Adapting to Tariff Turbulence: How Companies are Navigating Tariff Risk and Building Supply Chain Resilience with Veridion

The global trade environment has entered a new phase of uncertainty.

On April 9, 2025, the U.S. announced a 90-day pause on previously threatened elevated tariffs, returning most to a baseline rate of 10%, except for China, which is now facing a staggering 125% tariff rate.

This move comes just days after the U.S. first announced broad new tariffs, causing strong market reactions and confusion among global trade partners.

Industries deeply dependent on global imports, especially automotive, fashion, agriculture, electronics, pharmaceuticals, and steel – now face a mixed picture: a relief in certain regions, but ongoing cost pressures and supply risk from high-tariff zones like China.

The bigger question is, for how long?

With trade policy shifting rapidly, it wouldn’t be surprising to see new measures emerge.

One thing is certain: this turbulent environment is here to stay and companies can no longer afford to rely on reactive procurement models.

Today’s tariffs are not uniform, they vary not only by country but also by product type.

A component sourced from China may be 125% more expensive overnight, while the same part from Vietnam or Brazil may remain at 10%.

And these rules can shift with little warning.

That variability – combined with tightening ESG regulations and geopolitical instability – creates a complex risk environment for procurement teams.

To maintain competitiveness, companies must go beyond visibility. They must build agile, data-driven supply chains that can respond to disruption in real time.

This is where Veridion comes in.

To succeed in this volatile environment, companies must transition from reactive responses to data-driven strategic decision-making.

Resilient supply chains are no longer built on visibility alone – they require deep, end-to-end understanding of supplier relationships, risk exposures, and regulatory requirements.

Veridion is the strategic data engine built for this new reality.

It empowers businesses to shift from reactive sourcing to proactive planning by combining AI-powered supplier discovery and insights, tariff risk simulation, and embedded ESG intelligence into one seamless platform.

Dependency on limited suppliers or specific regions significantly amplifies vulnerability to tariffs.

To build resilience, companies need both speed and strategic depth in how they discover and evaluate suppliers.

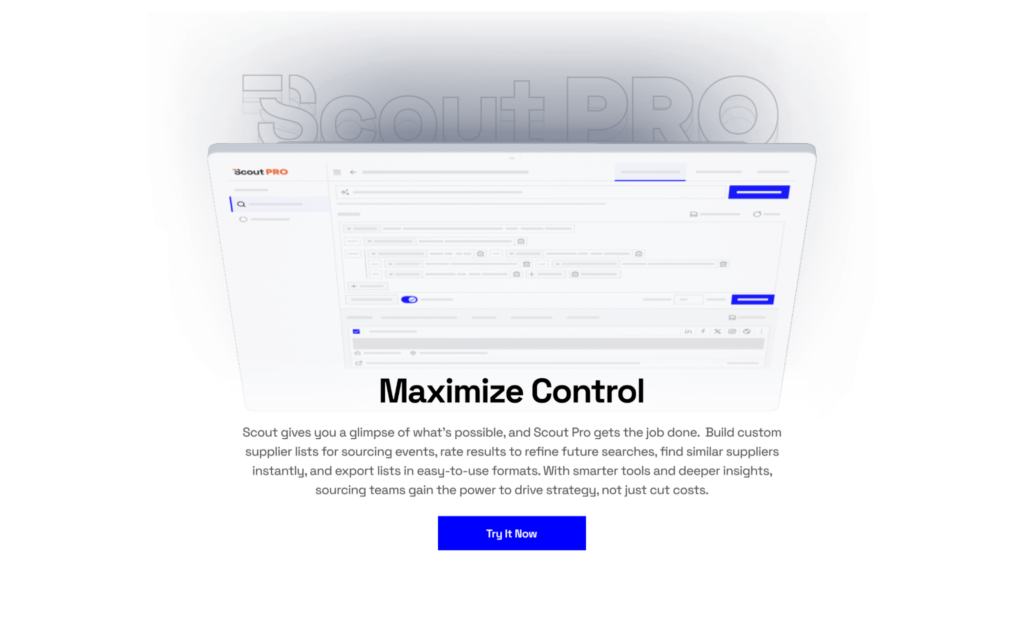

Veridion’s Scout Pro platform enables procurement professionals to quickly and accurately explore 129 million suppliers across over 250 countries.

