4 Challenges of Supplier Tiering to Overcome

Key Takeaways:

How far does your supplier visibility actually reach?

You may know your Tier 1 vendors well, but the deeper risks often lurk in the further regions of your supply chain, threatening your reputation and profitability.

After all, accountability won’t stop at your direct partners.

To manage exposure, improve resilience, and make smarter decisions, you need clear supplier tiering.

Let’s unpack four challenges holding procurement teams back and how technology can help overcome them.

When it comes to supplier tiering, one of the most persistent challenges is the lack of visibility into lower-tier suppliers.

Gaining visibility into Tier 1 suppliers has become a baseline expectation, but beyond that, many companies are essentially in the dark about who their suppliers’ suppliers are.

In his analysis of the recent practice of publicly sharing supplier lists, Tim Kraft, associate professor of operations and supply chain management at NC State University, confirms this.

Illustration: Veridion / Quote: Supply Chain Digital

It’s still uncommon for brands to track and publish supplier lists beyond Tier-1 for the simple reason that they can’t accurately map their supply chains.

And it’s clear why this would be problematic—lack of oversight makes it difficult to identify vulnerabilities that may lie deeper in the supply chain.

Eventually, blind spots that have been concealing risks can lead to compliance violations, reputational damage, and operational disruptions.

Sphera’s research highlights a worrying trend: a 12% increase in potential human rights violations within supply chains, driven largely by the growing complexity of supplier networks.

Illustration: Veridion / Data: Sphera

The consequences of this opacity have made headlines before.

In the Bangladesh textile industry, for instance, a series of devastating factory fires over a decade ago exposed appalling working conditions and deep-seated non-compliance within subcontracted operations.

As reported by The Guardian, cleaning up convoluted supply chains also came into focus.

Source: Guardian

As the article reveals, factories holding direct contracts with global brands often met the necessary standards, but their subcontractors operated in unsafe, unethical conditions.

Kalpona Akter, executive director of the Bangladesh Centre for Worker Solidarity, pointed out how this layered structure allowed buyers to sidestep responsibility when things went wrong:

“Often, the factory that gets the order is fully compliant. But multiple subcontracts make a mockery of so-called ethical sourcing. Then, when an accident happens, the buyers can simply deny responsibility”.

Still, things have been changing.

Initiatives like the Bangladesh Accord have helped improve conditions, rectifying over 97,000 safety violations in just five years.

Moreover, with reputational damage becoming an increasingly more significant risk to organizations, buyers have also had to proactively manage risks.

One effective strategy is for buyers to require their Tier 1 suppliers to disclose their own suppliers.

This starts a ‘cascading invitation’ process, where each tier invites the next to participate in supply chain mapping.

This structured, step-by-step approach can be complemented with solutions like Sourcemap, which enable businesses to map their entire supplier ecosystem.

