How to Assess Suppliers for More Sustainable Procurement

Key Takeaways:

With consumers, investors, and regulators all demanding greater sustainability, companies must extend their environmental, social, and governance (ESG) efforts to include their suppliers.

That means building a reliable process to assess whether suppliers meet your sustainability standards.

In this article, we’ll walk you through five practical steps to help you do just that, unlocking benefits like reduced risk, strong regulatory compliance, and improved brand reputation.

Before you can evaluate supplier sustainability practices, you need to define what “sustainable” actually means for your organization.

In most cases, these criteria will be a blend of regulatory requirements, industry standards, and your company’s own sustainability goals.

Because sustainability covers ESG factors that vary across industries and regions, complexity is unavoidable.

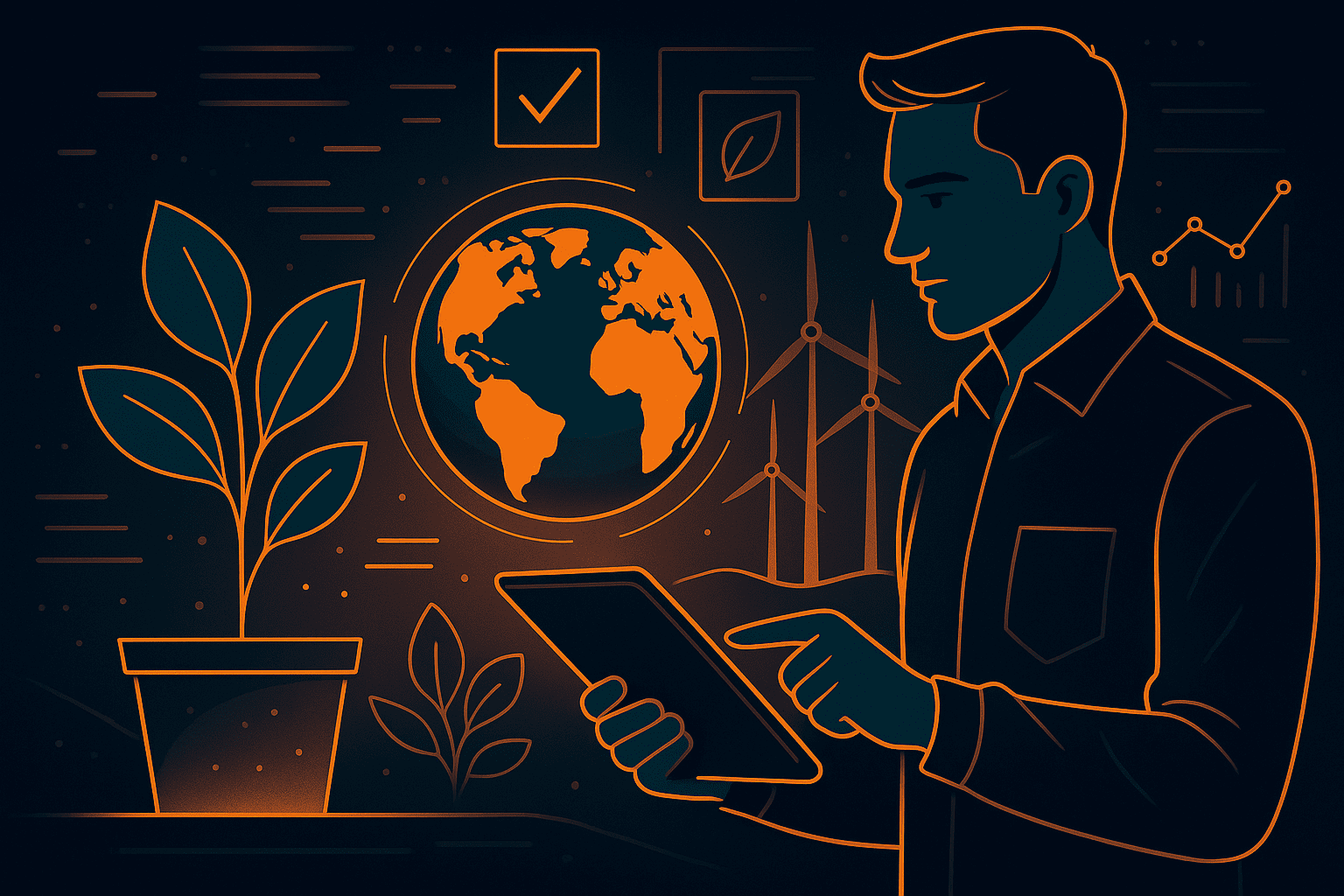

That’s further compounded by the regulatory landscape, with ESG-related regulations surging by 155% globally over the past decade.

Illustration: Veridion / Data: Edie

As a result, companies must align with a mix of mandatory and voluntary sustainability frameworks, depending on where they and their suppliers operate.

Many of these frameworks come with specific reporting obligations, which increasingly include supplier-level disclosures, especially from Tier 1.

Rather than starting from scratch, procurement teams can use these frameworks to set their supplier sustainability criteria.

The frameworks highlight what data matters most, clarify material risks, and establish consistent metrics for tracking ESG performance across the supply base.

Here’s an overview of the main elements of four major sustainability frameworks.

Source: Traace

