9 Essential Sources of Market Intelligence

Key Takeaways:

Market intelligence doesn’t come from one place.

It comes from many.

The smartest companies combine internal data, frontline feedback, and external signals to get a sharper view of where the market is heading.

From customer service trends to regulatory updates and competitor activity, the right mix of sources helps you act early, reduce risk, and stay ahead of change.

Read on for a breakdown of the most essential sources to build smarter market intelligence.

Internal sources come from inside your organization: your teams, tools, and data.

They often provide early signals of change before the market makes them obvious.

They are fast to access, low-cost, and already available if you know where to look.

Sales teams are often the first to sense when something’s shifting in the market.

They hear buyer objections, new priorities, and repeated feature requests long before those signals show up in data dashboards.

For example, if more customers start asking about AI model transparency, your sales team might flag it as a growing concern.

You trace this back to upcoming regulations like the EU AI Act, which classifies certain AI applications like CV screening or automated hiring decisions as high-risk.

Hans-Petter Dalen, IBM’s Business Executive EMEA for WatsonX and embeddable AI, explains:

Illustration: Veridion / Quote: IBM

The law requires companies to meet strict transparency and accountability standards.

That kind of feedback tells you two things:

Buyers are becoming more cautious, and they may soon demand proof that your AI meets those requirements.

With that insight, you can act early, improve explainability features, prepare documentation, or train your sales team to answer AI compliance questions.

This positions your company ahead of competitors who missed the signal and stayed unprepared.

Intelligence can also come from analyzing your sales data.

