Market Intelligence vs Market Research: What’s the Difference?

Key Takeaways:

If you work in procurement or strategic planning, you’ve probably encountered the terms market research and market intelligence.

The two sound similar, but they serve very different roles in how you gather and apply information.

Once you understand the difference between market research and intelligence, you can choose the right approach to support both your short-term decisions and long-term strategy.

That’s why we’ll break down what each one involves, when to use them, and how the right tools can help you stay ahead in an increasingly data-driven world.

Let us start with market research, because it is a more familiar and widely recognized term, especially outside of large enterprises or strategic roles.

In fact, market research is so widely used that the global industry is expected to surpass USD $140 billion in revenue by the end of 2025, with 85% of professionals relying on online surveys to gather insights directly from customers and users.

Illustration: Veridion / Data: Statista

Now, the crucial point in defining market research is this:

It’s all about direct feedback from the people you’re trying to understand.

As Investopedia defines it, it’s the process of testing whether a product or service makes sense by going directly to potential customers and asking for their input.

Source: Investopedia

So, instead of analyzing trends from a distance, market research lets you listen to your audience in real time.

And how exactly can you do that?

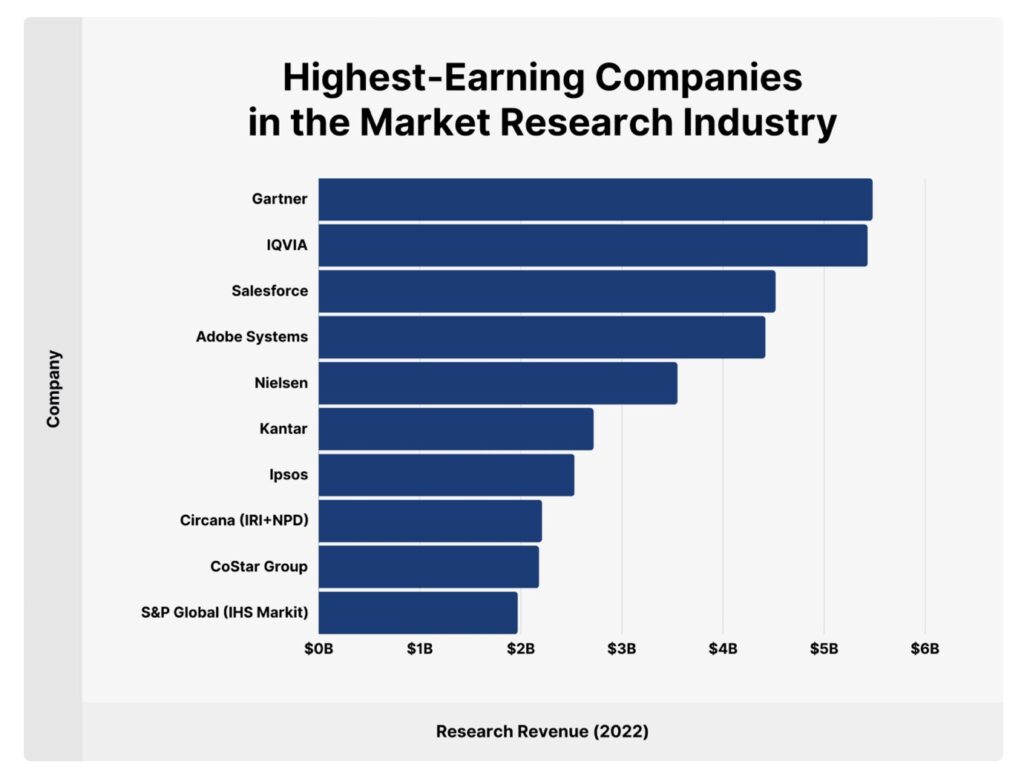

Consider the companies leading the field, such as Salesforce, Ipsos, Gartner, and Nielsen.

Source: Backlinko

You probably associate these companies with activities such as customer surveys or feedback tools—precisely the kinds of primary research methods market research relies on.

