6 Key Benefits of Insurance Business Intelligence

Key Takeaways:

Business intelligence solutions are growing in popularity, with over one-third of the world’s largest organizations leveraging more than four distinct BI tools.

The aim? Making faster, smarter decisions that improve performance and profitability.

In insurance contexts, BI helps you see what really drives claims, customers, and competitors.

This article explores six key benefits businesses gain simply by investing more resources into insurance business intelligence.

So, let’s get right into it.

One of the key advantages of insurance business intelligence (BI) is its ability to detect and prevent fraudulent claims or activities.

Using data visualization, pattern recognition, and anomaly detection, BI tools flag suspicious claims or inconsistent customer details that deserve a closer look.

In other words, they transform massive volumes of data into early warnings.

BI tools leverage pattern recognition and anomaly detection to flag suspicious claims or inconsistent customer data, helping insurers minimize financial losses and protect the integrity of operations.

How important is this?

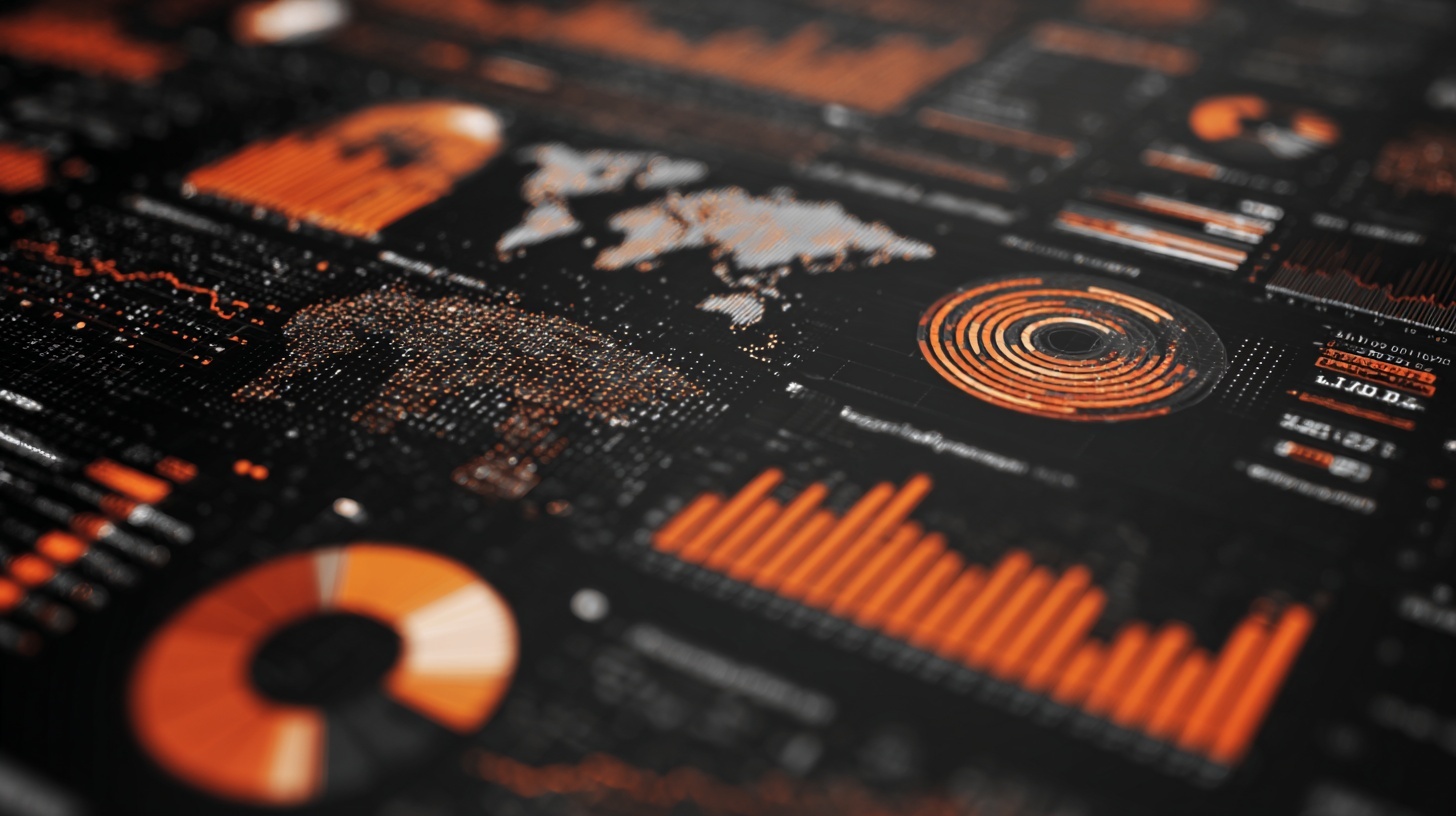

Well, just consider the findings of Deloitte’s recent survey.

Their research revealed that 35% of insurance executives view fraud detection as one of the top five areas for developing or implementing generative AI over the next 12 months.

Illustration: Veridion / Data: Deloitte

The scale of the problem is undeniable.

Allianz UK uncovered £157.24 million in fraudulent claims in 2024. The amount went up 10% in just one year, and that’s just one company.

James Burge, the company’s former Head of Counter Fraud, noted that commercial insurance today leaves little room for blind trust.

Illustration: Veridion / Quote: Insurance Times

