7 Things to Look for In a Supplier Location Intelligence Provider

Key Takeaways:

You wouldn’t pick a supplier without knowing where they operate.

But what if the location data you’re using is incomplete, outdated, or just plain wrong?

Too often, supplier location intelligence stops at a single office address.

But a headquarters location doesn’t tell you where your goods are made, where raw materials are stored, or which sites are at risk from regulatory, environmental, or geopolitical disruption.

If your provider can’t show you the full map of a supplier’s footprint, it’s time to find a better one.

In this article, you’ll learn about seven capabilities your location intelligence provider must deliver to support smarter supplier decisions, reduce risk, and build a more resilient supply chain.

If your supplier location intelligence comes from just one data source (say, a company registry), you’re already at risk.

In many countries, official business registries are patchy, outdated, or lack the level of detail procurement professionals need.

A supplier may be registered at a legal address that has nothing to do with where they actually manufacture, store, or ship from.

Working with such incomplete or outdated supplier information can lead to misinformed decisions, delayed deliveries, or worse, compliance violations.

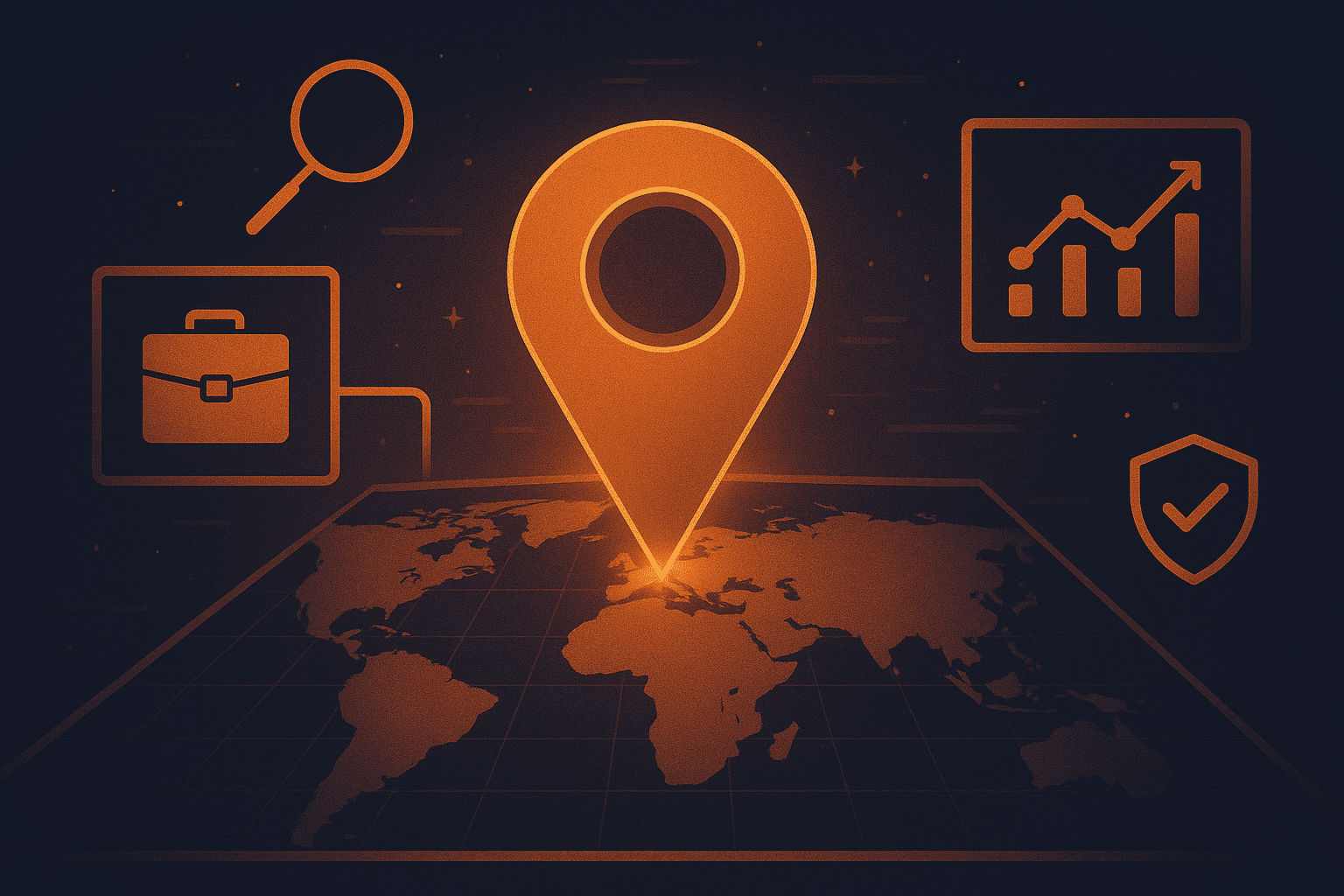

Given all these, it’s no surprise that nearly 18% of procurement leaders cite unreliable supplier data as their biggest challenge for 2025.

Illustration: Veridion / Data: TealBook

That’s one more reason why your provider needs to aggregate data from a wide range of sources, including:

The value of this multi-source approach is simple: broader coverage, better accuracy, and higher confidence in the data you’re working with.

Veridion, a leading platform in this space, has built a global footprint of over 400 million business locations (HQs, branches, affiliates) across 250+ geographies.

It blends structured records with web-scraped content and digital signals, giving you a fuller picture of where suppliers operate and how current that information is.

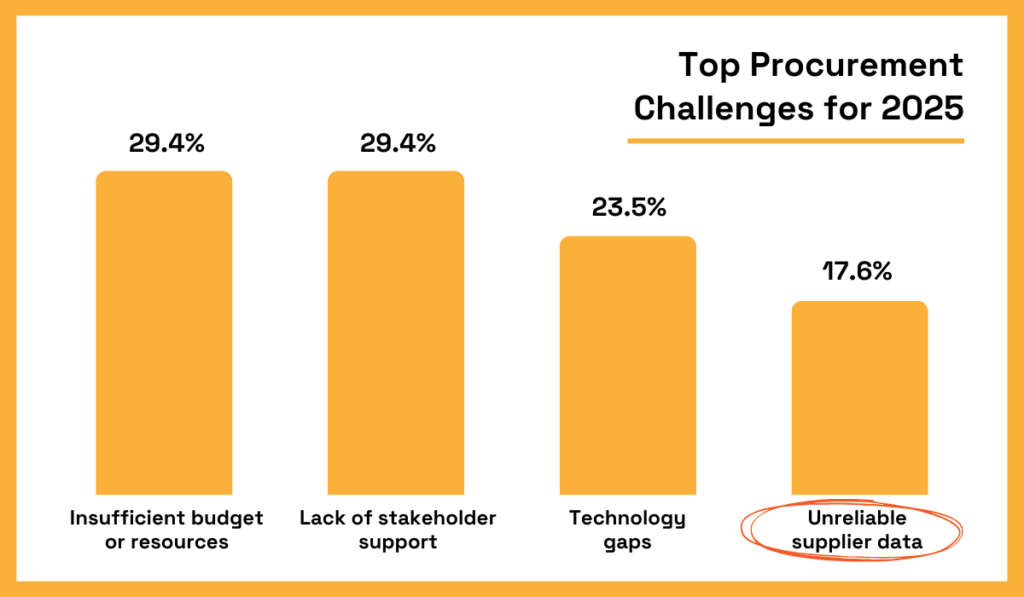

It does it with the help of:

Source: Veridion

What does this mean in practice?

With Veridion’s data, you’re not relying on what a supplier submitted five years ago to a registry.

Instead, you’re seeing the address they listed on their careers page last week or the new facility just mentioned in a press release.

How is this possible, you wonder?

With the power of AI.

Even if you have access to more sources, the next challenge is making sense of all that messy, inconsistent, multilingual data.

That’s where AI becomes essential.

Manually collecting and validating supplier address data is slow, error-prone, and nearly impossible to scale.

Address formats vary widely by country, languages mix within a single document, and many supplier locations are mentioned in unstructured formats like PDFs, news articles, or poorly formatted spreadsheets.

That’s why top-tier location intelligence providers use AI, particularly large language models (LLMs), to extract and interpret location data from this chaos.

These models can spot address elements in multiple languages, handle regional formatting differences, and even resolve incomplete or conflicting entries.