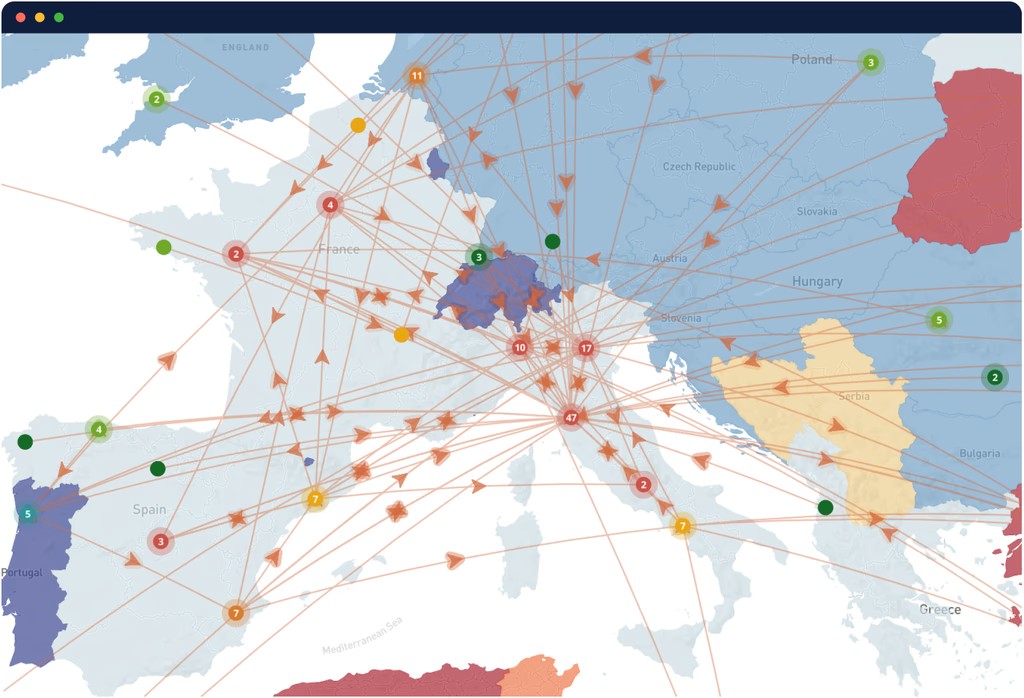

Source: Sourcemap

Sourcemap’s centralized portal facilitates direct engagement, enabling suppliers and sub-suppliers to input data in a standardized, efficient format.

Consequently, buyers can easily trace materials and services back to their origins.

Keep in mind that not every supplier will readily participate.

In those cases, buyers may need to combine contractual requirements with incentives or use third-party audits and data intelligence providers to fill in the gaps.

Ultimately, the goal is gradual but persistent progress, enabling you to reduce risk and strengthen supplier relationships at every tier.

As supply chains expand and become more layered, communication tends to become more fragmented across supplier tiers.

While a buyer might enjoy strong, direct communication with their Tier 1 suppliers, there’s no guarantee that the same clarity exists between those Tier 1 suppliers and their own partners.

Each additional tier introduces new variables, from differences in language, culture, and business practices to gaps in technology adoption.

And this makes it increasingly difficult to maintain alignment throughout the supply chain.

Source: Veridion

This makes it increasingly difficult to maintain alignment throughout the supply chain.

What’s worse, such fragmentation isn’t just a theoretical problem—it creates tangible risks.

No matter your industry and sector, it’s not difficult to imagine a scenario where a Tier 3 supplier experiences a factory shutdown due to local regulatory changes.

If that information only reaches you days later through delayed updates from Tier 1 and Tier 2 suppliers, this can result in late deliveries, unfulfilled customer orders, or costly production halts.

Simply put, the damage compounds when information isn’t passed along quickly or accurately, and those gaps become more likely the deeper you go in the supply chain.

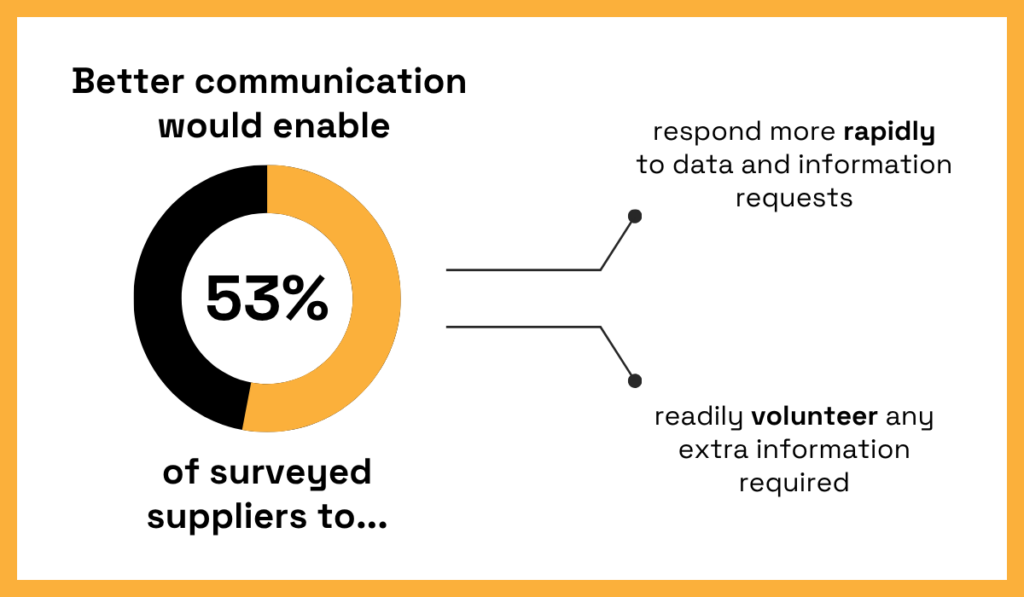

According to research by HICX, an overwhelming 98% of suppliers believe there’s room to improve communication with buyers.

