6 Characteristics of Good Procurement Market Intelligence

Market intelligence involves gathering and analyzing market data, from information on competitors, trends, and customer preferences, to make informed business decisions.

Procurement market intelligence, in essence, is the application of this process to procurement.

It means collecting and analyzing data related to suppliers, materials, pricing, and market conditions to optimize procurement strategies, negotiate better deals, discover new suppliers, identify risks, and ensure an efficient and cost-effective supply chain.

However, for market intelligence to bring these significant benefits, it has to be, above all, specific, accurate, and unbiased.

Today, we will explore these and other essential characteristics of good procurement market intelligence in-depth, so let’s get started.

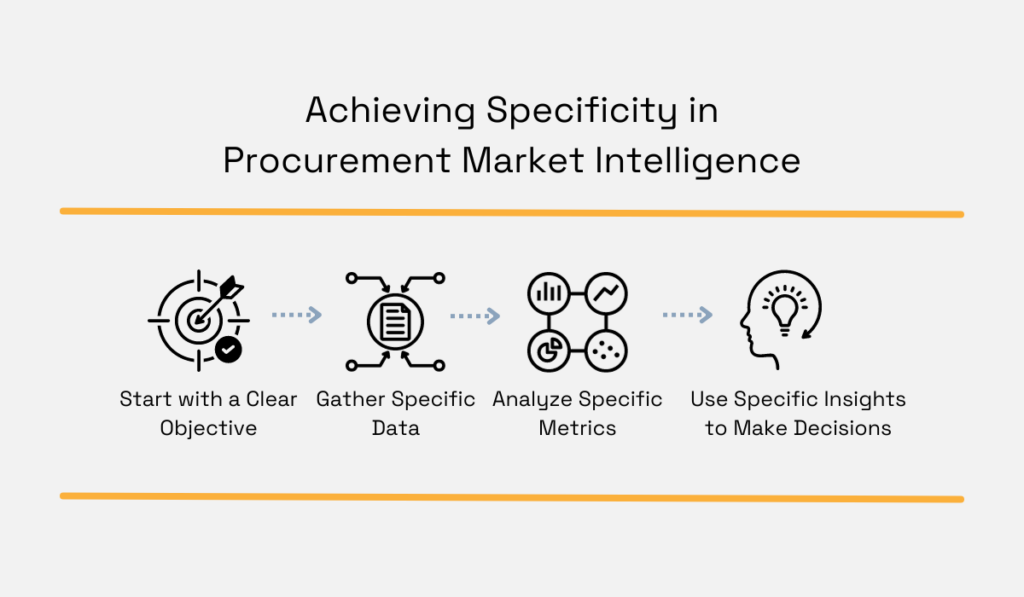

The first characteristic of good procurement market intelligence is specificity.

In other words, the market intelligence you gather and analyze should be specific and relevant to your procurement’s needs and objectives.

For instance, comprehending how a specific supplier’s delivery time and reliability impact the organization’s production schedule and overall efficiency is more valuable to chief procurement officers (CPOs) than generic market research.

Why?

Only with such specific insights can CPOs make data-driven decisions and take appropriate steps.

But, to be able to gather specific information, you first have to define your purpose, as Kaushikkumar Patel, director of global data operations at TransUnion, aptly points out .

Illustration: Veridion / Quote from Linkedin

So, the first step is to define the purpose of gathering and analyzing market intelligence, or, in other words, the objective.

In our CPO’s case, the objective is to learn how a specific supplier impacts the production schedule—and take action accordingly.

The next step would be to collect and analyze data specifically related to the selected supplier’s delivery times. The sources for this data include historical data or even real-time tracking to assess consistency.

What’s more, the procurement team should analyze this supplier’s track record for meeting deadlines and any instances of delays to understand their reliability.

Based on these metrics, the CPO can assess the supplier’s direct impact on the organization’s production schedule.

Finally, these insights can lead the CPO to decide whether to continue working with the supplier in question or explore new sourcing options.

Source: Veridion

Without specific insights into how individual suppliers influence the production schedule, the CPO might have to make decisions based on incomplete or generalized information or not make decisions at all.

