Vendor Risk Assessment Report: The Full Guide

Ever felt like you’re flying blind when choosing or monitoring vendors?

With global supply chains under constant pressure, knowing who you’re working with and what risks they carry is no longer optional.

What’s often missing is a single, standardized document that consolidates those risks into a format that’s easy to compare, track, and act on.

That’s where a vendor risk assessment (VRA) report comes in.

So, let’s explore how these reports give you a clear, structured picture of a supplier’s risk profile so you can make smarter, faster decisions.

A vendor risk assessment report is your organization’s snapshot of a vendor’s risk profile.

It summarizes the findings from a vendor risk assessment and distills them into a format that procurement leaders, IT security teams, and compliance executives can act on.

And the need for it couldn’t be clearer.

Research from Inspectorio shows that 40% of supply chain professionals see resilience as their top concern.

Illustration: Veridion / Data: Inspectorio

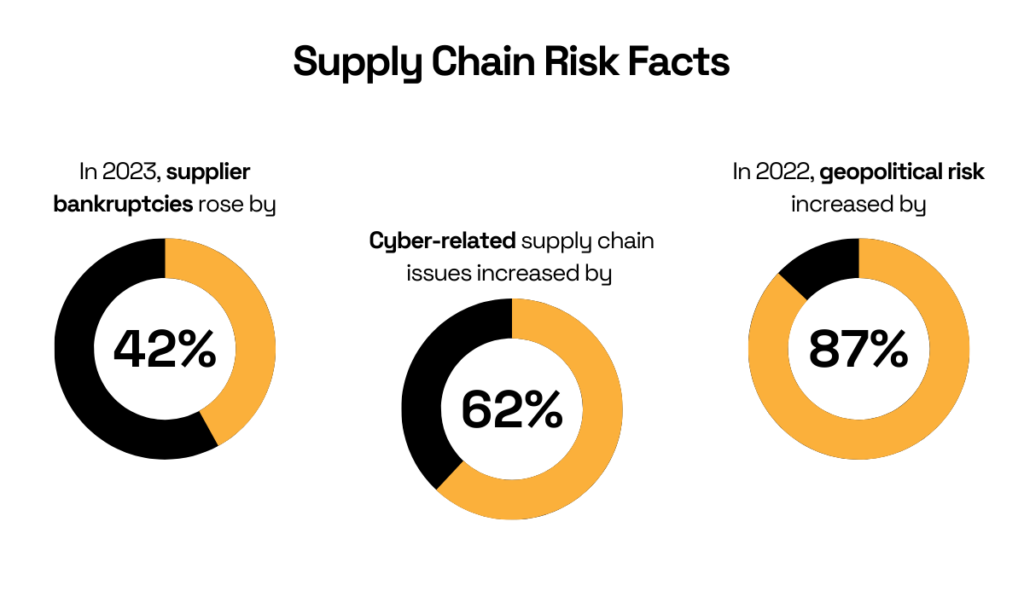

On top of that, Sphera reports a 42% spike in supplier bankruptcies, a 62% increase in cyber risks, and an 87% rise in geopolitical threats.

Illustration: Veridion / Data: Sphera

In that environment, a vendor risk assessment report is essential for staying ahead of disruptions.

So, instead of digging through raw data or scattered notes, you get the essentials: the likelihood of a risk, the potential impact, and an overall rating that’s easy to understand at a glance.

That’s why:

And there’s a good reason for that effort.

