Best Practices for Managing Supplier Tiers

Key Takeaways:

Not all suppliers are created equal.

From critical raw material providers to low-risk indirect vendors, you likely rely on a diverse mix of partners to keep your operations running smoothly.

The key to reduced risks and better performance?

Effectively categorizing and managing these suppliers through tiers.

This article explores the best practices for managing supplier tiers, offering practical insights into how you can optimize relationships, boost visibility, and allocate resources more effectively.

Ready to learn how to get the most value from your supplier network?

Let’s begin.

Before you can properly tier your vendors, you first need to know who they are and how they connect.

This is where supplier mapping comes in, enabling you to create a clear and thorough inventory of all suppliers involved in delivering a product or service to your company.

It shows you who your partners are, where they’re located, and how important they actually are.

By laying all of this out, you’ll start to see patterns, dependencies, and potential vulnerabilities, all of which will help group suppliers into meaningful tiers.

Here’s the kind of information you’ll want to gather:

At the beginning, there’s no need to overcomplicate things with complex visualisations.

Keep it simple for now.

Steve Schwartz, founder of Art of Tea, a subscription retailer of fine teas from around the world, offers this advice:

Illustration: Veridion / Quote: Shopify

This is more than enough to get started.

Once you have your partners catalogued in a spreadsheet, you’ll have a solid foundation for effective tiering.

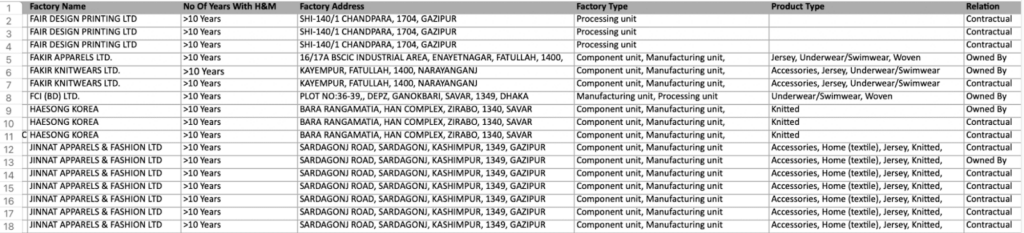

Just look at how H&M does it.

They manage a huge network of suppliers, but they keep it organized with an inventory that shows exactly how long each supplier has worked with them, their certifications, and more.

Below, you can see just a tiny portion of their supplier inventory.

Source: H&M

That kind of visibility helps them stay agile and informed, even with a massive supplier base.

After all, you can’t manage what you don’t see.

Keeping a detailed record of all your vendors will allow you to effectively categorize, evaluate, and monitor suppliers by tier, no matter how big or small your supplier portfolio.

In addition to a detailed inventory of your suppliers, you need a clear, consistent system for classifying them into tiers.

By defining these categories early on, you ensure that your partners are always tiered consistently, regardless of their specific product type or how many vendors you engage with.

Naturally, there’s no one-size-fits-all approach here.

Every company has different priorities, so your definition of a Tier 1, 2, or 3 supplier should reflect your unique business needs.

Some key factors to consider when defining your tiers include:

In general, it’s advisable to keep the number of tiers to a minimum.

Overcomplicating the structure with too many tiers can make coordination and relationship management difficult.

That’s why most businesses stick with three or four tiers—but depending on your industry or product, you might need more.

