How to Implement AI in Insurance Underwriting

Key Takeaways:

Repetitive manual tasks are a big time and energy drain for underwriters, making it harder to focus on strategic, needle-moving tasks.

On top of that, they can heavily impact your team’s motivation and overall productivity.

Luckily, incorporating AI into the underwriting process can save time and energy for decisions that matter.

But, how do you do it so both your underwriters and your business thrive?

In this article, you’ll find out the exact steps on how to utilize AI strategically and change your underwriting process for the better.

Let’s dive in.

To make the best use of AI, you need to know what issues you want to solve in the underwriting process.

Is insurance fraud up from last year, but your team can’t handle it effectively? Or are they perhaps drowning in manual claims processing?

When you’ve defined the issues, find out how they translate into numbers so you can later compare these outcomes with the ones provided by an AI tool.

Otherwise, you may end up on a wild goose chase. To put it simply, the vaguer your goal, the less value you’ll get from AI.

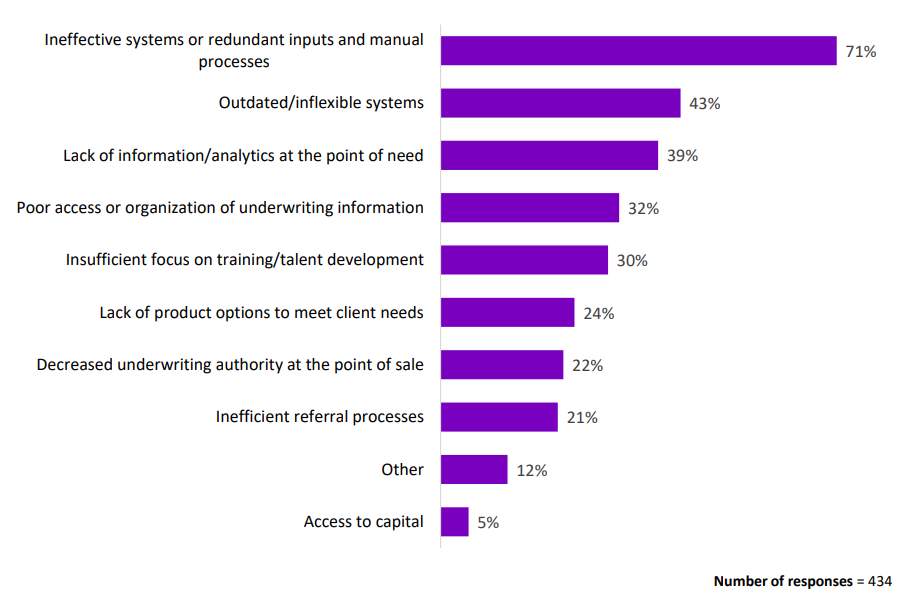

Surveys, like the one conducted by Accenture in 2021, show just how burdened underwriters are by manual and administrative work.

Source: Risk and Insurance

At the same time, they’re also influenced by big-picture problems.

Just look at the current state of the world. The political, social, and even environmental landscapes are volatile.

On top of that, pressure from customers keeps on growing.

