5 Best Alternatives to OpenCorporates

OpenCorporates is the world’s largest open database of companies, with over 220 million profiles across 140+ jurisdictions.

It’s a go-to source for investigative journalists, researchers, and transparency advocates who rely on official data from government registries.

But if your goals include ESG insights, third-party risk analysis, or richer, web-sourced company data, you’ll likely need more.

Here’s how five top alternatives compare—and what they offer beyond the basics.

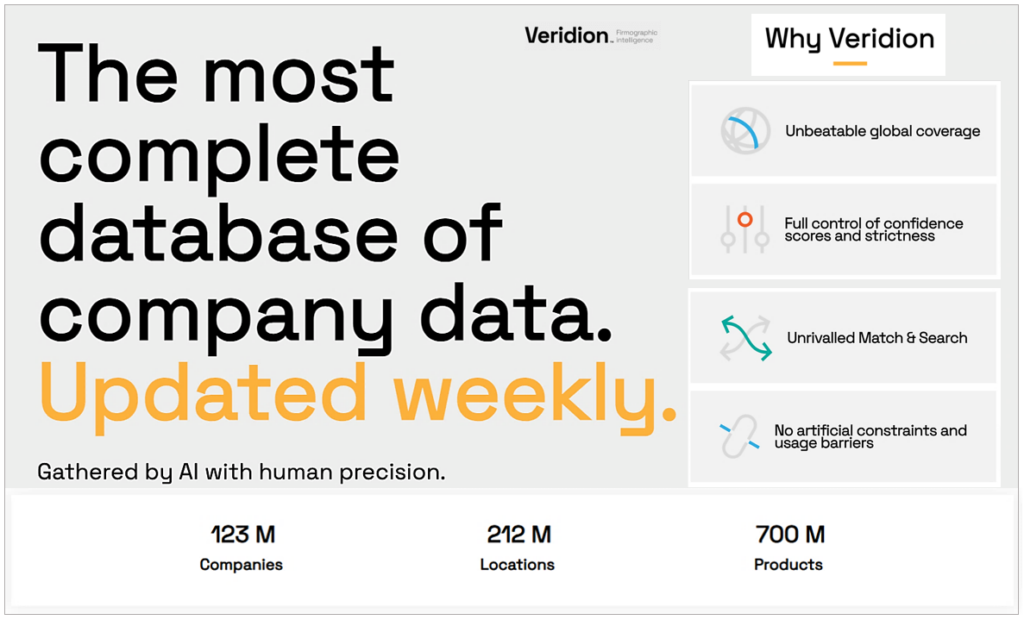

The first alternative today is Veridion—our own big data engine.

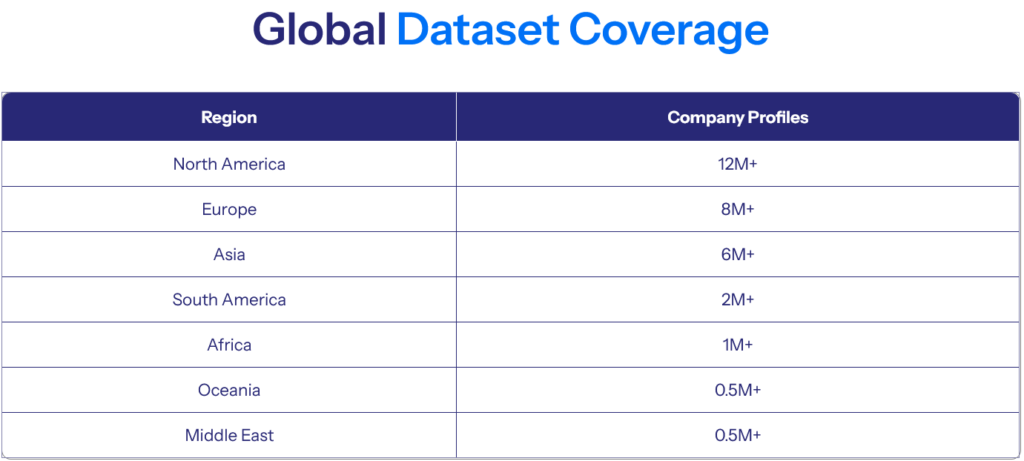

Veridion delivers data on more than 120 million companies across over 250 locations.

Source: Veridion

Unlike OpenCorporates, which focuses on official government data, Veridion gathers information from billions of websites, social media, and various online sources (with the help of AI and ML).

This enables a more comprehensive view of a company’s online presence, including news mentions and other media coverage.

