Market Intelligence: Use Cases Across Departments

Key Takeaways:

Market intelligence isn’t just for analysts or strategy teams.

It’s a powerful, cross-functional tool for smarter, faster decision-making across your business.

From shaping product roadmaps and sourcing strategies to guiding risk management, the right market insights help every team operate more effectively.

In this article, we’ll show how teams like sales, procurement, and finance are using market intelligence in practical, high-impact ways.

Without some form of market intelligence, developing products and services would be a shot-in-the-dark exercise with potentially costly consequences.

That’s why today’s product teams rely heavily on market intelligence to:

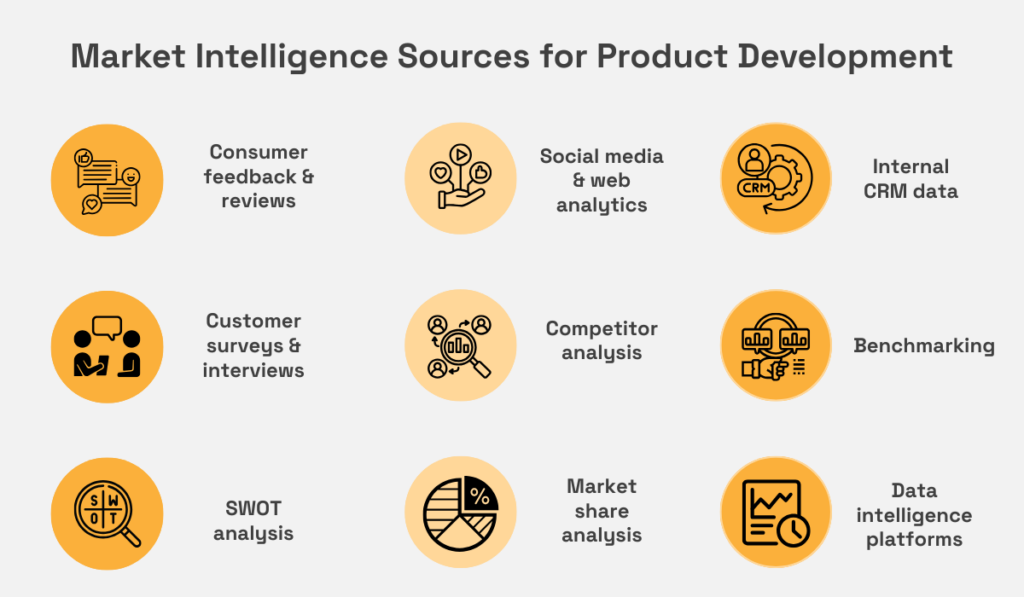

To do this effectively, they pull from a wide range of market intelligence sources—both qualitative and quantitative.

The most commonly used ones are shown below:

Source: Veridion

This range of sources underlines one fact: there is no single source of market intelligence that provides a complete picture.

Rather, product teams must synthesize insights from multiple channels to build an accurate, well-rounded view of market conditions, evolving customer expectations, and competitor activity.

Often, this intelligence is used to adapt products or services to local market preferences.

Let’s look at Coca-Cola’s innovations in Japan.

After conducting local market analysis, consumer behavior research, and competitive benchmarking, the company launched its first alcoholic drink, Lemon Hall.

Source: BBC

Relying on the local population’s strong preference for lemon flavor, Coca-Cola introduced multiple versions with varying alcohol content (3%, 5%, 7%, and 9%).

In just two years, Lemon Hall became the eighth most popular ready-to-drink product in Japan, proving how localized market intelligence can turn insights into tangible success.

Overall, market intelligence is the foundation of nearly every successful product or service development project, guiding teams from idea validation to launch.

By grounding R&D in real-world market insights, businesses can build offerings that not only meet customer expectations but exceed them.

Now more than ever, sales success depends on data-backed precision.