Even more importantly, over 53% of suppliers say that better communication would enable them to respond to data requests more quickly and proactively offer valuable updates.

Illustration: Veridion / Data: HICX

Can you imagine the impact of these small improvements, repeated across supplier networks, on supply chain agility and resilience?

To get there, buyers need to encourage stronger communication downstream, even with suppliers they don’t engage with directly.

One approach is to embed communication expectations into supplier contracts and collaboration agreements.

Buyers can require Tier 1 suppliers to implement clear information-sharing policies with their direct suppliers, ensuring important updates travel quickly through the chain.

These cascading communication frameworks are similar to the supply chain mapping process, creating formal, reliable pathways for supplier updates, risk alerts, and operational coordination.

Spanish retailer Mango provides a good example of how implementing such structured communication can improve supplier relationships and deliver results.

As Andrés Fernández, Mango’s Head of Sustainability and Sourcing, explains, the company maintains an open communication channel with its vendors to ensure a steady flow of information.

Illustration: Veridion / Quote: Just Style

Beyond day-to-day operations, Mango also hosts an annual Vendor Summit to align strategies, share challenges, and reinforce the importance of clear, two-way communication.

Strong relationships create natural channels for reliable information flow, closing gaps before they cause problems.

This is why more and more organizations invest in supplier collaboration as one of the key procurement priorities.

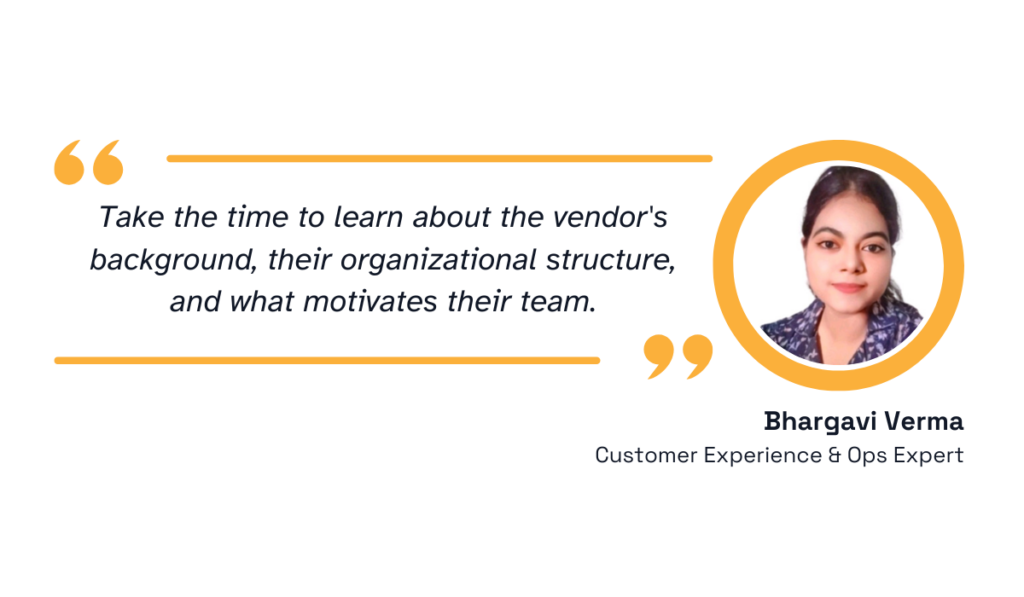

As Bhargavi Verma, an operations specialist, points out, building strong supplier communication starts with investing time in understanding them—their structure, priorities, and motivations.

Illustration: Veridion / Quote: LinkedIn

In the end, reducing communication gaps means embedding clarity, consistency, and trust at every tier.

Unclear classification criteria present another common obstacle in managing multi-tier supply chains.

Without standardized, clearly defined rules for assigning suppliers to specific tiers, companies risk inconsistency and confusion in their vendor management practices.

Why does this happen?

Well, it’s a part of the broader supply chain complexity challenge.

