What to Look for in a Market Intelligence Tool

Key Takeaways:

Markets shift faster than ever, and if you are in procurement, strategy, or investment, you know how difficult it can be to keep track of the companies and trends shaping your decisions.

A market intelligence tool is, therefore, no longer a “nice to have,” but a necessity.

The challenge, however, lies in choosing the right one.

And that means looking beyond the surface to see whether the tool gives you visibility, accuracy, and speed where you need it most.

Read on to see what a market intelligence tool needs to have to deliver these results.

A strong market intelligence tool should cover a wide range of companies, from global corporations to SMEs and niche startups.

If your intelligence only shows you the world’s largest corporations, you miss the smaller players where innovation, disruption, or supply risk often begins.

Traditional databases do a good job of capturing the well-established names everyone already knows.

But most opportunities and risks hide in small, specialized, and emerging companies that are harder to track but often more relevant to sourcing, partnership, or competitive research.

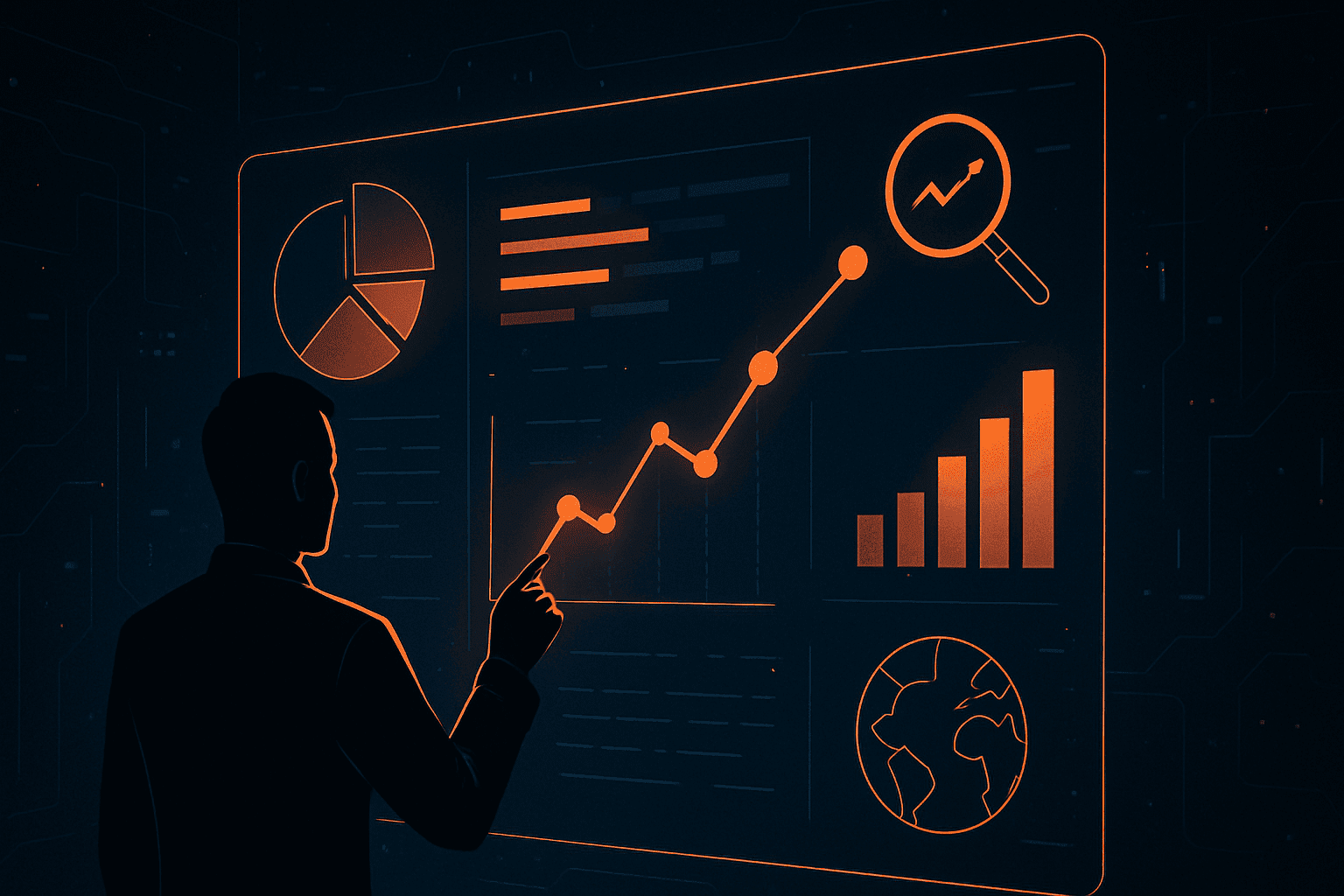

In fact, research shows that SMEs generate 50–60% of value added globally and are often the source of disruptive innovation.

