7 Types of Tools Insurance Underwriters Need

Key Takeaways:

In business, risk doesn’t come from a single bad decision. It builds quietly through gaps in visibility, outdated data, and disconnected systems.

Insurance underwriting sits at the center of these risks, influencing approvals, contract terms, and long-term exposure.

When underwriters lack the right tools, the impact is undeniable: slower decision-making, higher premiums, and missed warning signs.

As supply chains grow more complex and regulations become stricter, relying on manual reviews or fragmented platforms is no longer sustainable.

So, equipping underwriting teams properly is not merely a technical choice.

It’s a strategic move that strengthens negotiations and supports confident, data-backed business decisions.

In this guide, we’ll explore the seven essential types of tools insurance underwriters need.

Business data platforms aggregate everything you need to know about a company: financials, employee counts, locations, and actual day-to-day operations.

You’re no longer relying solely on what applicants claim.

These platforms use public records, digital signals, and third-party sources to build a verified company profile.

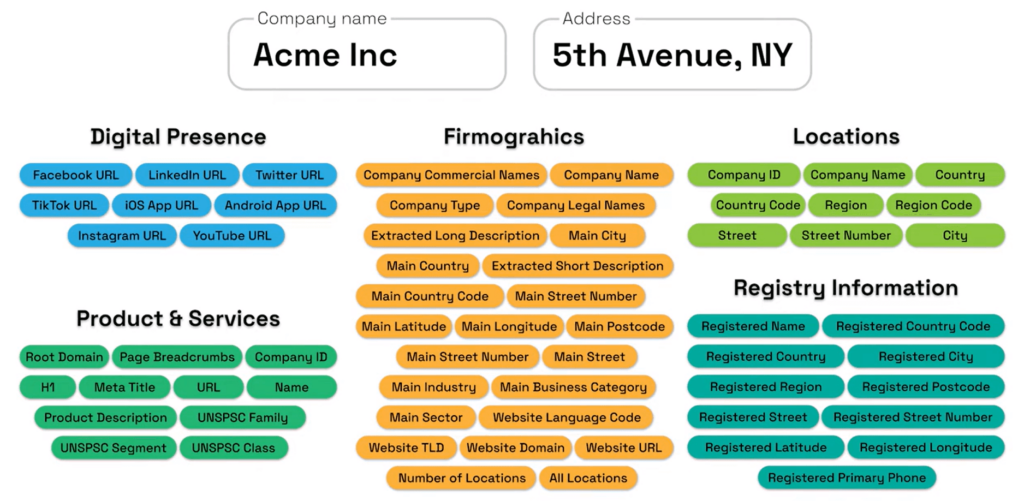

Enter a company’s name or tax ID, and you get firmographic data (industry, revenue, employee size) alongside operational details like product lines and facility types.

This is important because what businesses say they do can differ from what they actually do.

