Top Retail Sourcing Insights for Procurement Specialists

Retail sourcing is a field that never stands still, constantly evolving with market demands and technological advancements.

Blink, and you might miss some crucial insights that could impact your sourcing strategies and bottom line.

This article is for all you procurement specialists who want to stay on the bleeding edge of retail sourcing.

We’ll highlight eight key facts you should be aware of, providing context and analysis to help you understand their implications.

These insights cover everything from emerging markets and sustainability practices to digital transformation and supplier relationships.

So, let’s explore the numbers that are shaping the future of retail.

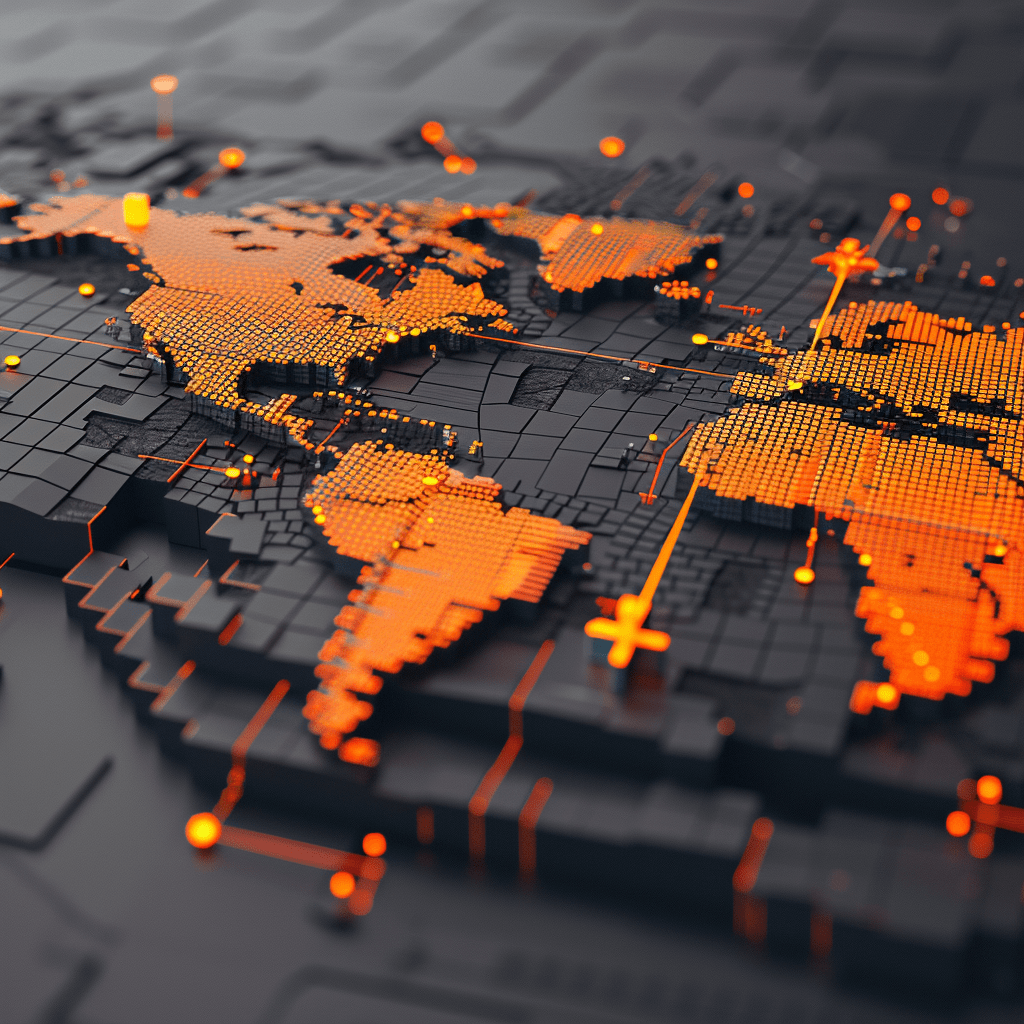

A 2021 report by Zion Market Research provides valuable data into this sector, covering regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

According to their projections, the market is in great health and is set to grow at a CAGR of 13.4%, reaching an impressive USD 9.1 billion by 2026.