That’s why high-performing sales teams turn to market intelligence to:

Whether it’s spotting underserved markets, tracking competitor churn, or recognizing buying intent, market intelligence helps sales reps work smarter—and close faster.

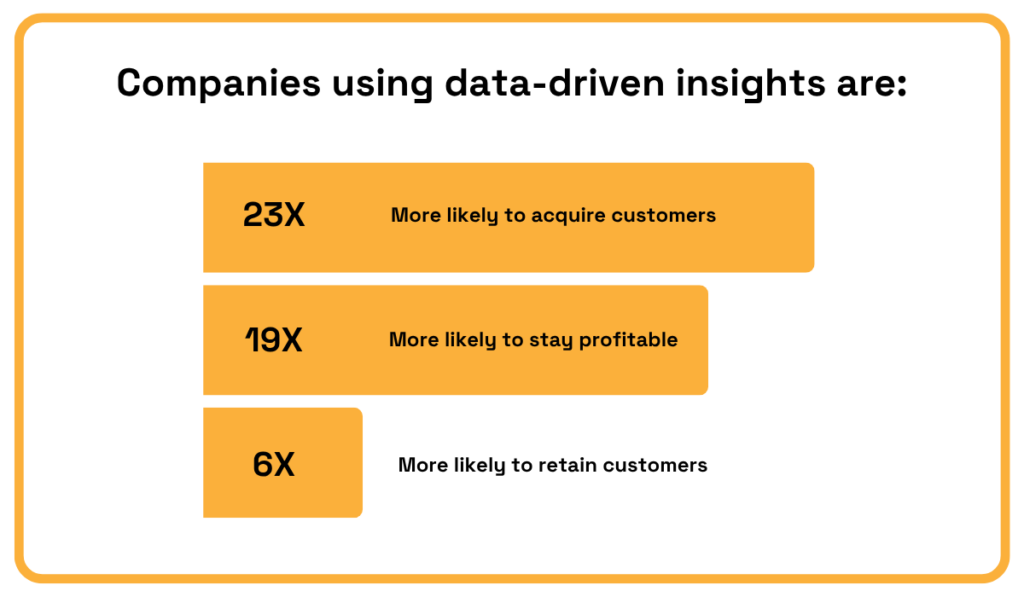

According to McKinsey, companies that rely on data-driven sales insights significantly outperform their peers.

Illustration: Veridion / Data: McKinsey

To achieve this level of performance, sales teams rely on a mix of market intelligence sources, often integrated directly into their CRM or sales platforms.

They include firmographic data, buyer intent signals, funding announcements, competitor news, and, in the case of tech sellers, technographic data.

