Underwriting Data Analytics: A Guide

Key Takeaways:

When people think about underwriting, many still picture time-consuming manual reviews and stacks of paperwork.

But they are overlooking a major revolution happening right now.

With advanced data analytics in the mix, underwriting has completely transformed, becoming faster, smarter, and more accurate than ever before.

In this article, we take you inside this transformation, explaining exactly what underwriting data analytics is, how it’s being used, and the best practices to keep in mind when implementing it.

Let’s get started.

Data analytics is significantly transforming the insurance industry as a whole, and underwriting is no exception.

Compiling and interpreting data from diverse sources, analytics enables underwriters to make decisions that are faster, smarter, and more evidence-based.

These data sources typically fall into three categories:

| Structured data | Numeric or categorical information such as credit scores, age, income, and past claims |

| Unstructured data | Text, images, emails, social media content, and documents such as medical records |

| External data | Public records, market trends, weather data, IoT sensor outputs, telematics (for auto insurance), and online behavior |

Using these inputs, underwriters can build a rich risk profile, complete with factors like age, claims history, and more, to accurately estimate the likelihood of a claim and determine premium levels.

Compared with traditional underwriting, which is often slow, paper-heavy, and prone to errors, data-driven underwriting offers a new level of accuracy, efficiency, and even cost savings.

That’s because it’s powered by advanced technologies that automatically gather, clean, and interpret massive amounts of data.

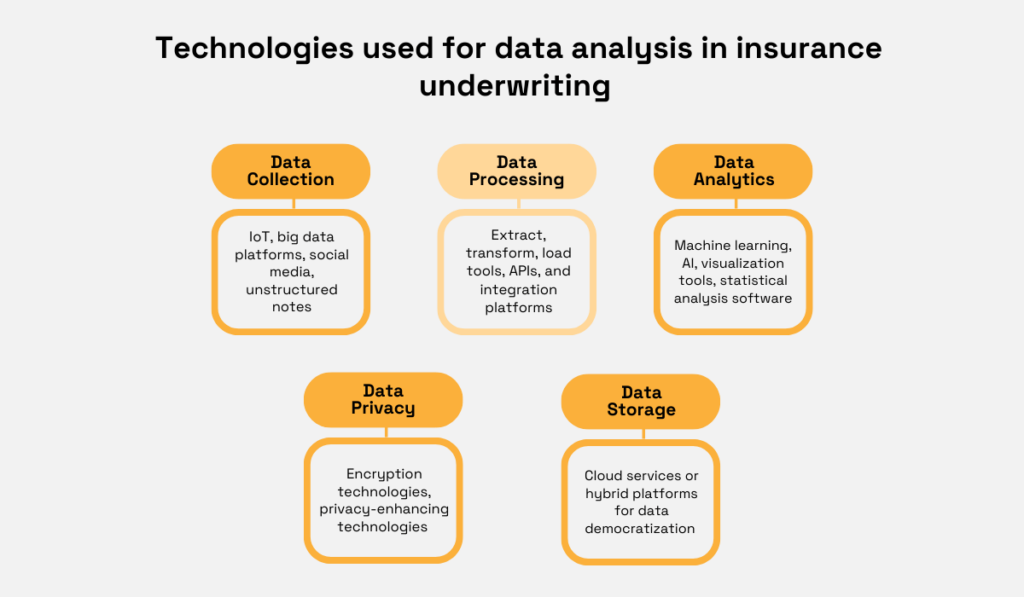

This includes:

Illustration: Veridion / Data: Intellias

Each of these adds its own layer of insight, but together, they form an interconnected system that fundamentally reshapes how underwriters work.

A single application may draw on dozens of data points, each evaluated against years of historical information and processed by systems designed to improve their accuracy over time.

It’s the kind of insight traditional underwriting processes simply weren’t built to deliver.

Now that you understand what underwriting data analytics is, let’s explore some of its specific benefits.

As mentioned, data analytics aggregates info from a wide range of sources, from claims history, credit scores, and telematics to medical records, weather patterns, and socioeconomic data.

Using machine learning, it then analyzes all these inputs, revealing patterns that would be nearly impossible for humans to spot on their own.