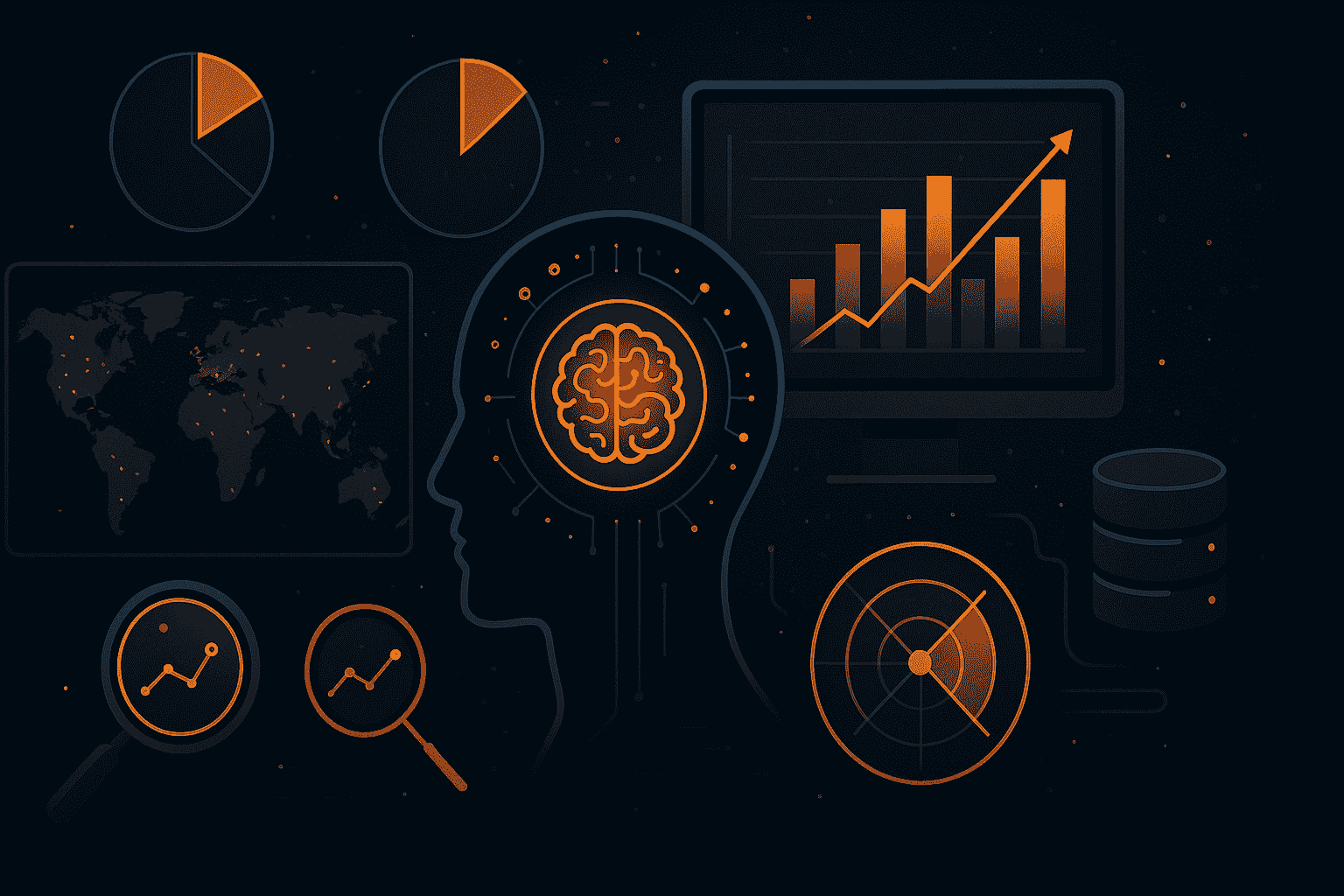

Take Bob’s Watches, an online marketplace for buying, selling and trading pre-owned watches.

They reviewed 15 years of sales transactions to uncover how Rolex resale prices evolved.

Source: Quill & Pad

Paul Altieri, founder and CEO of Bob’s Watches, explains the idea behind it:

“What really excites me about our 15-year report is that it’s built on actual sales, not estimates. We’ve mapped every peak, correction, and rebound, giving collectors the real data they need to plan their next move.”

Public guides often show asking prices or estimates, but they don’t reflect actual buyer behavior.

Internal sales data captures what people are really paying, making it one of the most accurate and actionable forms of market intelligence.

That’s something you can replicate by digging into your own data.

Patterns in volume, pricing, and customer segments often reveal more than surveys or press releases ever could.

Customer support teams are on the front lines of product experience.

They deal with complaints, questions, and feature requests every day.

If the same issue keeps coming up, say, customers struggling with setup or missing a key feature, that’s a signal that your offer may no longer fully meet market needs.

For instance, if more users start asking about connecting your product to a specific CRM, that could mean the CRM is gaining popularity, either with your current customers or even your competitors’ customers.

These patterns often surface well before sales notice a slowdown or marketing hears about changing preferences.

They can reveal three things early:

By acting on these patterns, product teams can prioritize smarter, marketing can speak to real pain points, and leadership can adjust strategy before competitors do.

Because this intelligence comes directly from your customers in real time, it’s one of the most useful sources of market insight.

Your internal operations don’t just reflect how efficiently your company runs.

They also reveal what’s happening in the broader market.

For example, if your procurement team starts seeing longer lead times or rising input costs, that might point to wider supply chain issues, perhaps driven by global demand spikes, new regulations, or regional disruptions.

Operational teams like procurement, logistics, and supply chain often detect these kinds of shifts before they show up in the news or financial reports.

That’s what happened at AGCO, the agricultural machinery manufacturer behind brands like Massey Ferguson and Fendt.

When COVID-19 disrupted global supply chains, AGCO’s internal teams stayed in close communication across regions.

As Greg Toornman, then VP of Global Materials, Logistics, and Demand Planning, explained in a Forbes interview:

“The supply side of our global organization talks at least once every week. Our global leadership team (Global and Regional) and front-line reporting employees in each region align on activities, supply escalation, initiative implementation, and performance. We talk about what we are hearing from suppliers and customers.”

Because of that internal coordination, AGCO spotted issues early and was able to adjust inventory, reroute shipments, and avoid major delays, while many competitors were still scrambling to respond.

This example shows how closely monitoring your internal operations can give you a head start.

Internal operational intelligence helps you detect external changes before they become obvious and act faster than the rest of the market.

External sources of market intelligence include insights about the market, competitors, and customers from information published outside the company.

Here are the five sources to watch closely.

Analyst reports, white papers, and market studies help you understand what’s happening in your market, and where it’s going next.