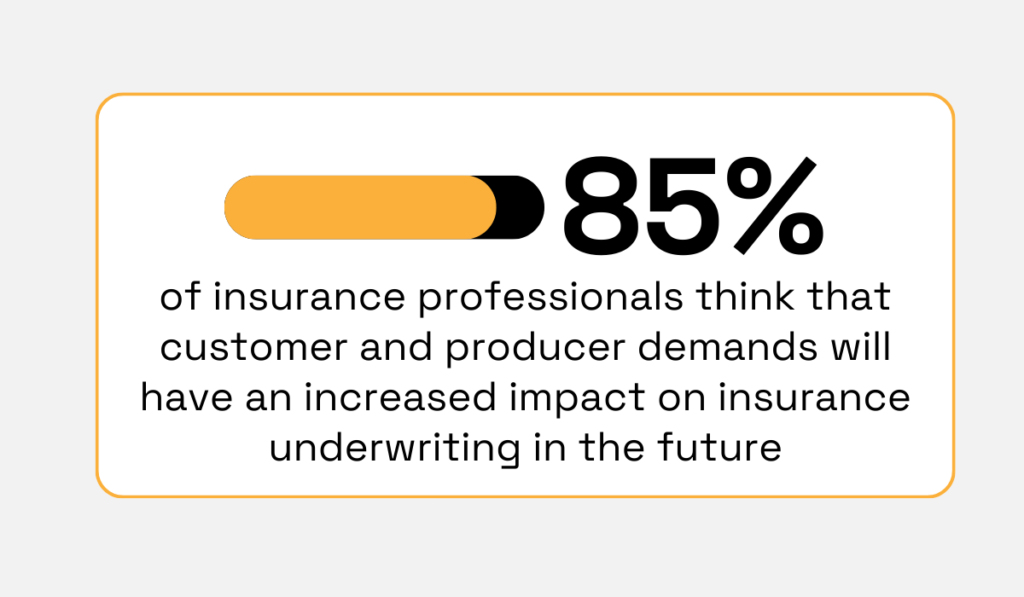

According to the same study, 85% of respondents predicted that customer and producer demand would have an increasing impact on underwriting in the future.

Illustration: Veridion / Data: Risk and Insurance

This signals that it is crucial to adapt as quickly as possible. One way to do this is through rethinking underwriting.

As Adam Denninger, Global Insurance Industry Leader at Capgemini, puts it:

Illustration: Veridion / Quote: Capgemini

That means leaving behind the concept of underwriting as a painstaking manual process.

Enter technologies like deep machine learning or generative AI models.

With their speed and accuracy in automating while also being adaptable, they’re the perfect tools for successfully navigating the industry.

Now, let’s take a look at what defining an AI-solvable problem looks like.

A great starting point is asking the ones working on the front lines: underwriters themselves.

Do they spend more time than necessary on obtaining additional information before binding?

Do they miss nuances when processing claims because they have to manually analyze risk engineering reports?

Or maybe the issue is in the data: it’s either incomplete, hard to access, or outdated.

Once you’ve identified your most common bottlenecks, decide whether they can be mitigated or decreased with automation.

Remember, not every underwriting task can be delegated to AI.

So, carefully choose those that are proven by predictable patterns, consistent historical data, include repetitive work, and large amounts of data.

And last but not least, connect your pressing issues with desired business outcomes, underwriting guidelines, and regulatory requirements.

A holistic overview will help you stay focused while remaining adaptable as conditions change.

When you can pinpoint and evaluate your specific issue(s), you’ll know what to look for in an AI vendor later.

The better the data you feed the AI with, the better the outputs will be.

If your data is incomplete, outdated, or faulty, you’ll be forced to spend a lot of time correcting the AI model’s errors.

This sounds like more work, not automation, right?

But a bad dataset won’t just impact your precious time. It can also translate into serious financial losses down the line.