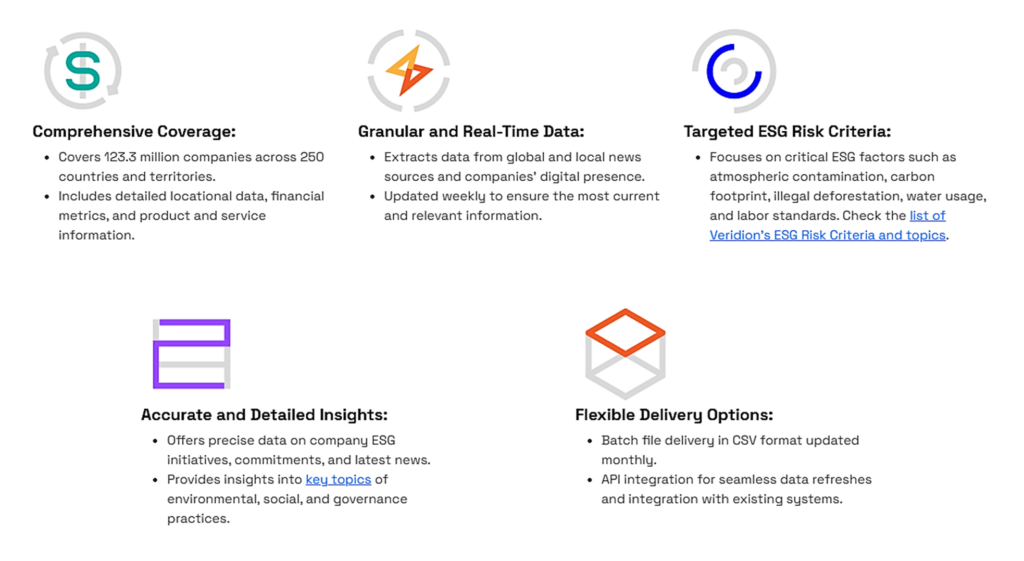

As a result, Veridion’s data is rich in real-world sentiment and includes environmental, social, and governance (ESG) information about every company.

Source: Veridion

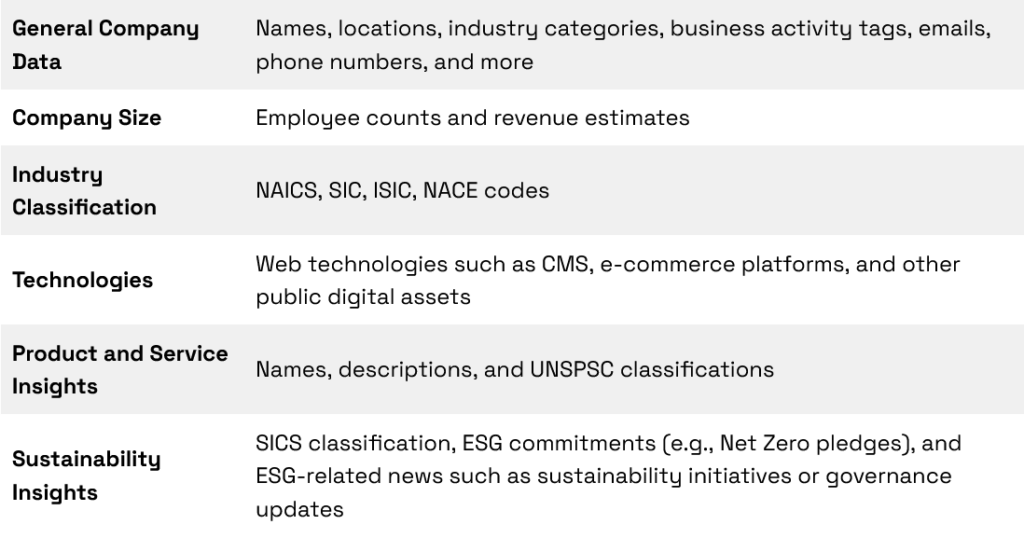

Each company profile in Veridion includes over 60 data points, such as product specifications, classifications, certifications, and more.

Here is just a small part of what Veridion’s data covers:

Source: Veridion

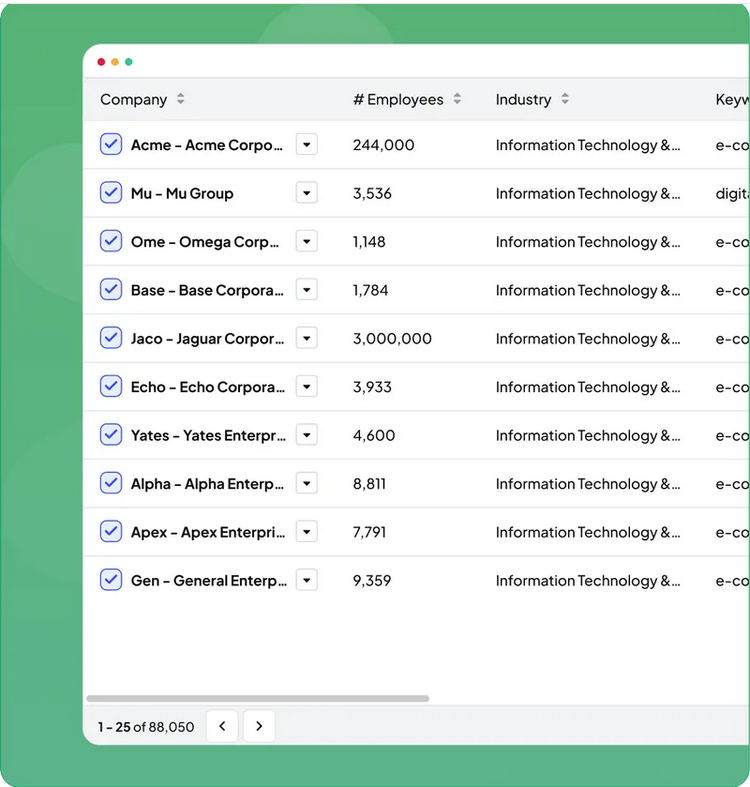

You can access this data through an API that integrates with your system or by using Scout, a natural language search tool (currently in Beta).

Source: Scout

While OpenCorporates also offers API access and a website search function, the results differ significantly.

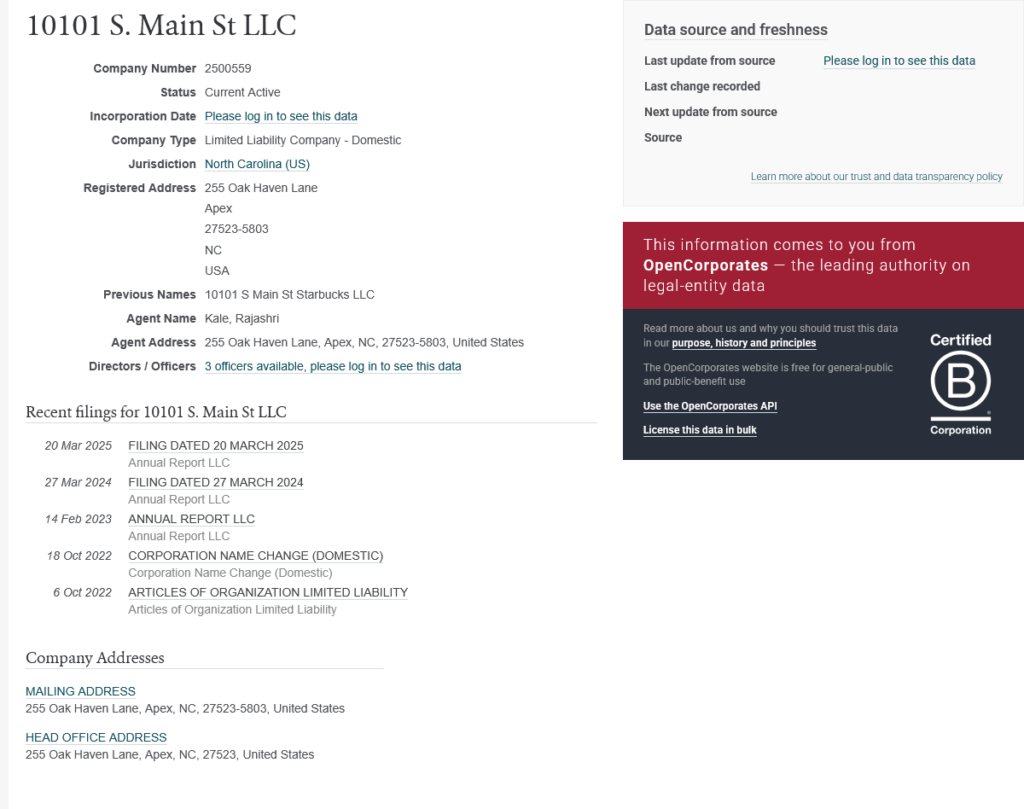

OpenCorporates provides information like incorporation dates, registered addresses, directors and officers, ultimate beneficial owners, latest company events and filings, and unique identifiers like LEI and UK VAT numbers.

Here is an example of a company profile:

Source: OpenCorporates

In contrast, Veridion delivers richer company profiles with more detailed and diverse data points.

Another key difference is data validation.

OpenCorporates provides data “as is,” meaning users should verify critical details themselves.

Veridion, on the other hand, processes its data through validation procedures to ensure accuracy.

This makes Veridion particularly useful for applications like procurement and supplier discovery, insurance, market intelligence, ESG data analysis, and third-party risk management.