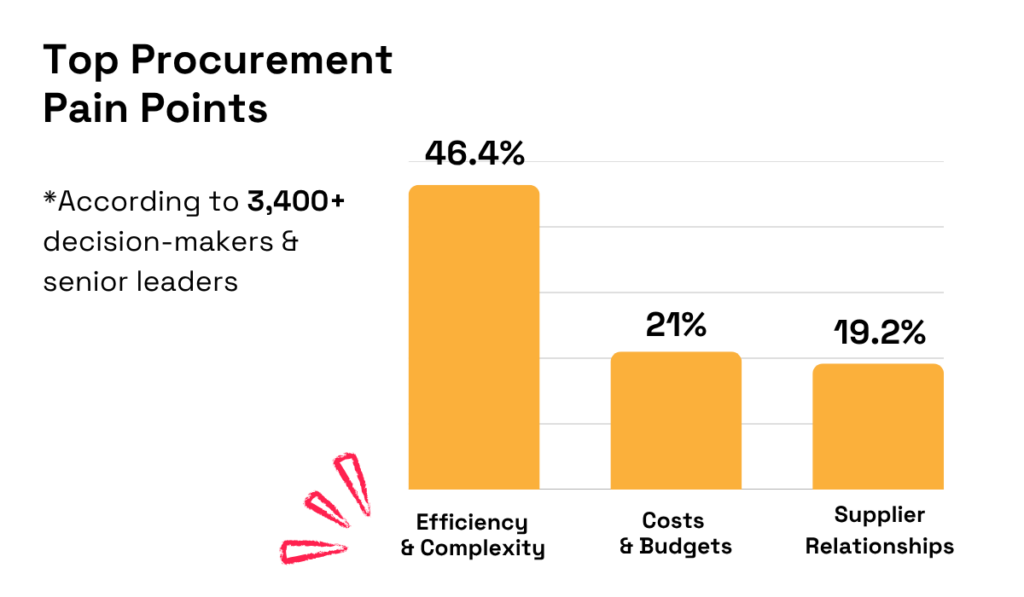

According to the latest Amazon Business report, 46.4% of procurement decision-makers rank internal and external complexities as their top operational pain point.

Illustration: Veridion / Data: Amazon Business

That’s more than double the second-most-cited issue revolving around cost management.

When you’re dealing with thousands of suppliers, multiple regions, and disconnected business units, inconsistency creeps in fast.

It’s not that classification frameworks don’t exist.

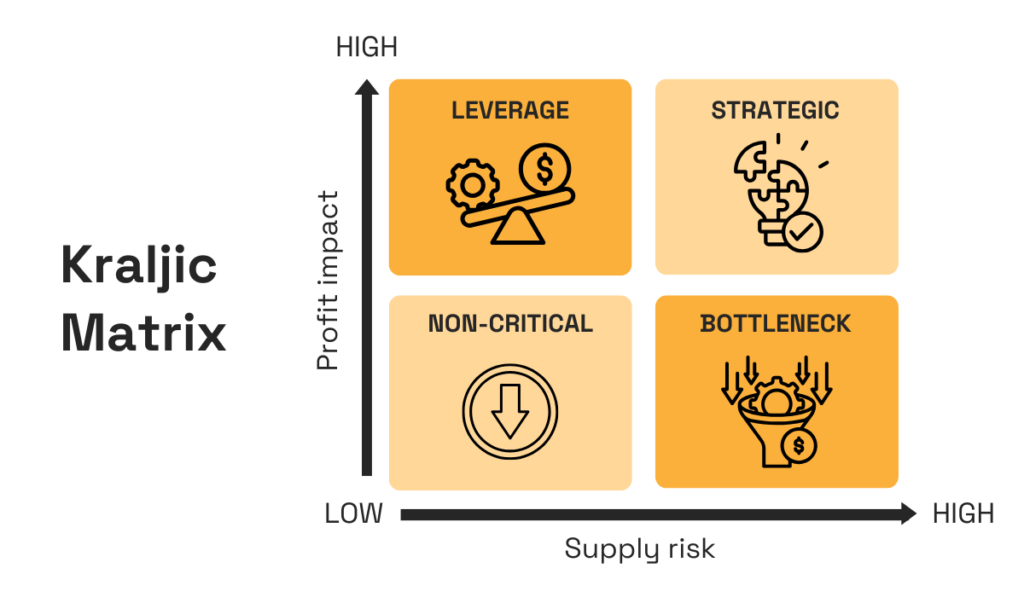

Procurement teams have long relied on models like the Kraljic Matrix shown below, or pyramid structures and risk-based frameworks.

Source: Veridion

Many organizations even combine these into hybrid models to suit their supply base.

The real problem?