They can confirm what you’re already seeing, or highlight risks and opportunities you might’ve missed.

Research from companies like McKinsey, Gartner, IBISWorld, Statista, and Forrester often includes benchmarks, market forecasts, customer insights, and competitive breakdowns that would be time-consuming or expensive to gather yourself.

Source: IBIS World

If you’re planning a product launch, market entry, or investment, these reports give you a faster, more confident starting point.

They also track emerging technologies, regulatory shifts, or geopolitical factors that could reshape your industry.

For example, the 2024 Reshoring Initiative Annual Report showed that U.S. companies announced 244,000 manufacturing jobs through reshoring and foreign direct investment.

Source: Reshoring Initiative

That kind of insight signals where demand is moving, which industries are investing, and what might be changing in your supplier base.

A manufacturer or logistics provider reading that report could use it to adjust site selection plans, explore new service offerings for high-tech clients, or reevaluate exposure to offshore suppliers.

Even broader trends, like workforce shortages or rising tariffs, become decision-making inputs when they’re backed by data like this.

News and media outlets are one of the fastest ways to detect changes in the market.

They’re often the first to report on regulatory decisions, competitor moves, funding rounds, product launches, and broader macroeconomic shifts.

For example, the Financial Times flagged rising shipping costs and Red Sea disruptions in early 2024, which were a leading signal for supply chain stress.

Source: Financial Times

In the automotive sector, for instance, Automotive News covers raw material shortages and regulatory updates in EV production.

Source: Automotive News

If your business touches any part of the auto value chain, knowing about shifts in battery sourcing or emissions rules ahead of time can influence everything from pricing strategy to supplier selection.

Some other sources to monitor include:

It’s also worth looking beyond your immediate sector.

Adjacent industries often serve as leading indicators.

For example, if you provide packaging, then shifts in retail like new sustainability mandates or direct-to-consumer trends will eventually shape your requirements.

If you work with clients in agriculture, climate policy or subsidy changes reported in the news can affect their investment cycles and purchasing priorities.

Macroeconomic trends shape the backdrop against which all business decisions are made.

Data on interest rates, inflation, employment levels, GDP growth, and commodity prices influence everything from customer demand to input costs and investment timelines.

These indicators are especially useful when you’re trying to anticipate market conditions before they show up in your sales pipeline or supplier behavior.

The sources of this intelligence are public and published regularly.

Some of them include:

Market-facing platforms like Trading Economics, Bloomberg, or Reuters often compile, contextualize, and visualize economic indicators, making them easier to monitor over time.

By checking these sources routinely, procurement and strategy teams can make more informed planning, hedging, and pricing decisions.

Unlike economic data, competitive intelligence is often pieced together from public but scattered sources, including:

While these sources are valuable, the more strategic insights often come from reading between the lines.

For example, a competitor’s job postings might suggest new product development or regional expansion.

Patent filings can signal where a company is investing in R&D.

Even real estate or logistics news, like a competitor leasing warehouse space near a key port, could point to a push into faster delivery or export markets.

Experts like Robin Riviere, VP of Enterprise BD Analytics & CRM at SAIC, point out that effective competitive intelligence requires digging deep into various units of a competitor’s organization:

Illustration: Veridion / Quote: ArchIntel

In other words, effective competitive intelligence means going beyond the headline and understanding why a competitor is making a move, and what that move means in context.

Done well, this helps you anticipate their next steps, refine your own strategy, and identify opportunities they might overlook.

New laws and policy changes can reshape entire markets, from how products are built to how they’re sold.

But the most useful intelligence often comes before those rules are finalized.

That’s why experienced market watchers track regulatory signals at every stage:

This way, companies can adjust product plans, messaging, and compliance efforts before the market catches up.

Now, what are the actual sources of regulatory intelligence?

Here are some of them:

For example, if you spot that an ESG disclosure mandate is entering consultation, you can start preparing your reporting frameworks early.

Or if a proposed ban on PFAS chemicals is under review, you can begin risk-mapping affected materials and suppliers.

By the time competitors respond to the final rule, you’ve already moved.

Even when you know which sources to track, the real challenge is scale.

Gathering and analyzing this intelligence manually, continuously, and from dozens of places quickly becomes unmanageable.