Illustration: Veridion / Source: Zion Market Research

The report attributes this growth to several key factors, including improved network infrastructure, increased digital penetration in logistics and support services, and overall technological advancements (something we’ll explore further in another section).

According to the report, the key players leveraging this growth include Oracle Corporation, Sciquest, JDA Software Group, GT Nexus, and Proactis, among others.

These companies are well-positioned to capitalize on the market’s rise by creating cutting-edge solutions, expanding their offerings, and further increasing their market share.

For procurement specialists, this means that the future of retail sourcing and procurement looks promising, with ample room for growth and innovation.

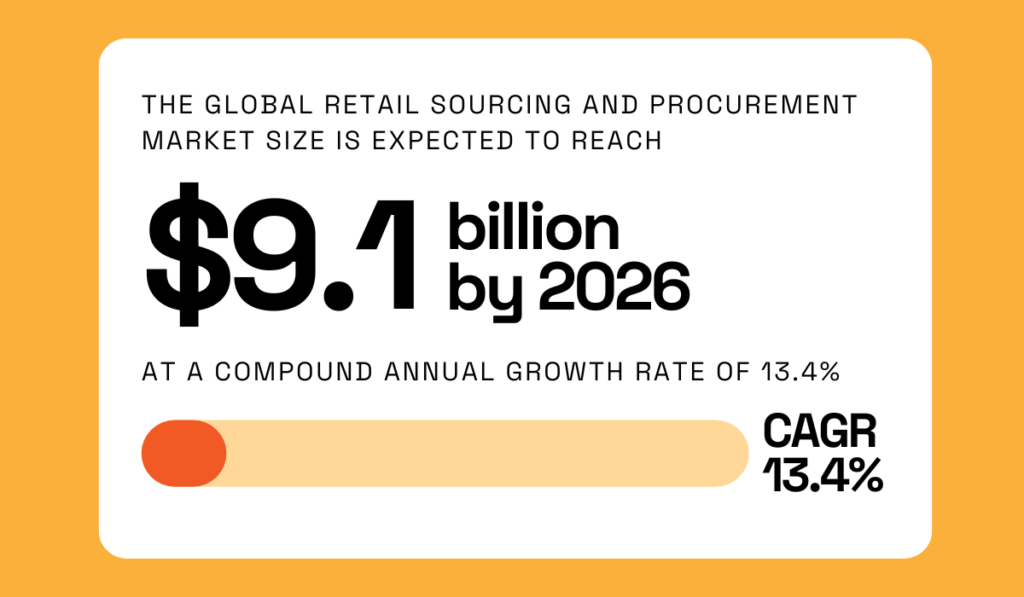

Despite the sector’s growth, it’s important to note that retail sourcing is not without challenges.

Among these, geopolitical issues are becoming increasingly relevant, with a large number of retail organizations finding these factors impacting their operational efficiency and driving up costs, as illustrated below.

Illustration: Veridion / Data: Capgemini

This data comes from a 2023 Capgemini survey, which gathered insights from senior executives (general manager level and above) across 150 consumer product organizations and 150 retailers worldwide. All participating organizations had annual revenues exceeding $1 billion.

While inflation emerged as the top challenge, with 82% of surveyed executives in agreement, geopolitical issues followed closely behind at 77%.

Karel Schindler, CEO of ROI Hunter, a Product Performance Management platform, shared his perspective on the issue in Business Reporter.

Illustration: Veridion / Quote: Business Reporter

Schindler points out that even in 2024, we’re still grappling with the aftermath of the pandemic.

Additionally, ongoing issues such as the conflict in Ukraine are causing a range of problems, including supply chain delays and strategic and logistical challenges.

This statistic reminds us that geopolitical factors are not abstract concerns but have tangible consequences—ones that we need to be aware of and develop mitigation strategies against.

