6 PitchBook Alternatives for Gathering Market Intelligence

PitchBook is a quite popular tool for gathering market intelligence, providing its users insights on both private and public companies.

However, it’s not the only such solution out there.

In fact, there are so many alternatives currently available on the market, each with its own strengths—whether it’s price, features, data quality and coverage, or specific use case.

So, if you’re on the hunt for that perfect market intelligence platform, this article will set you on the right path to finding the best fit, no matter your industry or role.

Veridion is an AI-driven platform specializing in business data enrichment, with unparalleled coverage of private companies.

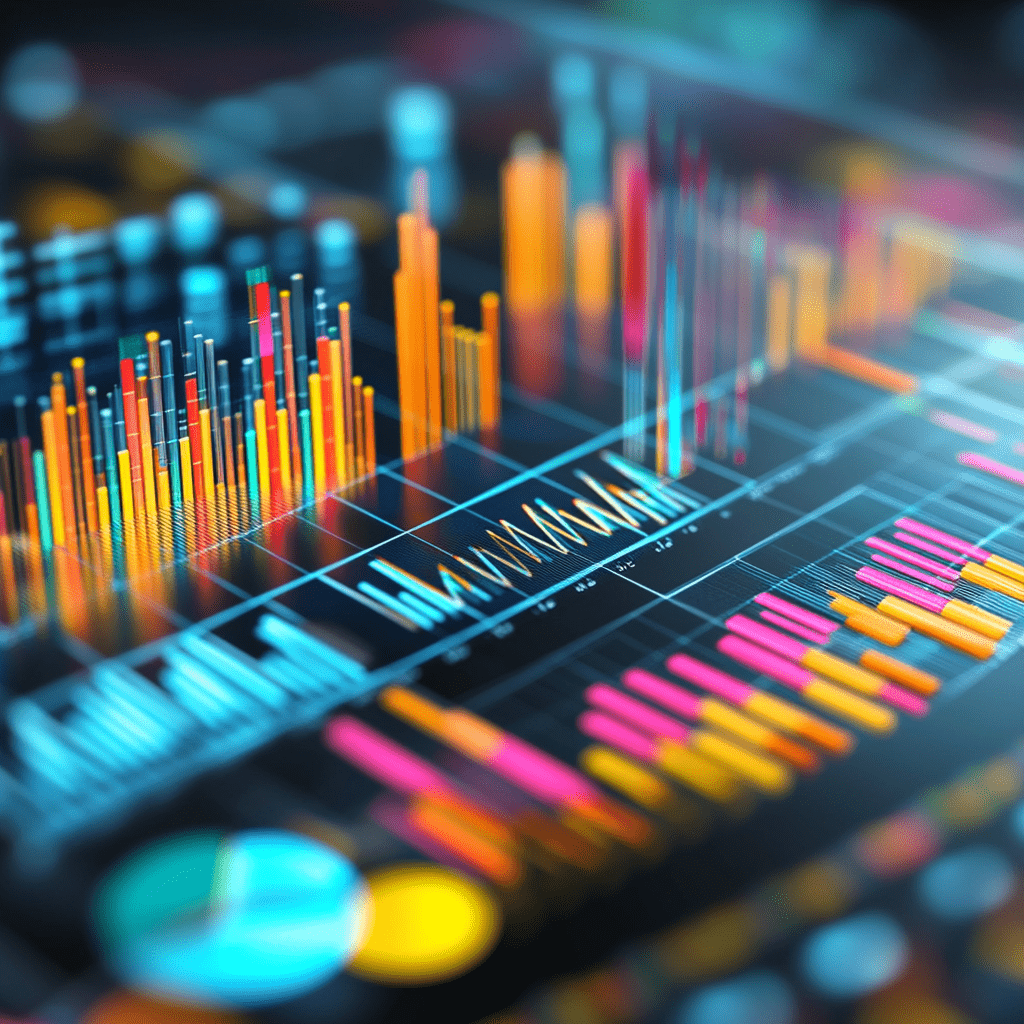

Where does our data come from?

Well, we use advanced web scraping techniques to gather information from all over the internet—often leveraging data that other platforms miss.

