S&P Global Alternatives Offering Private Company Data

S&P Global Market Intelligence is renowned for its thorough financial analysis, industry research, and macroeconomic data.

Over the years, they’ve earned a strong reputation for their high-quality insights, serving both buy-side and sell-side professionals.

However, this isn’t to say that this solution is for everybody.

Some might need broader coverage of niche markets that S&P Global just doesn’t cover.

Others might find it either too complex or pricey.

This article is precisely for those individuals.

It reveals six fantastic alternatives to S&P Global, each offering different price ranges, features, and use cases, so you can find the perfect fit for your needs.

Let’s kick things off with our own solution. At Veridion, we believe everyone should have access to reliable, highly accurate information.

That’s why we decided to build the largest, freshest, AI-powered source of truth for detailed company data.

Using advanced web scraping techniques, we gather information from all across the internet that is often not found in other data sources.

Our machine learning algorithms then transform this large, unstructured content into data that you can easily search and understand.

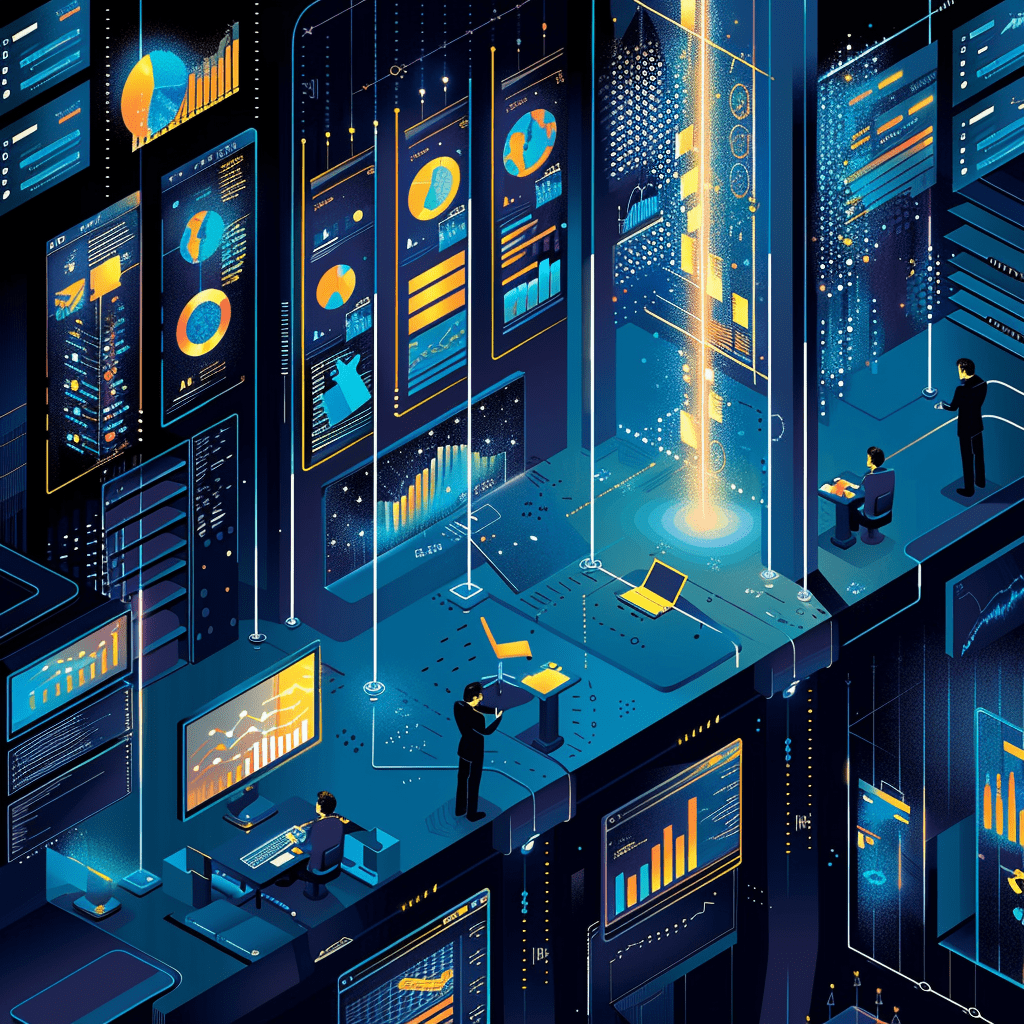

Source: Veridion

But we don’t stop there.