This is where specialized tools come in.

They consolidate data from a wide range of external and internal signals, organize it by use case, and often, they do it with the help of AI.

Big data platforms like Veridion are built for this kind of work.

Veridion tracks over 134 million companies globally and enriches each profile with more than 220 attributes.

Source: Veridion

Veridion sources its data from publicly available and first-party sources, including company websites, registries, regulatory filings, product catalogs, and news outlets.

Its proprietary engine continuously verifies and enriches this data using AI models to ensure accuracy and relevance.

The data spans from ESG policies to technographic stacks, operational footprints, and compliance signals and is refreshed weekly, giving you a living view of the market.

For market intelligence teams, this means faster and more nuanced segmentation, better risk models, and earlier trend detection.

Veridion’s use cases span across business functions:

| Analytics | Company data enrichment; update, validate, and complete company records | Ensures clean, deduplicated datasets for accurate analysis |

| Investment Research | Thematic research and market sizing | Identify growth-stage firms in niche sectors (e.g., tissue chip industry) |

| Deal Sourcing | Discover hard-to-find companies in specific niches | Doubles the speed and quality of building high-potential deal pipelines |

Here are some of the concrete results companies achieved with Veridion’s market intelligence:

In short, Veridion turns a fragmented data landscape into a single source of structured intelligence for faster, smarter decisions.

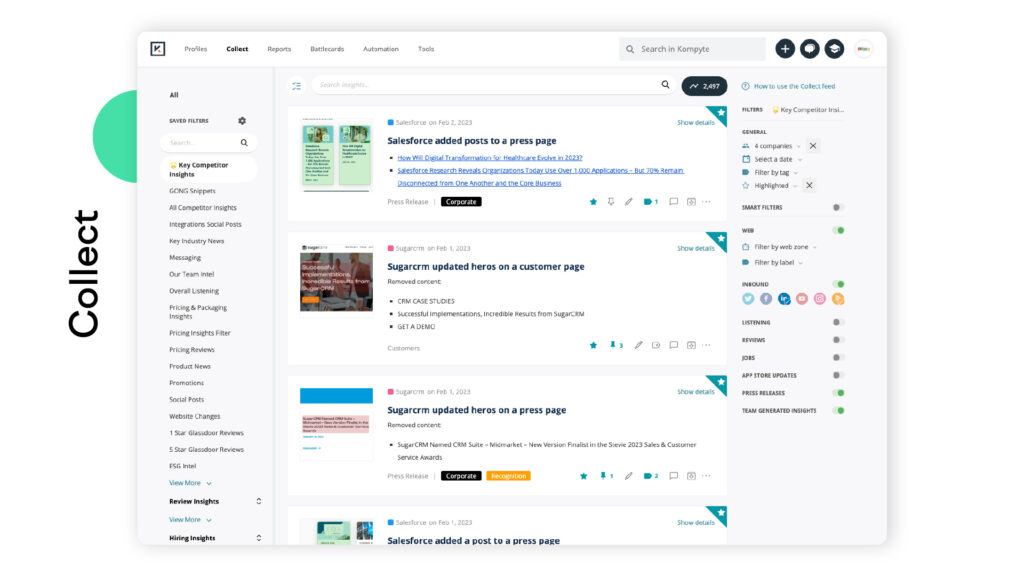

Next, there are specialized competitive intelligence tools like Crayon, AlphaSense, Kompyte, and Klue.

They scan public and private signals, like press releases, executive interviews, hiring trends, policy news, and more, to deliver real-time monitoring of competitors and adjacent markets.

Source: G2

CI tools can also spot patterns and notify you when something meaningful shifts, whether it’s a regulatory change or a competitor launching in a new region.

Whether you’re refining segmentation, tracking key accounts, or preparing for a new product launch, specialized sources like these give you the clarity and scale that manual methods can’t match.

Market intelligence is more than news and reports.

It’s the full picture you get by combining internal signals, customer trends, external data, and specialized tools.

Each source fills a different gap.

Together, they help you move faster, plan smarter, and make confident decisions before your competitors do.

The real advantage is in knowing where to look for data and what to do with it.