5 Types of Market Intelligence You Need to Know About

Key Takeaways:

The world doesn’t slow down to let you catch up.

Competitors launch new products. Technologies appear overnight. Customer needs shift. New regulations drop.

So, if you want to make the right moves and stay competitive, you need more than instinct and gut feel. You need facts.

About your market, your competitors, your customers, and the forces shaping them.

That’s what market intelligence is for. And there are five types you can’t afford to ignore.

You’ve probably heard the saying, “Keep your friends close, but your enemies closer.”

And while competitors might not be your enemies in a literal sense, you are ‘fighting’ for the same things:

So keeping an eye on competitors and knowing as much as possible about their activities puts you in a much better position to outcompete them—or at least stay in the game.

That’s what competitive intelligence is for.

Competitive intelligence (CI) is the process of gathering, analyzing, and using competitors’ information to understand their strengths and weaknesses so you can find opportunities to gain a competitive advantage and get ahead.

What’s considered information?

Well, everything:

Basically, any move that your competitor is making, you want to know about it—no matter if it’s something as small as a new job listing, or something as big as a change in leadership.

And remember, although some data points might feel unimportant, they can still matter. A lot.

As Peter Mertens, Director of Market Strategy at Sprout Social at the time, put it:

Source: Sprout Social

There are two types of competitive intelligence.

Strategic competitive intelligence focuses on the long game.

It helps you understand big-picture trends, like new technologies, shifts in customer preferences, or regulatory changes, and can be used to spot long-term risks or opportunities that could change your market position drastically.

Tactical competitive intelligence, on the other hand, is more short-term and deals with the here and now. It helps you optimize pricing, positioning, and messaging based on what others are doing at this moment.

Both are useful. But only when used proactively.

Unfortunately, or fortunately, depending on how you look at it, many companies only use competitive intelligence to justify decisions they’ve already made.

They cherry-pick data that supports it, and ignore what doesn’t.

That’s not intelligence. That’s confirmation bias. And it’s a huge mistake.

Philip Tetlock, in his best-selling book ‘Superforecasting’, wrote it well:

Illustration: Veridion / Quote: Superforecasting

You don’t want that; you want to do what the smart ones do and use it before decisions are made.

Take airlines, for example.

They constantly monitor each other’s ticket prices, and when one drops the price, others usually follow quickly.

That’s CI in action.

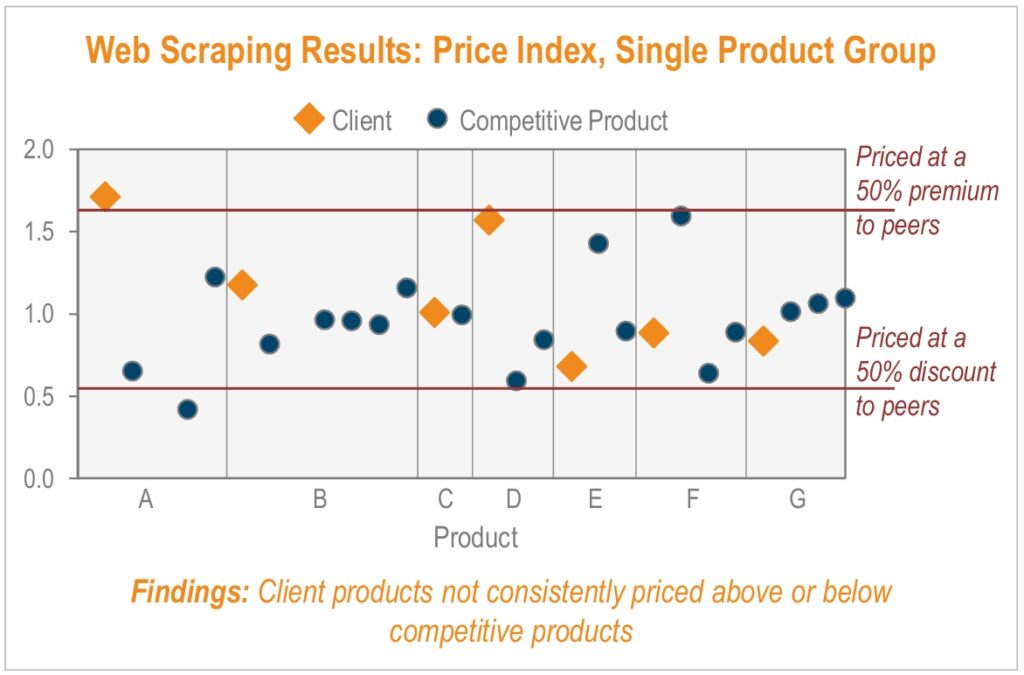

Or take a look at a case study from Insight2Profit.