We’re also witnessing a growing trend towards increased cost efficiency in the retail sourcing and procurement sector.

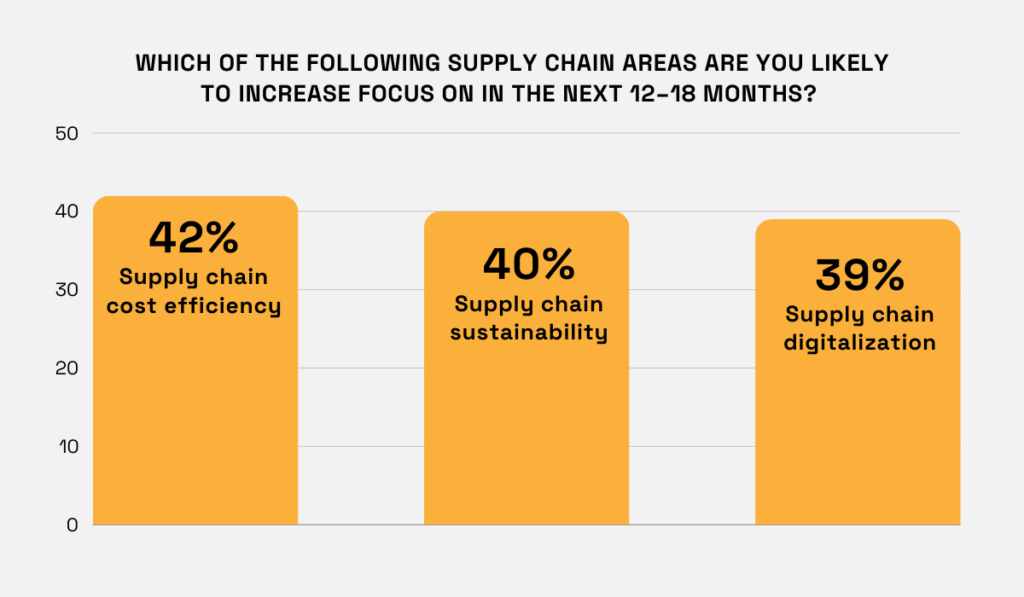

The already mentioned Supply Chain In Consumer Products And Retail report by Capgemini highlights three key focus areas for organizations.

Illustration: Veridion / Data: Capgemini

Supply chain cost efficiency emerges as the primary focus area in the next 12-18 months, followed by sustainability and digitalization.

While procurement efficiency has always been a key objective, the rising instabilities and uncertainties in the global market have only increased its importance.

In fact, another survey from BCG encompassing more than 600 C-suite executives shows the same trend.

It revealed that leaders are launching enterprise-wide cost reduction initiatives, targeting various functions, including manufacturing and supply chains.

