7 Types of Procurement Risks You Should Be Aware Of

Risks are, unfortunately, inherent in procurement.

From supply shortages and supplier bankruptcy to subpar products, sudden price fluctuations, and collusion bidding, these challenges are ever-present—and diverse.

Add in the constant threat of system errors or cyberattacks, along with the complexities of compliance with procurement policies and regulations, and navigating this landscape becomes daunting.

However, by categorizing these risks into types, you can equip yourself with the knowledge needed to confront them head-on, ensuring resilience and efficiency in procurement operations.

So, join us as we explore the seven essential procurement risk types you need to know about.

Economic risks in procurement stem from fluctuations in the broader economy.

In other words, changes in macroeconomic indicators such as GDP growth, inflation rates, unemployment rates, or consumer spending patterns can all impact demand, market conditions, and pricing dynamics.

Sometimes, even the overall business outlook.

For example, a recession or economic downturn may lead to reduced demand for certain products or services, which then affects procurement decisions and strategies.

And this is happening right now in the textile industry.

The textile industry faced a decline in demand during a global economic slowdown post-2022, following a period of pent-up demand after COVID-19 lockdowns.

This slowdown led retailers in major export markets like the US and EU to struggle with clearing high-cost inventory accumulated during the pandemic.

A survey conducted by the International Textile Manufacturers Federation (ITMF) in 2023 reports that this slowdown happened because of several reasons:

Illustration: Veridion / Data: ITMF

Since the demand is low, almost half (44%) of retailers have reported cancellations of orders in recent months, indicating the tangible impact of economic risks on procurement operations.

Now, how can you prevent economic risks?

You can’t entirely, but you can mitigate them to some extent.

One effective strategy is to build flexibility into procurement contracts.

Including clauses that allow for the renegotiation of terms in response to economic changes or force majeure events can give you some agility needed to adapt to evolving circumstances.

In simple terms, this is a risk of higher procurement costs than you planned for.

Now, the reasons for such risks can be several, ranging from fluctuations in raw material prices and currency exchange rates to supplier performance issues.

Let’s start with the former.

Sudden price increases of raw materials may result in higher expenses for acquiring necessary materials, affecting budgeting and financial planning.

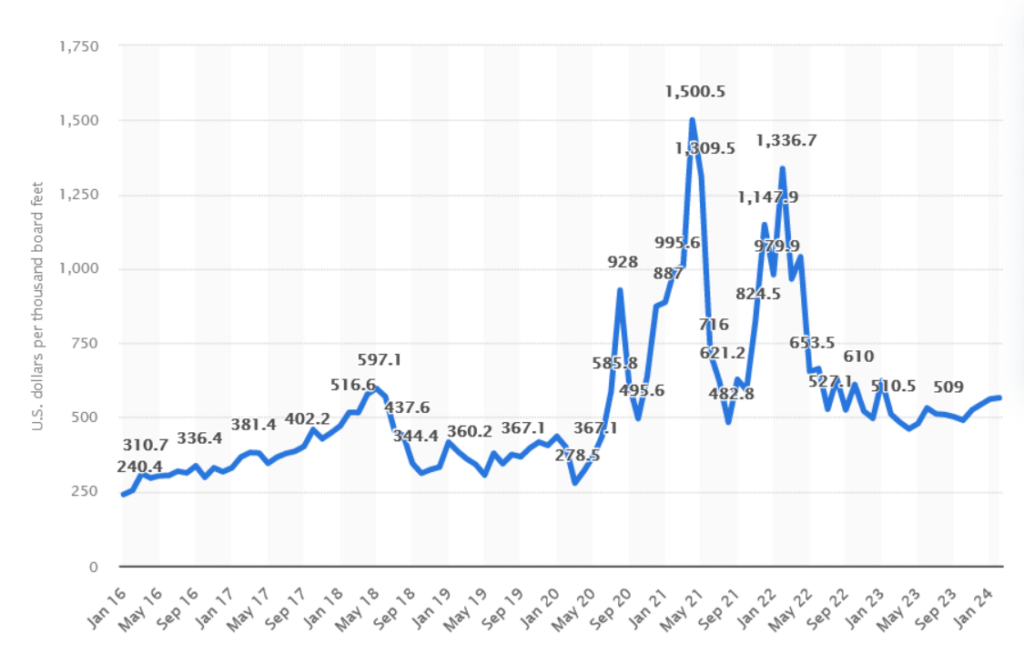

We witnessed this in 2021 when several factors, including increased demand for housing construction, supply chain disruptions, and wildfires in the western parts of North America and Canada, contributed to a significant rise in lumber prices.

