Data Requirements for Underwriting Liability in Shared Commercial Properties

Key Takeaways:

Large insured losses tied to commercial properties are rising, yet the root cause is often not the event itself, but how risk was understood beforehand.

In shared commercial environments, liability exposure is frequently mispriced because underwriting relies on incomplete data.

Accurate liability underwriting depends on knowing what happens where, who shares the space, and how operations actually interact.

This article breaks down the data required to assess that risk correctly.

Liability underwriting in shared commercial properties begins with two foundational inputs:

Together, they determine how external hazards intersect with on-site activity and how liability exposure ultimately accumulates.

But accurate location data goes far beyond an address or ZIP code.

Small spatial differences can change liability exposure materially due to various factors:

When underwriting relies on estimated or generalized locations, these differences are often averaged away.

As a result, risks that behave very differently are priced as if they were the same, creating blind spots in both risk selection and premium adequacy.

This doesn’t happen only in theory.

Research cited by Forbes Insights, based on studies conducted by Perr&Knight, found that the use of imprecise location data led to premium corrections in 5.7% of policies, with 3.8% initially underpriced.

In some cases, correcting the location resulted in premium increases of more than 80%.

Bruce Rogers, former Chief Insights Officer at Forbes Media, sums it up:

Illustration: Veridion / Quote: Forbes

Broader industry data reinforces why this matters.

A 2025 Nationwide survey of commercial property stakeholders found that roughly one-third of property owners nationwide experienced damage from severe weather in the past five years.

That figure rose to more than half in wildfire-prone states and nearly two-thirds in hurricane-risk regions.

Source: Risk&Insurance

Even without naming individual hazards, the data shows that location significantly influences incident frequency and downstream liability outcomes.

Location data alone, however, is not sufficient. Function defines the liability profile of the site.

A manufacturing facility, an R&D laboratory, and an office building may share the same footprint, but they do not carry the same exposure to injury, negligence, or third-party claims.

For example, a fire in a general office environment typically results in temporary displacement and potential injury claims.

The same incident in an R&D laboratory can trigger far more complex liability outcomes, including:

Without accurate functional classification, underwriters may price fundamentally different risks as if they were interchangeable.

Ultimately, precise location and function data ensure that liability models reflect where risk actually sits and what happens on-site.

If location and function explain where risk exists, building intelligence explains how that risk plays out.

For liability underwriting, the physical characteristics of a building shape both the likelihood of incidents and the severity of resulting claims.

Basic structural details, such as building size, number of floors, layout, ceiling height, and access points, help underwriters understand how people, equipment, and operations move through a shared commercial space.

These characteristics shape key drivers of liability exposure, including foot traffic patterns, congestion, equipment density, and the speed and effectiveness of emergency response.

As complexity increases, so does the likelihood that a routine incident escalates into a multi-party event.

Larger or multi-story buildings, in particular, tend to involve:

For example, a slip in a single-story facility may result in a single injury.

The same event in a dense, multi-floor building can involve multiple occupants, delayed access for responders, and a more complex chain of liability.

This is why building intelligence cannot be reduced to square footage alone.

Underwriters need visibility into how a structure actually functions under normal conditions and under stress.

Mary Rieck, principal underwriter for renewable energy and pharmaceuticals at FM, the commercial property insurer, describes their approach:

“We work closely with engineers who provide us with detailed site assessments — what equipment is in use, how it’s maintained, and how resilient it is. They help us understand what could go wrong and how likely it is. I think of underwriting as trying to predict the future.”

That logic applies directly to commercial properties.

Whether a site contains heavy machinery, laboratory equipment, or high-traffic public areas, physical details determine not just what can fail, but how failure spreads.

Moreover, seemingly minor structural features, such as emergency exits, stairwell placement, or internal layout complexity, can materially change the outcome of an incident.

A real-world example illustrates this clearly.

In 2017, a fire at a sports center in Jecheon, South Korea, resulted in 29 deaths and 36 injuries.

Source: The Guardian

Investigators later found that emergency responders were unaware of a rear exit that could have been used to evacuate people trapped on the second floor.

One National Fire Agency official stated:

Illustration: Veridion / Quote: The Korea Times

The lack of clear building knowledge contributed to delayed rescue and a higher loss of life.

From a liability perspective, this lack of building intelligence increases exposure to wrongful death claims, multi-party litigation, and cascading responsibility across owners, operators, and tenants.

Overall, incorporating building-level intelligence into liability underwriting helps ensure that exposure estimates reflect how a property actually functions under stress.

