Operational Due Diligence: A Guide for Investors

Key Takeaways:

When investors hear the term due diligence, they often think of financial statements, valuations, and legal checks.

But operational due diligence goes deeper. It focuses on how a business actually runs: its processes, people, systems, suppliers, and ability to scale without breaking.

In this guide, we break down what operational due diligence really involves, the key areas investors should examine, the detailed process to perform ODD, and how it helps uncover risks and opportunities that financials alone cannot reveal.

So, if you’re evaluating an acquisition, investment, or partnership, read on.

Understanding operational due diligence can be the difference between a deal that looks good on paper and one that delivers long-term value.

Before closing a deal, smart investors want to know how a company actually operates day-to-day.

That’s where you need Operational Due Diligence (ODD). It examines the core operational domains that drive day-to-day results and discloses hidden issues that could derail your investment.

According to Deloitte’s 2024 M&A survey of 1,500 corporate and PE dealmakers, leadership and operational factors are increasingly central to how investors prepare for deals and manage risk.

Below are five critical areas you’ll want to examine. Depending on the business, you may also need to look at production facilities, R&D capabilities, or other domain-specific functions.

How does work actually get done in this company?

This is about understanding workflows from the front line to the back office.

You’re testing documentation quality, process efficiency, and quality controls while checking for bottlenecks.

The goal is simple: find inefficiencies before they become expensive problems.

Look for concrete signals, such as:

If processes aren’t documented, repeatable, and scalable, you’re looking at lost time and a deal that may fall short of its strategic goals.

And that’s more important than you might think.

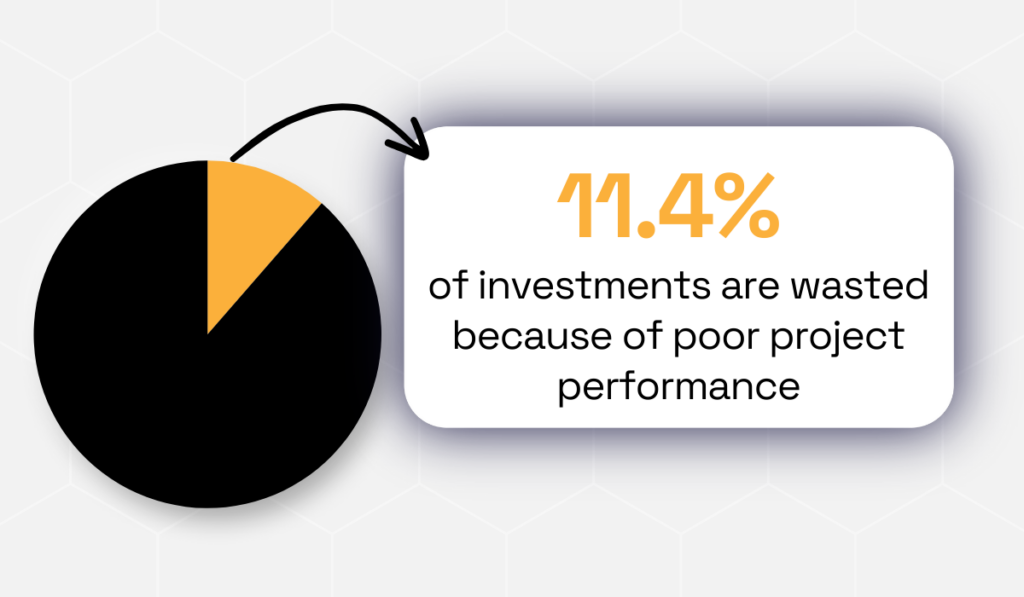

Organizations waste an average of 11.4% of investments due to poor project performance.

Illustration: Veridion / Data: PMI

By mapping these gaps early, you can identify quick wins or flag processes that will fail under scale, both of which are core to prudent operational due diligence.

Even the best systems can’t save a deal if leadership is weak.

You need to assess the team’s leadership skills, clarity of roles, track record, decision-making ability, and succession plans. This is core to ODD.