Moreover, SMEs represent around 99% of all firms across OECD countries.

Illustration: Veridion / Data: OECD

Imagine sourcing for a new supplier category and only finding the same ten predictable options, while your competitor discovers an agile niche startup with a breakthrough product.

That is the risk of limited coverage.

That’s why comprehensive company coverage is a non-negotiable feature in any market intelligence tool.

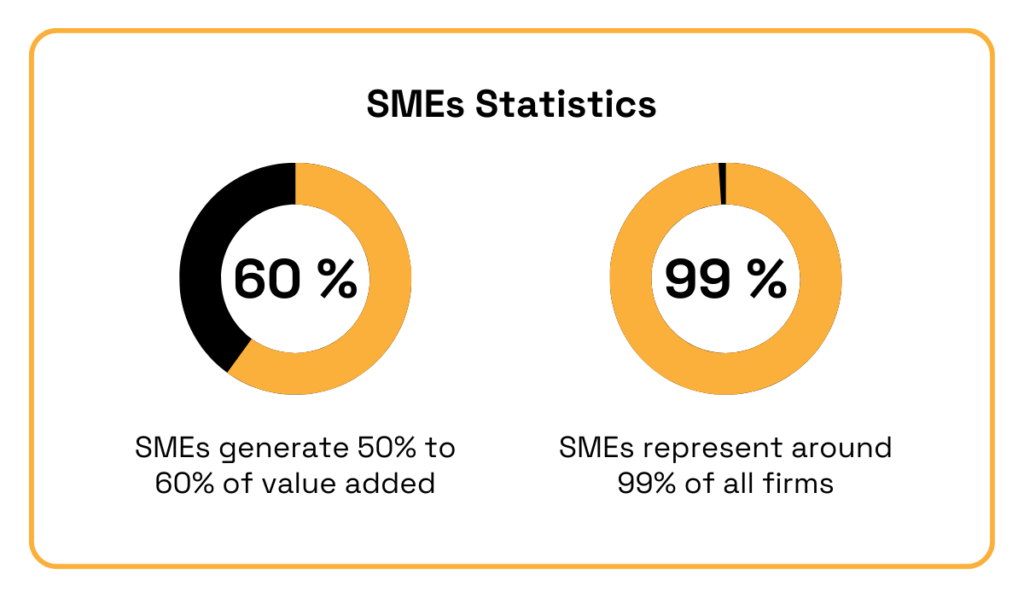

Veridion, for example, maps more than 130 million companies worldwide, including the long tail of specialized and emerging firms that most databases miss.

Source: Veridion

With this breadth, you gain a balanced view of your market, seeing both the giants and the hidden players that can reshape the landscape.

But the breadth of company coverage only matters if the underlying data is trustworthy.

A market intelligence tool that draws from a narrow set of sources risks showing you an incomplete or outdated picture.

For example, if a supplier’s website hasn’t been updated in years, relying on it alone might make you think the company is still active when, in reality, it has quietly shut down.

Strong MI tools, on the other hand, collect intelligence from multiple, verifiable sources and then validate that information.

The sources include:

The more diverse the sources, the less likely you are to base your decisions on a single outdated or biased stream of data.

Veridion, for instance, uses advanced crawling systems and proprietary aggregation engines to continuously capture company data from these sources, feeding it through AI-driven verification models.