Without building intelligence, risks are often underpriced, and losses feel “unexpected” only because the underlying structure was never fully understood.

Once location, function, and building characteristics are understood, underwriters need to answer another important question:

How much activity is actually happening at this site?

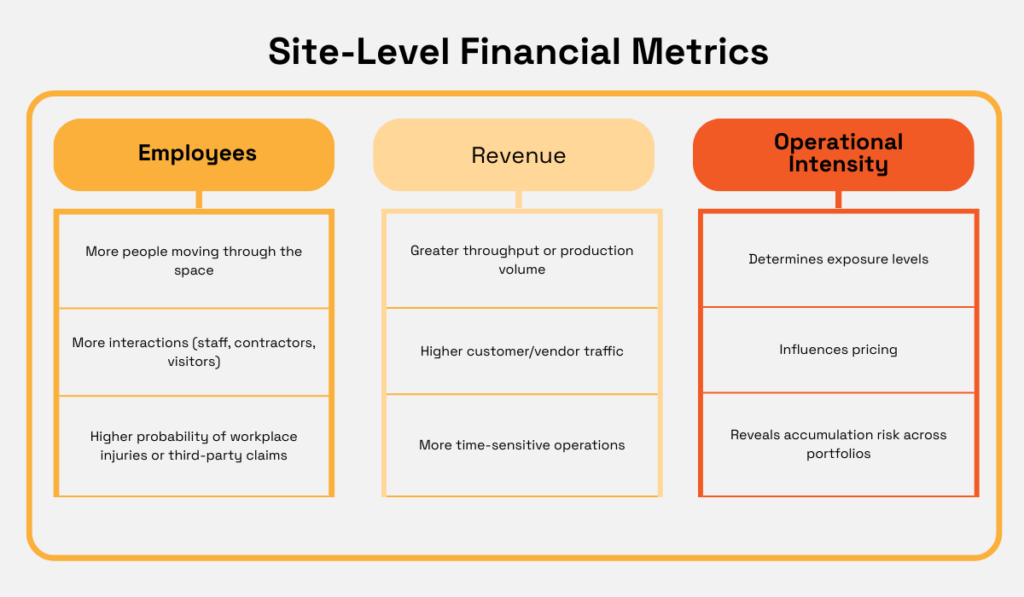

Site-level financial metrics, primarily estimated revenue and employee counts, help underwriters answer this.

They do so by acting as proxies for operational intensity, which strongly influences liability exposure.

More employees generally mean:

Higher site-level revenue can indicate:

Two locations with identical square footage and function can represent very different liability profiles.

A modest warehouse with ten employees may pose limited exposure.

Meanwhile, a high-traffic, around-the-clock facility with hundreds of staff and substantial commercial activity carries significantly greater risk.

Source: Veridion

Without site-level financial context, underwriters often rely on averages.

A facility may be priced as a standard warehouse or office simply because no better data is available, even if it is, in reality, a mission-critical hub supporting a regional or national operation.

When incidents occur at these sites, losses often exceed expectations.

This isn’t because the hazard was unusual, but because operational intensity, and therefore exposure, was underestimated.

This problem compounds at scale.

If underwriting models assume “typical” activity levels across dozens or hundreds of locations, a single regional event, such as a:

can trigger correlated losses that were never priced into the portfolio.

Site-level financial metrics anchor liability assessments in operational and economic reality. They allow underwriters to:

In shared commercial environments, where multiple tenants operate side by side, these metrics are especially important.

Liability exposure is rarely evenly distributed, and site-level financial data helps reveal which tenants or operations are driving risk within the building.

The insured’s risk is rarely isolated in shared commercial properties.

Co-tenancy data identifies who else operates within the same building or immediate footprint, and what activities they perform.

For liability underwriting, this information is essential because one tenant’s operations can materially affect another tenant’s exposure, even when businesses appear unrelated.

For example, a dry-cleaning operation, commercial kitchen, laboratory, or fuel-dependent facility can generate hazards that extend through walls, floors, ventilation systems, or shared infrastructure.

Without this visibility, underwriters may evaluate a tenant as if it operates in isolation, underestimating exposure.

Site-level co-tenancy data enables underwriters to:

Real-world losses show why having this data is important.

In Clayton County, Georgia, an early-morning fire that began in a dry-cleaning business spread through a strip mall, destroying two neighboring businesses and severely damaging a third, despite those tenants having no direct involvement in the fire.

