10 Things to Ask Before Onboarding a New Supplier

Key Takeaways:

Have you ever rushed to onboard a new supplier, only to regret it months later?

You’re not alone.

Many businesses fall into the trap of prioritizing speed over scrutiny, only to discover hidden costs, missed deadlines, or compliance issues down the line.

That’s why today, we’ll walk you through ten critical questions to ask before introducing new suppliers into your operations and systems.

So, if you want to avoid costly mistakes and build stronger, more reliable partnerships from the start, keep reading.

The most fundamental question to ask before onboarding a vendor is:

Are they good at what they do?

Evaluating their past performance and ability to meet customer demands offers valuable insight into how your partnership might unfold in the future.

And let’s face it: poor performance can negatively affect your business in so many ways, from increased costs to operational disruptions and more.

Consider the case of Mercedes-Benz Korea.

In 2024, they faced a wave of customer backlash after sourcing EV batteries from a Chinese supplier known for reliability issues.

As it turns out, the NCM battery produced by this supplier had already been linked to several international safety concerns.

Source: The Korea Times

For instance, in April 2021, Chinese automaker BAIC recalled some EV models equipped with these batteries due to fire risks.

Despite this history, Mercedes-Benz Korea chose to source from the same company, putting not only its reputation at risk but also the safety of its vehicles.

This is precisely why it’s so important to thoroughly vet any supplier.

Take the time to investigate those references, case studies, customer testimonials, financial reports, and relevant news.

Doing this up front can reveal vital details about a vendor’s quality and reliability—and protect your organization from costly risks in the future.

Even if a supplier looks great on paper, you need to be absolutely sure they can physically and logistically handle your order volume, delivery deadlines, and any special requirements.

Because if they can’t, you risk:

Scalability and flexibility are especially important here.

Can the supplier ramp up production during peak seasons, or will they already be stretched thin serving other clients?

And what if your product suddenly blows up because an influencer raves about it in a viral video? Will your supplier rise to the occasion?

These aren’t just hypothetical scenarios. They happen quite frequently.

For instance, Dubai chocolate, once a niche product, became a global sensation after a TikTok video went viral in December 2023, racking up over 120 million views.

The trend exploded, causing a worldwide pistachio shortage due to the unexpected surge in demand.

Source: The Express Tribune

Another example is Fujifilm.

Once struggling to sell cameras, the company saw its retro-style X100 series become a massive hit—again, thanks to TikTok.

The viral buzz led to demand far exceeding forecasts, stretching their supply chain to the limit and perfectly illustrating how rapidly market conditions can shift.

Source: Reuters

While these are extreme examples, they highlight an important point: your suppliers must be able to handle volatility.

So, be sure to thoroughly evaluate their production capacity, delivery reliability, technology infrastructure, and overall process efficiency.

Because building agility into your supply chain is a must nowadays.

Your suppliers’ security standards must be robust. Otherwise, they pose significant cybersecurity risks to your organization.