Of course, gathering and analyzing data that ends up invaluable would be a waste of time and resources.

As you can see from our example, procurement market intelligence must be specific to be useful.

This specificity begins with a well-defined objective, ensuring that the gathered data is relevant to it and directly influences the decision-making process in achieving that procurement goal.

As much as it should be specific, procurement market intelligence has to be accurate to be reliable.

Only if your information is accurate will you be able to use that information to improve your procurement, which is why you gather and analyze intelligence in the first place.

Procurement professionals rely on this accuracy to select suppliers, negotiate deals, and navigate potential risks.

The repercussions of inaccurate data then, even at a minimal 1% error, reverberate across all these aspects of procurement.

Just think about the tangible impact on project budgets.

A slight miscalculation in the pricing of raw materials, such as steel, can accumulate into a significant budget overrun.

For instance, in a construction project where the estimated cost for steel is $100,000, a 1% error shifts to an additional $1,000.

Multiply this across various materials, and the financial implications become substantial.

This budget overrun, stemming from inaccurate raw material pricing data, directly impacts the overall profitability of the manufacturing project.

It can lead to financial strain, hinder the ability to meet initial cost projections, and potentially jeopardize the competitiveness of bids in the market.

So, how do you ensure your procurement market intelligence is accurate?

Well, as a business transformation consultant at Gordon Withrow & Company, Gordon Withrow explains , you must gather the same data from more sources because that will show the accuracy of underlying elements.

Illustration: Veridion / Quote from Linkedin

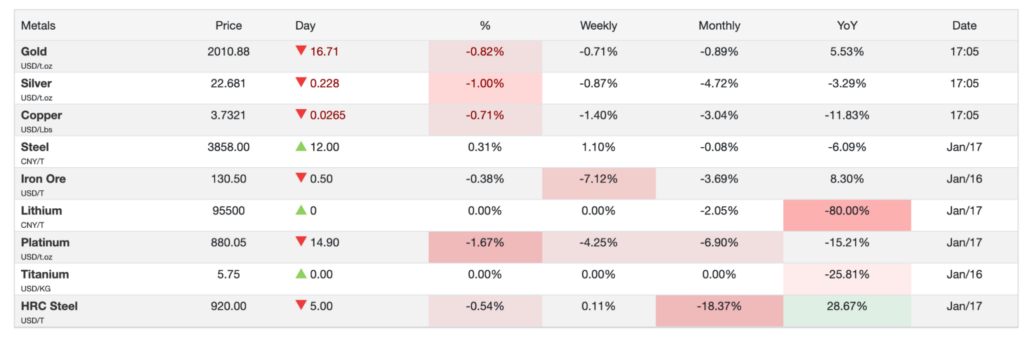

If we go back to our steel pricing accuracy, you would have to gather data from sources like commodity exchanges, industry reports, government agencies, steel suppliers and online pricing platforms to verify steel pricing data.

Example of steel prices from Trading Economics

Moreover, you would then have to use the data accurately.

Making a mistake in interpreting or applying the data could lead to unintended consequences, impacting procurement outcomes, project budgets, and overall organizational success.

Therefore, ensuring accuracy extends beyond the collection and analysis phase to the vigilant and error-free application of the insights gained from procurement market intelligence.

When it comes to procurement market intelligence, timeliness is another key characteristic.

Essentially, it means being up to date with information about suppliers, geopolitical factors, and market fluctuations.

Timely updates on these and other pertinent factors in procurement are the lifeblood of effective procurement decision-making.

Why so?

Just consider the risks inherent in the procurement landscape—from inflation and sudden supply chain disruptions to geopolitical events impacting the reliability of suppliers.

In a market characterized by such constant fluctuations, relying on outdated information can be disastrous.

If you base decisions on market intelligence from the last month or last year, the repercussions can be severe.

This may lead to increased costs, missed opportunities, and, in the worst cases, damage procurement’s credibility with stakeholders.

On the other hand, timely procurement market intelligence will empower you to quickly adapt and take action to mitigate risks and ensure an uninterrupted supply chain.

However, getting timely intelligence is a challenge, especially if you are doing manual desktop research or searching through your historical data.

