Supplier Tiers: The Ultimate Guide

Key Takeaways:

Most companies believe they know their suppliers.

But in reality, most only know their Tier 1—the direct suppliers they interact with day to day.

That’s not enough anymore.

Regulatory risk, reputational damage, and operational disruptions often begin several layers deeper in the supply chain.

This guide explores what supplier tiers are, why they matter more than ever, and how businesses can gain visibility into them, even when that’s far from easy.

The concept of supplier tiers began in the automotive industry, where large OEMs needed to organize their vast supplier networks.

It’s now a standard practice across most industries, helping companies categorize suppliers based on their proximity to the final product or service.

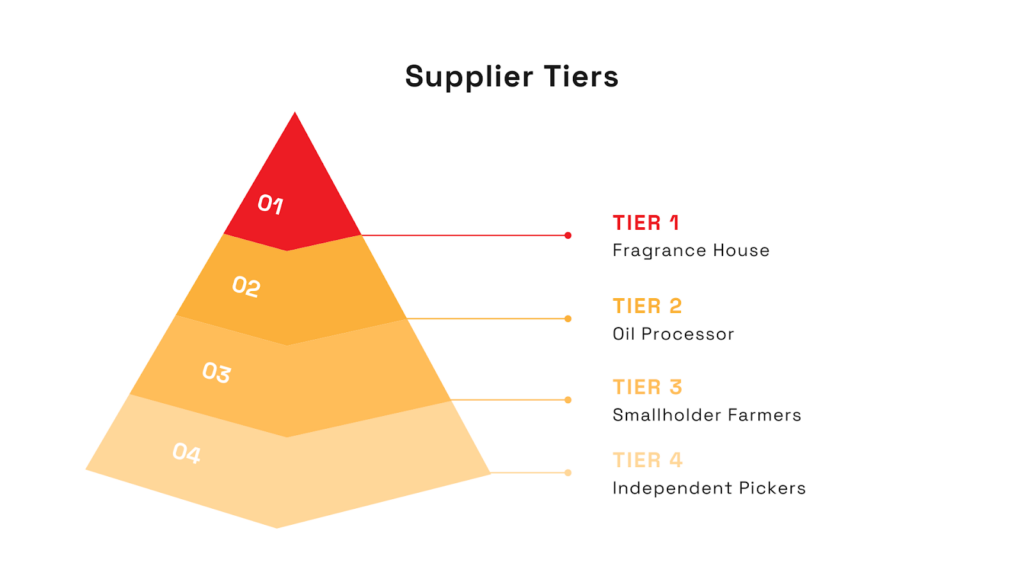

In other words, supplier tiers represent levels of separation in a supply chain, starting from your direct suppliers and moving upstream:

To better illustrate supplier tiering, let’s take the perfume industry.

A brand like Lancôme (L’Oréal) works with fragrance houses such as Givaudan (Tier 1).

Givaudan buys jasmine oil from processors like A. Fakhry & Co. in Egypt (Tier 2).

These processors source flowers from thousands of smallholder farmers (Tier 3), who in turn rely on independent flower pickers at the very bottom of the chain.

Source: Veridion

By the time you get to those jasmine pickers, you’re likely at Tier 4 or deeper, and most companies have no direct visibility at that level.

These lowest tiers are often invisible, unregulated, and left out of due diligence processes.

Yet, they’re deeply embedded in the production of the final product.

To sum up, the deeper the tier, the harder it is to trace. But ignoring these upstream suppliers comes with serious risks.

It’s not enough to audit Tier 1 suppliers and assume everything upstream is fine.

Deeper-tier suppliers, often overlooked and undocumented, can introduce serious risks.

Unethical labor practices, poor environmental standards, and hidden dependencies make the entire supply chain vulnerable.