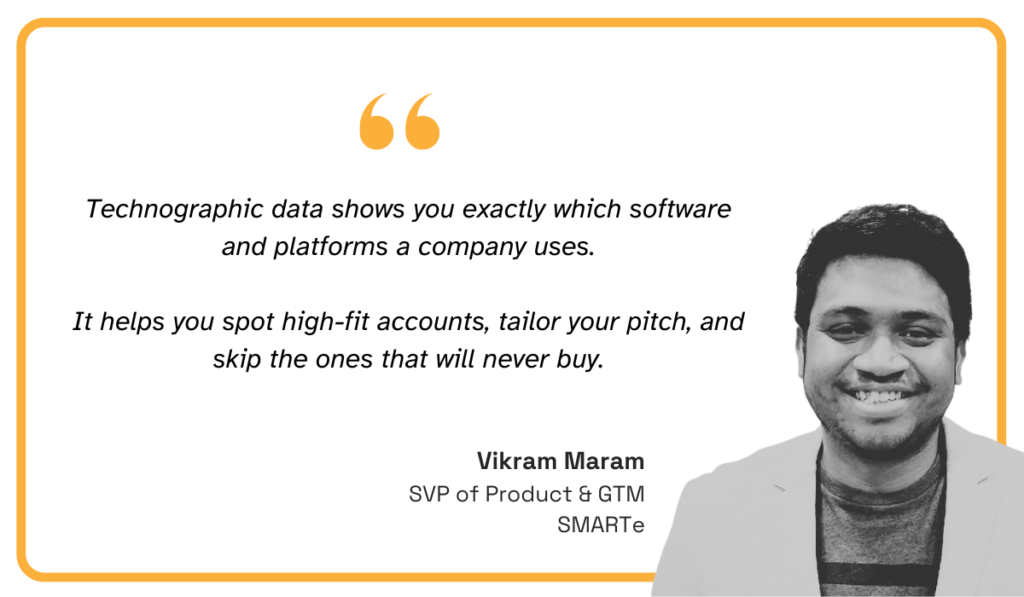

Here’s how Vikram Maram, Senior Vice President at SMARTe, a B2B sales intelligence provider, explains it:

Illustration: Veridion / Quote: Smarte

Technographic insights help sales reps time their outreach and personalize messaging based on the technologies prospects already use.

For example, an enterprise software company can identify leads still running outdated ERP systems, which is an ideal signal to pitch modern solutions with clear ROI.

But technographic data is just one piece of the puzzle.

When combined with real-time funding news, hiring trends, or industry shifts, market intelligence gives sales teams a dynamic edge.

It helps them spot and act on sales opportunities at the right moment—often the factor that separates a win from a miss.

For today’s marketers, success depends on understanding not just who their target audience is but what they care about, where they spend their time, and how they make decisions.

That’s why market intelligence is essential for building accurate customer personas, refining campaign targeting, and identifying emerging trends.

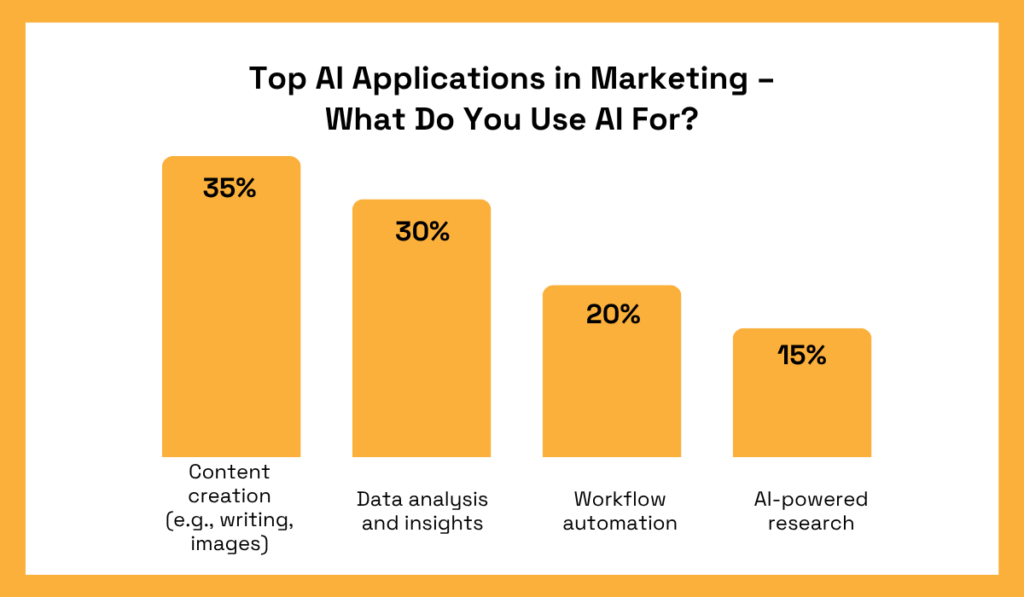

Increasingly, teams are using AI-powered tools to turn raw data into actionable insights.

According to HubSpot’s 2025 State of Marketing Report, here’s how marketers are putting AI to work:

Illustration: Veridion / Data: HubSpot

Except for content creation, the remaining categories show how AI-powered tools help marketers gather, analyze, and act on market intelligence.