This is a significant problem, especially knowing that up-to-date supplier data is the most critical procurement asset.

Matt Palackdharry, vice president of sales and commercial strategy of TealBook, points that out :

Trusted supplier information is the most critical asset a procurement organization can possess. This information is the fuel that powers all procurement technology, influences billions of dollars of business decisions, and without it, organizations lose the ability to be agile when supply chains become overrun.

Luckily, there is a way to get hold of such intelligence—big data platforms that bring information on suppliers.

Our supplier sourcing enabler, Veridion , is one of them.

Source: Veridion

But apart from bringing you near real-time firmographic data on millions of suppliers around the globe, Veridion also enables procurement teams to quickly respond to changes in supplier activities.

Through Veridion, you can receive alerts when a supplier undergoes changes, ensuring you are always aware of potential disruptions.

Source: Veridion

Take, for example, a scenario where your critical supplier loses a certification vital to your operations.

With Veridion’s alerts, you are immediately notified, allowing you to make timely decisions.

What’s more, through Veridion’s company search service, you can explore a global network of suppliers and discover new, more reliable options to maintain the integrity of your supply chain.

All in all, procurement market intelligence has to be timely. Otherwise, you can’t grapple with the dynamic procurement landscape where changes happen constantly.

Procurement market intelligence must also be objective and unbiased toward any specific company, vendor, or region.

This is especially crucial when evaluating potential vendors and deciding who to work with.

Being objective in sourcing suppliers ensures you make decisions based on merit and that your choices align with the organization’s needs and standards rather than personal inclinations.

It all boils down to being grounded in facts rather than swayed by personal preferences.

But how can you ensure that the intelligence you gather is, indeed, objective?

First and foremost is cultivating a mindset within your procurement department that prioritizes impartiality.

It’s about recognizing and mitigating any preconceived notions or biases that might cloud your judgment on what suppliers to work with.

Once this mindset is clear among all team members, you can define steps for fair and objective assessment.

A key step in this process is the implementation of a balanced scorecard through which you can gather and analyze objective supplier intelligence.

Through this tool, you can assess suppliers’ delivery times, costs, product quality, order accuracy, innovation initiatives, and more factors, and then use those scorecards to compare suppliers.

Vineet Prabhakar, the general procurement manager at LG Electronics, adds another important point —such metrics will stand as an unbiased reference for future buyers and organizations.

Illustration: Veridion / Quote from Linkedin

This data-driven approach to supplier assessment will foster transparency and ensure that your assessments are rooted in concrete evidence rather than personal preferences.

In a nutshell, objectivity in your procurement market intelligence is not just some theoretical ideal—it’s a practical necessity.

By prioritizing objectivity, you can build a foundation of trust, both internally and with external partners, and create a procurement process that is not just efficient but also fair and impartial.

Another key characteristic of good procurement market intelligence is its robustness.

Essentially, that means good market intelligence is gathered through multiple sources and from different perspectives, providing you with a holistic view indispensable for making well-informed procurement decisions.

You can gather market intelligence at two levels:

| Category-level analysis | This broader analysis looks at general trends and dynamics within a larger group or category of products or services. It provides an overview of the market. |

| Individual-level analysis | This more detailed analysis focuses on specific products, services, or components. It is necessary when the broader category is not clearly identified or when you need in-depth information about particular items. |

Let’s explain this through an example.

Say you are sourcing electronic components for manufacturing. In that case, robust market intelligence would look like this:

As you can see, robust market intelligence would give you both a clear picture of the market and ways to improve procurement and get the best deal.

Naturally, such market intelligence requires you to gather data from more sources. In this example, the sources would be:

In addition to these sources, competitor analysis would add another layer to robust intelligence.

For example, understanding what new materials competitors are adopting in terms of electronic components would give you a benchmark for innovation and cost-effectiveness.

And by benchmarking against industry peers, you can identify areas where adopting similar technologies or negotiating better terms with suppliers can lead to competitive advantages.

As evident from this theoretical example, robust procurement market intelligence can present a nuanced and detailed picture of the market from multiple perspectives and sources.

Such market intelligence ensures that you don’t just scratch the surface but dive deep into the market and find ways to improve your procurement strategies.

