What Is the Difference Between Business and Market Intelligence?

Key takeaways:

Figuring out Business Intelligence and Market Intelligence can be confusing, especially as the terms are often used interchangeably.

But having a clear understanding matters, as each of the two practices serves a specific purpose. And, the wrong approach can waste resources and miss key opportunities for growth.

For a clear way to see how these two forms of intelligence differ and how they work together to support your goals, read on, as we break everything down.

Let’s start by looking at business intelligence, or BI, first.

In essence, BI is the process of analyzing an organization’s internal data. This involves gathering information from all of your company’s departments to get a clear picture of what is happening inside the business.

As this definition from IBM neatly puts it, BI uses current business data as a foundation for better decision-making.

Illustration: Veridion / Quote: IBM

The ultimate goal of BI is to help decision-makers identify strengths, weaknesses, and areas for improvement in a business.

These insights can apply across different company functions, including operations, sales, and marketing performance, but they can also affect the business as a whole.

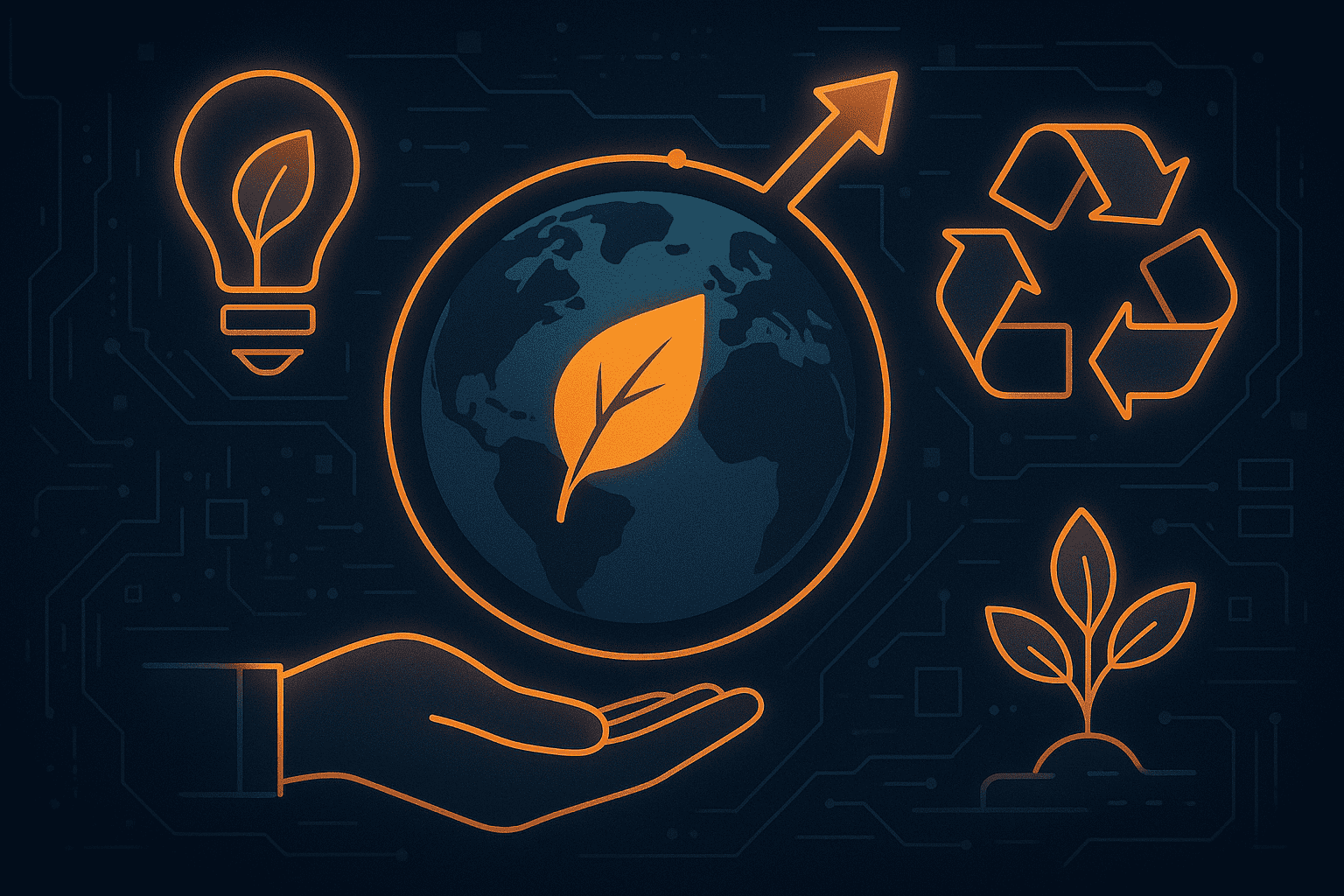

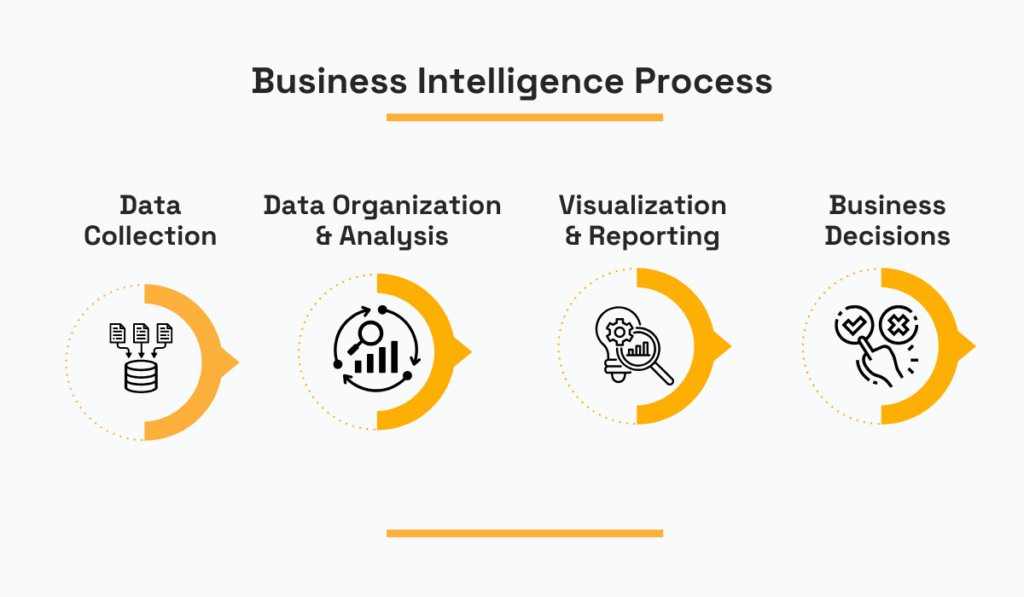

But, how does the entire BI process actually work? Take a look at the next image to see the key steps involved.

Source: Veridion

First, internal data needs to be collected from various systems, then organized and prepared for analysis.

This initial step is critical because the quality of your insights depends entirely on the quality of your data.

This information can come from many different sources within the company, including:

Once collected, the data is analyzed to uncover patterns, trends, and relationships.

For example, you might analyze sales data from the last two years to see which products are selling the most and which are seeing a decline in popularity.

To make getting these insights easier, the analyzed data is then often structured into reports or interactive visualizations.