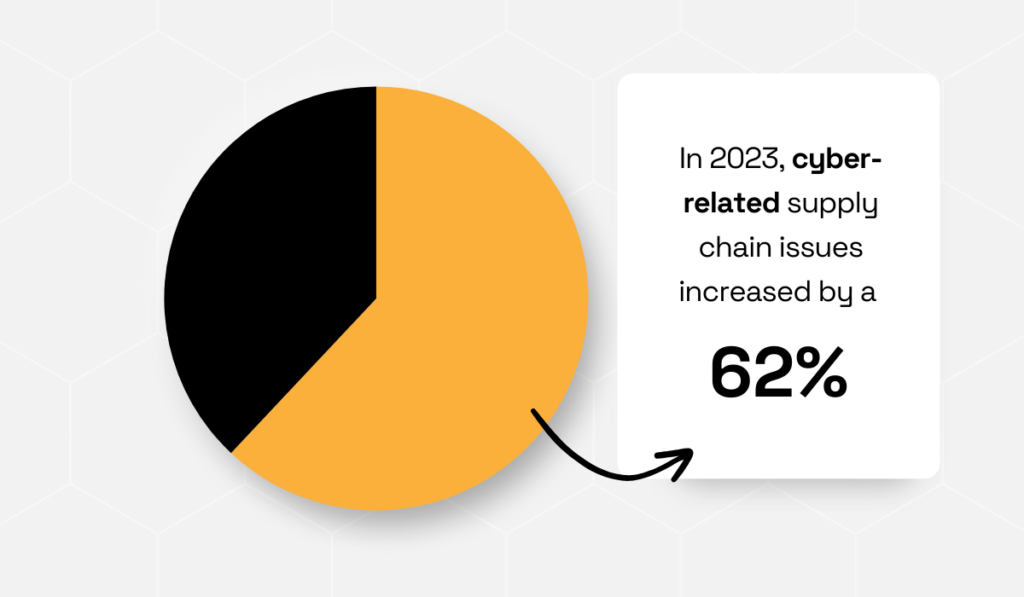

A 2024 Sphera study confirms that these threats are not only real but rapidly increasing.

In 2023, cyber-related supply chain issues rose by 62% compared to 2022.

Illustration: Veridion / Data: Sphera

This affects vendors and buyers alike.

That’s because suppliers are often linked to enterprises via platforms like bidding portals, creating potential entry points for attackers.

Hackers, bots, and cybercriminals usually target the weakest link in the chain—the supplier with the least protection.

Once they get in, they can access enterprise systems, steal sensitive data, disrupt operations, or demand ransom.

The consequences are severe: cyber incidents often cause delays, data breaches, factory shutdowns, and substantial financial loss.

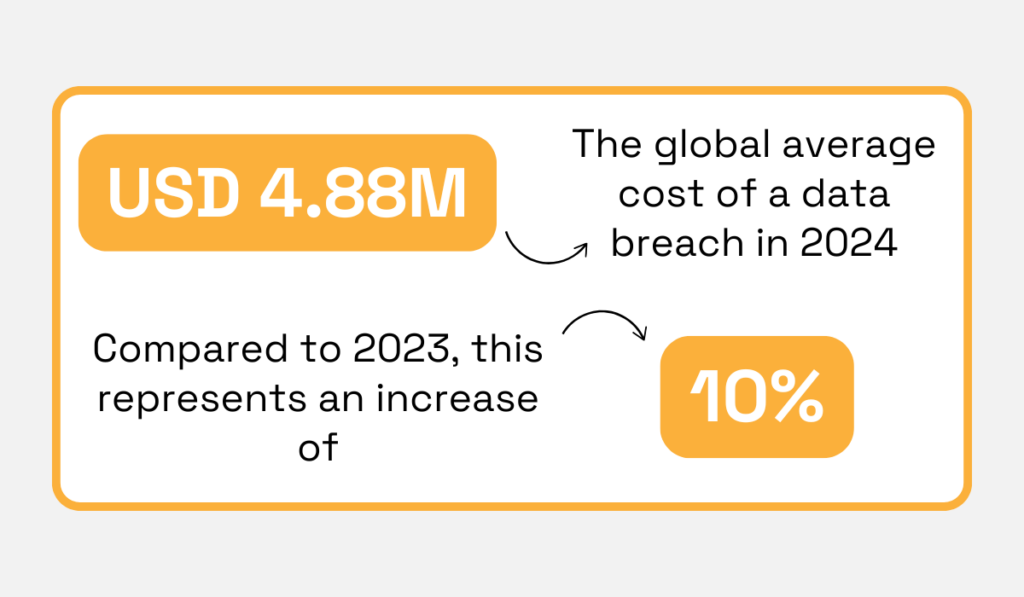

For instance, IBM’s 2024 report states that the average global cost of a data breach reached USD 4.88 million—a 10% increase from the previous year and the highest ever recorded.

Illustration: Veridion / Data: IBM

The key takeaway?

Don’t ignore your suppliers’ security posture.

Check for data protection policies, certifications like ISO 27001, and incident response plans.