How inconsistently these frameworks are applied.

Can you imagine the operational headaches when one team classifies a supplier as Tier 1 while another marks them Tier 3 based on different criteria?

This is why investing in data governance matters.

Trade Interchange CEO Mike Edmunds explains that good governance ensures supplier data is stored, categorized, and used according to a consistent, pre-determined corporate framework.

Illustration: Veridion / Quote: LinkedIn

In other words, it’s not just about having data to classify suppliers into appropriate tiers—it’s about controlling how it’s applied.

Nevertheless, governance is just one piece of the broader control picture presented below.

| Control Mechanism | Overall Effect |

|---|---|

| Centralized tiering framework | A formal policy with clear, measurable criteria helps outline key definitions and thresholds. |

| Data governance role | The data owner or governance lead monitors data integrity, approves exceptions, and audits classifications. |

| Automated classification rules | Digital procurement tools help you assign tiers based on pre-set, rule-based criteria to accelerate processes and eliminate subjectivity. |

| Regular consistency audits | Periodic reviews of supplier classifications across teams help flag and correct discrepancies. |

Plenty of modern procurement solutions support this.

For example, automated supplier classification has been around since at least 2004, when Zycus launched its AutoClass module to improve procurement data quality.

Source: Supply and Demand Chain Executive

While early systems relied on static rules, today’s platforms integrate AI, dynamic segmentation, and real-time risk data to drive smarter, consistent supplier tiering across global networks.

In the end, without clear, consistent classification criteria, no amount of tier management strategy will stick.

And the sooner organizations commit to fixing this, the sooner they can build a more stable supply chain.

What complicates supplier tiering further is having your data scattered across disconnected systems.

Many procurement teams know who their suppliers are and have plenty of supplier information, but it exists only in silos, disconnected systems, and incompatible formats.

That makes it nearly impossible to consolidate performance data, map supplier relationships, or track risks across multiple tiers in real time.

And the effects of this fragmentation become especially dangerous beyond Tier 1 suppliers.

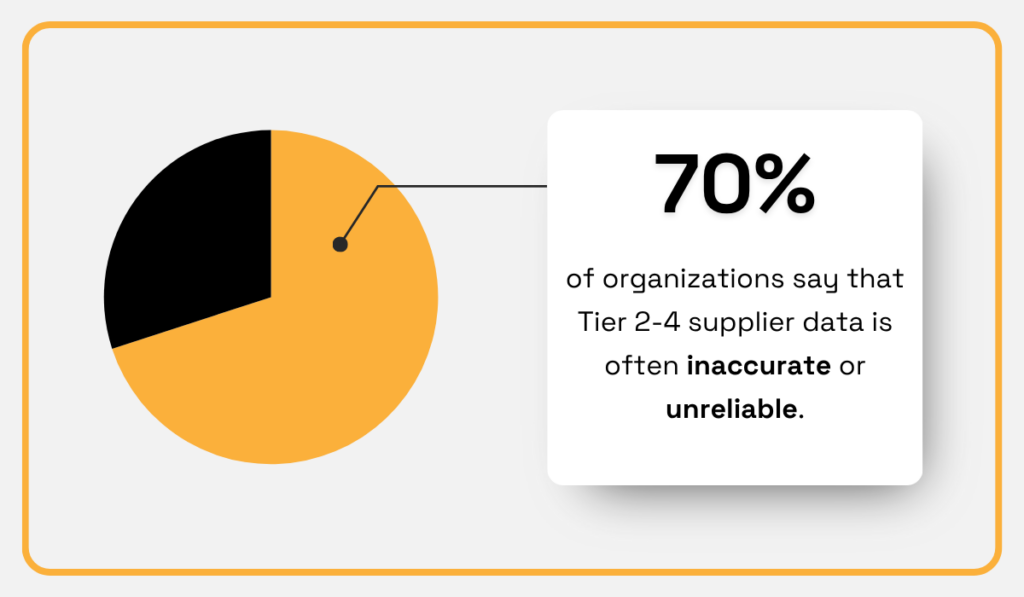

Sphera research reveals that 70% of organizations report unreliable or incomplete data for their Tier 2-4 suppliers, the very areas where visibility tends to break down fastest.

Illustration: Veridion / Data: Sphera

If procurement teams can’t access accurate data for these deeper layers of the supply chain, managing operational, financial, or ESG-related risks becomes guesswork.