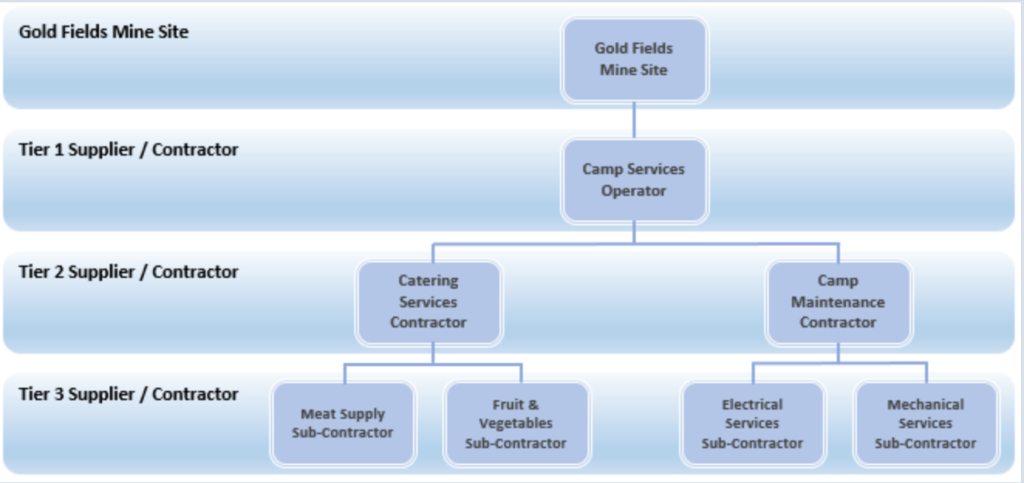

A common tiering model is based on proximity and directness of the relationship.

Tier 1 suppliers are the ones you work with directly, Tier 2s are their vendors, Tier 3s are one step further removed, and so on.

Gold Fields, a global gold mining company, is one of the many organizations that use this model:

Source: Gold Fields

Each level plays an important role, but they all require a different approach.

Therefore, besides the tier criteria, Gold Fields has also developed specific management strategies for each tier.

For instance, Tier 1 suppliers are monitored far more thoroughly than the other tiers, according to their website:

Illustration: Veridion / Quote: Gold Fields

Additionally, these vendors are regularly screened by a third-party tool for compliance risks, including regulatory, labor, environmental, health and safety, and operational factors.

The bottom line?

You can’t—and shouldn’t—manage every supplier the same way.

But by defining tier-specific criteria and management practices, you can focus your energy where it counts, build long-lasting partnerships, and, ultimately, strengthen your overall supply chain.

Tiering vendors is not a one-time task.

It requires regular reassessment and updates to reflect changes in supplier relationships, performance, risk, and your evolving business priorities.

If you’re not doing this regularly, you risk relying on stale data, which can lead to poor decisions and missed opportunities.

The most effective approach here is to establish clear KPIs and use them to evaluate suppliers consistently over time.

This will allow you to update tier classifications based on actual performance.

Some common KPIs include:

Of course, you don’t have to limit yourself to these. You can track what matters most to your business.

For example, Adidas places strong emphasis on social and environmental compliance, which is why they developed dedicated Social Key Performance Indicators (S-KPIs).

They provide a more detailed description of these S-KPIs on their website:

“Our Social Key Performance Indicator (S-KPI) rating tool measures the following: reduced accident rates, higher retention levels, or improved worker satisfaction and the effectiveness of our worker empowerment initiatives.”

Suppliers are assigned an S-rating from 1 to 5, with tier 1 suppliers expected to score at least 4S.

Non-compliance is taken seriously:

Illustration: Veridion / Quote: Adidas

All in all, at Adidas, they understand that a set-it-and-forget-it attitude doesn’t work when it comes to supplier tier management.

Today, adaptability is vital, and maintaining up-to-date, performance-based supplier tiers empowers data-driven, agile decision-making.

Let’s face it: there’s a lot that can go wrong when it comes to suppliers.

Therefore, it’s important to regularly and proactively evaluate the risks associated with each tier, including those related to finances, ESG practices, operational continuity, and beyond.