The good news is that the same digital tools enabling more sophisticated fraud are now also powering stronger defenses.

BI systems help insurers hold down the fort by analyzing claim clusters, historical trends, and behavioral anomalies to identify red flags such as:

For Allianz, this involves advanced data enrichment and AI-based validation.

But you don’t have to be a global carrier to apply similar tactics.

Even mid-sized insurers can improve fraud detection by integrating BI dashboards with machine learning models or connecting to shared data platforms like the Insurance Fraud Bureau (IFB) for cross-verification.

And the impact speaks for itself.

One success story comes from Aksigorta, a leading Turkish insurer that partnered with SAS to deploy predictive analytics and anomaly detection models.

By searching for hidden links across internal claims data, industry databases, and even social media, the company boosted fraud detection by 66%.

Illustration: Veridion / Data: SAS

When properly integrated, BI helps you refine detection models over time.

This continuous stream of data strengthens accuracy, reduces false positives, and protects your organization’s bottom line.

To sum up, BI has become one of the sector’s most powerful shields against fraud in an ever-changing landscape.

BI helps insurers manage claims throughout every stage, from first notice of loss to final resolution, thereby preventing delays that waste money and erode trust.

By consolidating data from multiple systems, insurance BI tools give you a clear view of where claims stand, how long they take to close, and which steps create avoidable bottlenecks.

Back in 2020, Dresner Advisory Services found that the financial services sector, which includes insurance companies, had the second-highest rate of cloud BI adoption.

That early shift reflected a growing demand for real-time insight.