The result is highly accurate address data.

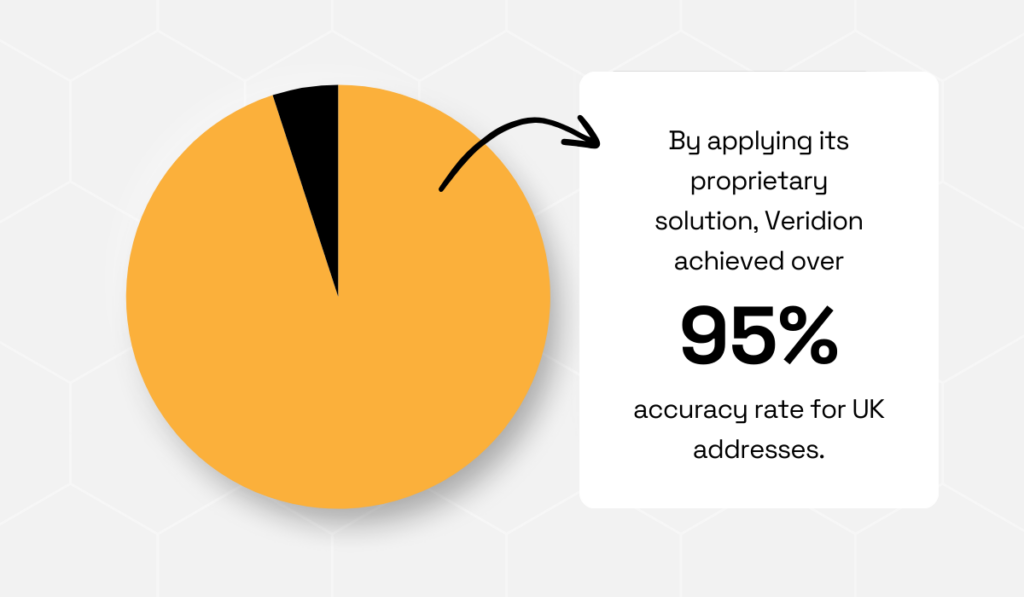

For example, with optimized LLMs, Veridion can achieve an over 95% accuracy rate for addresses, which was proven in a collaboration with Experian.

Source: Veridion

When you’re working across a global supply base, the speed and accuracy of AI are game changers.

Whether you’re mapping suppliers for risk, capacity, or compliance, AI-driven precision is the only way to get location data you can trust.

Supplier locations aren’t static.

Facilities open, close, shift operations, or relocate entirely.

If your provider isn’t updating that information frequently, you’re making decisions based on a moving target.

In fact, research shows how quickly things change.

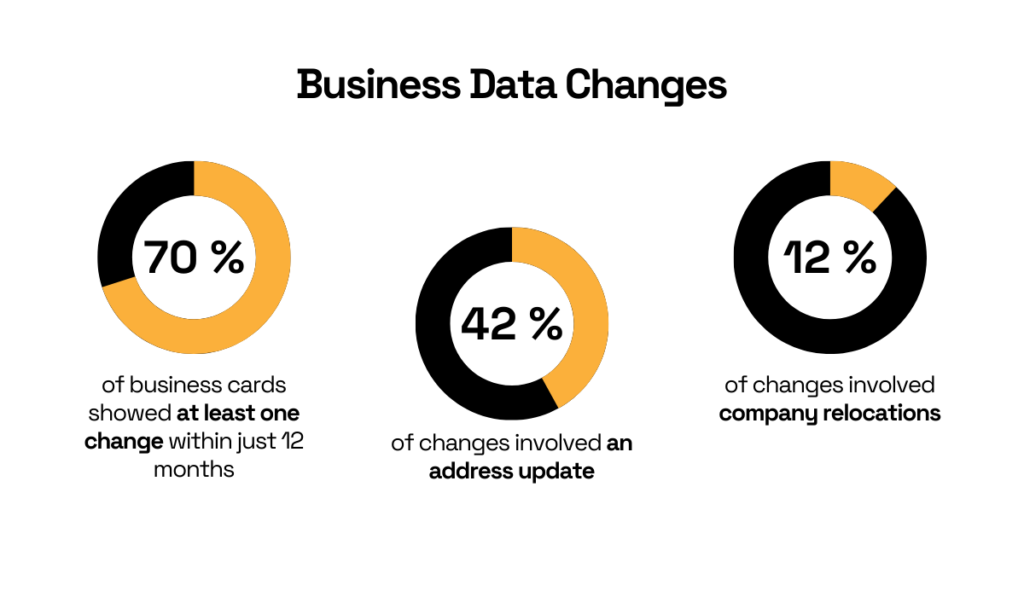

In a study of 1,000 business cards, over 70% showed at least one change within just 12 months.