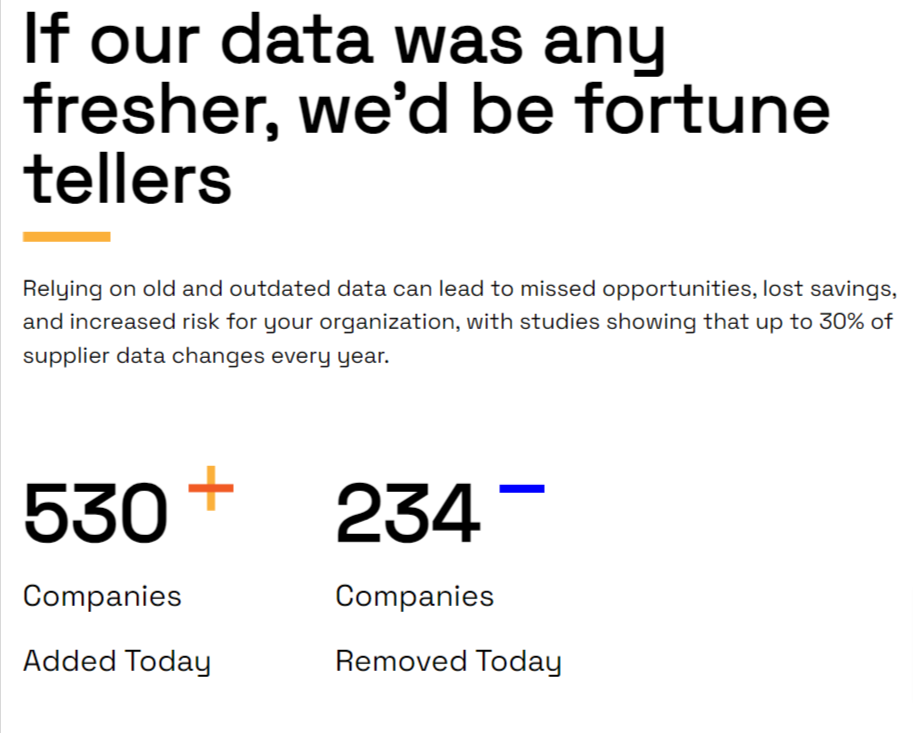

Once the data is classified and structured, we keep it fresh by updating it on a weekly basis, making sure you get only accurate and relevant insights.

Source: Veridion

With Veridion, you gain access to the most complex database of company data, spanning 80 million companies and over 200 company attributes.

From broader company information like legal names and locations to their product insights and sustainability metrics such as ESG commitments, Veridion provides it all.

You can access this data through a natural language search or two APIs.

Our Search API, for example, allows you to search companies by specific criteria and create complex query structures to isolate only those that meet your unique requirements.

Source: Veridion

Meanwhile, Match & Enrich API enables you to expand your data and match it with our records, ensuring you’re working with only the most accurate information.

Whether you’re in procurement, insurance, or a startup looking for high-quality data at a fraction of the standard cost, Veridion just might be the solution for you.

It’s effective, easy to use, quick, and thorough.

If you’re interested, you can download a data sample, try out our free data explorer, or schedule a data consultation and learn more about how our data can help grow your business.

AlphaSense is an AI-powered search engine for market intelligence, using machine learning and natural language processing (NLP) to provide rich data about both public and private companies.

Their solution consists of three main components: search, monitor, and expert insights.

First up, their AI-powered search is all about finding company information quickly and easily, without the distraction of market noise.

Source: AlphaSense

For instance, their Smart Synonyms feature allows for advanced keyword and thematic searches, while the AI Assistant summarizes billions of data points for you, eliminating the need to sift through any lengthy documents.

Secondly, they offer various monitoring features for topics or companies you want to follow, such as an interactive dashboard, customizable alerts, and recommended reads.

These tools allow you to track company press releases, broker research, and news so that you can stay in the loop about market trends and macroeconomic shifts.

Lastly, AlphaSense also offers access to Expert Insights, a library of tens of thousands of expert call transcripts from a wide variety of industries and sectors.

Source: AlphaSense

This can help you better understand the strategies of big players in the market and gain insights into a business’s competitive landscape, growth potential, or possible risks.

