5 Key Benefits of Underwriting Data Analytics

Key Takeaways:

Is your team struggling to balance speed with accurate risk assessments?

Traditional, manual checks often leave underwriters laboring through outdated information, causing unnecessary delays and leaving gaps in your data.

If you want to modernize your underwriting process, you are in the right place.

We will explore how leveraging advanced data analytics can fundamentally change your underwriting strategy for the better.

For professional underwriters, precision is everything.

In essence, much of what these teams do when evaluating a potential client is analyzing data, whether the goal is to insure a small local business or assess risk for a loan application for a multinational corporation.

However, with the massive amount of information available today, achieving that precision manually is becoming impossible.

This is where sophisticated data analytics tools and practices become essential.

They allow underwriters to cut through the noise and focus on the details that truly matter for accurate coverage.

As Srinu Kalyan, CEO at Selectsys, a leading provider of insurance processing and technology services, explains, analyzing historical claims data is a huge part of this approach.

Illustration: Veridion / Quote: Insurance Journal

By looking at past data, algorithms can recognize specific patterns that a human might miss.

For example, they can identify risk correlations between specific business activities and the frequency of claims in certain geographic areas.

Techniques like these, however, are just scratching the surface of what is possible today.

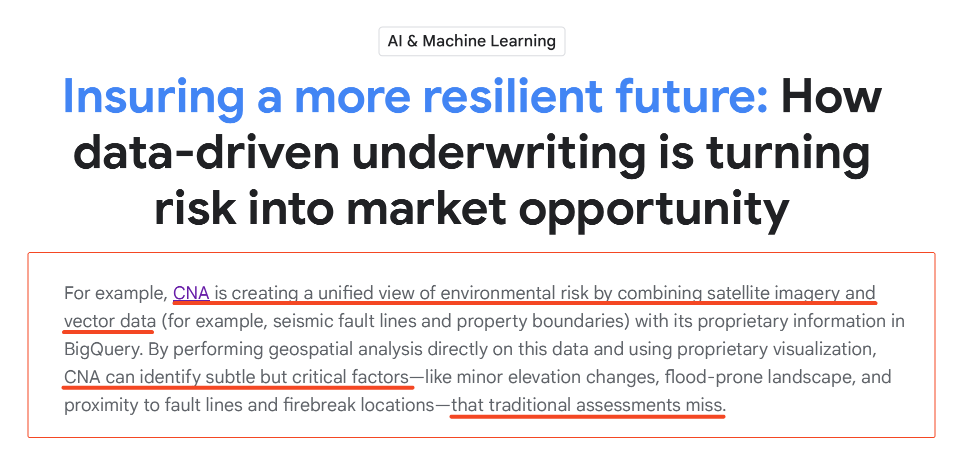

Consider the case study of CNA, a major commercial insurer.

They are currently assessing incredibly subtle environmental risk factors using data from satellite imagery and vector data.

Source: Google

In fact, the industry trend is moving heavily toward incorporating alternative data sources like these into risk evaluation processes.

This approach allows underwriters to build risk profiles that account for far more than basic demographic details or the information provided on an application form.

If you are building risk profiles for commercial clients, this could mean using specialized data engines like Veridion.

With its business data enrichment service, Veridion can help underwriters get more context on business profiles, including their industry classification, current size, specific operations, and risk signals with far greater confidence.

Source: Veridion on YouTube

The process is straightforward but powerful.

Veridion maintains a massive database of over 130 million companies.

Our Match & Enrich service adds fresh, up-to-date data to your existing company profiles, offering upwards of 320 attributes per profile.

This data is sourced from the entire internet and passes through proprietary AI and ML algorithms to ensure it is verified and always current.