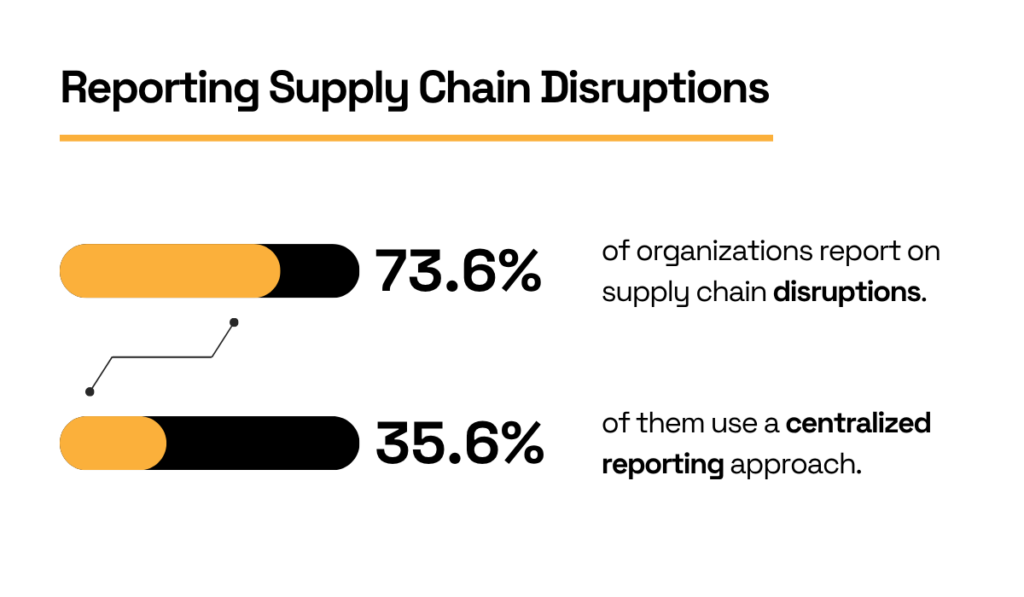

It’s no surprise, then, that disruption reporting suffers too.

According to the 2023 Business Continuity Institute (BCI) report, only 35.6% of companies now use a centralized approach to supply chain disruption reporting

Illustration: Veridion / Data: BCI

While this is the highest figure on record, that still leaves nearly two-thirds of organizations without a reliable, unified system.

This is the direct result of fragmented data ecosystems.

Disconnected platforms mean suppliers report issues in different ways, data flows through isolated channels, and decision-makers lack a single source of truth.

Can you imagine the scale of risk lurking in the operational blind spots of that remaining 64.4%?

Missed disruption risks, untracked ESG violations, unmonitored financial exposure…

When multiplied across complex global networks, these small gaps in visibility can undermine supply chain agility overnight.

The clearest way forward means investing in interoperable, data-driven infrastructure.

Capgemini’s Global Supply Chain Lead, Mayank Sharma, explains why this is the best approach:

Illustration: Veridion / Quote: Supply Chain Digest

In other words, a data-driven and scalable approach requires tools that consolidate, normalize, and unify supplier data from multiple tiers.

There’s no one-size-fits-all answer, but two practical routes stand out.

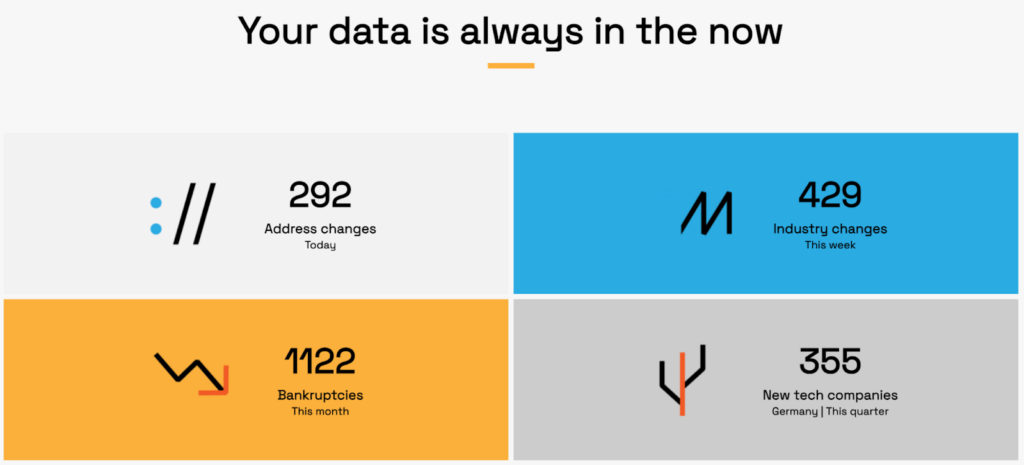

First, data intelligence platforms like our Veridion play a critical role.