In addition to these frameworks, it’s useful to review ESG goals and standards set by other major players in your industry.

They may reveal how peers define and prioritize sustainability issues, such as carbon footprint, labor practices, or governance transparency, and provide benchmarks for your own efforts.

These examples can also offer practical models for structuring your supplier sustainability assessments, including how to weigh different ESG dimensions.

For instance, Iberdrola, a Spanish electric utility company, assesses suppliers across 43 ESG criteria summarized below, and assigns each area a specific weight.

Source: Iberdrola

Of course, the ESG criteria you establish should be clear, measurable, and communicated to suppliers promptly.

A common best practice is to include supplier-related ESG expectations in your company’s supplier code of conduct, thereby setting the foundation for accountability and alignment.

At the same time, ESG factors need to be balanced with traditional procurement criteria such as cost, quality, and delivery.

This is typically achieved by taking an integrated, structured approach that aligns sustainability goals with your broader business objectives.

To sum up, defining supplier sustainability criteria—anchored in industry standards, regulatory frameworks, and your company’s goals— is the foundation for effective supplier ESG assessments.

The next step is to collect relevant supplier sustainability data.

This process consists of several stages and is most effective when supported by supplier/ESG intelligence platforms.

Needless to say, it’s essential to have access to reliable and up-to-date data on a supplier’s sustainability performance and its operating environment.

Without it, ESG assessments become time-consuming, error-prone, and difficult to scale.