Users can perform searches with structured filters (like industry codes, locations, and certifications) or intuitive natural language queries such “soybean suppliers in Brazil with ISO 22000.”

By significantly reducing discovery time while improving match accuracy, Scout Pro ensures that every potential supplier aligns with your operational, compliance, and geographic needs.

For seamless integration, Veridion also offers an embeddable Search API, allowing businesses to embed supplier discovery directly into existing platforms, procurement portals, or internal tools.

This enables faster decision-making without the friction of switching systems.

But discovering new suppliers is only one part of the equation.

Veridion also supports sourcing within existing supplier networks by identifying operations in countries with more favorable tariff conditions.

Many suppliers have facilities in multiple regions, and shifting procurement to their lower-tariff sites allows businesses to reduce costs while maintaining strong partnerships and minimizing transition time.

This dual approach – relationship building and geographical diversification – helps companies better absorb trade policy changes while preserving competitive advantage.

Whether you’re looking to nearshore, diversify Tier 2 suppliers, or navigate newly imposed tariffs, Veridion gives you the tools to move quickly—and intelligently.

With Veridion, businesses can:

In an era of trade volatility and regulatory complexity, knowing who your suppliers are isn’t enough.

You need to understand what they produce, how they operate, where they’re located, and whether they meet your technical, financial, and ESG requirements.

Unlike conventional databases that offer limited company details, Veridion provides a deeper level of supplier intelligence, delivering structured, verifiable, and continuously refreshed data across the full scope of a supplier’s operations, offerings, and footprint:

To reduce exposure, companies must begin by identifying critical components and materials that are highly susceptible to tariff increases.

For instance, in sectors like automotive, a significant amount of production costs may be tied to imported components such as semiconductors, wiring harnesses, and steel parts.

Any tariff hike on these components can have a significant financial impact.

Veridion enables teams to pinpoint and evaluate high-risk materials across multiple tiers of the supply chain, providing the insight needed to prioritize the components that matter most to the bottom line.

With tariff rates constantly shifting across goods, categories, and countries, understanding where you’re exposed – and by how much – is critical to protecting margins and supply continuity.