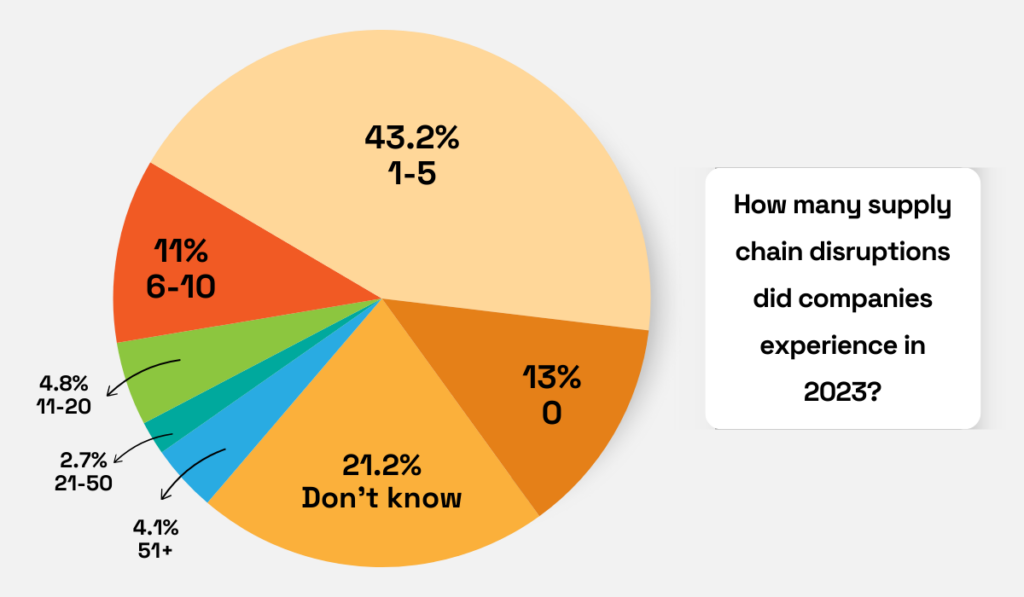

After all, today’s supply chains are more volatile than ever.

According to a 2023 BCI survey, 43.2% of companies experienced between one and five supply chain disruptions in a single year.

For some, the number of incidents was much higher, ranging from 10 to an astonishing 50.

Illustration: Veridion / Data: The Business Continuity Institute

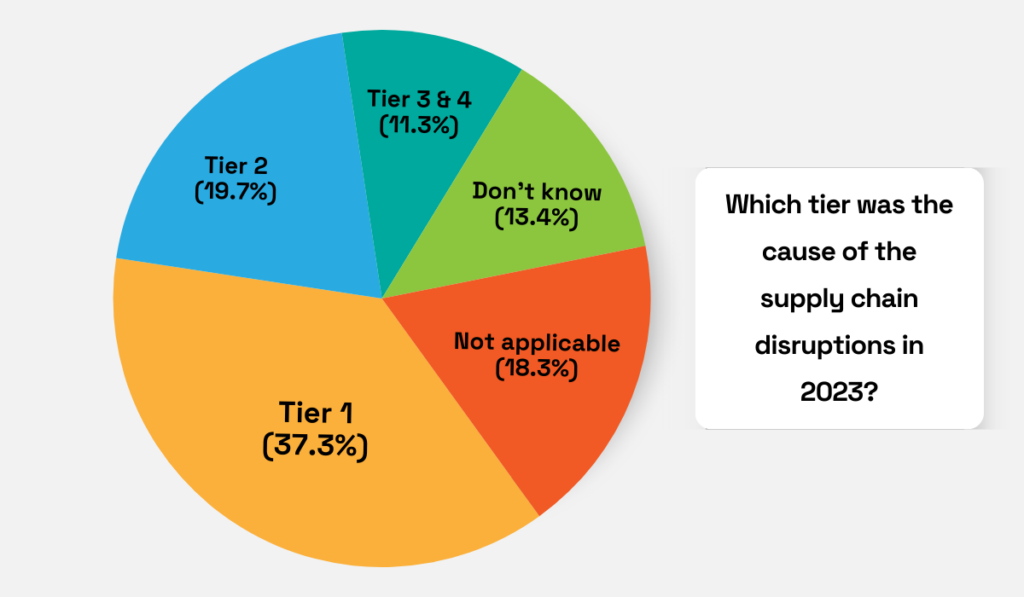

But the issue isn’t just frequency—it’s the pervasiveness of disruptions.

Many of the surveyed companies (37.3%) reported disruptions at tier 1, while 19.7% experienced issues at tier 2.

An additional 11.3% faced disruptions at tier 3 or beyond.

Illustration: Veridion / Data: The Business Continuity Institute

So, how do you stay ahead of all those risks?

The short answer: data.

You need accurate, real-time insights into your suppliers’ reliability and stability across all business dimensions.

That’s the only way to minimize risk and maintain supply chain continuity.

However, here’s the problem: almost 60% of companies still rely on Excel for risk monitoring, according to BCI.