Ultimately, this enables you to build a clearer and more detailed picture of risk.

Scott Logie, Membership Advocate at the Data & Marketing Association UK, highlights just how big an improvement this is:

Illustration: Veridion / Quote: The Fintech Times

So, instead of lumping applicants into broad categories, you can now micro-segment them based on real behaviors and risk signals.

This leads to more accurate pricing, reduced losses, and premiums that more closely reflect true risk.

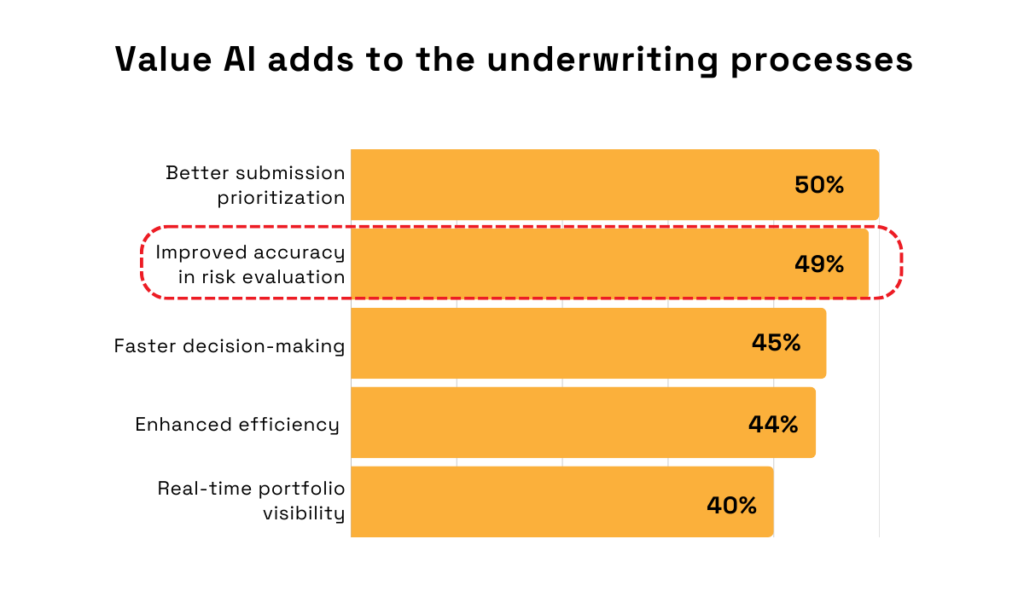

The 2025 Federato survey backs this up, showing that many underwriters agree that AI improves accuracy in risk evaluation.

Illustration: Veridion / Data: Federato

One good example is the growing adoption of AI-powered driver analytics, which helps understand how insureds actually drive.

For this, telematics devices are typically used, which, after being installed in vehicles, track numerous parameters such as speed, distance, location, braking, and cornering.

This data allows insurers to implement usage-based insurance (UBI) programs and price premiums and policies more accurately.

Rashid Galadanci, CEO and co-founder of Driver Technologies, an AI-based mobility tech company, explains:

“[…] insurance companies can now underwrite and classify the risk based on how an individual […] really drives instead of traditional factors like credit scores or motion-only telematics, which miss critical factors like tailgating and traffic sign adherence.”

Put simply, analytics provides underwriters with a full picture.

And when you can finally see the whole picture—not just bits and pieces—you’re far better equipped to judge risk accurately, tailor pricing to customers, and prevent premium leakage.

With data analytics, insurers can compare behaviors across millions of past cases to flag anomalies and identify suspicious connections among applicants, medical providers, or claimants.

That’s great news for your bottom line.

After all, fraud is still one of the biggest cost drivers in insurance, costing companies millions every year.

For instance, Adyen’s research shows that the average cost of a fake claim reaches a shocking £84,000 per incident.

