Tail Spend: The Complete Guide

When we talk about managing company expenses, we often focus on the big things—major contracts, the big suppliers, and hefty purchases.

It’s like we’re always looking at the elephant in the room, but sometimes we forget about everything else.

But the smaller expenses, which fall under what we call tail spend, can add up quickly without us noticing.

In this article, we’re going to give you a full overview of tail spend, so you can understand and manage it effectively.

We’ll cover what tail spend is, why it’s so easy to miss, and share some practical ways to analyze and manage it.

So, let’s get started.

Tail spend refers to the small, often overlooked purchases made within an organization.

This includes things like office supplies, travel expenses, or IT equipment.

When not managed properly, these purchases happen outside of official contracts and company policies and lack proper documentation.

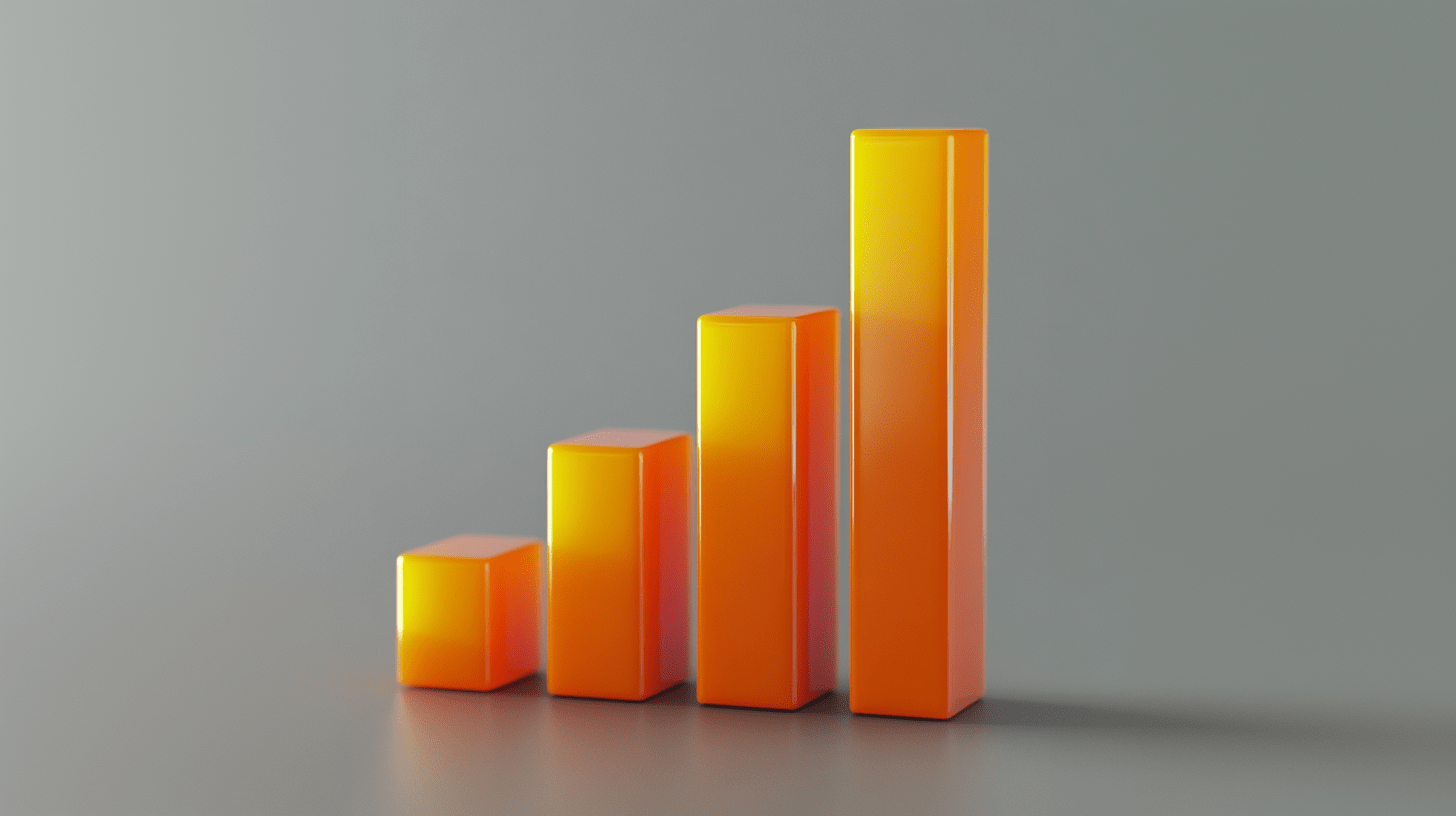

In terms of suppliers, tail spend typically entails about 80% of a company’s purchases that come from many small transactions, which only make up about 20% of total spend.