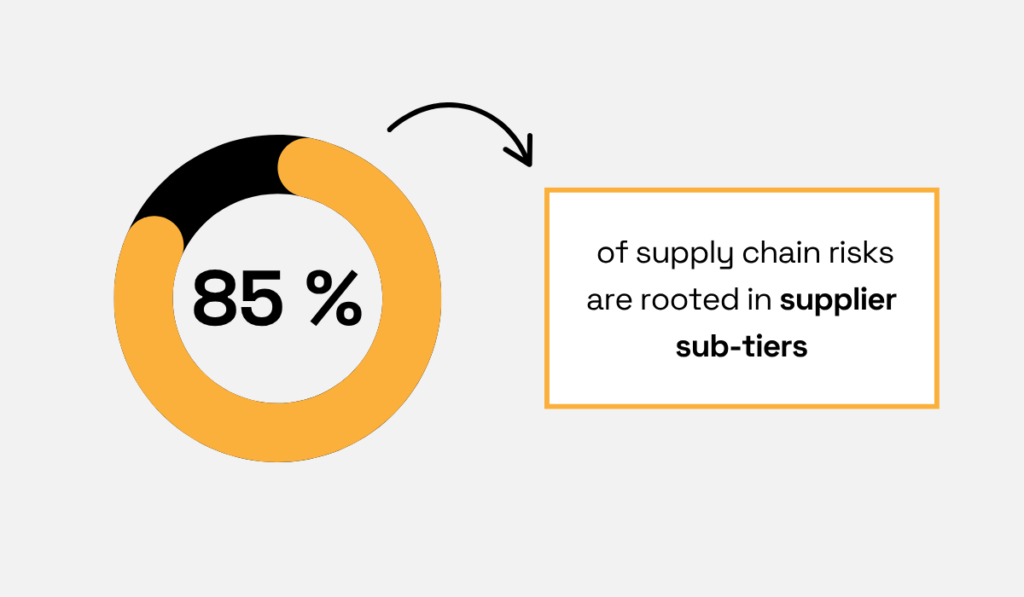

In fact, a study by Sphera found that 85% of supply chain risks and critical events are rooted in these sub-tiers.

Illustration: Veridion / Data: Sphera

As Paul Marushka, CEO and President of Sphera, puts it:

“Firms with limited visibility into their supply chain face risks and exposures from sub-tier suppliers vulnerable to disruptions.”

These risks can be reputational, operational, and legal.

Take environmental impact, for example.

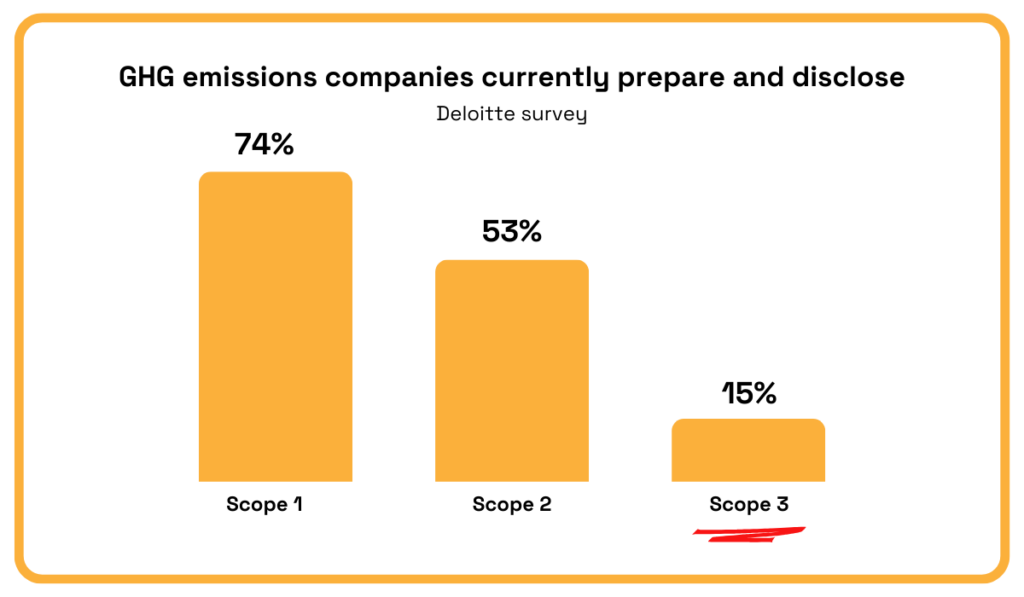

Under the Greenhouse Gas Protocol, companies are expected to measure and report on Scope 3 emissions—indirect emissions that occur throughout their value chain.

But most organizations still struggle to do so.

While 74% of companies report on Scope 1 emissions, and 69% on Scope 2, only 15% currently report on Scope 3, according to Deloitte.

Illustration: Veridion / Data: Deloitte

That’s a major gap, especially since in most industries, Scope 3 emissions lie outside Tier 1.

In the high-tech sector, for instance, 86% of upstream Scope 3 emissions come from beyond Tier 1.

Without visibility into deeper tiers, these emissions remain unmeasured and unaddressed, undermining both ESG goals and regulatory compliance.

But the risks go beyond carbon accounting.

In 2023, a BBC investigation exposed how some luxury fragrance brands were indirectly linked to child labor in Egypt’s jasmine supply chain.