For instance, social listening and competitive monitoring platforms let teams track trends, assess brand sentiment, and understand market positioning.

Another example is when market intelligence is used to uncover underserved customer segments and tailor campaigns accordingly.

Kapital Bank took a similar approach.

Since early 2024, the institution has blended fintech agility with banking stability to grow its SMB reach in Mexico and Colombia, providing clients with a single banking/loan platform.

As CEO, René Saul, highlights:

Illustration: Veridion / Quote: Contxto

This example also highlights how today’s marketing teams need real-time insights into market shifts, customer sentiment, and competitor activity.

Market intelligence makes this possible.

By grounding campaigns in data, marketers can craft messages that truly resonate, reach audiences at the right time, and ultimately drive better performance across all channels.

When it comes to procurement, market intelligence gives teams the insights they need to quickly discover, evaluate, and select suppliers.

Beyond that, market intelligence helps teams monitor supplier performance in real time, enabling proactive risk mitigation and stronger supplier relationships.

Key sources of procurement intelligence include:

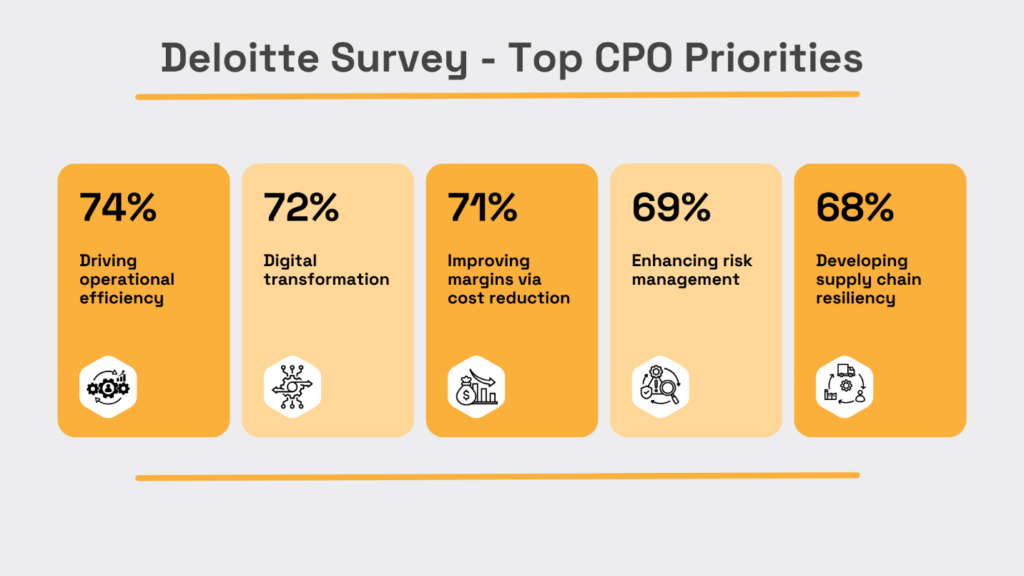

Such tools directly support many of the top CPO priorities outlined in Deloitte’s 2023 report:

Illustration: Veridion / Data: Deloitte

In light of these priorities and the ongoing global supply chain disruptions, it’s clear that market intelligence is vital for efficient supplier sourcing and risk-aware procurement decisions.

Take supplier discovery, for example.

When procurement teams have access to reliable, up-to-date intelligence in a single platform, they can reduce the time it takes to identify eligible suppliers by over 90%.

That often translates into saving weeks—or even months—of manual research and outreach.