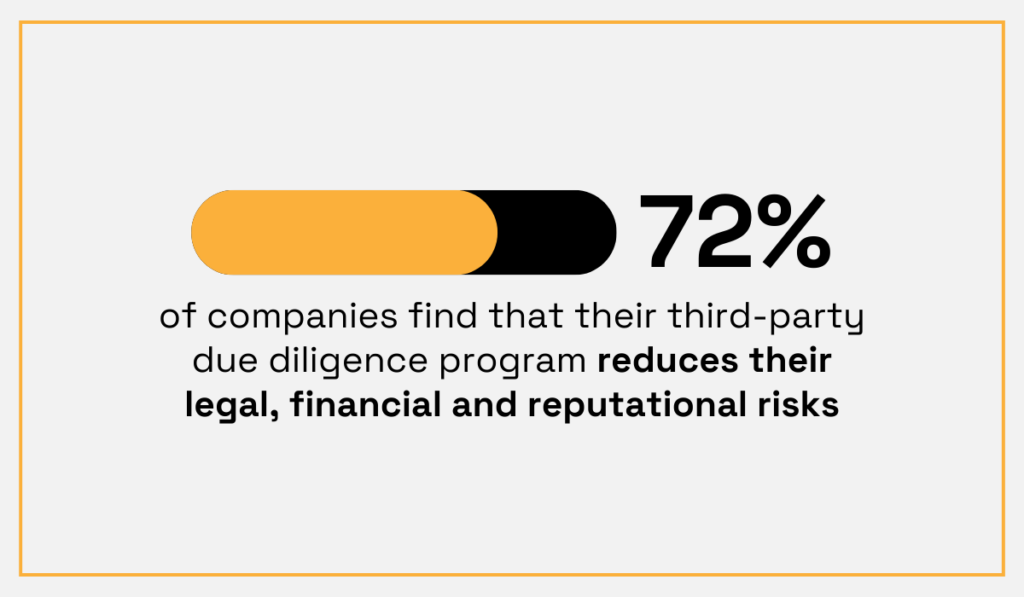

A Navex survey found that 72% of companies believe their third-party due diligence activities significantly reduce legal, financial, and reputational risks.

Illustration: Veridion / Data: Navex

Think of it as a common language between departments.

Whether it’s about contracts, data handling, or financial stability, the VRA report keeps everyone aligned on the same risk picture.

It also helps prioritize action, spotlighting which risks can be tolerated and which could damage operations or reputation if ignored.

For example, a vendor may be financially sound, but over-reliant on a fragile supply chain.

Spotting that early gives you the chance to prepare before disruption hits.

At its core, a VRA report is about clarity.

When you’re juggling hundreds or even thousands of vendors, that clarity is what lets you act quickly and confidently.

A VRA report is a practical tool that helps you reduce risk and protect your organization.

The real value lies in how it turns scattered risk data into clear action points.

One of the biggest benefits is proactive risk mitigation.

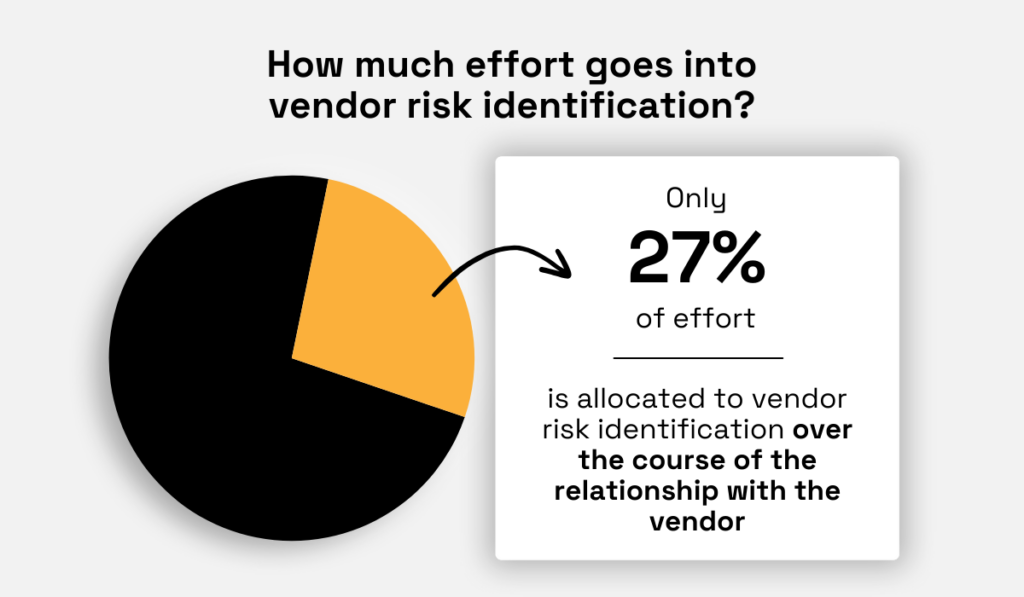

According to Gartner, legal and compliance leaders dedicate only 27% of effort to identifying risks during the actual vendor relationship.