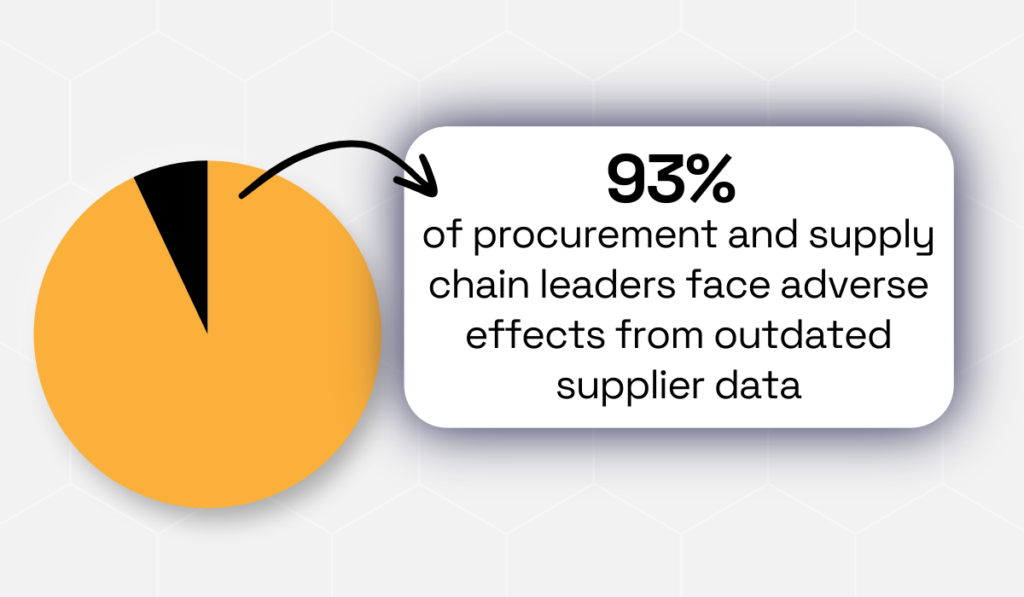

In fact, 93% of procurement and supply chain leaders report negative impacts from poor supplier data, including delays and financial losses.

Illustration: Veridion / Data: Tealbook

For instance, you might have an applicant who lists themselves as “office supplies provider,” but the platform reveals they manufacture electronics.

Or that the R&D facility they mentioned turns out to be located at their main site.

These differences aren’t trivial.

After all, a manufacturing plant presents far greater risk than a warehouse or corporate office.

Insurance pricing depends on accurate occupancy classification. Get it wrong, and you either underprice the policy or create underwriting surprises later.

Let’s look at a real-life example.

One major North American insurer had a 15% match rate when validating client data through its current data providers.

After integrating Veridion‘s Match & Enrich API, their match rate jumped to 60% for SMBs.

Source: Veridion

That’s four times more clients with verified, detailed data.

What changed?

Well, after implementing Veridion, they could automatically validate thousands of businesses with accurate classifications, firmographics, and operational insights without constant broker follow-ups.

Providers like Veridion go further by combining a company’s digital footprint with AI to deliver location-specific intelligence.

You get precise addresses, branch identifiers, and revenue and employee estimates for each site.

Source: Veridion

This visibility shows exactly what’s happening at every location. Is that address a production facility or just a headquarters?

The answer shapes your coverage decisions, such as whether product liability applies to manufacturing sites.

The bottom line is: business data platforms remove guesswork from your underwriting processes.

You get faster underwriting, more accurate quotes, fair pricing that reflects real risk, and fewer surprises at claims time.

Instead of chasing down proof of operations, you gain instant insight, knowing the data is solid.

Once you know what a business does, you need to measure what could go wrong.

That’s where risk assessment software becomes essential. These tools help underwriters quantify potential losses and compare coverage options using real data.

Risk assessment platforms analyze company locations, property characteristics, and historical claims data.

Many focus specifically on natural hazards, because unpredictable events can devastate a portfolio in the blink of an eye.

Even catastrophe modeling platforms like RMS and AIR Worldwide (acquired by Verisk Analytics in 2022) simulate earthquakes, hurricanes, and floods at specific locations to estimate probable losses.

So, instead of guessing exposure in a hurricane zone, you’re running scenarios with actual data.

Actuarial tools, on the other hand, work differently.

They use historical loss records and statistical models to forecast expected claims.

Many also support “what if” scenarios, such as modeling the financial impact if a fire damages a client’s largest facility.

Together, these insights support core underwriting decisions, including pricing, capacity limits, and portfolio balance.

They help identify overexposure by region, industry, or risk type.