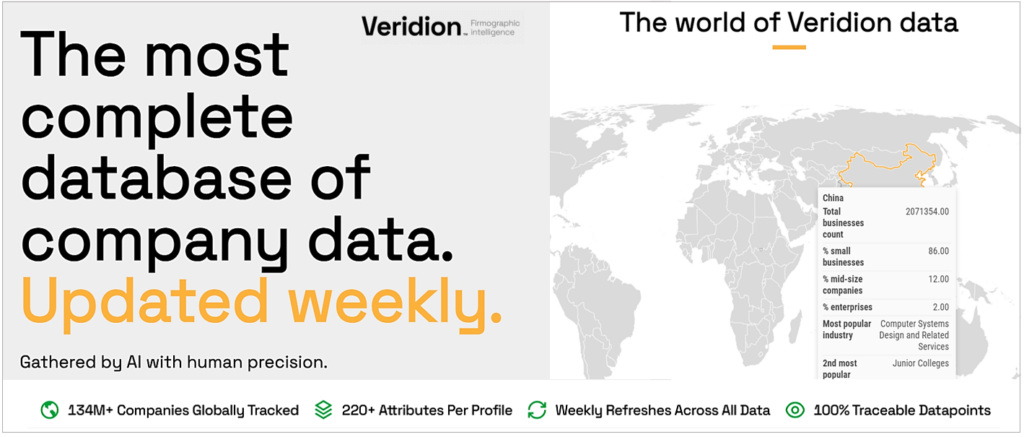

One platform that enables this kind of efficiency is our Veridion.

Using Veridion’s APIs or its search engine, Scout, your team can enter any criteria in natural language and receive a curated list of suppliers in seconds.

Beyond quickly finding suppliers anywhere in the world, Veridion’s market intelligence also enables your team to:

All this helps transform procurement from a cost-driven, reactive function into a strategic, data-informed operation.

Ultimately, this empowers procurement teams to make faster, more confident sourcing decisions, leading to more resilient and cost-efficient supply chains.

Finance leaders face mounting pressure to guide their organizations through economic uncertainty, evolving regulations, and shifting competitive landscapes.

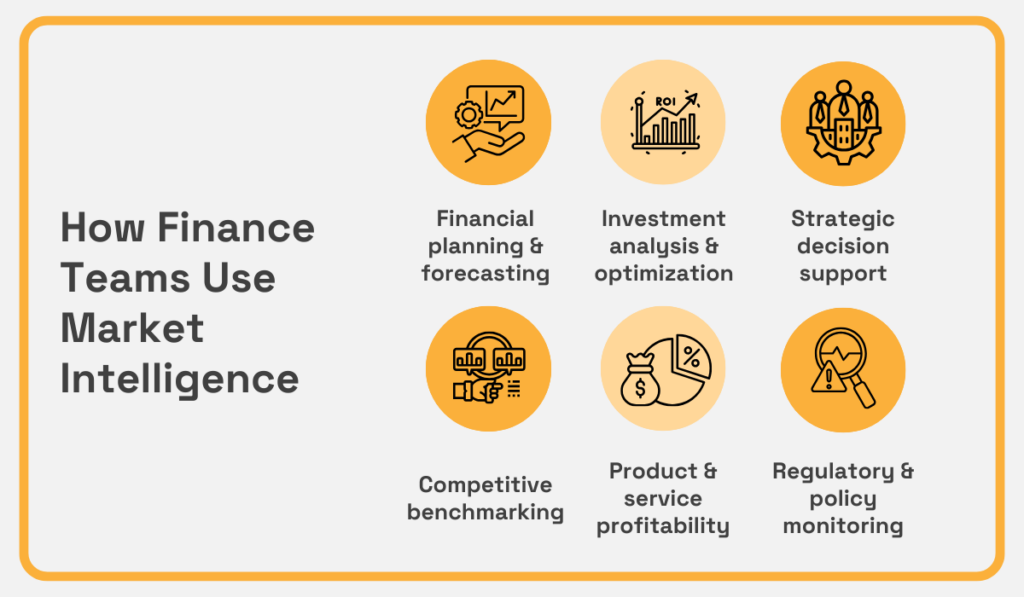

To stay ahead, finance departments increasingly turn to market intelligence for planning and forecasting, strategic support, investment analysis, competitive benchmarking, and more.