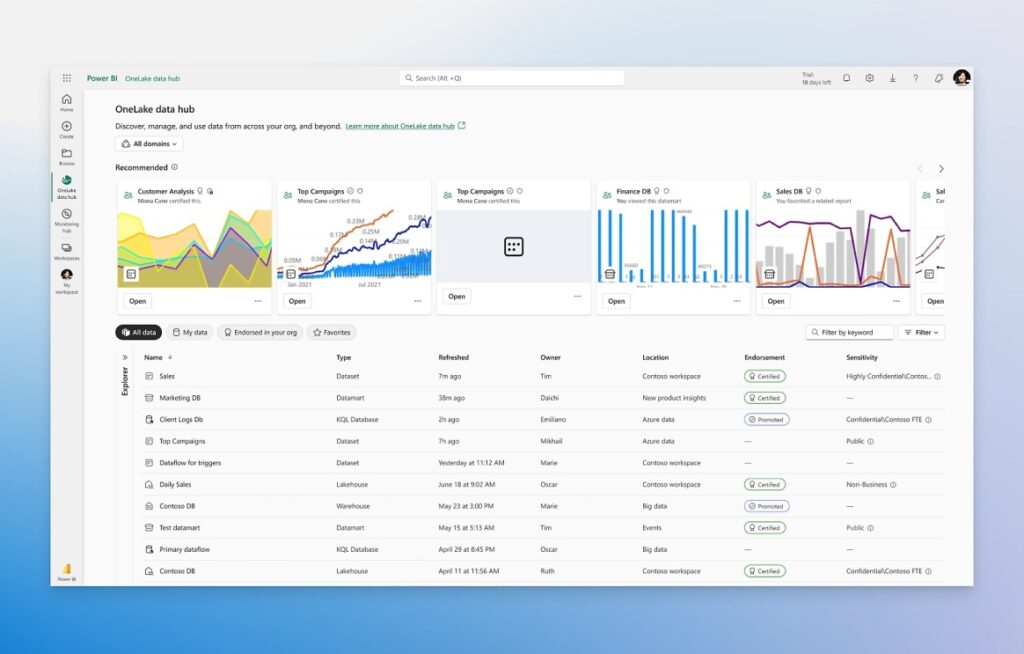

You have likely heard of tools like Microsoft Power BI, which are used for this exact purpose.

Source: Power BI

The goal of these reports is to present complex information in a way that is easy to understand at a glance.

They give leaders a clear, summarized view of internal performance, enabling faster, more informed responses to changing conditions.

If we were to summarize everything in just a few words, BI offers a detailed look inward to help optimize a company’s operations.

If BI focuses on internal data and processes, market intelligence (MI) is the opposite.

In short, market intelligence is the process of gathering and analyzing information from the external environment in which your business operates.

This includes everything from your direct competitors to broader economic trends and customer opinions.

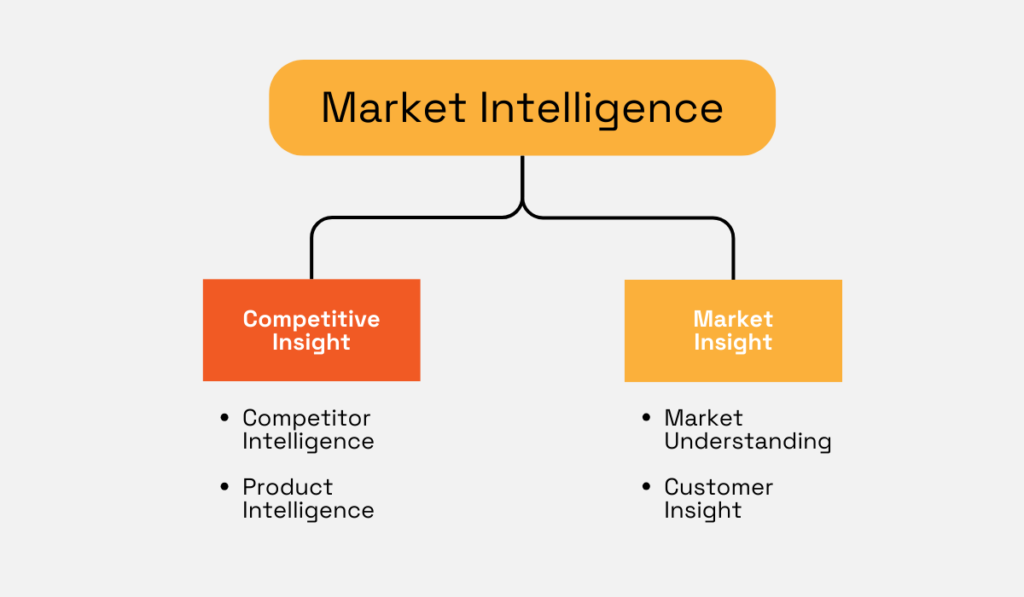

We can look at MI as being made up of two broader types of insight, as illustrated below.

