6 Steps for Managing Regional Third Party Risks

Key Takeaways:

Your procurement team did everything by the book.

Vendors went through rigorous vetting, contracts were negotiated and signed, and performance reviews happen regularly.

Then, a flood hits Southeast Asia, and three critical suppliers go offline simultaneously.

When you investigate, you discover they all operate in the same industrial zone, a concentration risk nobody caught during assessment.

This kind of scenario plays out more often than it should.

Geography isn’t just another field in your vendor database. It fundamentally determines whether your suppliers can deliver when regional disruptions strike.

Here are six steps for managing regional third-party risks across your vendor network.

The first step is identifying where each supplier and distributor operates.

This might sound like common sense, but in reality, most organizations only track where their partners’ headquarters are located.

You need the complete picture, including facility locations, sourcing origins, and shipping routes.

Why?

Because risk exposure varies dramatically by geography due to factors like regulatory environments, political stability, labor laws, and climate hazards.

These regional factors shape a vendor’s risk profile before you even look at their financials or operational metrics.

And research conducted by PwC confirms this sentiment.

Illustration: Veridion / Quote: PwC

Without this visibility, you can’t understand what fails when a provider fails.

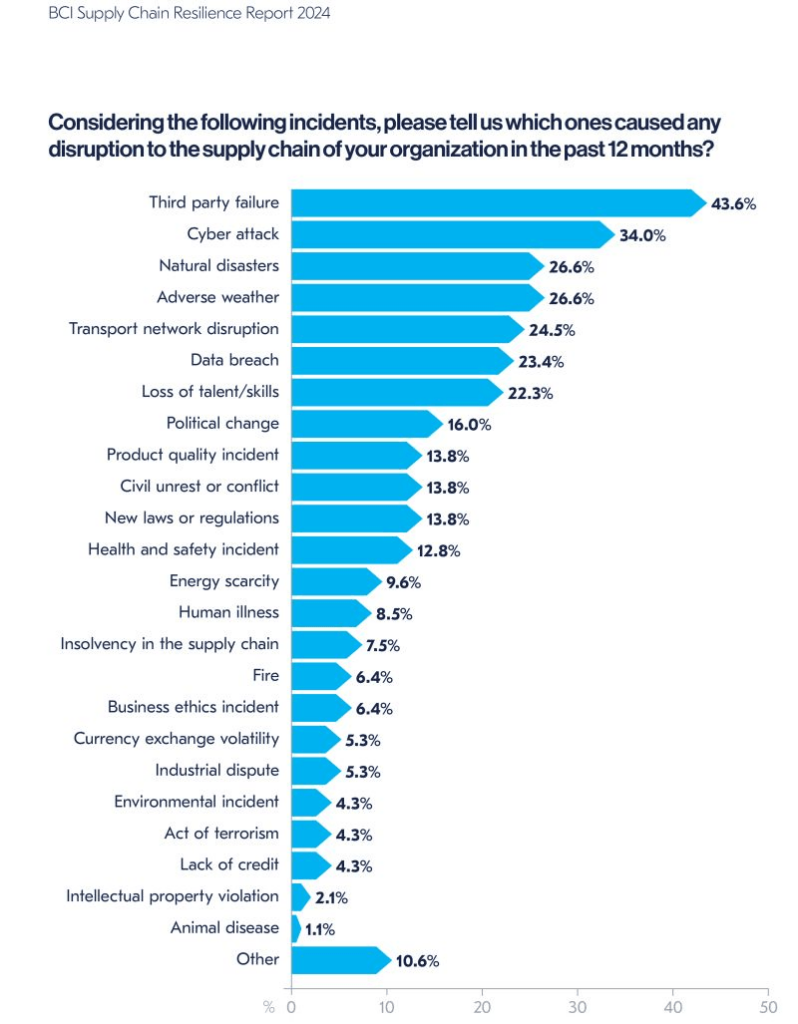

The BCI’s 2024 Supply Chain Resilience Report found that disruptions primarily originate within the first two tiers of supply chains, with extreme weather events ranking among the leading causes.

Source: BCI

But organizations lacking visibility into supplier locations can’t anticipate which vendors face such shared regional threats.