Here’s a quick overview of the common forms that market research can take, depending on your goals:

| Research market method | What it does |

|---|---|

| Surveys | Collect structured feedback at scale |

| Interviews | Explore in-depth individual opinions and experiences |

| Focus groups | Observe reactions and preferences in a group setting |

| A/B testing | Compare two versions of a message or product feature |

All these methods are considered primary research, meaning you’re creating and collecting new data rather than pulling it from existing sources.

This is another key factor that differentiates market research and market intelligence.

Because these studies are designed around clearly defined goals, they’re time-limited and tactical.

You run them when you need actionable input to shape something concrete, such as:

In summary, market research involves collecting direct feedback from your target audience to answer specific questions and guide short-term decisions.

Now, let’s see how market intelligence takes a broader, longer-term approach.

Let’s say you wanted to evaluate the stability of your supplier network across Europe.

In that case, you wouldn’t send out a survey to your end customers or even individual suppliers because they wouldn’t have the information you actually need.

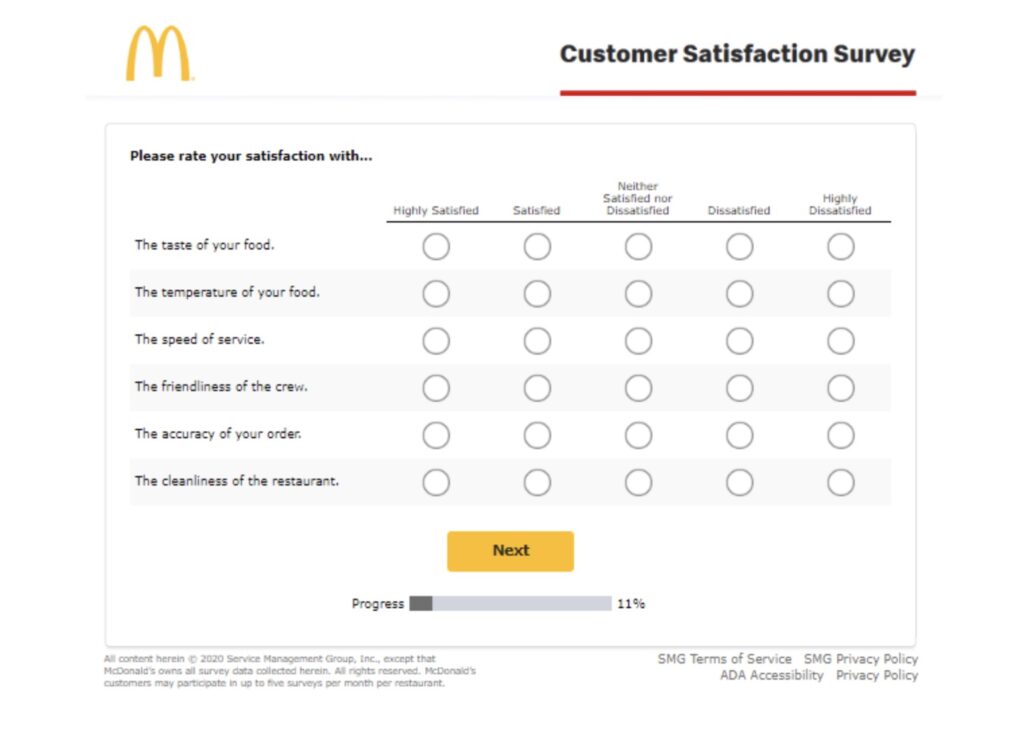

So, a survey like the one below (which would be perfectly fine for market research purposes) would not be useful in this scenario.

Source: User Feedback

Instead, you would:

Congratulations, you’ve just stepped into the world of market intelligence!

This is exactly the kind of work that helps businesses stay in tune with the market.

It’s no surprise that already in 2015, more than half of executives used market intelligence to keep track of what competitors were doing, and discover new opportunities.

