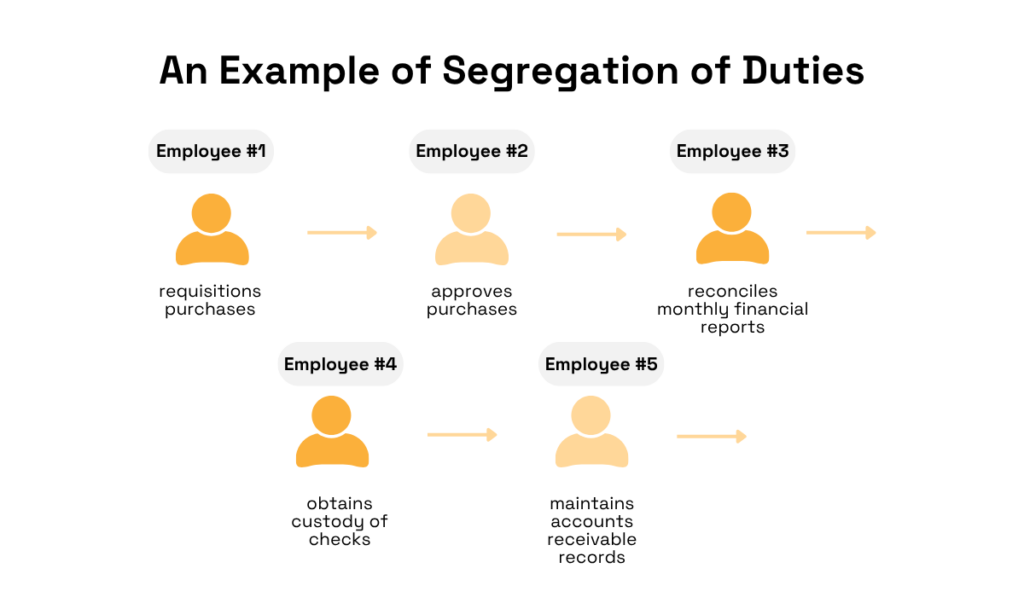

To prevent deliberate fraud facilitation, it’s recommended that you conduct comprehensive employee background checks, rotate procurement duties, and establish clear accountability protocols.

For instance, segmenting procurement duties makes it harder for bad internal actors to commit fraud due to restricted access.

Here’s how one CPA firm illustrates it:

Illustration: Veridion / Idea: Dembo Jones

In addition to this, many companies could benefit from tightening oversight of internal processes.

For example, employees may develop close relationships with vendors over time, which can increase the risk of collusion and fraud.

Ongoing oversight reduces the likelihood of such a risk going undetected.

There are many ways to practice this.

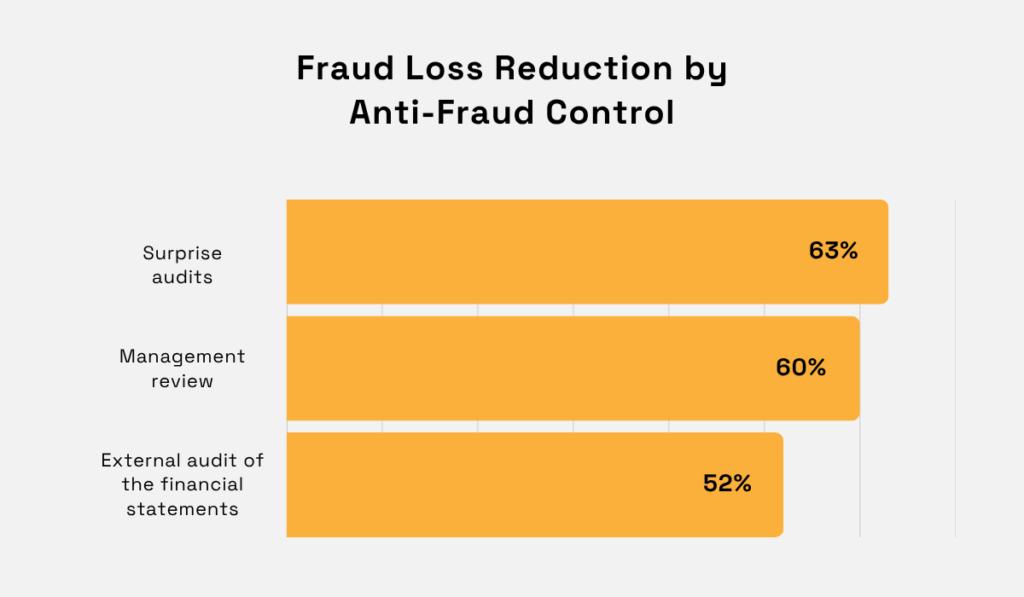

A 2024 study on occupational fraud suggests the three most effective ones include surprise audits, management reviews, and external audits of financial statements.

Illustration: Veridion / Data: ACFE

Companies should identify which of these controls they’re overlooking or underusing, and integrate them more deeply into their processes.

For instance, the same study found that the most effective anti-fraud control, surprise audits, is also among the least adopted.

If your company isn’t leveraging it yet, the data suggests it’s time to start.

Remember: a data-driven strategy will outperform one built on guesswork.

Now you know the five best practices for preventing vendor fraud.

From strengthening internal controls to leveraging technology for vendor verification and fraud detection, these steps give you the tools you need to protect your organization.

While no strategy can guarantee zero fraud attempts, implementing these practices will make you far more prepared to identify and respond to threats.

Start today, take control of your processes, and make prevention your strongest defense.

Your organization will thank you for it.