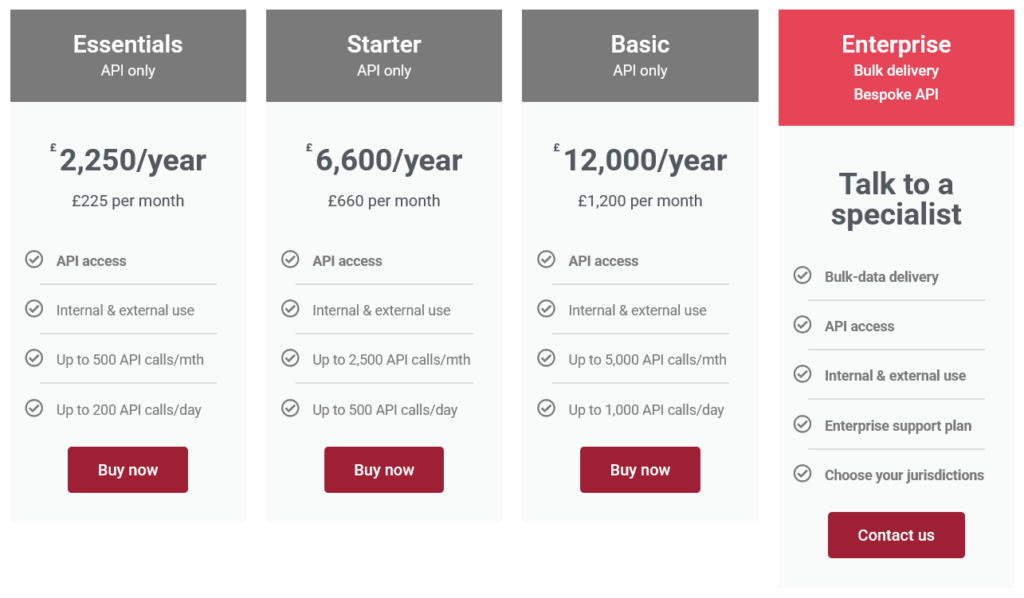

It’s also important to note that while OpenCorporates promotes itself as an open data provider, most of its advanced features are no longer fully open.

The data is free for personal use and public-benefit projects, but if you need bulk access, API integration, or plan to use the data commercially, you’ll need to pay for it.

Source: OpenCorporates

So, while OpenCorporates is still a valuable resource for official company records, Veridion gives you much more—richer profiles, real-time validation, and insights like ESG factors and media presence.

You do pay for Veridion, but what you get in return is a far more capable, flexible dataset built for commercial use cases.

That makes it a strong alternative if you need fast, comprehensive, and actionable company data.

Contact us to learn more.

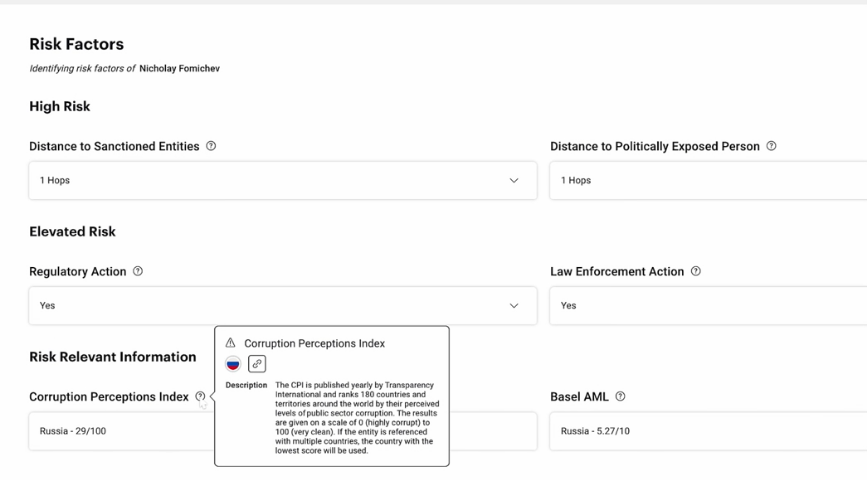

Sayari is another more advanced alternative to OpenCorporates, especially if you’re looking for deep insights into ownership structures and cross-border connections.

Essentially, this is a commercial risk intelligence platform that goes far beyond simple registry data.

With over 7 billion records, 724 million companies, 745 million key people, and 3.5 billion relationships, it’s built for users who need to understand not just who owns what, but how everything is connected.

Source: Sayari

Sayari pulls corporate and trade data from more than 250 jurisdictions.

This includes company registration information, trademark data, trade records, and in some cases, sanctions lists.

Compared to OpenCorporates, which focuses strictly on legal entity information from government sources, Sayari brings in more variety and provides better context for understanding risk at both the company and individual levels.

What makes Sayari different is how it handles person-level data.

You’re not just seeing directors and officers (like in OpenCorporates), but detailed profiles of individuals, including their connections to multiple entities, and any potential red flags associated with them.