One industrial chemicals supplier thought their prices were too high compared to competitors, so they partnered with Insight2Profit to validate the assumption.

The team ran distributor interviews, surveyed 200 buyers, and scraped pricing data from six major distributors.

Here’s what they found:

Source: insight2profit

The result?

They were able to raise prices without worrying about losing customers.

Without competitive intelligence, they might’ve gone the other way and left money on the table.

But that’s the power of solid intel. It clears the fog. It gives you confidence. And it keeps you one step ahead.

In business, everything revolves around customers.

And yet, most companies know far more about their product than they do about the people and businesses they’re selling it to.

They can list every feature, walk you through every roadmap item, and explain every technical detail.

But when it comes to understanding who’s actually buying, what they care about, how those companies make decisions, what their current tech stack looks like, or why they’d switch to someone else, they’re often guessing.

That’s the gap account intelligence helps close.

Account intelligence is the process of collecting, organizing, and analyzing all relevant data about your potential and existing customers.

This includes:

Put simply, it’s everything you can legally and ethically know about your customers, without them telling you directly.

Now, before we go any further, it’s important to make one distinction.

You’ll often see account intelligence and customer intelligence used interchangeably, and while they’re related, they’re not the same.

Customer intelligence typically refers to insights at the individual level, like demographics, behavior, needs, and preferences.

Account intelligence, on the other hand, refers to insights at the organizational level, because in B2B, the company—also called the ‘account’—is the actual customer.

Here, the decision maker isn’t one person. It’s a buying committee, which usually involves 5 to 11 people.

Illustration: Veridion / Data: Gartner

So no, you’re not just targeting “Sarah from IT.” You’re targeting the entire account. And that requires a deeper, more layered understanding of the whole company.

For that, you need account intelligence. Not only does it help you understand your account, but it also gives you signals.

Maybe a company just hired a new CIO. That often means new systems, new tools, and new vendors. Maybe they raised funding and are now scaling fast. Or maybe they’ve started hiring heavily in a department your product directly supports.

Whatever the signal is, account intelligence helps you catch it early and focus your efforts where they’ll count the most.

This means prioritizing the right accounts and segmenting them based on what’s actually happening inside those businesses, not just surface-level data.

And once you know who matters and why, it becomes a lot easier for every team to do their job better.

Marketing gets to aim instead of spray. They know which companies to reach out to, when, and with what message.

In fact, 80% of companies that use market segmentation report increased sales.

Illustration: Veridion / Data: Emergen Research

In such cases, sales teams start showing up to conversations with context. They know who they’re talking to, what’s changing inside that company, and why that change matters.

And customer success doesn’t wait for problems. They act early, while they still have a shot at keeping the customer.

All of this leads to the thing that matters most for your company: more revenue.

If you look around online, you’ll notice product intelligence is one of those terms everyone defines a little differently.

Some say it’s about how people use and see your product. Some say it’s about how people use and see your competitors’ products. Others add product performance to the mix.

The point is, there’s no single agreed-upon definition.

So let’s bring some clarity.

You see, no matter what type of intelligence we’re talking about, the goal is always the same: Helping you find opportunities for improvement.

Looking at it from that lens, we can logically conclude that if you want to find as many opportunities as possible, you need the fullest view you can get. Your data. Competitor data. And a lot more than just usage, perception, and performance.

So the ‘right’ definition would be:

Product intelligence is the process of gathering, analyzing, and leveraging data about your own and your competitors’ products, covering everything from the ecosystem to the lifecycle.