Nearly 42% involved an address update, and 12% were due to company relocations: same organization, different physical location.

Illustration: Veridion / Data: Industry Select

Now imagine relying on last year’s data for supplier vetting or compliance reporting.

Outdated location data leads to numerous issues, like:

To prevent this in your organization, you should choose a provider that doesn’t treat location data as a one-time extraction.

The best providers use AI to scan billions of records and web pages continuously, refreshing their databases weekly to keep pace with your suppliers’ changing footprints.

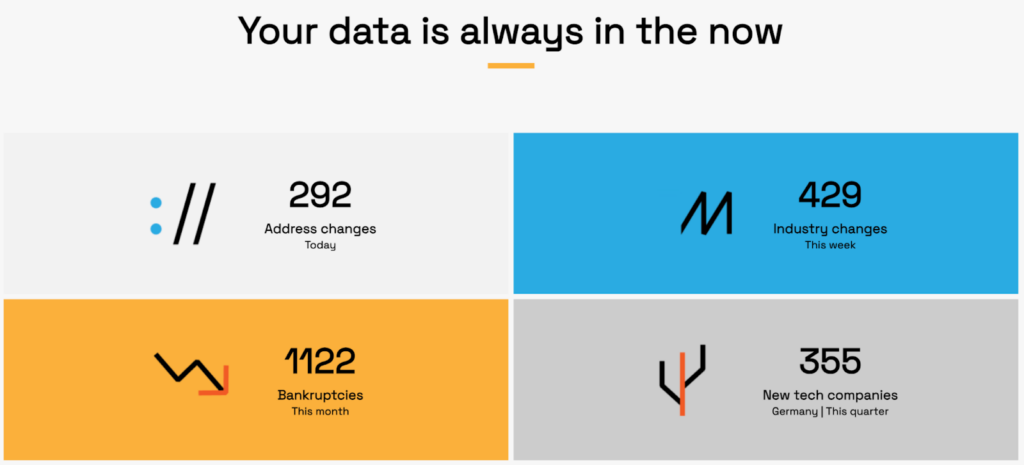

Source: Veridion

So when a key supplier shuts down a plant, opens a warehouse in a lower-cost region, or restructures due to M&A, you’re not hearing about it months later.

You’re already adapting.