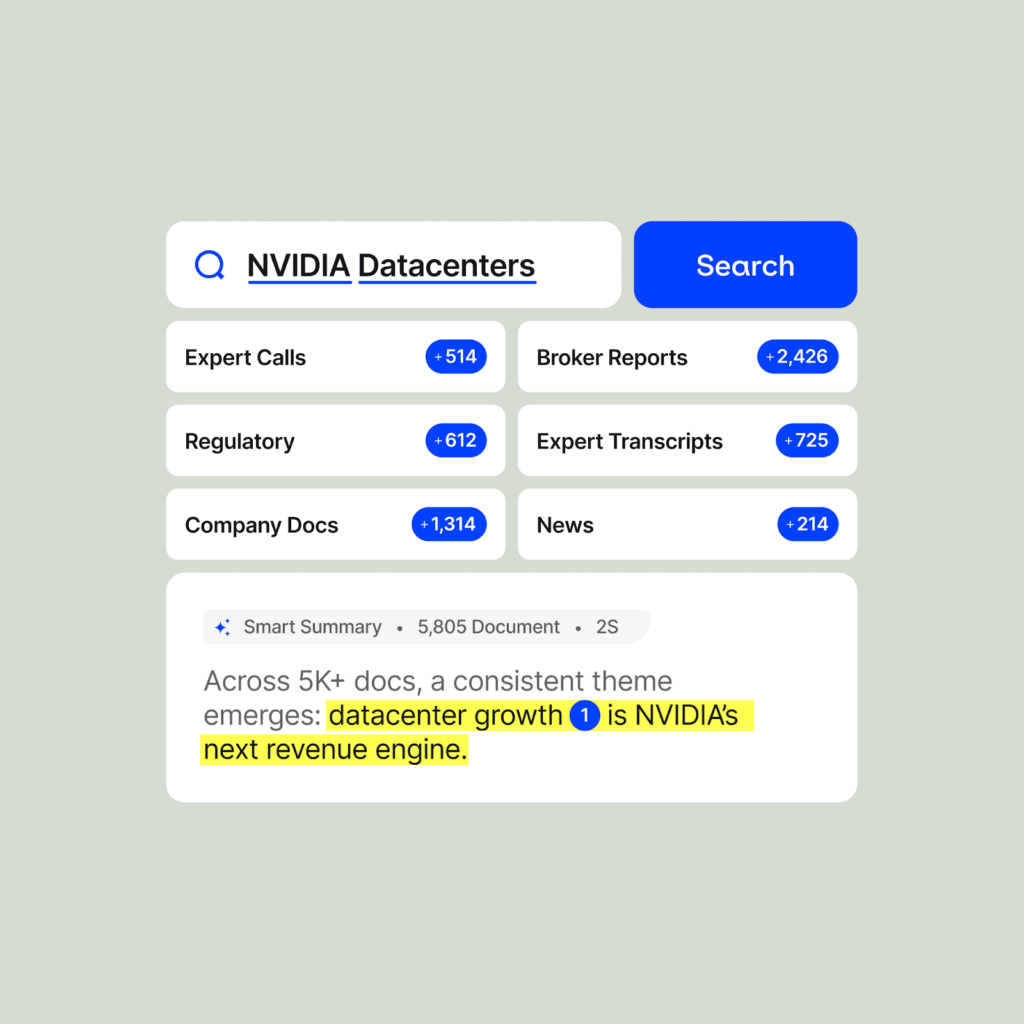

Similarly, AlphaSense—another MI tool—aggregates data from over 10,000 sources, including expert calls, analyst research, and company filings.

The point is that quality depends on diversity.

The more original and verifiable the sources, the more you can trust the intelligence.

If your tool cannot answer where the data came from and how often it is refreshed, you may end up making decisions on shaky ground.

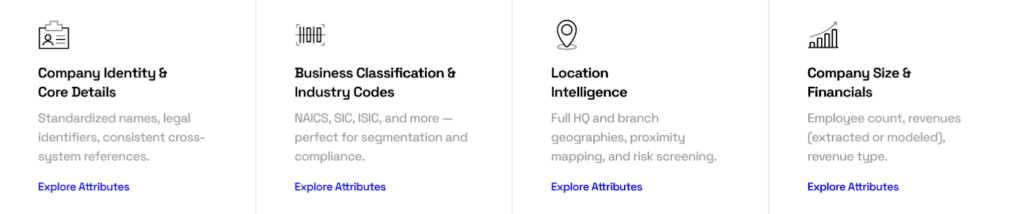

A market intelligence tool is only as good as the detail it provides.

Raw company data, like names, addresses, and websites, doesn’t tell you much about how markets are structured or where opportunities and risks truly lie.

Data enrichment is what transforms static records into actionable intelligence.

A well-enriched company profile doesn’t just say where a company is located, but what role that location plays: is it a factory, a logistics hub, or just a sales office?

It tells you whether the site is active or inactive, who owns it, how it fits into a larger corporate group, and whether it carries certifications or risk exposures.