Illustration: Veridion / Data: PwC

In essence, market intelligence is a continuous, strategic process. Rather than running one-off studies, companies build systems that constantly collect and analyze external data.

This data reflects the entire market, not just their own customer base.

That way, companies can spot shifts early, react to competitor moves, track risks, and make better long-term decisions with real context.

While market research has straightforward methods of gathering feedback, market intelligence can seem more abstract. Still, it relies on concrete sources and repeatable methods.

The difference is that you’re pulling data from the outside world, often without direct interaction.

Here are some of the most common sources used in market intelligence:

Inputs from these sources are often analyzed using specialized platforms, dashboards, or even AI tools to surface patterns and insights.

And with that, companies can see the bigger picture of the market.

Market research is your go-to when you’re trying to validate something specific.

You might be developing a concept for a new product, testing a campaign message, or exploring a new pricing strategy.

In each case, you want to know how real customers or users will respond before investing in a full launch.

Source: Veridion

So, when your favorite coffeehouse or fast-food chain rolls out a new flavor, it is likely the result of market research driven by surveys like the one below.

Source: QuestionPro

But market research is not limited to physical products or consumer brands.

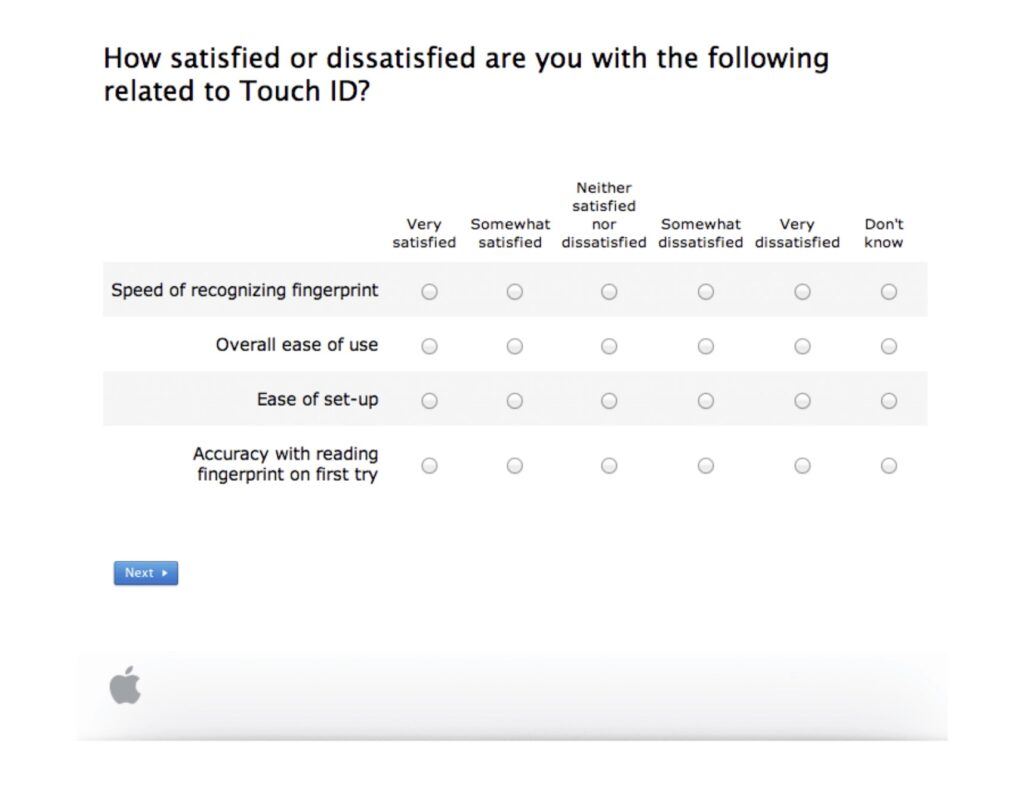

Let’s say you were testing a new feature for a software product, such as Apple’s Touch ID.