That’s far from ideal. It’s just too slow, prone to errors, and ineffective.

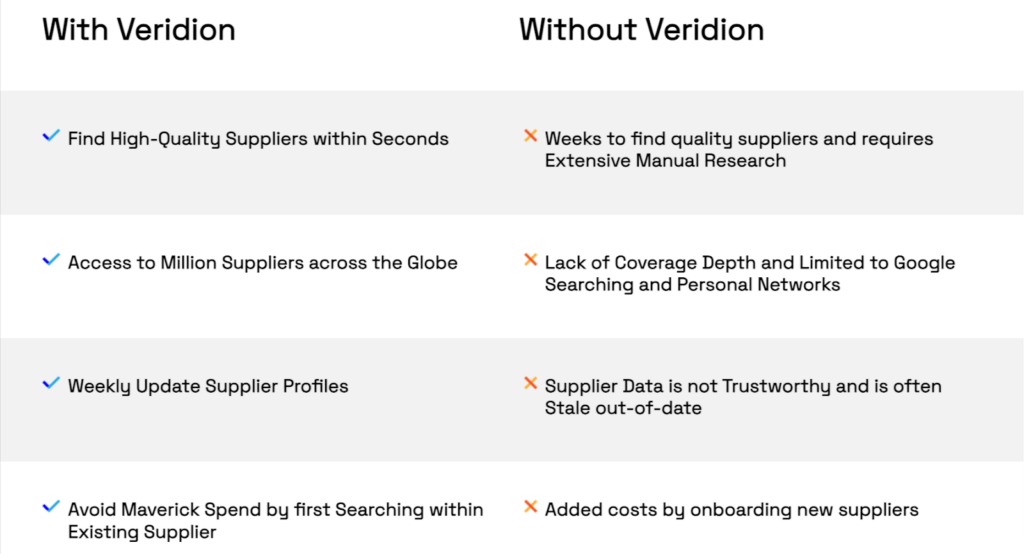

That’s why we created Veridion—an AI-powered supplier intelligence platform that continuously monitors your suppliers around the globe, in real time, and with remarkable detail.

Source: Veridion

Whether you’re evaluating risks related to foreign ownership, ESG performance, financial health, or any other category, Veridion delivers.

It provides detailed business profiles and alerts you the moment a potential risk emerges, so you can respond quickly and with confidence.

No manual tracking. No costly delays. No preventable mistakes.

Veridion brings the speed, depth, and foresight to the risk assessment process that traditional methods simply can’t match.

Your Tier 1s are more valuable than you might think.

If you stop treating them like vendors and start treating them like partners, you can unlock significant benefits, from better pricing and increased innovation to joint problem-solving during disruptions.