Source: Veridion

The first is competitive insight.

This type of intelligence focuses specifically on understanding your competitors.

It includes competitive intelligence, which is about who your competitors are and what they are doing, and product intelligence, which looks closely at their products and features.

The main aim of this type of MI is to understand your competitive landscape so you can find opportunities to stand out and identify potential threats before they impact your business.

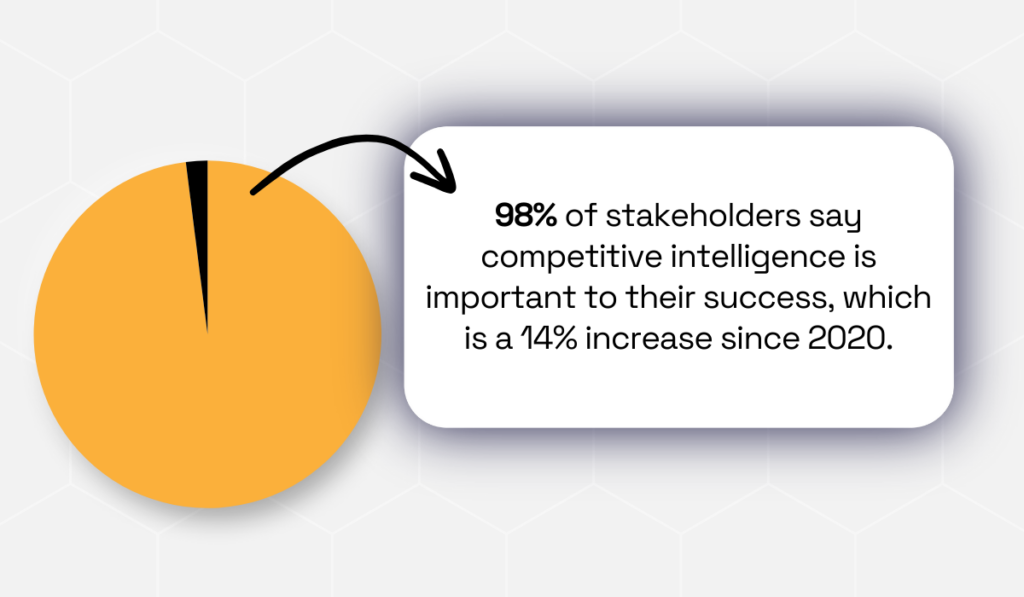

Competitive intelligence is an especially important type to consider, as according to 2022 Crayon data, the overwhelming majority of stakeholders believe this type of insight is crucial for their success.

Illustration: Veridion / Data: Crayon

This type of insight is essential, as knowing what your rivals are planning allows you to be proactive with your own strategy, rather than just reacting to their moves.

The next type of market intelligence is broader, looking at overall market understanding and insights from your own existing or ideal customers.

For example, you might have seen industry reports like the one shown below, which go over market sizes, shares by country, and other market details.

Source: Fortune Business Insights

This kind of information is great for spotting shifts in markets and being on top of emerging trends that could affect your entire industry.

