Supplier Segmentation: Best Practices to Follow

Key Takeaways:

Supplier segmentation matters.

It helps you tailor each supplier relationship based on its strategic importance, ensuring you’ve optimized your resources and strengthened partnerships while minimizing risks.

If you’re wondering how to make the most of it, you’ve come to the right place.

In this article, we’ll focus on 5 proven practices you can apply.

Let’s dive right in!

The Pareto Principle observes that roughly 80% of results come from 20% of actions.

Using it, you can pinpoint strategic suppliers.

When it comes to supplier management, this rule dictates that only a small percentage of suppliers (20%) impact your supply chain the most (80%).

We can visualize it like this.

Source: Veridion

So, instead of spreading your resources too thin across the whole supplier base, you can pinpoint 20% of suppliers needing your attention the most, investing resources into core supplier relationships.

Prioritizing key suppliers in this way helps organizations achieve maximum returns, from negotiating better terms and delivery schedules to building stronger supplier relationships.

The Pareto Principle benefits supplier segmentation by:

While this principle works as a practical method for prioritization, it has its limitations.

Nowadays, supply chains are complex and influenced by a variety of factors. The same goes for supplier relationships.

Pareto-based segmentation is based on quantitative data which overlooks many of the nuances critical to success.

As such, blindly following the 80/20 rule can cause you to overlook decisive details about your suppliers, leading to missed opportunities.

Keep in mind that while this principle can’t work as a standalone strategy, it’s still an excellent starting point!

Mohib Rahmani, the Managing Principal at a global management consultancy Argon & Co., says as much.

Illustration: Veridion / Quote: LinkedIn

Rahmani notes that he applies this principle in many different client engagements—the important thing is knowing how to tailor it to specific needs and circumstances.

For example, you can apply the principle to different scenarios, whether it is to detect suppliers bringing the most value, posing the most risk, or accounting for the most spending.

Used strategically, the Pareto Principle can quickly transform supply chain operations by boosting understanding of supplier value and risks.

Qualitative data makes a world of difference in supplier segmentation because it reveals value beyond numbers.