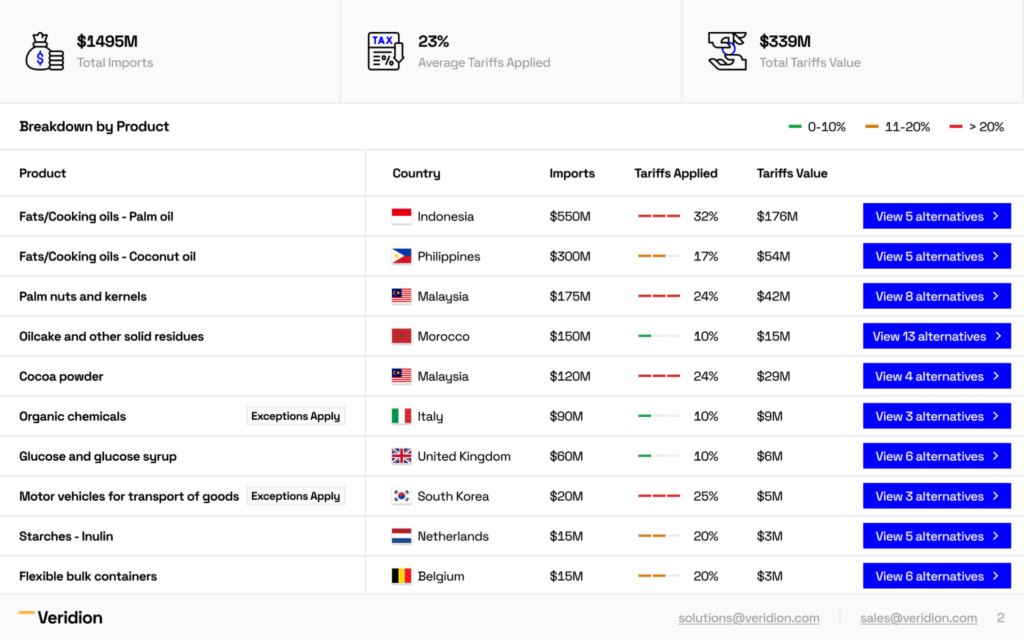

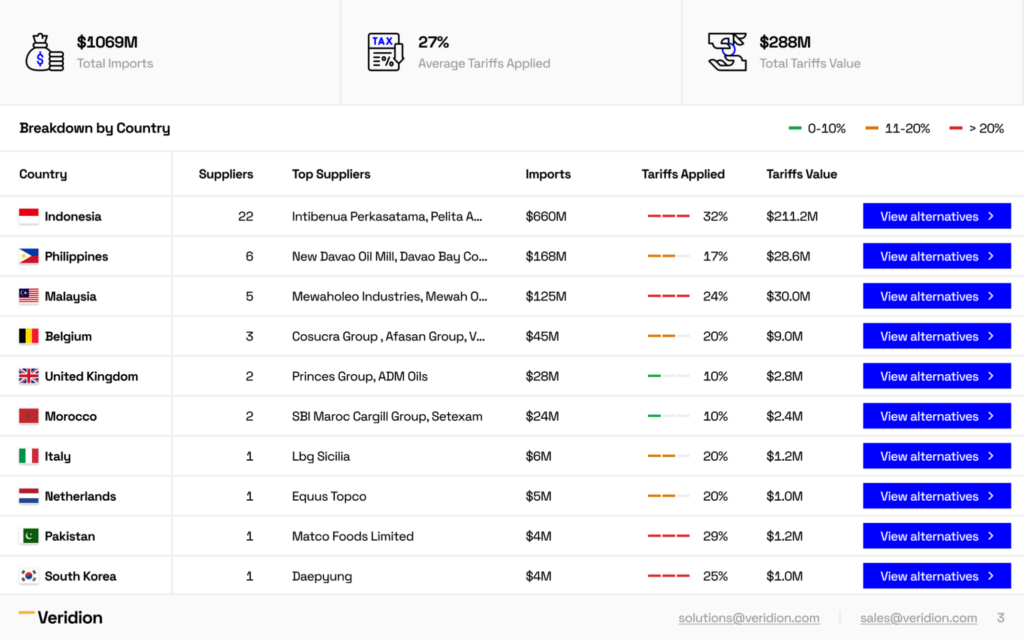

Veridion can help you create Data-Driven Tariff Exposure Reports to evaluate how different suppliers and products are affected by tariff changes and to calculate the cost implications of continuing or adjusting these relationships.

The result?

A clear, real-time view of which supplier relationships are most vulnerable—and where there’s room to pivot.

With Veridion you can simulate scenarios, compare options, and make informed adjustments before disruptions escalate.