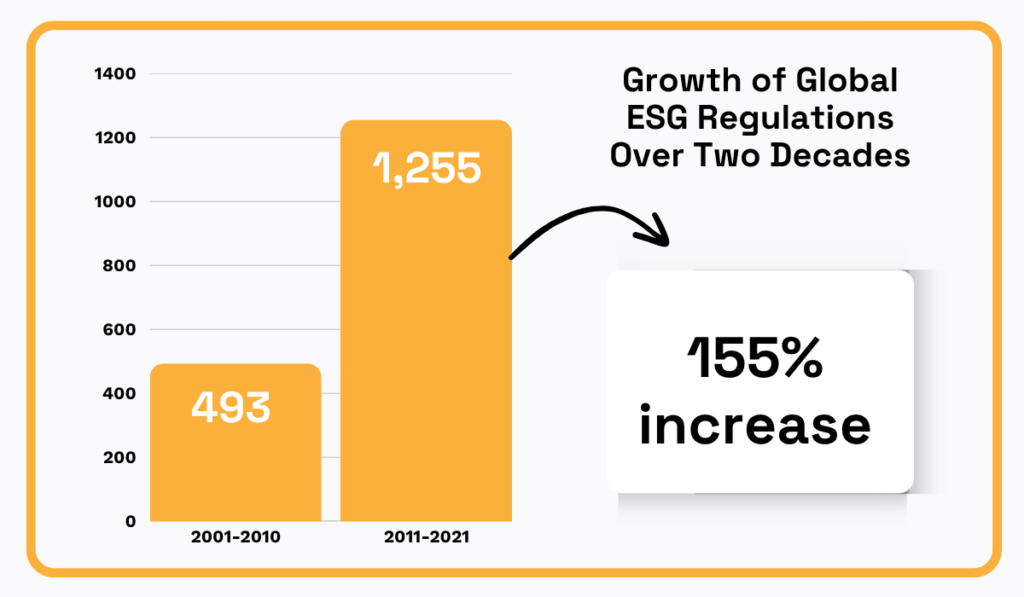

A D&B survey on what affects corporate ESG goals revealed the main data collection challenges: insufficient data quantity and reliability.

Illustration: Veridion / Data: BusinessWire

This should give companies plenty of reasons to consider digital tools to improve both supplier data accuracy and ESG data collection.

One of them is Veridion, our supplier intelligence platform.

Veridion uses AI-driven algorithms to gather and continuously update information on all companies with an active web presence worldwide.

Its database—updated weekly—currently includes over 121 million companies across 240+ geographies, covering a wide range of ESG-related data points shown below.

Source: Veridion

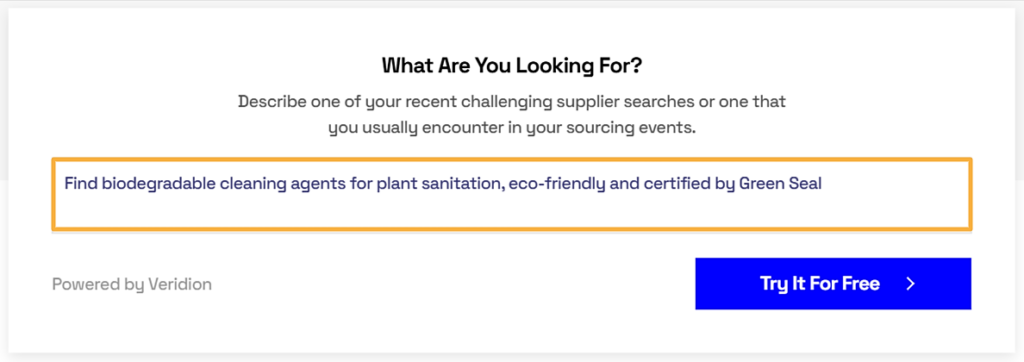

By using our search engine Scout or integrating your tools with Veridion’s API, you can search the database using natural language and receive an initial list of suppliers that meet your set criteria within seconds.

Here’s an example of a highly specific, environmentally friendly global supplier search:

Source: Veridion

This search returned over 1,000 relevant companies in just a few seconds, as shown below:

Source: Veridion

You can also use Veridion’s market intelligence to gather ESG-relevant data about suppliers’ countries or regions, including applicable standards and common environmental or social risks.

Other digital tools further support ESG data collection, particularly for supplier self-reporting, documentation management, and compliance monitoring.