Conversely, accurate regional mapping ensures you know which third parties are tied to which regional vulnerabilities.

Ultimately, this knowledge lets you prioritize oversight accordingly.

When multiple critical vendors operate in the same industrial zone, a single regional event is enough to disrupt your entire operation.

Sure, one facility fire might be manageable.

But widespread power outages affecting your manufacturing as a whole represent a completely different problem.

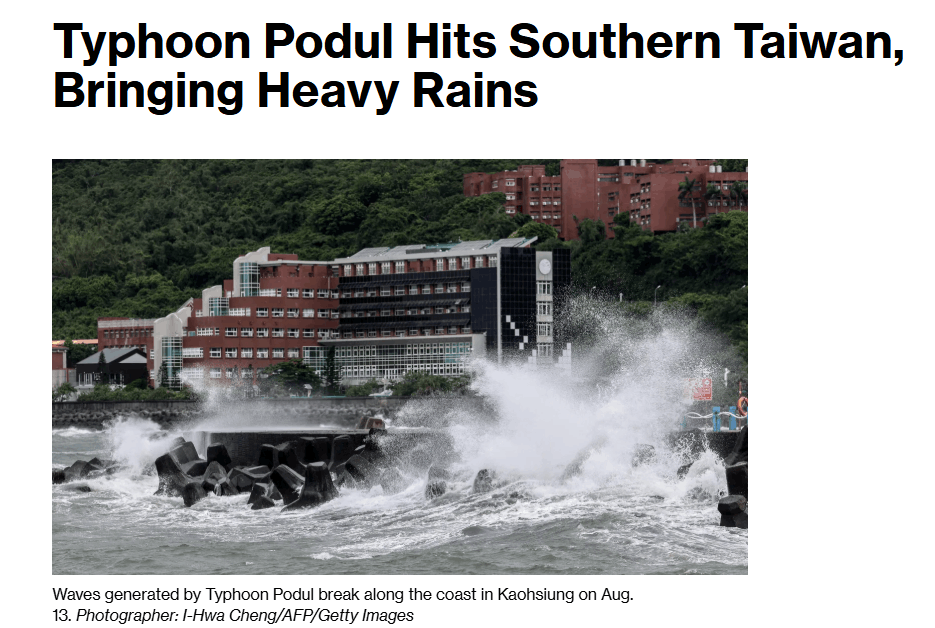

Take Taiwan’s semiconductor manufacturers as an example.

They can face both drought risks that directly impact production because chip manufacturing requires vast amounts of water, but also torrential rainfall due to typhoons.

Source: Bloomberg

For organizations that depend on manufacturers in these regions, not knowing exactly where facilities are located, or whether they fall within the affected area, turns environmental risk into a business continuity issue.

What might seem like a localized climate concern can quickly escalate into production delays, supply shortages, and operational downtime.

That is why thoroughly mapping where third parties actually operate, and not just where they are headquartered, is the essential first step for protecting your business continuity.

You can’t meaningfully assess regional risk until you make sure the underlying supplier data is reliable.

Many organizations misjudge risk severity based on outdated vendor addresses, missing facility information, or incorrect corporate structures.

As a result, most procurement teams discover their vendor database quality falls short only after a disruption exposes the gaps.

For instance, your records might show a supplier’s registered address in a low-risk region while their actual operations are run from a high-risk zone.

But the challenge extends beyond basic contact information.

Corporate ownership structures change through acquisitions, mergers, or restructuring.

In other words, that vendor you vetted two years ago might now be a subsidiary of a company facing sanctions.

The worst part is, scenarios like that are not uncommon.

