Top 5 Challenges In Insurance Underwriting

Key Takeaways:

Insurance underwriting has never been short on data. But turning that data into confident, consistent decisions is a different story.

As commercial risks grow more complex and customer expectations for speed rise, underwriters are being asked to do more, faster, and with fewer mistakes.

Thankfully, there are tools to ensure more seamless processes.

In this article, we explore the five most pressing challenges in insurance underwriting today and reveal how you can address them with smarter processes, better data, and more forward-looking approaches.

For many insurers, underwriting still depends heavily on manual workflows.

That’s data collection, document reviews, risk verification, and endless admin tasks, all scattered across emails, spreadsheets, and sometimes, across disconnected systems, too.

Each task demands human intervention to move the process forward.

This patchwork approach slows down decision-making and, as a result, amplifies errors by a great deal.

What should be a strategic function turns into a logistical grind that can cost entire companies.

In fact, reliance on manual processes slows down decision-making at every single stage of the underwriting lifecycle.

Each handoff introduces friction, while repetitive tasks increase the likelihood of human error.

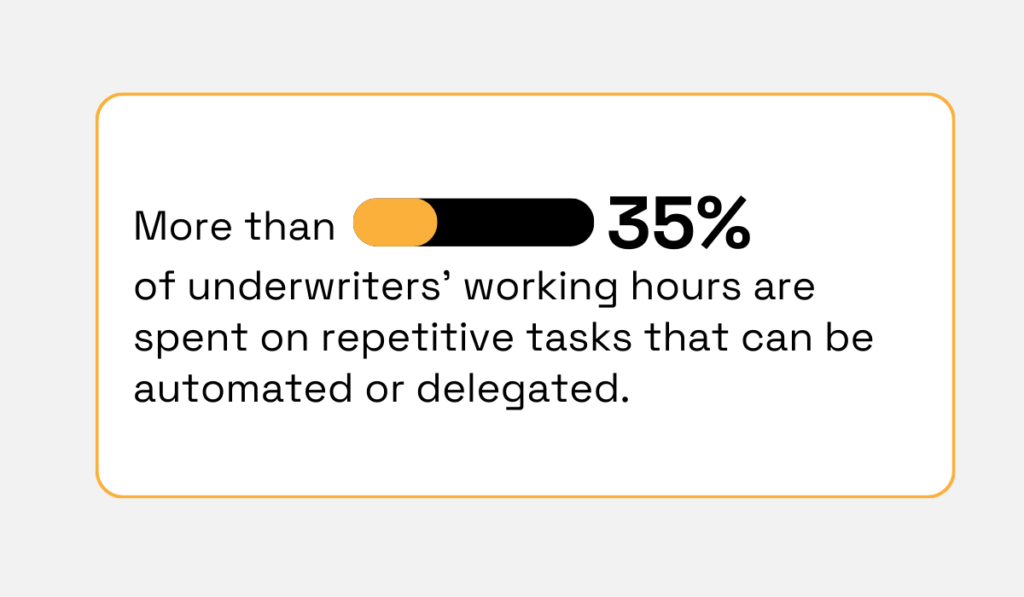

Underwriters spend at least 35% of their time on administrative work, rather than on higher-value analytical tasks that actually improve risk selection and pricing accuracy.

Source: Veridion

Manual workflows also make it difficult to scale.

As submission volumes increase (especially in commercial lines), underwriting teams struggle to stay consistent across decisions.

In other words, two similar risks may be assessed differently simply because information was interpreted differently or missed altogether.

And over time, this is not a negligible issue. Snowballed inconsistency erodes portfolio performance and underwriting discipline.

The opportunity cost is just as high.

When underwriters are tied up validating addresses, cross-checking classifications, or searching for business activity details, they have less time to apply professional judgment.

That’s contextual reasoning, experience-based intuition, nuanced risk evaluation—precisely those areas where human underwriters add the most value.

So, how are leading insurers responding to this challenge?

For starters, by automating these low-value, repetitive steps across the underwriting workflow.

Pre-filled submissions, automated data validation, and rule-based triage let their teams focus on complex or borderline cases.