Source: Veridion

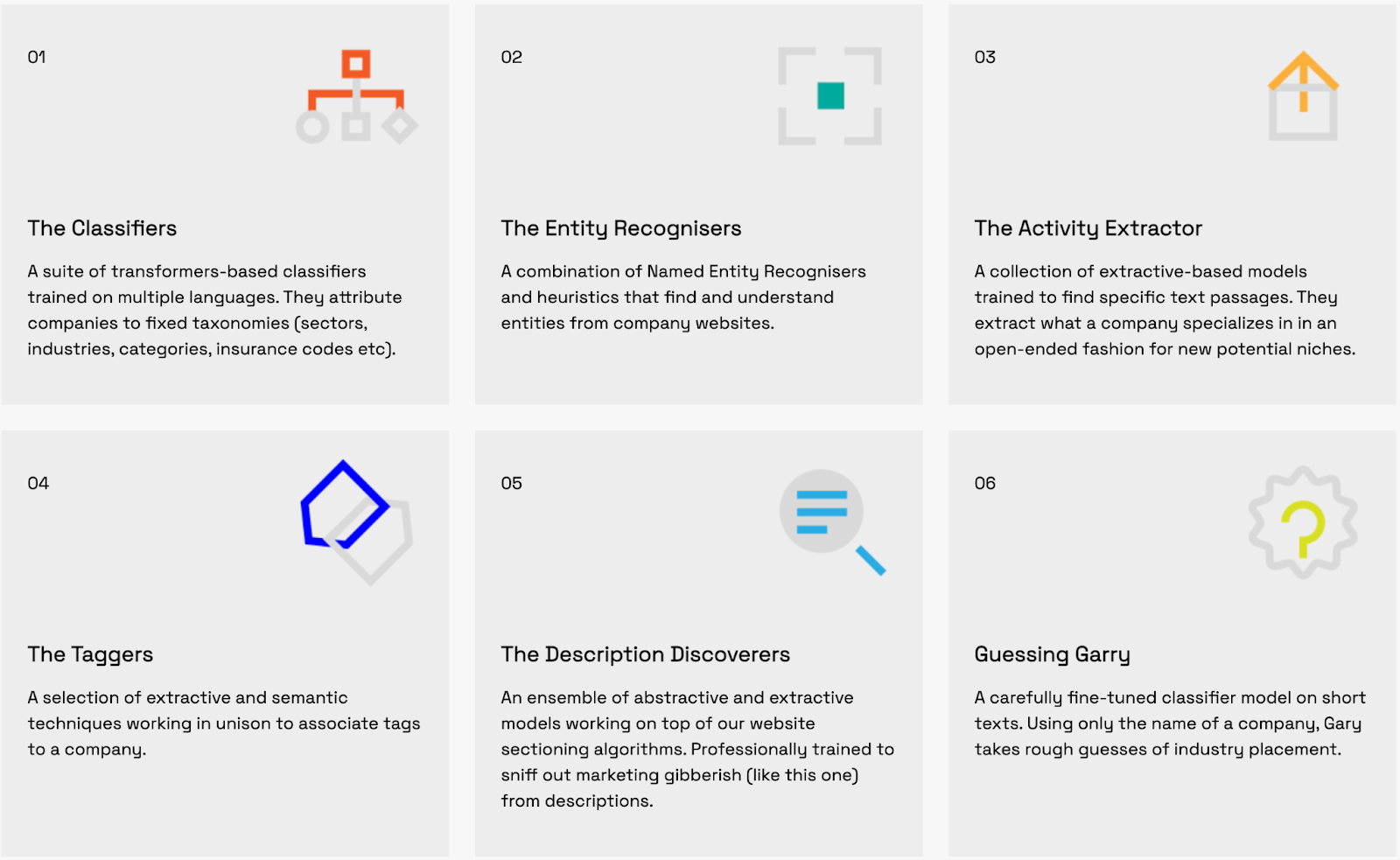

Our machine learning algorithms then transform this vast, unstructured information into searchable and understandable insights.

But that’s not all.