In that case, you could design a survey asking testers about their experience with the function.

That’s precisely what Apple did when rolling out Touch ID.

Source: QuestionPro

There’s no reason why you couldn’t do the same for your business.

Regardless of what you’re testing, the point is that market research is best suited for short-term, tactical projects where the goal is clear.

You begin with a hypothesis and look for either confirmation, rejection, or refinement.

Once you’ve developed a prototype or outlined a campaign, market research can tell you if the effort is worth pursuing.

As opposed to validating specific ideas, market intelligence is best used for making strategic, long-term decisions.

If you were designing a new pair of wireless earbuds, you might create a few prototypes and ask potential users what they think. That’s market research.

But if you were planning to launch an entire electronics brand in a new country, you’d need more than just a handful of opinions.

You’d want to know if there’s real demand for that kind of product, who your competitors are, what import regulations apply, how local distribution works, and what price ranges customers expect.

In such a case, market intelligence would be the appropriate approach.

Other situations where market intelligence comes into play include:

The sort of information that comes out of market intelligence isn’t always straightforward.

That’s okay!

You want to base your business decisions on as much context, nuance, and real-world data as possible.

However, with so many moving parts (industries, geographies, company sizes, trends), it is easy to get overwhelmed.

Therefore, it is often best to work with a market intelligence platform that can help interpret the data, such as Veridion.

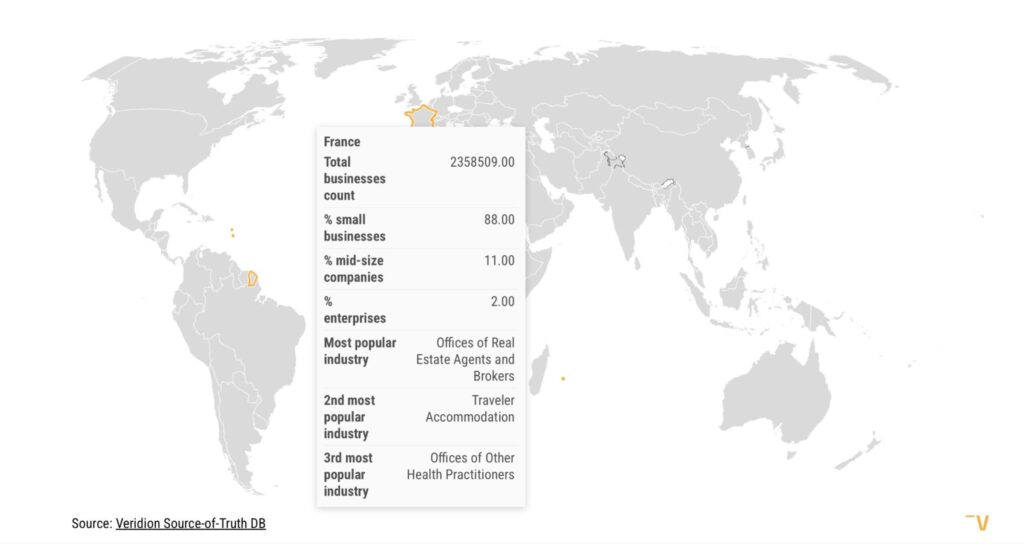

For example, if you were exploring France as a potential market, you could quickly see what industries dominate, how many businesses are active, and what the typical company breakdown looks like.

Source: Veridion

Instead of browsing company by company or stitching together fragmented reports, Veridion would help you scout potential markets in seconds.

Such structured, dynamic data enables you to analyze entire industries at once, so that you can navigate market intelligence data effectively and use it to guide decisions.

As you’ve seen, market intelligence data can be vast. Staying on top of hundreds of news sources, filings, datasets, and competitor updates is not the easiest task.

You might even end up working with inaccurate data, which is one of the biggest data management mistakes to avoid.

So, if there are tools that can handle much of this work for you, why not use them to your advantage?

