Understanding SMBs digital footprint for better business underwriting

Find suppliers across any category or industry with advanced filtering, real-time search capabilities, and weekly data updates.

We love our data, and now that you're here, you're one step closer to loving it too.

A wide sample of data, so you can explore what is possible with our data

Choose ->

built with procurement in mind. Focused on manufacturers, products and more

Choose ->

built with insurance in mind. Focused on classifications, business activity tags and more

Choose ->

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

Choose ->

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Choose ->

A wide sample of data, so you can explore what is possible with our data

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Keep up to date with our technology, what our clients are doing and get interesting monthly market insights.

Can a deep understanding of a business’s digital footprint solve the classification problem that causes billions in losses in industries like insurance and lending? At Soleadify, we think it can.

Let’s start by defining the terms and understanding the numbers.

A digital footprint is the sum of a business’ online activities and external mentions. Any content that you can find online related to a brand or a legal entity makes up that company’s digital footprint.

According to the Consumer Federation of America, 60% of businesses may be misclassified.

Commercial insurance is one of the business lines that can tap into value-creating opportunities by leveraging SMB digital footprint data.

According to our records, there are around 25 million SMBs in the US alone (SMBs with a minimum digital presence). Dealing with high volumes of quote requests can be challenging from an underwriting point of view. By looking into a business’s digital footprint, underwrites can access crucial firmographic data and accelerate the quote-to-bind process.

With the current industry standards, insurance carriers have to deal a lot with patchy classifications for businesses, leading to premium leakage worth billions of dollars every year ( 4.5 billion premium leakage just in commercial property, according to Verisk).

On top of that, small businesses often change and pivot their main activities. This type of material changes add an extra layer of complexity to this already complex problem.

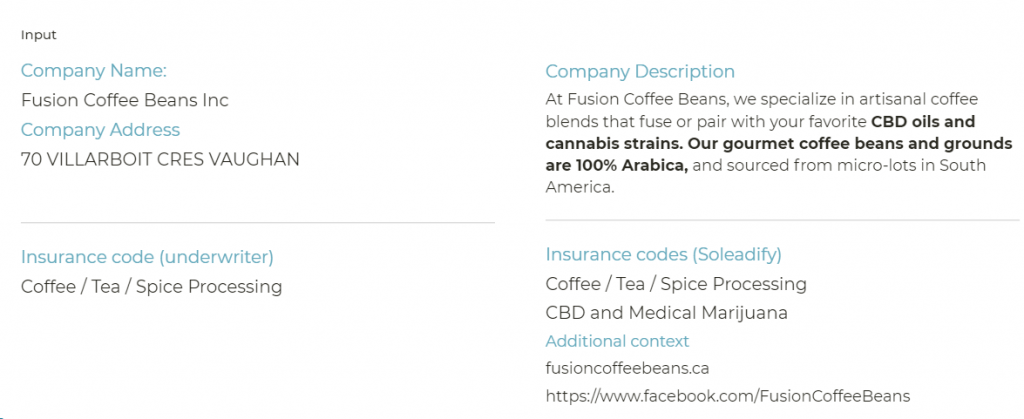

By taking advantage of digital footprint data, insurers can mitigate the risk of misclassification and get a clear view of a company profile. By extracting and analyzing the data found on the company website, social media pages, and other digital sources, insurers can better picture a business’s principal activities and classify them with high accuracy and granularity.

An easy-to-understand example can be businesses that work under classification codes with relatively low risks and sell products that fall under high-risk categories.

One particular example from our database is this coffee shop that, at first glance, can be classified with the “Coffee/Tea/ Spice processing” insurance code. More in-depth text analysis reveals that they are selling Marijuana and CBD products.

ESG standards are slowly becoming a norm in risk assessment, but in the SMB space, there’s low coverage for ESG data.

Given that ESG is a complex domain and most SMBs don’t have the resources to research the topics that should concern them, AI plays a significant role in lowering the barrier to entry for SMBs. Through analysis of a business’s digital footprint, AI algorithms can classify firms with a high level of granularity and identify key sustainable business activities, policies, and discussions about a company, subsequently classifying them into their respective ESG dimensions and topics.

Insurance carriers can use digital footprint data to automatically generate and validate quotes to lower the operational overhead and associated costs of providing commercial insurance for small companies. These improvements can easily translate to increased conversion rates in the quote-to-bind funnel and more accurately priced policies.

You can check out the following case study to find out how a large Canadian commercial insurance company uses Soleadify data enrichment API to validate insurance quotes automatically.

AI can make considerable contributions to assessing challenges in the insurance industry. With a capacity to account for exponentially more data points than human underwriters, AI will take over more of this space as our capability to create complex models evolves.Achieving such a feat, however, requires these models to be trained. That requires vast amounts of data.

Soleadify not only has 50+ data points on companies from all around the world but also tracks weekly changes in the business landscape. That means that 70M companies x 50 data points would be 70M companies x 50 data points x 52 (weeks in a year) → tonnes of data to fine-tune the future models.

Understanding a company’s tech stack is the first step in assessing cyber security risk. In-depth technology profiles can be built by just looking at a website’s source code and extracting the snippets of code that indicate what web frameworks, plugins, and tools are used on that website.

Underwriters dealing with cyber insurance policies need a clear picture of a company’s technographic data to ask the right questions and identify the key factors that can influence premium prices and the policyholder’s risk profile.

As you might expect, collecting the digital footprint data for all the use cases listed above would require a lot of resources and expertise, and that’s what we do @Soleadify.

We are on the path to building the search engine for business data, with coverage for over 70 million companies with 50+ data points for each of those companies.

If you want to learn more about how we collect SMB data at scale, you can check out this FAQ page about our data collecting methodology.

Acces to in depth data collected from a company’s digital footprint can be the stepping stone for the next generation of commercial insurers. By leveraging this type of data, insurance companies can build seamless quote-to-bind experiences and serve customers at scale with minimum risks.

Building the framework for this kind of end-to-end experiences is quite a difficult challenge. But in the long run it will make the difference between the players that lead the market and the ones that struggle to survive.

Let’s discover together how Soleadify’s data can help your company streamline commercial insurance underwriting.