If it seems like this might be the right solution for you, head on to the AlphaSense website.

Over there, you can set up a free trial (no credit card info required), take an interactive product tour, or calculate the ROI for this solution.

Pricing information itself isn’t provided, but they claim to offer annual plans for teams of all sizes, from enterprise packages to per-seat options.

For more details, contact them directly via their website’s contact form.

PrivCo is a 100% private-focused search engine concentrating exclusively on financial data for US companies with over $10 million in annual revenue.

It provides in-depth coverage of more than 700,000 private companies, amassing over 140 million data points across 100 different verticals.

This is quite a versatile solution, used in corporate development, investment banking, venture capital, executive search, and even academic research.

PrivCo’s search capabilities include access to crucial company metrics such as:

At PrivCo, they seem to really prioritize timely data. For instance, their users can easily create watchlists for specific businesses or entire industries to stay up-to-date with their research.

Moreover, the platform also offers a Chrome extension that helps you discover critical information on private companies as you’re browsing their websites.

Source: PrivCo

With such features, it’s really hard not to stay well-informed at all times.

PrivCo provides four pricing plans, including a completely free plan that never expires. This is ideal for those who want to test the solution before fully committing to the purchase.

As for the paid options, they range from $999 to $1,999 annually, with the Enterprise plan offering custom pricing available upon contact.

If you’re unsure which plan best suits your needs, you can always contact their sales team through the PrivCo website to get more information.

All in all, if you’re looking for accurate and timely insights about large US organizations specifically, this system is definitely worth considering.

However, if you’re in the market for data on smaller, local businesses or international companies, you might want to consider looking for an alternative solution.

Bloomberg offers a wide array of products and tools for research, market news, data analysis, and collaboration across various industries and use cases.

One of those products is company financial data.

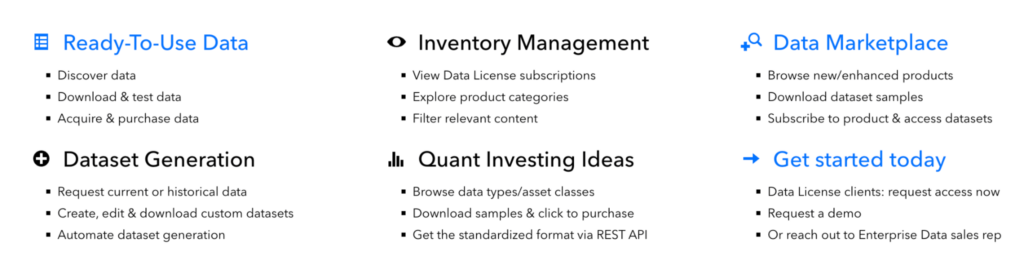

In their enterprise data catalog, you’ll be able to find standardized, scrubbed, and always-fresh:

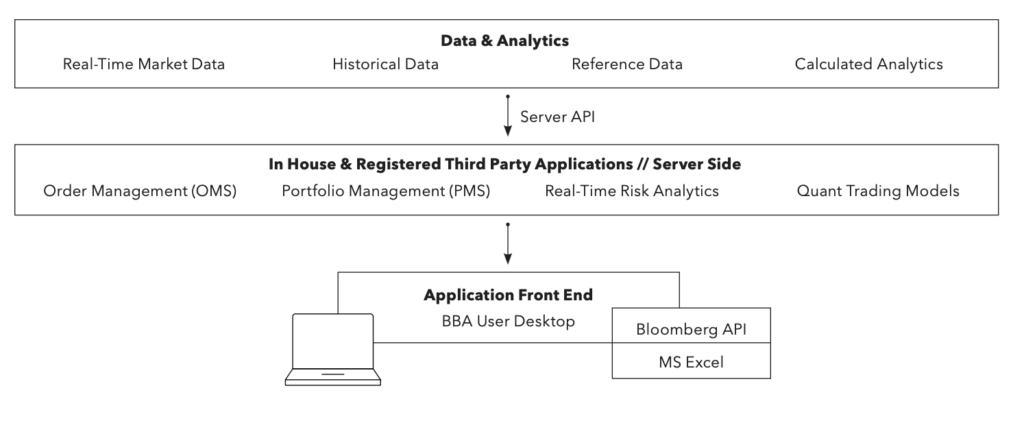

In terms of access to those insights, Bloomberg provides two options: software solution, Bloomberg Terminal, or their web-based linked data platform, Bloomberg DATA.