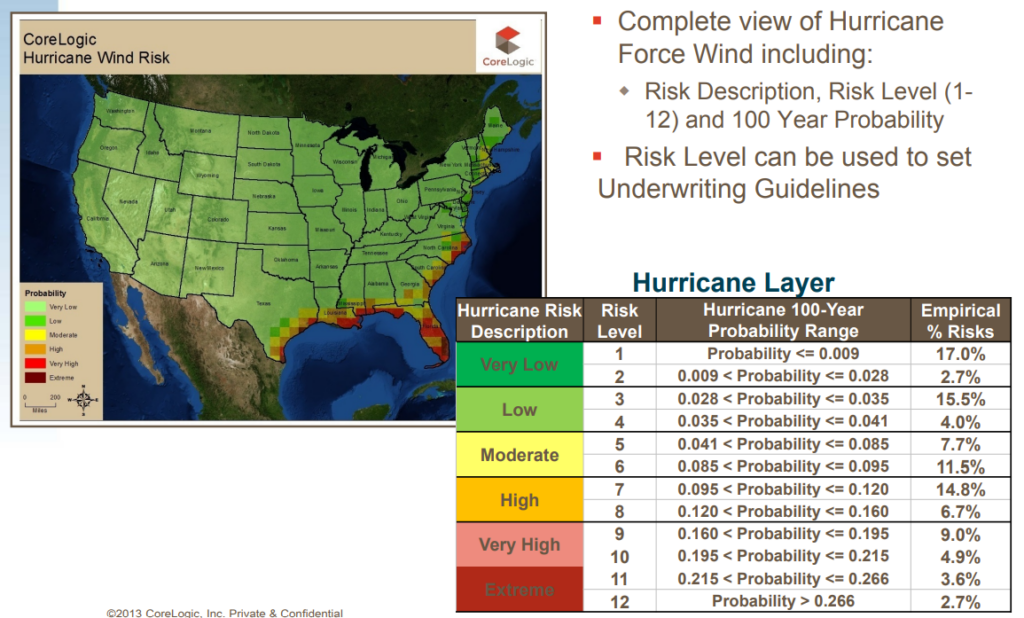

CoreLogic’s RiskMeter is a great example.

It delivers instant hazard risk data for properties, such as flood scores, wind risk, and earthquake exposure.

Underwriters get accurate, location-based risk determinations quickly.

Source: PIA

Applied Rater takes a different approach.

This cloud-based platform automates rate comparisons across multiple carriers by integrating hundreds of insurers’ rate filings.

Underwriters can generate and compare quotes in real-time without juggling manual spreadsheets.

Source: Applied Systems

Behind the scenes, insurers also depend heavily on catastrophe (CAT) models and actuarial software.

CAT models are critical for quantifying rare but severe events, because you can’t predict hurricanes or major earthquakes using simple trends.

Traditional actuarial methods fall short for these low-probability, high-impact risks.

Running your portfolio through an RMS or AIR model helps you estimate probable maximum losses, directly informing reinsurance decisions and capital allocation.

Actuarial software like SAS or Moody’s AXIS handles advanced statistical modeling of claims experience.

This helps refine pricing for casualty and specialty lines where patterns emerge over time.

Without this technology, underwriting becomes guesswork, leading to mispriced policies, portfolio volatility, and premium leakage.

Data-backed risk assessment software changes that. You price policies accurately, allocate capital wisely, and maintain a balanced portfolio.

Every premium reflects quantified risk, and every underwriting decision is backed by defensible data.

Beyond being good underwriting, that’s good business.

Underwriting doesn’t end when you bind a policy.

Risks evolve, markets shift, and unforeseeable events happen.

A company that looked stable six months ago may face entirely new exposures today.

That’s why continuous risk alerting tools are now essential. These platforms monitor your portfolio in real-time, flagging emerging threats before they become claims.

Platforms like Dataminr, Prewave, and Moody’s Early Warning Systems continuously scan news feeds, social media, financial signals, and other data sources.

They look for events that could affect insured businesses or their industries.

Such events include:

When something happens, you get instant alerts. That gives you time to adjust coverage, offer mid-term changes, or prepare for renewals.

Dataminr‘s insurance solution illustrates this well.

Its AI platform processes data from over a million global sources in real-time, delivering alerts on fires, cyber events, geopolitical crises, and supply chain disruptions.

Source: Dataminr

These alerts can feed directly into underwriting and catastrophe models, creating a more complete view of customer risk.

The payoff is refined pricing, strong stress testing, and earlier detection of potential business interruptions.

Say a political strike is brewing in a region where several of your clients operate.