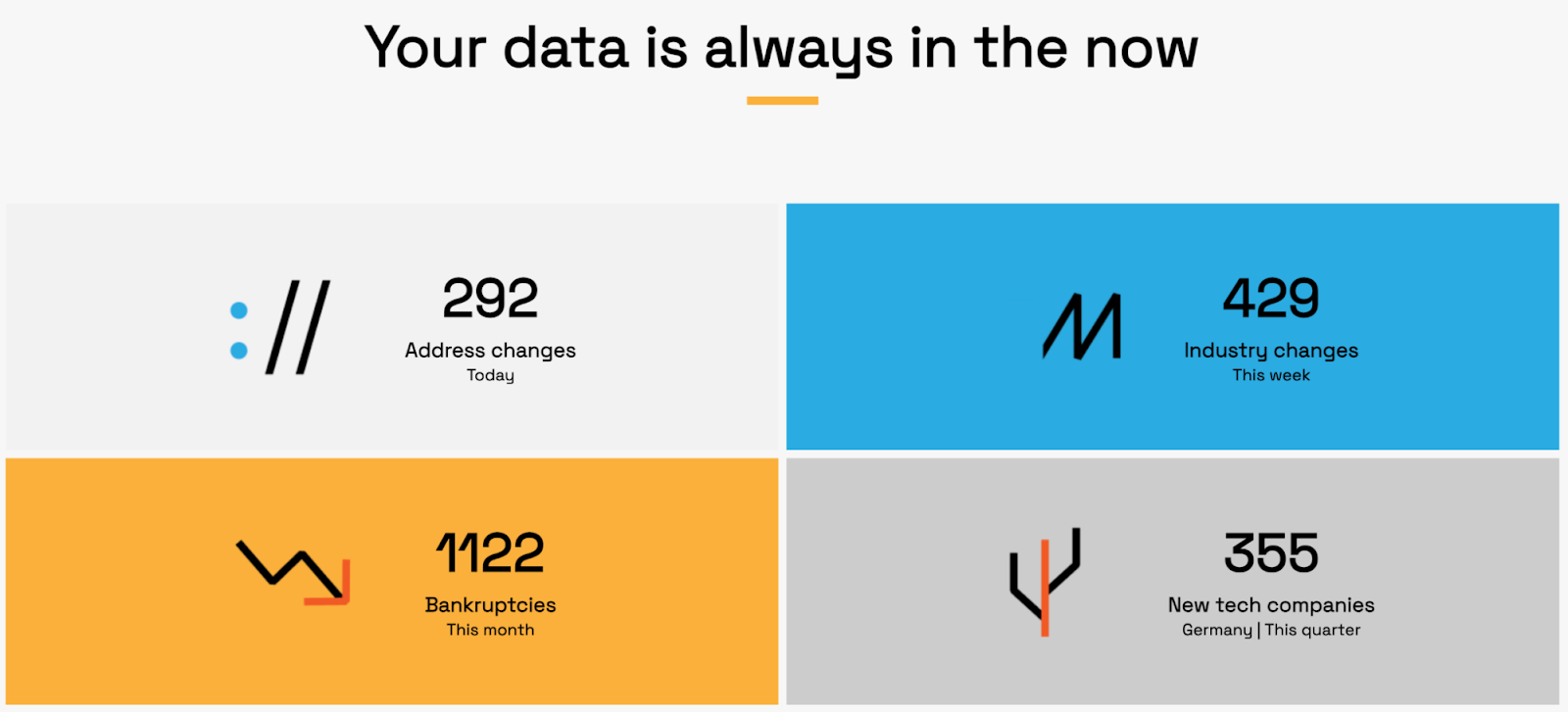

Our data is refreshed on a weekly basis, ensuring you always have the most accurate and up-to-date information at your fingertips.

Source: Veridion

In other words, with our solution, you get access to reliable, high-quality market intelligence data you won’t find elsewhere.

And guess what?

Veridion’s data has excellent coverage, too.

Our database spans over 100 million companies, 200 million business locations, 70 attributes, and 200 company attributes.

You can access this data using natural language, letting the AI do the heavy lifting, or through our two APIs.

For example, our Search API, allows you to search companies by specific criteria and create complex query structures, while Match & Enrich API enables you to expand your data and match it with our records, ensuring you’re working with only the freshest information.

Whether you want to filter organizations by business activities, tech stacks, news signals, ESG data, or any other metric, Veridion supports a truly wide range of criteria.

Source: Veridion

This makes it a great tool for investment research, keeping up with market trends, assessing supply chain risks, supplier discovery, and more.

That’s precisely why procurement and insurance professionals, as well as startups, love Veridion.