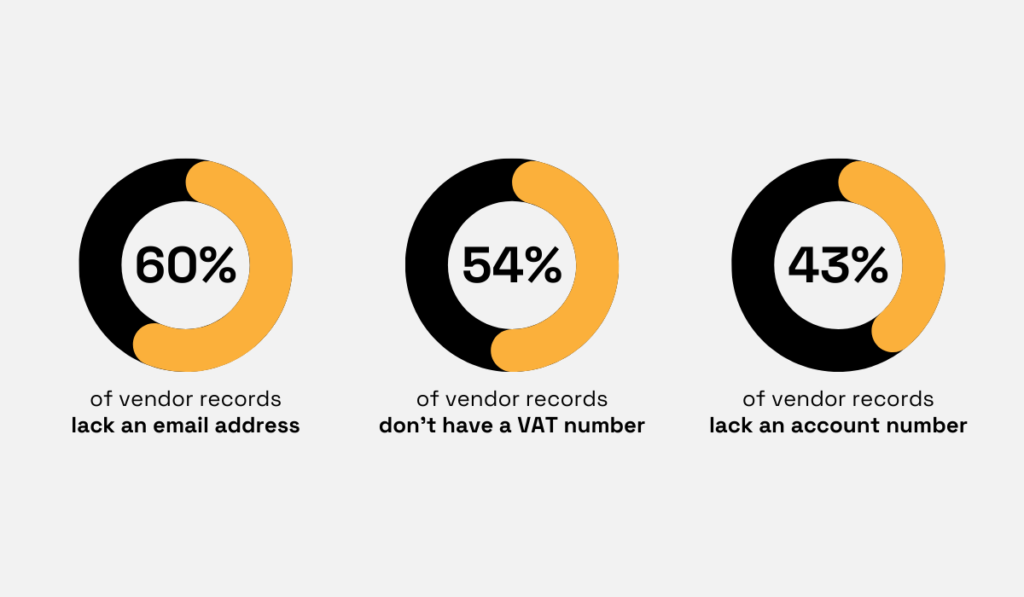

Transparent’s analysis of 9.6 million vendors globally found that 60% of vendor records at average companies lack email addresses, 54% are missing VAT numbers, and 43% don’t have a bank account number.

Illustration: Veridion / Data: Transparent Global

It would be wrong to assume that these are just minor administrative details.

In reality, they’re critical data points required for meaningful risk assessment and compliance verification.

Therefore, data verification needs to happen continuously, not just during initial onboarding.

Why?

Because vendors expand into new regions, shift manufacturing to different facilities, and change their operational footprint regularly.

So, data can become stale within months, and keeping track of vendors across different categories requires systems that can handle the scale and complexity.

This is an issue that Veridion can help with.

Our platform provides continuously refreshed vendor intelligence that includes data points such as precise locations, ownership links, operational details, and global business identifiers.

The platform delivers over 320 data points per company profile, with data refreshed on a weekly basis.

This means you’re making all your decisions based on the freshest, most up-to-date information available.

Source: Veridion

This data freshness is critical.

Fraudsters and bad actors often exploit time gaps between data updates to create short-lived shell entities that slip through initial checks.

Near real-time updates ensure those windows of opportunity disappear.

Every region has its own data protection laws, operational standards, tax rules, and reporting obligations.

Failing to understand these local regulations can lead to penalties or operational disruptions.

For instance, the EU’s GDPR imposes strict requirements on data handling that don’t apply in other regions.

California’s CCPA, on the other hand, creates different obligations than federal U.S. standards.

And China’s data localization laws require certain information to stay within national borders.

These aren’t minor compliance details. There are fundamental differences in how businesses must operate.

This means that a vendor meeting all requirements in their home country might violate regulations when serving customers in another jurisdiction.

Recent regulatory trends show increasing complexity that organizations have no choice but to adapt to.

Kory Fong, VP of engineering at Private AI in Toronto, understands that well.

He explains:

Illustration: Veridion / Quote: CIO

Considering that third-party relationships don’t absolve organizations of their compliance responsibilities, this might be a smart move.

Fong goes on to explain that the company’s system is set up in such a way that adjusting policies as regulations change is easy:

“To stay ahead of new regulations, we prioritize proactive privacy engineering and continuous monitoring of regulatory developments worldwide. Our technology is designed to flexibly adapt to different definitions of personal information, and we invest heavily in partnerships with legal and compliance experts across regions.”

Industry-specific regulations add another layer.

Healthcare vendors must navigate HIPAA in the United States, but face different health data regulations in the EU.

Likewise, financial services vendors deal with varying anti-money laundering requirements across different banking jurisdictions.

Assessing compliance maturity shouldn’t feel abstract.

Think about it from a practical, day-to-day perspective. If a vendor says they’re licensed to operate in a region, ask to see the actual license.