Source: Veridion

Tail spend can occur in a few different ways, from one-off purchases, spot buying, and maverick spend, to expense reimbursement and more.

While all of these are considered tail spend, it’s important to understand the differences between them.

Take a look at the following table comparing some of these commonly confused concepts.

| Type | Definition | Control | Example |

|---|---|---|---|

| Tail Spend | Small, low-value purchases from a large number of suppliers | Low visibility, often overlooked | Indirect purchases like office supplies |

| Maverick Spend | Unauthorized purchases made outside of procurement policies | Can be corrected with training and policy enforcement | Employees purchasing directly from suppliers without contracts |

| Spot Buying | Unplanned, one-off purchases for immediate needs | Limited control, reactive | Emergency equipment or materials purchase |

As you can see, while these terms are sometimes used interchangeably, it’s important to see the nuanced differences.

This will be especially useful later on when conducting tail spend analysis.

Here’s a couple of ways tail spend can look like in an organization:

Overall, knowing what tail spend is and identifying some specific instances of it in your organization is the first step in effectively managing it.

With all the ways in which tail spend can manifest, how does it manage to fly under the radar so often?

Well, because tail spend purchases are usually small, they’re often seen as not worth the trouble of tracking.

Take petty cash, for example.

It’s often tracked with simple paper logs like the one below.

Source: Veridion

These logs are meant to track all small purchases, but mistakes can happen, and things can be left untracked.

A coffee here, a pack of pens there—these small items might seem too insignificant to record.

Over time, though, they can open the possibility of fraud or misuse and add up to a significant amount.

Then there’s spot buying, which occurs when purchases are made to meet immediate or emergency needs.

When done by procurement professionals, this type of buying can even be beneficial, providing flexibility to address urgent requirements.

But, as the EmpoweringCPO team wrote for Medium, the problem is that spot buying is often done by the end-user in an organization, not the procurement department.

Illustration: Veridion / Quote: Medium

Because these end-users don’t have the necessary skills or knowledge of procurement best practices, they can make various kinds of mistakes.

For instance, they might buy items at a much higher price than necessary, fail to track their purchases properly or choose suppliers without proper vetting.

All of these issues contribute to larger, undocumented tail spend.

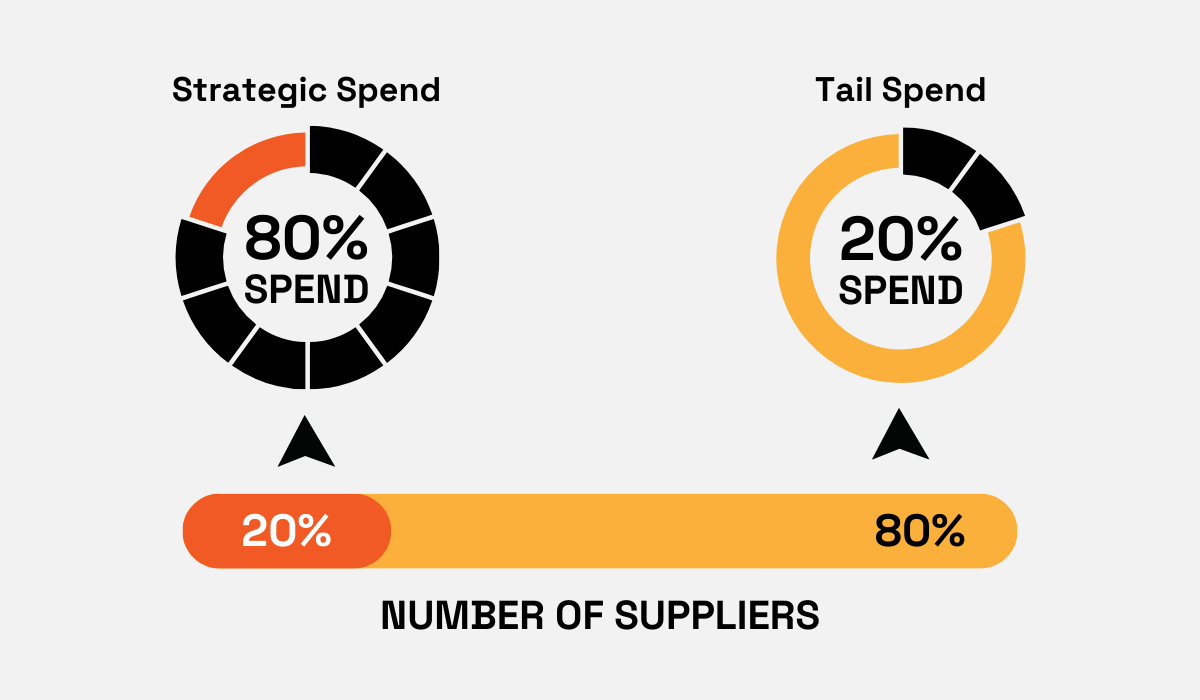

This situation is closely related to the final reason that tail spend often goes unnoticed: it’s decentralized and dispersed among different departments.