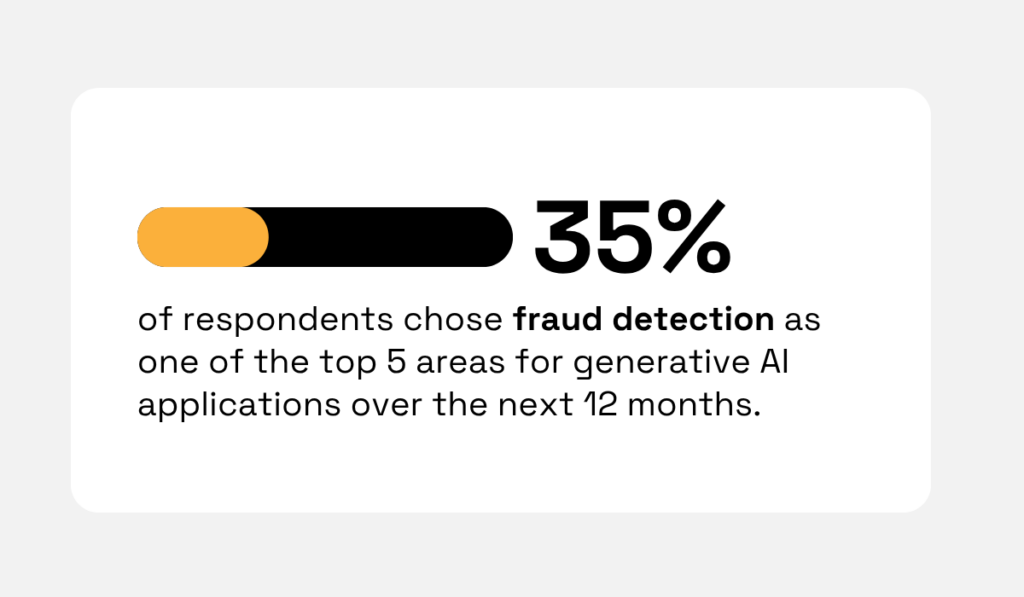

Fast-forward four years, and their latest report shows that 39% of enterprises (10,000+ employees) now use four or more BI tools.

Illustration: Veridion / Data: Dresner Advisory Services

Finance is once again among the top business functions adopting BI, but the sheer number of tools indicates a company-wide reliance on analytics, both in terms of operations and strategy.

In claims management, BI dashboards are there to help you visualize every key metric, be it claim amounts, processing times, or loss ratios, all from a single place.

These insights expose workflow inefficiencies and bottlenecks, enabling managers to address issues before they affect service quality.

Source: Solver

Something as simple as setting up automated KPI tracking (e.g., claims closed within 30 days) can help teams respond faster and adjust workflows accordingly.

Moreover, predictive analytics can forecast which claims are likely to escalate or require additional review, enabling smarter prioritization and resource allocation.

AI is increasingly powering these tools, helping insurers cut response times and improve accuracy.

Aviva, for example, now runs more than 80 AI models to streamline liability assessment and route claims more precisely.

The result: a 65% drop in customer complaints and $82 million saved through efficiency gains.

Data doesn’t lie:

When BI is woven into claims management, it turns one of insurance’s most complex processes into a source of competitive strength.

Underwriting feeds on robust, accurate data, and business intelligence is there to deliver and ensure more accurate pricing decisions and faster responses to market changes.

By consolidating internal loss histories, market performance trends, and client financials, BI gives underwriters a 360-degree view of risk.

The ability to visualize loss frequency by region, policy type, or industry supports more complex analyses.

Still, many challenges stem from the sheer volume of data.

Even something as simple as entering a new submission can become time-consuming when dozens of prior carriers and losses are involved.

Rajesh Radhakishtan, a Product Platform Director at Hadron Insurance, puts it plainly:

Illustration: Veridion / Quote: LinkedIn

Processing the data from a single loss run can prove time-consuming while still delivering questionable accuracy.

But that’s where BI comes in.

It automates extraction and powers predictive models that refine underwriting and claims performance over time.

Guidewire’s analytics suite demonstrates this well.

Once predictive models are deployed, their insights feed directly into underwriting workflows through codeless configuration.

Source: Guidewire Software on YouTube

This fresh stream of data enables your team to easily adjust pricing or risk parameters in real time based on new data.