Source: CB Insights

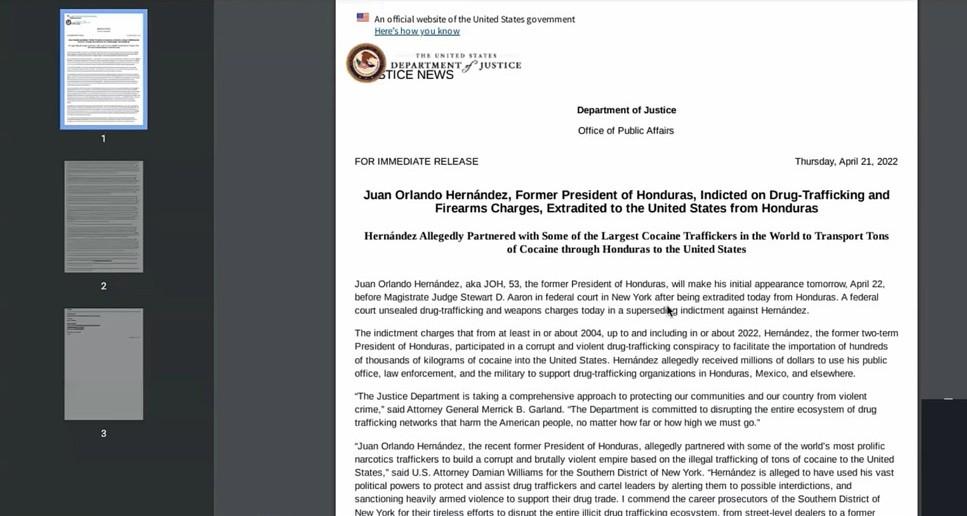

You can also view original source documents, like PDFs, or get redirected to the exact government website or publication the data came from.

Source: CB Insights

That adds a layer of transparency that’s valuable for investigations.

Plus, you can translate non-native languages with a single click anywhere in the platform.

However, there’s something important to keep in mind.

Sayari’s data overage and level of detail really depend on the country.

Each country has its own public records systems, disclosure laws, and levels of transparency.

Some countries offer a ton of useful information, like company ownership, shareholders, and full director profiles.

Others might only offer a basic registration number and an address.

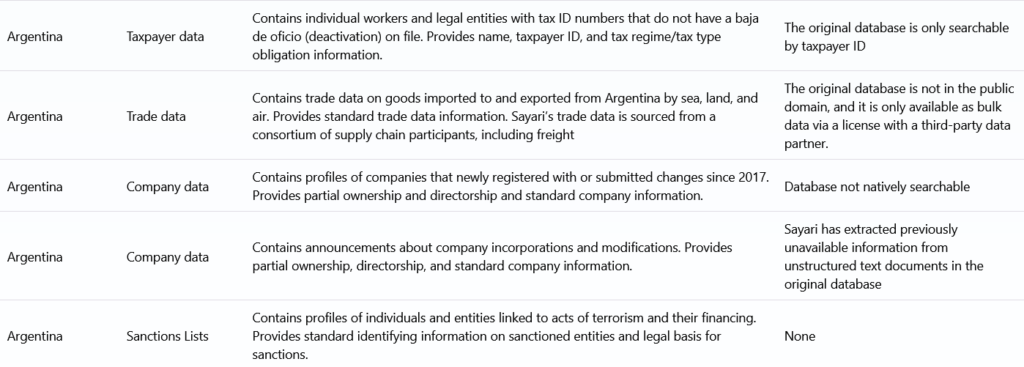

To give you a better idea: in Argentina, Sayari offers company data from the Central Business Registry, trade data, taxpayer records, and sanctions information.

Source: Sayari

In Afghanistan, on the other hand, they provide standard company and trade data, but no sanctions lists or taxpayer data.

Source: Sayari

One thing to note is that, unlike Veridion or Coresignal, Sayari (like OpenCorporates) doesn’t source data from social media.

Instead, it collects data from official records, corporate connections, and the risks hidden in ownership webs.

All in all, Sayari is fast, efficient, and built for investigations.

That’s why it’s trusted by Fortune 100 companies, financial institutions, and even national security agencies in the US.

You can access the platform through their interface or use APIs. Data can also be exported as a CSV to integrate with other systems.

If your priority is tracing ownership, uncovering hidden relationships, or making sure you’re not missing anything in global compliance, Sayari offers a more thorough and investigation-ready alternative to OpenCorporates.

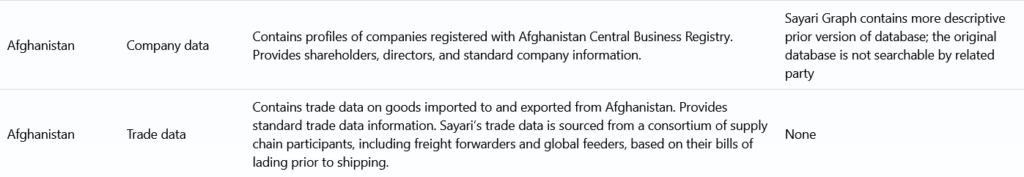

Coresignal is a public web data provider that focuses on delivering large-scale, enriched company and employee datasets for commercial use.