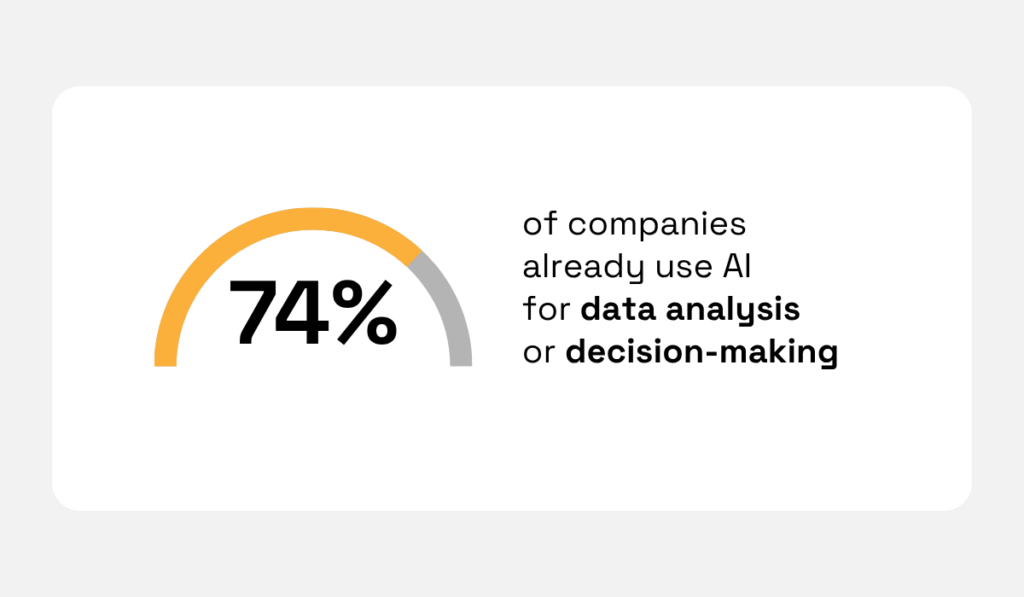

Given that 74% of companies use AI for data analysis or decision-making already, there is little reason to remain in manual mode.

Illustration: Veridion / Data: Cint

The specific AI tools that will benefit your business the most depend on your goals and data sources.

However, if you’re scouting markets, suppliers, or competitors at scale, Veridion’s AI-powered platform offers a highly targeted, data-rich approach to market intelligence.