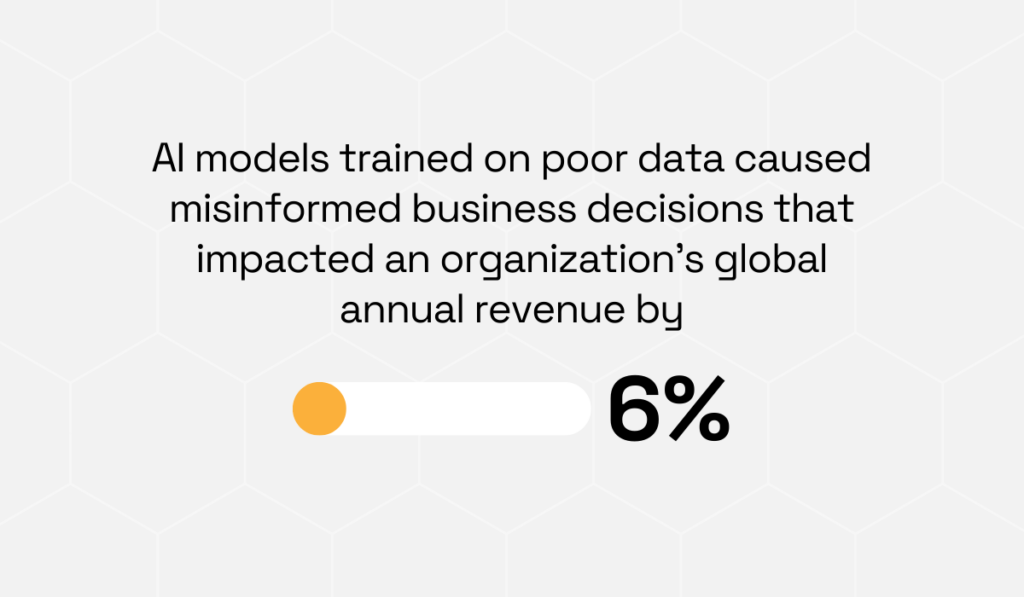

A study from Vanson Bourne and Fivetran shows the extent of the possible damage.

Namely, they found that models trained on poor data caused misinformed business decisions that impacted an organization’s global annual revenue by 6%, or $406 million on average.

Illustration: Veridion / Data: Fivetran

That’s why it’s crucial to take your time, dig a bit deeper, and evaluate all the internal data at your disposal.

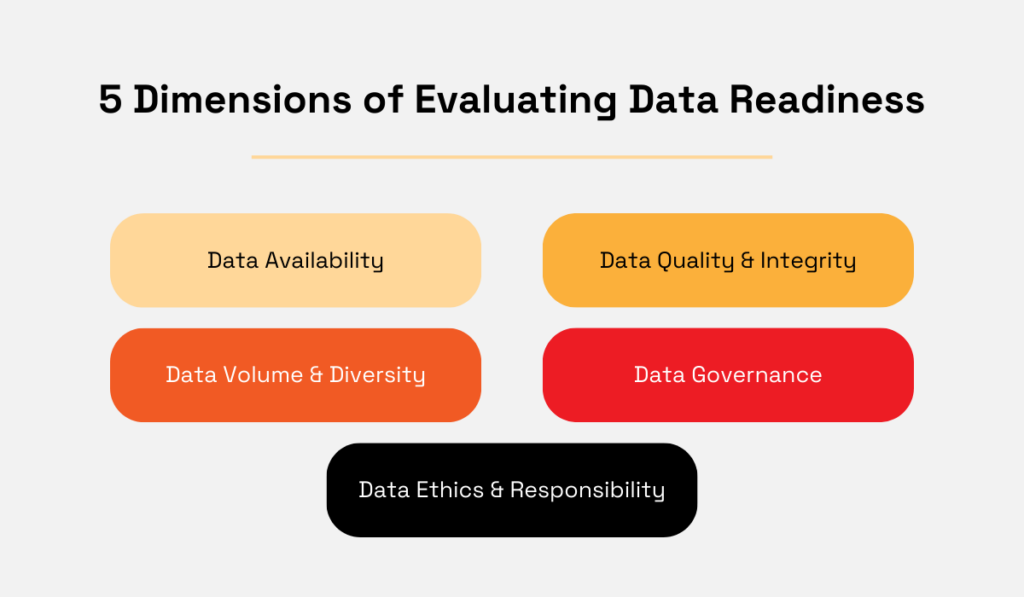

According to Deloitte, you should assess data across the following five dimensions:

Illustration: Veridion / Data: Deloitte

Assessing data according to these criteria can be easier if you ask practical questions such as:

The answers will give you a robust foundation critical for faster, more reliable, and more impactful automation.

In case your internal assessments show that your current dataset isn’t fresh enough, diverse enough, or is incomplete, it’s time to fill in the gaps with some outside help: external data sources.

But how do you find a high-quality source for all the data you need for underwriting?