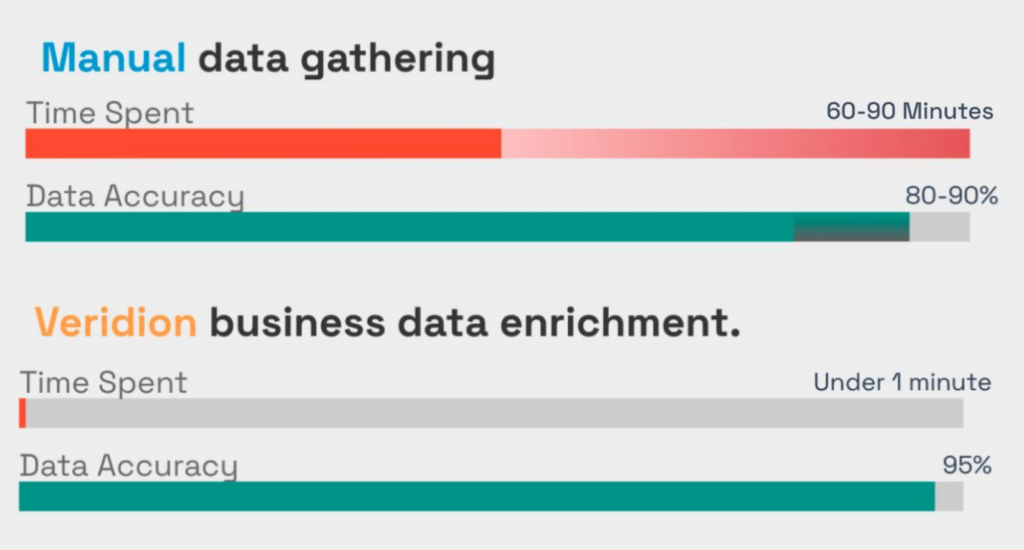

Plus, risk assessments utilizing this type of data enrichment are significantly more efficient than relying on a manual approach.

Source: Veridion

With this tool, you can input specific underwriting risks and scan a company’s website and other digital resources to pinpoint them in seconds.

The combination of comprehensive data coverage, automated enrichment, and continuous updates means underwriters can make decisions based on current, verified information.

Data analytics goes far beyond simply providing more accurate insights for your underwriting decisions.

In fact, one of the most immediate benefits of adopting analytics tools is how greatly they can speed up the entire process.

This increase in speed is much needed when we consider that current workloads for underwriting teams can be extensive and quite complex.

David Heard, a business mentor and former VP of personal lines and agency at Chubb, elaborates on this specific point.

He explains that underwriters are required to make many important decisions on a daily basis.

To do this, they effectively have to sift through a lot of data, which takes time and mental energy.

Illustration: Veridion / Quote: Chubb

That task becomes even more difficult when talking about underwriting with regard to risk exposure for low-frequency and high-severity events, such as natural disasters.

In these cases, underwriters have to rely heavily on their expertise on the matter.

But to avoid tying up professionals in manual data review, the right analytics systems are crucial.

They help speed up the assessments by centralizing all data and instantly modeling various outcomes based on historical information.

This gives the underwriter a solid foundation to work from immediately.

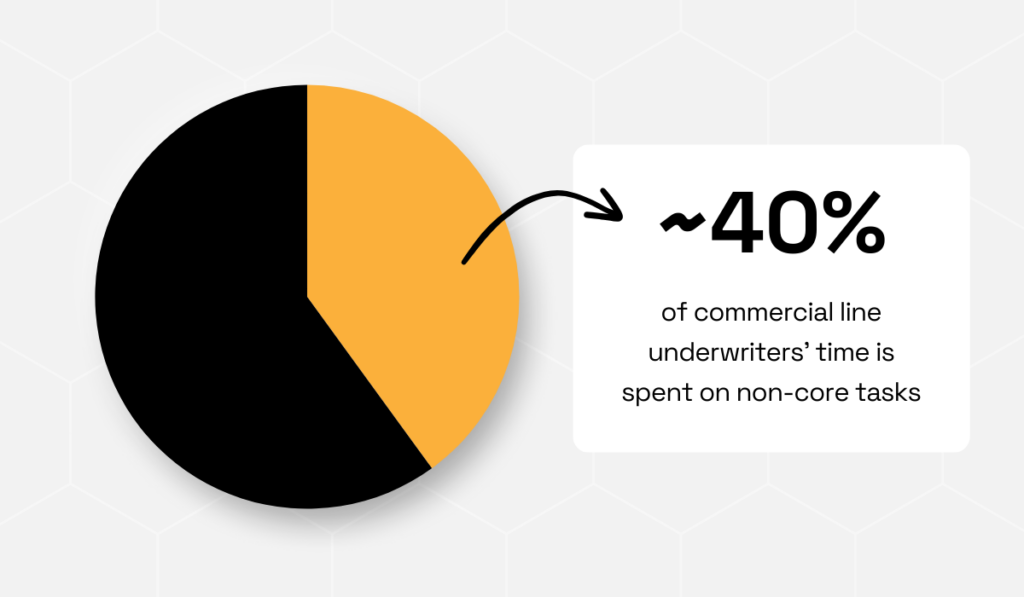

The potential efficiency gains become even higher when you consider that a large percentage of underwriters spend a significant amount of time on non-core tasks.