Then take a few minutes to check it against the issuing authority’s public website to confirm it’s valid and up to date.

This simple step often catches expired or misaligned approvals.

Taken together, these regional differences make regulatory evaluation a critical part of third-party risk management.

Understanding where and how requirements change helps organizations avoid compliance gaps and reduce the risk of legal, financial, or reputational consequences.

Currency volatility, political changes, trade restrictions, or sanctions can significantly impact vendor reliability.

Therefore, procurement teams should evaluate vendors’ exposure to these macro conditions and determine whether contingency plans exist.

The Geopolitical Risk Index reached elevated levels in 2024.

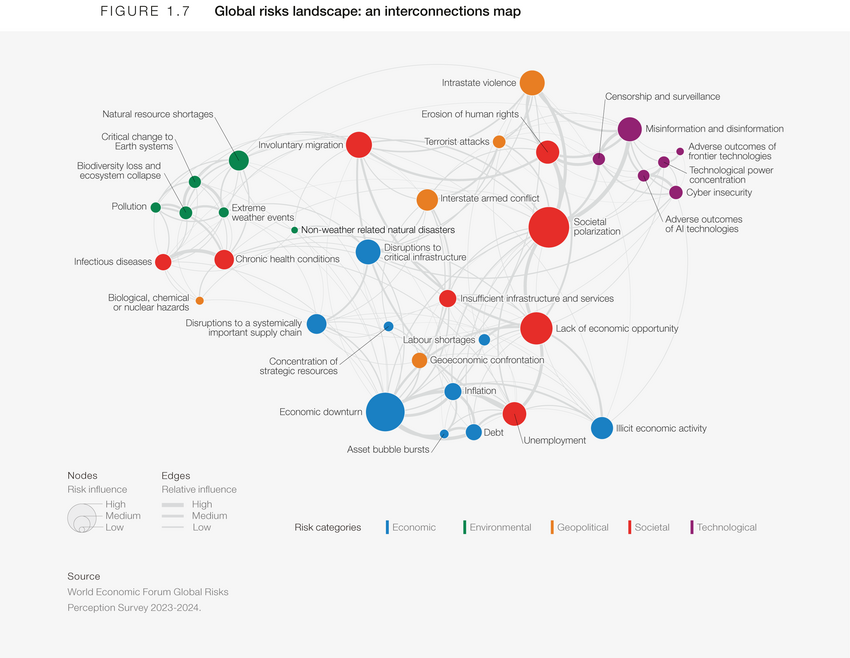

On top of that, the World Economic Forum report shows that Interstate armed conflict entered the top 10 global risk rankings for the first time in recent years.

And, according to the same report, specific flashpoints could absorb focus and split resources of major powers, degrading global security and destabilizing financial systems and supply chains.

It’s important to keep in mind that these global risks don’t exist in isolation.

They are interconnected in ways that can amplify their impact.

The visual below illustrates just that:

Source: World Economic Forum

But what does this have to do with your third parties?

Well, a vendor you work with might have strong financials and excellent operational controls, yet face disruptions from factors completely outside their management.

That is why assessing the local geopolitical stability helps prevent supply chain disruptions driven by external regional shifts.

To do this in practice, procurement teams should start by monitoring a small set of reliable geopolitical indicators for each vendor’s operating region.

Source: Veridion

This can include government travel advisories, trade policy updates, sanctions announcements, and currency stability reports.

Reviewing these sources on a regular basis helps identify early warning signs before disruptions occur.

The next step is to understand how prepared vendors are for sudden regional changes.

Ask vendors simple, direct questions: what happens if a border closes, a tariff is introduced, or a local currency drops sharply?

Vendors that can clearly explain alternative sourcing options or backup operating locations are typically better positioned to withstand geopolitical shocks.

The importance of assessing how well a third party can function during region-specific disruptions like power outages, transportation bottlenecks, labor strikes, or natural disasters can’t be overstated.

Understanding a vendor’s local infrastructure, alternate operating sites, and emergency response capabilities helps determine how quickly they can recover during shocks.

Recent flooding in Valencia, Spain, demonstrated this reality.