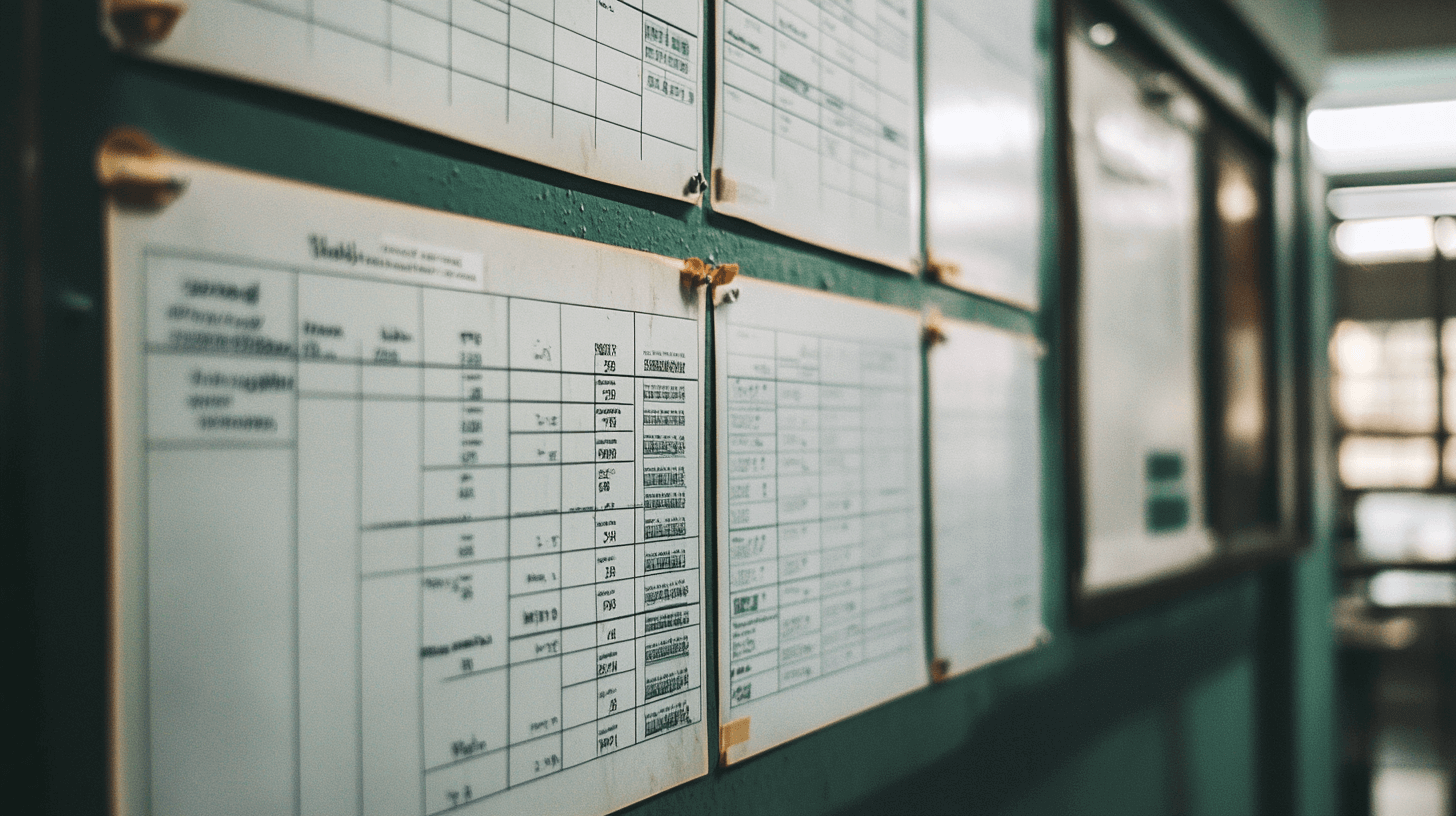

Many companies realize that. For instance, Gartner’s 2020 report shows that the majority of companies pursue deeper, more collaborative supplier relationships.

Illustration: Veridion / Data: Gartner

These findings reflect the need for more resilient supply chains, but they also raise questions.

For one, how do organizations decide which relationships to invest in?

This is where qualitative data comes in.

Evaluating the supplier’s capacity for innovation, growth potential, and your existing relationship gives you crucial insights for effective segmentation.

In this context, a supplier that seems largely unimportant may become extremely valuable.