Illustration: Veridion / Data: Risk and Insurance

Data analytics aims to lessen this workload.

This includes aiding with tedious processes like data extraction, data cleansing, and validation, or even providing initial scoring.

Plus, advanced analytics enables “touchless” underwriting for simple cases where the system automatically gathers data, scores the risk, and issues a policy in seconds.

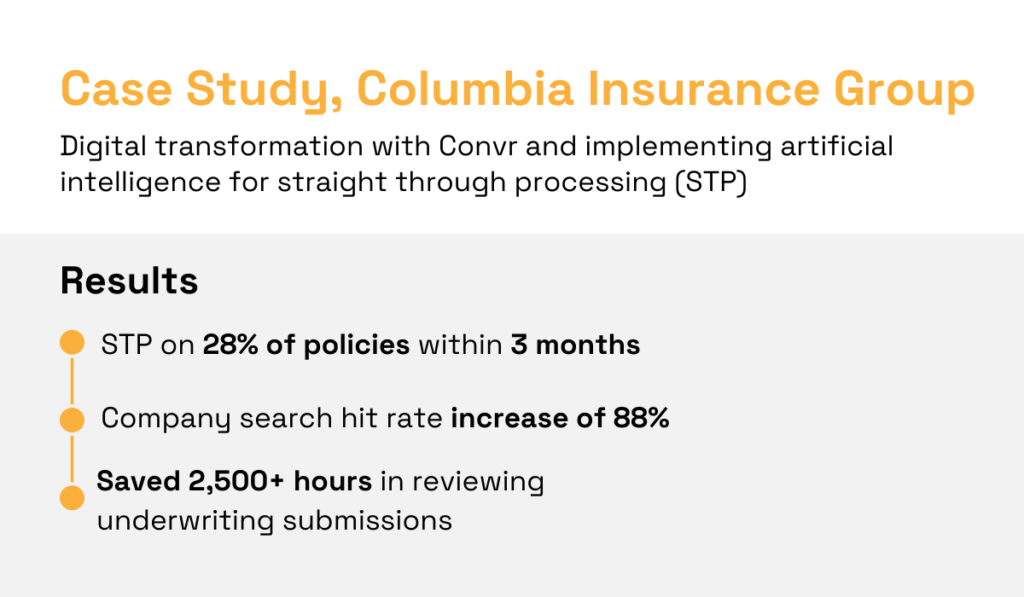

Consider the following case study of Columbia Insurance Group to see this in action.

Illustration: Veridion / Data: Convr

Using Convr, an AI underwriting and analytics workbench, this company achieved straight-through processing on a third of its policies.

Beyond their massive resulting company hit rate, they also saved thousands of hours in review time for their underwriters.

To summarize, when underwriting efficiency increases this dramatically, the benefits ripple throughout the entire organization.

Teams can handle higher volumes without adding headcount, and turnaround times can shrink from days to hours or minutes.

As you might expect, the efficiency gains we just discussed usually translate directly into significant cost savings.

After all, automating your underwriting operations and ensuring better data accuracy frees up a substantial amount of your team’s time.

Instead of reworking assessment report mistakes and letting a backlog of cases pile up, your underwriters can handle more cases in less time.

Also, reliable automation allows you to cut down on the costs associated with external labor, often hired just to handle manual data entry and verification work.

This isn’t just in theory. Let’s see an example of some tangible benefits.

Take the case of EXL, a data analytics company that aimed to support insurance underwriting by reducing manual effort.

Source: Amazon

Working with Amazon Web Services, they produced a solution called LDS Underwriting Assist, an AI-powered service for processing and evaluating documents with high precision.

By deploying this tool, they drastically reduced the need for human intervention in data extraction.

The results were impressive.

Insurers using this technology were able to save up to 80% of their underwriting costs and speed up their processing times from days to mere hours.