Source: Bloomberg

Those who opt for the first option can supplement their system with Bloomberg’s Software API (SAPI), which allows ingestion of real-time data into proprietary or third-party applications.

This is a great way to keep your data consistent across multiple systems and tasks such as trade and order management, risk, compliance, portfolio control, or analytics.

As per their own website, SAPI is “a practical solution for clients looking for something between Excel and a market data feed.”

Source: Bloomberg

However, access to this thorough and high-quality information does come at a steep price, it seems.

While no pricing details are available on their website, various internet sources suggest the subscription is quite expensive, around $2,000 per month or $24,000 annually.

This makes Bloomberg more suitable for large corporations’ data without significant budget constraints and financial analysts who need extensive, high-quality data.

Those who are interested can request a demo through a contact form on their website.

LSEG Data and Analytics is a division within the London Stock Exchange Group and one of the world’s largest providers of financial markets data and infrastructure.

In terms of company data itself, this cloud-based solution boasts coverage of 99% of the world’s market cap and offers access across various data categories, such as:

| People | Information about executives, directors, pay and performance, education, etc. |

| Organization Information | Addresses, classifications, categorizations, etc. |

| Events | Public events, stock exchange activities, market holidays for 130+ countries, real-time economic indicators, dial-in numbers, and webcasts |

| Ownership | Contact details for buy-side and sell-side companies, including affiliations, investment approach, and key investment personnel |

Essentially, this system provides access to extremely detailed company profiles, helping you identify trends such as changes in market leadership or investment opportunities with ease.

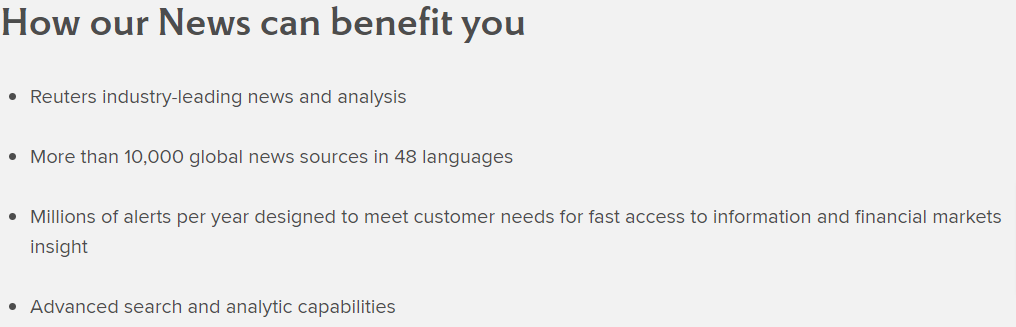

Besides this rich data, LSEG also keeps its users in the loop about the latest news about companies and industries.

Source: LSEG Data and Analytics

The platform provides top news curated by Reuters and even offers news analytics that analyze asset sentiment, relevance, and novelty, helping you make sense of all that unstructured content.

In addition to all of this, LSEG Data and Analytics offers extensive market and pricing data for various financial assets such as commodities, derivatives, fixed income, funds, loans, and more.

They boast 7.3 million price updates per second for over 90 million instruments and 2.5 terabytes of real-time pricing data, with a history dating back to 1996.

For those who need really robust, reliable, and thorough financial data to support their investment strategies, risk management practices, or regulatory compliance efforts, this system is truly a no-brainer.

However, for smaller firms and private investors, it could turn out to be too complex.