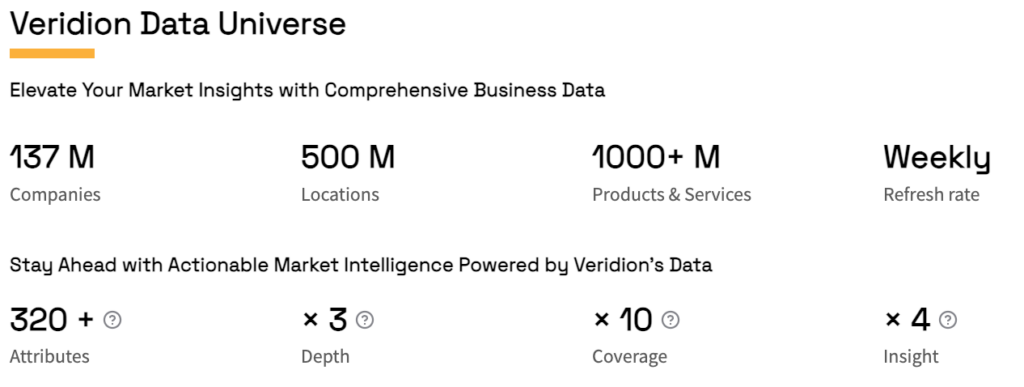

The answer lies in comprehensive external data providers such as Veridion.

This AI-powered platform aggregates and enriches verified business data from all around the world, thus enabling underwriters to feed more accurate and comprehensive inputs into AI models.

Source: Veridion

Veridion doesn’t just aggregate basic business data, either.

It also provides you with the details on a business’s operational footprint, ownership structures, financial signals, and risk indicators.

This data is sourced from the entire internet and passes through proprietary AI and ML algorithms to ensure it is reliable and up to date.

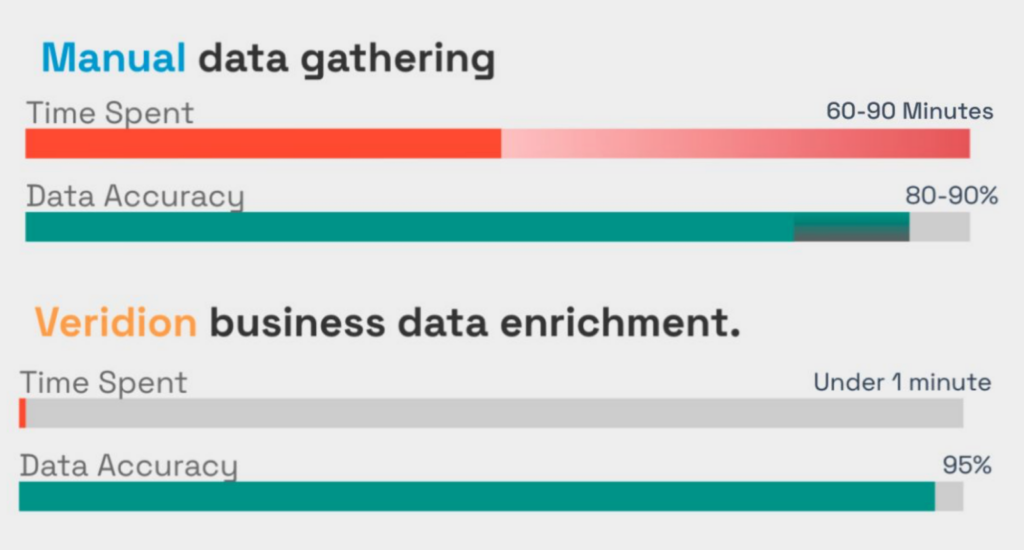

Veridion boasts an admirable 95% data accuracy and unmatched speed, providing you with over 320 data attributes in under just one minute.

Source: Veridion

And it doesn’t stop there.

You can also use it for automating tasks like risk identification.

Traditional methods can be faulty. Applicants may not disclose potential risks when asked, or the underwriter may overlook critical data points when doing it manually.

But by using external data sources like Veridion, you can validate businesses with greater accuracy than ever before.

The result?

Reduced risk and increased confidence in making important underwriting decisions.

The AI in the insurance market is thriving at the moment.

