6 Benefits of Supplier Tiering You Need to Know About

Key Takeaways:

You probably know your key suppliers.

But what about their suppliers or even their suppliers’ suppliers?

Without clear visibility into these complex relationships, hidden risks and inefficiencies can quietly undermine your supply chain.

Enter supplier tiering.

It brings structure and insight, helping organizations better understand and manage supplier networks.

In this article, we’ll explore six key benefits that supplier tiering brings.

These days, companies can no longer claim ignorance if their supplier pollutes the environment or violates labor rights.

Even if they genuinely didn’t know, they’re still the ones who face public backlash—and the financial and reputational fallout that follows.

That’s why companies need full visibility into their entire supply chain.

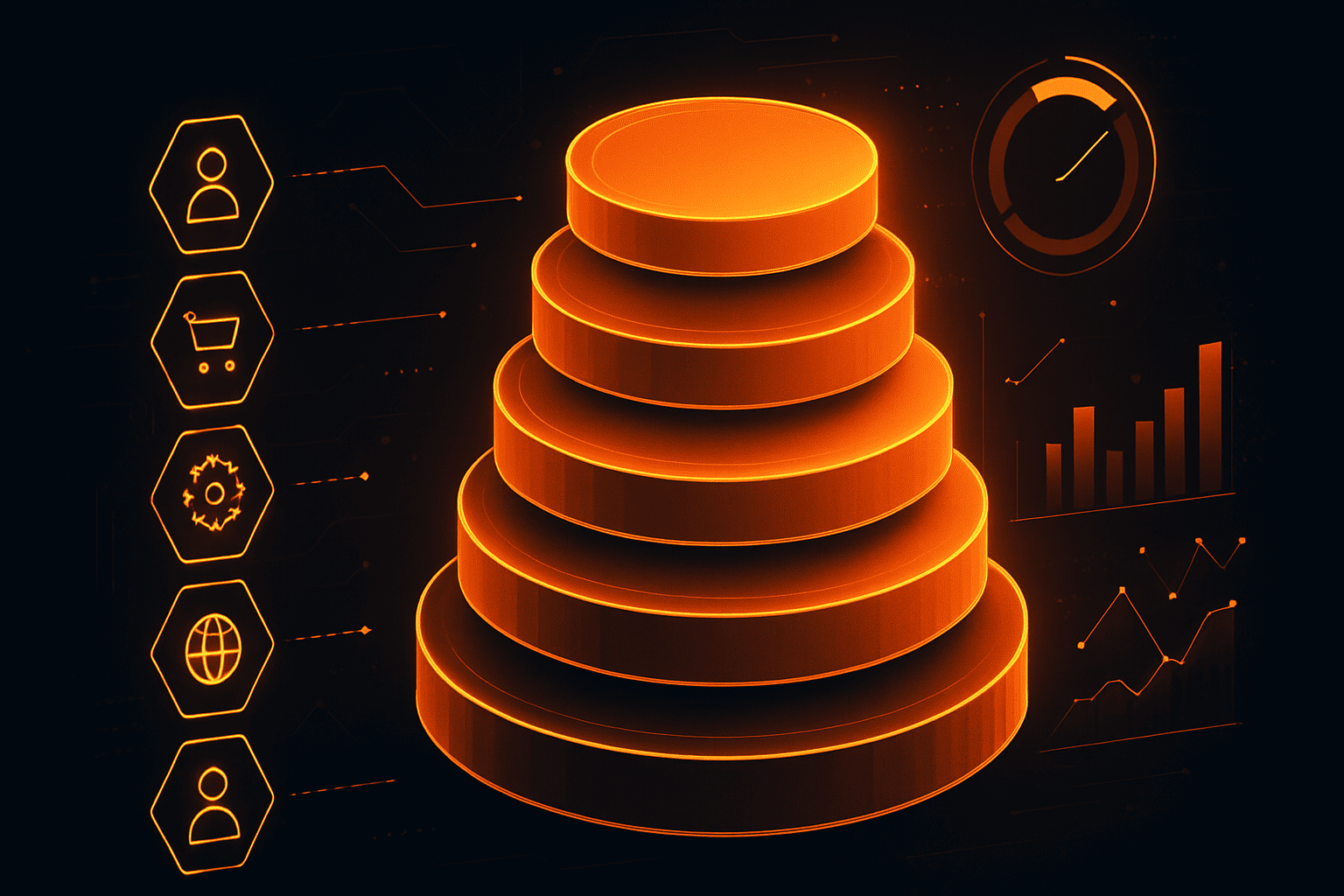

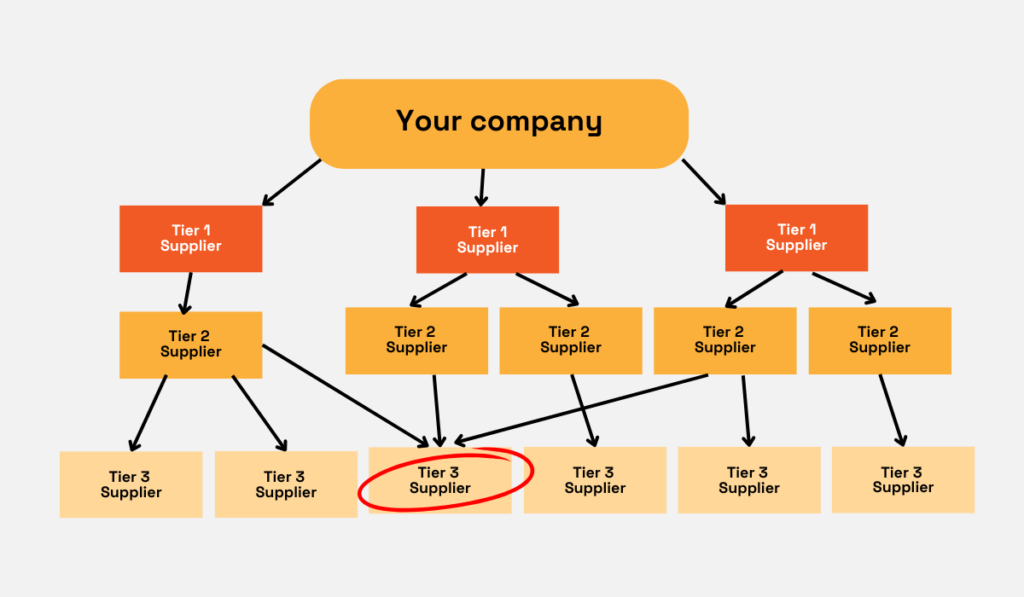

Not just the suppliers they contract directly (Tier 1), but also their suppliers (Tier 2), their suppliers’ suppliers (Tier 3), and oftentimes beyond.

Supplier tiering helps make these hidden, risk-carrying layers visible and manageable.

The image below illustrates how tiering organizes suppliers based on their proximity to the business.

Source: Veridion

For example, in Apple’s case, mining firms sourcing raw materials are Tier 3, companies refining them are Tier 2, and iPhone manufacturers like Foxconn are Tier 1.

This tiered structure highlights just how complex modern supply chains have become—and why visibility into all tiers is essential.