This depth is what makes enrichment a critical feature in a market intelligence tool.

It allows you to:

| See structure | Understand ownership links, subsidiaries, and parent groups that shape competitive and supply landscapes. |

| Gauge scale | Use enriched signals like employee counts and revenue indicators to size companies and markets accurately. |

| Assess resilience | Track certifications, operational status, and proximity to risk zones to spot vulnerabilities before they disrupt your plans. |

| Spot opportunities | Identify niche players with growth signals, such as recent funding or rapid hiring, that might otherwise go unnoticed. |

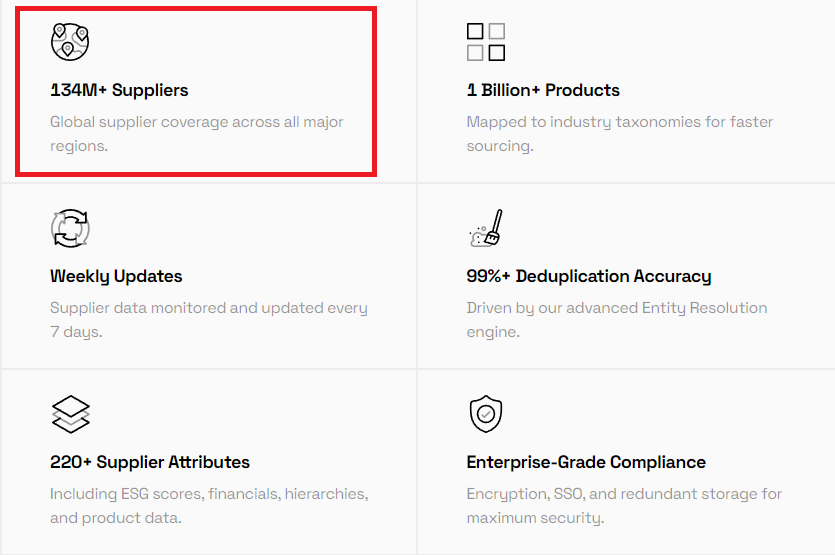

Veridion enriches company profiles with more than 220 attributes, covering firmographics, operations, financial proxies, certifications, and geographic markers.

Source: Veridion

That’s why its datasets don’t just map companies, but entire ecosystems.

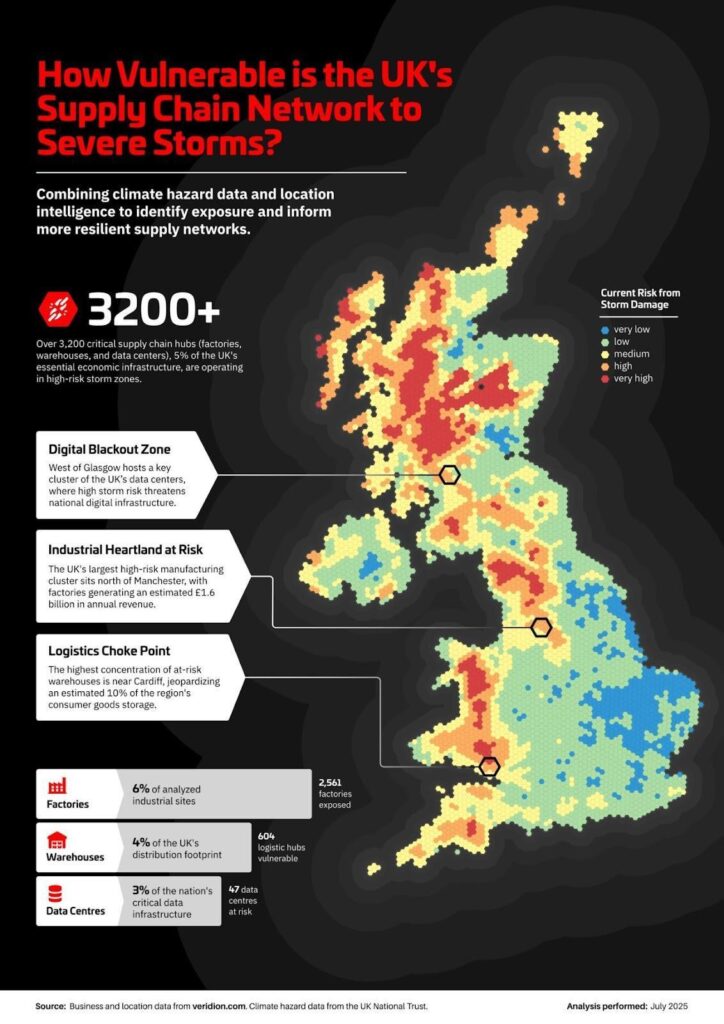

Consider our recent analysis of the UK supply chain.