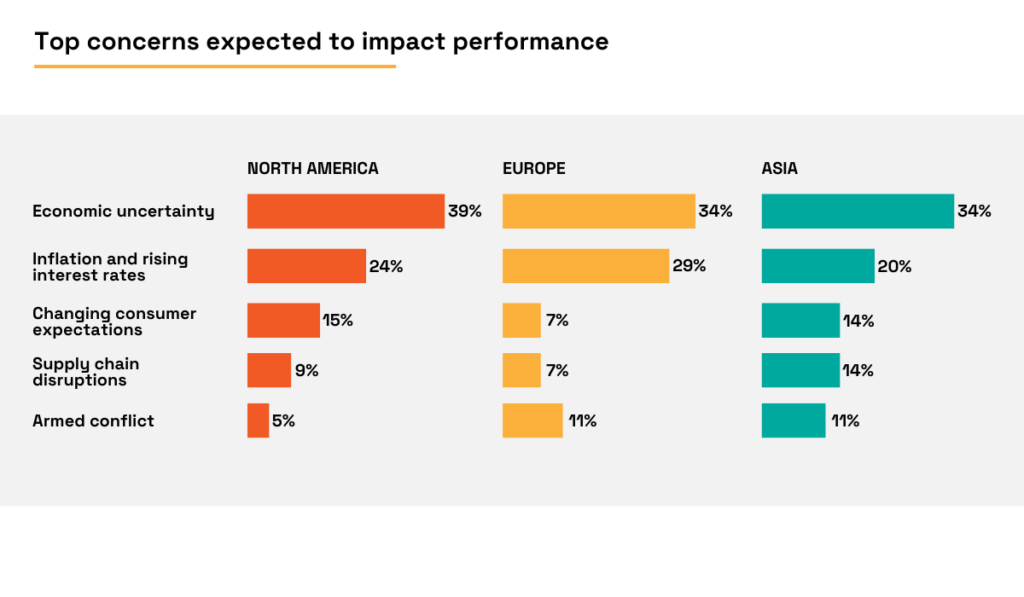

These campaigns are driven by the top concerns identified from the survey data, illustrated below.

Illustration: Veridion / Data: BCG

Economic uncertainty and inflation are the top two concerns across the board, which makes sense given the current geopolitical climate. Changing consumer expectations are also a factor for North America and Asia, while armed conflict is, understandably, a growing issue for Europe.

To summarize, with these rising costs and unpredictable conditions, it’s no wonder why retailers are pursuing cost efficiency even further to protect their bottom lines and remain competitive.

You may have noticed that, in the Capgemini survey data we explored, sustainability was the second most important focus area, coming in at 40%.

Then it’s not surprising that the same report shows a strong commitment to sustainability among retail organizations, with 74% of them conducting regular supplier audits to ensure compliance with sustainability standards.

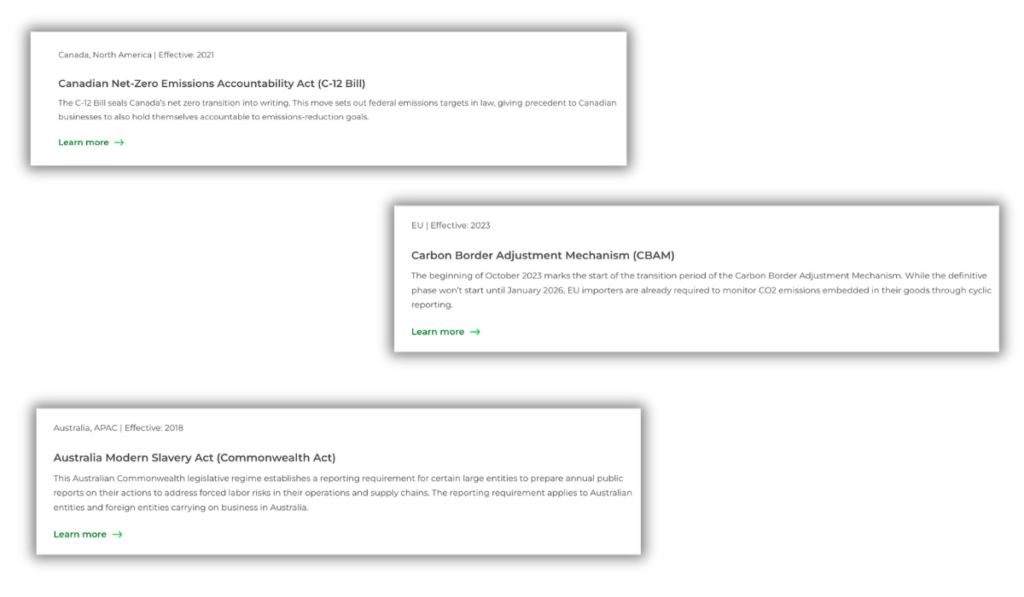

Both of these trends are largely driven by the increasing number and stringency of sustainability regulations implemented worldwide.

Source: Ecovadis

Having retail organizations and their suppliers follow these regulations is crucial for various reasons, including:

Luckily, we’re seeing a trend where some suppliers are proactively making changes to meet these expectations.