Illustration: Veridion / Data: Gartner

The rest goes into onboarding and recertification.

The problem?

Risks aren’t static. They change with ownership shifts, cyber threats, or financial troubles.

A vendor risk assessment report helps you track those changes continuously, so you’re not blindsided between check-ins.

In other words, instead of waiting for problems to show up in operations, you can spot them early.

A vendor showing signs of financial instability? That’s a signal to tighten contracts or line up alternatives.

A supplier relying too heavily on one subcontractor? That’s a point to monitor before it disrupts your supply chain.

As Chris Audet, Vice President and Chief of Research at Gartner, explains:

Illustration: Veridion / Quote: Gartner

Another major benefit is strengthening cybersecurity.

Today, vendors are often an organization’s weakest link when it comes to data protection.

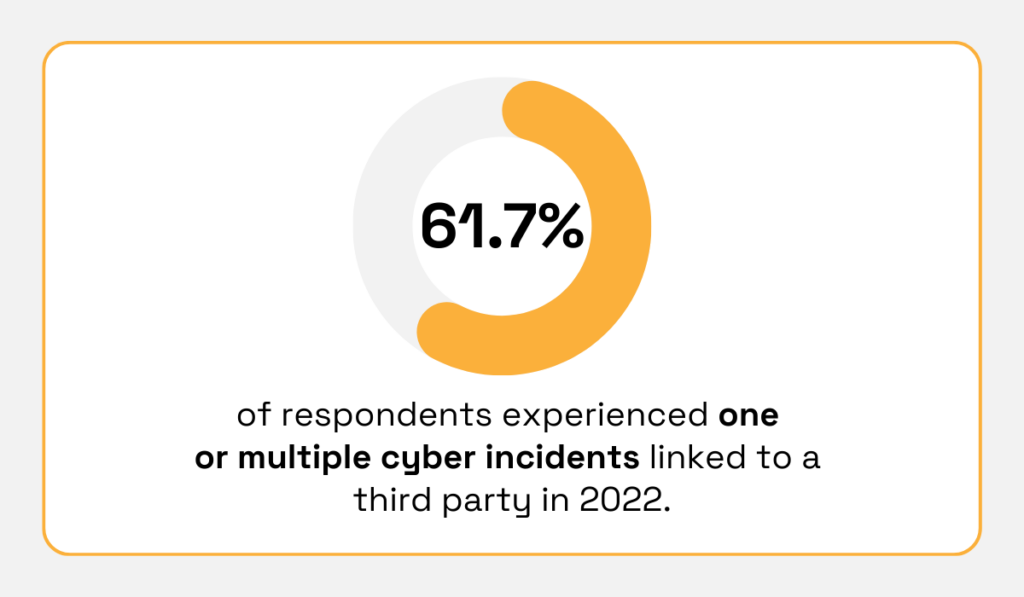

A 2023 survey by Cyber GRX and ProcessUnity revealed that over 60% of organizations experienced a cyber incident caused by third parties:

Illustration: Veridion / Data: Cyber GRX

A VRA report reviews your vendors’ data handling, access controls, and security protocols. So, if there are gaps, you’ll know.

Then, you can either enforce improvements or rethink the relationship.

This insight can be the difference between business as usual and a costly disaster, like Bank of America experienced at the end of 2023.

Source: IT Security Guru

A hack on Infosys McCamish Systems, a Bank of America service vendor, exposed the personal data of over 57,000 customers, including social security numbers, account details, and addresses.

And this wasn’t the first time the bank was hit through a vendor, either.

Just months earlier, the accounting firm providing services to the bank was breached, ultimately leaking similar sensitive customer data.

These breaches show why vendor risk reports matter: they help spot and track risks with third parties before incidents like this happen.

Compliance is also easier with a robust VRA report.

Whether you’re following GDPR, HIPAA, or industry-specific frameworks, regulators expect proof that you’ve done due diligence on your vendors.

Documented reports demonstrate exactly that.

They show auditors, stakeholders, or even internal review boards that risks are being actively managed.