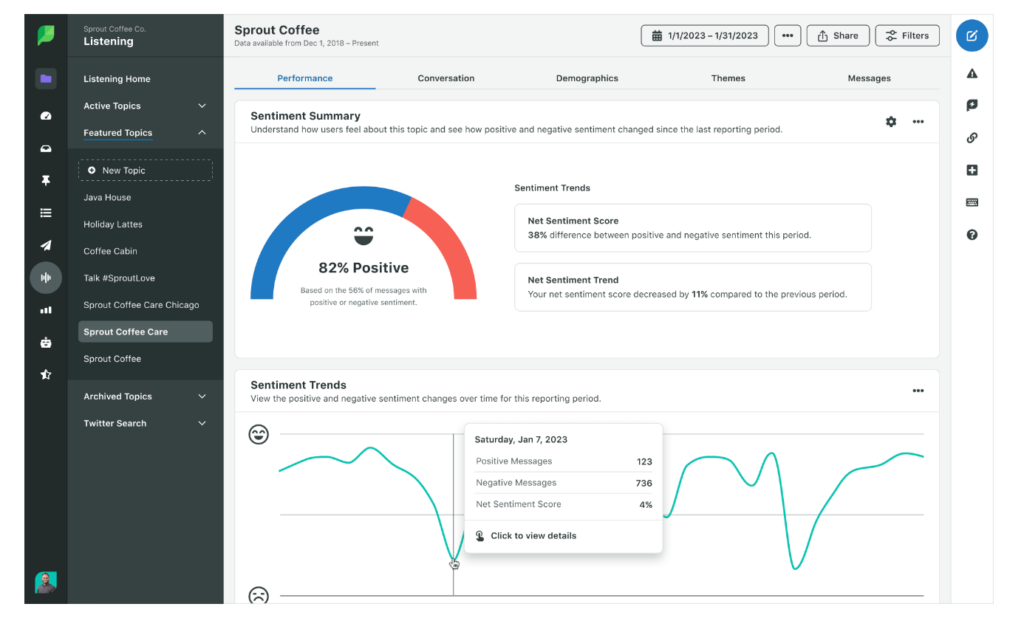

But this market insight can also come from your customers, through surveys, interviews, direct data, and even social listening tools like the one shown below.

Source: Sprout Social

Social listening tools track mentions of your brand, competitors, and relevant keywords across social media and the web.

They help you understand public opinion and see what real people are saying about topics important to your business.

In summary, market intelligence provides an essential external view, helping you understand both your competition and the wider market so you can position your company effectively.

While you may have gotten the core difference between the internal focus of BI and the external focus of MI from the previous sections, let’s dive a bit further now.

Clarifying and understanding these distinctions is important, as working with one type of intelligence while expecting the results and time frames of the other can affect your team and the quality of insight you ultimately get.

Let’s first go over all of the differences by looking at the next table.

| Aspect | Business Intelligence | Market Intelligence |

|---|---|---|

| Primary Focus | Internal performance and operations | External market dynamics and competition |

| Main Objective | Optimize decision-making and efficiency | Inform strategic positioning and market entry |

| Data Sources | Internal systems (CRM, ERP, financials) | Public data, competitor analysis, customer feedback |

| Approach | Analytical, retrospective, dashboard-driven | Investigative, predictive, trend-driven |

| Typical Use Cases | Sales tracking, cost analysis, performance metrics | Competitor benchmarking, market sizing, GTM planning |

| Time Orientation | Historical and real-time | Forward-looking and trend-based |

| Key Users | Operations, finance, product teams | Strategy, marketing, executive leadership |

As we have already covered, BI and MI have a completely opposite focus, and that directly translates into the data sources they need.

BI requires data from internal systems like your CRM and financial software, while MI wants broader competitor and market data from external sources—interchanging these simply doesn’t work.

Plus, the approach of the two is different.

With BI, you want concrete data and insights, either based on historical or real-time information, to understand what has happened or what is currently happening.

In contrast, MI is not that exact. With market insights, you are looking toward the future, and the goal is often to investigate or predict certain shifts or trends before they affect your business.

On top of this, there is a difference in the cost and time frames between these two practices.

As Hidayat Rizvi, Founder of the digital marketing agency Rosetta Digital, explains, BI is typically less expensive to implement than MI.

Illustration: Veridion / Quote: Hidayat Rizvi

This is because BI uses data that your company already owns and generates.

For MI, you often need to source and pay for external data from third-party providers or subscribe to specialized market research tools.