Then there are tools like the EY Document Intelligence platform.

This system combines machine learning, natural language processing (NLP), and computer vision capabilities to tackle unstructured data.

Source: EY

With this platform, various documents can be collected and centralized automatically.

The system processes and analyzes them, aiding the review and interpretation process and removing administrative burden from underwriters almost entirely.

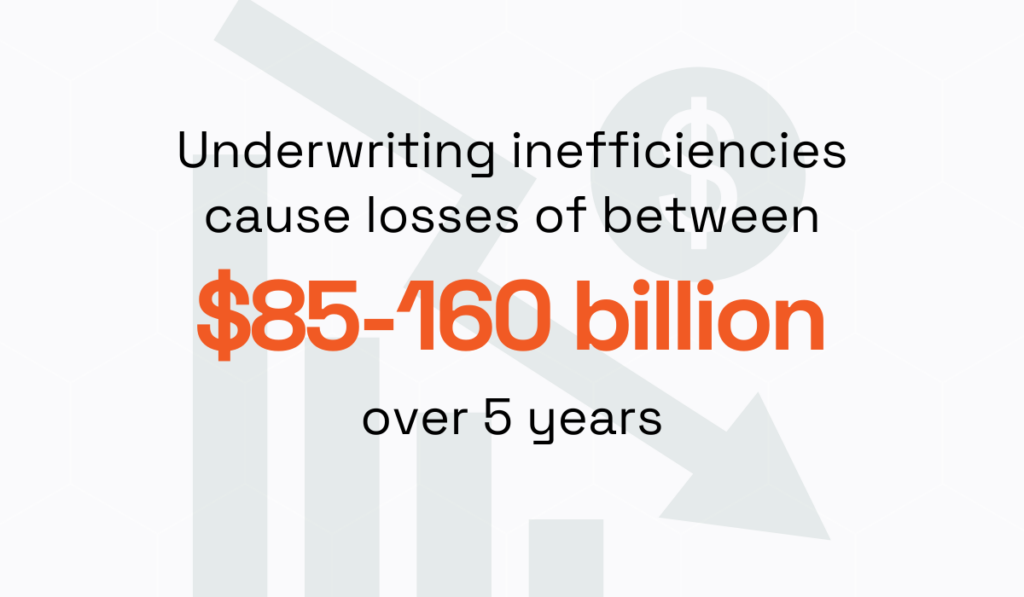

These are amazing tools and results, especially if we consider the fact that inefficiencies can add up to massive costs.

In fact, a 2022 Accenture report predicted that underwriting inefficiencies would cause losses of up to 160 billion dollars over the next five years.

Illustration: Veridion / Data: Accenture

In short, manual processes cost more than most companies realize.

Data analytics prevents these expenses, making the investment cover its own cost through the savings.

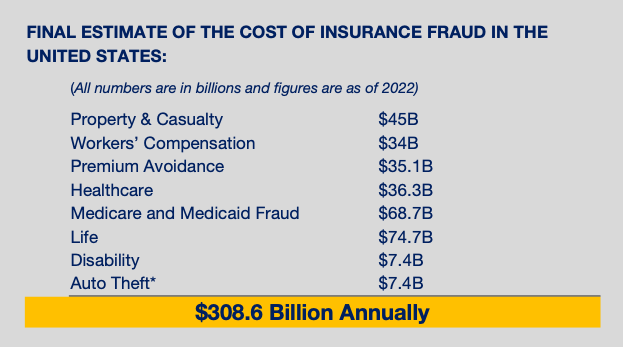

Speaking of operational costs, we must address one of the most significant financial drains on an underwriting business: fraud.

While efficiency saves money on the process side, fraud detection saves money on the payout side.

And the numbers are staggering.

According to data from the Coalition Against Insurance Fraud, the total cost of insurance fraud in the United States alone added up to 308.6 billion USD in 2022.

Source: Coalition Against Insurance Fraud

The best remedy for this issue?

Preventing these fraudulent policies right at the onboarding stage, rather than dealing with them after a claim has already been filed.

Luckily, analytics platforms are now capable of identifying these threats before a policy is ever signed.