And if fines or legal challenges ever arise, having a clear audit trail can protect your organization.

In short, a VRA report equips you to act early, stay compliant, protect data, and make decisions with clarity.

For any organization working with multiple vendors, those benefits are essential.

Every vendor risk assessment report looks a little different, depending on the organization’s priorities and the vendor being evaluated.

But the strongest reports share a set of common components.

These sections give you a complete view of who the vendor is, how they operate, and where risks may surface.

Let’s break them down.

Start with the basics: who is this vendor?

This section should summarize key details like company size, industry, location, ownership structure, and leadership team.

It can also include a short history, notable milestones, and the vendor’s current market position.

The point isn’t to create a corporate biography, though.

Rather, it is to ground the rest of the report in context.

If your team is assessing a niche supplier with just a few years of operations, that paints a different risk picture than a global enterprise with decades of experience.

Likewise, a vendor located in a politically unstable region might present geopolitical risks that wouldn’t surface with a domestic supplier.

This is where reliable data becomes critical.

Pulling details from outdated directories or vendor self-disclosures leaves gaps that can cause costly blind spots.

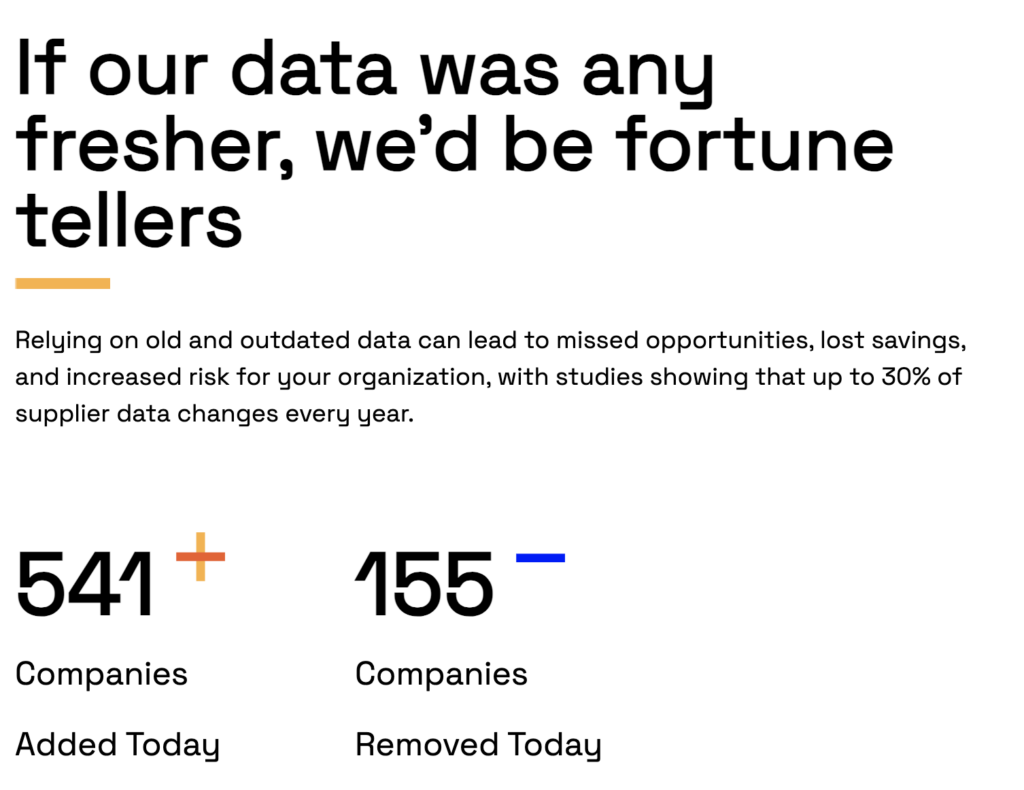

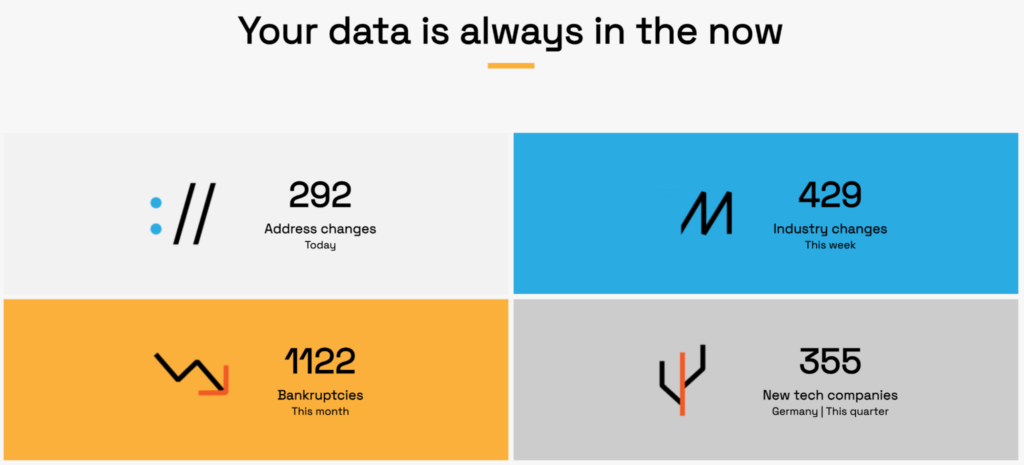

Solutions like Veridion help close that gap by providing verified company data on over 134 million organizations worldwide.

Source: Veridion

From ownership structures to global footprint, Veridion refreshes its data weekly by scanning more than 800 billion web pages, ensuring you’re working with the latest, most accurate information.

With a solid background overview, you quickly understand who the vendor is, how strategically important they are, and whether deeper due diligence is warranted.

It sets the stage for the rest of the report by answering a simple, but vital question: Are we dealing with a partner who is stable and trustworthy?

This section is all about what the vendor actually provides.

Document the products or services delivered, the scope of those services, and the models they use for delivery.

Are they supplying raw materials, providing IT services, or managing a critical logistics function?

Clarifying this early makes it easier to map risks to their potential impact.

For procurement teams, knowing the criticality of the service is essential.