The goal isn’t to remove humans from underwriting.

As Dina Tarantola-Froner, Chief Underwriting Officer at International Medical Group (IMG), puts it:

Illustration: Veridion / Quote: ITIJ

Human underwriters, using AI tools, can spend their time on things that matter: evaluating risk, structuring coverage, and making confident decisions.

Data-driven insights should complement, not replace, human judgment.

Even the most experienced underwriter is only as good as the data behind the decision.

Yet many underwriting teams still struggle with incomplete, outdated, or inconsistent information when assessing commercial risk.

A common issue is over-reliance on self-reported data.

Sometimes, applicants might unintentionally omit critical business activities or misclassify their industry when using a new system.

Or even worse: they might fail to disclose operational changes that materially affect risk.

Legacy databases and siloed internal systems only compound the problem when they offer partial views of a company’s true footprint, ownership structure, or financial health.

Research from the CRO Forum highlights that poor data quality remains one of the biggest structural weaknesses in insurance decision-making, directly impacting pricing accuracy and loss ratios.

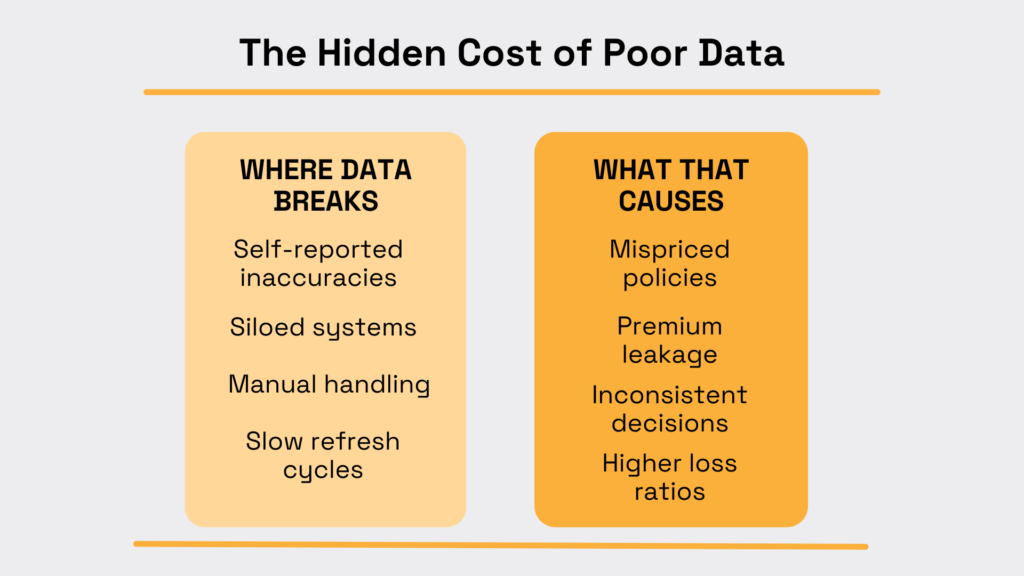

Poor data can mean—as well as cause—myriad issues, as outlined below:

Source: Veridion

These issues don’t exist in isolation, either. They compound across underwriting, pricing, portfolio management, and more.

Without reliable, continuously updated data, underwriters are forced to make assumptions. That means uncertainty seeping into every policy decision.