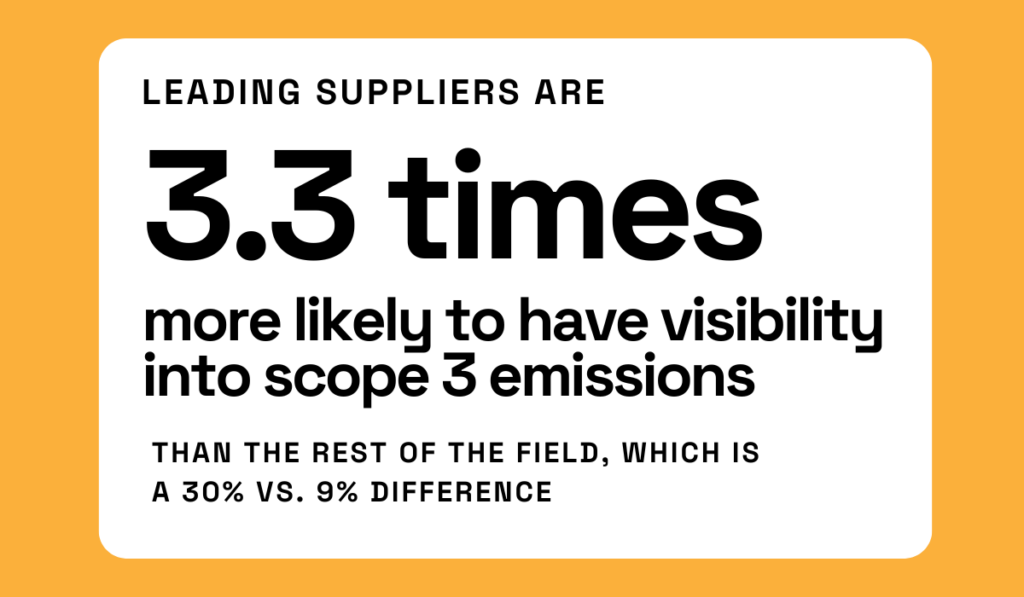

For example, Deloitte’s data on leading suppliers, defined as the top performers in their report, shows a strong commitment to more transparency and sustainability.

Just as an example, these suppliers are 3.3 times more likely to have visibility into scope 3 emissions, which are the indirect greenhouse gas emissions that occur in a company’s value chain.

Illustration: Veridion / Data: Deloitte

These statistics highlight the positive shift toward greater sustainability from both retail organizations and their vendors.

While some of this shift is definitely driven by stricter regulations, it still addresses the growing need for more ethical and environmentally friendly sourcing practices.

Working with reliable suppliers is a must for efficient retail operations, but it’s not easy to trust them.

Michael Orr, senior director of retail portfolio marketing at Blue Yonder, a leading supply chain software and consulting firm, emphasizes the importance of trust in the retail supply chain with the following quote.

Illustration: Veridion / Data: Blue Yonder

Trust directly translates to supplier reliability, timely order fulfillment, accurate inventory information, and consistent product quality.

These factors are essential for retailers to maintain smooth operations and meet customer expectations. That’s a notion 210 global retailers and suppliers agree with, according to a 2020 Coresight report.