Illustration: Veridion / Data: Adyen

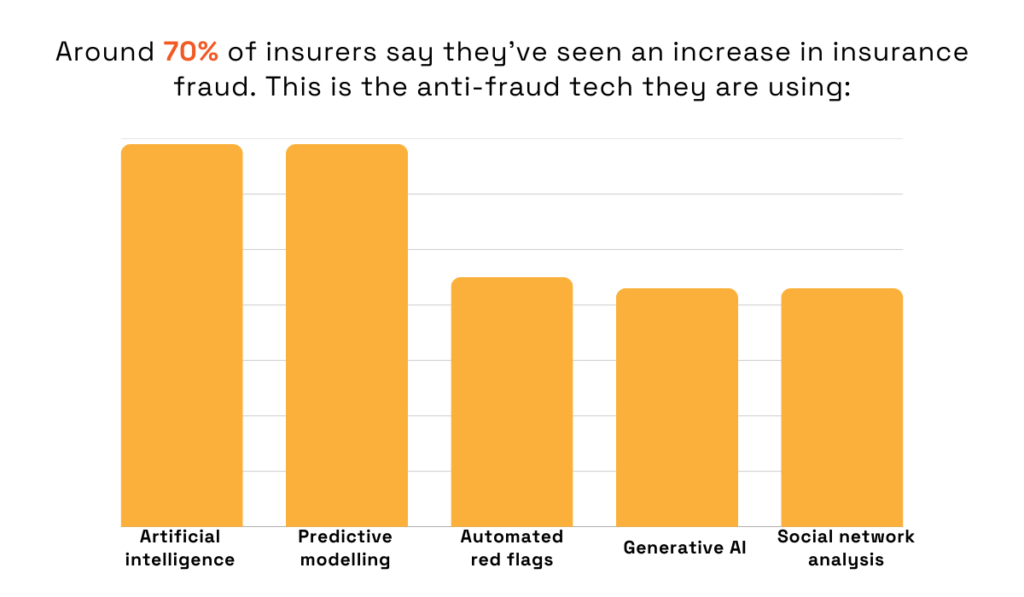

Even more concerning is that fraud appears to be increasing.

According to the Coalition’s 2024 study, most insurers have observed a rise in fraud over the previous three years.

So how are they fighting back?

With artificial intelligence and predictive modeling, the study shows.

Illustration: Veridion / Data: InsuranceFraud

The industry is clearly recognizing that advanced data analytics is among the most effective weapons in the fight against fraud.

By improving detection, it enables a shift from reactive investigations to proactive prevention, flagging potentially fraudulent claims before they are processed.

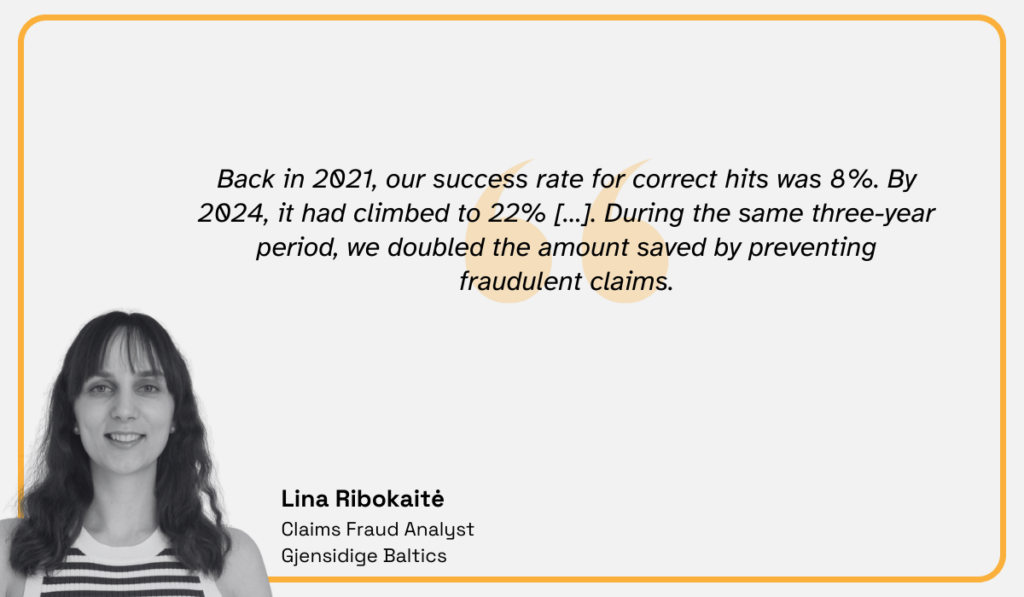

Gjensidige Baltics, a provider of non-life insurance, has seen it firsthand.