As you can see in the image below, different departments can make various indirect purchases.

Source: Veridion

With proper documentation often lacking in such purchases and limited spend visibility across departments, these expenses can remain unknown to the central procurement team.

What’s more, this lack of coordination can lead to duplicate spending from various departments.

For example, multiple teams might subscribe to the same software service without realizing it, missing out on potential volume discounts.

In summary, tail spend is often overlooked due to its seemingly insignificant, decentralized nature across departments.

These factors make it easy for tail spend to slip through the cracks, leading to hidden costs and missed savings opportunities.

Naturally, you don’t want to overlook tail spend.

The good news is that there are some signs that can help you detect whether you have a tail spend problem.

Let’s jump right into some of the most common signs:

Let’s take having a high supplier number as an example.

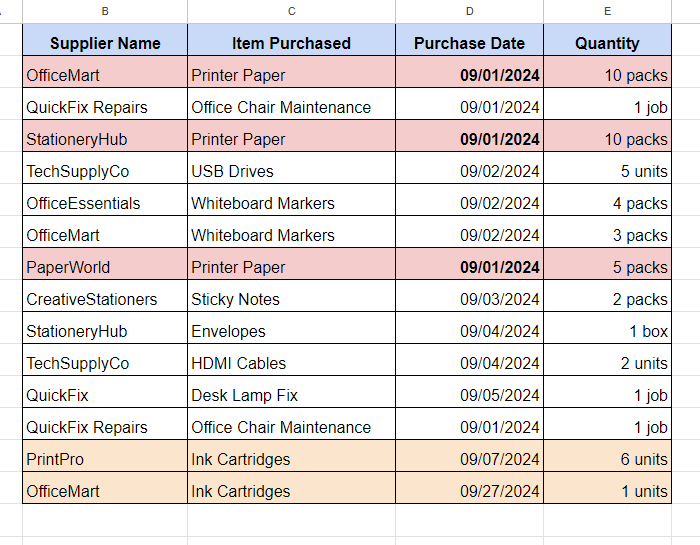

Check out this supplier list, which shows some purchased items, their quantity, and purchase date.

Source: Veridion

From this supplier list, you can see smaller purchases of the same items were made by various departments and from different suppliers.

Now imagine this issue, but with hundreds of suppliers, or more.

This can indicate a lack of standardization in purchasing processes, resulting in potential missed opportunities for bulk discounts and increased complexity in managing vendor relationships.

Not to mention, these various smaller purchases made from different suppliers also come with separate processing costs.

Source: Veridion

For example, instead of making a bulk purchase, you get tens of individual purchases with costs that can range from $50 to $150.

These costs can add up, becoming higher than those of a single processing cost for a larger, consolidated purchase.

Not only that, but an additional cost that can arise is from inventory overflow.

When different departments make uncoordinated purchases, it can lead to excess stock that, according to IHL projections, cost the industry around $562 billion in 2023.

Illustration: Veridion / Data: IHL

Overflowing stock ties up capital in unnecessary inventory and can lead to waste if items expire or become obsolete before they get the chance to be used.

On top of that, it takes up valuable storage space and can increase handling costs.

Ultimately, all of these issues can stem from a lack of visibility and transparency in your spending data.

When you don’t have a clear picture of what’s being purchased, by whom, and at what price, it’s easy for tail spend to spiral out of control.

These warning signs indicate that it’s time to take a closer look at your tail spend and implement strategies to gain better control.

To uncover the signs of a tail spend problem or analyze some of your already known issues, you need to conduct tail spend analysis.

This process involves collecting and analyzing spend data to gain a deeper understanding of your tail spend patterns, identify areas for improvement, and develop strategies for better control and cost savings.

Several key practices are involved in tail spend analysis, including the ones shown below.

Source: Veridion

The first step is to gather as much data as possible on all purchases made within your organization.

You should collect data on suppliers and their associated spend, products, and services purchased.