Finally, the time frames for gathering and analyzing data for BI and MI can be very different. BI can often be automated to provide real-time dashboards, while a comprehensive MI project might take weeks or months to complete.

In the end, recognizing these key differences in focus, approach, cost, and timing is the first step to using both types of intelligence effectively.

Now that we’ve covered the differences, let’s look at specific scenarios where you would use BI and MI.

For BI, the main use case is when you need to understand and improve what’s happening inside your organization.

It’s about using your own operational data to guide decisions and make processes more effective.

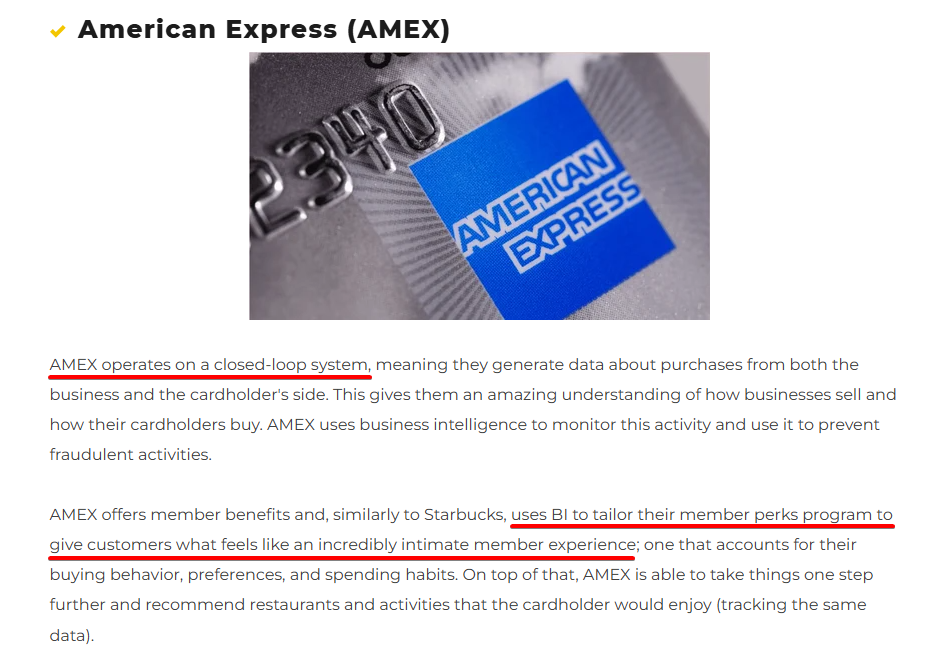

A concrete example is American Express (AMEX). The company continuously collects data about purchases from both businesses and cardholders, using this internal information to improve the customer experience and drive sales.

Source: Toucan

Based on their internal data showing where customers spend the most, AMEX tailors card perks to match those spending habits.

This is about optimizing performance by aligning products and services with actual customer behavior, ensuring that decisions are backed by measurable evidence rather than assumptions.

When it comes to market intelligence, the focus is much broader.

This could mean analyzing whether the market is ready for a new product launch or evaluating the potential of entering a new geographic market.

In Apple’s case, they used MI and key indicators, such as new US tariffs imposed on China, to make a major strategic shift for the iPhone 17 models.

Source: CNET

By assessing the geopolitical situation, they decided to move production away from China. After evaluating India’s manufacturing capabilities, labor market, and trade conditions, they identified it as a viable alternative and acted accordingly.

On an even broader level, consider Coca-Cola.

With rising health concerns, WHO recommendations to reduce sugar intake, and growing consumer health consciousness, they recognized that the market would shift toward healthier beverage options.

As noted in a TeamVisory post, Coca-Cola used this insight to adapt its product lineup over a decade ago.

Illustration: Veridion / Quote: LinkedIn

They introduced more sugar-free and reduced-sugar options, meeting demand before it peaked and positioning themselves ahead of competitors.

In general, MI is about scanning the outside world to anticipate changes, spot opportunities, and reduce risks.