PitchBook, on the other hand, is more often used for networking, fundraising, and due diligence, making it better suited for investment and sales professionals.

At Veridion, we also prioritize user-friendliness and cost-effectiveness with smart pricing policies that encourage exploration and experimentation with the solution.

So, if you’re looking for a more straightforward, budget-friendly alternative to PitchBook that still has amazing data coverage, head over to our website.

Over there, you can download a data sample, try out our free data explorer, or schedule a data consultation and learn more about how our data can help grow your business.

AlphaSense is an AI-powered market data and organizational research platform mostly used by consultancies, asset management firms, pharmaceutical companies, and many S&P 100 companies.

The platform provides access to over 10,000 sources of public, premium, and proprietary content, organized into four perspectives:

| Company | Public and private companies’ documents, like filings, presentations, earnings transcripts, and ESG reports |

| Analyst | Research from Wall Street analysts, covering both national and global levels |

| Journalist | Content from news outlets, trade journals, government agencies, and NGOs |

| Expert | On-demand interviews with customers, partners, competitors, former employees, and industry experts |

So, in terms of content offering, AlphaSense is a bit more advanced than PitchBook, which lacks an expert transcript library or trade journals.

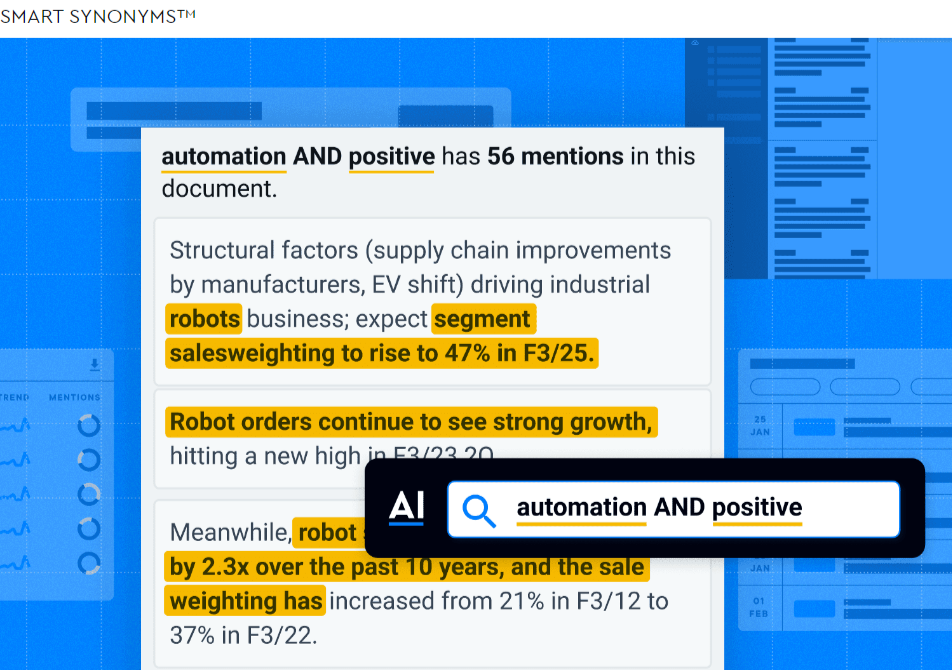

Where this solution really outshines PitchBook, however, is its AI capabilities.

PitchBook does provide keyword search and filtering, especially for private companies, but it doesn’t have AlphaSense’s AI-powered features that speed up the research process and ensure no vital information slips through the cracks.

For example, Smart Synonyms can be used for faster, more accurate searches, and Smart Summaries for instant earnings insights and SWOT analyses.

Source: AlphaSense

Keep in mind, though, that this system’s reporting capabilities are somewhat weaker than PitchBook’s.

For instance, its visualization tools are currently limited to only financial data.

And what about the price?

AlphaSense offers two pricing plans with specific price information available upon request:

| Market Intelligence | Enterprise Intelligence |

| ideal for smaller teams | for larger organizations |

Overall, if you’re looking for a platform with strong AI capabilities that simplify and accelerate research across both financial and non-financial data, AlphaSense may be the better option for you.

We definitely recommend requesting a free trial through their website to see whether the solution truly fits your own needs.

CB Insights is a market intelligence platform that uses machine learning and data visualization to provide in-depth information on venture capital, startups, and emerging technologies.