As you analyze this data, keep an eye on key metrics like:

Another crucial metric to track is compliance rates.

As Derek Bush, Procurement Advisory Leader at IBM, writes:

“Measuring compliance is a critical KPI for accountability. [It answers questions like:] Are internal stakeholders following policies or going outside the system? Are suppliers meeting contract requirements, service levels, and sustainability goals?”

After collecting and analyzing supplier data, you’ll want to segment your suppliers.

With all the information you’ve gathered, this becomes a more straightforward process with techniques like ABC spend analysis that can be done in Excel, as the video below shows.

Source: Accelerated Insight on YouTube

In the context of tail spend, supplier segmentation can help identify which suppliers or categories of spend should be prioritized for management.

For example, with ABC analysis, you can categorize suppliers into three groups:

A (highest value), B (medium value), and C (lowest value), uncovering potential to consolidate suppliers from the C category.

Of course, for a more thorough analysis, you’ll want to use a spend management system.

Such systems offer more advanced analytics capabilities, automation of data collection and analysis, and other features specifically designed for managing tail spend.

Overall, conducting a comprehensive tail spend analysis provides the foundation for developing effective strategies to manage and optimize this area of spend.

Finally, after you’ve conducted your analysis, it’s time to think about tail spend management.

Creating a strategy around this issue is one of your best options, as it can help ensure tail spend doesn’t go by unnoticed, and all of the spend data you’ve gathered is put to good use.

One of the most important practices to consider here is strategic sourcing.

This practice involves identifying key suppliers and consolidating your supplier base and purchases to increase efficiency and reduce overall spend.

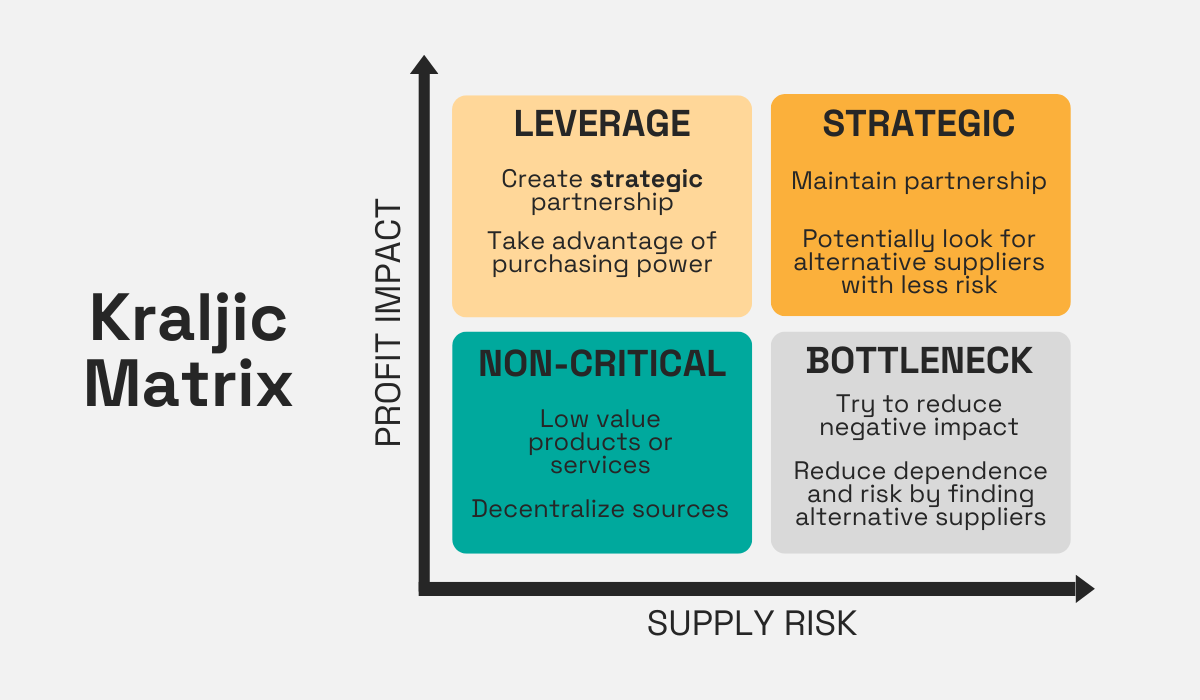

Here, tools like the Kraljic matrix are usually employed.

Source: Veridion

This matrix can help you sort through your supplier base by looking at their profit impact and the supply risk.

This is particularly useful for tail spend management, as it allows you to identify which suppliers might be critical to your operations or have a significant cumulative impact on your profits.