This surge, with prices peaking at over $1,500 per 1,000 board feet from a low of $240 in January 2016, affected industries reliant on lumber, including construction and furniture manufacturing.

Source: Statista

Currency exchange risk is another significant financial risk in procurement.

When a buyer’s domestic currency depreciates against the currency of the supplier’s country, the cost of imported goods or services increases.

This can erode profit margins and disrupt financial planning.

For instance, the sharp depreciation of the Turkish lira against the US dollar in 2021 increased the cost of imported raw materials for pharmaceutical manufacturers in Turkey, leading to significant financial challenges.

Back then, Mehmet Sapci, the owner of an 86-year-old pharmaceutical company, expressed his concerns to Al Jazeera, stating:

“Cancer medicines, diabetes medicines, surgical disinfectants – all medicines are being affected, because they are all connected in some way to imports. And because imports are affected by the exchange rate, it’s a real problem for us right now to produce medicine. We risk being left with no medicines for the Turkish public.”

So, financial risks can have much more serious consequences than directly impacting a company’s bottom line.

Financial risks in procurement can also stem from supplier performance issues.

Late deliveries or non-compliance with agreed-upon timelines can disrupt production schedules and result in additional costs, while procurement from financially unstable suppliers may lead to supply chain disruptions or loss of deposits.

Additionally, suppliers delivering substandard or defective products can result in additional costs for rework, repairs, or replacements.

For example, Honda Motor Co incurred a substantial financial loss due to significant recall costs related to Takata airbags, resulting in a net loss of 93.4 billion yen ($860 million) and nullifying profit growth from other areas.

To prevent financial risks in procurement, you can use various strategies.

These include hedging, forward contracts, and diversification of suppliers to mitigate currency exchange risks.

Regular risk assessments to identify potential financial risks and implementing quality assurance measures to address supplier performance issues are also crucial for effective risk management in procurement.

Compliance risks in procurement demand careful attention as they stem from non-compliance with procurement policies, laws, and regulations.

These risks threaten your organization’s financial stability, reputation, and legal standing.

Within procurement departments, inefficiencies in processes or disregard for procurement laws can escalate compliance risks, leading to severe consequences.

What’s more, fraud and corruption are specific risks within this category.

And they can be done in more ways:

These risks are more common than you might think.

Recent research indicates that almost a quarter of organizations have experienced collusion between employees and suppliers and among suppliers.

Illustration: Veridion / Data: Sas

The top two fraudulent activities are faulty invoicing and bid rigging.

These risks are unfortunately common across industries, with real-world examples such as a corruption scandal in the Rawalpindi District Health Authority involving violations of procurement rules, resulting in financial misconduct and misuse of public funds.

Source: Tribune

Similarly, irregular procurement practices were found in projects like the Beijing-Shanghai High-Speed Railway.

Source: China Daily

To mitigate these risks effectively, you should prioritize regular and thorough procurement audits covering all aspects of procurement processes.

When you identify and address potential compliance issues in time, you can uphold integrity and legality in procurement practices.

This safeguards against financial losses, reputational harm, and legal repercussions.

So, make sure to stay vigilant to remain compliant.

As their name implies, operational risks are risks to your day-to-day procurement operations.

They stem from internal processes, systems, people, or external events and lead to delays, cost overruns, and quality issues.

Let’s dive into the internal challenges first.

Inefficient procurement processes characterized by manual workflows, lengthy approval processes, siloed data, and lack of collaboration between departments or between you and suppliers can all lead to operational issues.

On top of that, inadequacies in quality control processes can amplify operational risks, as exemplified by the Samsung Galaxy Note 7 incident, where faulty batteries led to explosions due to failures in quality control processes and design issues.

Source: NDZ

External factors, like supply chain disruptions, add to these operational risks.

For example, Gap Inc. faced significant operational risks during the COVID-19 pandemic due to its reliance on Vietnam for production.

Extended lockdowns in Vietnam led to supply chain disruptions, resulting in substantial sales losses and increased air freight expenses for Gap.

As you can see, the causes of operational risks are diverse, from inside your procurement department as well as from external factors.

However, effective strategies such as streamlining internal processes, leveraging technology for collaboration and visibility, diversifying supplier networks, and developing robust contingency plans can mitigate these risks and enhance your procurement resilience.

Strategic risks in procurement are those that stem from long-term decisions and moves made by senior management.

Senior management is responsible for setting procurement objectives and defining sourcing strategies.

Their decisions can impact the organization’s overall procurement approach, including supplier selection, contract negotiation, and technology adoption.

Source: Veridion

For example, suppose senior management decides to prioritize cost savings above all else and opts for a single-source procurement strategy to negotiate bulk discounts with one supplier.

In that case, it exposes the organization to the risk of over-reliance on that supplier.