Source: BBC

While these brands sourced from established fragrance houses (Tier 1), those suppliers in turn bought oil from processors who relied on smallholder farms, where informal labor, including children, was used to harvest jasmine.

None of this was visible at the Tier 1 level, but the reputational damage still landed at the top.

The same is true in the case of cobalt, a key material in electronics and electric vehicle batteries.

A significant portion of the world’s cobalt comes from the Democratic Republic of the Congo, where mining operations in deep-tier supply chains have been tied to child labor and unsafe working conditions.

In 2019, Apple, Google, Tesla, and Microsoft were among the companies named in a lawsuit over injuries and deaths of child miners.

Source: BBC

The impact was not only reputational, but also financial and long-lasting.

Today’s consumers expect transparency and accountability at every level.

They want to know that brands are aware of where their products come from, down to the raw materials, and are taking meaningful steps to ensure ethical and sustainable sourcing.

At the same time, regulations are catching up, with laws like the EU Corporate Sustainability Due Diligence Directive requiring companies to address ESG risks across their entire supply chain.

Despite all this, many organizations still rely solely on Tier 1 data.

It’s often not because they don’t care, but because managing supplier tiers beyond the first is incredibly difficult.

So, why is it still so hard to see past Tier 1?

Despite growing awareness, increased regulation, and public pressure for transparency, most companies still struggle to gain full visibility into their extended supply networks.

Here are three key reasons why.

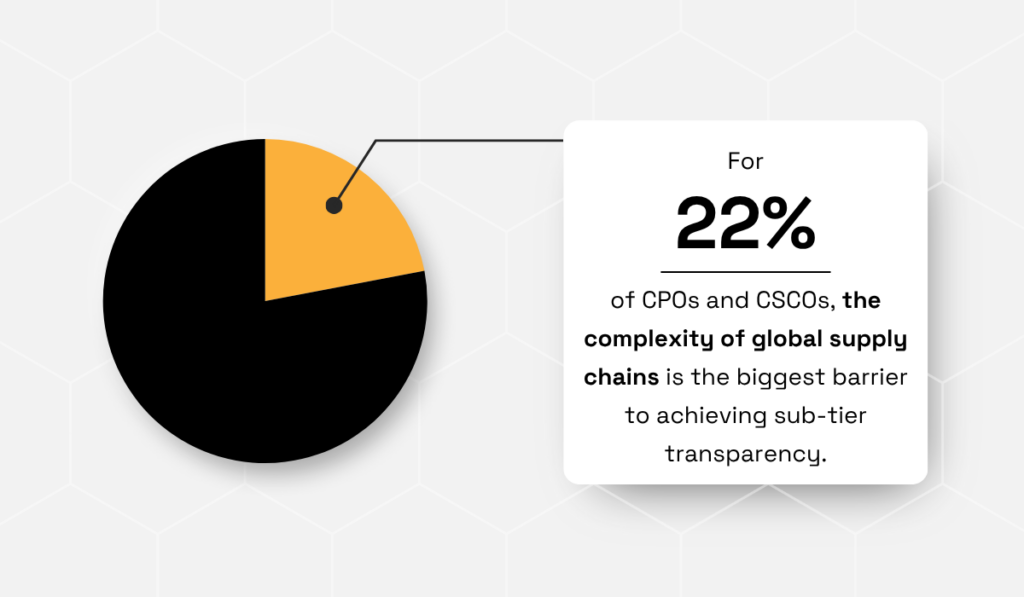

Supply chains are rarely neat or linear.

A Tier 1 supplier may outsource part of their operations to a subcontractor, who then relies on yet another vendor, and so on.

This cascading structure quickly becomes difficult to trace, especially when it spans multiple countries, industries, and languages.

Sphera’s recent study confirms this.

Among 250 CPOs and CSCOs surveyed, 22% cited the complexity of global supply chains as a major barrier to achieving sub-tier transparency.

Illustration: Veridion / Data: Sphera

Another 24% said the cost of mapping these networks was too high.

But the challenge isn’t just the number of layers—it’s how those layers interconnect.

As Ulf Venne from Everstream Analytics explains, many supply chains include Tier 2 suppliers who support multiple Tier 1s.

Illustration: Veridion / Quote: Everstream Analytics

This creates hidden bottlenecks.

A single disruption at Tier 2 can ripple across the entire supply chain, affecting multiple Tier 1 suppliers simultaneously.

Without full visibility, these chokepoints remain unknown until it’s too late.

Unfortunately, a lack of visibility is another challenge in supplier tiering.