According to the 2025 report by Market.Us, the industry is projected to grow from $14.99 billion in 2025 to $246.3 billion by 2035.

That means there’s a vast array of solutions to choose from, and their number is only expected to grow.

But just like in any aspect of life, it takes skill to separate the wheat from the chaff.

After all, quality underwriting is the backbone of a successful insurer.

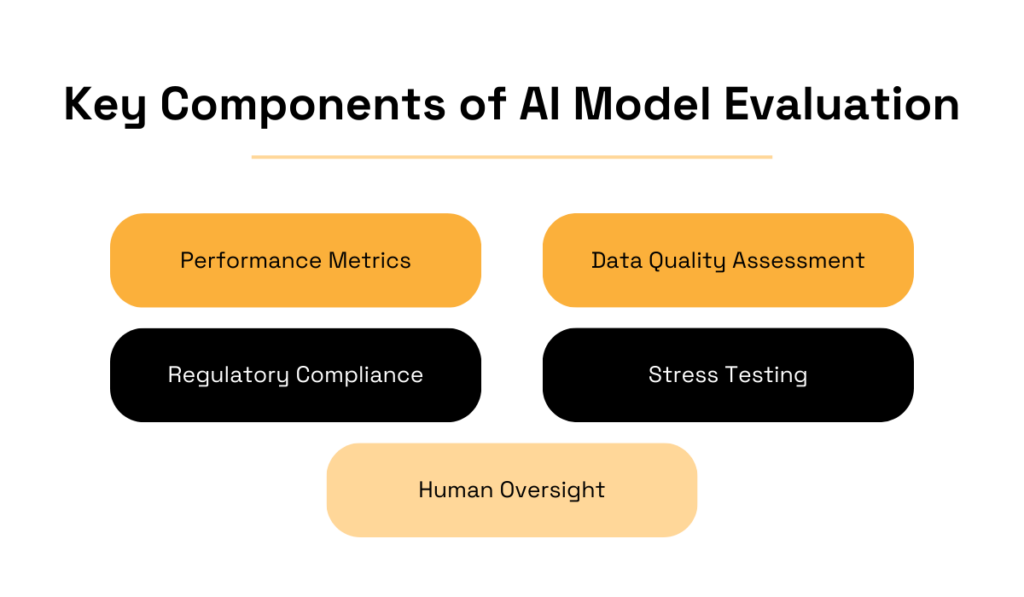

To make sure you choose a reliable, safe, and accurate technology, consider AI model evaluation.

This process is built to help you accurately assess whether an AI model can perform the underwriting tasks you need it to and help you achieve the goals you set in step one of the implementation process.

To assess a prospective solution as accurately as possible, you want to use specific criteria like performance metrics, stress testing, or human oversight.

Illustration: Veridion / Data: Meegle

And don’t forget to keep humans in the loop.

To make it easier to track accountability, appoint team members in charge of supervising the tool. After all, if a mistake happens, the human, not the AI, is held accountable.

This need for AI education is already acknowledged by the top stakeholders.

According to IBM’s 2025 C-suite report, over one-third of CEOs say that their workforce will require retraining and reskilling over the next three years to handle the increased use of automation and AI.

The verdict is clear:

AI is here to stay, so remaining educated and informed is crucial for any insurer that wants to stay competitive and compliant.

Skipping pilot testing—whether by fully deploying an AI solution or training employees too early—can lead to issues later on.

They can range from financial losses and security risks to reputational issues.

So, always test the waters first.

You can do that by implementing smaller, expert-controlled pilots that will enable you to test the tool’s capabilities and analyze the results before making a commitment.