Over a year’s worth of rain fell in eight hours during October 2024, devastating infrastructure and causing extensive property damage.

Businesses had minimal warning, and those without resilience plans faced extended shutdowns.

Source: European Union, Copernicus Sentinel-3 imagery

Events like this show why reviewing a vendor’s regional operational resilience is not optional, but this review needs to be structured and practical.

Begin by understanding how dependent a vendor is on a single location or system.

Ask whether production, storage, or service delivery relies on one facility, one power source, or one transportation route.

Vendors should be able to identify backup facilities, alternative logistics routes, or inventory buffers and explain how quickly they can switch to them.

Next, assess whether these contingency plans have been tested.

Vendors that regularly run continuity or disaster recovery tests tend to recover faster than those relying on informal plans.

Documenting recovery timelines and fallback options allows procurement teams to compare resilience across regions and identify concentration risks before disruptions occur.

Knowing the local infrastructure of a vendor implies information about their backup operating locations.

The capacity to respond to an emergency depends on local resources and institutional capacity by region.

There are regions where disaster response systems are well-established and their communication procedures are clear and quick in terms of resource mobilization.

Other ones do not have coordinated emergency infrastructure, prolonging the response to disaster recovery.

These realities highlight a clear disconnect between where risks occur and how well they are managed.

Regional operational resilience is not just about identifying potential disruptions, but about understanding whether vendors can continue operating when those disruptions happen.

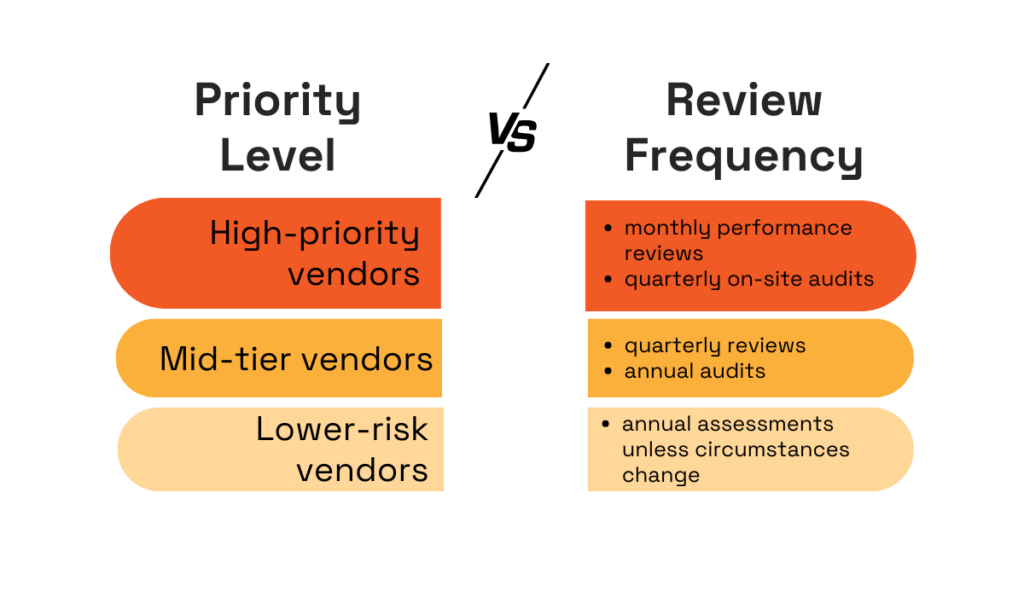

Not all third parties require the same level of oversight. Vendors in high-risk regions may need more frequent checks, performance reporting, or compliance audits.

Encouraging teams to define monitoring tiers based on geographic exposure ensures resources are allocated where risks are highest, improving efficiency and resilience.

High-priority vendors might require monthly performance reviews, quarterly on-site audits, and continuous monitoring of news and regulatory developments affecting their region.

Mid-tier vendors, on the other hand, could undergo quarterly reviews with annual audits.

Lastly, lower-risk vendors might only need annual assessments unless circumstances change.

Source: Veridion

The monitoring intensity should reflect both regional risk and vendor criticality to your operations.

For instance, a vendor providing non-critical services in a high-risk region needs more monitoring than the same vendor in a stable region, but less than a critical vendor in the same high-risk location.