It’s widely used in corporate strategy, corporate innovation, IT, and more.

The platform itself consists of three main components:

| Technology Search Engine | An AI-powered tool that enables users to discover new technologies or market and company trends through customizable filtering options |

| Market Analytics and Visualization | This feature allows users to easily create custom market landscapes and includes a Market Sizing tool that aggregates market size data for thousands of markets. Essentially, it helps visualize all relevant insights |

| Team Management and Collaboration | Facilitates sharing and updating market data within teams as well as creating presentations on funding data, investor information, etc |

CB Insights is particularly valuable for tech professionals like tech analysts and strategists since its data is very tech-oriented, providing insights into emerging technology trends, patents, and vendors.

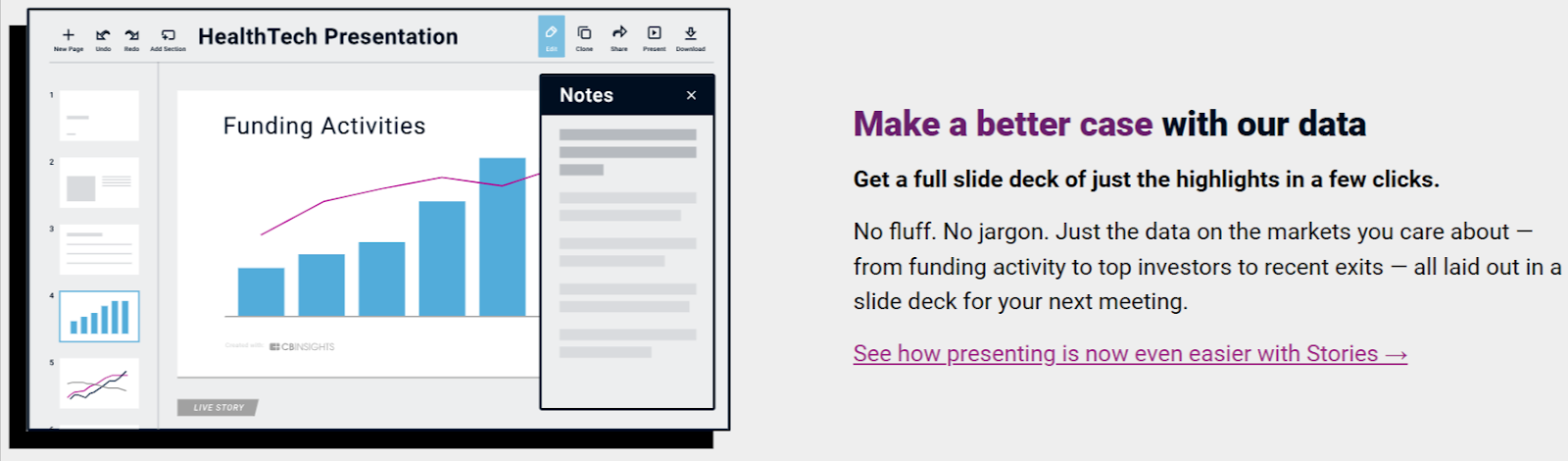

But the users love their visualization tools the most.

Source: CB Insights

They allow them to present data in easily digestible ways as well as create appealing pitch decks and all kinds of market intelligence reports.

While the pricing for CB Insights isn’t listed on their website, some sources suggest the system costs may start around $60,000 per year, making it more expensive than many of their competitors.

This could be quite an obstacle for startups and smaller organizations.

However, for larger institutions that need strong reporting features and detailed market intelligence with a focus on technology, CB Insights could be an excellent choice.

Feel free to request a free demo through their website to learn more.

S&P Global is a huge and widely recognized name in the world of private and public company data providers.

It serves all kinds of sectors, from commercial banking, corporations, and insurance to government and regulatory agencies.

Their S&P Global Market Intelligence platform stands out for its amazing market data coverage, offering insights into over 56,000 banks, 58,000 asset management companies, and much more.