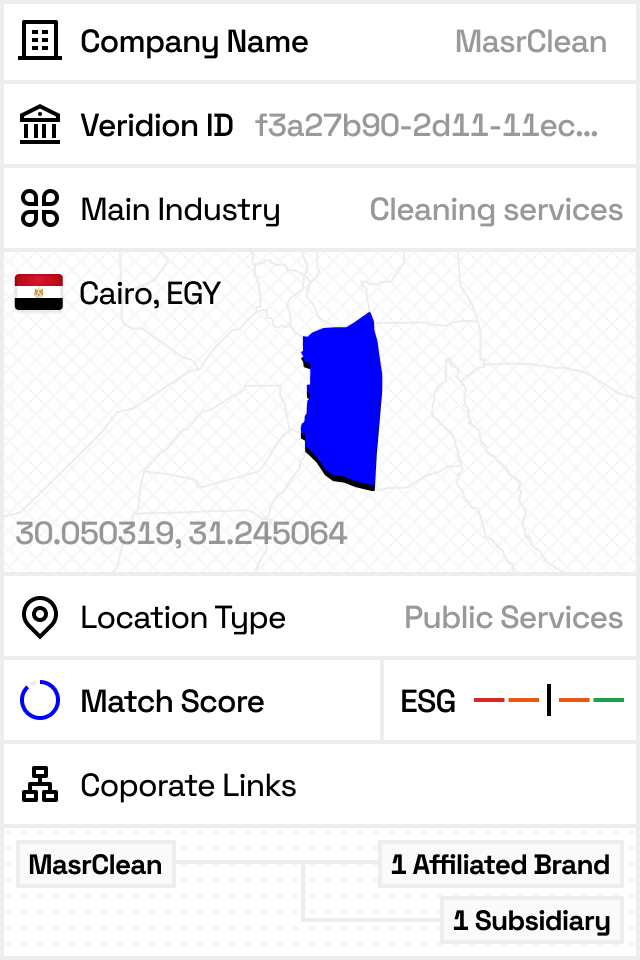

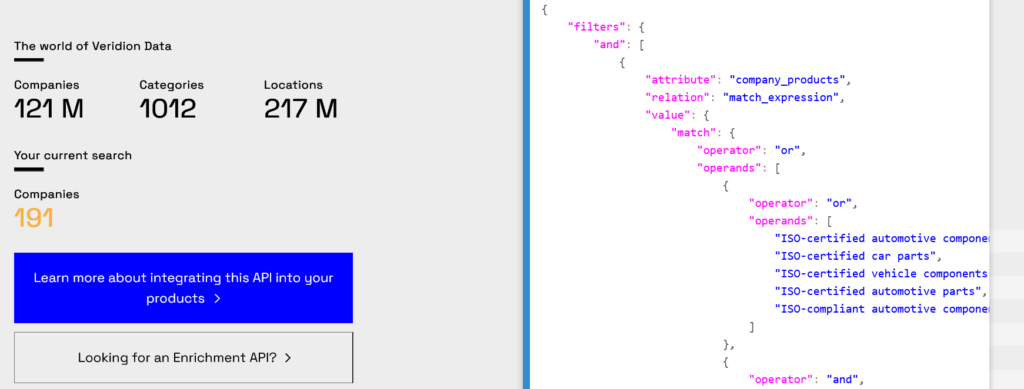

With its Search API, you can quickly discover businesses that match your criteria and monitor changes over time.

The platform draws from a database of over 130 million companies worldwide, updated continuously to maintain accuracy.

Source: Veridion

What sets Veridion apart is the depth and granularity of its data—over 220 attributes per company.

This includes detailed firmographic data, location intelligence, industry classification, regulatory compliance records, certifications, and product information.

If you prefer not to write complex queries, Veridion Scout allows you to search in natural language.

You can simply type what you are looking for, such as “suppliers of ISO-certified automotive components in Germany,” and the AI will interpret and execute the search across its database.

Source: Veridion

This combination of scale, detail, and AI-assisted search means you can:

From identifying what you need to research to delivering highly relevant, structured data, Veridion’s AI tools transform raw information into actionable market intelligence.

The quickest way to differentiate between market research and market intelligence would be to say that one is short-term and specific, and the other is long-term and broad.

Here’s a quick rundown of how they differ in purpose, methods, and outcomes, so you can confidently choose the right one for your next decision.

| Market research | Market intelligence | |

|---|---|---|

| Purpose | Validate specific ideas and products | Understand broad market dynamics and trends |

| Approach | Direct feedback from target audience | Analyzing external data |

| Typical methods | Surveys, interviews, focus groups, A/B testing | Monitoring news, regulations, filings, import/export data, competitor tracking, databases |

| Timeframe | Short-term | Long-term |

| Data source | Primary, created by the researcher | Secondary, gathered from external sources |

| Key strength | Captures customer views in real time | Reveals strategic opportunities and risks across markets |

So, if you would like to, for example, offer instalments for your products, use market research to test if “pay in 4” or “buy now, pay later” resonates more.

But if you’re expanding into, say, consumer electronics abroad, start with market intelligence to map demand, competitors, and local regulations.

While market research helps you adjust your tactics with input from real customers, market intelligence provides the strategic, big-picture insights you need to remain competitive.

Remember, both have their place in business strategies.

One helps you test ideas before launching them; the other helps you understand the playing field.

Used together and at the right time, they allow you to act confidently during all stages of planning, decision-making, and growth.