Source: FOX5 Atlanta

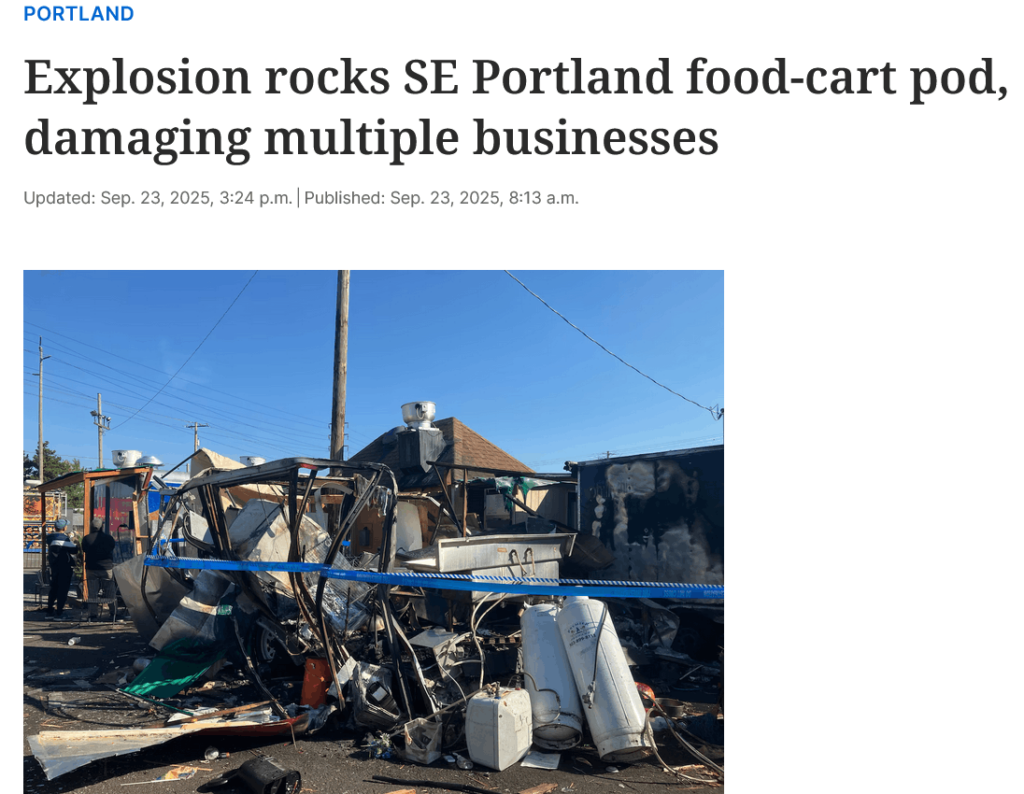

Similarly, in Portland, Oregon, a propane tank explosion at a food-cart pod damaged eight surrounding businesses.

Shops that didn’t use propane themselves still suffered structural damage, broken windows, inventory loss, and business interruption because of their proximity to the source of the incident.

Source: Oregon Live

From an underwriting perspective, these events are predictable outcomes of shared environments.

All in all, incorporating co-tenancy data into liability underwriting is vital.

It ensures that exposure estimates reflect the true operational context, pricing aligns with the combined risk profile of all tenants, and that the accumulation risk is visible before losses occur.

One tenant’s risk is often another’s, making co-tenancy data a critical input for accurate liability underwriting.

You can only price liability accurately if you understand what is happening at each insured location.

In reality, much of that information is missing, outdated, or spread across inconsistent sources.

Veridion, a global business data provider focused on data enrichment for commercial insurance, changes that.

With minimal input, typically a business name and address, Veridion delivers an enriched business profile in seconds, covering up to 60 structured data points per location, worldwide:

Source: Veridion

Veridion consolidates official business registry data with unstructured digital signals such as company websites, news, filings, and job postings.

Proprietary AI validates and connects these sources to reveal how a business actually operates at a specific site.

This directly supports the key liability data requirements:

| Location & function | Veridion identifies the precise location of each site and classifies its true operational function (e.g., office, manufacturing, R&D, logistics). |

| Building intelligence | Where available, Veridion enriches records with physical attributes such as building size, height, number of floors, and occupancy indicators. |

| Site-level financial metrics | AI models infer revenue and employee counts at the location level, helping underwriters understand operational intensity. |

| Co-tenancy & occupancy context | Veridion maps active business locations, including those missing from traditional databases, improving visibility into shared environments. |

Why does this data depth matter?