Source: S&P Global

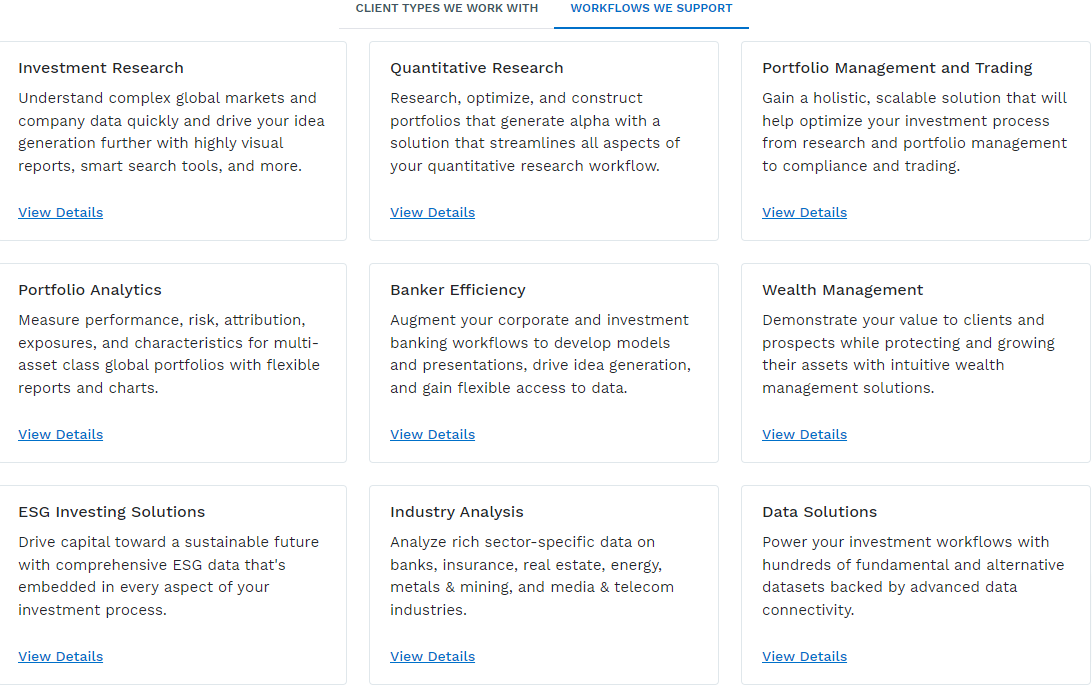

This system offers a wide range of solutions specifically tailored to various market intelligence needs and workflows.

The Capital Formation solution, for example, supports decision-making throughout the entire deal lifecycle by providing timely market data, news, and press releases.

It includes screening tools to evaluate capital raising and M&A opportunities, too.

Meanwhile, the Sustainability solution allows users to track and report on sustainable business risks, opportunities, and impacts.