Why?

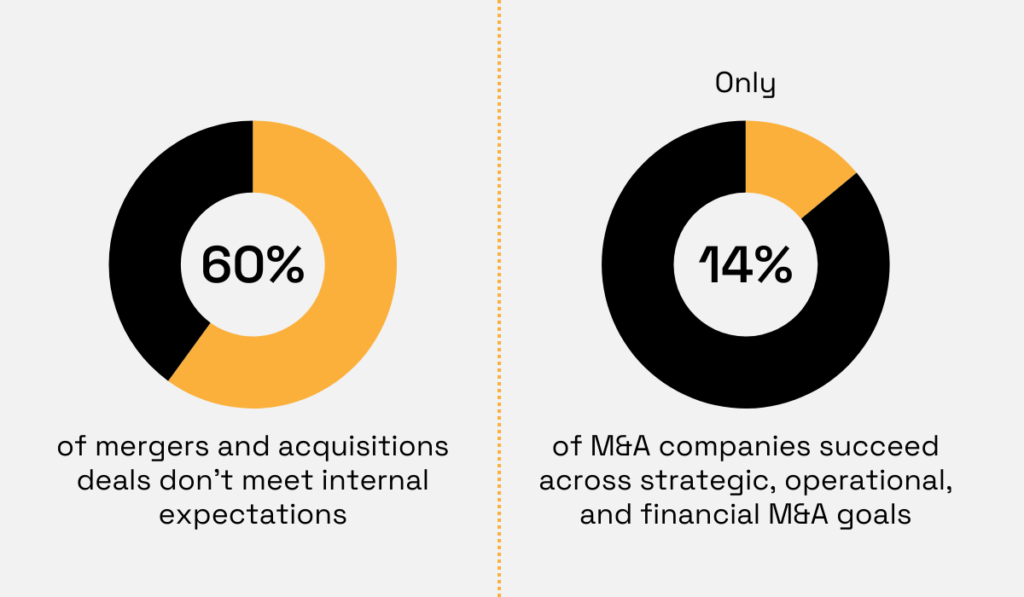

Because up to 60% of all mergers and acquisitions deals fall short of internal expectations.

On top of that, as reported by PwC’s 2023 M&A integration survey, only 14% of companies achieved meaningful success across strategic, operational, and financial goals.

Illustration: Veridion / Data: Bain and PwC

This makes leadership quality impossible to ignore.

Ask yourself:

Do these leaders have relevant experience? Is there a clear succession plan if key people leave?

Investors look for management teams that can make sound decisions and actually execute the growth strategy.

When a founder controls all decisions, and no succession path exists, that concentration of authority becomes a quantifiable risk.

Over time, weak leadership structures often signal value erosion.

Investors want confidence that the right people are in place and that they can work together effectively through the transition.

A brilliant team and streamlined processes mean nothing if the technology can’t keep up.

Outdated or fragmented systems slow growth and create risk, especially when you’re trying to scale.

Modern operational due diligence always includes a technology review along with traditional financial checks.

This means examining core platforms such as ERP and CRM systems, checking how well systems integrate with each other, and reviewing cybersecurity safeguards.