According to research on TPRM trends, continuous monitoring took center stage in 2024 as organizations recognized that point-in-time assessments miss emerging risks.

Real-time monitoring tools can provide early alerts about problems developing in supply chains, giving organizations time to make changes before severe issues develop.

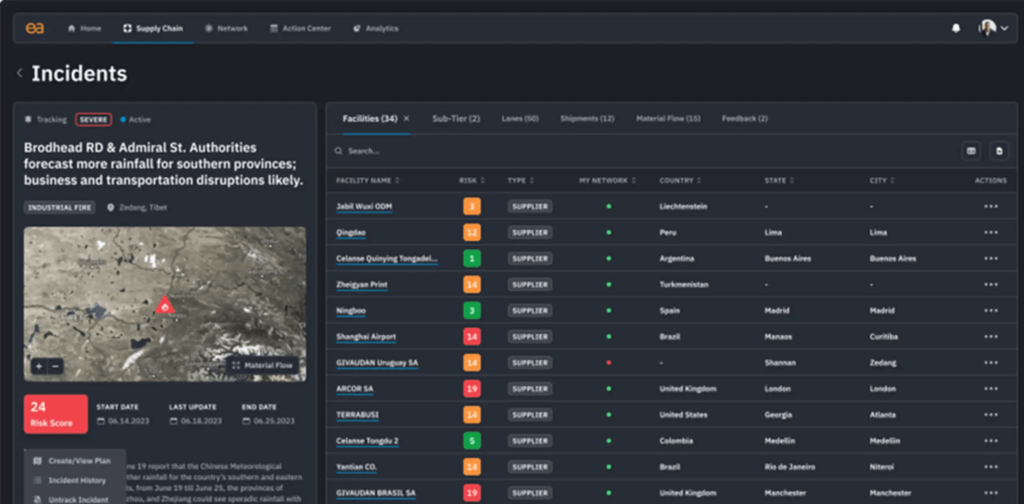

Take Everstream Analytics’ monitoring platform as an example.

The system tracks global disruptions across 220 countries and matches them against your specific vendor locations and materials.

So, when a typhoon hits Taiwan, for instance, you don’t just get a news headline. You get an alert identifying which of your suppliers operate in the affected region, which materials might be delayed, and which alternative suppliers could fill the gap.

The key benefit is filtering.

Instead of sorting through 50 daily headlines about Asian disruptions, the tool shows you the three incidents that actually affect your supply chain, giving you exactly the information needed to act.

Source: Everstream Analytics

Regional monitoring can be explained as the tracking of both the performance of vendors and the conditions of the region.

The political changes, economic changes, weather, and infrastructure conditions are all indicators of possible disruption in advance.

But, according to the BCI report from 2024, future risks extend well beyond that:

“This year’s top supply chain risks also include civil unrest/conflicts, human and animal illnesses, industrial disputes, supply chain insolvency, product quality, environmental incidents, and new laws and regulations. All these issues were flagged as the greatest concerns for practitioners over the coming five years.“

A practical way to monitor regional risks is to establish automated regional event alerts.

Start by identifying trusted news sources, government advisories, and industry bulletins relevant to each vendor’s location.

Use a monitoring tool or dashboard to track events such as extreme weather, political unrest, or regulatory changes.

And make sure to configure the system to flag incidents immediately, so your team can assess potential impacts quickly.

Pair these alerts with a simple escalation plan: define who reviews the alert, how they evaluate vendor exposure, and how findings are communicated to decision-makers.

This approach ensures you’re not reacting to crises but responding proactively, based on real-time regional intelligence.

The third-party risk profiles are shaped by regional factors in a manner that is not restricted to vendor-specific evaluations.

Geography determines regulatory requirements, political risks, operational risks, and recovery ease.

The six steps identified offer a systematic way of knowing and dealing with regional third-party risks.

Companies that incorporate the study of regional risks into the management of third parties end up with a clear picture of the focal points of vulnerabilities.

They are also able to respond more quickly to regional interference and develop a stronger supply chain.

So, arm your teams with systems that improve the efficiency and accuracy of data, and your vendor management practices will constitute a proactive line of defense that can save you.