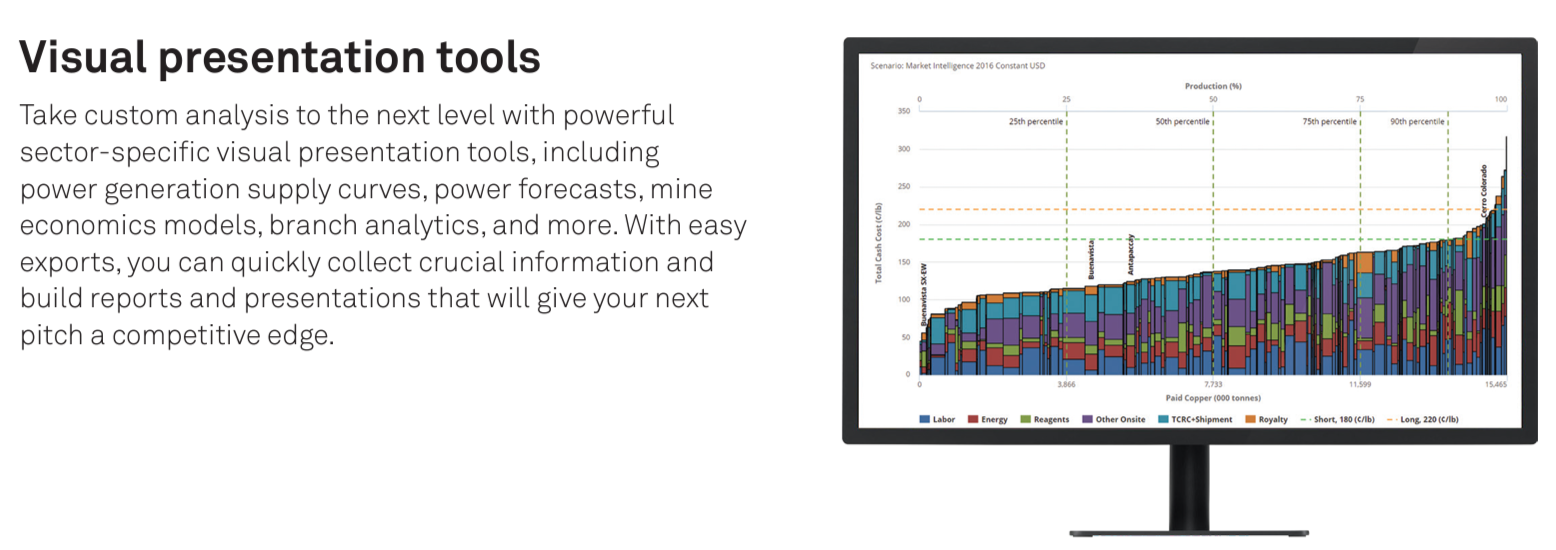

But besides research, the platform also facilitates efficient data analysis.

For instance, their Maps tool provides a visual depiction of asset-level data, market characteristics, and industry participants, helping users understand geographic markets better.

Source: S&P Global

Plus, there are plenty of specialized visual presentation tools available, such as power generation supply curves, power forecasts, mine economics models, and brand analytics.

However, the system’s versatility does come at a price, it seems, as some online reviews suggest it can get quite expensive and has a steep learning curve.

Besides, some users have mentioned that its private capital market data is a bit less detailed compared to PitchBook.

To explore all of its features, tools, and solutions, it’s best to take full advantage of the free demo they offer on their website.

FactSet is one of the oldest financial research tools, operating since the 1970s.

It’s a solution widely used by investors, asset managers, traders, and investment bankers alike to:

One of the platform’s standout tools is the FactSet Workstation, which allows users to combine thousands of data sources into one intuitive research solution accessible via mobile, web, or desktop apps.

The Workstation features efficient research and analytics tools, enabling users to surface fresh insights and spot opportunities through customizable charts and advanced screening options.

It incorporates alerts, too, keeping you informed on global topics, companies, and industries by bringing you curated news, quotes, and third-party content.

Source: FactSet

However, reviews suggest that FactSet’s private company data is not as strong as PitchBook’s, and some note that the system can be quite slow.

Still, if you’re looking for a financial research platform with excellent customer care and a stronger emphasis on quantitative data, FactSet could be an ideal solution for you.

When it comes to pricing, you’ll need to contact their sales team to get specific information, but some sources estimate the cost to be around $12,000 per year.

A free trial of the platform is also available.