Done right, this gives you a side-by-side view of where you stand and how the rest of the market stacks up.

| Focus Area | Your Product | Competitor’s Product |

|---|---|---|

| Feature Set | Which features are used most, which are underused, which need improvement | Which features they have that you don’t, and which ones are their biggest selling points |

| Usage | How customers use each feature, common workflows, drop-off points | How customers seem to use it (from public data, reviews, case studies, demos) |

| Performance | Speed, reliability, downtime, bug frequency, scalability | Reported performance issues, benchmarks from third-party testers, downtime incidents |

| Customer Feedback | Reviews, NPS scores, support tickets, direct interviews | Public reviews, social media mentions, analyst reports, user forums |

| Pricing & Packaging | Current pricing model, customer response to it, conversion rates | Their pricing model, tiers, free trials, discounts |

| Roadmap | Planned features, releases, beta programs | Announced updates, hints from job postings, press releases, or early user chatter about new features |

| Market Positioning | How you want to be seen vs. how you’re actually perceived | How they present themselves vs. market perception |

Once you have that level of visibility, the possibilities open up fast.

You can build features customers will use because you know what they value, where they’re struggling, and what competitors aren’t delivering.

You can also spot friction points and remove them, improve performance where it matters most, and make sure your roadmap reflects what customers truly want.

When you do both, ship what matters and make it work seamlessly, customer satisfaction goes up.

And that fuels everything else.

Retention, as satisfied customers stick around longer, LTV, because they stay longer and are easier to upsell and cross-sell, and customer acquisition, since happy customers are the best marketing channel.

In fact, according to the Trust in Advertising Survey, 88% of global respondents trust recommendations from people they know more than any other marketing channel.

Illustration: Veridion / Data: Nielsen

Speaking of getting more customers, product intelligence also gives marketing and sales the intel they need to win more often.

Marketing gets better insights, so they can shape positioning around what actually matters to customers and run more effective campaigns. Sales gain a deeper understanding that helps them handle objections, show why your product is the better choice, and close more deals.

As you see, when product intelligence is embedded into the way you build, market, and sell, every part of your business gets better.

Supply chains have always been complex.

But in the last few years, global disruptions, rising costs, stricter ESG requirements, and geopolitical instability have pushed that complexity to a whole new level.

That means every decision you make now carries far more weight, simply because the cost of a wrong call has never been higher.

And when the stakes are that high, you can’t afford to rely on assumptions, guesswork, or outdated and incomplete data.

You need information you can trust—clear, complete, accurate, and up to date.

As Matt Palackdharry, founder of Kinetic Brands and former VP of Sales and Commercial Strategy at TealBook, put it:

Illustration: Veridion / Quote: TealBook

And that’s what procurement intelligence gives you.

Procurement intelligence is the process of gathering, analyzing, and using data on suppliers, vendors, markets, products, and industry trends to make better sourcing and purchasing decisions.

It covers everything from supplier financial stability and ESG compliance to operational capacity, ownership structures, market activity, and risk indicators.

Basically, it pulls in everything you need to see the full picture before you choose, negotiate with, or continue working with a supplier.