As you can see, the use cases of both these practices can be vastly different and apply to unique business scenarios.

When combined, BI and MI create a complete strategic view for your company.

They enable a business to anticipate broader market shifts while keeping its internal operations efficient, focused, and well-directed.

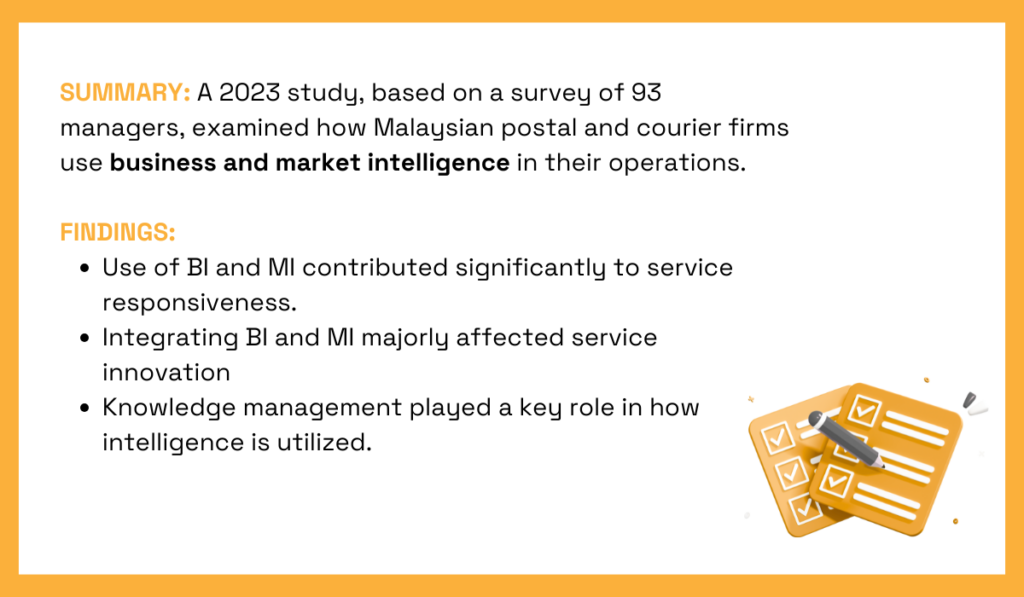

One example comes from a 2023 study on several postal and courier firms in Malaysia.

Illustration Veridion / Data: Research Gate

The findings showed that integrating BI and MI improved how responsive the businesses were to outside changes while also improving their innovation capabilities.

However, these positive outcomes were strongly influenced by how well the companies managed and integrated their data, i.e., their knowledge management practices.