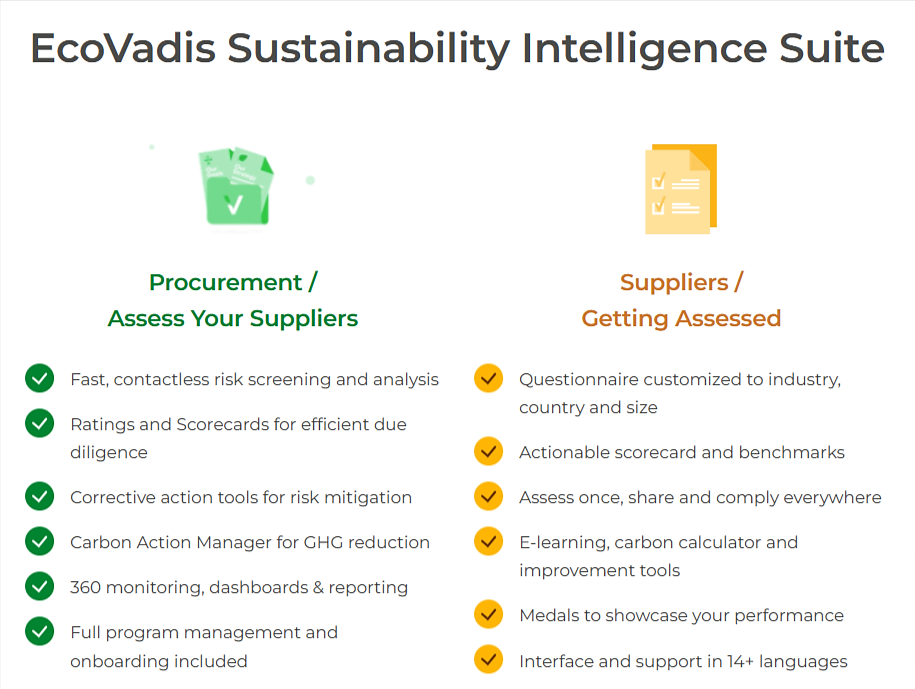

For instance, EcoVadis is a widely used platform offering ESG ratings for more than 150,000 companies and has screened over 2 million globally.

Source: EcoVadis

As shown, EcoVadis enables organizations to conduct fast, contactless ESG screening and due diligence.

Once a supplier is flagged as relevant, the platform supports distributing customized sustainability questionnaires based on industry, location, and company size.

With these tools in place, the first stage of supplier sustainability data collection—especially when sourcing new suppliers—can begin.

At this point, there’s typically no direct contact with suppliers.

Instead, supplier databases and intelligence platforms are searched to create an initial long list of eligible candidates.

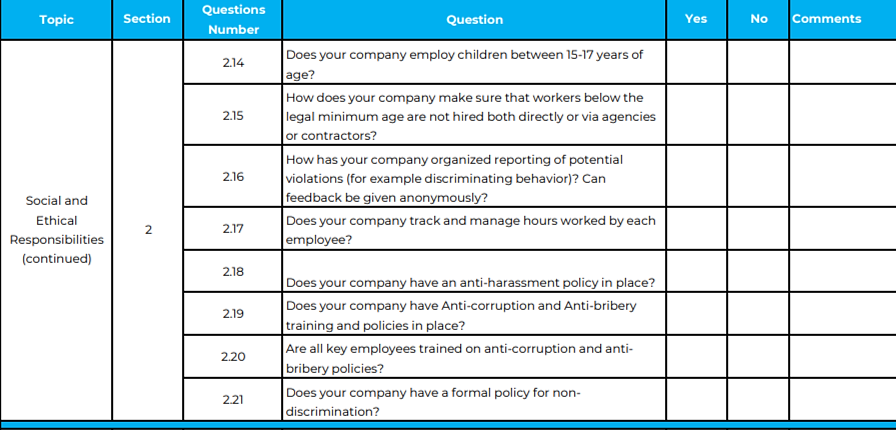

After verifying data, shortlisted suppliers are usually contacted and provided with detailed sustainability questionnaires to gather more specific information.

To illustrate, below is an excerpt from the social aspect of an ESG questionnaire:

Source: Case

While standardizing ESG questionnaires helps ensure consistency and streamline analysis, they should still be slightly tailored to the supplier’s industry, size, and location.

Since these questionnaires are self-reported, it’s also essential to verify suppliers’ ESG claims—another area where Veridion can provide valuable support.

Once the questionnaires are completed and the data verified, it’s time to move on to the next step: evaluating suppliers.