Veridion uses AI to map global supplier networks beyond Tier 1 and flag potential risks, whether it’s geopolitical exposure, ESG violations, or financial instability.

The profiles of over 130 million suppliers are updated weekly, ensuring your business always works with current data.

Source: Veridion

And that speed doesn’t come at the cost of depth.

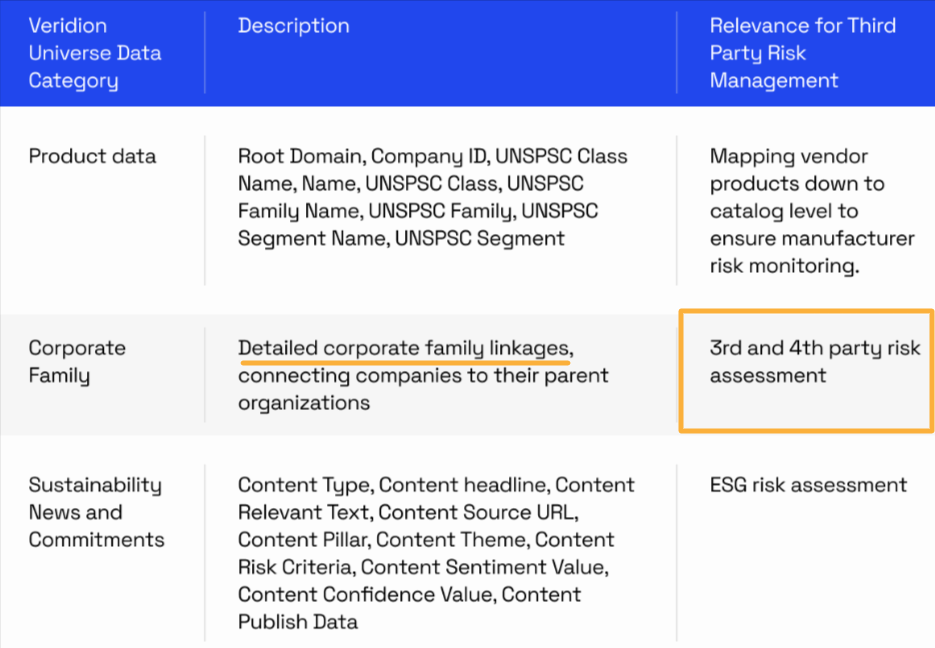

One notable feature in Veridion’s TPRM dataset is the “corporate family” category, which maps parent-subsidiary relationships.

This allows for more precise third- and fourth-party risk assessments, revealing hidden exposures deeper in the supply chain.

Source: Veridion

For industries with stricter traceability demands, such as food, fashion, or pharmaceuticals, blockchain-powered platforms offer another valuable layer of transparency.

For example, IBM’s Food Trust initiative, used by giants like Walmart, helped reduce mango traceability times from seven days to just 2.2 seconds.

Source: LF Decentralized Trust

Incidents like the 2018 U.S. romaine lettuce recall, which affected an entire region, demonstrate why this level of data agility matters.

While Food Trust wasn’t available at the time to prevent that specific event, situations like it underscore the need for better, faster, and more reliable supply chain data to protect both consumers and suppliers.

The bottom line?

Data fragmentation limits visibility, slows responses, and raises risk exposure.

No single system can do it all, but connected, interoperable data flows make it possible to act faster, smarter, and with far fewer blind spots.

When done right, supplier tiering lays the foundation for resilience, risk management, and smarter procurement decisions.

Without it, your organization remains reactive, blind to vulnerabilities, and unable to act quickly when issues arise.

But once you build a supplier visibility strategy that reaches beyond Tier 1, you’ll see how it strengthens your entire supply chain.

Rethink how you segment suppliers, invest in stronger data practices, and explore technology like AI-driven mapping tools, intelligence platforms, and blockchain solutions—the results are sure to follow.