By overlaying storm hazard data on 67,000 company sites, Veridion revealed that over 3,200 critical infrastructure locations, including factories, logistics hubs, and data centers, sit in high-risk zones.

Source: Veridion on LinkedIn

Without enrichment, this would have been just a list of addresses.

With it, it became a map of market vulnerabilities that decision-makers could act on.

All in all, a market intelligence tool without enrichment leaves you with raw data.

One with it gives you foresight.

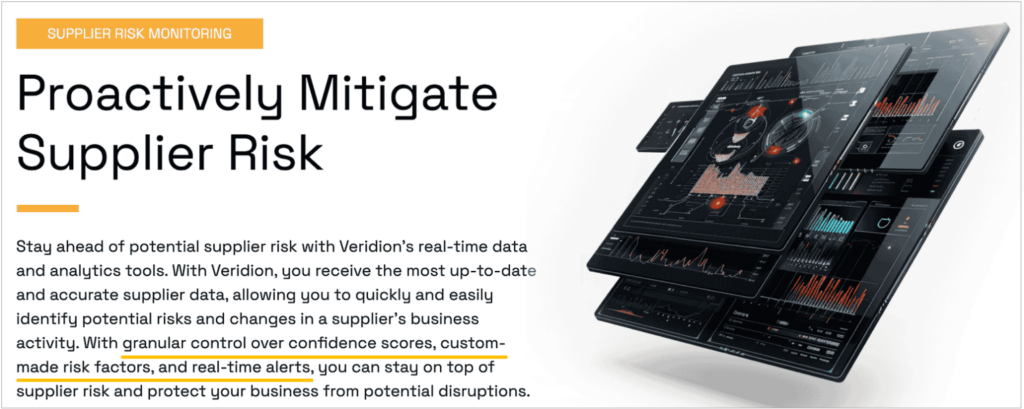

Markets don’t stand still, and neither should your intelligence.

A supplier may lose a certification overnight, a competitor may launch a new product line, or a startup might announce funding that signals a wave of growth.

If your market intelligence tool updates monthly, or worse, annually, you risk making decisions on data that is already outdated.

That’s why a MI tool should regularly update intelligence and ensure you’re working with information that reflects the present, not the past.

The impact is immediate across three dimensions:

| Risk management | If a critical supplier loses an environmental certification this week, you need to know now, so you can source alternatives before disruption hits. |

| Opportunity capture | Spotting a competitor’s expansion or a startup’s funding round in near real-time gives you a head start in responding. |

| Data trust | Frequent refreshes increase confidence that the insights you base your strategy on are accurate and current. |

Veridion continuously crawls billions of web pages and refreshes company profiles on a weekly cycle, far exceeding the industry norm.

Beyond refreshing, it also flags significant changes, such as controversies, ownership updates, or operational shifts, so that you’re alerted to events that matter, not just overwhelmed with raw updates.

Source: Veridion

The lesson?

Market intelligence is only as good as its timing.

With timely data, you can respond to risks and opportunities as they unfold, often before your competitors even notice.

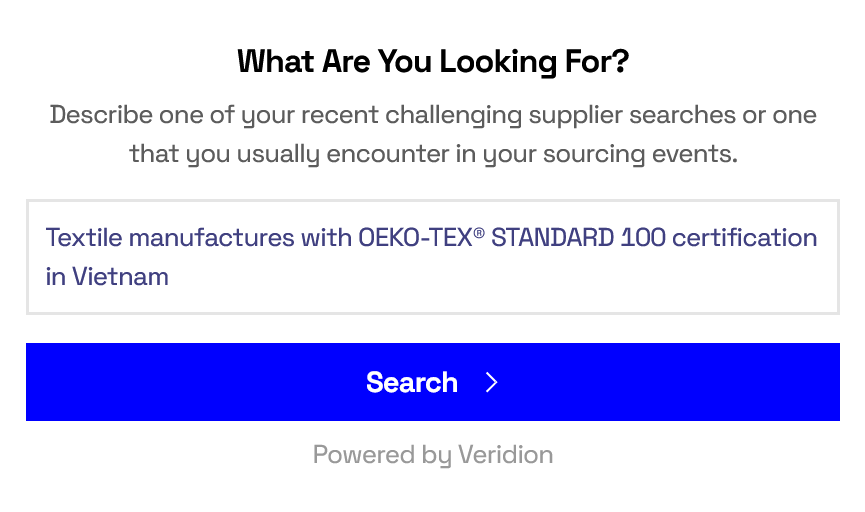

Another critical element is how easily you can search and shape the data to answer your own questions.