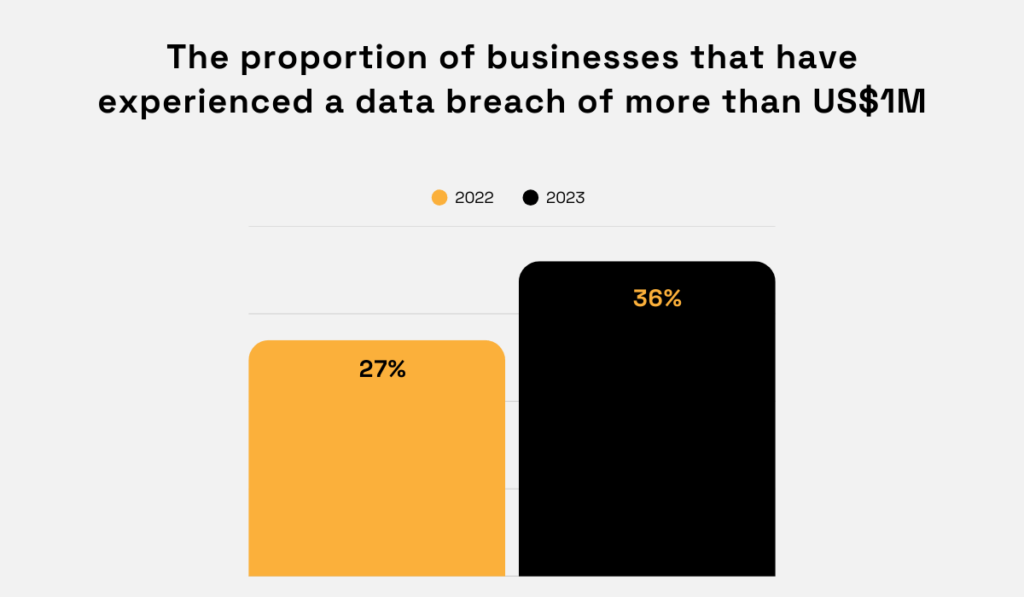

Cybersecurity diligence is now mandatory. With more and more businesses experiencing serious data breaches every single year, there’s no room for carelessness.

Illustration: Veridion / Data: PwC

The questions you should be asking include: Are the systems modern and efficient? Are data and networks secure?

An outdated on-premise ERP or an unsecured cloud database can pose serious risks.

A poor tech stack has direct implications for deal value. If major upgrades will be needed, that cost needs to be factored into your valuation.

Non-compliance is both risky and expensive.

Every business must follow the rules, and highly regulated industries like healthcare and finance face particularly heavy scrutiny and financial penalties when targets don’t meet standards.

This covers everything from environmental permits and labor laws to data privacy regulations. Think HIPAA for health data, SEC rules for finance, and FDA registrations for pharmaceuticals.

The penalties for non-compliance can be severe.

Regulators can levy massive fines or even shut down parts of the operation.

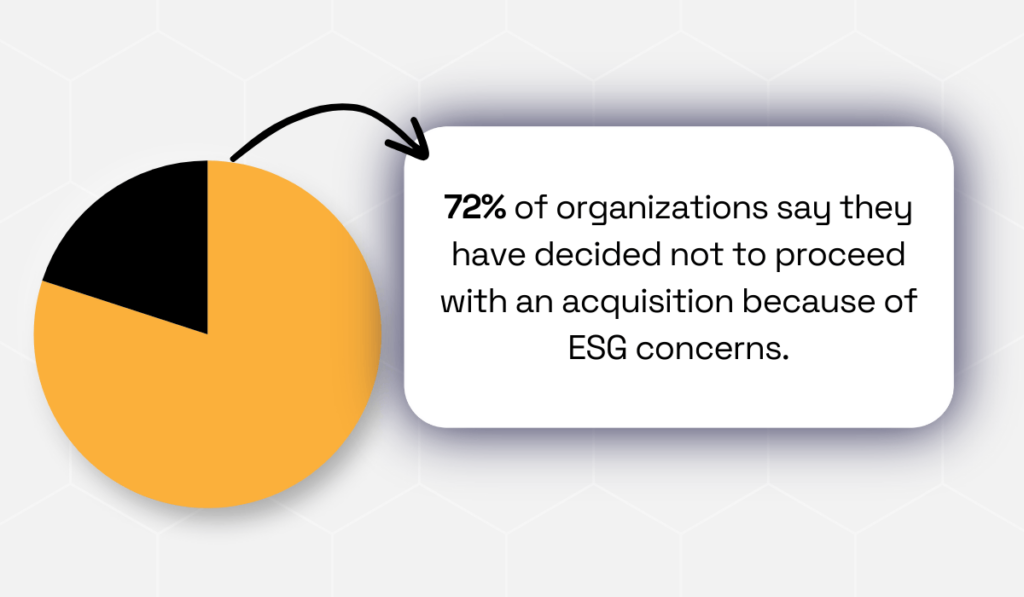

No wonder, then, that 72% of companies have walked away from acquisitions due to non-financial concerns, particularly those regarding ESG.