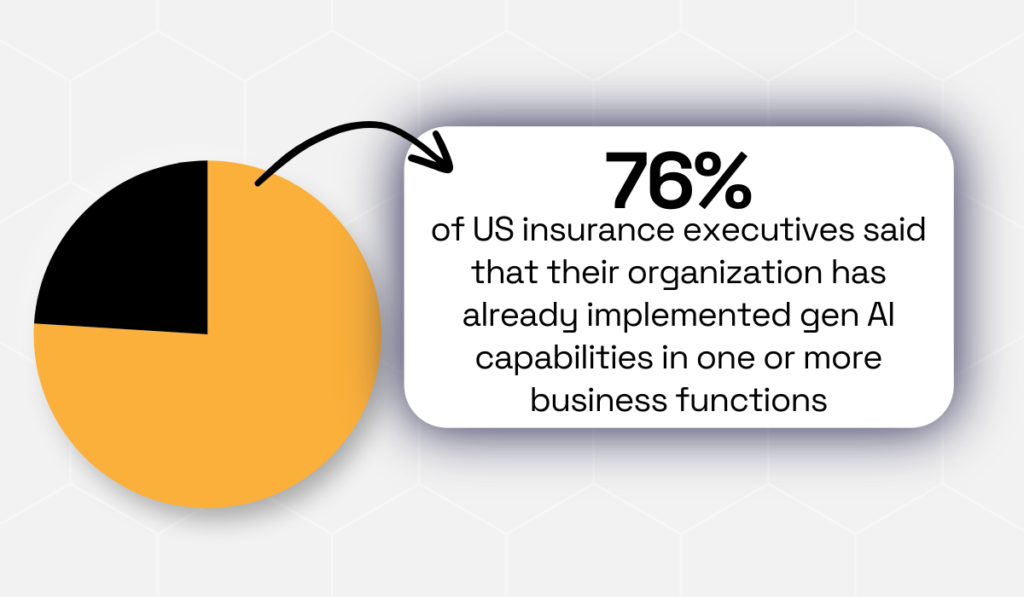

Companies are also aware of the benefits, as shown in a 2025 global insurance outlook report by Deloitte.

In a survey of 200 U.S. insurance executives, 76% said that their organization has already implemented AI in at least one business function.

Illustration: Veridion / Data: Deloitte

This level of adoption underscores the importance of structured implementation approaches.

That is where pilot programs come in, allowing organizations to reduce operational risk and make data-driven adjustments before scaling.

The result?

A clear and informed insight into how AI can work for your organization and better decision-making.

In conclusion, it’s safe to say that dipping your feet in the water with smaller AI pilots is the safest way to start implementing AI into your underwriting processes.

When done strategically and responsibly, it can serve as a foundation for innovation down the line.

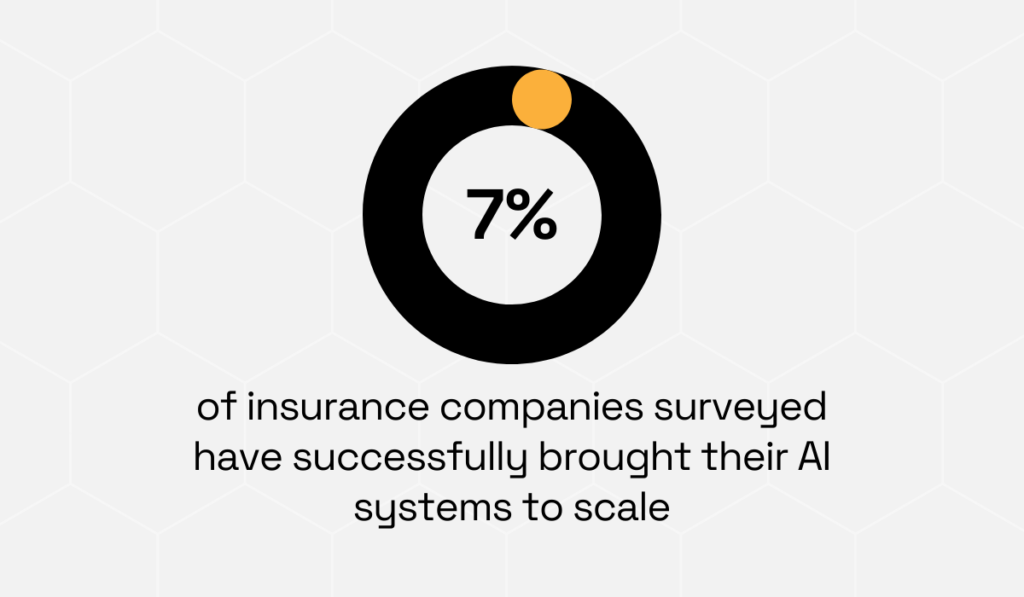

With only 7% of insurance companies successfully scaling their AI systems, it’s clear that a successful pilot doesn’t necessarily mean smooth scaling.