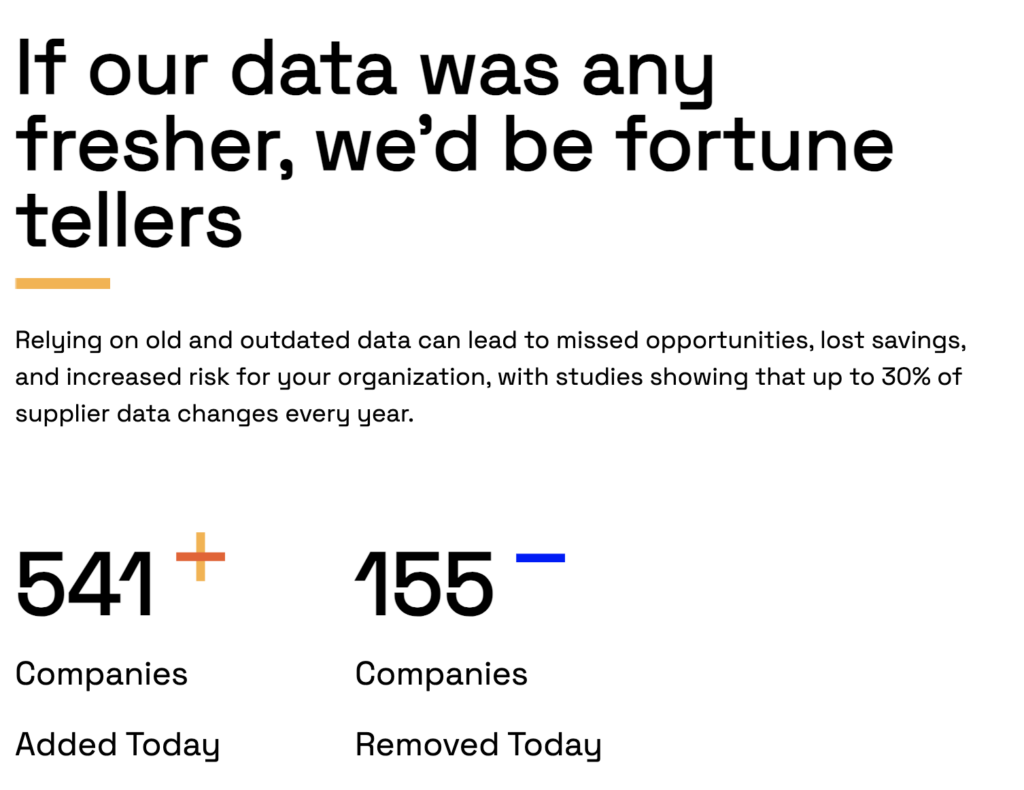

Luckily, this is where modern data intelligence providers, such as Veridion, are changing the equation.

Platforms like Veridion aggregate, verify, and enrich business data using AI at scale.

By analyzing billions of web pages weekly and combining digital and legal sources, Veridion delivers everything from firmographics to operational activity signals, financial indicators, and corporate hierarchies needed for the right decision.

If that’s not useful enough, it does so in near real time.

Source: Veridion

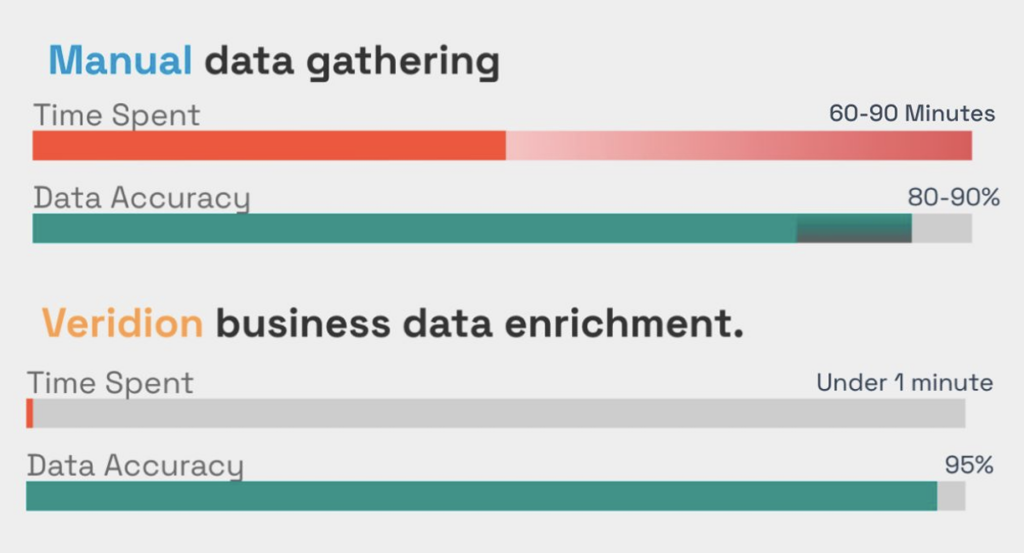

In practical terms, this means underwriters can build a complete business profile using just a company name and address.