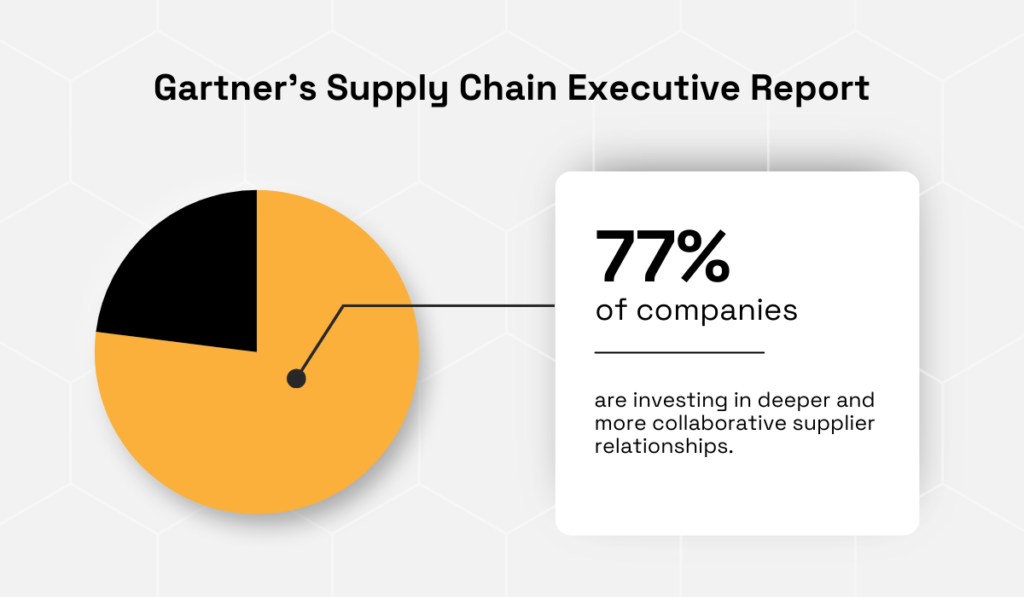

One such example comes from Italy at the peak of the COVID-19 pandemic.

When the local hospital realized they were nearly out of critical respirator valves, it was already too short of a deadline for their supplier to provide the missing components.

Fortunately, a previously unassuming startup Isinnova rose to the occasion.

By joining hands with another company and using 3D printing, Isinnova was able to start manufacturing valves in just 6 hours, ultimately saving lives.

Source: 3D Printing Industry

Virtually overnight, Isinnova positioned itself as a critical supplier for Italy’s faltering healthcare sector.

This shows procurement leaders need to factor in qualitative metrics when assessing and segmenting suppliers to anticipate future potential.

Ultimately, recognizing these core qualities calls for a more holistic approach that accounts for metrics outside of spend volume or performance.

Supplier segmentation is a complex process, but it can be made simpler with the right technology.

Leveraging technology saves time, reduces manual errors, and paves the way for more consistent and scalable segmentation practices.

Moreover, it helps organizations bridge existing visibility gaps.

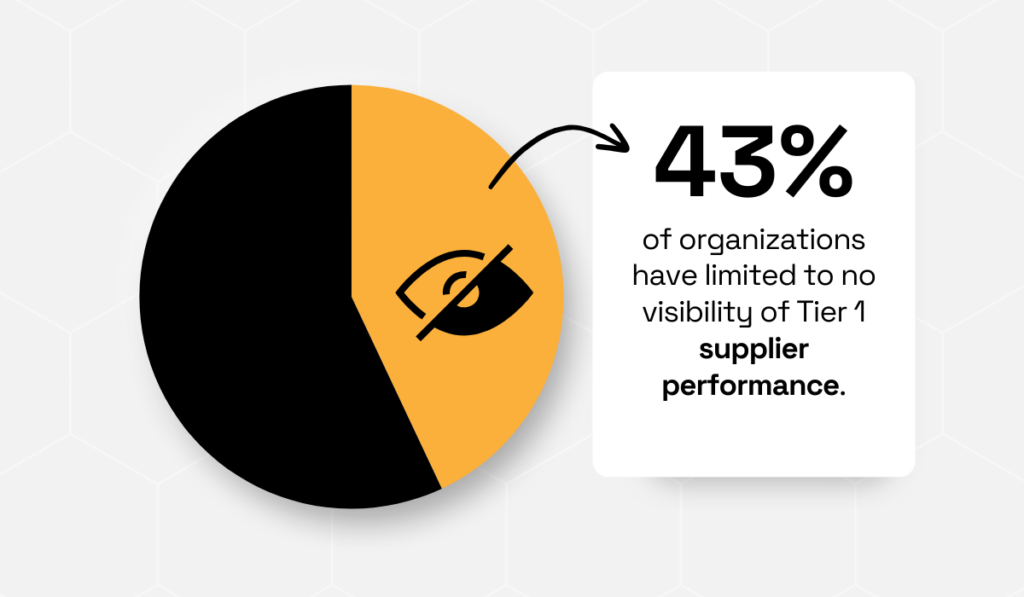

KPMG’s recent report on supply chain trends revealed that almost half of surveyed organizations have limited to no visibility of tier-one supplier performance.