Cybersecurity can’t be an afterthought—even with your smallest vendor.

Suppliers should be your partners, not just vendors.

If their goals are pulling in a different direction from yours, you’ll constantly be pushing uphill.

But when your objectives are aligned, it paves the way for smoother, long-term relationships that create real value for both sides.

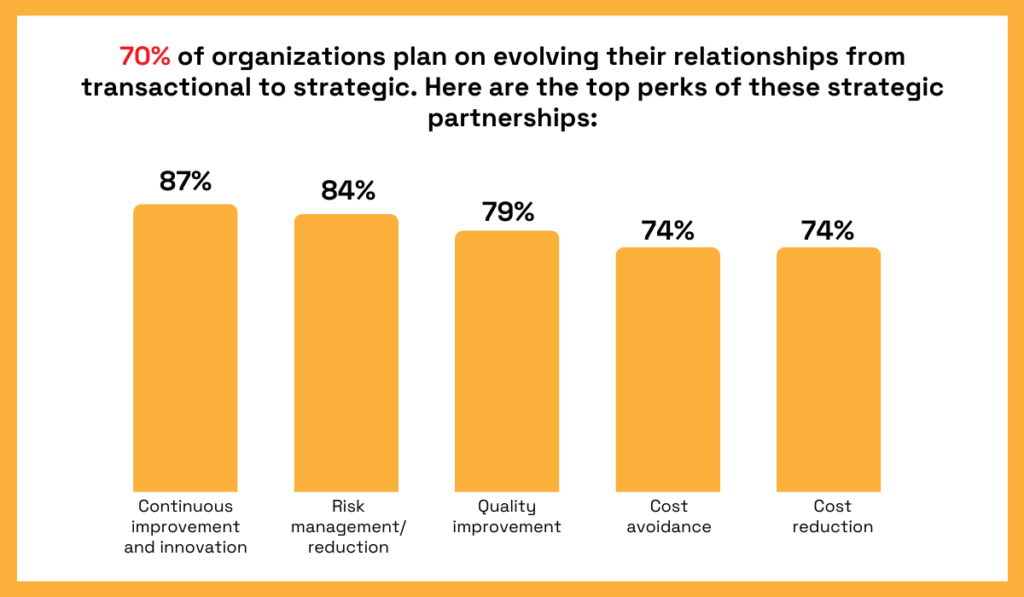

It’s no wonder the 2024 State of Flux survey found that 70% of organizations plan to shift from transactional to strategic supplier relationships.

It seems they are well-aware that strategic partnerships unlock major advantages, from cost savings and innovation to risk mitigation and quality improvement.

Illustration: Veridion / Data: State of Flux

Essentially, with the right suppliers, you don’t just get better pricing. They can also offer priority treatment, flexibility, and even a lifeline during material shortages.

That’s why it’s smart to do your homework during the pre-onboarding phase. Do some research on a supplier’s:

These will tell you a lot about where a supplier is headed and whether you’re on the same path.

When your visions align from the start, you set the stage for a strong, strategic partnership that builds a competitive edge.

Today, Diversity, Equity, and Inclusion (DEI) are top priorities for consumers, investors, and a wide range of stakeholders.

This means that partnering with diverse suppliers not only supports corporate social responsibility goals but can also potentially drive real business results.