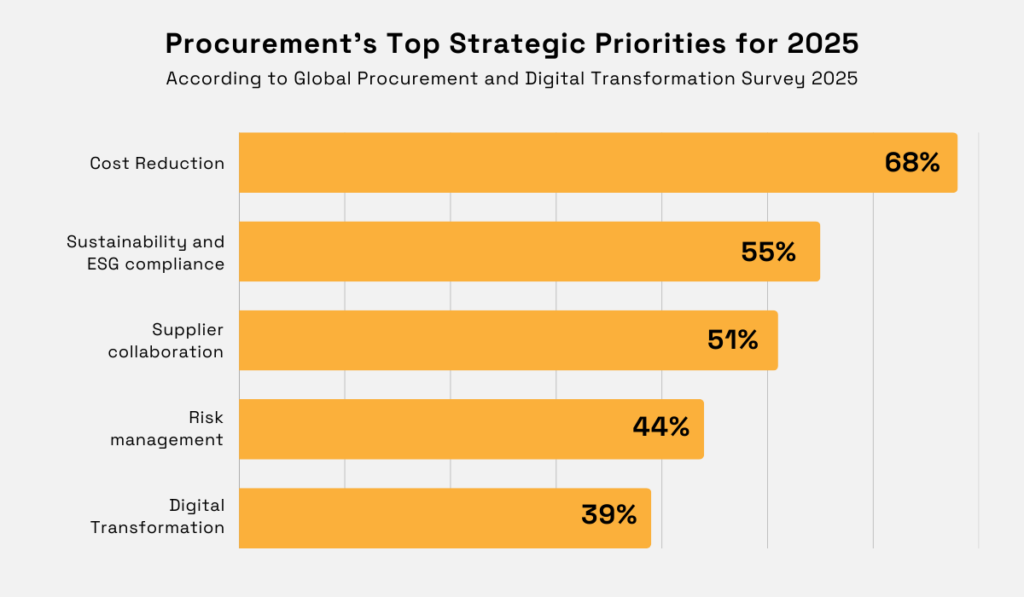

And when you look at the biggest priorities in procurement today, it’s clear why this matters.

According to Deloitte’s 2025 Global Chief Procurement Officer (CPO) Survey, the number one priority for CPOs this year is cost reduction.

Illustration: Veridion / Data: Deloitte

As shown, 68% of respondents said cost reduction is their top focus, followed by sustainability and ESG compliance.

Procurement intelligence supports these priorities by giving you the hard data you need to negotiate better, identify more competitive suppliers, and uncover hidden inefficiencies that drive costs up.

You can also track ESG performance across your supplier base, spot gaps before they turn into compliance issues, and make sure every new vendor aligns with your sustainability goals.

And if you look across almost every study in the field, risk mitigation is always in the top five.

Procurement intelligence enables your team to flag potential supplier failures before they disrupt your operations—whether it’s signs of financial trouble, ownership changes, capacity constraints, or exposure to geopolitical risks.

That early warning gives you time to find alternatives, negotiate from a stronger position, and keep production running smoothly.