Illustration: Veridion / Data: KPMG

Now, if this is the case with priority suppliers, you can only imagine the lack of insights on tier 2 and 3 suppliers.

How do you group suppliers if you have little to no performance data?

This report and a growing body of research point us toward technology.

Talking about supply chain trends today is impossible without mentioning procurement and supplier management tools that can automate data collection, run detailed analyses, and segment workflows.

Generative AI and machine learning (ML) are a huge transformative force in itself.

So huge that a 2024 report by Meticulous Research predicts a real boom in the AI supply chain market, projected to reach a stunning $58.55 billion by 2031.

The main reason is its unparalleled ability to collect and leverage data.

When it comes to leveraging AI supplier insights, look no further than our Veridion.

With Veridion, you can quickly sift through a wealth of company data updated continuously.

Source: Veridion

Since supplier data changes rapidly, fresh insights significantly accelerate supplier discovery but also enable you to detect even the smallest changes in your suppliers’ business to nip potential risks in the bud.

Supplier evaluation demands a systematic, data-centric approach to ensure you’re making the best decisions.

With the right technology, you’ll streamline these processes and step up your game.

Once you get a hold of critical supplier findings, it’s important to share them with the other departments.

Internal collaboration and cross-functional alignment create a foundation for meeting organizational goals.

This is true for any key process, and supplier segmentation is no different.

Departments like operations, finance, and risk management need continuous access to the most up-to-date supplier data.

Source: Veridion

For instance, finance teams would have immediate insight into which high-value contracts they need to prioritize, enabling them to plan early payments for key suppliers.

However, sharing findings and leveraging key insights is not without its difficulties.

XPLM’s research shows that the majority of decision-makers agree on data silos impeding collaboration efforts.

Furthermore, even when data is shared, much of it is only available in Excel spreadsheets or sent via email.

Illustration: Veridion / Data: XPLM

Keeping your data stuck in an endless loop of emails and outdated spreadsheets seriously limits its use and overall efficiency.

This is also one of the main symptoms of poor internal communication that many organizations struggle to overcome.

So, how do you make data easily accessible instead?

Invest in a single source of truth.

By using robust procurement software like SAP Ariba or similar platforms, you enable centralized information, reduce errors, and allow everyone to access the same information.

With that, you’re one step closer to integrated decision-making and stronger company-wide collaboration.

You’ll know you’ve done a good job when the data structure feels logical and intuitive to everyone, says Abhijeet Kaku, Cloud & Analytics Business Lead at Tatvic.

Illustration: Veridion / Quote: LinkedIn

Additionally, it’s essential to establish a clear division of roles and duties for each department and data-sharing protocols that facilitate smooth information transfers between departments.

Putting all the systems and protocols in place takes time, but once you do that, there should be no obstacles to making full use of supplier findings across all relevant departments.

The final puzzle piece is periodic reviews of your supplier segmentation model.

Forward-thinking organizations put considerable time and effort into crafting or tailoring their supplier segmentation model.

Laura W, Chief of Staff at Swoop LLC, which specializes in building supply chains for small-dimension package delivery, points out that the matrix needs to fit like a glove.

Illustration: Veridion / Quote: LinkedIn

But even the most reliable system factoring in all your needs and circumstances has to evolve over time.

Simply put, it needs to stay relevant and account for:

With regular or at least periodic reviews, you’ll keep your categories relevant and the model adaptive, ensuring that it remains aligned with current priorities and risks.

While procurement teams should take the lead in this process, reviews and potential redesigns will run smoother with input from other teams and stakeholders.

Keep in mind that if you do this on time, you’ll be looking at minor adjustments and tweaks, rather than lengthy revamps.

In essence, effective supplier segmentation depends on three things: thorough planning, reliable data, and consistent execution.

To succeed, you need to combine tried methods with new technology and foster a collaborative, agile mindset.

As long as you’re ready to refine your systems with fresh insights, you’ll stay on track and achieve your procurement goals.