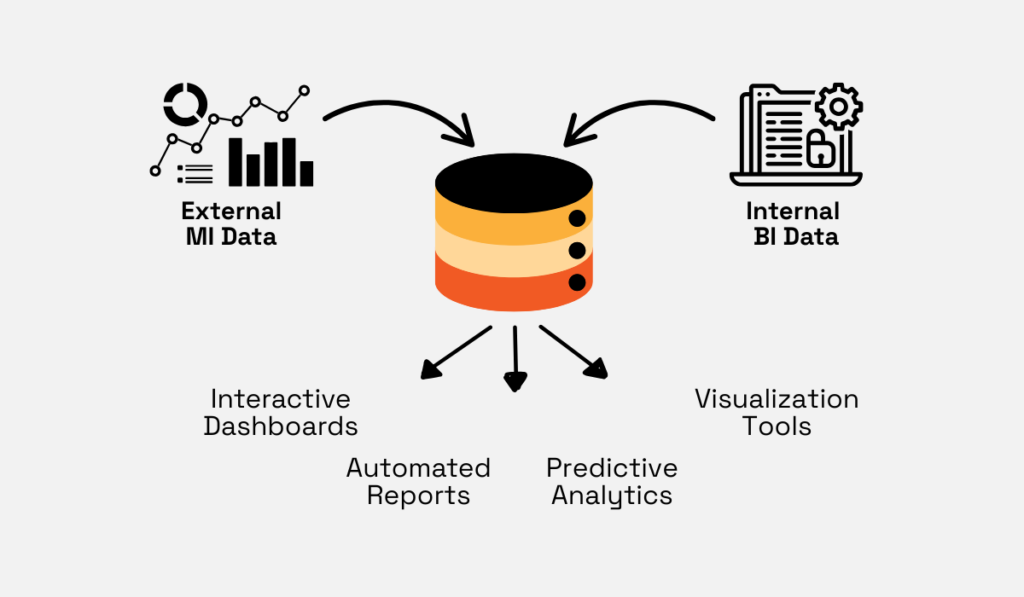

To get the most out of both, the ideal approach is to centralize them into a single environment where dashboards, reports, and analytics can be used.

For example, internal performance data—such as customer satisfaction scores or sales conversion rates—can be continuously measured against external competitor benchmarks like industry averages, market share shifts, or pricing trends.

This allows you to see how internal processes stack up in the broader market, making it easier to spot gaps and opportunities.

Of course, the quality of the data you use is paramount.

While internal BI data is often easier to collect and validate, selecting the right MI data can be challenging.

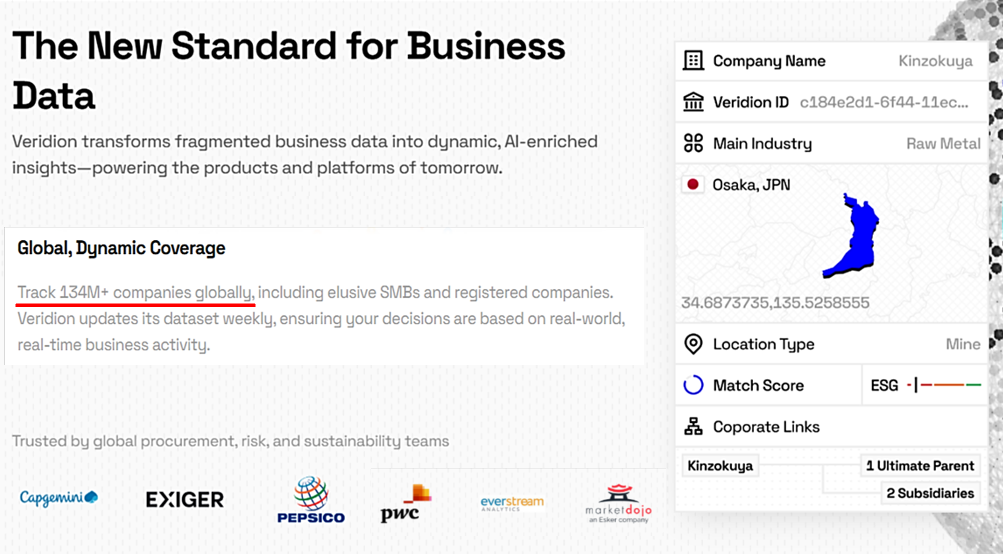

That’s where advanced AI-powered market intelligence systems like Veridion come in.

Our platform collects vital information on millions of companies worldwide, with detailed attributes to help you understand competitors, suppliers, or entire industries at scale.

Source: Veridion

With access to a global database of over 130 million companies and 220+ attributes per company, you can ensure you’re working with the most relevant and granular data possible.

Weekly refresh cycles and fully traceable datapoints mean you can verify the source and accuracy of every insight and ensure your strategy is based on the latest and most reliable info.

Overall, a centralized approach to BI/MI data management, combined with access to high-quality, reliable MI data, can really make a difference in how well a business adapts and thrives.

You now have a complete overview of these two powerful concepts.

In this article, we covered what both Business and Market Intelligence mean, how they differ, and when each is most useful.

You’ve also seen how combining them creates a more balanced and effective strategy.

With this understanding, you can confidently apply the right intelligence mix to unlock greater value for your business.