When embedded into daily workflows, market intelligence transforms finance from a back-office function into a proactive, insight-driven advisor.

The image below highlights the main ways finance teams use market intelligence to drive smarter, faster, and more resilient decision-making.

Source: Veridion

For instance, in financial planning and forecasting, market data helps teams anticipate shifts in demand or costs across sectors.

In investment analysis, private equity firms use intelligence to evaluate how scalable acquisition targets are across regions.

Another example is competitive benchmarking, where corporate finance teams monitor peer performance to refine budgets and investor guidance.

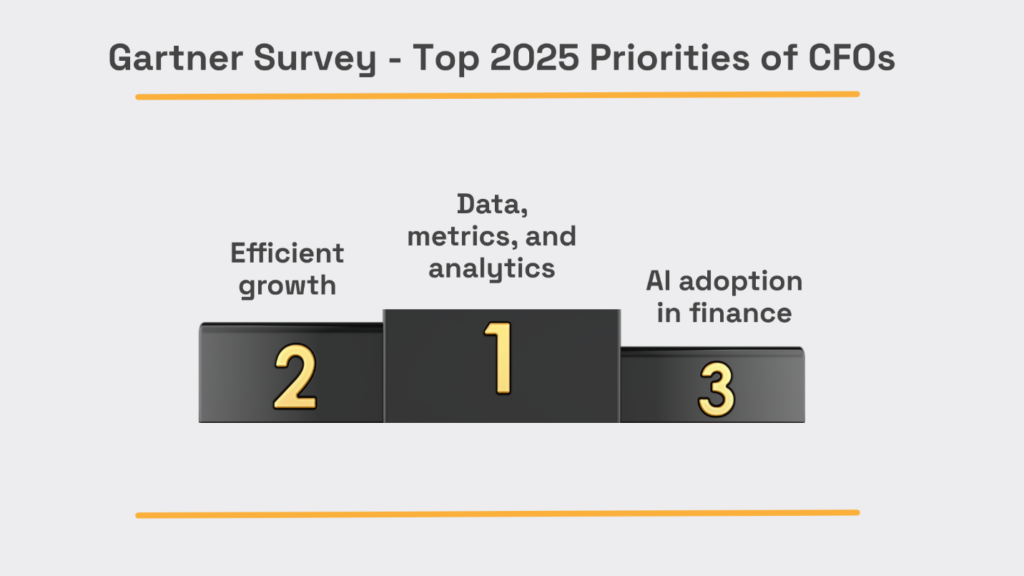

These use cases align closely with the top priorities CFOs have identified for 2025 in a Gartner survey, especially the push for better data and analytics.

Illustration: Veridion / Data: Gartner

Market intelligence directly supports these priorities by feeding analytics tools with high-quality data that can be turned into actionable insights.

Whether it’s forecasting revenue trends with AI, optimizing investment decisions, or benchmarking against peers, finance teams gain a sharper, faster view of financial realities.

Legal and compliance teams rely on market intelligence to navigate ESG compliance, manage risk, monitor anti-bribery and corruption exposure, and ensure policy alignment across jurisdictions.

For that, they use:

One major area of focus is sustainability, and specifically, environmental, social, and governance (ESG) factors.