One of the biggest challenges in managing supplier tiers is simply not knowing who the suppliers are beyond Tier 1.

Most companies have a direct relationship with Tier 1 suppliers, but beyond that, the view quickly becomes blurry.

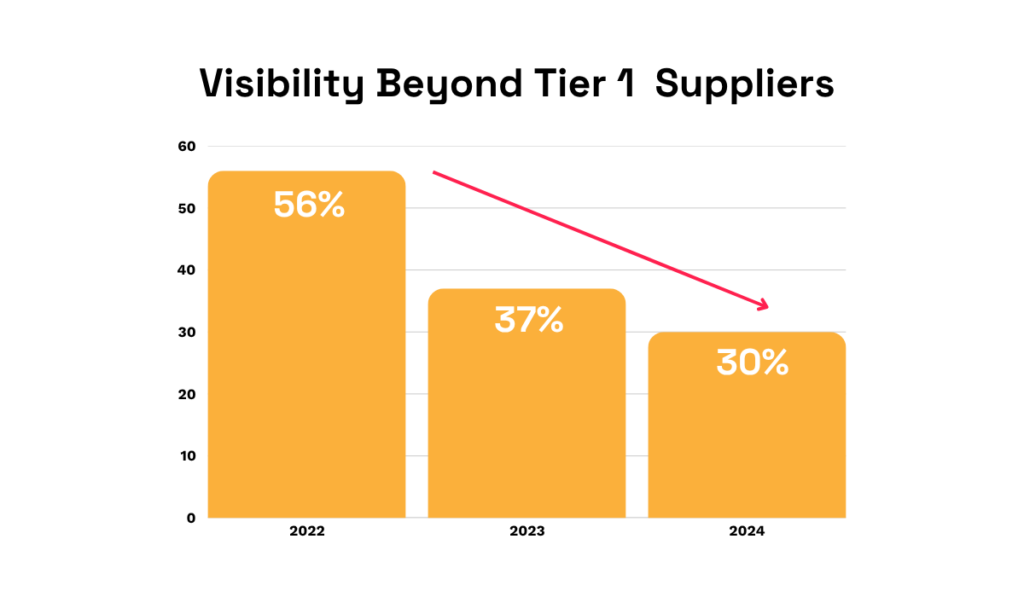

A McKinsey survey from 2024 confirms this.

While 60% of companies say they have good visibility into Tier 1, only 30% report the same beyond Tier 1.

That’s a steep drop, and a concerning one because just two years ago, 56% of companies had some visibility into deeper tiers.

That figure has nearly halved.

Illustration: Veridion / Data: McKinsey

To make matters worse, this erosion of insight is happening just as the need for visibility grows.

Global ESG regulations have increased by 155% in the past decade, with new laws requiring companies to account for human rights, labor practices, and environmental risks throughout their entire supply chains, not just Tier 1.

At the same time, it’s becoming clear that disruptions and ESG violations typically don’t originate at Tier 1.

They happen where oversight is weakest, at the edges of the supply chain, among subcontractors, rural suppliers, and informal labor networks.

But you can’t act on what you can’t see.

And in most cases, businesses don’t know who their Tier 2 or Tier 3 suppliers are, let alone what risks they may carry.