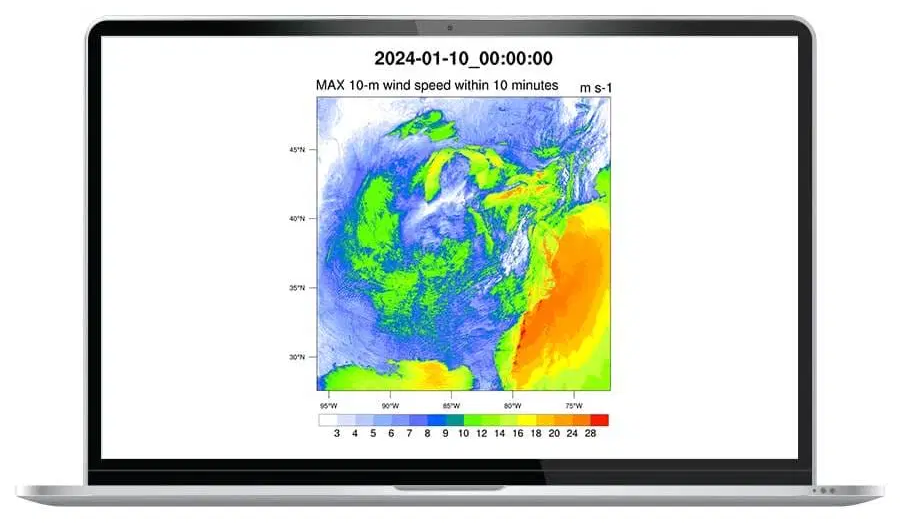

Geospatial data adds another layer of accuracy, as shown with Climavision.

Combining BI with environmental analytics lets underwriters evaluate risks tied to flood zones, theft-prone areas, or storm exposure, ensuring every quote reflects real-world conditions.

Source: Climavision

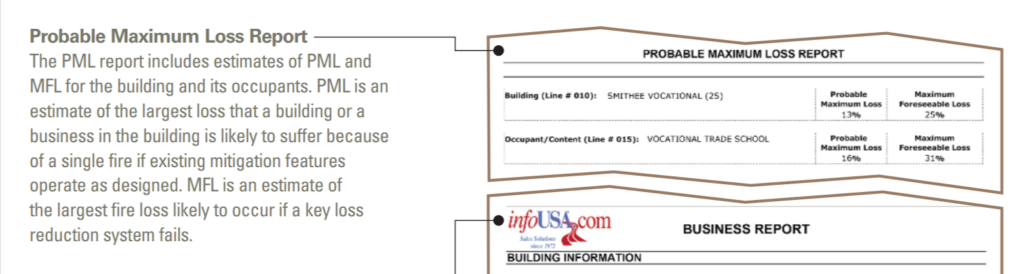

BI also strengthens underwriting through smarter reporting.

Verisk’s ProMetrix connects directly to its commercial property database to generate detailed building underwriting reports.

These reports include everything from construction details and sprinkler system design to probable maximum loss calculations.

Source: Verisk

Those are exactly the kind of insights that prevent under- or over-pricing.

With these capabilities, BI transforms underwriting into a dynamic, data-informed discipline.

With shorter submission time, increased accuracy, and clear alignment with the latest market and risk intelligence insights, insurance business intelligence is sure to have a positive ripple effect across your organization.

BI tools give insurers a clearer understanding of their position in the marketplace by analyzing competitor offerings, market trends, and customer demand.

With BI dashboards, you can benchmark rates and coverage, monitor market share shifts, and track customer sentiment from reviews or claims behavior.