And, as we already stated, less time spent on manual tasks means more time for analytical tasks where human underwriters are most valuable.

Source: Veridion

Automated classification also improves underwriting triage, while validated business activities help reduce premium leakage caused by mispriced or misclassified risks.

Continuous monitoring supports book and risk management, too, as it lets insurers detect changes in exposure during renewals, and not weeks or months after the losses are already there.

Access to high-quality data doesn’t just improve accuracy by the truckload. It also gives you confidence.

When you trust the data in front of you, decisions move faster, stay consistent, and are far easier to stand behind.

This is paramount, whether you’re explaining decisions to internal stakeholders or defending them to regulators.

Speed has become a competitive weapon in insurance. This, in turn, has become a serious challenge.

Digital distribution channels, broker platforms, and customer expectations have dramatically shortened acceptable turnaround times for quotes and underwriting decisions.

And yet, no one wants to compromise risk accuracy.

So, yes, faster decisions can improve conversion rates, but they also introduce risk.

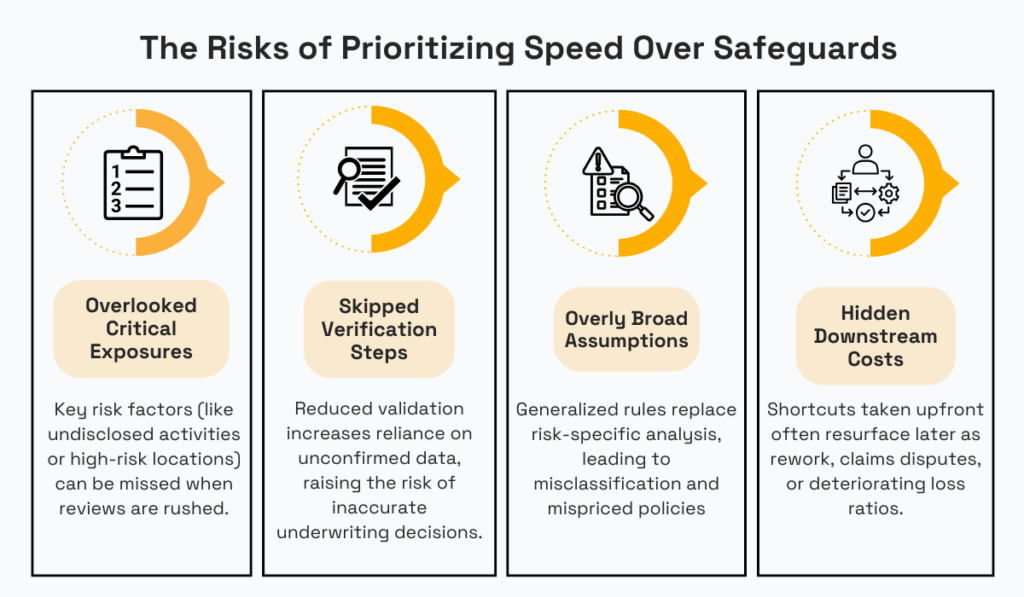

When speed is prioritized without the right safeguards, underwriters may overlook critical exposures, skip verification steps, or rely on overly broad assumptions.

Source: Veridion

The result is mispriced policies that look profitable on paper but underperform over time.

A McKinsey analysis of property and casualty insurers shows that pricing and underwriting errors are a major driver of profitability gaps, especially in competitive markets.

These errors rarely come from a lack of expertise, but from time pressure and the limits of the data you have available at the moment decisions need to be made.

Now, before you feel caught between a rock and a hard place, the solution isn’t choosing between speed and accuracy.

It’s designing workflows that support both.

Automated triage allows low-risk, well-understood submissions to move quickly. Additionally, it flags complex or unusual risks for deeper review, and that’s where underwriters come into play.

Pre-validated data sources reduce the need for manual checks, while clear underwriting guidelines ensure consistency across teams.

Some insurers are also adopting decision-support tools that surface risk indicators in real time. This basically helps them understand why a submission is high-risk, not just that it is.