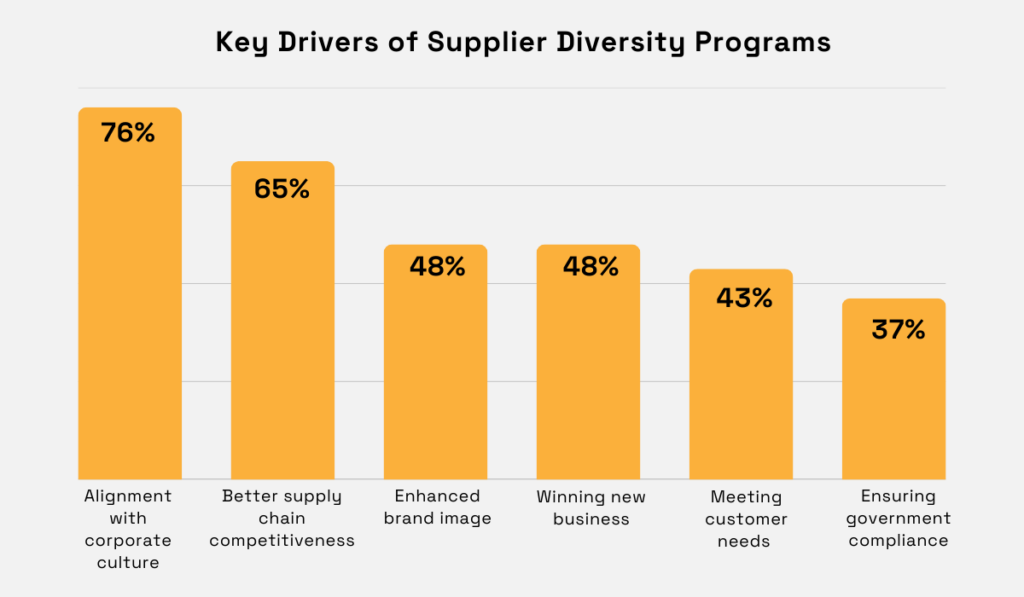

A 2024 survey by Supplier.io confirms this.

It reveals that some of the key drivers behind supplier diversity programs are higher supply chain competitiveness, improved brand image, and increased success in securing new business.

Illustration: Veridion / Data: Supplier.io

In short, focusing on DEI doesn’t just promote equity—it can also improve your bottom line.

It’s a true win-win.

So, as you evaluate potential partners, consider their diversity certifications (e.g., minority-owned, women-owned), DEI policies and initiatives, and overall workforce diversity.

You can also rely on third-party certification organizations to verify that businesses meet diversity criteria in ownership, operations, and control.

Some key organizations include:

Ultimately, supplier diversity is good business.

It opens the door to fresh ideas, broader market appeal, and stronger, more inclusive growth.

It’d be a mistake to overlook it.

Just like DEI, sustainability is becoming increasingly important—not only to consumers and investors but also to regulatory bodies.

Therefore, by evaluating a supplier’s sustainability performance, you actually help ensure compliance and reduce the risk of costly fines and legal issues.

Etosha Thurman, Chief Marketing Officer for Finance & Spend Management at SAP, agrees that sustainability is no longer optional.

In fact, she asserts that the rules and regulations are only getting stricter:

Illustration: Veridion / Quote: SCMR

This means you may need to prioritize suppliers who, for instance, meet greenhouse gas and carbon emissions standards, even over those who offer the best prices or product quality.

Tricky?

Certainly. But also a huge opportunity.