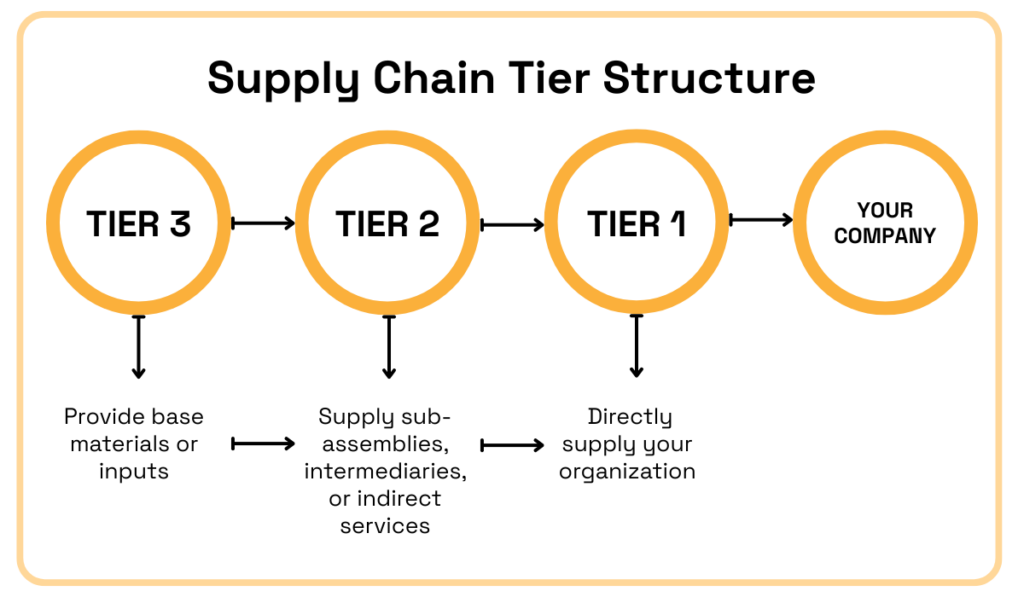

Yet that kind of end-to-end visibility is precisely what most companies still lack.

According to a 2021 McKinsey survey, fewer than half of companies understand the risks associated with their Tier 1 suppliers.

That figure alone is concerning, but visibility drops sharply in deeper tiers, as illustrated below.

Illustration: Veridion / Data: McKinsey

This lack of visibility across tiers makes it harder to identify risks, and even harder to anticipate or respond to disruptions in time.

When a deeper-tier supplier fails, companies without insight into those layers are often caught off guard, facing delays, shortages, or reputational damage.

In contrast, mapping suppliers by tier—and also by their operational criticality—gives organizations a clearer picture of:

In fact, the benefits outlined in the following sections all stem from this improved supply chain visibility.

Better risk management is one of the most practical benefits of supply chain tiering.

By categorizing suppliers based on tier and criticality, companies can systematically identify and assess risks—financial, operational, geopolitical, or reputational—across all levels.

Without this structure, risks buried in lower tiers can go unnoticed until they erupt.

A recent example involves Apple, whose Tier 3 suppliers—mining companies—became the focus of international scrutiny and legal action.

Specifically, the Democratic Republic of Congo (DRC) filed a lawsuit in Europe, alleging Apple used conflict-rare-earth minerals in its supply chain.

In response, Apple suspended purchases of DRC-sourced minerals and instructed its Tier 2 suppliers—those refining the metals—not to use any materials from the region.

Here’s Apple’s statement:

Illustration: Veridion / Quote: Reuters

This statement on suspending sourcing was made despite Apple stating that it does not source raw materials directly and regularly audits its suppliers.

However, the company took this step due to growing concerns that its auditors and certification mechanisms were no longer sufficient to ensure proper due diligence in the region.

The incident highlights how even distant links in the supply chain can carry significant consequences for global brands—and why proactive, risk-based monitoring across tiers is essential.