If a vendor provides non-essential office supplies, the risk of disruption is minor. But if they supply a specialized component for your production line, downtime could cost millions.

The service description, therefore, helps quantify how dependent your organization is on the vendor.

A real-world example shows why this matters.

Boeing faced major production delays when Spirit AeroSystems—its sole fuselage supplier—ran into manufacturing defects.

Because there were no backups, the disruption cascaded through Boeing’s entire 737 Max program.

Source: AP News

A simple description of what a vendor delivers, and how critical it is, can highlight vulnerabilities like this before they catch you off guard.

This section should also clarify delivery models.

Are services managed in-house, outsourced, or cloud-based? Do they operate globally or in a single region?

For example, a vendor delivering cloud services through data centers in Europe may be subject to GDPR, while one serving from U.S. facilities might not.

These differences directly shape compliance and security risks.

Adding performance expectations or service-level agreements (SLAs) here also strengthens the report.

If a vendor consistently struggles to meet SLA targets, procurement teams can factor that into contract renewals or negotiations.

Simply put, this section helps teams evaluate both operational dependence and potential exposure: what happens to your business if this vendor can’t deliver as promised?

A vendor’s financial health directly impacts their ability to deliver reliably. That’s why financial analysis is a cornerstone of any VRA report.

This section should cover revenue trends, profitability, credit ratings, liquidity ratios, and any signs of distress such as layoffs, missed payments, or declining market share.

However, the goal is not to produce a full audit, but to assess stability.

A financially sound vendor can withstand disruptions, invest in improvements, and honor contracts. A vendor on shaky ground may be one bad quarter away from failing to deliver.

Needless to say, that difference could make or break supply chain continuity.

Apple’s experience with Qualcomm shows the impact of financial leverage.

As its key supplier of 5G modems, Qualcomm used its near-monopoly position to raise prices and enforce strict terms.

As a result, Apple ended up developing its own custom modems to reduce this dependency.

Source: Wccftech

The lesson? A financial review reveals where your vendors may have too much negotiating power.

For example, credit rating agencies like Moody’s or S&P often flag vendors with weak balance sheets before insolvency hits.

If your report includes these indicators, executives can prepare backup plans rather than being blindsided.