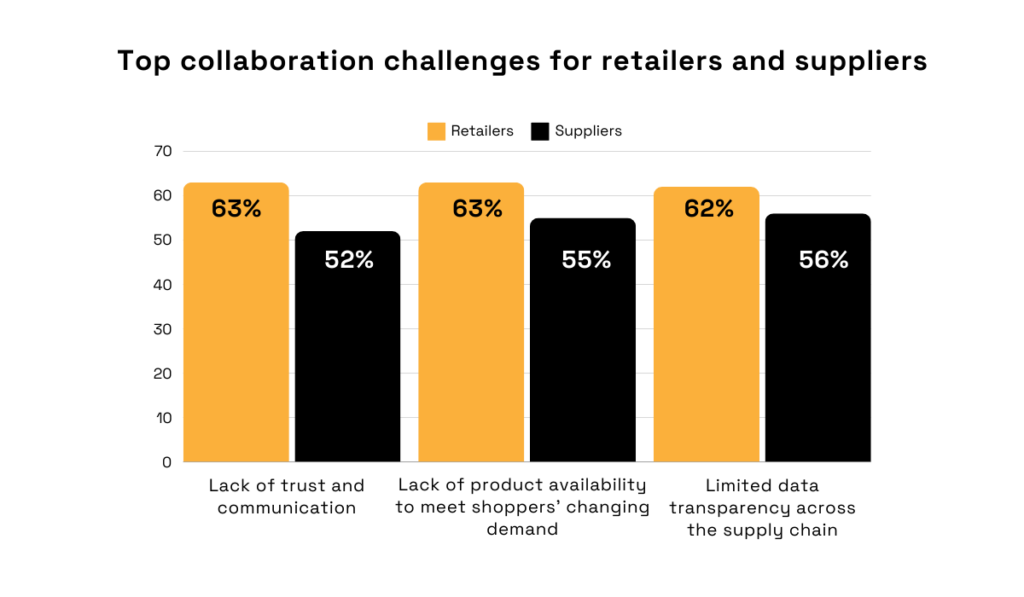

The main collaboration challenges reported by retailers and suppliers are illustrated next.

Illustration: Veridion / Data: Coresight

As you can see, the primary challenge for retailers is a lack of trust and communication, alongside a lack of product availability.

Interestingly, when suppliers were asked the same question, only 52% saw trust and communication as a challenge, reporting limited data transparency as a bigger issue.

Building trust with suppliers is crucial for retailers to ensure product availability, quality, and timely delivery.

Without it, they may be hesitant to share sensitive information with suppliers, leading to the transparency issue, which can ultimately harm both parties.

So trust, communication, and transparency are all connected.

Ultimately, this disconnect highlights the need for retailers and suppliers to view themselves as partners with shared goals and mutual dependencies and address these challenges together.

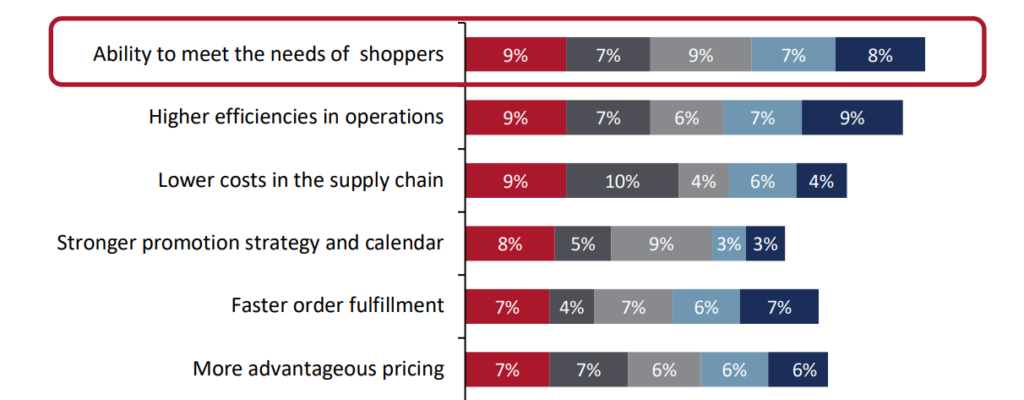

The Coresight research report we mentioned asked retailers and suppliers to rank a detailed list of potential benefits associated with good retailer-supplier collaboration and select the top five.

The image below illustrates these rankings, with the red bar representing the percentage of respondents who ranked a specific benefit as their first choice, all the way to the dark blue bar representing those who ranked it as their fifth choice.

Data: Coresight

When we add up these percentages, we can see that 40% of respondents have placed the ability to meet the needs of shoppers as a top 5 advantage, and 38% ranked higher efficiencies in operations among their top 5.