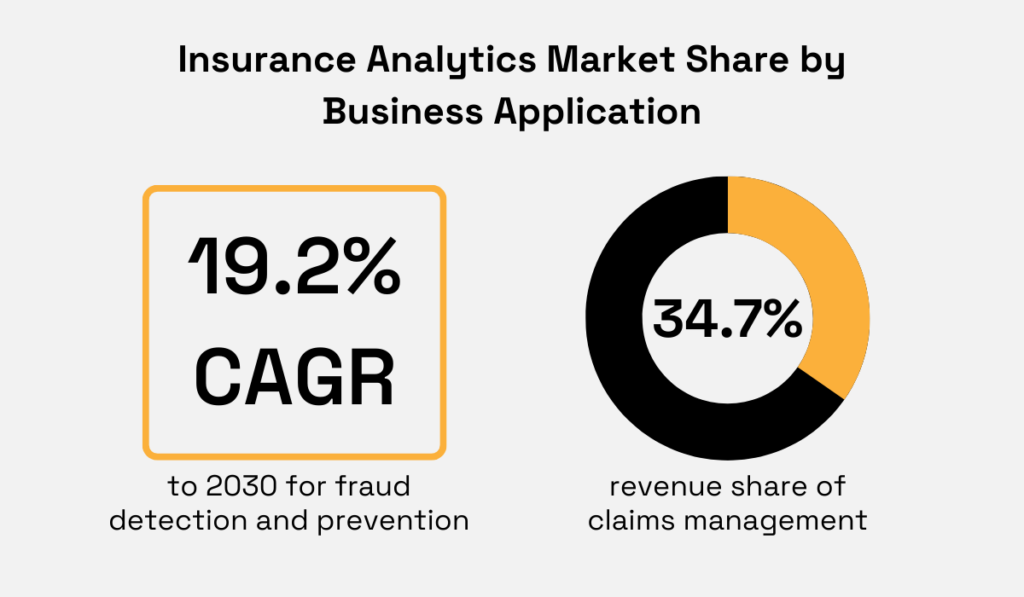

When we look at the market data, it is clear that the industry is responding.

While claims management currently holds a large share of insurance analytics revenue, fraud detection and prevention are rising quickly as top use cases.

In fact, they are projected to grow at a Compound Annual Growth Rate (CAGR) of 19.2% through 2030.

Illustration: Veridion / Data: Mordor Intelligence

This statistic simply means that insurance companies are aggressively investing in analytics technology to stop fraudsters because the return on investment is so high.

For starters, modern analytics platforms can easily detect anomalies in application data and flag them against common fraud indicators and historical data.

That acts as an excellent filter for your underwriting team.

The software can quickly reject obvious bad actors or suspicious applications, leaving your human underwriters with more time to focus on more complex cases.

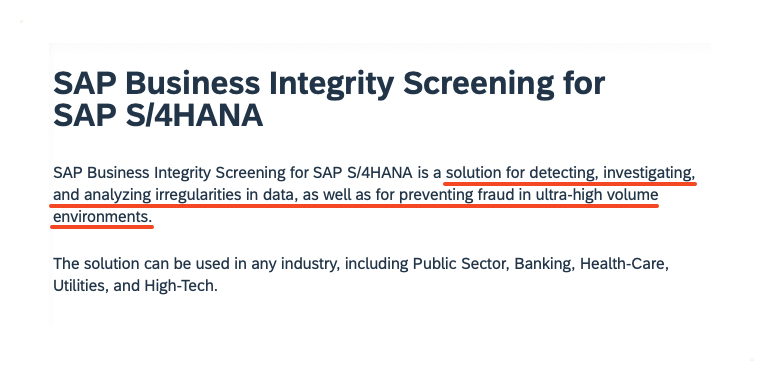

As an example of this technology in action, look at SAP Business Integrity Screening, which is designed for high-volume environments.

Source: SAP

This tool can be used in claims fraud to screen large amounts of real-time or stored data.

It is designed specifically to detect, investigate, and analyze irregularities before they become a problem.

It works by running your data against complex detection strategies, effectively screening business partners and transactions for potential risks.

In short, incorporating data analytics provides a necessary shield for your business.

Finally, beyond speed and cost, advanced analytics systems play a critical role in protecting your business by helping you strictly adhere to industry rules and standards.

As you already know, the underwriting sector is heavily regulated.