Likewise, news of lawsuits or sudden restructuring should raise red flags for long-term viability.

This is where, once again, trusted data providers like Veridion are useful, as they aggregate legal filings, public disclosures, and digital footprints to surface credible financial signals.

Even if exact numbers aren’t available, patterns like shrinking headcount or shifting corporate ownership can suggest deeper issues.

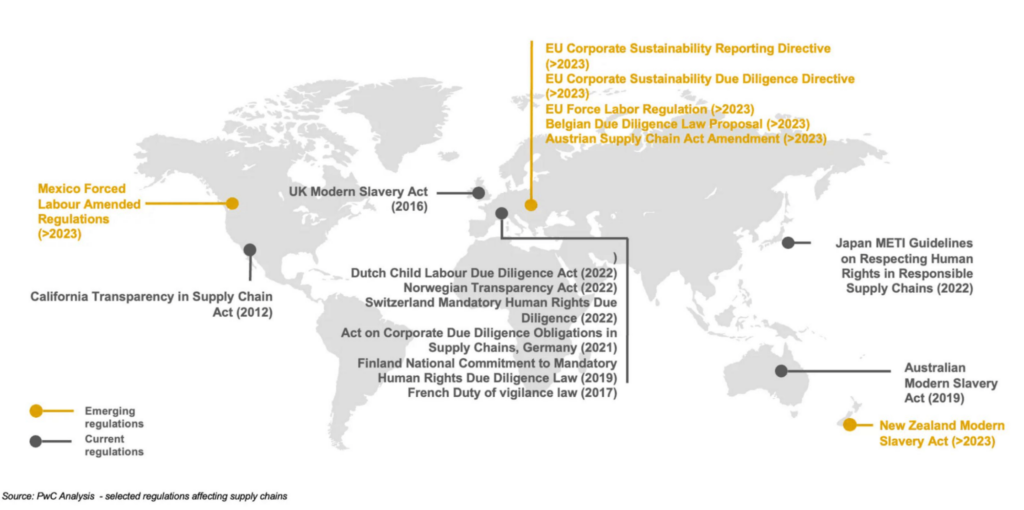

Regulatory compliance is one of the most important areas of vendor risk management.

Think vendors’ certifications, adherence to standards, and compliance with laws relevant to your industry.

For example, a healthcare vendor must meet HIPAA standards.

A financial services provider should align with PCI-DSS and SOX requirements, and a cloud services vendor may need ISO 27001 certification.

Ignoring any of these frameworks can have huge legal and reputational consequences down the line.

Including compliance data in your VRA report has two benefits.

First, it proves due diligence.

If regulators ever question your vendor management practices, documented reports show that your team actively verifies compliance.

Second, it makes sure nothing falls through the cracks.

A vendor who lacks up-to-date certifications could expose your organization to fines, penalties, or reputational fallout.

This section can also cover country-specific laws, like GDPR for data privacy in Europe or CCPA in California.

The map below shows just how many laws your vendor could face:

Source: Veridion

Vendors operating across borders may be subject to multiple overlapping frameworks, so it’s no wonder they can get confused and make costly mistakes.

That’s exactly where a VRA report helps, keeping track of what applies and showing whether those requirements are actually being met.

Using technology-driven tools that scan corporate filings and global legal records in real time, you get speed and accuracy.

Source: Veridion

This has become a must for procurement executives managing hundreds of suppliers.

Data is now one of the most valuable assets an organization handles, but also one of the riskiest.

That makes a vendor’s data management practices a critical part of any risk report.

This section should evaluate how the vendor collects, stores, and secures data.

Does the vendor encrypt sensitive information? Do they have multi-factor authentication for system access?

And how do they handle data subject requests under privacy laws?

Documenting these details reveals whether a vendor can be trusted with your customers’ and employees’ sensitive information.

And the stakes here are high.