In 2021, the company implemented advanced analytics with real-time scoring to create a smarter, more adaptive system capable of identifying suspicious activity as it happens.

The results were amazing. Within three years, fraud detection accuracy soared by 175%.

Lina Ribokaitė, Claims Fraud Analyst at Gjensidige Baltics, commented:

Illustration: Veridion / Quote: SAS

This isn’t just a win for Gjensidige Baltics. It’s a win for insurers everywhere.

It’s proof that data and analytics can turn the tide against fraud, protecting the bottom line in ways that were once unimaginable.

Your customers benefit from underwriting data analytics in two main ways: it makes the process more efficient and more personalized.

According to Nedeljko Kuzmanovic, Partner & Delivery Manager at Vega IT, a software development service provider, this is exactly what modern consumers expect:

Illustration: Veridion / Quote: Vega IT

Historically, insurance companies have been seen as slow-moving and heavily reliant on manual processes.

But today, data analytics allows insurers to streamline workflows, reducing the need for lengthy forms and manual document reviews, while tailoring policies to individual customer needs.

The result is higher customer satisfaction, increased loyalty, and reduced churn.

Take it from a real insurance customer themselves.

AO, one of the UK’s largest electrical retailers, recently installed telematics across its fleet of over 1,000 vehicles to monitor driver performance and unlock more tailored premiums.

Shaun Carter, Regional Manager at AO, explains:

“The [driver] safety score is now a hugely important KPI as it demonstrates the work we’ve done […] – and by proving that score – we can get a discount on insurance premiums too, it’s a win-win.”

The reason they love this approach at AO is that it ensures premiums are truly fair.

They are based on actual driver performance and, more importantly, adjusted to reflect improvements in driving.

This makes AO a very happy customer, and one that is likely to stay with (and even recommend) their insurer for years to come.

If you want to unlock all of these amazing benefits for yourself and your company, be sure to have these best practices in mind during data analytics implementation.

Analytics is only as effective as the data it relies on.

If your data is complete, reliable, current, consistent, and free of major errors or bias, your decisions will reflect that.

But if not, your analytics system may cause more harm than good.

Mike Young, VP of Insurance Industry Growth at the tech transformation specialist, CI&T, agrees:

Illustration: Veridion / Quote: Reinsurance News

That’s why thorough validation of all your data sources is a must.

This includes internal records such as past claims, customer demographics, financial records, and any other data you use.

It also includes external data from third-party sources such as credit reports, social media, and IoT device data.

For external sources, it’s wise to work with data vendors who already have robust validation processes in place, rather than manually checking each source individually.

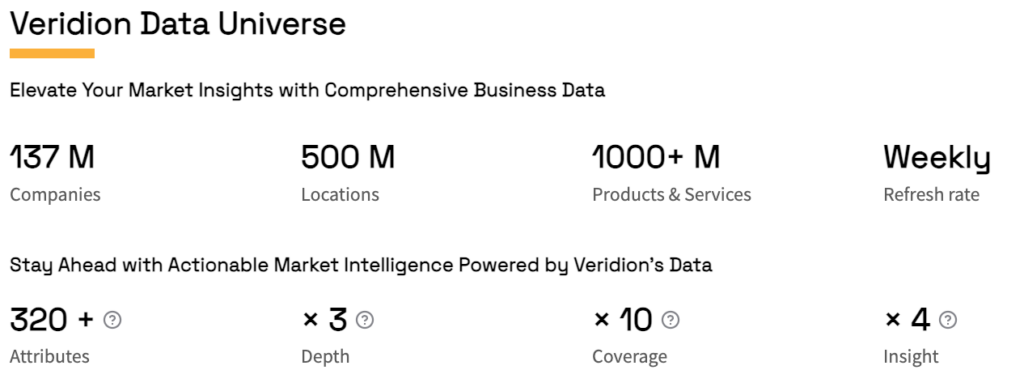

For example, our team at Veridion prides itself on delivering the most accurate, detailed, and fresh commercial insurance data out there.