Standard industry codes like SIC or NAICS are blunt instruments—too broad to capture the nuances of real markets.

What if you need to identify “growth-stage EV battery recyclers in Asia” or “suppliers of tissue-chip technology for medical research”?

A strong market intelligence tool allows you to move beyond generic codes, building custom taxonomies and thematic queries so you can define industries and markets on your own terms.

Veridion supports this with advanced filters and natural language processing via Scout that let you query millions of company profiles with both precision and simplicity.

Source: Scout

Instead of forcing your analysis into rigid classifications, the tool adapts to the way you think.

This makes market intelligence more actionable for procurement teams sizing niche categories, strategy teams mapping fast-evolving sectors, and investment groups tracking emerging technologies.

In short, the value of market intelligence lies not just in the volume of data, but in how easily you can interrogate it to get the answers you need.

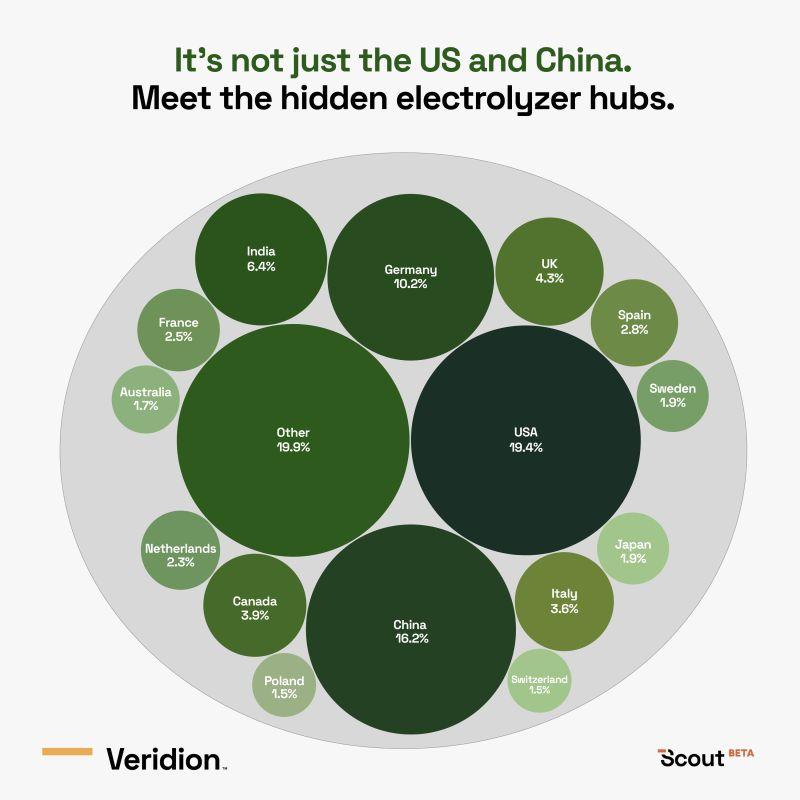

Sizing markets and understanding their geographic spread is often the heart of strategic planning.

Whether you are considering entering a new region, assessing supplier distribution, or estimating growth potential, you need a tool that goes beyond company lists and provides geographic and market sizing analysis.

Without it, you are left guessing how big an opportunity truly is, or where the risks are concentrated.

With company-level data and global filters, Veridion enables you to build detailed market maps and estimate market sizes with accuracy.

The electrolyzer market offers a vivid example.

As global demand for green hydrogen accelerates, the market is forecast to grow from $7.6 billion in 2025 to more than $180 billion by 2032.

Veridion’s analysis shows the U.S., China, and Germany leading in supply, but also highlights nearly 20% of suppliers located in smaller markets such as the Netherlands and Poland that are often missed in broad datasets.

Source: Veridion

For procurement, this means being able to diversify beyond major hubs, map supplier risks by geography, and track smaller innovators as they scale.

With this kind of intelligence, you avoid overreliance on just a few regions and instead position your sourcing strategy where growth and resilience intersect.