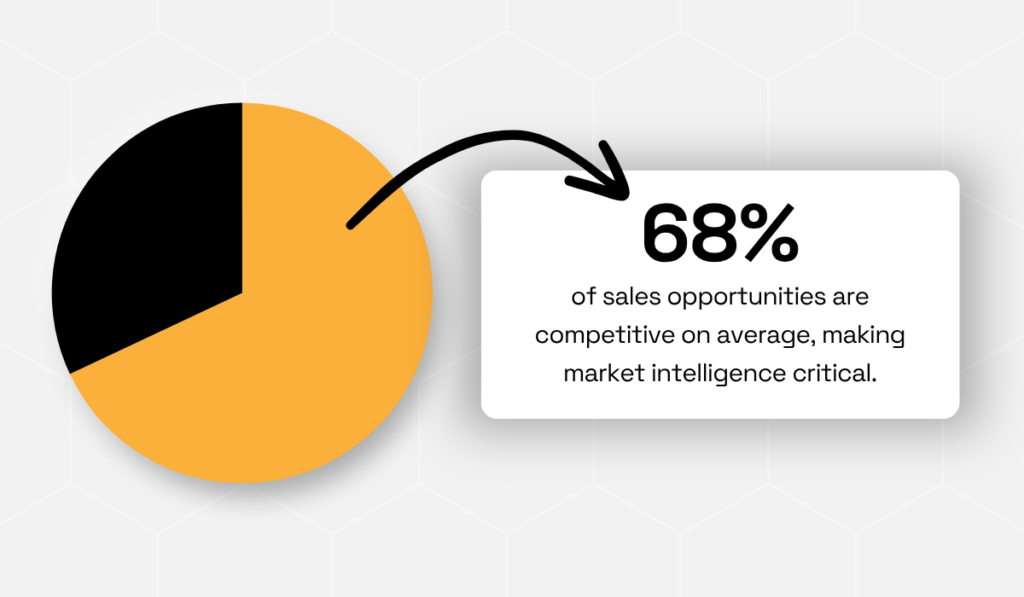

After all, the goal is to stay agile and anticipate where the market is heading, especially in the face of growing competition.

Crayon’s 2025 research shows that in highly competitive industries, such as insurance, nearly 70% of deals are now direct head-to-head battles.

Illustration: Veridion / Data: Crayon

That level of competition makes real-time market intelligence indispensable.

Insurers need to see how their offerings stack up, and to do that, external data becomes just as critical as internal reporting.

This is where Veridion’s data makes all the difference.

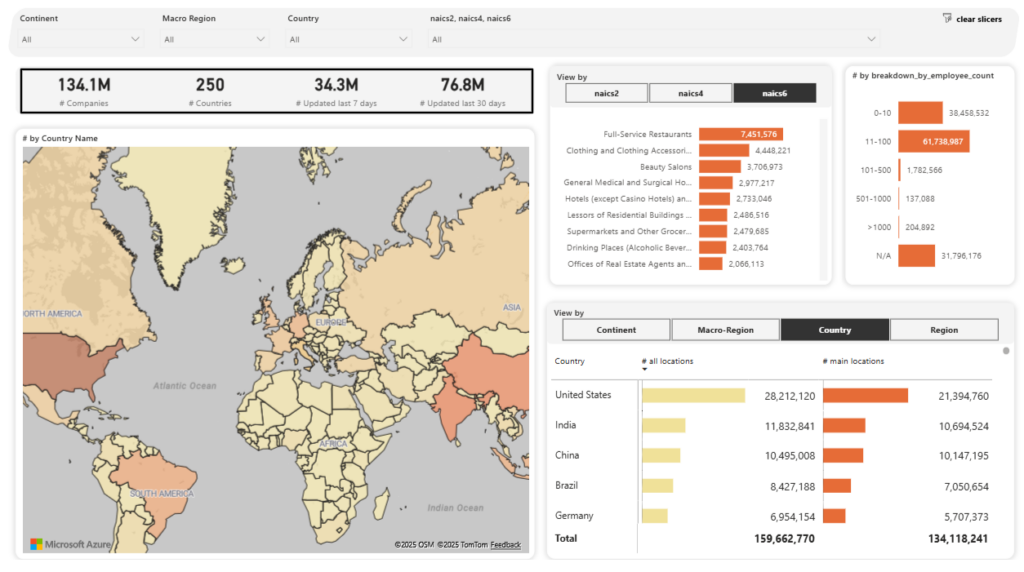

Our AI-powered intelligence platform provides weekly-updated, granular data to help insurers monitor new entrants, assess potential partners, and detect competitive shifts before they appear in public filings or reports.

With 134+ million companies mapped across 250 countries, 500 million business locations, and 320 attributes per profile, Veridion delivers unprecedented global coverage to serve several commercial insurance use cases.

Source: Veridion

Such depth directly addresses long-standing challenges in insurance analytics:

But even with this scale, Veridion remains highly accessible by prioritizing a user-friendly interface and natural language search.

The Match & Enrich capability can generate complete business profiles from just a name and address, streamlining workflows like client vetting, partner discovery, and policy validation.

Source: Veridion on YouTube

Finally, thanks to Veridion’s APIs and bespoke setup options, there won’t be any issues with fitting the data into your existing BI environments.