Last but not least, good procurement market intelligence has a strategic impact.

In other words, the insight you get from it should help you understand how procurement market trends and dynamics align with your organization’s broader strategy.

For example, market intelligence might reveal some opportunities for doing business with more sustainable and eco-friendly suppliers.

Luckily, that aligns with your organization’s broader strategy for corporate social responsibility, so it has a strategic impact.

Or, by gathering, analyzing, and following various sources for procurement market intelligence, you will discover new trends happening.

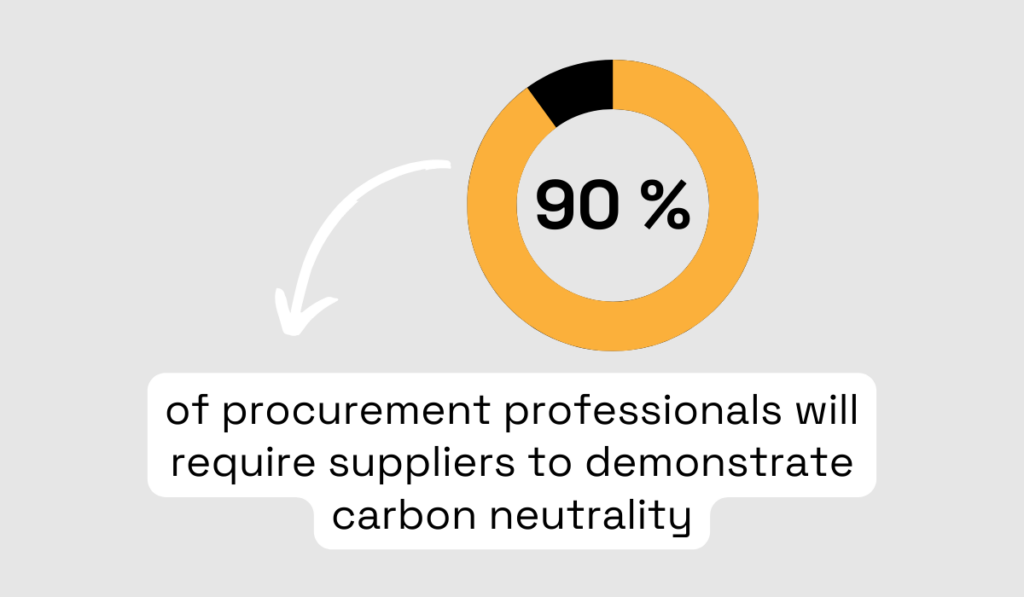

Let’s take, for instance, BloombergNEF’s forecast that 90% of procurement experts will soon require suppliers to demonstrate carbon neutrality.

Illustration: Veridion / Data: BloombergNEF cited in Procurement Tactics

In practical terms, this market intelligence is a proactive guide for your procurement strategy.

Understanding the imminent demand for carbon-neutral suppliers allows you to evaluate your current supplier landscape and include this important factor as a new criterion when choosing new suppliers to work with.

By incorporating this intelligence into your decision-making process, you will not only keep up with evolving market dynamics but also align your procurement practices with the broader strategy of corporate social responsibility (CSR).

Conversely, failing to adapt to this rising demand for carbon neutrality could potentially place you at a disadvantage, affecting your competitiveness and reputation in an increasingly environmentally conscious market.

In essence, strategic impact in procurement market intelligence means leveraging insights to shape your procurement in line with your organization’s long-term goals.

Now you know that good procurement market intelligence exhibits six key characteristics.

First, it must be specific and related to the procurement objectives and goals you have set.

Second, it must be accurate and timely, enabling you to make quick and correct decisions in response to changes in the procurement market.

Procurement market intelligence also demands objectivity, particularly in supplier sourcing. Only by gathering and analyzing data objectively can you ensure that selected suppliers genuinely meet your procurement needs and standards.

Lastly, procurement market intelligence has to have a strategic impact on your organization’s broader strategy. In other words, the data you gather should help you understand your procurement and improve it to align with your overarching strategy.

If the intelligence you gather and analyze possesses these six qualities, you are on the right path to optimizing your procurement processes and making better, data-driven decisions.