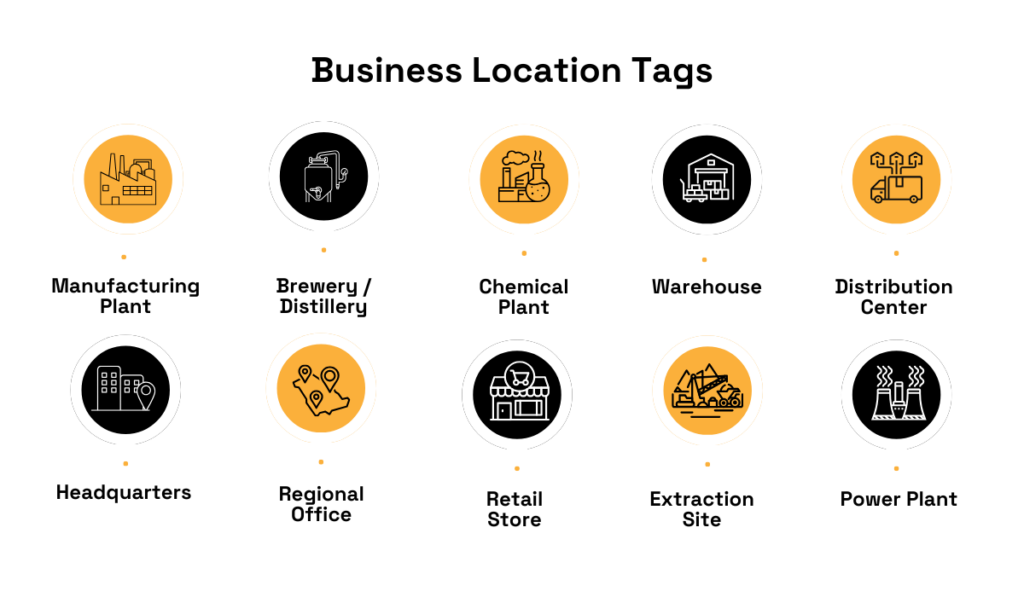

Knowing a supplier’s address is one thing, but knowing what that address represents is another.

Some addresses are corporate headquarters.

Others are manufacturing sites, distribution centers, or simple sales offices.

But if your data provider can’t distinguish between them, how will you know which location is relevant for logistics, risk, or compliance?

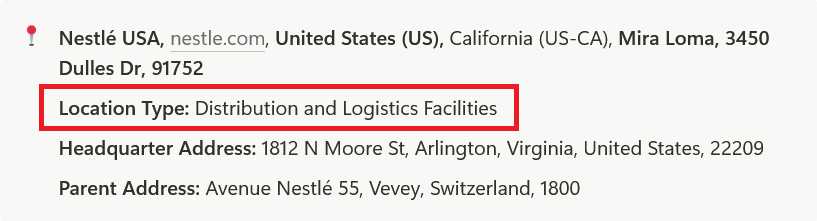

Take Nestlé USA as an example.

One of its key locations is at 3450 Dulles Dr, Mira Loma, California (91752)—but that’s not its headquarters.

Source: Veridion

It’s a distribution and logistics facility, which plays a completely different role in the supply chain than its corporate office in Arlington, Virginia, or the parent headquarters in Vevey, Switzerland.

Being able to classify the Mira Loma location correctly means you can:

Without this clarity, sourcing decisions can misfire, especially when disruptions like new tariffs or local regulations affect certain types of sites more than others.

For instance, if a supplier has a corporate address in Europe but manufactures goods in China, you need to know that to anticipate the impact of tariffs on Chinese exports.

A good supplier location data provider should, therefore, help you differentiate address types.

Veridion, for example, tags supplier locations using over 100 specific labels (e.g., factory, farm, retail outlet).

Source: Veridion

With these granular location insights, you can make smarter supply chain decisions, like selecting nearby production sites for reduced transport costs or avoiding regulatory pitfalls.

In the end, knowing where your supplier operates is useful, but knowing what each location does is critical.

Most suppliers don’t operate from just one address.

They have manufacturing plants in one country, warehouses in another, and administrative offices somewhere else entirely.

Source: Veridion

Some of these are formally registered, while others might fly under the radar, especially if they’re tied to subsidiaries or smaller operational units.

Without full visibility into all these locations, you risk duplicate entries, missed sourcing opportunities, and hidden exposure to regional risks.

It also becomes much harder to assess a supplier’s true production capacity or understand their logistical footprint.

But when you do know where every site is and how it connects to the broader supplier entity, you unlock a new level of agility.

That’s exactly what John Dickson, former CPO of AstraZeneca, was referring to when he said:

Illustration: Veridion / Quote: Deloitte

In other words, you can’t build resilience if you don’t know where your suppliers operate.

To enable this, your supplier location intelligence provider needs to go beyond static records.

They must be able to map all known locations tied to a single supplier, no matter if they’re directly owned, registered under a subsidiary, or part of a broader corporate group.

This is the kind of consolidated view that allows you to plan with confidence, adapt quickly, and source more strategically.

Let’s say you’ve sourced a critical component from a listed facility, only to find out, weeks later, that the site shut down months ago.

Not only is this frustrating, but it can lead to missed deadlines, contract penalties, or worse, reputational damage.

Unfortunately, this happens more often than most realize.

Many providers simply pull from registries or company websites without validating whether a location is still active.

But supplier sites open, close, or go dormant all the time—sometimes temporarily, sometimes for good.

In the UK alone, DSA Connect’s analysis shows that nearly 1,200 businesses close every single day.