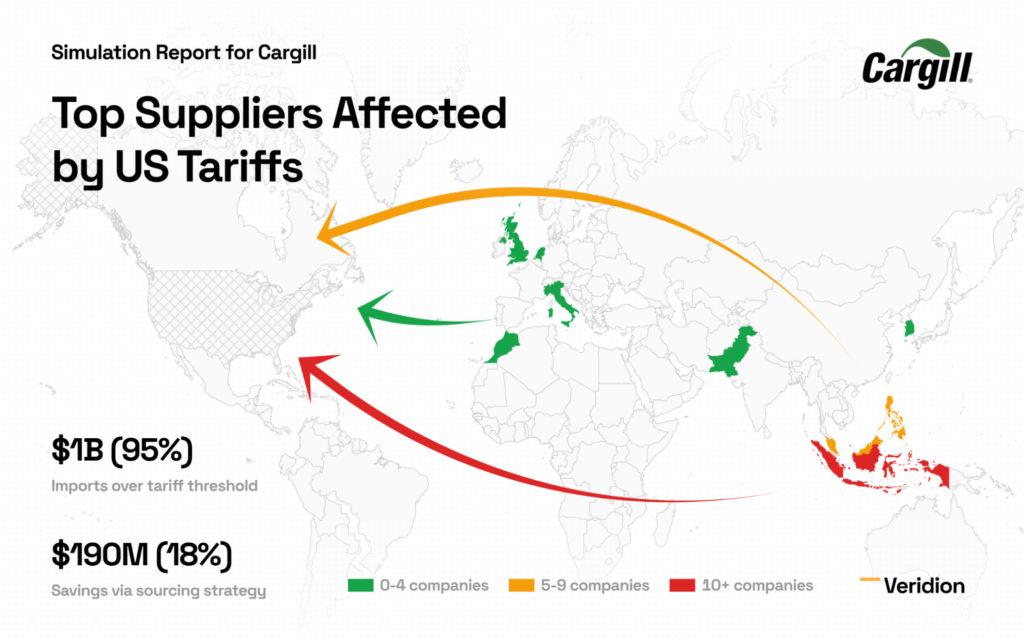

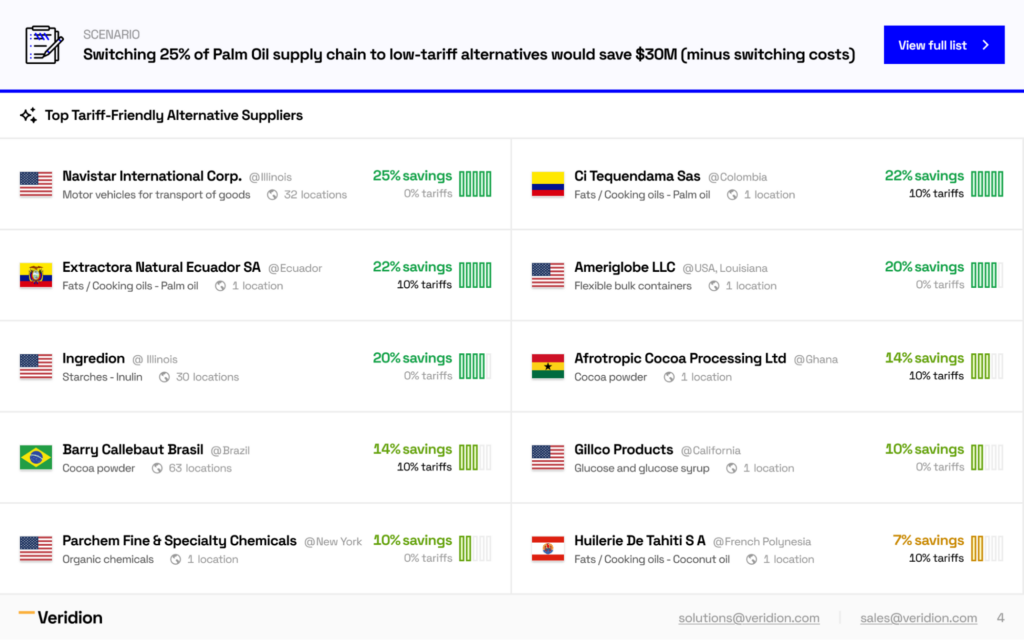

In our simulation report for Cargill, we analyzed the top countries based on the number of suppliers and identified top products based on import value, assessing the direct impact of tariffs on these imports.

We also considered scenarios where alternative suppliers, either in the U.S. or in countries with lower tariffs, are identified for these key products.

By evaluating potential alternatives, we can quantify potential cost savings and strategically minimize tariff exposure.

Importantly, even amid trade policy chaos, you cannot afford to ignore the growing importance of ESG and risk metrics.

While it may seem secondary in a turbulent market, ESG is increasingly becoming a regulatory and financial priority.

Governments are enacting sweeping disclosure mandates like CS3D and CBAM, which require companies to report site-specific ESG data—from emissions to labor practices.

Moreover, sustainable sourcing is beneficial from an environmental standpoint and serves as a risk mitigation strategy.

Suppliers with strong sustainability practices are better prepared to comply with regulations and withstand disruptions.

A recent study showed that 62% of companies with advanced sustainability programs experienced fewer supply chain disruptions.

Our All-in-One Solution for ESG Performance Evaluation offers substantial strategic value in managing tariff exposure by integrating sustainability metrics directly into supply chain decisions.

Specifically, companies benefit by:

Tariff turbulence is now an integral part of the global trading landscape, but companies can proactively manage these risks.

By leveraging Veridion’s comprehensive data solutions, businesses gain clarity, agility, and resilience.

They protect immediate financial interests and position themselves strategically for sustained competitive advantage in a dynamic market environment.

Ready to explore how Veridion can support your sourcing strategy?

Let’s talk. → Contact Us