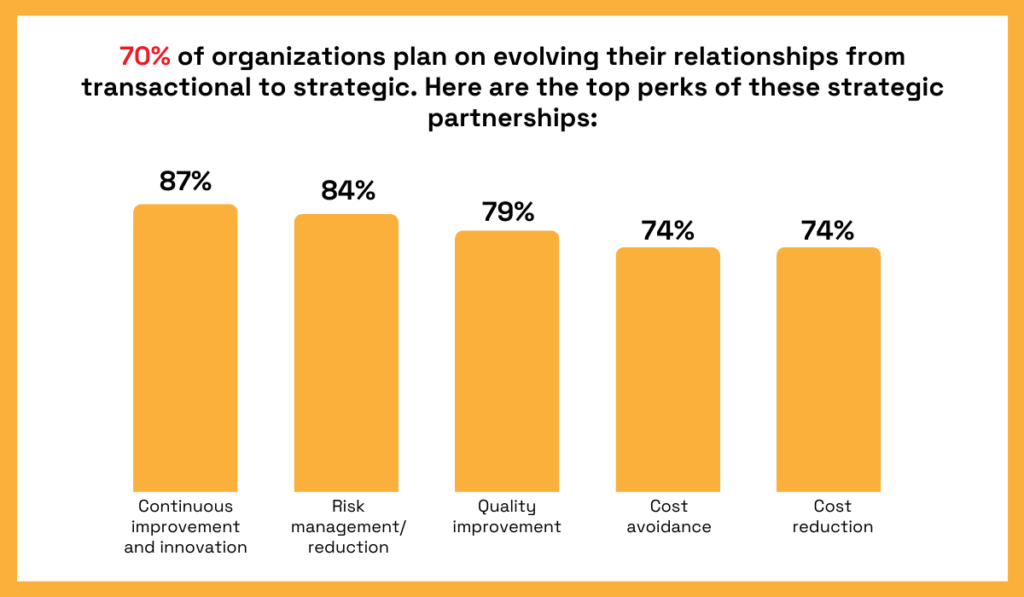

In fact, the 2024 State of Flux survey found that 70% of organizations plan to shift from transactional to strategic relationships, precisely because of the many perks this can bring.

Illustration: Veridion / Data: State of Flux

At PUMA, these benefits are well understood, too.

They treat their suppliers like true partners, as evidenced by the longevity of many of their relationships.

Zoe Yuen, VP of Sourcing and Development at PUMA, shares:

Illustration: Veridion / Quote: PUMA

But this doesn’t happen by accident.

According to Yuen, finding a good supplier is challenging enough, but keeping one is even more difficult.

So, to keep buyer-supplier relationships strong, PUMA focuses on clear, frequent communication and regular in-person check-ins.

Yuen explains:

“At PUMA, a representative makes regularly planned visits. We do random checks, and we train a person on the inside to be an expert at quality control.”

This expert is employed by the factory—not by PUMA—which helps strengthen trust and accountability even further.

Ultimately, this enables both parties to effectively communicate and resolve any issues in real-time, before they start causing major disruptions for everybody.

That’s exactly what successful supplier relationships look like: You stop pointing fingers and start solving problems together.

You build trust. You build resilience.

And when tough times hit, you’ve got each other’s backs.

Of course, you should never underestimate the value and impact of your Tier 2 and lower-tier suppliers, either.

Even if your Tier 1 suppliers appear stable, disruptions at sub-tier levels can significantly affect your operations.

Paul Marushka, CEO and President of Sphera, a provider of Enterprise Sustainability Management (ESM) performance and risk management software, agrees:

Illustration: Veridion / Quote: Sustainability Magazine

That’s why building visibility and open lines of communication with sub-tier suppliers is a must.

Mango, for example, has made notable strides in this area.

In fact, in 2023, the company became the first major fashion brand in Spain to publish a list of its Tier 3 factories.

Source: Just Style

This deep level of supply chain visibility enables Mango not only to stay ahead of potential risks but also to achieve its sustainability goals.

One such goal is to ensure that by 2030, 100% of the fibers used in its garments are sustainable or recycled.

To make that happen, the company needs a clear understanding of where materials originate: tracking not only direct suppliers, but also their suppliers, and even further down the chain.

Andrés Fernández, Mango’s Head of Sustainability and Sourcing, explains how they’re able to achieve this:

Illustration: Veridion / Quote: Just Style

One way Mango does this is through annual manufacturing summits, where they discuss topics such as sustainability, digitalization, efficiency, and other key issues.

They’ve also created a dedicated communication channel to stay in close contact with all their vendors, Fernández adds:

“Mango has a dedicated channel of communication with vendors so we can deal with all of these discussions closely with them. We want to let them know how we’re measuring sustainability, performance, and the quality of our product.”

This story perfectly demonstrates that, while engaging sub-tier suppliers can be challenging, it’s certainly not impossible.

A good starting point is to work with your Tier 1 suppliers and ask them to introduce you to their partners.

Take it step by step, and before you know it, you’ll have the visibility you need to take full control across every tier.

If there’s one thing to remember from this article, it’s this: data lies at the heart of effective supplier tier management.

It’s what forms the foundation for informed decision-making, strategic resource allocation, and proactive risk mitigation.

However, the deeper you go into the tiers, the cloudier the visibility gets. Manually tracking all critical information becomes practically impossible.

So, make data your priority.

Try to keep it accurate and up-to-date.

Maintain open communication with your suppliers, leverage the right tools, and stay alert to any changes in the supply chain.

By doing so, you get control across all tiers—and that’s where real resilience begins.