Dataminr might flag it days in advance, giving you time to adjust terms for exposed accounts.

Prewave takes a similar approach but focuses specifically on supply chain and ESG risks.

The platform analyzes local news in multiple languages and tracks over 200 risk categories, including financial, ESG, labor disputes, and natural disasters.

Source: Prewave

This is important for underwriting because client risk doesn’t exist in isolation.

A manufacturer may appear stable, but if a key supplier faces labor strikes or environmental penalties, that risk travels downstream. Prewave helps reveal those hidden dependencies.

Take the case of this ESG monitoring.

A global insurer integrated Veridion’s ESG data to strengthen how it tracked non-financial risks across its commercial portfolio.

Source: Veridion

The insurer needed a scalable way to assess environmental exposure, labor practices, and governance risks at the individual company and location level, rather than relying on high-level ESG scores with limited operational context.

By using Veridion’s ESG dataset, built from verified business activity and location-specific signals, the underwriting team gained continuous visibility into ESG risk changes across thousands of insured entities.

This enabled earlier risk flagging, more informed renewal decisions, and closer alignment with internal sustainability goals.

Continuous monitoring tools transform underwriting from a point-in-time decision into an ongoing process.

Instead of waiting until renewal to discover that risk has evolved, you stay ahead of it.

You can recommend loss control visits when new exposures emerge and adjust terms mid-policy as conditions evolve.

The result is fewer surprises, stronger loss prevention, and premiums that reflect real-time risk. That’s what agility looks like in modern underwriting.

Insurance is a heavily regulated industry.

But what’s often underestimated is how much time underwriters lose manually tracking regulatory changes across states, products, and industries.

Regulatory compliance platforms remove that burden by automatically keeping you up-to-date on laws, licensing requirements, and industry regulations.

Every policy must meet legal requirements, and these tools ensure you don’t miss anything.

If new environmental rules affect an energy client, you’re alerted.

Updates to healthcare privacy rules? Flagged.

Changes to construction safety verifications? Covered.

The platform monitors regulatory changes and notifies you automatically, eliminating the need for constant manual research.

This is critical because underwriting a technically uninsurable or non-compliant risk can trigger serious consequences.

You might face policy rescissions, regulatory penalties, or claims that aren’t actually covered.

RegEd illustrates the value well.

Its compliance and licensing management tools are built for insurance and financial firms, automating license renewals and continuing education tracking.

Brokers and agents remain properly licensed, reducing the risk of unauthorized policy sales.

Source: RegEd

ComplianceGenius takes a different approach by delivering up-to-date regulatory guidance across insurance lines, with a strong focus on consumer protection and data privacy.

Source: Compliance Genius

It helps you manage compliance across multiple states and products.

The impact shows up in two key areas: efficiency and risk reduction.

On the efficiency side, compliance software eliminates manual research, freeing underwriters to focus on underwriting instead of hunting down regulatory requirements.

Turnaround times improve, and bottlenecks ease in tightly regulated sectors like healthcare, energy, finance, and construction.

On the risk reduction side, these platforms protect organizations from unintentional violations.

Every bound policy is admissible in its jurisdiction, and your business stands up under audit and demonstrates strong governance to regulators.

The result?

Fewer fines, fewer rescissions, and greater confidence.

Underwriting isn’t a solo activity. It’s a team effort.

You’re coordinating with sales teams, brokers, claims departments, and sometimes multiple underwriters on complex accounts.

Without the right system, critical details get buried in email threads or scattered across spreadsheets.

CRM systems solve this by centralizing all client and broker interactions in one place.

Submissions, renewals, follow-ups, meeting notes, emails, and tasks live in a shared system everyone can access.

This is why CRMs like Salesforce, HubSpot, and Zoho CRM are widely used in insurance.

Salesforce Financial Services Cloud is often customized for insurers, helping manage broker pipelines and identify cross-sell opportunities.

HubSpot CRM offers an intuitive way to organize client data and track interactions.

Source: HubSpot

And Zoho CRM adds insurance-friendly automation.

You can set up reminders for when brokers go quiet or trigger follow-ups at specific pipeline stages.