In the end, teams that can actually act on competitive insights, instead of spending all their time collecting them, win the race, so be sure to choose your BI tool(s) wisely.

BI helps insurers better understand customer behavior, renewal trends, and satisfaction drivers, insights that directly influence loyalty and lifetime value.

Consumer expectations are evolving constantly, and with tools like generative AI used across all walks of life, carriers are more pressed than ever to adapt quickly.

For instance, an Ontario Securities Commission study found that 29% of respondents already access financial or investment information via tools like Chat GPT.

Illustration: Veridion / Data: Ontario Securities Commission

If individuals are comparing insurance offers and weighing options more actively than ever, it’s easy to imagine business entities applying even greater forethought and diligence.

Customer retention depends on knowing who is likely to renew, what drives satisfaction, and where churn risk exists.

With several key factors affecting customer loyalty, carriers need to raise their game on advisory, communication of product value, and price transparency.

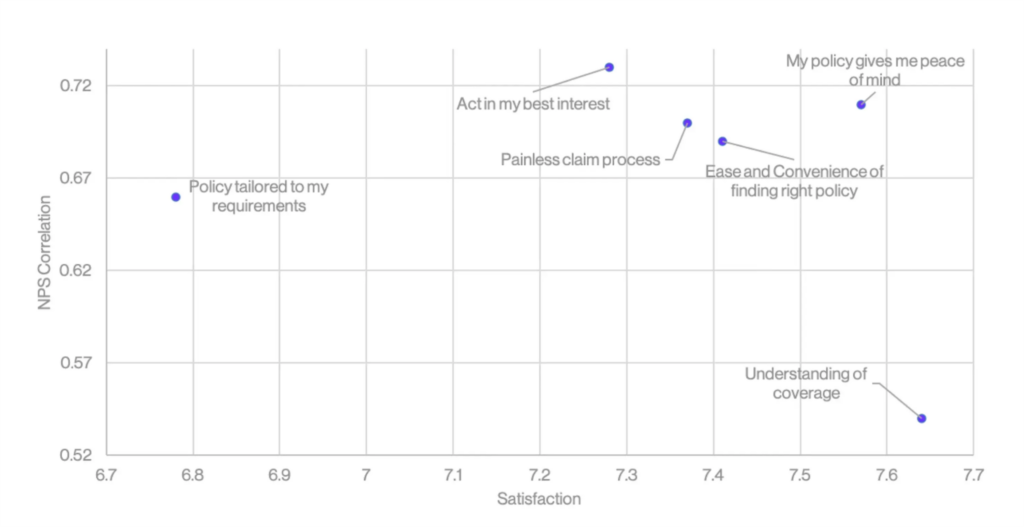

Source: CustomerGauge

And that’s exactly where business intelligence comes in.

BI supports these efforts with cohort analysis, predictive churn modeling, and segmentation by profitability, renewal likelihood, or risk profile.

For instance, insurers can track renewal rates by policy type and flag clients whose interactions, claims history, or service experiences suggest they may not renew.

Visualizing NPS value drivers, such as the number of purchases and likelihood to recommend service to others, helps refine engagement strategies.

Source: Userpilot

With BI dashboards segmented by customer value tiers, you can prioritize outreach, tailor communications, or offer targeted incentives to your most valuable clients.

Simply put, it’s about knowing exactly where to personalize experiences, optimize touchpoints, and increase satisfaction that drives long-term relationships.

In conclusion, while BI helps you track retention metrics, its key value is reflected in enabling proactive, data-driven strategies that persuade customers to not only maintain, but expand their relationship with your company over time.

Finally, insurance BI gives you the tools to spot untapped market segments, emerging risk products, and cross-selling possibilities.

Insurers who leverage BI can enhance strategic foresight, identifying areas where demand is rising before competitors do.