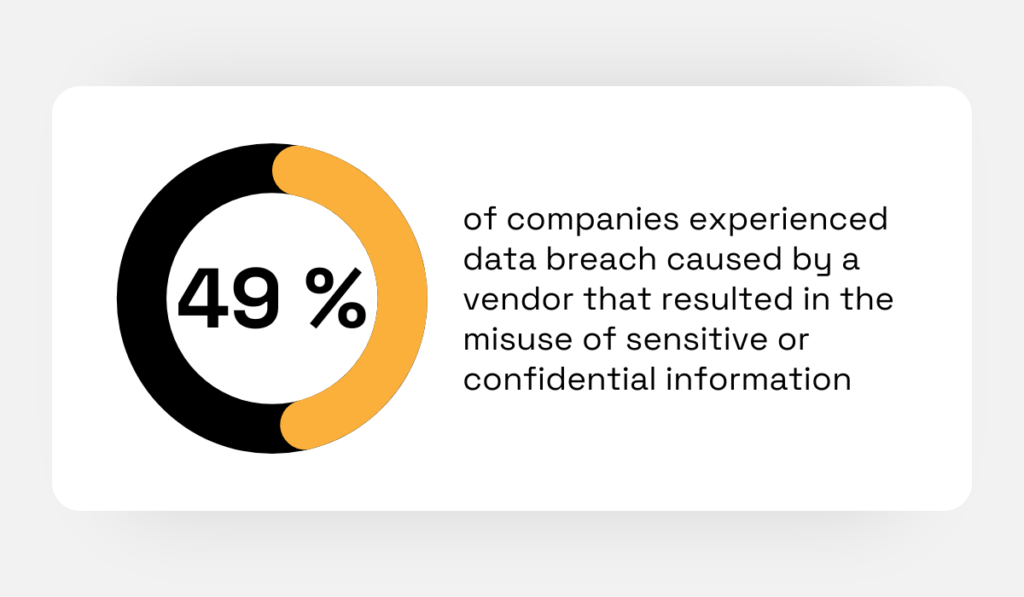

Research shows that 49% of companies have had confidential information misused due to a data breach caused by a vendor.

Illustration: Veridion / Data: Buckley Firm

Poor oversight can lead to reputational damage, customer distrust, and costly legal penalties.

According to IBM’s Cost of a Data Breach 2025 Report, the global average cost of a data breach is $4.4 million, and breaches caused by third parties are consistently among the most expensive.

Beyond cybersecurity, this section should also cover data retention and disposal policies.

Holding onto unnecessary data or failing to delete it securely can create liabilities, and evaluating these practices helps you see whether vendors are not only compliant but also disciplined in their approach.

With clear visibility into how a vendor manages data, procurement and security teams can align on next steps.

That might mean requiring contract clauses around encryption, mandating annual audits, or even seeking alternative partners if risks are too high.

Finally, every vendor is also a customer.

This means they rely on their own suppliers, logistics partners, and subcontractors to deliver their services to you.

That’s why a complete VRA report should analyze a vendor’s supply chain dependencies, too.

This section looks at who your vendor depends on, how stable those relationships are, and what risks they introduce.

For instance, a vendor that sources raw materials from a single overseas supplier may face disruption if that supplier goes offline.

The risk of overdependence is well illustrated by Ford.

In 2018, a fire at a key supplier’s factory forced Ford to halt production of its F-150 pickup trucks because no backup suppliers existed.

Source: NPR

General Motors, by contrast, kept production running because it had proactively lined up alternatives.

The difference shows why mapping dependencies is so important.

Regulatory exposure is another hidden layer.

Boohoo, the UK fashion retailer, saw its share price drop 18% and faced the threat of a U.S. import ban after one of its Leicester suppliers was accused of modern slavery.

Source: The Guardian

You can easily see how all these aspects, from compliance to supply chain dependencies, go hand in hand, and how much easier things get when you have a thorough VRA report in place.

By mapping dependencies alongside other risk factors, you’re better prepared with backups, stronger contracts, and more resilient operations.

A vendor risk assessment report helps you cut through complexity and act with confidence.

By including background, services, financial health, compliance, data practices, and supply chain dependencies, you build a complete view of vendor risk.

That means fewer surprises, stronger supplier relationships, and smoother decision-making.

Success, however, depends on your approach.

So take the time to standardize your process, involve the right stakeholders, and choose tools that give you accurate, up-to-date insights.

The work you put in now will pay off with stronger resilience, better compliance, and procurement decisions you can stand behind, today and in the future.