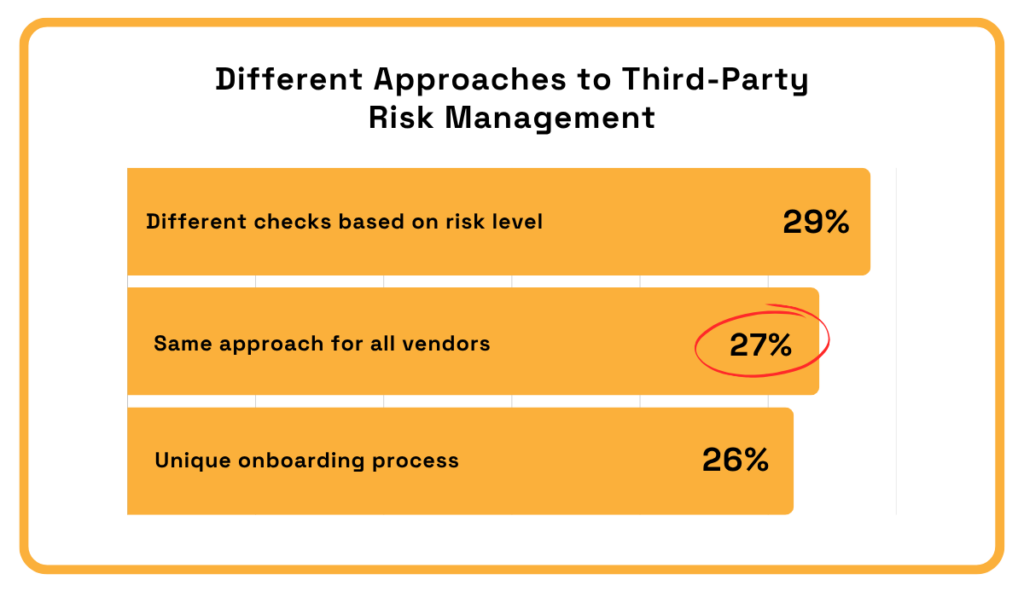

Yet, as the survey results below show, many organizations still apply a one-size-fits-all approach to managing third-party risks, regardless of how critical or exposed those suppliers may be.

Illustration: Veridion / Data: Navex

For those companies still applying the same checks to all vendors, tiering provides a practical framework for improving their processes.

By organizing suppliers into tiers and evaluating their operational importance, companies can align risk management efforts with actual exposure.

This allows for more targeted due diligence, applying stricter controls to high-risk, high-impact suppliers, especially in lower tiers where risks often go unchecked.

In short, tiering helps you transform risk management from reactive and uniform to proactive and strategic.

Mapping and categorizing suppliers into tiers acts like an X-ray for your supply chain.

It exposes the inner workings of Tier 1 relationships, revealing who they rely on, and helping assess how compliant those lower-tier partners really are.

That’s why a structured approach is essential for monitoring regulatory, contractual, quality, and safety standards across complex, multi-layered networks.

Without it, organizations often lack the visibility to enforce compliance effectively, even with Tier 1 vendors.

As a result, risks often go undetected until after contracts are signed or goods are delivered.

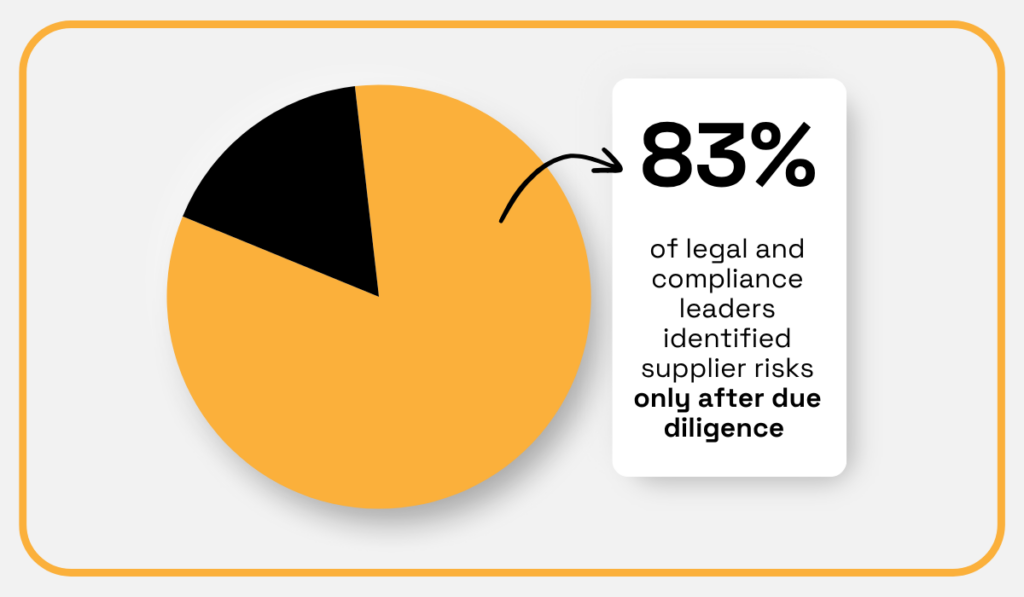

A Gartner study of over 250 legal and compliance leaders confirms just that:

Illustration: Veridion / Data: Gartner

The said survey didn’t ask how many of the identified risks were related to Tier 2 suppliers and beyond, but it’s safe to assume a significant portion came from those deeper tiers.

Why? Because they tend to receive far less scrutiny during Tier 1 supplier due diligence.

That’s where structured tier management makes a real difference.

For instance, mapping your supplier network may reveal that several of your Tier 1 vendors rely on the same Tier 2 or Tier 3 supplier.