Illustration: Veridion / Data: DSA Connect

Multiply that across global markets, and the pace of change is staggering.

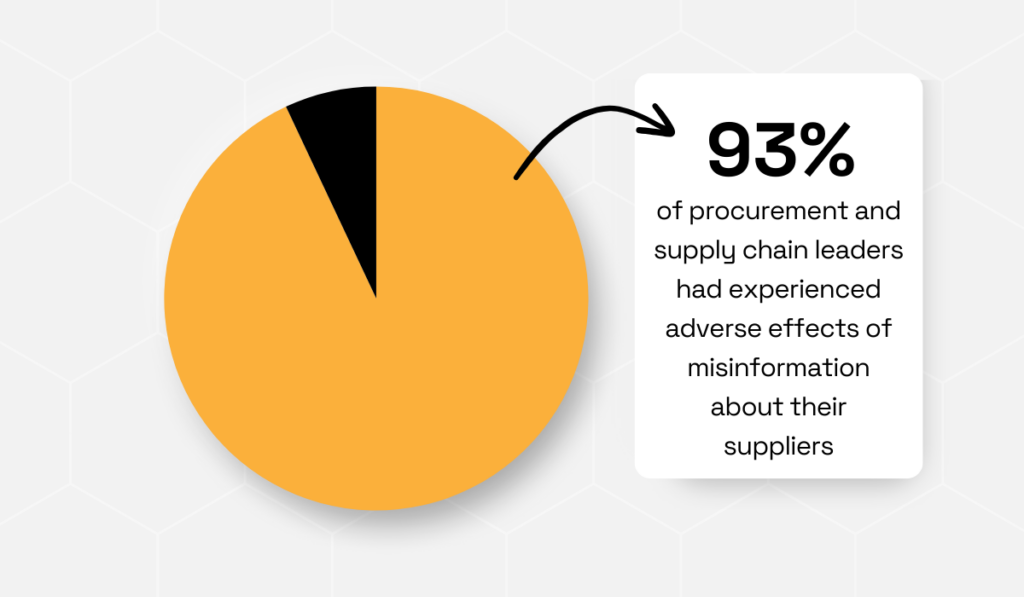

That’s why operational status matters.

Without current, verified data, you’re operating blind, and this harms you.

A TealBook survey found that 93% of procurement and supply chain leaders have faced consequences from bad supplier data, including missed deadlines, unhappy clients, and financial losses.

Illustration: Veridion / Data: TealBook

To avoid these costly setbacks, your supplier location intelligence provider must tell you not only where a site is, but also:

Veridion, for example, tags each location with its operational status and clearly separates live production or logistics sites from those used solely for corporate registration.

This ensures you’re planning based on real-world conditions, not outdated assumptions.

A supplier’s street address tells you where they are, but not what it means to your business.

To make smarter decisions, procurement and supply chain teams need context around that location:

This is where supplier location intelligence goes far beyond maps and pins.

Strong providers enrich address data with layers of environmental, infrastructural, and organizational insight.

For example, Veridion adds context by identifying what surrounds a location—ports, highways, rail lines, airports, power plants—or what may threaten it, such as flood zones, wildfires, water stress, or biodiversity-sensitive areas.

This helps assess logistics feasibility, environmental exposure, or disaster risk, without relying on the supplier to report it.

Beyond that, Veridion classifies:

Procurement teams can use this intelligence to prioritize local vs. offshore production, avoid overreliance on one region or site, and understand how sites are tied to broader corporate networks.

Even sustainability efforts benefit.

Using EXIOBASE3 and IEA emissions factors, Veridion can estimate the carbon intensity of a supplier location, even if that supplier hasn’t reported emissions.

Source: Veridion

That makes ESG screening or scope 3 estimates more reliable and complete.

In short, Veridion doesn’t just tell you where a supplier is.

It tells you what that location means for your supply chain—across performance, risk, sustainability, and resilience.

Supplier location intelligence is only as good as the depth and accuracy behind it.

A single HQ address won’t help you assess risk, optimize sourcing, or meet ESG goals.

To truly support resilient, data-driven supply chains, your provider should deliver all seven capabilities outlined here—from identifying active production sites to mapping hidden subsidiaries and contextual risks.

Anything less means decisions are made in the dark.