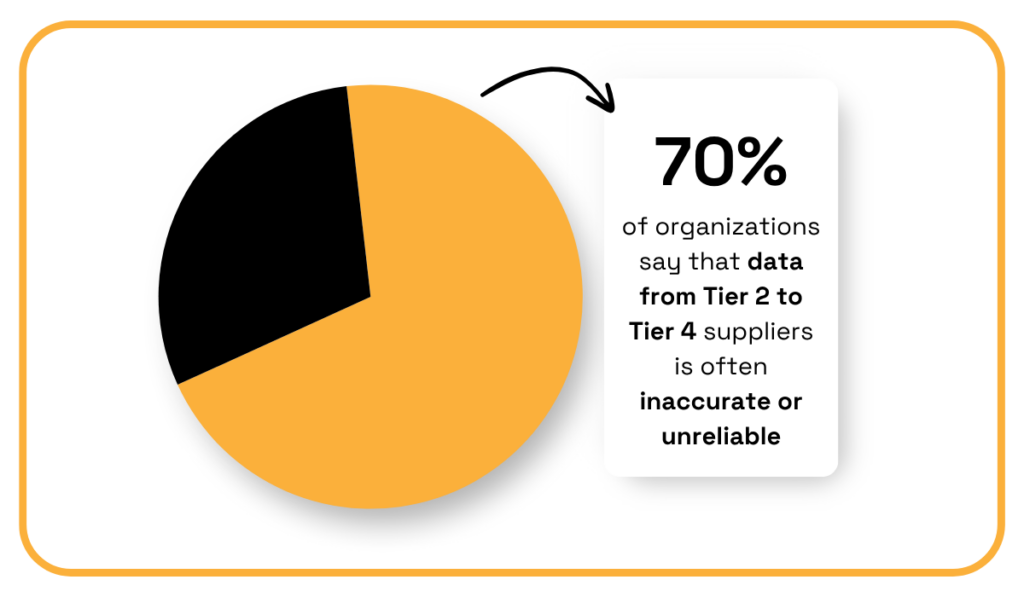

Even when companies try to map deeper tiers, data challenges often bring those efforts to a halt.

Supplier information tends to be fragmented and spread across internal systems, regions, and departments.

It’s not uncommon for the same supplier to appear under different names in different databases, or for records to be incomplete or outdated.

This makes it hard to even identify who is in the supply chain, let alone evaluate their practices.

According to the previously cited Sphera study, roughly 70% of surveyed organizations said data from Tier 2 to Tier 4 suppliers is often unreliable or inaccurate.

Illustration: Veridion / Data: Sphera

That level of inconsistency undermines both compliance efforts and risk management.

And despite advances in supply chain software, 26% of companies are still conducting manual risk assessments, which are vulnerable to human error and blind spots.

Lack of traceability also creates ethical dilemmas.

One example is the cosmetics company Lush, which once sourced natural mica, a mineral linked to child labor in India, from suppliers who claimed to use child-free labor verified by third parties.

But when the supplier’s pigment division was sold, the company could no longer guarantee third-party auditing or transparency.

Source: The Guardian

They switched to synthetic alternatives because they couldn’t confirm their supply chain met their ethical standards, explains Gabbi Loedolff, Director of Buying at Lush:

“It became clear that we couldn’t get the transparency that we wanted in our natural mica supply chains, so we decided synthetic mica was a better and more ethical option for us.”

All in all, without quality data and traceability, even companies with strong intentions struggle to act responsibly.

Visibility into deeper-tier suppliers is no longer a distant goal.

Thanks to technology, it’s becoming increasingly achievable.

According to Sphera, 90% of organizations are either using or planning to use tools designed for N-Tier transparency.

Illustration: Veridion / Data: Sphera

Similarly, McKinsey reports that over half of companies (55%) have already adopted or plan to adopt AI specifically for end-to-end supply chain visibility.

These trends point to a clear shift: businesses are turning to tech to bridge the visibility gap.

Modern tools are capable of cutting through the complexity that used to make deeper-tier mapping so difficult.

AI, machine learning, blockchain, and supplier network platforms are making it easier to discover hidden supplier relationships, track ESG compliance, and respond to emerging risks in real time.

Take Veridion, for example.

Our advanced data engine uses data analytics and AI to illuminate the entire supplier ecosystem, delivering profiles for more than 120 million suppliers across the globe.

Source: Veridion

It reveals not just who your direct suppliers are, but who they rely on, and who those suppliers rely on in turn.

Veridion’s technology is particularly effective at uncovering hidden supplier risks by analyzing:

| Foreign ownership and geopolitical influence | To avoid exposure to sanctions or political instability. |

| Geographical distribution | To identify location-based risks such as environmental hazards, labor law violations, or regulatory concerns. |

| Operational health | To identify worker safety practices, legal compliance, and business continuity indicators. |

| Financial stability | To assess a supplier’s long-term viability and avoid disruptions from financial collapse. |

| ESG performance | To gain clarity on how well third parties align with your sustainability and social responsibility goals. |

Combined, these insights allow companies to map their entire supplier network, not just by name, but by risk, reliability, and responsibility.

And while Veridion delivers much more than this, its ability to connect scattered data points into a coherent, actionable supply chain picture makes it a powerful tool for tackling the very challenges we’ve explored in this guide.

In short, the technology is ready, and the companies that adopt it will be far better positioned to meet both today’s expectations and tomorrow’s disruptions.

As supply chain disruptions and ESG scrutiny grow, so does the need to see beyond Tier 1.

But visibility into deeper tiers remains difficult, as tangled networks, inconsistent data, and limited traceability continue to stand in the way.

Technology alone isn’t a silver bullet, but it’s shifting what’s possible.

Tools like AI-driven mapping and supplier network platforms are helping companies uncover hidden risks and strengthen due diligence.

It won’t happen overnight, but with the right approach and the right tools, deeper-tier transparency is within reach.