Unlike OpenCorporates, which sticks to official government sources, Coresignal scrapes the public web to build detailed company profiles with far more context around business activity, workforce, and market presence.

At a high level, their coverage includes data on over 73 million companies across more than 185 countries.

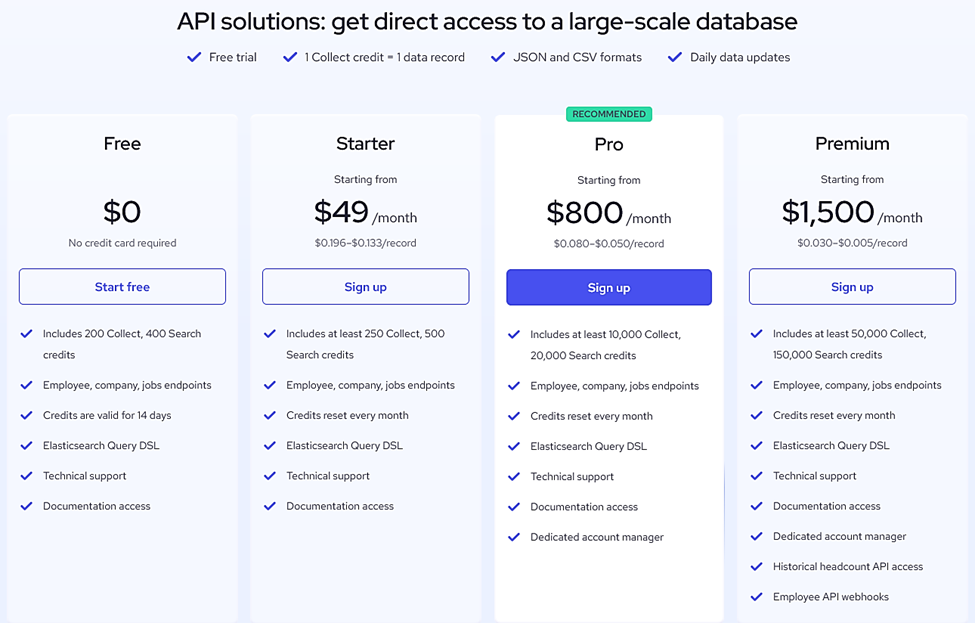

The company profiles include everything from firmographics and contact information to key executives, employee structures, salaries, revenue, product information, competitor insights, and many other data points.

Source: Coresignal

It’s one of the broadest commercial datasets available, going well beyond what you’d find in a company register.

But not every company profile comes with the full list of 500+ data points.

Coresignal offers three processing levels for its data:

| Base company dataset | 73M+ records, 70+ data points | One source, structured and normalized scraped data |

| Clean company dataset | 39M+ records, 80+ data points | One source, structured, normalized, and standardized, free of duplicated and irrelevant data |

| Multi-source company dataset | 39M+ records, 500+ data points | Multiple sources, structured, normalized, and standardized, free of duplicated and irrelevant data, AI-enriched and additional data fields |

All datasets get fully refreshed every month, which is relatively frequent, though still a bit slower compared to platforms like Veridion, which refresh every two weeks at most.

Still, monthly updates keep the data quite fresh for most business use cases.

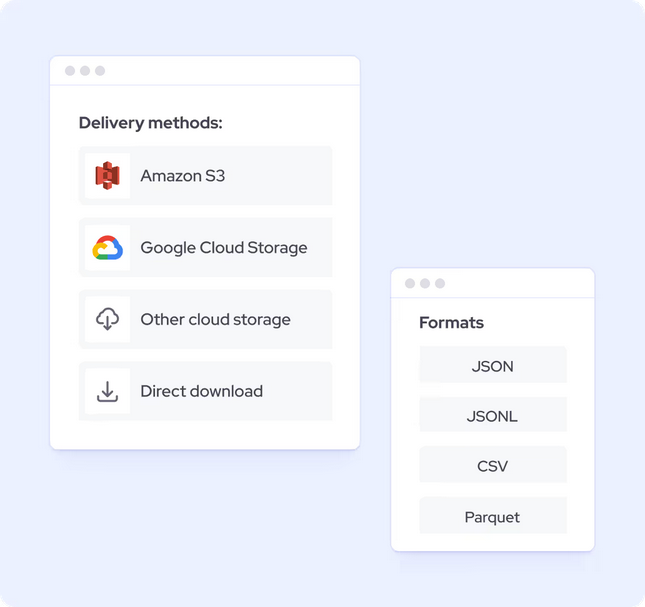

You can access the data in multiple ways, depending on what works best for your team.

There’s an API if you want to automate enrichment or integrate resume and company data into your own product or system.