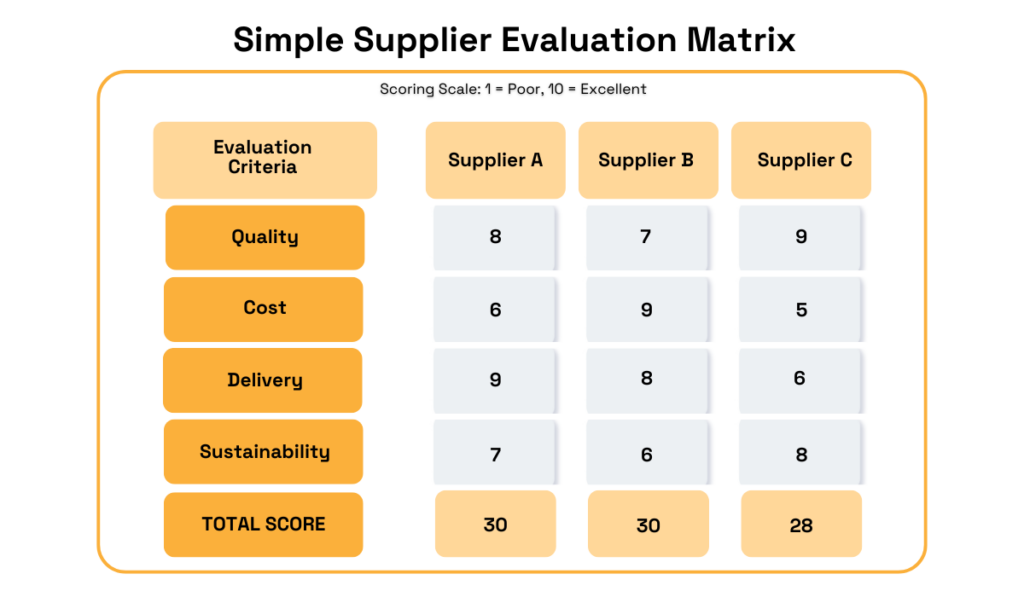

At the evaluation stage, each supplier’s ESG performance is assessed alongside traditional procurement criteria, enabling a more balanced and informed selection of the best supplier.

For existing suppliers, this evaluation determines whether they still meet your organization’s sustainability and compliance standards for continued engagement.

The evaluation process typically combines quantitative scoring—using standardized KPIs or benchmarks—with qualitative analysis, such as reviewing supplier commitments, policies, and sustainability reports.

In many cases, the evaluation also includes site visits for shortlisted or high-impact suppliers.

These visits are often critical for verifying ESG claims and observing real-world practices.

Chynna Pickens, ESG & Sustainability Consultant, explains what typically takes place during these assessments:

Illustration: Veridion / Quote: SLR Consulting

Beyond site visits, verifying relevant sustainability certifications, such as ISO 14001, SA8000, or Fair Trade, is also an integral part of the evaluation process.

Findings from on-site assessments, along with all other ESG-related data, are typically consolidated into a supplier scorecard.

Scorecards provide a consistent, structured way to evaluate suppliers against both sustainability and traditional procurement criteria.

Their format can vary depending on the complexity of the ESG evaluation and your organization’s goals.

To illustrate, here’s a simple supplier evaluation matrix:

Source: Veridion

As Daniel Dowd, VP of Supplier Quality at Estée Lauder Cos, points out:

“Scorecards help us understand and evaluate the performance of our suppliers in a tangible, consistent, and scalable way.”

Beyond establishing ESG compliance, another key part of supplier evaluation is identifying and assessing potential supplier risks.

These can include:

Identifying these risks early and collecting relevant data—ideally through supplier intelligence platforms—is essential.

Such tools not only support the evaluation process but also enable ongoing monitoring of your existing supplier base, as explained below.

Source: Veridion

The data and real-time alerts provided by third-party risk management tools can be integrated with platforms that offer features like risk dashboards and customizable scorecards.