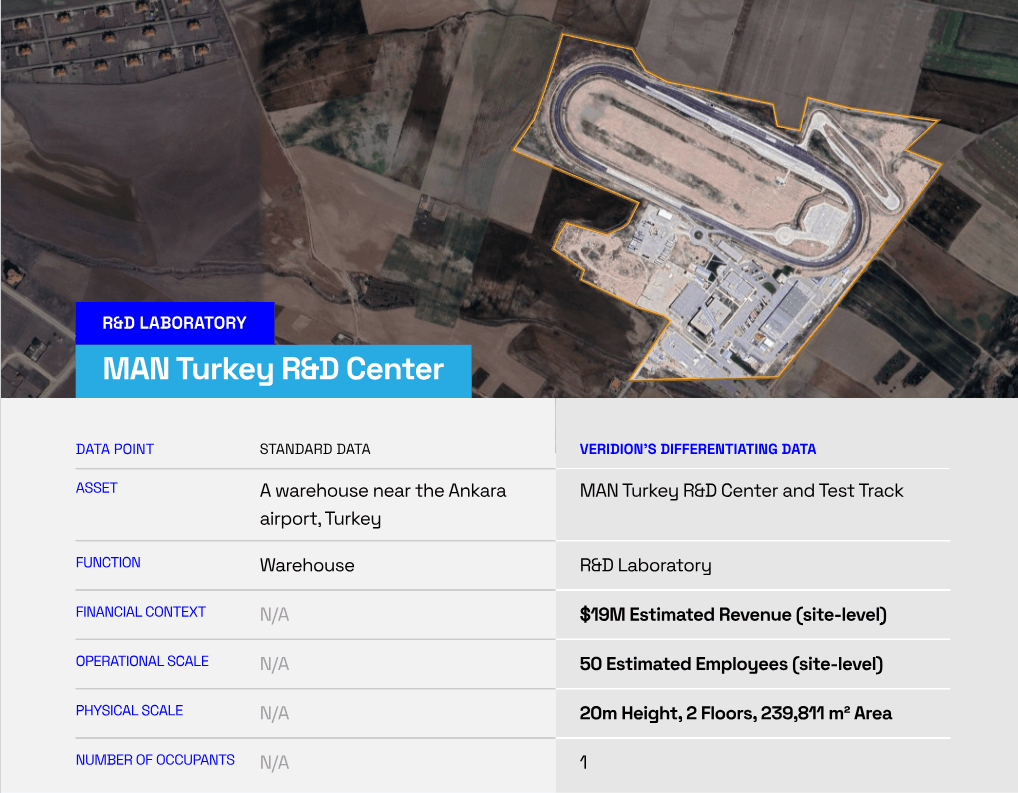

Consider a site located near Ankara Airport in Turkey.

Using standard data sources, this location appears as a generic warehouse, with no financial information, no operational detail, and no indication of strategic importance.

Veridion’s enrichment reveals a very different risk profile:

Source: Veridion

From a liability standpoint, these are entirely different risks.

A generic warehouse would typically be priced as standard property risk, with limited consideration for high-value activity.

In contrast, a mission-critical R&D facility requires:

Misclassifying just one such site can create $15–20 million in uninsured or underpriced exposure. Repeated across a portfolio, these gaps accumulate into systemic volatility.

But accurate liability underwriting requires both depth and speed.

Underwriters need to act quickly without sacrificing accuracy, especially when evaluating large portfolios or complex shared commercial properties.

Veridion’s AI-powered platform makes this possible.

A 2025 technical analysis found that AI-enabled underwriting reduced average decision times from three to five days to just 12.4 minutes, while maintaining 99.3% risk assessment accuracy.

Guillaume Bonnissent, CEO of Quotech and former underwriter, puts it like this:

“The best way to achieve better underwriting results is to improve risk selection and pricing.

You do this by recording all available data and applying both traditional actuarial methods and new data science techniques, essentially artificial intelligence.”

Veridion ensures that the process starts with the right inputs, giving you confidence that liability pricing truly reflects how risk accumulates in shared commercial environments.

Hopefully, we made it clear that underwriting liability in shared commercial properties is only as strong as the data behind it.

When you rely on assumptions, you leave portfolios exposed to hidden risk, unexpected claims, and costly surprises.

By leveraging precise location, verified function, detailed building intelligence, site-level financial metrics, and co-tenancy insights, you get a complete picture of how risk actually accumulates.

But not all data is created equal, so choose your sources carefully.

The right data ensures your underwriting decisions reflect reality, not assumptions, and helps build portfolios that perform when it matters most.