Source: Zoho

The efficiency gains are immediate: faster responses and better service quality.

But the value goes beyond just operational efficiency.

CRM data feeds analytics that support better strategic decisions.

Overall, a good CRM ensures underwriting decisions are made with full context and that your team collaborates smoothly toward closing deals.

Imagine trying to manage dozens of commercial submissions simultaneously, each with its own approvals, documentation, and pricing rules.

Without the right system, it’s chaos.

Underwriting workflow platforms bring order by automating the entire process end-to-end.

From submission intake to policy issuance, they keep work moving smoothly.

This kind of platform ingests submissions electronically and runs them through predefined underwriting rules.

It manages attachments, tracks decisions, and routes each case through the correct approval chain.

When you’re ready to bind, the software generates standardized policy documents and forms automatically.

These systems embed your business rules directly into daily workflow, so everyone follows the same process every time.

Guidewire and Insurity are leading solutions in this space.

Guidewire offers a comprehensive underwriting lifecycle suite designed to improve productivity and decision-making.

Source: Guidewire

Insurity‘s cloud-based system delivers similar benefits: automating tasks, enhancing collaboration, and providing insights through analytics.

What does this mean for your operation?

Let’s break it down:

| Speed | Routine checks that once took hours run automatically, accelerating submissions through the pipeline. |

| Consistency | Every underwriter follows the same rules and processes. New hires ramp faster within a structured system. |

| Scalability | As your book grows, you handle higher volumes without proportional headcount growth, while the system guides less experienced staff through complex decisions. |

| Auditability | Every action and decision is logged, creating a complete, defensible record for audits, reviews, or disputes. |

The result is faster turnaround times and lower operational risk across the underwriting function.

Applications, inspection reports, photos, contracts, endorsements, financials, correspondence, and addenda.

Multiply this across thousands of policies, and you have a massive organizational challenge.

Document management systems (DMS) solve this by securely storing and organizing everything in one searchable, centralized location.

But these platforms go beyond basic storage.

They provide version control, so you always use the most current policy forms.

Full-text search allows you to find documents by content.

And integration with e-signature tools enables digital signing, thereby speeding up approvals and binding.

In a regulated industry like insurance, DMS platforms are also compliance-friendly.

They retain records for required timeframes, maintain audit trails, and enforce secure access controls.

DocuSign is one of the best-known tools in this category.

While best known for e-signatures, it allows underwriters to securely sign, manage, and track documents electronically, streamlining approval workflows.

Source: DocuSign

Microsoft’s SharePoint is another commonly used solution, particularly for larger insurers with complex compliance needs.

It provides secure document storage, collaboration features, and workflow management, and is often used as a central repository for underwriting and policy documents.

Source: Microsoft SharePoint

When you need information, you can search by metadata or by the actual content inside documents.

This capability is essential during audits or litigation.

Regulators and legal teams may require instant access to signed applications, endorsements, and complete correspondence histories.

Without a DMS, teams scramble through archives and email threads, hoping to locate the correct version of a document.

With a DMS, retrieval is simple: search, access, done.

Version control is another huge benefit.

Everyone references the latest policy forms, eliminating the risk of outdated endorsements circulating in the workflow.

DMS platforms also let you document exactly what was provided to the insured, when it was signed, and who accessed it.

For underwriters, that means less time searching for files and more time underwriting. The reduction in operational and legal risk alone makes these systems a worthwhile investment.

Underwriting effectiveness depends on more than experience or intuition. It depends on access to the right intelligence at the right time.

From business verification and risk scoring to financial analysis, compliance checks, and real-time monitoring, each tool plays a role in reducing uncertainty across procurement decisions.

When these tools work together, underwriters can assess suppliers more efficiently, identify hidden risks earlier, and support procurement teams with greater clarity rather than caution.

Investing in the right underwriting tools means fewer surprises, stronger supplier relationships, and better leverage at the negotiating table.

The result is a procurement function that moves decisively, manages risk proactively, and supports growth without exposing the organization to avoidable losses.