Illustration: Veridion / Data: Deloitte

Clearly, compliance issues don’t only create risks; they can kill deals outright.

Failure to meet regulatory requirements can lead to millions in penalties.

For cross-border deals, you also need to consider foreign regulations and sanctions.

A strong compliance framework prevents legal headaches and fines after the acquisition closes.

Your supply chain is a strategic asset, not just a cost center.

Modern businesses depend on complex networks of suppliers, so you need to scrutinize the supply chain for weak links.

Start with these questions: Are there any particular suppliers on which the company depends? How solid are sourcing and logistics processes? Could geopolitical events or natural disasters disrupt the chain?

Consider a manufacturer that relies on one factory for an essential component. If that factory stops producing, the entire company grinds to a halt.

The numbers tell the story. According to the research by GEP, supply chain disruptions typically consume 6–10% of annual revenue when they occur.

Here’s a real-world example.

In 2018, KFC’s UK operation switched from its chilled-food logistics partner, Bidvest (now Best Food Logistics), to a cheaper provider: DHL.

They didn’t conduct proper checks.

Source: Google

Bidvest had deep experience with chilled food logistics and operated six regional depots.

DHL was inexperienced with perishable goods and planned to run deliveries from just one distribution center.

Expectedly, things went wrong fast.

Shortly after DHL took over, a major accident on the M6 caused severe traffic delays. DHL’s single-depot system couldn’t handle it.

The resulting backlog prevented fresh chicken deliveries, forcing over 700 UK restaurants to remain closed.

The mistake cost KFC millions in lost sales and serious brand damage.

Source: X

The failure resulted from more than just unfortunate circumstances; experts point to a significant lack of preparation by DHL.

According to Professor Samir Dani, Professor of Operations and Supply Chain Management at Keele University, the combination of factors created a “perfect storm” of logistical failure.

Illustration: Veridion / Quote: Wired

The blame was shared; KFC’s focus on cutting costs blinded them to the operational risks of the switch.

They got what they paid for: lower service costs, yes, but also empty restaurants and frustrated customers.

This is an example case of inadequate supplier evaluation and zero contingency planning.

Had KFC properly assessed DHL’s capabilities against their previous provider, they might have avoided the reputational hit and the customers who left for competitors.

Source: @sparc_digital on X

The lesson for investors? Analyze vendor concentration, contract terms, and backup plans carefully.

You need to spot single points of failure and hidden supplier risks before they become your problem.

Conducting ODD follows a structured, multi-step approach. Each phase builds upon the previous one to give you a comprehensive picture of operational health.

Here’s how the process typically unfolds:

This is where you define what’s most important based on strategy and deal thesis.

In this planning phase, you will tailor the ODD scope to fit the target’s business model and your investment thesis.

Start by identifying the company’s critical functions, key assets, and main revenue drivers.

Set clear objectives. What specifically do you need to learn? What could break this deal?

Assemble the right team: tech specialists, compliance experts, industry veterans, whoever you need to assess the unique risks at hand.

A customized checklist helps you focus on the highest-risk operational areas instead of trying to examine everything at once.

This focused approach ensures you spend time on the highest-priority risks, not on irrelevant details.

Next, you gather the evidence.

Collect key documents and data from the target organization, such as:

Examine historical performance data, including uptime metrics, defect rates, and productivity numbers.

Review financial controls, too. Your goal is to verify every claim the company makes.

If they say “we have no debt,” check the financial statements.

If they mention a key supplier relationship, get the vendor lists.

You can use standardized questionnaires or virtual data rooms to streamline this process.

A successful data collection effort finds information and checks its completeness and accuracy.

Missing documents, outdated information, and contradictory data are red flags and often the first sign of deeper operational problems.

Seeing is believing.