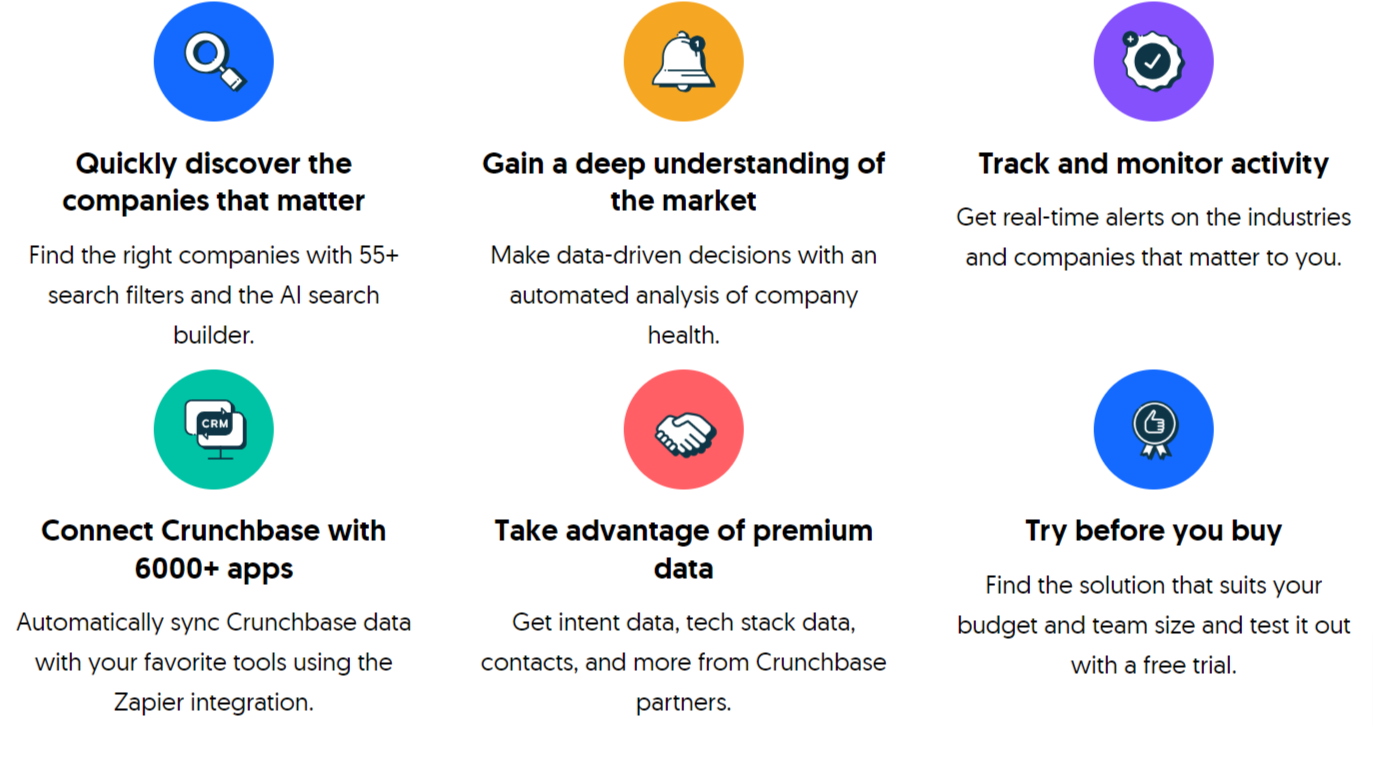

Let’s wrap up our list with Crunchbase, an AI-powered company intelligence platform that provides:

| Company details | Information such as the company location, key management personnel, and a brief overview of their products or services |

| Funding data | Details about key investors, investment amounts, and their dates |

| Marketplace insights | Data on popular technologies, areas of innovation, and emerging opportunities |

Crunchbase is a very useful tool for identifying key contacts within companies, particularly within startups, but it can also be used for prospecting new business opportunities, outreach, and deal sourcing.

Here are some of its features:

Source: Crunchbase

Unlike other platforms on this list, Crunchbase offers a completely free version of their solution.

While its features are limited, it can be a great option for those who want to quickly and easily learn about companies and access some of their basic or financial data.

Just keep in mind that the free plan only delivers up to 5 results per search.

Another very important thing to consider is that Crunchbase largely relies on its investor network, contributor community, and companies’ own submissions to build its database.

Unfortunately, this can lead to duplicate entries, outdated data, and other data reliability issues.

In contrast, the other platforms we’ve covered are more rigorous in keeping their data fresh and high-quality.

Nevertheless, Crunchbase is user-friendly and cost-effective, making it a good choice for individuals and smaller companies looking for a simple solution, especially for sales prospecting.

In fact, this just might be the most accessible alternative to PitchBook on this list.

However, if you need more in-depth data, you may want to explore other options.

Crunchbase is a bit more transparent with its pricing plans than the other companies, too.

There are two options: Pro, which costs $99 per month (or $49 per month if billed annually), and Enterprise, which is customized and available upon request.

There’s also a free trial for those who want to test out these plans before committing to the purchase.

Now you’re all set to dive a bit deeper into each solution and find the market intelligence platform that perfectly suits your needs.

Explore all features thoroughly, reach out to the sales team for pricing and other relevant details, and take advantage of those free trials or demos whenever possible.

Don’t assume that the most advanced features or the lowest price automatically make a platform the best choice for you.

Instead, focus on your specific requirements.

For instance, if you’re in procurement, consider solutions designed specifically for that purpose, like Veridion.

If you’re looking for basic company data and a budget-friendly option, Crunchbase might be a better fit.

Remember, none of these platforms are inherently good or bad.

It’s just a question of whether a particular solution can deliver what you need, exactly the way you need it.