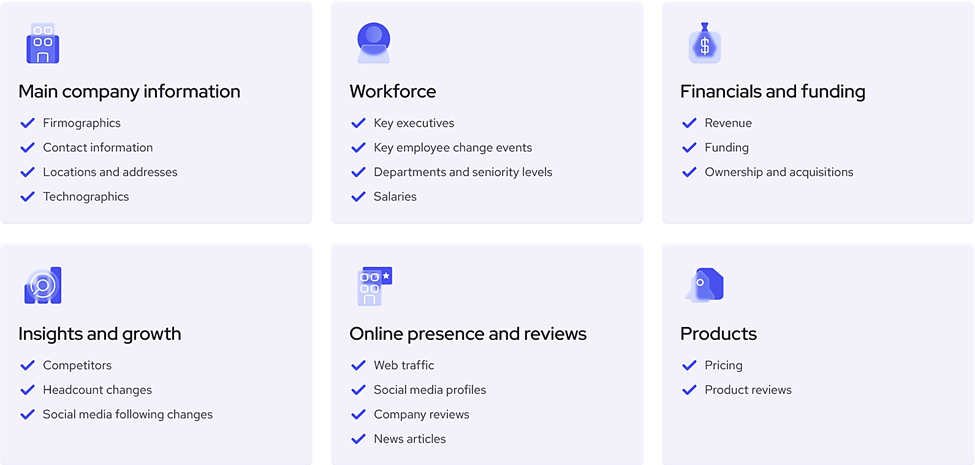

Check the pricing for API options below:

Source: Coresignal

You can also download full datasets based on your selected processing level, format, and delivery method, with prices starting from $1,000.

Source: Coresignal

If you’re not into coding, they also offer a no-code Data Explorer platform.

That tool lets you filter and create datasets of up to 10,000 records directly from the Base Company Dataset.

Coresignal is particularly useful if you’re working in investment analysis, HR tech, sales intelligence, or market research.

It’s strong at helping identify companies worth targeting or monitoring, understand workforce dynamics, and analyze competitive landscapes.

Overall, Coresignal is a good alternative to OpenCorporates if you want a broader picture of a company’s digital footprint.

It gives you a more complete view of the company’s real-world activity, staffing, reputation, and growth indicators, all based on publicly available web data.

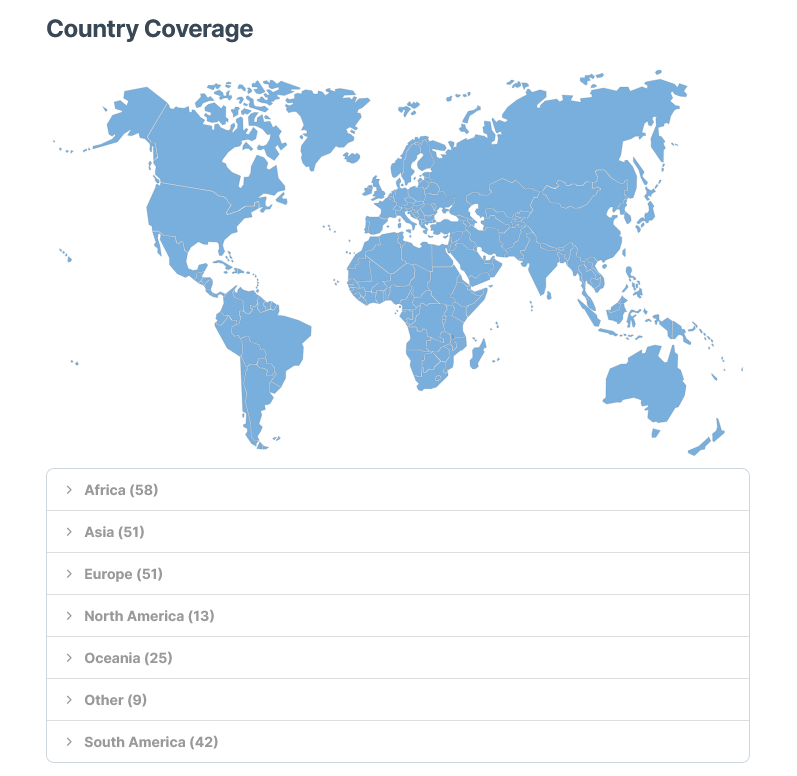

BoldData is a strong alternative to OpenCorporates, especially if you need detailed, verified company data to support growth and decision-making.

It collects data from official sources like Chambers of Commerce, Companies House, insolvency registries, and statistics offices, as well as local data providers, and covers more than 200 countries.

Source: Datarade

BoldData enables access to over 350 million companies and 500 million contacts, including names, registration numbers, phone numbers, emails, CEOs, revenue figures, legal status, ownership information, and more.