Source: Veridion

We maintain full end-to-end control of the data pipeline, managing every step from sourcing and extraction to normalization and delivery.

No reliance on external vendors.

Additionally, our database of over 130 million companies is updated weekly, so outdated information is never a concern.

Learn more about how our data can be used here:

Source: Veridion on YouTube

In short, whether pulling from company websites, public registries, regulatory filings, online product catalogs, social profiles, or news outlets, we guarantee exceptional quality.

That’s why underwriters love Veridion.

It empowers them to validate businesses and monitor changes in their risks, ESG performance, financial health, and more with confidence and ease.

Along with accuracy, you should also prioritize the security, confidentiality, and lawful handling of sensitive customer information used during underwriting.

This is often easier said than done, though, as insurers need to navigate multiple regulatory frameworks simultaneously, including, for instance:

Despite the challenges, compliance is non-negotiable.

Misusing personal data can trigger huge fines, lawsuits, and other kinds of damage that are difficult to fix later.

Arzoo Wadhvaniya, Analyst at Info-Tech Research Group, a global IT research and advisory firm, warns:

Illustration: Veridion / Quote: Reinsurance News

In other words, it’s not just money at stake, but the company’s long-term success.

So, what’s the solution?

A strong data governance framework.

That means clearly defining:

for data management.

With these in place, errors are minimized, and compliance becomes part of your company’s DNA.

Everyone knows what data is collected, why it’s collected, where it’s stored, and who is responsible for it.

Matt McGivern, Managing Director, Enterprise Data & AI Governance Leader at the consultancy Protiviti, hits the nail on the head:

“Too many of our clients call data an asset without treating it like any other asset. No company would have a financial asset on their books that they didn’t know the definition, the number of, the location for, or how it was being accessed or leveraged.”

So, start treating your data like the valuable asset it is.

Gather, store, analyze, and manage it carefully, and you’ll safeguard your company against noncompliance and its potentially severe consequences.

Underwriting analytics leverages some highly advanced technologies, but these tools should support—not replace—underwriting professionals.

Dina Tarantola-Froner, Chief Underwriting Officer at International Medical Group (IMG), a company specializing in international health and travel insurance, explains:

Illustration: Veridion / Quote: ITIJ

While AI can provide underwriters with useful information, it cannot interpret or act on that information with the nuance and judgment of a seasoned underwriter.

This is especially true in high-value or unusual cases.

The goal, therefore, is to establish a hybrid model where data-driven insights and human judgment complement each other.

One way to achieve this is by implementing Human-in-the-Loop (HITL) processes.

HITL is an industry-standard approach that keeps humans actively involved in decision-making, working alongside AI to guide, correct, govern, or approve AI outputs.

Designing effective HITL systems typically involves:

| Defining Intervention Points | Clearly identify when and where humans should intervene, establish appropriate thresholds, and flag exceptions |

| Ensuring Understandable Outputs | AI outputs should not only be accurate but also interpretable and genuinely useful for human reviewers |

| Creating Robust Feedback Loops | Implement mechanisms for humans to provide feedback, enabling continuous model improvement and more reliable AI performance |

In the end, advanced data analytics offer significant benefits, but we are still far from a point where they can fully replace human judgment.

This is where our underwriters come in, bringing expertise, experience, and a uniquely human perspective to the process.

In the end, there’s no denying that data analytics is taking underwriting to an entirely new level.

It’s automating repetitive, manual tasks while delivering powerful insights that support more precise decision-making.

It’s definitely a significant upgrade!

But even with all this progress, the heart of underwriting hasn’t changed. At its core, it’s still about people, judgment, and real-world experience.

AI can detect patterns and highlight insights, but it can’t replace the human ability to interpret context or see beyond the numbers.

So use data analytics to its fullest and let it elevate your work, but keep human expertise at the center.

When strong analytics and skilled underwriters come together, that’s when decisions improve, risks are assessed more effectively, and stakeholders get the best outcomes.