Source: Veridion

In such a case, even if none of the Tier 1 suppliers appear critical on their own, that shared Tier 3 supplier clearly warrants closer attention.

A compliance issue at that one shared supplier—say, a labor rights violation or failure to meet safety standards—can ripple across the network and damage multiple Tier 1 relationships at once.

And because everything may seem fine at the Tier 1 level, these risks often go undetected until it’s too late.

That’s why companies are increasingly turning to external risk intelligence platforms that monitor compliance beyond Tier 1.

One such AI-powered platform with unparalleled global coverage is our Veridion.

Source: Veridion

Veridion gathers real-time data from the internet on all companies with an active web presence, flagging potential compliance issues as they emerge.

This enables organizations to receive timely alerts about risks, regardless of the supplier’s tier or location.

In addition to using such tools, companies can instruct their Tier 1 suppliers to extend monitoring and due diligence to their own partners, especially those that overlap within their supply network or present elevated risks in other ways.

This helps push compliance standards deeper into the supply chain through contractual clauses, codes of conduct, or audit requirements.

Ultimately, a tier-based, proactive approach to compliance monitoring not only supports regulatory adherence but also supports ESG-aligned sourcing.

Supplier tiering provides the structure needed to identify and evaluate environmental, social, and governance (ESG) performance deeper in the supply chain.

What does this mean in practice?

First, once Tier 1 suppliers are identified and their sub-tier suppliers mapped, your team can more effectively verify ESG claims made by direct suppliers.

This helps prevent greenwashing and other forms of misreporting.

This is also vital because regulators, investors, and, most importantly, customers are increasingly aware of unethical ESG practices and ready to hold companies accountable.

This is backed by overwhelming consumer sentiment, as shown in the PwC survey below.

Illustration: Veridion / Data: PwC

This kind of pressure means companies can no longer afford to rely solely on self-reported ESG metrics from their Tier 1 suppliers.

Instead, they need to be proactive and move beyond surface-level declarations to detect ESG risks hidden deeper in the supply chain.

That could be a Tier 2 supplier operating in a deforestation hotspot or a Tier 3 partner with a record of labor violations.

To identify and assess such risks, organizations need timely, reliable ESG data—not just about their direct suppliers, but across the entire supply chain and beyond.

Again, that’s where supplier intelligence platforms that provide structured, up-to-date ESG data become essential to effective tier management.

Here you can see the ESG data Veridion delivers:

Source: Veridion

With greater visibility into supplier tiers and access to real-time data, companies can more effectively monitor and evaluate the ESG performance of their Tier 1 suppliers.

This includes conducting audits, reviews, site visits, and recertifications as needed.

At the same time, they can automate the monitoring of lower-tier suppliers, ensuring early awareness of any ESG risks that may arise deeper in the supply chain.

Overall, tier-based insights empower procurement teams to meet sustainability targets and report on progress transparently.

Naturally, this also lays the groundwork for more strategic, value-driven sourcing.

Tiering informs smarter sourcing decisions by providing insights into each supplier’s wider ecosystem, capabilities, and dependencies.

This visibility helps identify which of your Tier 1 suppliers are indispensable, which could be consolidated, and which may present risks.

Without a clear view of their sub-tier partners, critical vulnerabilities are more likely to go unnoticed.