The report elaborates on this insight, saying that with increased competition and the growing prevalence of omnichannel shopping, both retailers and suppliers understand the importance of aiming to deliver an optimal customer experience and do so efficiently.

The reasons why collaboration works to streamline operations include:

Overall, the fact that both parties recognize that collaboration is useful is a good sign. We might see more collaborative partnerships within the retail supply chain going forward.

So, what other factors, besides trust and communication, are crucial for successful collaboration?

Let’s look at four of the top criteria for success, according to retailers.

Illustration: Veridion / Data: Coresight

Not surprisingly, suppliers “delivering on their promises” objective takes the top spot, with 75% of surveyed retailers agreeing.

Trust and delivering on promises is a fundamental need for any successful partnership. As Lorraine Longato, innovations experience leader at SAP, puts it:

Our economy works because people trust each other and the businesses they support to deliver on the promise of contractual obligations and as I discussed earlier, [trust is] the fundamental currency of commerce.

When suppliers fail to deliver on time or meet the quality standards they’ve promised, it can directly impact the ability of retailers to deliver products to their customers.

And with IBM’s 2022 consumer report saying that 63.7% of customers will go elsewhere when the product or service they want is unavailable, retailers are feeling the pressure.

Given the domino effect of suppliers’ adherence to their promises, it’s no surprise this factor serves as the bedrock of a successful retailer-supplier relationship.

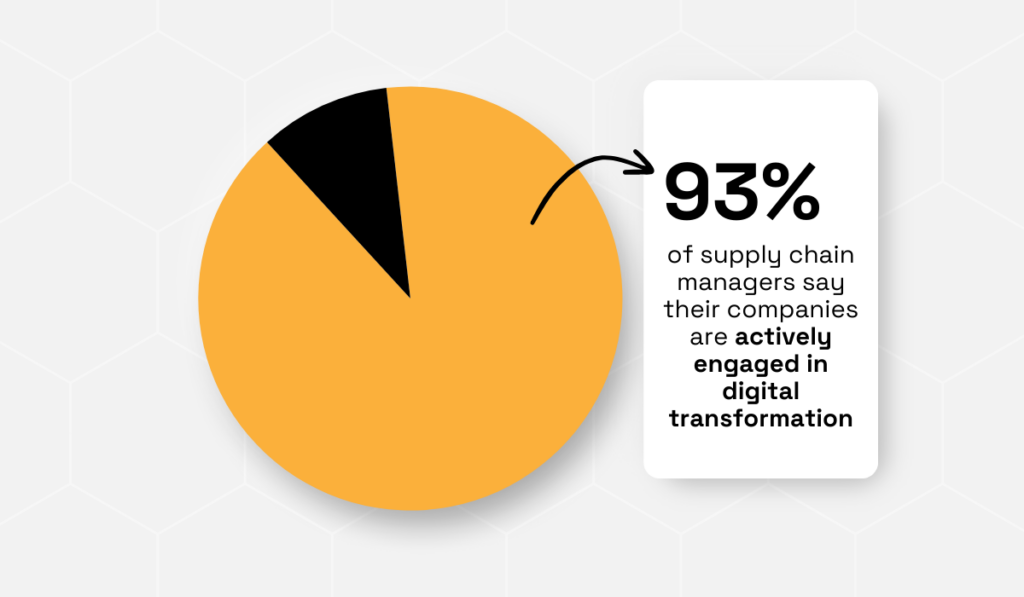

In this section, we’ll examine the Digital Transformation in Supply Chain Planning report, where the Council of Supply Chain Management Professionals (CSCMP) and ToolsGroup surveyed nearly 300 supply chain professionals worldwide.

The survey, conducted in January 2022, included companies with annual revenues ranging from less than $100 million to over $5 billion.

The findings are clear: almost all of these organizations are actively pursuing digital transformation.