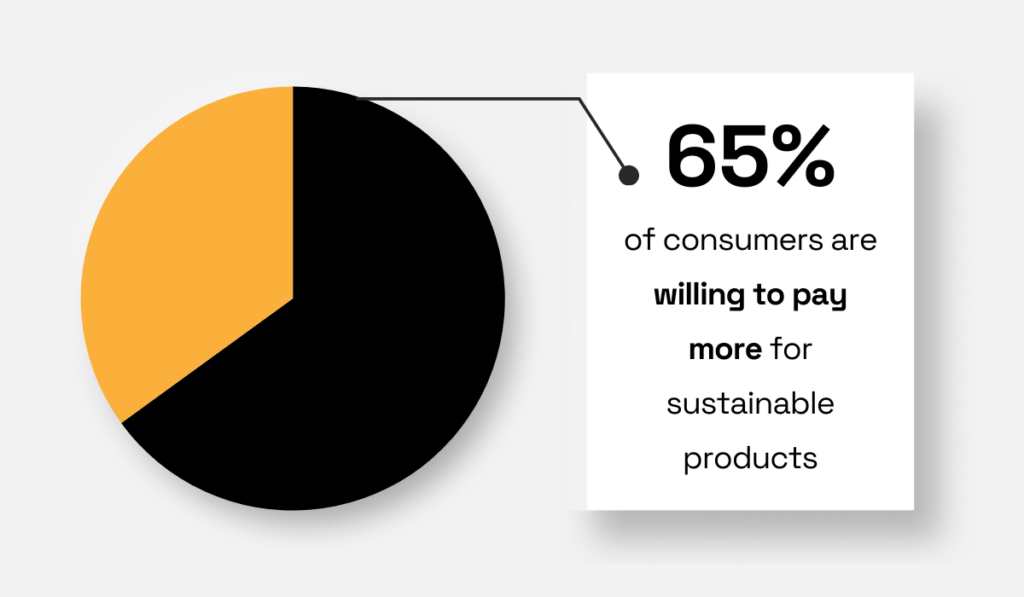

According to a 2025 BlueYonder survey, 65% of consumers say they’re willing to pay more for sustainable products.

Illustration: Veridion / Data: BlueYonder

In other words, when you partner with vendors who care about their ecological impact, you can significantly boost your bottom line.

Now, that’s a powerful incentive.

This is why it’s smart to ask your partners about their sustainability certifications (e.g., ISO 14001), green initiatives (e.g., carbon reduction), and ESG reporting processes.

Because at the end of the day, suppliers who check the right boxes not only protect you from noncompliance but can actively contribute to your business success.

Every new supplier introduces some level of risk, whether financial, operational, reputational, or compliance-related.

Still, it’s always a good idea to try to limit it wherever you can to protect your business continuity.

How do you do that?

By understanding and evaluating supplier risk before onboarding. This can really make a big difference.

Just look at Volta Trucks.

In 2023, the electric vehicle startup went under, not because of their product, but because their battery supplier went bankrupt.

Source: Fleet News

This seriously impacted Volta Trucks’ manufacturing plans as well as the ability to raise capital and ultimately forced the company to shut down.

This is a clear example of how your suppliers’ risks can quickly become your own.

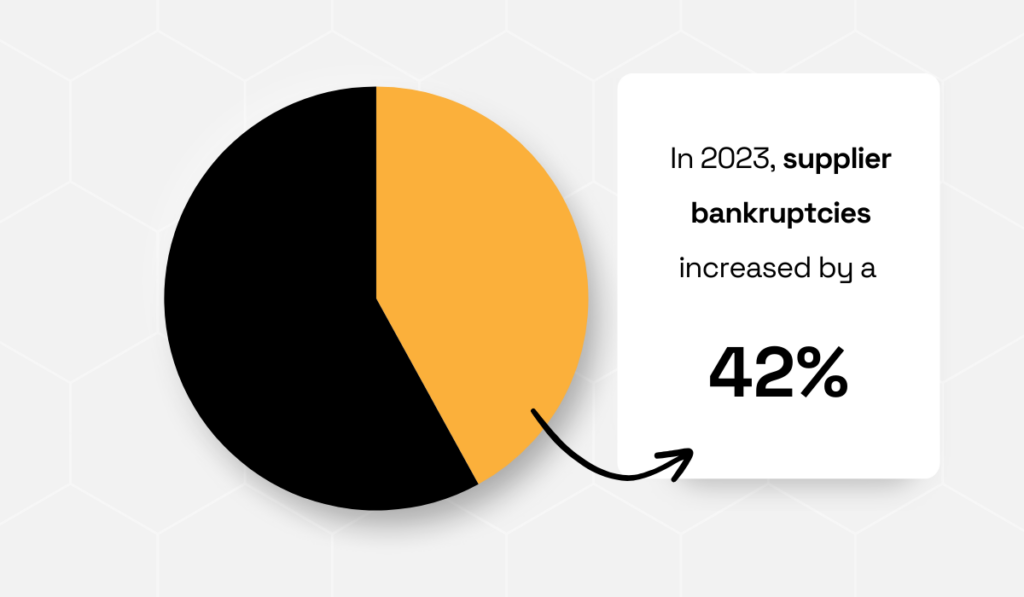

And keep in mind, this is not an isolated case.