The goal is to find your strategic partnerships and maintain them well, while cutting out non-critical and especially bottleneck suppliers.

This approach can significantly reduce the complexity of your tail spend and make it more manageable.

To help with your decision-making, leveraging data services like Veridion can really help.

Veridion is a supplier sourcing enablement service that maintains a global, regularly updated database of suppliers.

Source: Veridion

With our AI-powered supplier enrichments, you can identify duplicate suppliers, standardize data, and roll suppliers up to parent entities.

Then, with our Match and Enrich service, you can update your existing supplier records to ensure you have the most accurate and fresh data on each supplier.

This will help you spot opportunities for consolidation, identify preferred suppliers across different departments, and see if you’re missing out on optimizations due to misclassified suppliers.

Then, combining automation tools with systems like Veridion can help streamline purchase orders, approvals, and invoicing, ultimately reducing manual intervention and the potential for errors.

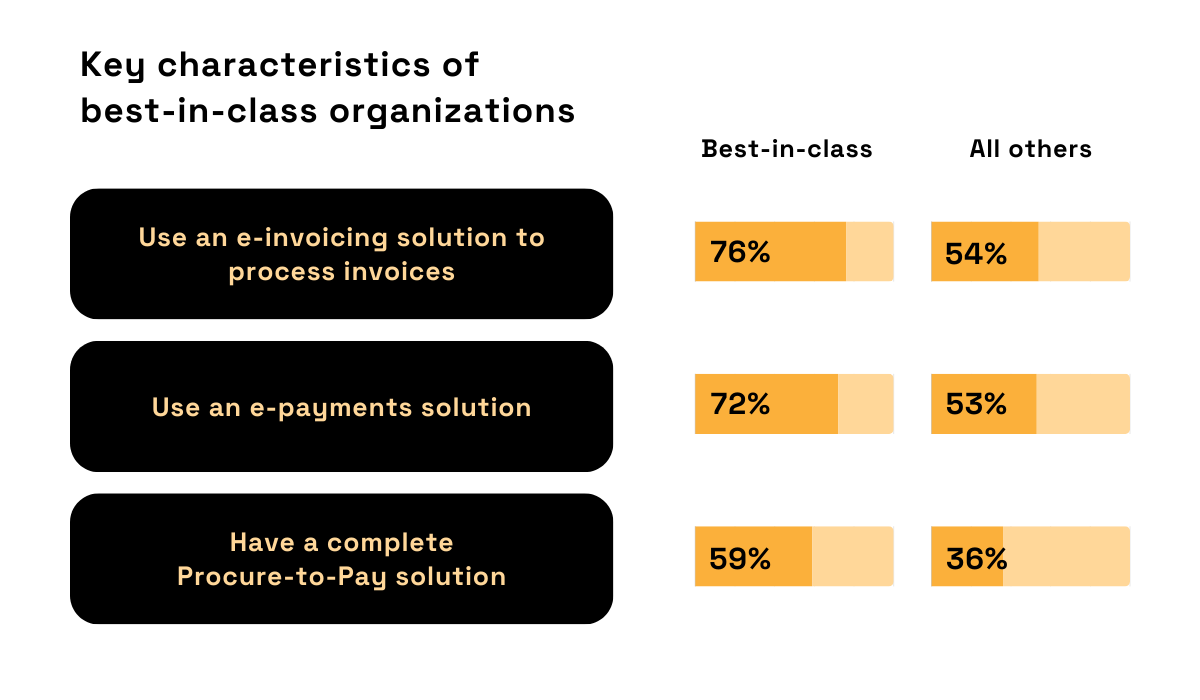

In fact, research from Concentric shows that best-in-class organizations are already utilizing specialized tools and automation to a greater extent than others.

Illustration: Veridion / Data: Corcentric

These tools can significantly help address tail spend by reducing the manual effort required to manage numerous small transactions.

They can automatically route purchases to preferred suppliers, flag non-compliant spend, and, most importantly, provide real-time visibility into all purchases across the organization.

Ultimately, a successful tail spend management strategy combines these key practices to gain better control and reduce this mismanaged spend, reduce costs, and enhance your overall procurement efficiency.

That brings us to the end of our tail spend guide.

We’ve covered all the key details: from its definition to its often-underestimated impact and some strategies to gain control over it.

We hope you’re walking away with a new perspective on these “minor” expenses and how they can be a great area for cost optimization and savings.

Now, it’s time to apply this knowledge to your own procurement practices.

Dive into your spending data, look for patterns, and start implementing the strategies we’ve discussed—even small changes can lead to big results.