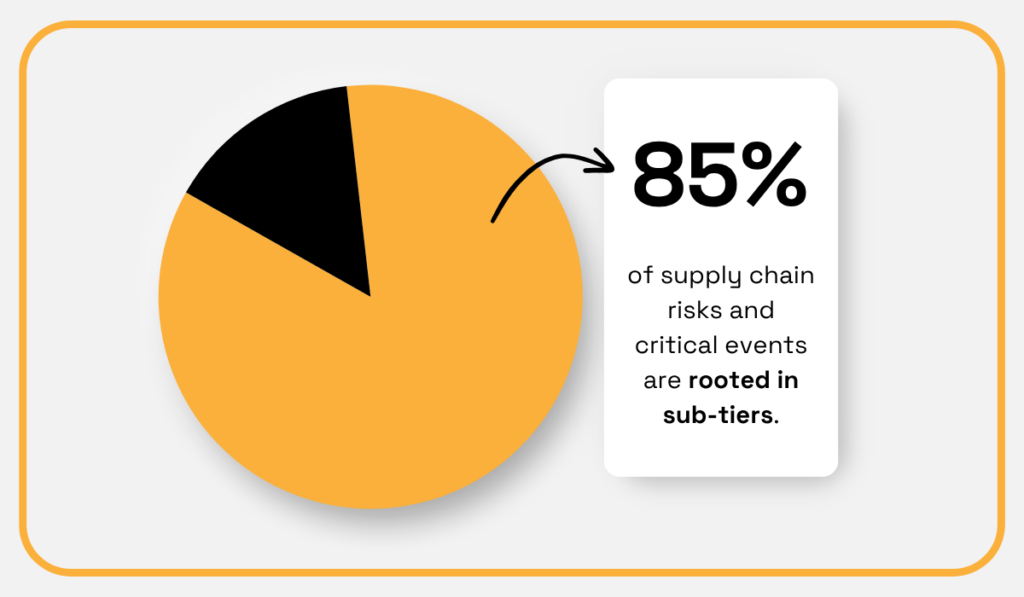

In fact, a study by Sphera revealed that the overwhelming majority of disruptions don’t start with Tier 1 suppliers—they originate deeper in the chain.

Illustration: Veridion / Data: Sphera

This estimate underlines why a tier-based view is essential for sourcing strategies.

It enables companies to assess not just the performance of direct suppliers, but also the ethical and operational risks that lie deeper in the chain.

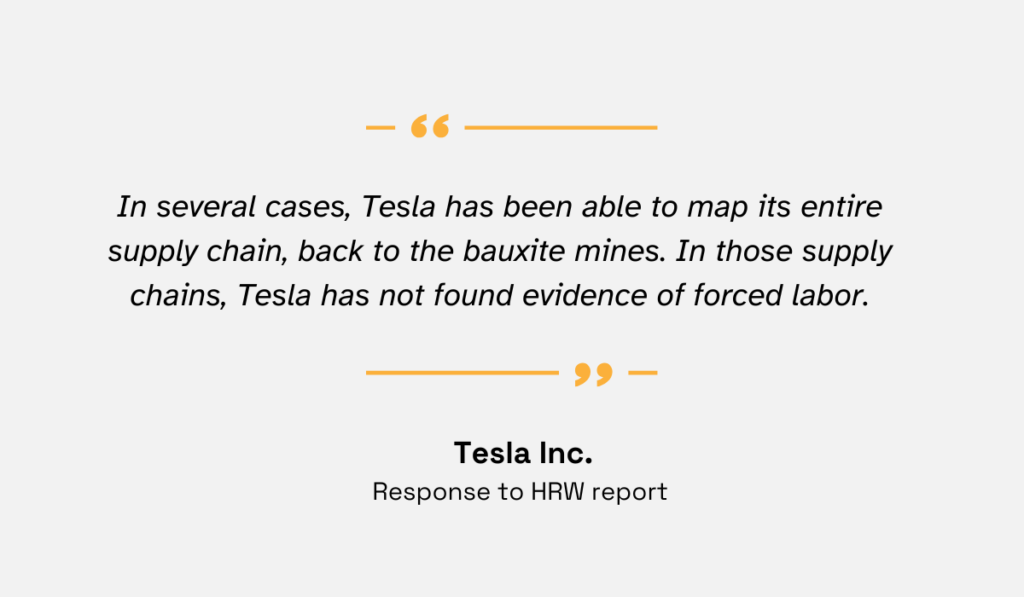

For example, a recent Human Rights Watch report revealed that global automakers operating in China face elevated risks of exposure to forced labor in their aluminum supply chains.

The report says they’re slow to map their supply chains and identify forced labor risks.

In response, one of the named car makers, Tesla, stated:

Illustration: Veridion / Quote: HRW

They also note that mapping efforts are underway for both existing and new suppliers.

This quote clearly demonstrates that mapping supply chain tiers is possible, though it remains complex and often shaped by political and economic pressures.

For existing suppliers, tiering supports strategic decisions such as diversification, consolidation, or deeper collaboration and innovation initiatives.

It’s just as valuable when evaluating new suppliers.

Even without direct data, supplier intelligence tools that aggregate publicly available information can help you infer a prospective supplier’s likely tier structure.