Together, these insights enable procurement teams to make ESG-informed, balanced supplier selection decisions.

After the preferred supplier is selected, the process moves to formalizing supplier sustainability commitments.

Formalizing ESG requirements in supplier contracts ensures that sustainability expectations are legally binding.

While certain ESG topics, like child labor, modern slavery, or bribery, are already standard in most commercial contracts, others, such as energy efficiency, emissions, or circularity, are often not.

In other words, many companies still don’t regulate supplier sustainability commitments through specific clauses and metrics.

Instead, contracts typically require suppliers to comply with broader supplier codes of conduct and other company policies.

IKEA’s IWAY Supplier Code of Conduct, which outlines detailed ESG requirements for all suppliers and service providers, is a good example.

Source: IKEA

When compliance with a supplier code is explicitly formalized in a contract, it becomes enforceable.

However, as these policies are often general in nature, it may be difficult to determine when and how a breach has occurred.

As Emma Davies, Legal Director at TLT, argues:

Illustration: Veridion / Quote: TLT

Still, due to the broad scope of ESG topics, translating every expectation into a clear, enforceable clause can be challenging.

However, some reporting, transparency, and monitoring obligations can be easily codified.

For example, this emissions disclosure clause from a supplier code of conduct can be quickly adapted into a formal contract provision:

Source: Siempelkamp

Beyond using precise language, it’s also advisable to specify ESG metrics and timelines where feasible (e.g., “reduce Scope 1 emissions by 15% by 2027).

With modern tools enabling better monitoring of supplier ESG actions, it’s now easier to track compliance over time.

That said, not every supplier requires detailed ESG clauses.

Many companies segment suppliers by risk, spend, or criticality to determine where more specific terms are needed.

It’s also effective to link ESG performance to incentives like greater order volumes and remedies for non-compliance, like corrective action plans or termination clauses.

Once sustainability is embedded in contracts or supplier codes of conduct, the last, ongoing step is ensuring that suppliers stay compliant.

Ongoing monitoring, auditing, and collaboration are essential to ensure that suppliers remain compliant with ESG commitments over time.

Continuous supplier performance monitoring also helps you respond to evolving sustainability standards, spot non-conformances early, and address emerging risks.

This step can involve a mix of methods—from automated ESG risk tracking and real-time alerts to scheduled performance audits and on-site inspections.

Technology plays a central role in making ESG monitoring more efficient.

Real-time intelligence sources, supplier relationship management (SRM) tools, and analytics dashboards allow procurement teams to track trends, flag issues, and drive improvements with greater speed and precision.

Source: Achilles

We’ve already mentioned several performance monitoring tools, such as clear sustainability criteria, tracking metrics, audit checklists, scorecards, and supplier guides.

But the goal is not only to track supplier ESG compliance.

The goal is to create “triggers” tied to predefined risk thresholds, like a supplier falling below a sustainability score, receiving a fine, or losing a key certification.

As Chris Audet, Chief of Research at Gartner, points out:

Illustration: Veridion / Quote: Gartner

When such triggers are in place, teams can proactively investigate or engage with the supplier before issues escalate.

It’s important to remember that monitoring is also an opportunity for collaboration.

Engaging with suppliers on ESG performance through regular check-ins, constructive feedback, and capacity-building initiatives fosters long-term improvement and transparency.

Once the ESG monitoring process is underway, procurement teams can begin closing the loop.

In practice, insights from performance monitoring are fed back to suppliers to support their progress and are also used to inform future sourcing decisions.

Achieving sustainable procurement and building a responsible supply base requires continuous effort, from robust monitoring programs to targeted technology investments.

By defining clear ESG criteria, collecting reliable data, evaluating suppliers effectively, and monitoring performance over time, procurement teams can drive meaningful impact.

With the right tools and processes in place, sustainable procurement becomes not only achievable but also scalable.

Ultimately, this empowers your company to realize benefits ranging from reduced risk and enhanced brand reputation to cost savings and greater innovation opportunities.