Supplier bankruptcies jumped 42% in 2024, according to the same Sphera survey we mentioned earlier.

Illustration: Veridion / Data: Sphera

This is quite concerning, especially when you consider that financial health is just one aspect of supplier performance that’s vulnerable to risks.

So, to protect your company, assess every supplier’s credit ratings, audit reports, and regulatory compliance history.

Pay close attention to geographic, political, and supply chain factors as well.

If there’s a weak link, you want to know about it before it puts your organization at risk.

Even if you’re willing to accept some level of risk, your suppliers must actively manage and mitigate it.

After all, without strong internal controls, they become a liability.

Toyota learned this firsthand in 2011, when a magnitude 9.0 earthquake struck off the coast of Miyagi Prefecture, Japan.

The disaster revealed serious vulnerabilities in their supply chain, with many factories lacking disaster recovery plans and being forced to shut down.

Within hours, 75% of the company’s profits were wiped out, and parts shortages plagued operations for weeks.

Source: The Guardian

Since then, Toyota has taken a different approach.

Today, it works closely with suppliers on contingency planning and risk controls.

For example, suppliers now stockpile two to six months’ worth of semiconductor chips, based on lead times, to cushion against shortages, whatever their cause may be.

You need the same from your suppliers.

Ask them about their formal risk management frameworks, business continuity and disaster recovery plans, as well as insurance coverage.

If they’re not ready for disruptions, they put your business at risk.

Relying solely on suppliers to manage their own risks is not enough.

As a buyer, you also need to do what you can to monitor their performance, identify potential issues early, and ensure ongoing compliance.

So, how can you effectively monitor supplier performance and risk? And, more importantly, how do you ensure the data you work with is reliable?

That’s where AI-powered supplier intelligence platforms like Veridion come in.

Veridion leverages artificial intelligence and machine learning to scan and process billions of websites and petabytes of company data each week.

The result?

A vast, always-up-to-date global database covering over 100 million companies and more than 200 million business locations, complete with rich business profiles you won’t find anywhere else.

Source: Veridion

This means that, with Veridion, you can quickly detect any type of supplier risk.

For example, you can identify and evaluate risks tied to Foreign Ownership, Control, or Influence (FOCI) to ensure compliance and mitigate geopolitical exposure.

Or, you can assess the operational stability of third-party partners by analyzing indicators such as worker safety and labor law compliance.

In essence, Veridion knows everything there is to know about your suppliers.

This makes it quite a powerful tool for data-driven decision-making and proactive risk management.

Even the strongest business relationships can change over time.

That’s why it’s important to establish a clear, fair, and low-risk exit strategy before onboarding a new supplier.

Whether due to declining performance, evolving business needs, or rising costs, having a predefined path to disengage can help prevent rushed or risky decisions later on.

So, take the time to carefully review and negotiate termination clauses, notice periods, and transition support, such as knowledge transfer and asset handover.

Brad Keller, VP of Third Party Risk at LPL Financial, a leader in the retail financial advice market, offers this advice:

“Your termination process should include potential replacements, including the time, cost and complexity of moving to a new vendor and, most importantly, what happens to your data or other assets that are in the vendor’s possession.”

He also emphasizes the importance of clearly defined processes to verify the vendor’s compliance with these requirements.

All in all, while it may be uncomfortable to consider the end at the beginning, doing so during the pre-onboarding phase can save you significant time, stress, and risk down the road.

Hopefully, you’ll never need to use the exit plan, but it’s definitely essential to have one in place.

And there you have it.

By asking these questions, you significantly improve your chances of building a long-lasting, productive partnership with your suppliers.

As we’ve seen, even major companies can stumble when they overlook red flags or rush through due diligence.

Learn from their mistakes.

Instead of just asking, “Can this supplier deliver?” take it further and ask:

“Can they deliver consistently, securely, ethically, and strategically?”

Being thorough from the start can make all the difference in the success of your supply chain.