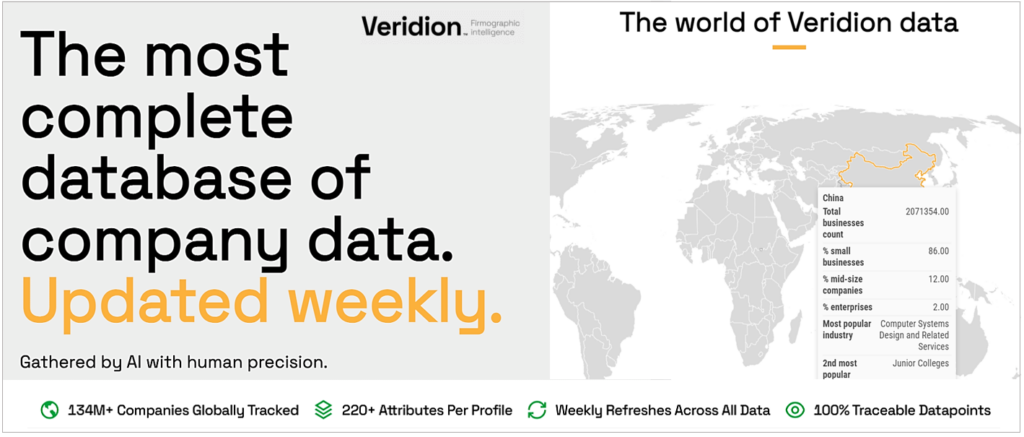

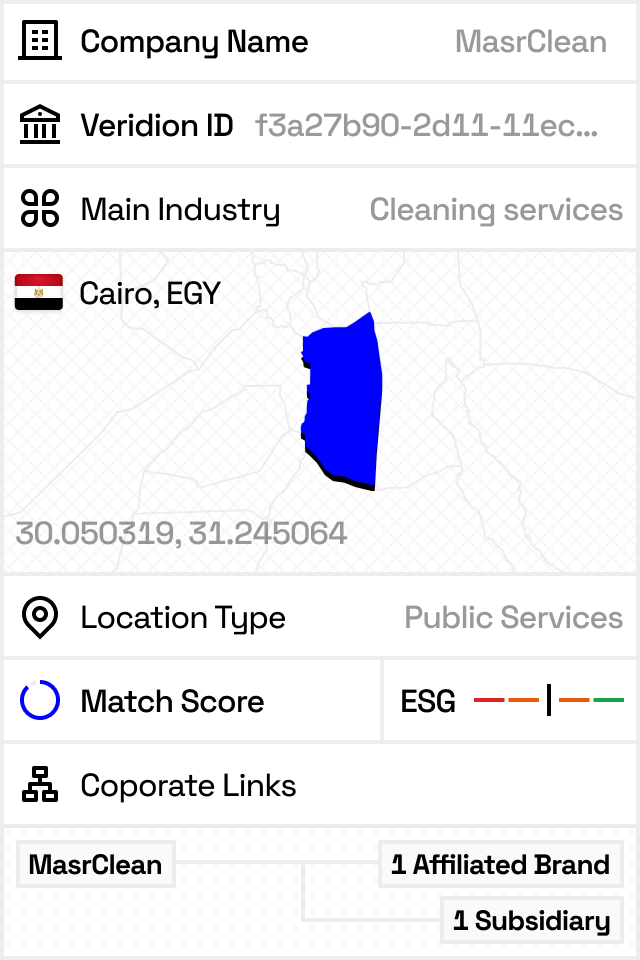

Of course, to get this level of insight, you need to have access to accurate, up-to-date supplier data. And that’s what Veridion provides.

Source: Veridion

With a global database of over 134 million suppliers, more than a billion products, and weekly updates, Veridion gives teams a broad, reliable, and current view of the procurement market.

It tracks over 220 supplier attributes, from ESG scores and financials to product data and ownership hierarchies, helping teams vet partners, predict risks, and spot opportunities before their competitors do.

So whether it’s sourcing new vendors, monitoring existing ones, or scanning the market for emerging risks and opportunities, Veridion is the data partner you want on your side.

After COVID-19 hit in 2020, every industry faced rapid, unpredictable shifts in demand, supply, and customer behavior. Entire markets reshaped almost overnight.

Add rapid technological advancements, including the AI boom, along with inflation, shifting regulations, and geopolitical instability, and you get an environment where change isn’t the exception. It’s the norm. And it’s only speeding up.

All this made it very hard to keep up, let alone stay ahead. But you have to if you want to stay competitive.

That’s why industry intelligence is important.

Industry intelligence is the process of gathering and analyzing data on markets, competitors, technologies, regulations, and economic trends to understand what is shaping your industry today, and what is likely to shape it tomorrow.

So, instead of reacting after a change hits, you can anticipate shifts, make faster decisions, and move in the right direction before others even see what’s coming.

As Bob Sternfels, partner at McKinsey, says:

Illustration: Veridion / Quote: McKinsey & Company

For example, industry intelligence might reveal a spike in venture capital activity around climate tech—often an early sign that the market is heating up—giving you time to explore partnerships or product ideas before it becomes crowded.

It might also flag new ESG reporting mandates in your sector, so you can adjust operations and reporting processes before penalties or compliance issues hit.

Or it can even highlight technology shifts that are about to transform how your market operates.