McKinsey finds that insurers with mature analytics capabilities can improve operating profit by 10–25%.

Illustration: Veridion / Data: McKinsey

That’s quick proof of how better data paired with faster, supported decisions benefits performance.

This balance allows organizations to meet market expectations for speed without sacrificing underwriting discipline or long-term portfolio health.

Underwriting is all about anticipating what’s to come in the future.

In 2026, though, that future is shaped by risks that evolve faster than traditional models can track.

Cyber threats, climate-related exposures, supply chain fragility, and ESG considerations are becoming central underwriting concerns.

Yet historical loss data, which underpins so many pricing models, often provides little guidance for risks that are new or changing fast.

Swiss Re’s analysis of climate-related and cyber exposures shows that emerging risks are increasingly difficult to model using historical loss data alone, pushing insurers toward scenario-based and forward-looking risk assessment.

The same applies to ESG risks, where regulatory pressure, reputational exposure, and operational practices intersect in complex ways.

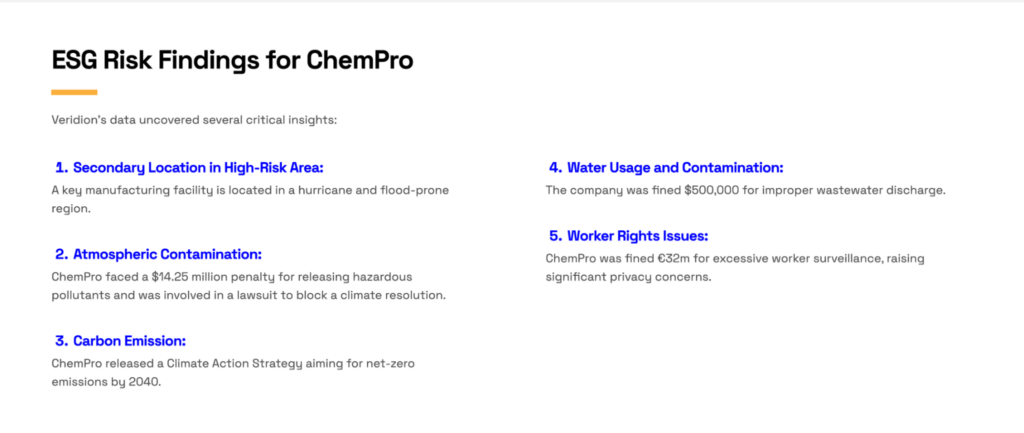

A Veridion case study on ChemPro, an industrial chemical manufacturer with a complex risk profile due to its regulatory and litigation history, is a great example here.

Granular ESG insights surfaced material risks that weren’t evident in traditional data.

Source: Veridion

The result?

A whopping 30% premium increase and tailored coverage terms addressing specific environmental and governance exposures.

This example shows how forward-looking ESG data doesn’t just inform underwriting but directly reshapes pricing, coverage structure, and portfolio risk management.

And this is exactly why underwriters are increasingly relying on forward-looking data, scenario analysis, and external intelligence to complement historical loss experience.

ESG data, in particular, can reveal operational practices or geographic exposures that don’t show up in claims history but still represent serious material risk.