Documents tell part of the story, but now it’s time to see operations firsthand.

Visit the facility (or multiple sites). Talk to people.

Interview C-suite executives, plant managers, and staff on the premises.

You’re looking to discover:

Walk the shop floor, inspect equipment, and watch workflows in action.

Sit in on an operations meeting. Observe a quality control check.

These face-to-face interactions usually yield the most valuable insights because you’re seeing reality, not just reading about it.

Once you’ve identified issues, it’s time to put a number on them.

Translate your operational findings into business consequences and financial impact estimates.

Ask yourself: How would each risk affect revenue continuity, costs, compliance, or scalability?

Estimate the cost to fix problems (a systems overhaul, for example) or calculate potential penalties for compliance lapses.

Score each risk (high, medium, low) based on likelihood and severity.

Let’s say your supply chain review uncovered a single-source supplier in a politically unstable region.

Calculate the potential revenue loss if that supply line gets disrupted.

Based on these numbers, the ODD team may recommend a price adjustment or set aside contingency funding.

Quantifying risks this way supports your go/no-go decision and gives you negotiation leverage.

Finally, compile everything into a formal ODD report.

This document should synthesize your findings, prioritize risks, and prescribe remediation steps.

A strong report includes an executive summary, a risk/opportunity matrix, clear recommendations by function, and supporting data.

The report should inform your strategy, pricing, integration timeline, and cost projections.

Use these insights to fine-tune your acquisition plan so you can address the biggest operational gaps immediately after closing.

Think of the final ODD report as your roadmap for post-close action.