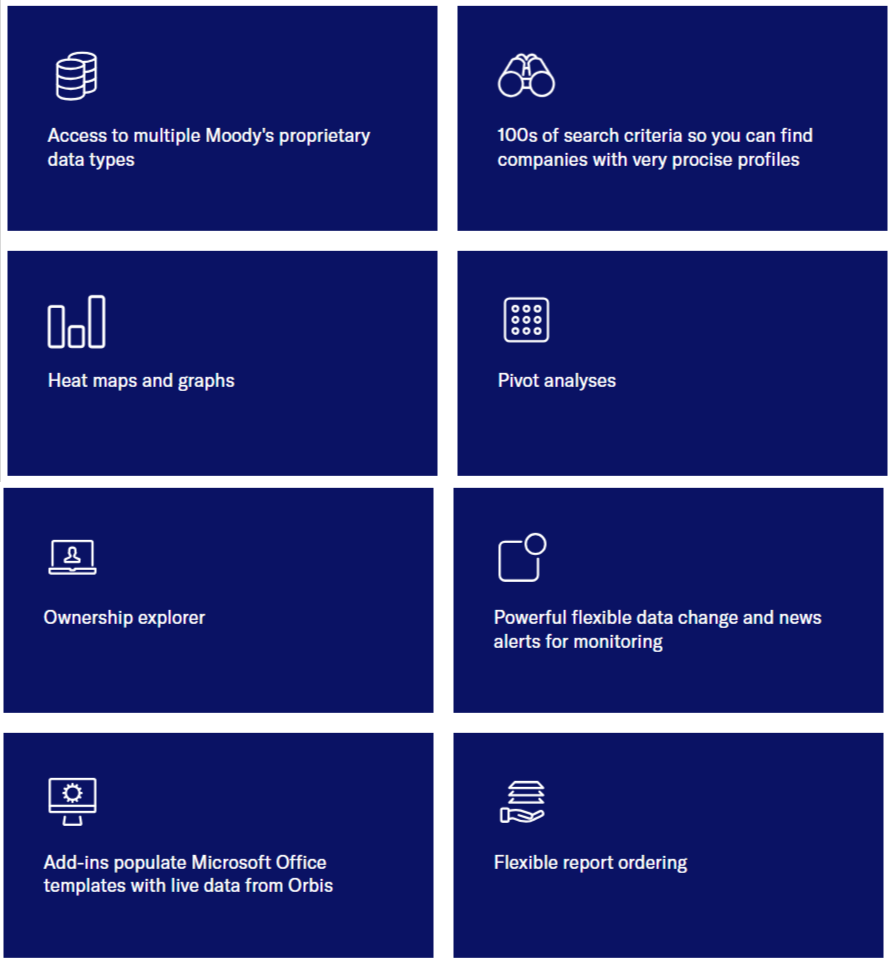

Orbis, a part of the financial services company Moody’s, is a database designed to help users find, analyze, and compare private company data from around the globe.

It captures and blends data from more than 170 sources for 527 million companies, allowing users to view and compare relevant insights with ease.

Their data encompasses:

Orbis’s strength lies in its corporate structures and hierarchies data, which boasts 1.9 billion ownership links, 1.7 billion historic ownership links, and 218 million active ownership links.

The solution can create detailed corporate trees, review entire corporate groups, and screen them for various risks such as adverse news or politically exposed persons (PEPs) through additional modules.

This can help you nip any issues in the bud, with both your existing and potential partners.

Below, you can see some of their other features.

Source: Orbis

The database can be used by professionals in any industry and for a wide variety of tasks.

For example, in sales and marketing, it can help sell more effectively by deduplicating and harmonizing datasets across departments.

Or, it can help manage supplier, credit, and cyber risks, check companies for compliance, or detect finance crimes. The options are truly endless.

So, if you’re curious about Orbis and want to see it in action, feel free to request a free demo through their website.

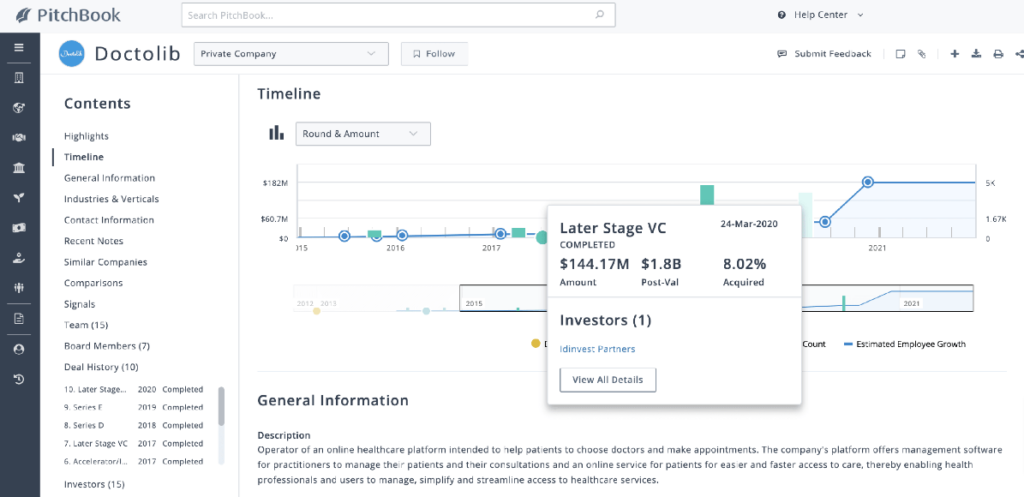

PitchBook is a provider of global financial data across various categories, including investors, limited partners, and, of course, companies, both public and private.