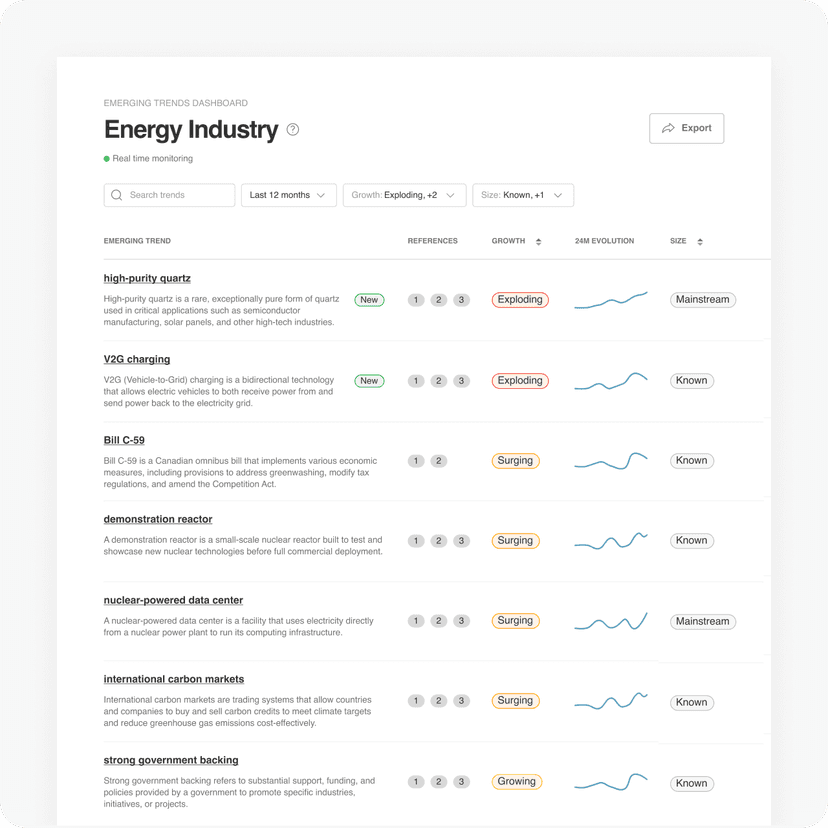

Equally valuable is the ability to detect weak signals or the early indicators of emerging trends that most competitors miss.

These signals might be subtle shifts in consumer demand, small changes in supplier behavior, or new product categories just beginning to take shape.

Early trend detection is, therefore, another core feature of any market intelligence tool.

Platforms like Nextatlas specialize in this kind of detection, combining AI-driven algorithms with expert interpretation to identify the whispers of change before they become mainstream trends.

As Luca Morena, CEO of Nextatlas, explains:

Illustration: Veridion / Quote: Market Logic

For you, this means catching risks and opportunities earlier, whether it’s a supplier entering a controversial ESG spotlight or a new niche technology gaining traction.

Some market intelligence platforms like Feedly also provide dashboards dedicated to emerging trends, helping you track shifts in real time.

Source: Feedly

Staying ahead of these signals is what allows organizations to adapt faster than others, and in competitive markets, speed is often the deciding factor.

Finally, no matter how advanced the features, a tool only delivers value if it fits into your daily work.

Market intelligence should flow seamlessly into your CRM, sourcing platform, or analytics system without extra effort from your team.

If it doesn’t, much of its value is lost.

In fact, 64% of CMOs cite disconnected data as a major barrier to getting full value from intelligence.

Illustration: Veridion / Data: NIQ

That’s why integration features should be a priority:

For instance, Veridion’s API-first design allows enriched company data to move directly into CRMs, BI dashboards, or sourcing platforms such as Market Dojo.

Source: Veridion

For procurement, this means supplier discovery and monitoring can happen directly inside the tools you already use.

For strategy and investment teams, it ensures insights are accessible where decisions are actually made.

The more natural the integration, the less friction your team experiences, and the more likely they are to act on the intelligence provided.

Choosing a market intelligence tool is not about chasing every feature but about making sure the fundamentals are strong.

Focus on coverage, data quality, timeliness, flexibility, trend detection, and seamless integration.

When those pieces are in place, you gain more than information: You gain foresight, accuracy, and confidence in your decisions.

And in a business environment where speed and clarity determine success, that is what sets the best tools apart.