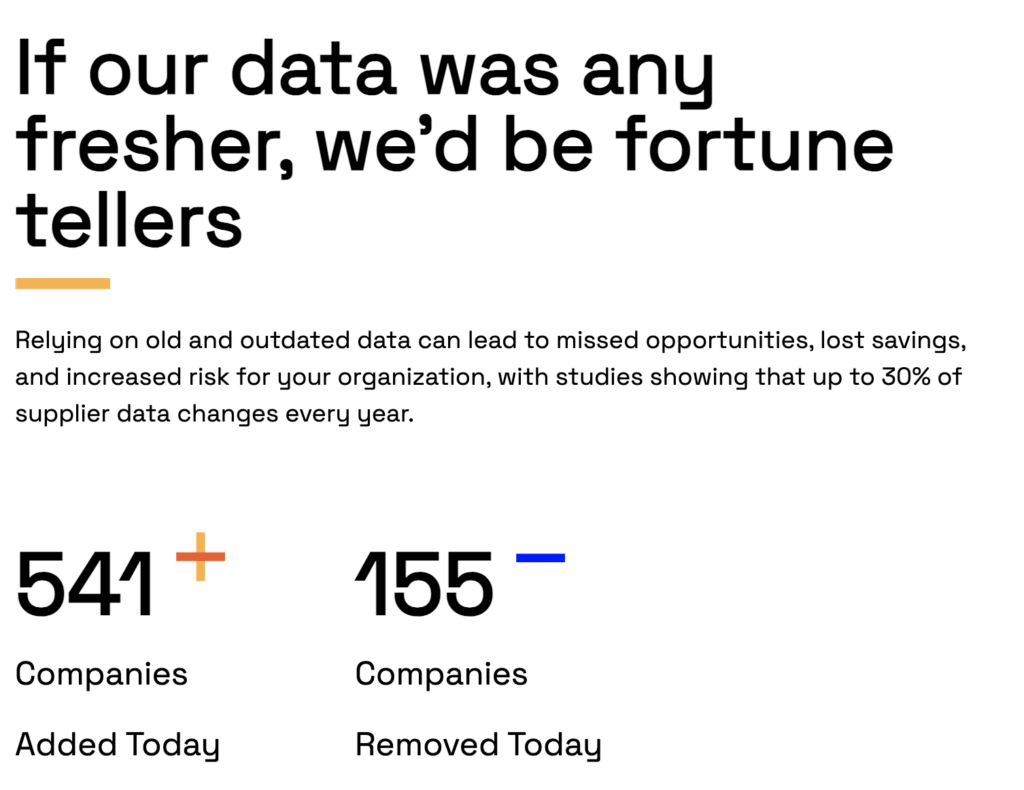

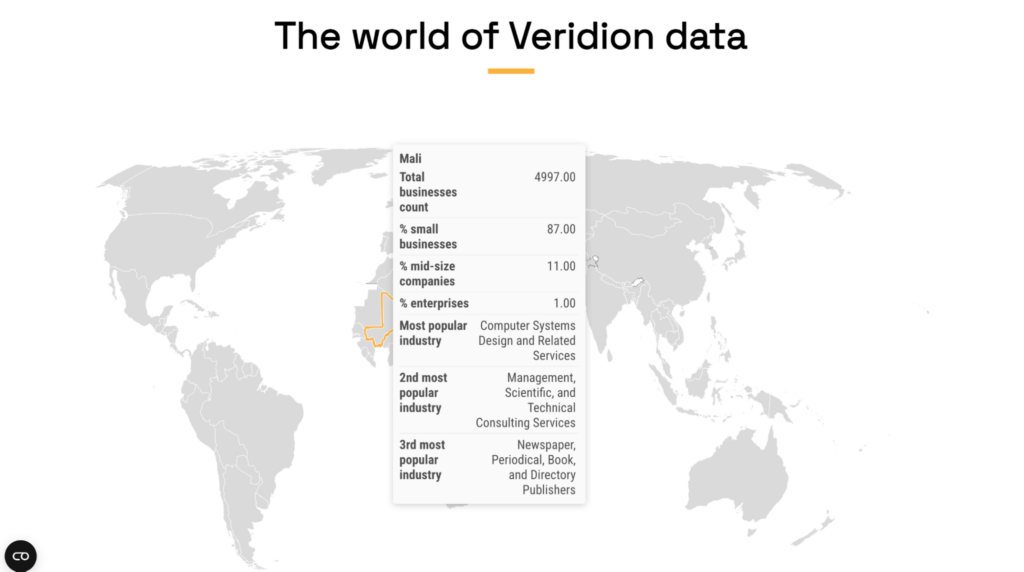

Our BI platform, Veridion, strengthens the ODD process by providing investors with access to high-accuracy, continuously refreshed global company data.

This is particularly crucial where ODD is most vulnerable to blind spots: supply chains, vendor dependencies, corporate structures, and location-level operations.

Source: Veridion

The platform enables investors to validate the full operational ecosystem around a target company.

This includes suppliers, subsidiaries, ownership structures, and operational sites across regions.

Instead of working with static disclosures or manually reconciled datasets, you get live, structured intelligence that shows how the business actually operates today.