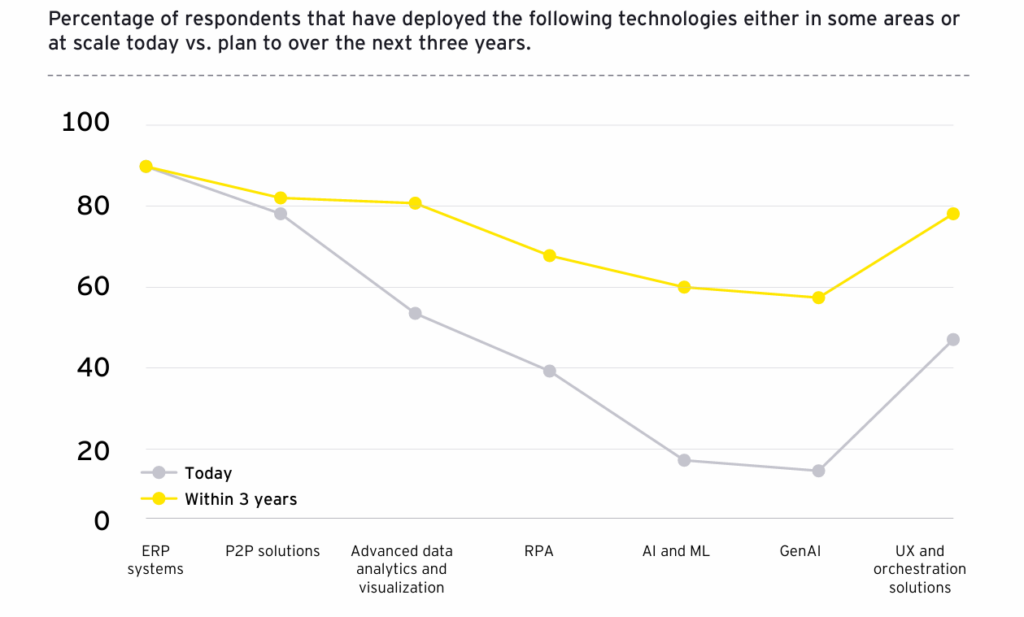

For instance, if you’re in procurement, you might see that 60% of Chief Procurement Officers plan to invest in AI and ML over the next three years, yet current adoption is still below 20%.

Source: EY

That gap shows a major opportunity to adopt early, so by the time the rest of the market catches up, you’ll already have the expertise, processes, and results in place.

And industry intelligence doesn’t just reveal changes and shifts inside your own sector, it goes far beyond.

For example, the push for electric vehicles is driving growth not just in automotive manufacturing, but in battery production, rare earth mining, and charging infrastructure.

Being able to link that macro trend to the exact companies and suppliers active in each segment helps you decide where to invest, partner, or expand.

Veridion enables this kind of macro-to-micro analysis by providing granular data on millions of companies across industries and regions, helping analysts map out cross-sector trends before they become obvious to everyone else.

It lets you start with broad market shifts and zoom down to detailed profiles of individual companies so you can connect industry-wide changes to specific, actionable opportunities.

Source: Veridion

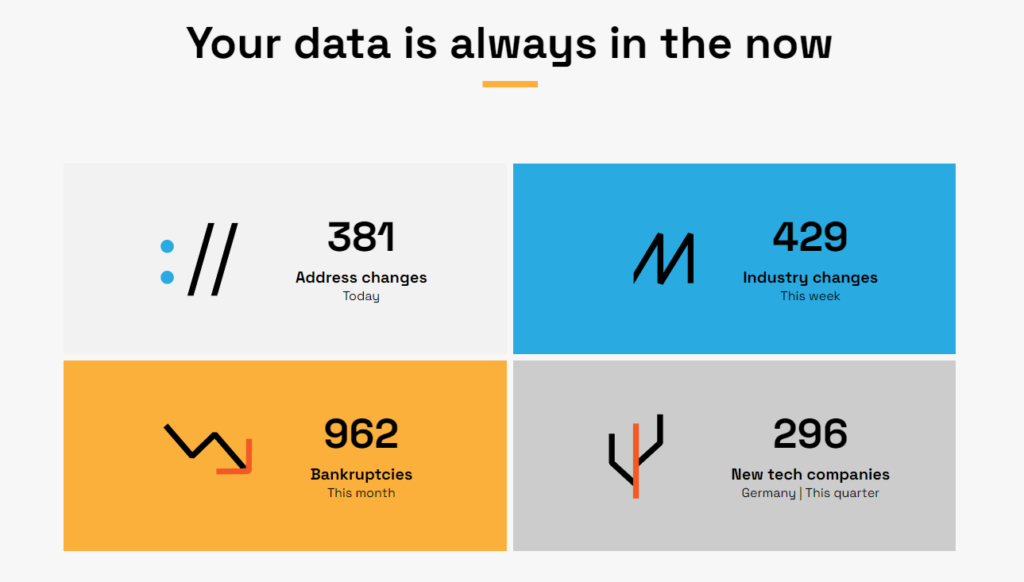

And while Veridion’s coverage is huge, its real strength is the freshness of its data. Data is updated weekly, with new information added every day, so you always have the latest view of the industry.

Source: Veridion

When everything moves and changes this quickly, staying ahead almost always starts with seeing things first, and industry intelligence helps you do exactly that.

The right decisions don’t happen by accident. They happen when you have the full picture.

And market intelligence gives you that picture. It shows you what’s changing, where the risks are, and where the next opportunity might be.

So, use the five types we covered, build them into how you work, and you’ll stop reacting to change. You’ll start driving it.