Illustration: Veridion / Data: CSCMP

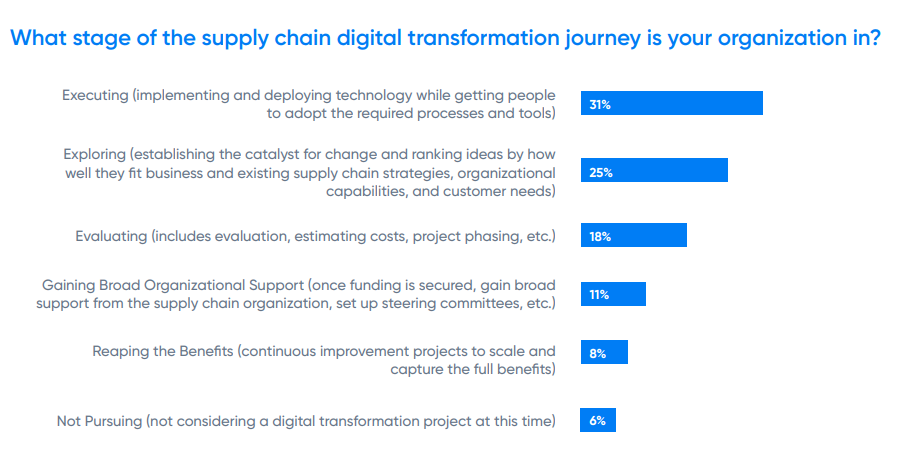

So the question isn’t whether they’re aiming to leverage technology, but rather what stage of implementation they’re at.

Here, the picture becomes more nuanced.

Source: Toolsgroup

While 31% are in the process of implementing digital solutions, 25% are still exploring and evaluating different technologies, and 18% are in the planning stages.

Only 8% of companies report reaping the full benefits of digital transformation, while 6% have not yet initiated any efforts.

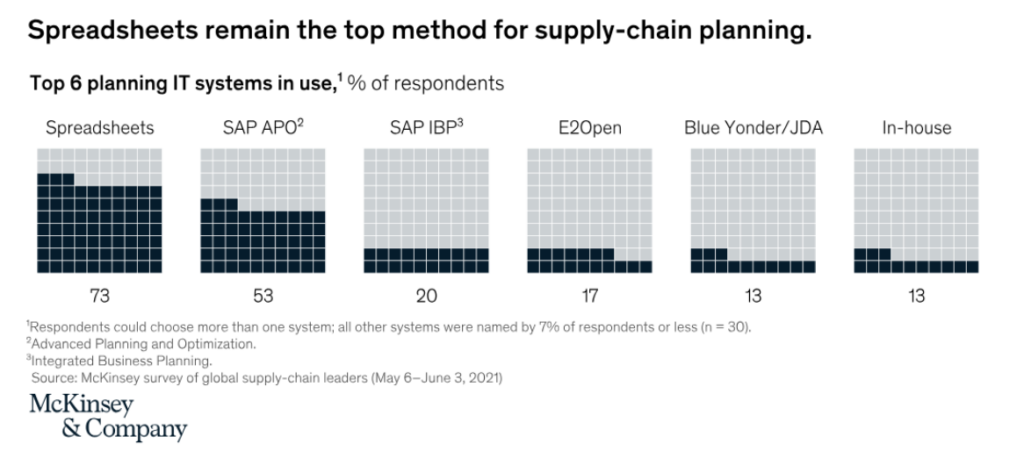

This gradual adoption is somewhat in line with McKinsey data, which reveals that the majority of supply chain planning is still done using spreadsheets.

Source: McKinsey

In other words, while technology is coming in fast, we’re actually seeing a gradual adoption and implementation across the industry instead of a sudden shift.

As we wrap up our analysis of the newest retail sourcing insights, it’s clear that the field is experiencing significant transformation.

From growing sustainability concerns to digital transformation, the data paints a picture of an environment that’s both challenging and full of potential.

For procurement specialists, this information can guide and inform decision-making and strategy development.

So, as you reflect on these insights, consider how they might apply to your specific context.

By staying informed about these trends and being willing to adapt, you can position yourself and your organization for success.