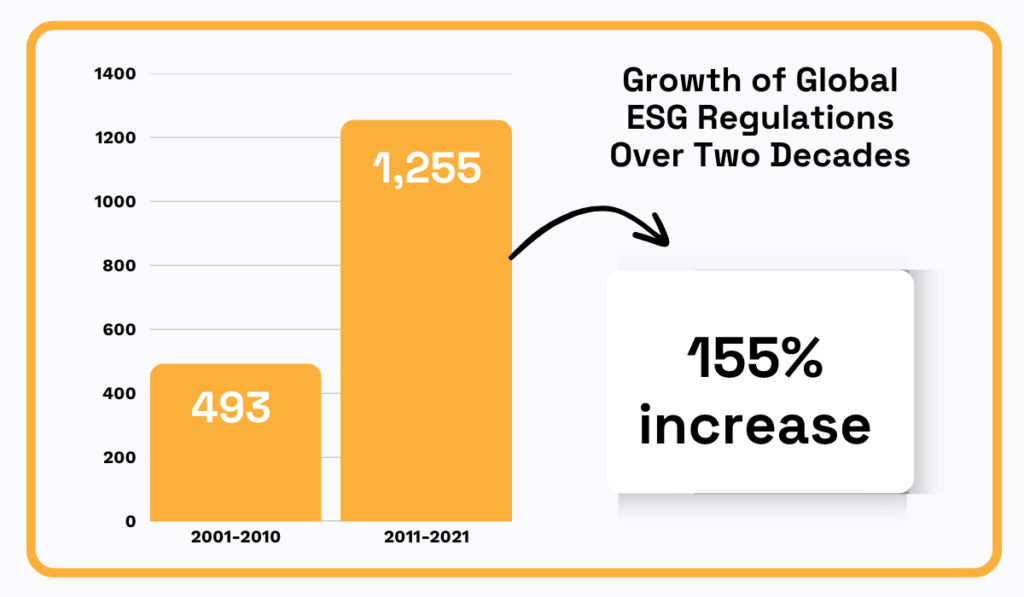

Given the breadth of ESG and the variation in regulations across countries and regions, navigating this landscape is increasingly complex.

In fact, research by ESG Book shows just how dramatically ESG regulations have expanded over the past decade, as shown below.

Illustration: Veridion / Data: Edie

Efficiently managing both mandatory and voluntary regulatory frameworks requires the tools mentioned above.

For example, companies can set up automated alerts to flag suppliers or partners added to sanctions lists or involved in litigation, allowing them to respond immediately and mitigate risk.

Beyond dedicated watchlist monitoring tools, many market intelligence platforms let users define custom risk factors in advance.

Once a flagged condition is met, the system triggers an alert automatically.

Source: Veridion

As shown, Veridion’s real-time alerts are paired with data confidence scores, helping teams assess the reliability of information before acting.

These risk-monitoring capabilities allow legal and compliance teams to move beyond manual tracking and respond effectively to growing regulatory scrutiny and other supplier risks.

With the scale, speed, and precision of market intelligence, organizations can stay compliant, avoid penalties, and maintain trust across global operations.

A company’s executive leadership uses market intelligence to gain a comprehensive, forward-looking understanding of the business environment.

By integrating insights from across departments, executives develop a high-level view of customer needs, industry shifts, competitive moves, and emerging risks or opportunities.

This broader perspective helps improve decision-making in areas such as:

As Franck Mathot, CEO of Italian hosting platform AlterVista, says about market intelligence:

Illustration: Veridion / Quote: Diplomatic Council

Clearly, executives across industries rely on market intelligence to guide critical decisions.

For example:

But beyond sound decision-making, the real value of market intelligence lies in gaining a strategic edge.

Isha Kutey, a market research and strategy expert, underlines that market intelligence is ultimately about competitive advantage.

She adds:

Illustration: Veridion / Quote: LinkedIn

To fully realize the value of market intelligence, executive teams must embed it into the company’s decision-making culture.

This means treating intelligence not as a one-off report or dashboard, but as a continuous input that informs decisions at every level.

When leaders champion data-informed thinking across departments, market intelligence becomes more than a tool.

It becomes a mindset that sharpens competitive advantage and drives sustainable growth.

Market intelligence is a unifying force that enables smarter, faster business decisions across departments.

Of course, the use cases we have covered don’t exist in silos.

Rather, they reinforce one another to build a more agile, competitive organization.

Whether you’re identifying new opportunities, managing risk, or planning your next move, the right market intelligence can make all the difference.

So, start integrating it today, and turn data into your most strategic asset.