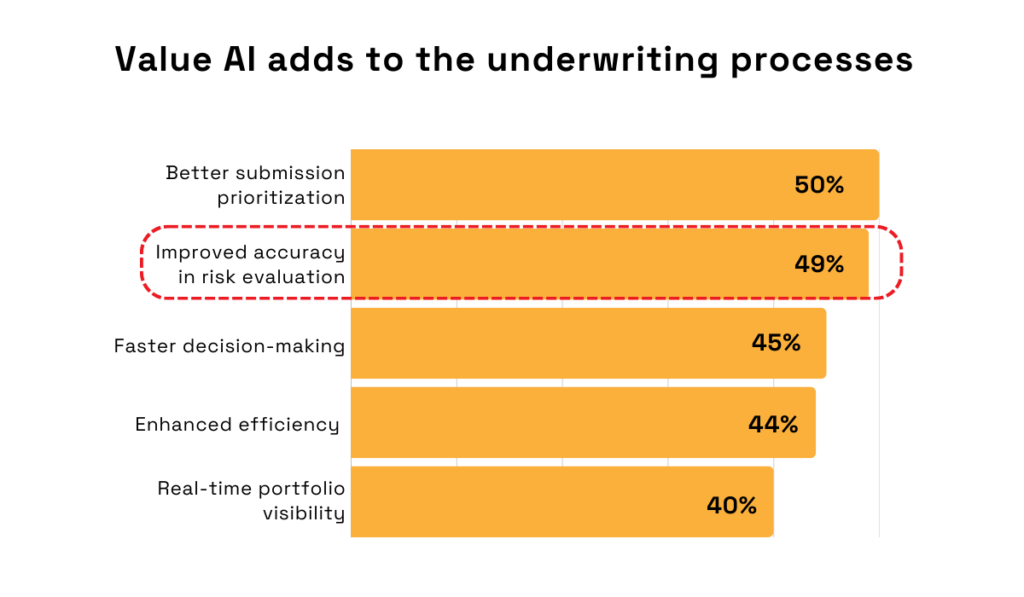

This shift is already underway: according to a 2025 Federato survey, 49% of underwriters say AI improves accuracy in risk evaluation.

That’s especially true when assessing complex or emerging exposures.

Illustration: Veridion / Data: Federato

Veridion’s ESG datasets show how this type of alternative data can be embedded into underwriting workflows.

By identifying sustainability indicators, business activities, and location-specific risk factors, your team can refine pricing models and better align coverage with emerging risks.

Ultimately, adapting to new risks requires both better tools and a mindset shift.

Insurance underwriting can’t just focus on what has happened anymore.

It must also assess what could happen and how quickly conditions can change.

Underwriting doesn’t always get credit for shaping customer experience, but it plays a bigger role than you might think.

Long waits, duplicate information requests, and opaque decisions can turn what should be a smooth process into a frustrating one, and fast.

Why?

From the customer’s perspective, underwriting often feels like a black box.

Requests for additional documents may turn up without explanation, and delays can stall business operations or cause deals to fall through.

In competitive markets, of course, these frustrations drive customers to better—clearer, faster—insurers.

Nedeljko Kuzmanovic, Partner & Delivery Manager at Vega IT, a software development service provider, explains what customers expect today:

Illustration: Veridion / Quote: Vega IT

Studies consistently show that process inefficiencies—not pricing alone—are a major driver of customer churn in commercial insurance.

Take this industry analysis, which observed that carriers still managing claims across six or more siloed systems turned a task that should take six hours into a 47-day ordeal.

The consequence was hard to miss: each day of delay cost 12–18% in customer retention.

These inefficiencies usually trace back to data gaps, manual workflows, or inconsistent underwriting practices.

Now, improving customer satisfaction doesn’t mean cutting corners.

It means designing underwriting processes that are transparent, predictable, and responsive. This brings us back to automated data validation.

Insurance IT Consultant and Lead Business Analyst Olga Vinichuk drives the point home:

“The level of customer satisfaction with digital servicing in insurance is the lowest among all finance domains. From my experience, automating those tasks cuts operating overhead, boosts customer satisfaction, and allows servicing teams to focus on complex relationship-building work, which is where they generate the biggest value.”

A great AI tool can reduce back-and-forth communication. Clear underwriting criteria help brokers submit cleaner applications. And faster decisions, even when the answer is “no,” build trust.

When underwriting works smoothly, customers may never notice it. And that’s exactly the point.

Efficient underwriting becomes an invisible advantage, supporting your reputation and long-term growth.

Insurance underwriting sits comfortably at the intersection of data, judgment, and trust.

The challenges facing underwriters today are deeply interconnected.

That’s exactly why addressing them takes more than tiny, incremental fixes. And that is why you need smarter workflows, better data, and better tools that support speed and accuracy equally.

For insurers willing to modernize their approach, underwriting can shift from a bottleneck to a strategic advantage.

So use data analytics to strengthen your portfolios, improve customer relationships, and build that much-needed resilience for the risks ahead.