If that supplier encounters financial issues or fails to meet quality standards, the organization’s operations could be severely impacted.

Similarly, if senior management is hesitant to invest in new procurement technologies due to budget constraints or a lack of understanding of their benefits, it can hinder the organization’s ability to streamline processes, improve efficiency, and adapt to market changes.

This reluctance to embrace technological advancements poses a strategic risk to the organization’s competitiveness and long-term success in procurement.

Additionally, geopolitical factors such as trade policies, international conflicts, or natural disasters can significantly affect global supply chains.

Senior management’s decisions regarding sourcing regions, trade agreements, and risk management strategies are crucial for mitigating these geopolitical risks and ensuring the resilience of the organization’s supply chain.

So, the key to preventing such strategic risks is close collaboration between the procurement department and senior management.

If you are in a position to influence senior management, leverage data, and present data-driven analyses and recommendations for more efficient procurement.

This way, you can influence strategic decision-making and ensure management’s decisions align with what’s best for procurement operations.

Transition risks in procurement pose significant challenges and uncertainties when shifting from one system, process, or strategy to another.

These transitions, whether adopting new technology, restructuring operations, or changing suppliers, come with their own set of risks.

During these transitions, several challenges can emerge:

Let’s focus for a moment on transitioning to new suppliers, as this brings additional risks to the picture.

For example, new suppliers may have different lead times, quality standards, or production capacities, leading to delays or shortages.

Also, suppliers may not meet the same quality standards or have the same level of reliability as previous ones, increasing the risk of defects or product recalls.

On top of that, transitioning to new suppliers may result in pricing fluctuations or unexpected costs, impacting budgeting and financial planning.

So—how can you overcome transition risks, especially when changing suppliers?

The answer is simple: due diligence on potential suppliers.

This includes assessing their capabilities, reliability, financial stability, and alignment with your organization’s values and objectives.

As a solution, consider leveraging Veridion, our supplier sourcing enabler.

Veridion provides a comprehensive database of global suppliers with up-to-date information on firmographics, product specifications, certifications, compliance data, and ESG criteria.

Source: Veridion

With such detailed information on potential suppliers, you can make data-driven decisions and streamline the transition process by selecting only the suppliers that best meet your requirements.

An efficient transition to new suppliers is guaranteed.

In procurement, safeguarding reputation is paramount.

But at the same time, it’s beyond challenging.

When working with many people, numerous stakeholders, and various suppliers—as procurement demands—the potential for reputational damage lurks around every corner, often originating from various quarters within and beyond the organization.

There is always a risk that someone will misuse their power, not comply, or engage in fraudulent activities.

And when that happens, the road to going back to how it was is almost impossible.

Let’s delve deeper into the different reputational risks.

According to Investopedia, there are three types:

Direct risks stem directly from the actions of the company itself.

For example, if a procurement decision leads to unethical practices or environmental harm, it can tarnish the organization’s reputation.

One such example is when Nestlé faced criticism for child labor in its cocoa supply chain, despite claims of ethical sourcing practices.

Source: The Guardian

Indirect risks arise from the actions of the company’s employees.

If employees engage in fraudulent activities or unethical behavior, it can reflect poorly on the organization.

For example, if procurement personnel are found to be involved in bribery or kickback schemes, it can severely damage the company’s reputation.

Tangential risks result from the actions of partners or suppliers.

Working with unethical suppliers who exploit labor or disregard environmental standards can pose significant reputational risks.

For instance, if a supplier fails to meet ESG (environmental, social, and governance) criteria, it can undermine the company’s commitment to sustainability and social responsibility.

So, how do you best protect your procurement and your company from reputational risks?

By implementing robust risk management strategies.

This includes rigorous vetting of suppliers to ensure alignment with ethical and sustainability standards and implementing robust compliance mechanisms.

Here, our big data platform, Veridion, proves invaluable.

By monitoring supplier activities for anomalies, it provides real-time alerts, enabling proactive risk mitigation.

Source: Veridion

All in all, by prioritizing ethical conduct, responsible sourcing, and regular compliance audits, you can fortify your procurement processes, safeguarding your company’s reputation and maintaining stakeholder trust over the long haul.

With this, we wrap up our in-depth exploration of procurement risk types.

Procurement is a complex field fraught with various risks that demand attention and proactive management.

From financial uncertainties to compliance complexities, transition challenges, and reputational threats, each risk requires careful consideration and mitigation strategies.

By understanding these risks and implementing robust risk management practices, you can protect your procurement and your organization.

We believe that this overview has refreshed your understanding of procurement risks and provided some valuable insights for navigating them more effectively, leading to a more secure and successful procurement process.

Wishing you the best of luck!