They update their data daily and currently cover more than 4 million private companies, as well as hundreds of thousands of publicly owned, venture capital-backed, private equity-backed companies, and startups.

PitchBook features quite an intuitive dashboard.

Source: PitchBook

It allows users to view key information at a glance, track company growth, and for public companies, access intraday market data, interactive stock charts, and more.

Plus, the dashboard can be customized to highlight information you actually want to see.

So, whether it’s companies’ financials, M&A metrics, or investor details, you can all have it neatly displayed in front of you.

The whole PitchBook experience is centered around an intuitive interface that helps you find what you’re looking for with minimal effort.

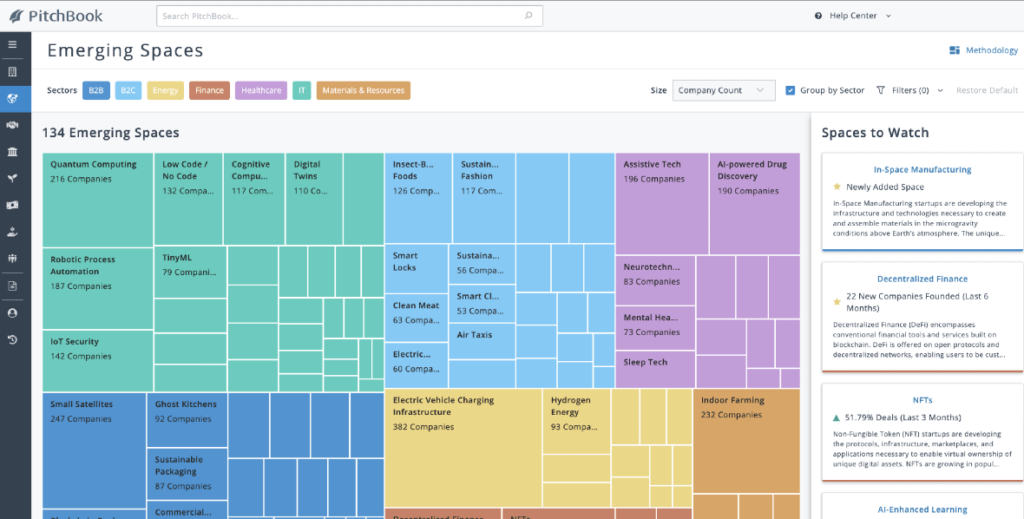

A good example is their Emerging Spaces feature.

Source: PitchBook

Through its data visualization tools, it enables users to easily surface key stats on companies, deals, capital invested, and more, helping identify new, promising investment opportunities and trends.

The platform is also strong in tracking non-financial metrics.

It gives you access to companies’ web traffic, social media following, job openings, clinical trial data, and more, to truly get to know the businesses you’re researching.

The exact subscription price isn’t listed on their website, but online sources indicate it ranges from $12,000 to $25,000 per year.

However, despite the steep price, PitchBook claims that 86% of organizations see a return on investment within the first year or even sooner.

Generally, online reviews indicate that users find PitchBook quite useful and its data sufficiently in-depth, although some note that the information can occasionally be a bit outdated and unreliable.

To find out more, reach out to them directly, or request a free trial.

Now that you have a list of potential S&P Global alternatives, it’s time to do your own research.

Think about what matters most to you and can make the most difference in your operations.

The goal here isn’t just to find the cheapest option or the one with the most features, but to discover the one that truly meets your needs.

For example, if you work in procurement and want to improve your supplier sourcing, Veridion might be a fantastic choice.

On the other hand, if mergers and acquisitions are your main priorities, Pitchbook could be the way to go.

Oh, and don’t forget to take full advantage of those free trials or data samples whenever possible. It’s the best way to see firsthand if the solution is the perfect fit for you.