Illustration: Veridion / Data: BCG

This is an indicator that an AI solution is only as good as how your organization handles its refinement.

Although the figure above might sound discouraging, it is possible to do it right.

First, take into account that risks, regulations, and business conditions are not set in stone.

They change, sometimes even before you can get used to them.

A good way to stay ahead of them is by incorporating consistent monitoring and refining the model through feedback.

For example, you can keep track of whether certain risk profiles are consistently misclassified or whether policy decisions reflect changing market conditions.

Feeding these insights back into the model allows it to learn and adapt over time, improving accuracy and reducing errors.

The refinement can be done by either a trained underwriter or your team’s data analyst. This way, you’re always in control, and it’s easier to catch risks before they escalate.

Another thing to keep an eye on is any cost drains that may happen because of overlapping tools, security gaps, or badly set up workflows.

Many insurers today spend a significant portion of their IT budgets just keeping legacy systems running rather than improving them.

According to Gonzalo Geijo, Chief Commercial Officer at Charles Taylor InsureTech, a staggering 74% of insurance companies still rely on legacy systems.

Illustration: Veridion / Quote: Charles Taylor

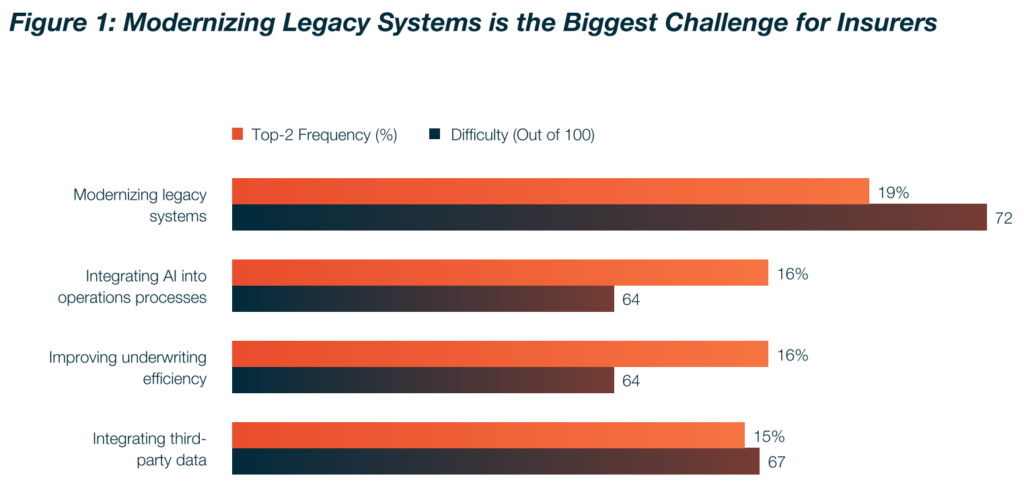

On top of that, the Earnix 2024 Industry Trends Report shows that modernizing legacy systems is the biggest challenge for insurers, closely followed by the struggle to integrate AI into operations processes.

Source: Earnix

This indicates that the successful implementation of AI in underwriting depends heavily on continuous refinement within existing operational and technology constraints.

In practice, insurers that actively monitor performance, adapt models to changing conditions, and streamline legacy systems are far more likely to scale AI effectively and sustain long-term value.

Incorporating AI into your underwriting process isn’t a one-and-done thing.

Think of it as building a house.

You base it on a strategic blueprint and build it brick by brick. But when it’s built, it also needs a lot of upkeep.

When done in synergy with human nuance, AI can become a powerful driver of an effective and profitable underwriting process.

So, don’t hesitate and start steering your business towards the front row of innovation.