This, in turn, can reveal much about their capabilities, dependencies, potential risks, reliability, and strategic alignment with your goals.

Tiering forces you to get to know your suppliers inside and out, resulting in improved communication across your supply chain.

With clearer visibility into each supplier’s dependencies, you can advise them, or even provide direct support, on how to manage their specific lower-tier risks.

These may include anything from their suppliers’ questionable labor practices to bottlenecks in critical subcomponent sourcing.

Armed with insights into who your Tier 1 suppliers work with, you can also tailor communication to channel relevant instructions or updates further upstream, ensuring the right message reaches the right tier.

However, having the right data is only part of the story.

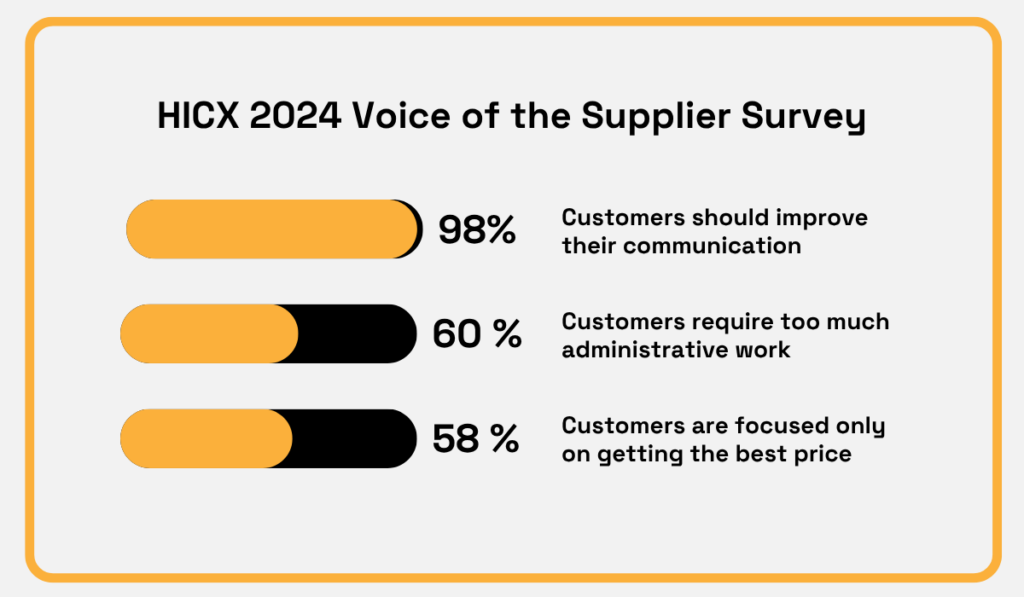

Supplier feedback from a 2024 survey suggests there’s still a gap in how companies communicate:

Illustration. Veridion / Data: HICX

These findings make it clear:

Even if your insights are accurate and helpful, a thoughtful and respectful approach is essential to ensure suppliers engage with your message.

That’s where tiering adds value again.

By knowing which suppliers are critical and where they sit in the chain, you can tailor the tone, content, and delivery of your messages.

While supplier portals or mass emails can serve a purpose, they rarely drive meaningful change.

As Jonathan Webb, Head of Advisory at Procurement Leaders, notes, real impact comes from targeted outreach grounded in mutual trust and clarity:

Illustration: Veridion / Quote: Forbes

He adds that suppliers are most responsive when expectations are clearly defined, complete with timelines and measurable deliverables.

In the context of tiering, this clarity enables your Tier 1 suppliers to pass accurate, actionable guidance to their own partners, i.e., your lower-tier suppliers.

Ultimately, tier-based classification and insights help streamline communication across the supply chain, reducing misunderstandings, accelerating issue resolution, and strengthening collaboration at every level.

Supplier tiering is clearly more than just identifying who supplies what.

It’s a strategic lens that helps you manage risk, strengthen partnerships, improve compliance, and communicate more effectively across your supply chain.

Whether you’re evaluating existing suppliers or vetting new ones, a clear understanding of tiers, supported by real-time data, gives you the insight needed to make smarter decisions and build a more resilient supply chain.

So, start by mapping your key suppliers—then look deeper.