Whether you are dealing with commercial loan assessments or complex insurance evaluations, there is a vast web of compliance requirements that must be met for every single policy.

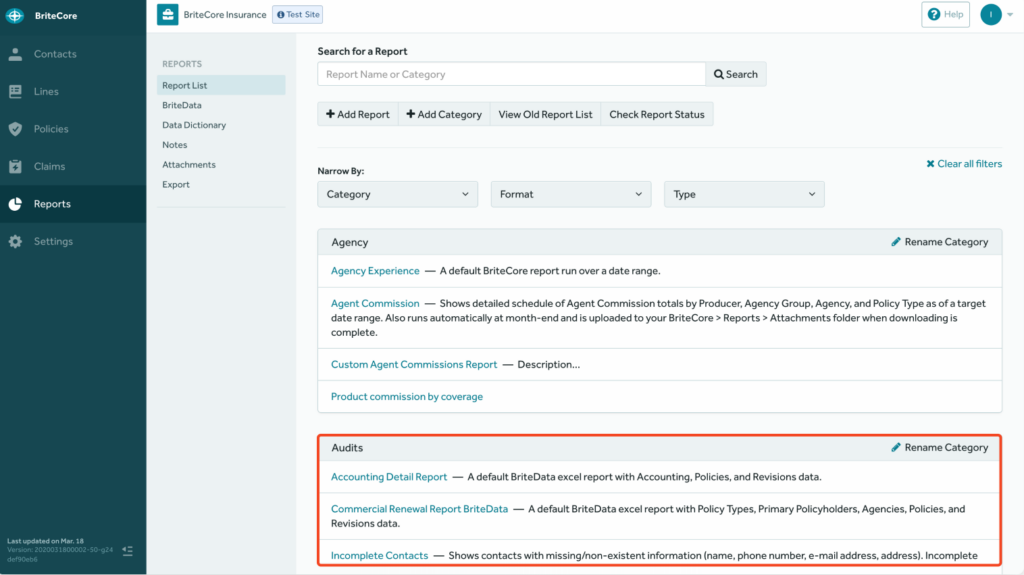

One major way some analytics platforms help is by providing audit-ready reports.

Rather than scrambling to compile data when an auditor arrives, these systems generate comprehensive compliance documents on demand.

Take a look at the image below at how a platform like BriteCore handles reporting.

Source: BriteCore

Plus, by standardizing these reports within these systems, you ensure that every decision your team makes adheres to external regulatory rules and your own internal compliance standards.

After all, when relying on manual checks, it is easy for small deviations to slip through the cracks, potentially leading to accidental non-compliance or inconsistencies.

Automated reporting removes this variable, forcing a consistent application of criteria across the board and reducing the risk of human error.

Plus, most modern analytics systems provide structured documentation trails.

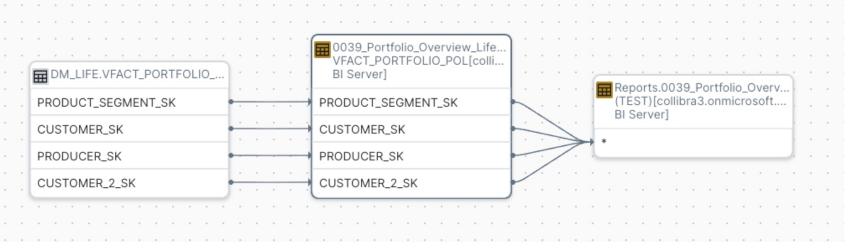

For example, the platform Collibra offers both technical and business data lineage.

Source: Collibra

This capability essentially allows you to visualize the entire history of a dataset, with traceability of data used in risk models or policy decisions.

Plus, it’s incredibly useful during an audit or a regulatory review.

It provides full audit trails for compliance with, e.g., Solvency II or IFRS-17 for insurers.

On top of that, it enables governance of sensitive data, which is crucial when dealing with customer records.

This allows your business to scale and operate with peace of mind, knowing that your regulatory bases are always covered.

That brings us to the end of our article.

We have covered how data analytics can lead to everything from stronger risk assessments, increased efficiency, and cost savings to improved compliance.

Hopefully, you have gained a fresh perspective on optimizing your workflows.

Ultimately, by adopting these insights, your organization can significantly improve its speed and serve clients with greater confidence.