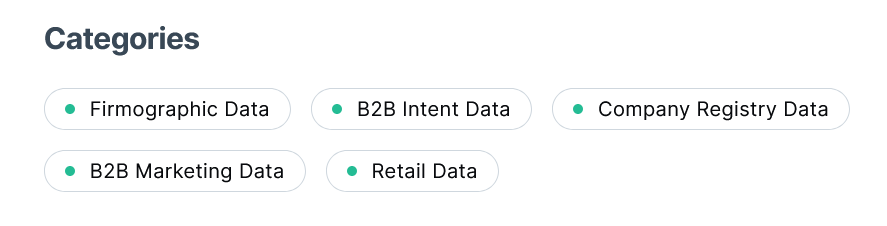

Beyond basic company profiles, BoldData also provides B2B intent signals, B2B marketing datasets, and even retail business insights.

Source: Datarade

It also includes legal entity types and historical revenue data for private, non-listed companies going back up to five years.

This is especially useful for banks, fintech firms, and analysts looking for deeper business insights that aren’t publicly disclosed.

The data isn’t just collected “as is” like in OpenCorporates.

Instead, it’s verified through automated checks and human review.

That makes it reliable enough to serve as a backbone for other data providers, investors, analysts, banks, and fintech platforms.

BoldData also builds custom datasets to match your business needs, so you’re not just getting a static export but a solution tailored to your goals.

BoldData prides itself on speed and ease of delivery.

You can receive the data within 24 hours, usually in Excel format, or via API, depending on your technical setup.

Source: BoldData

This makes it flexible for businesses that want either fast, ready-to-use files or full integration into their CRM, analytics, or targeting platforms.

Pricing starts at a minimum of €425, with a yearly data license available from €7,500.

If you’re interested in larger volumes or custom-made files, you can check BoldData’s pricing page for more details.

To sum up, BoldData is a smart alternative for companies needing a powerful B2B dataset that’s accurate, detailed, and built for commercial use.

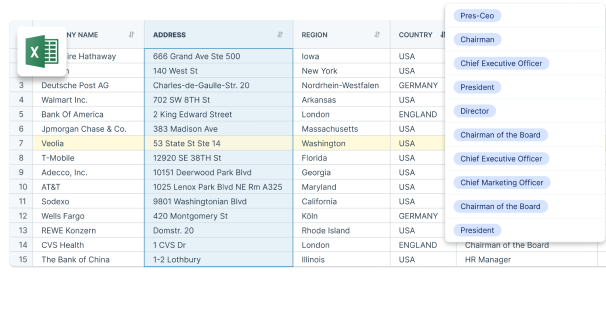

The last alternative on our list is Success.ai, a strong B2B data provider that focuses on enriched company profiles and verified contact information.

While it’s primarily known as a cloud-based email marketing platform, it also offers company, employee, and global people datasets as part of its custom solutions.

For the company dataset, Success.ai covers more than 30 million companies across 200+ countries and industries.

Source: Success.ai

For each company, you get the following data points:

Below is a sample of a company profile:

Source: Success.ai

Success.ai pulls this information from public databases, proprietary sources, web scraping, and trusted partnerships.

The company also collects LinkedIn data and employee records through AI-powered crawlers, so you get real-time visibility into team structures and key personnel.

This level of detail goes well beyond what OpenCorporates offers.

OpenCorporates sticks to registry data from government sources.

Success.ai, by contrast, provides enriched firmographic and contact-level data, similar to platforms like Veridion, though Veridion delivers many more data points and has broader coverage.

All Success.ai data is AI-validated with a 99% accuracy rate, reviewed by humans, and compliant with global privacy regulations like GDPR.

You can get your dataset in CSV, Parquet, or a custom format, depending on what fits your workflow.

Source: Success.ai

Just like BoldData, Success.ai offers quick delivery (even quicker) and supports customized datasets tailored to your needs.

Pricing for Success.ai’s Custom Companies & Professionals Datasets falls under the enterprise plan, which comes with custom pricing.

Overall, Success.ai’s data is collected for various use cases, from sales prospecting, lead generation, and account-based marketing to investment research and even supplier vetting.

And it’s yet another strong alternative to OpenCorporates, even though it has data on fewer companies.

OpenCorporates is still a trusted source for official records.

But if you’re looking for more than just registry data, it’s worth exploring alternatives.

Veridion stands out for enriched, web-sourced profiles with ESG insights, real-time validation, and flexible integrations, ideal for supplier vetting, market research, and risk analysis.

For deep dives into ownership structures and cross-border ties, Sayari offers unmatched visibility into complex corporate networks.

And if your focus is workforce insights or digital presence, Coresignal delivers large-scale, structured data on companies and employees from across the web.

In the end, the best alternative depends on what you need beyond OpenCorporates—whether it’s richer insights, faster updates, or specialized risk intelligence.

Whatever your goal, there’s a smarter dataset out there waiting to be put to work.