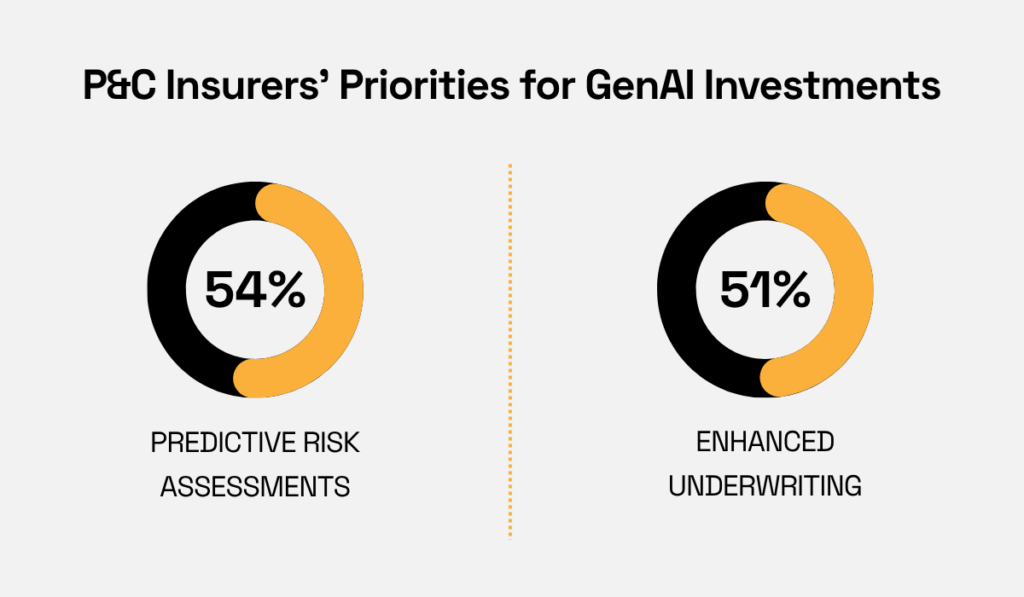

For example, a recent EY survey shows that carriers are focusing on advanced risk assessment (54%) and underwriting improvements (51%) to support innovation and mitigate emerging risks.

Illustration: Veridion / Quote: EY

Cyber insurance offers a clear case in point.

Many companies hesitate to insure against cyber threats due to accumulated risk or geopolitical uncertainty.

Yet, improvements in modeling and pricing are making this line increasingly viable.

Today, 41% of decision-makers are exploring cyber coverage, signaling a growing market that insurers can tap into with the right intelligence.

Illustration: Veridion / Data: Munich RE

Other opportunities arise in connection with demographic shifts.

Take Athene, whose success with retirement products stems from understanding and effectively addressing the financial needs of an aging population.

Martin Klein, the company’s former CFO turned Senior Advisor, highlights that retirees worried about outliving their income represent a vast, addressable market.

Illustration: Veridion / Quote: EY

Naturally, BI tools are there to help you map opportunities more effectively and create a strong framework that builds on the advantages we discussed earlier.

Here’s what you can do:

| Market Benchmarking | Compare competitor rates, coverage options, and product offerings in real time to document gaps or areas for differentiation. |

| Segmentation | Detect high-potential customer segments, such as underinsured SMEs or emerging risk categories, and allocate your resources accordingly. |

| Channel & Product Optimization | Analyze distribution channels and product adoption trends to refine offerings, launch new solutions, or expand into underserved markets. |

Whether you want to enter a new segment, design a product that meets emerging needs, or refine distribution for maximum impact, these small steps translate to major strategic moves.

Ultimately, the right BI strategy transforms data into growth, allowing insurers to invest with the best chance of success and sharpen their competitive edge.

Insurance business intelligence helps you keep a finger on the pulse of your entire operation and monitor changes in real-time.

Intuitive dashboards, data visualization tools, and insightful predictive models are there to help you combat fraud, streamline claims, and retain customers, all the while discovering new growth opportunities.

Keep in mind that success comes from turning data into actionable insights that are seamlessly integrated into your workflows to enable faster and smarter decision-making.

Remember, with the right BI strategy, insight becomes measurable impact.