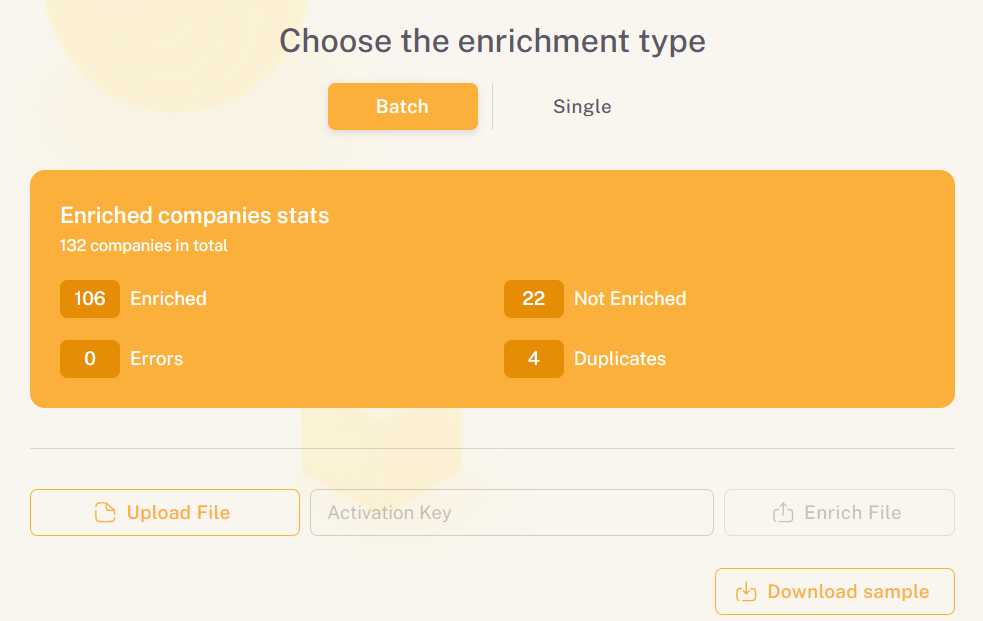

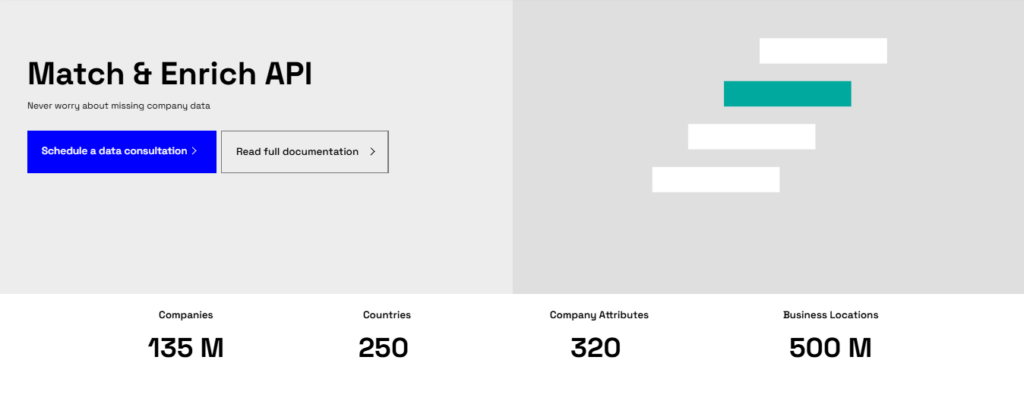

At the crux of this capability is its AI-powered Match & Enrich API.

Source: Veridion

Upload a target company’s vendor or counterparty list, and the system instantly confirms the existence, identity, ownership, and operational status of thousands of entities.

This eliminates risks from defunct companies, misrepresented entities, and shell companies.

The API also surfaces foreign influence, high-risk supplier relationships, and corporate linkages.

It reveals parent companies, subsidiaries, and shared ownership that could indicate concentration risk, conflicts of interest, or hidden dependencies.

Each enriched record includes over 220 operational attributes.

That covers ownership details, industry classification, subsidiaries, workforce size, revenues, and operational footprint.

This depth of data helps you detect hidden third-party risks.

For example, you might discover that several supposedly independent suppliers are actually controlled by the same parent entity.

Or you might find that key vendors operate in jurisdictions with elevated regulatory, political, or sanctions risk.

Source: Veridion

Veridion also strengthens your geopolitical and continuity risk analysis through location-level intelligence.

Investors can filter suppliers by country, map operational sites, and assess geographic clustering.

This makes it easy to spot dangerous exposure, like having multiple critical suppliers concentrated in a single high-risk location.

Source: Veridion

Ultimately, the platform equips investors with a continuously updated, end-to-end view of a company’s operational footprint and ecosystem.

By automating supplier validation, ownership discovery, and location-level risk assessment, Veridion makes your supply chain and corporate structure analysis faster, more accurate, and more reliable.

All things considered, operational due diligence is a critical step for investors who want clarity beyond the numbers.

Yes, it does take time, coordination, and the right data to get it right, but the upside is substantial.

Think fewer surprises post-close, stronger operational resilience, and better-informed investment decisions.

Because in today’s investment industry, you need to understand how a business operates to remain relevant.